Application of Act

“4b. This Act applies both within and outside Australia.”.

Powers of Corporation

4. Section 7 of the Principal Act is amended:

(a) by inserting in paragraph (2) (f) “and indemnities” after “guarantees”;

(b) by omitting subsection (3) and substituting the following subsection:

“(3) The consolidated borrowings of the Corporation and its subsidiaries (other than borrowings for temporary purposes) shall not exceed 15 times the consolidated capital, and retained profits, accumulated losses and other reserves, of the Corporation and its subsidiaries.”.

Matters to be taken into account by Corporation

5. Section 8 of the Principal Act is amended by omitting subsections (4) to (8) (inclusive).

6. Section 15 of the Principal Act is repealed and the following sections are substituted:

Appointment of Chief Executive

“13. (1) The Chief Executive shall be appointed by the Minister after the Minister has received a recommendation from the Board.

“(2) The Minister shall not appoint the Chairman or a Director referred to in paragraph 11 (1) (e) as Chief Executive.

“(3) The appointment of a person as Chief Executive is not invalid merely because of a defect or irregularity in relation to the appointment.

Chief Executive holds office during Board’s pleasure etc.

“14. The Chief Executive:

(a) shall be appointed with effect from the day specified in the instrument of appointment; and

(b) holds office during the Board’s pleasure.

Terms and conditions of Chief Executive not provided for by Act

“15. The Chief Executive holds office on such terms and conditions (including terms and conditions relating to remuneration and allowances) in relation to matters not provided for by this Act as are determined by the Board.

Disclosure of interests by Chief Executive

“15a. The Chief Executive shall give written notice to the Chairman of all direct and indirect pecuniary interests that the Chief Executive has or acquires in any business or in any body corporate carrying on any business.”.

7. (1) Sections 24 and 24a of the Principal Act are repealed and the following sections are substituted:

Capital of Corporation

“24. (1) The amount of $200,000,000 (in this section called the ‘capital amount’) is payable to the Corporation as its capital.

“(2) Amounts paid to the Corporation before the commencement of this section as capital of the Corporation form part of the capital amount.

“(3) The amount that would, but for this subsection, have been payable by the Corporation to the Commonwealth as dividend for the financial year that commenced on 1 July 1987 shall be retained by the Corporation and shall be taken to have been paid to the Corporation as part of the capital amount.

“(4) The remainder of the capital amount is payable to the Corporation, out of money appropriated by the Parliament for the purpose, in such instalments as the Minister for Finance, subject to subsection (5), determines, in writing.

“(5) The part of the remainder of the capital amount that has not, at any time, been paid to the Corporation is to be available for the purpose of enabling the Corporation to discharge its obligations.

“(6) The Board may, at any time, request the Minister for Finance to arrange for payment to it of any part of the remainder of the capital amount that has not been paid.

Payment of dividends to Commonwealth

“24a. (1) The Board shall, within 4 months after the end of each financial year, by written notice to the Minister, recommend that the Corporation pay a specified dividend, or not pay a dividend, to the Commonwealth for that financial year.

“(2) The Minister shall, within 30 days after receipt of the recommendation, by written notice to the Corporation, either:

(a) approve the recommendation; or

(b) direct the payment of a different specified dividend or a specified dividend, as the case requires.

“(3) In exercising their respective functions under subsections (1) and (2), the Board and the Minister shall, subject to subsection (4), have regard to:

(a) the policies of the Commonwealth government, and the general policy of the Corporation in relation to the performance of its functions and duties; and

(b) such other commercial considerations as the Board or the Minister, as the case may be, considers appropriate.

“(4) The Corporation’s dividend for a financial year shall not exceed its profit for the year, after allowance has been made for payment of income tax.

“(5) The Corporation shall for each financial year (other than a year in relation to which the Minister has approved a recommendation that the Corporation not pay a dividend), within 6 months after the end of the year or such further time as the Minister allows, pay to the Commonwealth:

(a) if the Minister has approved a recommendation of the Board that the Corporation pay a dividend for the year—the dividend approved by the Minister; or

(b) if the Minister has directed the Corporation to pay a dividend for the year—the dividend directed by the Minister.”.

(2) Section 24a of the Principal Act as amended by this Act applies in relation to the financial year that commenced on 1 July 1988 and subsequent financial years.

8. After Part IV of the Principal Act the following Part is inserted:

“PART IVa—RE-ORGANISATION OF THE BUSINESS OF THE CORPORATION

“Division 1—Interpretation

Interpretation

“29a. In this Part, unless the contrary intention appears:

‘asset’ means property of any kind, and includes:

(a) any legal or equitable estate or interest (whether present or future, vested or contingent, tangible or intangible) in real or personal property of any description;

(b) any chose in action;

(c) any right, interest or claim of any kind in or in relation to property (whether arising under an instrument or otherwise, and whether liquidated or unliquidated, certain or contingent, accrued or accruing); and

(d) any asset within the meaning of Part IIIa of the Income Tax Assessment Act 1936;

‘authorised person’ means the Minister or a person authorised, in writing, by the Minister for the purposes of this definition;

‘charge’ means a charge created in any way, and includes a mortgage and an agreement to give or execute a charge or mortgage (whether on demand or otherwise);

‘debenture’ has the same meaning as in Division 7 of Part IV of the Companies Act 1981;

‘holder’, in relation to a charge, includes a person in whose favour a charge is to be given or executed (whether on demand or otherwise) under an agreement;

‘income tax’ means tax the liability to which arises under the Income Tax Assessment Act 1936;

‘instrument’ means an instrument of any kind, and includes:

(a) any contract, deed, undertaking or agreement;

(b) any mandate, instruction, notice, authority or order;

(c) any lease, licence, transfer, conveyance or other assurance;

(d) any guarantee, bond, power of attorney, bill of lading, negotiable instrument or order for the payment of money; and

(e) any mortgage, charge, lien or security;

whether express or implied and whether made or given orally or in writing;

‘instrument to which this Part applies’ means an instrument:

(a) to which the Corporation is a party;

(b) that was given to, by or in favour of the Corporation;

(c) in which a reference is made to the Corporation; or

(d) under which any money is or may become payable, or any other property is to be, or may become liable to be, transferred, conveyed or assigned, to or by the Corporation;

‘interest’, in relation to land, means:

(a) a legal or equitable estate or interest in the land; or

(b) a right, power or privilege over, or in relation to, the land;

‘joint instrument’ means an instrument to which a determination under paragraph 29c (1) (e) applies;

‘liability’ means a liability of any kind, and includes an obligation of any kind (whether arising under an instrument or otherwise, and whether liquidated or unliquidated, certain or contingent, accrued or accruing);

‘nominated staff member’ means a person to whom a determination under section 29s applies;

‘non-reimbursable liability’ means a liability to which a determination under paragraph 29c (1) (c) applies;

‘non-transferring asset’ means an asset to which a determination under paragraph 29c (1) (a) applies;

‘non-transferring instrument’ means an instrument to which a determination under paragraph 29c (1) (d) applies;

‘non-transferring liability’ means a liability to which a determination under paragraph 29c (1) (b) applies;

‘proceeding to which this Part applies’ means a proceeding to which the Corporation is a party, other than a proceeding that does not relate to the transferred business;

‘receiving subsidiary’ means the subsidiary of the Corporation that is nominated under subsection 29b (1);

‘re-organisation day’ means the day fixed under section 29b;

‘share’ means a share in the share capital of a company, and includes stock;

‘staff member’ means a person who is an officer or employee of the Corporation;

‘tax exempt matter’ means:

(a) the nomination of the receiving subsidiary under section 29b;

(b) the making of determinations under section 29c;

(c) business of the Corporation ceasing, under this Part, to be business of the Corporation and becoming business of the receiving subsidiary;

(d) the making of payments, and the entering into of agreements, for the purposes of section 29l;

(e) the issue of shares under section 29n;

(f) the operation of this Part (other than Division 6) in any other respect; and

(g) giving effect to a matter referred to in another paragraph of this definition or otherwise giving effect to this Part (other than Division 6);

‘transfer day’, in relation to a nominated staff member, means the day applicable to the staff member in the determination under section 29s that is applicable to the staff member;

‘transferred asset’ means an asset that becomes, under this Part, an asset of the receiving subsidiary;

‘transferred business’ means the business that becomes, under this Part, business of the receiving subsidiary, and includes the transferred assets and transferred liabilities;

‘transferred liability’ means a liability that becomes, under this Part, a liability of the receiving subsidiary;

‘transferred staff member’ means a staff member who, under this Part, becomes employed by the receiving subsidiary;

‘wholly-owned subsidiary’, in relation to the Corporation, means a body corporate:

(a) that is a subsidiary of the Corporation;

(b) none of whose members is a person other than:

(i) the Corporation;

(ii) a body corporate that is, under any other applications of this definition, a wholly-owned subsidiary of the Corporation; or

(iii) a nominee of the Corporation or of a body of the kind referred to in subparagraph (ii); and

(c) no share in which is beneficially owned by a person other than:

(i) the Corporation; or

(ii) a body of the kind referred to in subparagraph (b) (ii).

“Division 2—Steps leading to re-organisation

Nomination of subsidiary to which business is to be transferred—the receiving subsidiary

“29b. (1) Subject to subsection (2), the Minister shall, by notice published in the Gazette, nominate a subsidiary of the Corporation as the receiving subsidiary for the purposes of this Part.

“(2) The Minister shall not nominate a subsidiary under subsection (1) unless the subsidiary is:

(a) a company incorporated under the Companies Act 1981;

(b) a wholly-owned subsidiary;

(c) a trading or financial corporation within the meaning of paragraph 51 (20) of the Constitution;

(d) a public company, and a company limited by shares, within the meaning of the Companies Act 1981; and

(e) subject to a provision in its articles of association prohibiting more than 30% of its voting shares (within the meaning of the Companies Act 1981) being held by members of the public.

“(3) If a subsidiary nominated under subsection (1) ceases, on or before the re-organisation day, to be a subsidiary of the Corporation of the kind described in subsection (2), the Minister shall, by notice published in the Gazette, revoke the nomination.

“(4) For all purposes and in all proceedings, proof of the fact that a body corporate was nominated under subsection (1) is conclusive evidence:

(a) that the body corporate was, on the day of the nomination, a subsidiary of the Corporation of the kind described in subsection (2); and

(b) that the body corporate did not cease, on or before the reorganisation day, to be such a subsidiary;

unless the contrary is established.

Determination of assets, instruments and liabilities not to be transferred etc.—the non-transferring assets, instruments and liabilities, non-reimbursable liabilities and joint instruments

“29c. (1) The Minister may, by notice published in the Gazette, determine:

(a) that specified assets of the Corporation are non-transferring assets;

(b) that specified liabilities of the Corporation are non-transferring liabilities;

(c) that specified non-transferring liabilities are non-reimbursable liabilities;

(d) that specified instruments to which this Part applies are non-transferring instruments; or

(e) that specified instruments to which this Part applies are joint instruments.

“(2) Where the Minister determines that specified instruments to which this Part applies are joint instruments, the Minister shall, in the same Gazette notice, determine in relation to each of those instruments:

(a) which references (if any) in the instrument to the Corporation are to have effect as if they were references to the receiving subsidiary; and

(b) which references (if any) in the instrument to the Corporation are to have effect as if they included references to the receiving subsidiary.

Fixing of day on which re-organisation is to take place—the re-organisation day

“29d. The Minister shall, by notice published in the Gazette, fix a day as the day on which the re-organisation under this Part is to take place.

Notices not to be published after re-organisation day

“29e. The Minister shall not publish a notice under this Division after the re-organisation day.

Proof of notices

“29f. For all purposes and in all courts, evidence of any notice under this Division may be given by the production of a copy of the Gazette purporting to contain it.

“Division 3—The re-organisation

Business of Corporation becomes business of receiving subsidiary

“29g. (1) On the re-organisation day, the business of the Corporation ceases, by force of this subsection, to be business of the Corporation and becomes business of the receiving subsidiary.

“(2) Subsection (1) does not apply in relation to the non-transferring assets and non-transferring liabilities.

Assets and liabilities of Corporation become assets and liabilities of receiving subsidiary

“29h. (1) Without limiting subsection 29g (1), on the re-organisation day, all assets and liabilities of the Corporation (other than the non-transferring assets and non-transferring liabilities) cease to be assets and liabilities of the Corporation and become assets and liabilities of the receiving subsidiary.

“(2) For all purposes and in all proceedings, an asset or liability of the Corporation existing immediately before the re-organisation day shall be taken to have become an asset or liability of the receiving subsidiary on the re-organisation day, unless the contrary is established.

Instruments

“29j. (1) Without limiting subsection 29g (1), an instrument to which this Part applies continues, subject to subsections (2) and (3), in full force and effect on and after the re-organisation day.

“(2) An instrument to which this Part applies (other than a non-transferring instrument or a joint instrument) has effect, in relation to acts, transactions and matters done, entered into or occurring on or after the reorganisation day, as if a reference in the instrument to the Corporation were a reference to the receiving subsidiary.

“(3) An instrument to which this Part applies that is a joint instrument has effect, in relation to acts, transactions or matters done, entered into or occurring on or after the re-organisation day, in accordance with the determination under subsection 29c (2) that is applicable to the instrument.

Pending proceedings

“29k. Without limiting subsection 29g (1), where a proceeding to which this Part applies is, immediately before the re-organisation day, pending in a court, the receiving subsidiary is, on that day, substituted for the Corporation as a party.

Receiving subsidiary to indemnify Corporation in relation to certain non-transferring liabilities

“29l. (1) The receiving subsidiary shall, in relation to each non-transferring liability (other than a non-reimbursable liability):

(a) reimburse the Corporation for any amount paid under the liability on or after the re-organisation day; and

(b) indemnify the Corporation against all expenses and costs incurred in relation to the liability on or after that day.

“(2) Subsection (1) has effect subject to any agreement between the receiving subsidiary and the Corporation.

Valuation of transferred business

“29m. (1) The Minister shall, by written notice given to the receiving subsidiary not later than 7 days after the re-organisation day, determine the net value of the transferred business.

“(2) In determining the net value of the transferred business, the Minister shall take into account the operation of section 29l.

“(3) For all purposes and in all proceedings, the net value of the transferred business shall be taken to be the net value determined under subsection (1), unless the contrary is established.

Issue of shares in receiving subsidiary to Corporation in relation to transferred business

“29n. (1) On the day on which the receiving subsidiary is given the notice under subsection 29m (1), the receiving subsidiary shall, subject to subsection (2), issue shares in the receiving subsidiary to the Corporation.

“(2) The Minister shall determine, in writing, the total nominal value of the shares to be issued to the Corporation.

“(3) The shares issued to the Corporation shall be taken to have been fully paid up and to have been issued for valuable consideration other than cash.

Authorised person may certify matters in relation to re-organisation

“29p. (1) An authorised person may, by signed writing, certify any matter in relation to the operation of this Division and, in particular, may certify:

(a) whether a specified body corporate is the receiving subsidiary;

(b) whether specified assets are or are not transferred assets or non-transferring assets;

(c) whether specified liabilities are or are not transferred liabilities, non-transferring liabilities or non-reimbursable liabilities; and

(d) whether specified instruments are or are not joint instruments, non-transferring instruments or other instruments to which this Part applies.

“(2) For all purposes and in all proceedings, a certificate under subsection (1) is conclusive evidence of the matters certified, except so far as the contrary is established.

“(3) A document purporting to be a certificate under subsection (1) shall, unless the contrary is established, be taken to be such a certificate and to have been properly given.

Extraterritorial operation of Division

“29q. It is the intention of the Parliament that this Division should apply, to the greatest extent possible, in relation to:

(a) things situated outside Australia;

(b) acts, transactions and matters done, entered into or occurring outside Australia; and

(c) things, acts, transactions and matters (wherever situated, done, entered into or occurring) that would, apart from this Act, be governed or otherwise affected by the law of a foreign country.

Corporation to take steps necessary to carry out re-organisation

“29r. The Corporation shall take such steps as are necessary to ensure that this Division is fully effective, particularly in relation to its operation outside Australia.

“Division 4—Transfer of staff

Determination of staff to be transferred to receiving subsidiary

“29s. The Chief Executive may, in writing, determine that the employment of specified staff members is to be transferred to the receiving subsidiary on and from such respective days as are specified in the determination.

Employment of nominated staff member to continue with receiving subsidiary

“29t. Subject to sections 29u and 29v, each nominated staff member who is a staff member immediately before his or her transfer day shall, on and from the transfer day, be taken to be employed by the receiving subsidiary on the terms and conditions on which he or she was employed by the Corporation immediately before the transfer day.

Act not to affect certain matters’ relating to transferred staff members

“29u. (1) This section has effect for the purposes of the application, at any time on or after the transfer day of a transferred staff member, of a law, award, determination or agreement in relation to the employment of the transferred staff member.

“(2) Neither the transferred staff member’s contract of employment, nor his or her period of employment, shall be taken to have been broken by the operation of this Part.

“(3) Without limiting section 29t or subsection (2) of this section, this Part does not affect any accrued rights that the transferred staff member had immediately before the transfer day in relation to any kind of leave.

“(4) Where:

(a) if the transferred staff member had, immediately before the transfer day, ceased to be employed by the Corporation, it would have been

necessary to take into account a period during which the transferred staff member was employed by the Corporation or any other person to determine:

(i) an amount payable to the transferred staff member; or

(ii) a benefit to which the transferred staff member would have been entitled;

because of his or her so ceasing; and

(b) but for this subsection, some or all of that period would not have

to be taken into account as a period during which the staff member

was employed by the receiving subsidiary; the receiving subsidiary shall treat the whole of the first-mentioned period as a period during which the transferred staff member was employed by it.

Variation of terms and conditions of employment

“29v. (1) It is a term of each transferred staff member’s employment after his or her transfer day that the terms and conditions of that employment may be varied to the extent to which, and the manner in which, the terms and conditions of his or her employment could be varied under this Act immediately before the transfer day.

“(2) Nothing in this Part prevents the terms and conditions of a transferred staff member’s employment after his or her transfer day from being varied:

(a) in accordance with those terms and conditions; or

(b) by or under a law, award, determination or agreement.

“(3) In this section:

‘terms and conditions’ includes a term or condition existing because of subsection (1);

‘vary’, in relation to terms and conditions, includes vary by way of:

(a) omitting any of those terms and conditions;

(b) adding to those terms and conditions; or

(c) substituting new terms or conditions for any of those terms and conditions.

Application of Part IV of Public Service Act

“29w. For the purposes of the application of Part IV of the Public Service Act 1922 in relation to a transferred staff member, the receiving subsidiary shall be taken to be, on and after the transfer day of the transferred staff member, a Commonwealth authority for the purposes of that Part.

“Division 5—Taxation matters

Exemptions relating to tax exempt matters

“29x. (1) Tax under a law of the Commonwealth or a State or Territory is not payable in relation to:

(a) a tax exempt matter; or

(b) anything done (including, for example, a transaction entered into or an instrument made, executed, lodged or given) because of, or for a purpose connected with or arising out of, a tax exempt matter.

“(2) In subsection (1):

‘tax’ includes:

(a) sales tax;

(b) tax imposed by the Debits Tax Act 1982;

(c) fees payable under the Companies (Fees) Act 1981;

(d) stamp duty; and

(e) any other tax, fee, duty, levy or charge;

but does not include income tax.

Authorised person may certify in relation to tax exempt matters

“29y. (1) An authorised person may, by signed writing, certify that:

(a) a specified matter or thing is a tax exempt matter; or

(b) a specified thing was done (including, for example, a transaction entered into or an instrument made, executed, lodged or given) because of, or for a purpose connected with or arising out of, a specified tax exempt matter.

“(2) For all purposes and in all proceedings, a certificate under subsection (1) is conclusive evidence of the matters certified, except so far as the contrary is established.

“(3) A document purporting to be a certificate under subsection (1) shall, unless the contrary is established, be taken to be such a certificate and to have been properly given.

Application of Income Tax Assessment Act to certain assets and liabilities

“29z. (1) This section applies to:

(a) the transferred assets;

(b) the transferred liabilities; and

(c) the non-transferring liabilities (other than the non-reimbursable liabilities).

“(2) It is the intention of the Parliament:

(a) that, on and after the re-organisation day, the receiving subsidiary should, for income tax purposes, be placed in the same position in relation to the assets and liabilities to which this section applies as the Corporation would have been but for the enactment and operation of this Part; and

(b) that, in relation to the financial year in which the re-organisation day occurs, the operation of this Part in relation to the assets and

liabilities to which this section applies should, for income tax purposes, be revenue neutral, that is to say, that no assessable income, deduction, capital gain or capital loss should be derived, allowed or incurred, or should accrue, by or to the Corporation or the receiving subsidiary in relation to those assets and liabilities in relation to that year merely because of the enactment and operation of this Part.

“(3) So far as it is necessary to achieve that intention:

(a) this Part (other than this section) shall be taken not to have been enacted and the operation of this Part (other than this section) shall be disregarded;

(b) the receiving subsidiary shall be taken to be, and always to have been, the Corporation;

(c) deductions that would have been allowable to the Corporation but for the enactment and operation of this Part shall be taken to be allowable to the receiving subsidiary, and not to the Corporation; and

(d) the Income Tax Assessment Act 1936 shall be applied as if any necessary modifications had been made by this Act.

Application of Income Tax Assessment Act to partnerships

“29za. Where the receiving subsidiary becomes, under this Part, a member of a partnership, the constitution of the partnership shall, for the purposes of the Income Tax Assessment Act 1936 (other than section 92 of that Act), be taken not to have been varied merely because of the receiving subsidiary becoming, under this Part, a member of the partnership.

Payments in relation to certain non-transferring liabilities

“29zb. (1) A deduction shall be allowable to the receiving subsidiary under the Income Tax Assessment Act 1936 in relation to a payment made, or required to be made, by it under section 29l of this Act (whether or not the payment is made, or required to be made, to the Corporation) in relation to an outgoing incurred by the Corporation, or that would have been incurred by the Corporation but for the enactment and operation of this Part, to the extent to which a deduction would have been allowable to the Corporation under that Act in relation to the outgoing but for the enactment and operation of this Part.

“(2) A deduction shall not be allowable to the Corporation under the Income Tax Assessment Act 1936 in relation to an outgoing incurred by it, or that would have been incurred by it but for the enactment and operation of this Part, to the extent to which a deduction is, under subsection (1), allowable to the receiving subsidiary under that Act in relation to the outgoing.

“(3) The assessable income of the Corporation for the purposes of the Income Tax Assessment Act 1936 shall not include any payment made by

the receiving subsidiary under section 29l of this Act (whether or not the payment is made, or required to be made, to the Corporation).

Conversion to accruals basis for returning interest

“29zc. (1) The provisions of this section apply in relation to the Corporation and the receiving subsidiary if the Corporation has converted, for income tax purposes, to an accruals basis for returning interest payable and interest receivable in the financial year commencing on 1 July 1987.

“(2) The Corporation shall not be entitled, or required, to convert, for income tax purposes, to an accruals basis for returning interest payable and interest receivable in a financial year commencing before 1 July 1987.

“(3) Subject to subsections (5) and (6), a deduction of an amount equal to one-fifth of the amount (if any) by which the Undeducted Interest exceeds the Deducted Interest shall be allowed to the Corporation under the Income Tax Assessment Act 1936 in relation to the financial year commencing on 1 July 1987 and each of the four immediately following financial years:

where:

Undeducted Interest is the total of amounts of interest payable by the Corporation that accrued before 1 July 1987 in relation to which, and to the extent to which, a deduction is allowable, or would have been allowable but for the conversion, to the Corporation under subsection 51 (1) of that Act, but has not been allowed to the Corporation in relation to a financial year commencing before that day; and

Deducted Interest is the total of amounts of interest payable by the Corporation that accrue on or after 1 July 1987 in relation to which, and to the extent to which, a deduction has been allowed to the Corporation under subsection 51 (1) of that Act in relation to a financial year commencing before that day.

“(4) Subject to subsections (5) and (6), an amount equal to one-fifth of the amount (if any) by which the Unassessed Interest exceeds the Assessed Interest shall, for the purposes of the Income Tax Assessment Act 1936, be included in the assessable income of the Corporation in relation to the financial year commencing on 1 July 1987 and each of the four immediately following financial years:

where:

Unassessed Interest is the total of amounts of interest receivable by the Corporation that accrued before 1 July 1987 to the extent to which those amounts are assessable income of the Corporation, or would have been assessable income of the Corporation but for the conversion, but had not been included in the assessable income of the Corporation in relation to a financial year commencing before that day; and

Assessed Interest is the total of amounts of interest receivable by the Corporation that accrue on or after 1 July 1987 to the extent to which those amounts have been included in the assessable income of the Corporation in relation to a financial year commencing before that day.

“(5) If the re-organisation day is a day other than 1 July, the following provisions apply, for the purposes of the Income Tax Assessment Act 1936, in relation to the Corporation and the receiving subsidiary in relation to the financial year in which the re-organisation day occurs:

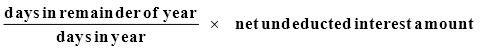

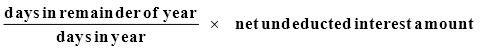

(a) the amount (in this paragraph called the ‘net undeducted interest amount’) of the deduction that would, but for this paragraph, have been allowable to the Corporation under subsection (3) in relation to the financial year shall be reduced by an amount (in paragraph (b) called the ‘receiving subsidiary deduction amount’) calculated in accordance with the formula:

where:

days in remainder of year | is the number of days in the financial year that occur on and after the reorganisation day; and |

days in year | is the number of days in the financial year; |

(b) a deduction of an amount equal to the receiving subsidiary deduction amount shall be allowed to the receiving subsidiary in relation to the financial year;

(c) the amount (in this paragraph called the ‘net assessable income amount’) that would, but for this paragraph, have been included in the assessable income of the Corporation under subsection (4) in relation to the financial year shall be reduced by an amount (in paragraph (d) called the ‘receiving subsidiary assessable income amount’) calculated in accordance with the formula:

where:

days in remainder of year | is the number of days in the financial year that occur on and after the reorganisation day; and |

days in year | is the number of days in the financial year; |

(d) an amount equal to the receiving subsidiary assessable income amount shall be included in the assessable income of the receiving subsidiary in relation to the financial year.

“(6) Subsections (3) and (4) have effect in relation to a financial year commencing on or after the re-organisation day as if the first reference in each of those subsections to the Corporation were a reference to the receiving subsidiary.

Treatment for capital gains tax purposes of shares issued to Corporation by receiving subsidiary

“29zd. (1) This section has effect for the purposes of Part IIIa of the Income Tax Assessment Act 1936 if:

(a) transferred assets (in this section called the ‘pre-CGT assets’) were acquired by the Corporation before 20 September 1985;

(b) the Corporation, by written notice given to the Commissioner of Taxation on or before the day on which it lodges its return of income for the year of income in which the re-organisation day occurs, or within such further period as the Commissioner allows, nominates as pre-CGT shares such of the shares issued to the Corporation under section 29n as are specified in the notice; and

(c) the number of shares nominated does not exceed the number calculated in accordance with the formula:

where:

Shares is the number of shares issued to the Corporation under section 29n;

Net Value of Pre-CGT Assets is the number of dollars in the market value, on the re-organisation day, of the pre-CGT assets reduced by the number of dollars in the total, on the re-organisation day, of the transferring liabilities and the non-transferring liabilities, to the extent to which those liabilities are attributable to the pre-CGT assets; and

Net Value of Total Assets is the number of dollars in the market value, on the re-organisation day, of the transferred assets reduced by the number of dollars in the total, on the reorganisation day, of the transferring liabilities and the non-transferring liabilities.

“(2) The Corporation shall be taken to have acquired, before 20 September 1985, the shares nominated under paragraph (1) (b).

“(3) The rest of the issued shares are post-CGT shares for the purposes of subsection (4).

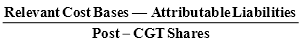

“(4) For the purpose of:

(a) ascertaining whether a capital gain accrued to the Corporation; or

(b) ascertaining whether the Corporation incurred a capital loss;

in the event of a later disposal of a post-CGT share by the Corporation, the Corporation shall be taken to have acquired the shares for a consideration equal to the amount calculated in accordance with the formula:

where:

Relevant Cost Bases is the sum of the respective amounts that would have been, for the purposes of Part IIIa of the Income Tax Assessment Act 1936:

(a) if the later disposal occurs within 12 months after the reorganisation day—the cost bases or the reduced cost bases, as the case may be; or

(b) in any other case—the indexed cost bases, or the reduced cost bases, as the case may be;

to the Corporation of the transferred assets (other than the pre-CGT assets) if the Corporation had disposed of those assets on the re-organisation day;

Attributable Liabilities is the total amount, on the re-organisation day, of the transferred liabilities and the non-transferring liabilities, to the extent that they are attributable to the transferred assets (other than pre-CGT assets); and

Post-CGT Shares is the number of post-CGT shares.

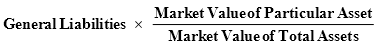

“(5) For the purposes of this section, to the extent that, apart from this subsection, they are not attributable to the transferred assets, the transferred liabilities and the non-transferring liabilities (other than the non-reimbursable liabilities) shall be taken to be attributable to a particular transferred asset to the extent of the amount calculated in accordance with the formula:

where:

General Liabilities is the total amount of those liabilities, to the extent that, apart from this subsection, they are not attributable to the transferred assets;

Market Value of Particular Asset is the number of dollars in the market value, on the re-organisation day, of the particular transferred asset; and

Market Value of Total Assets is the number of dollars in the market value, on the re-organisation day, of the transferred assets.

“Division 6—Raising of share capital from public

Issue of shares to public

“29ze. (1) The receiving subsidiary may issue shares to members of the public after the day on which shares in the receiving subsidiary are issued to the Corporation under section 29n, and not earlier.

“(2) The Minister may give written directions to the receiving subsidiary in relation to the first invitation to the public to purchase shares in the receiving subsidiary, and the receiving subsidiary shall comply with any such directions.

“(3) Subsection (1) does not prevent the allocation of shares to members of the public on or before the day referred to in that subsection.

“Division 7—Miscellaneous

Certificates in relation to land and interests in land

“29zf. Where:

(a) land or an interest in land becomes, under this Part, land or an interest in land of the receiving subsidiary; and

(b) a certificate that:

(i) is signed by an authorised person;

(ii) identifies the land or interest, whether by reference to a map or otherwise; and

(iii) states that the land or interest has, under this Part, become land or an interest in land of the receiving subsidiary;

is lodged with the Registrar-General, Registrar of Titles or other proper officer of the State or Territory in which the land is situated;

the officer with whom the certificate is lodged may:

(c) register the matter in like manner to the manner in which dealings in land or interests in land of that kind are registered; and

(d) deal with, and give effect to, the certificate;

as if it were a grant, conveyance, memorandum or instrument of transfer of the land (including all rights, title and interest in the land) or the interest in the land, as the case may be, to the receiving subsidiary that had been properly executed under the laws in force in the State or Territory.

Certificates in relation to charges

“29zg. Where:

(a) the receiving subsidiary becomes, under this Part, the holder of a charge; and

(b) a certificate that:

(i) is signed by an authorised person;

(ii) identifies the charge; and

(iii) states that the receiving subsidiary has, under this Part, become the holder of the charge;

is lodged with the National Companies and Securities Commission;

the Commission may:

(c) register the matter in like manner to the manner in which assignments of charges are registered; and

(d) deal with, and give effect to, the certificate; as if it were a notice of assignment of the charge that had been properly lodged with the Commission.

Certificates in relation to shares etc.

“29zh. Where:

(a) the receiving subsidiary becomes, under this Part, the holder of a share, debenture or interest in a company; and

(b) a certificate that:

(i) is signed by an authorised person;

(ii) identifies the share, debenture or interest; and

(iii) states that the receiving subsidiary has become, under this Part, the holder of the share, debenture or interest;

is delivered to the company; the company shall:

(c) register the matter in like manner to the manner in which transfers of shares, debentures or interests, as the case may be, in the company are registered;

(d) complete all the appropriate certificates, debentures or other documents in relation to the matter; and

(e) deliver the completed certificates, debentures or other documents to the receiving subsidiary;

as if the certificate were a proper instrument of transfer.

Certificates in relation to other assets

“29zi. Where:

(a) an asset (other than an asset in relation to which section 29zf, 29zg or 29zh applies) becomes, under this Part, an asset of the receiving subsidiary; and

(b) a certificate that:

(i) is signed by an authorised person;

(ii) identifies the asset; and

(iii) states that the asset has, under this Part, become an asset of the receiving subsidiary;

is given to the person or authority who has, under the law of the Commonwealth or of a State or Territory, responsibility for keeping a register in relation to assets of that kind;

the person or authority may:

(c) register the matter in like manner to the manner in which transactions in relation to assets of that kind are registered; and

(d) deal with, and give effect to, the certificate;

as if the certificate were a proper and appropriate instrument for transactions in relation to assets of that kind.

Part to have effect in spite of laws and agreements prohibiting transfer etc.

“29zj. (1) This Part has effect, and shall be given effect to, in spite of anything in:

(a) any other law of the Commonwealth or any law of a State or Territory; or

(b) any contract, deed, undertaking, agreement or other instrument.

“(2) Nothing done by this Part, and nothing done by a person because of, or for a purpose connected with or arising out of this Part:

(a) shall be regarded as:

(i) placing the Corporation, a subsidiary of the Corporation or another person in breach of contract or confidence; or

(ii) otherwise making the Corporation, a subsidiary of the Corporation or another person guilty of a civil wrong;

(b) shall be regarded as placing the Corporation, a subsidiary of the Corporation or another person in breach of:

(i) any law of the Commonwealth or of a State or Territory; or

(ii) any contractual provision prohibiting, restricting or regulating the assignment or transfer of any asset or liability or the disclosure of any information; or

(c) shall be taken to release any surety, wholly or in part, from all or any of the surety’s obligations.

“(3) Without limiting subsection (1), where, but for this section, the consent of a person would be necessary in order to give effect to this Part in a particular respect, the consent shall be taken to have been given.

Compensation for acquisition of property

“29zk. (1) Where, but for this section, the operation of this Part would result in the acquisition of property from a person otherwise than on just terms, there is payable to the person by the Corporation such reasonable amount of compensation as is agreed on between the person and the Corporation or, failing agreement, as is determined by a court of competent jurisdiction.

“(2) Any damages or compensation recovered or other remedy given in a proceeding that is instituted otherwise than under this section shall be taken into account in assessing compensation payable in a proceeding that is instituted under this section and that arises out of the same event or transaction.

“(3) In this section, ‘acquisition of property’ and ‘just terms’ have the same respective meanings as in paragraph 51 (31) of the Constitution.”.

Annual report

9. Section 37 of the Principal Act is amended by omitting subsection (2) and substituting the following subsections:

“(2) The financial statements of the Corporation shall comply with the requirements prescribed under the Companies Act 1981 for the accounts of a listed corporation so far as those requirements relate to the income of executive officers of a listed corporation.

“(2a) For the purposes of subsection (2):

(a) the Corporation shall be taken to be a listed corporation; and

(b) the Chief Executive shall be taken to be an executive officer of the Corporation.

“(2b) Expressions used in subsections (2) and (2a) and in the Companies Act 1981 have the same respective meanings as they have in that Act.”.

Consequential and minor amendments

10. The Principal Act is further amended as set out in the Schedule.

—————

SCHEDULE Section 10

CONSEQUENTIAL AND MINOR AMENDMENTS

Subsection 4 (1) (definition of “Territory”):

Omit the definition.

Subsection 4 (1):

Insert the following definitions:

“ ‘Australia’ includes the external Territories;

‘subsidiary’ has the meaning given by subsection (3);”

Section 4:

Add at the end the following subsection:

“(3) For the purposes of this Act, the question whether a body corporate is a subsidiary of another body corporate shall be determined in the same manner as the question whether a corporation is a subsidiary of another corporation is determined under the Companies Act 1981”.

Subparagraph 6 (1) (a) (i):

Omit “companies”, substitute “persons”.

Paragraph 6 (1) (b):

Omit “companies”, substitute “businesses”.

Subsection 7 (1):

(a) Omit “this section”, substitute “subsection (3)”.

(b) Omit “, in Australia or elsewhere,”.

Subsection 7 (2):

(a) Omit “the succeeding provisions of this section”, substitute “subsection (3)”.

(b) Omit “referred to in that subsection”.

Subsection 7 (4):

Omit the subsection.

Subsection 8 (3):

Omit “company”, substitute “person”.

Subsection 8a (3):

Omit “company” (wherever occurring), substitute “person”.

Subsection 8a (4):

(a) Omit “he”, substitute “the Minister”.

(b) Omit “to him”.

SCHEDULE—continued

Paragraph 8a (9a) (b):

Omit “or 24 (5)”.

Subsection 10 (4):

(a) Omit “he”, substitute “the Chief Executive”.

(b) Omit “to him”.

Paragraph 11 (1) (d):

Omit “Resources and Energy”, substitute “Primary Industries and Energy”.

Subsection 11 (3):

Omit “his”.

Subsection 11 (4):

Omit “he”, substitute “the person”.

Paragraph 11 (5) (a):

Omit “Resources and Energy”, substitute “Primary Industries and Energy”.

Subsection 12 (1):

(a) Omit “he”, substitute “the person”.

(b) Omit “his”.

Subsection 16 (1):

Omit “, the Chief Executive”.

Section 18:

(a) Omit “his office”.

(b) Omit “by him”.

Paragraph 19 (3) (a):

Insert “or her” after “his” (wherever occurring).

Paragraph 19 (3) (b):

Omit the paragraph, substitute the following paragraph:

“(b) a Director to whom this section applies, without reasonable excuse, contravenes section 22;”.

Subsection 19 (4):

Omit “he”, substitute “the Minister”.

SCHEDULE—continued

Paragraph 20 (1) (b):

Omit “his”, substitute “the”.

Subsections 20 (3) to (9) (inclusive):

Omit the subsections, substitute the following subsection:

“(3) Anything done by or in relation to a person purporting to act as Chairman is not invalid merely because:

(a) the occasion for the appointment had not arisen;

(b) there was a defect or irregularity in relation to the appointment;

(c) the appointment had ceased to have effect; or

(d) the occasion to act had not arisen or had ceased.”.

Paragraph 20a (1) (b):

Omit “his”, substitute “the”.

Subsections 20a (2) to (8) (inclusive):

Omit the subsections, substitute the following subsection:

“(2) Anything done by or in relation to a person purporting to act as a Director referred to in paragraph 11 (1) (e) is not invalid merely because:

(a) the occasion for the appointment had not arisen;

(b) there was a defect or irregularity in relation to the appointment;

(c) the appointment had ceased to have effect; or

(d) the occasion to act had not arisen or had ceased.”.

Paragraph 20b (1) (b):

Omit “his”, substitute “the”.

Subsections 20b (2) to (8) (inclusive):

Omit the subsections, substitute the following subsection:

“(2) Anything done by or in relation to a person purporting to act as Chief Executive is not invalid merely because:

(a) the occasion for the appointment had not arisen;

(b) there was a defect or irregularity in relation to the appointment;

(c) the appointment had ceased to have effect; or

(d) the occasion to act had not arisen or had ceased.”.

Subsection 21 (1):

Omit “he”, substitute “the Chairman”.

Subsection 21 (2):

Omit “two”, substitute “2”.

SCHEDULE—continued

Subsection 21 (3):

Omit “, within Australia or elsewhere,”.

Subsection 21 (4):

(a) Omit “he”, substitute “the Chairman”.

(b) Omit “his”, substitute “the Chairman’s”.

Subsection 21 (7a):

Omit the subsection.

Section 21a:

Repeal the section.

Subsection 22 (1):

(a) Insert “or her” after “his” (first occurring).

(b) Omit “his” (last occurring), substitute “the”.

Subsection 23 (1):

(a) Omit “, either generally or otherwise as provided by the instrument of delegation or the resolution, as the case may be,”.

(b) Omit “(except this power of delegation)”.

Subsections 23 (2), (3) and (4):

Omit the subsections.

Subsection 23a (1):

(a) Omit “, either generally or otherwise as provided by the instrument of delegation”.

(b) Omit “writing signed by him”, substitute “signed writing”.

(c) Omit “his”, substitute “the Chief Executive’s”.

(d) Omit “(except this power of delegation)”.

Subsections 23a (2) and (3):

Omit the subsections.

Subsection 25 (1):

Omit “, within Australia or elsewhere,”.

Paragraph 26 (1) (b):

Insert “and allowances” after “remuneration”.

Subsection 29 (1):

Omit “his”.

SCHEDULE—continued

Subsection 29 (2):

Omit “, at his discretion,”.

Subsections 29 (4) and (5):

Omit “him”, substitute “the Auditor-General”.

Subsection 29 (6):

(a) Omit “him” (first occurring), substitute “the Auditor-General”.

(b) Omit “him with”.

Subsection 29 (9):

Omit “or in an external Territory”.

Subsection 29 (10):

Omit the subsection.

Subsection 33 (1):

(a) Omit “Subject to the Remuneration Tribunals Act 1973, the”, substitute “The”.

(b) Omit “for the Chief Executive or”.

(c) Omit “Chief Executive,”.

(d) Omit “him”, substitute “the officer or employee”.

(e) Insert “or her” after “his”.

Subsection 33 (2):

(a) Omit “by him”.

(b) Insert “or her” after “his”.

Section 36:

Omit “, whether within or outside Australia,”.

Subsection 37 (1):

Omit “thirtieth day of “, substitute “30”.

NOTE

1. No. 15, 1970, as amended. For previous amendments, see No. 216, 1973; No. 4, 1975; No. 91, 1976; No. 36, 1978; No. 121, 1980; Nos. 61 and 92, 1981; Nos. 115 and 122, 1983; No. 65, 1985; and No. 11, 1987.

[Minister’s second reading speech made in—

House of Representatives on 7 November 1988

Senate on 24 November 1988]