An Act to appropriate certain aviation fuel revenues for Airservices Australia and the Civil Aviation Safety Authority

Do not delete : Chapter placeholder

Do not delete : Part placeholder

Do not delete : Division placeholder

This Act may be cited as the Aviation Fuel Revenues (Special Appropriation) Act 1988.

This Act commences on the day on which it receives the Royal Assent.

In this Act:

AA means Airservices Australia established by the Air Services Act 1995.

aviation fuel means aviation gasoline and aviation kerosene.

aviation gasoline means goods falling within subparagraph 11(A)(3)(a) in the Schedule to the Excise Tariff Act 1921.

aviation kerosene means goods falling within sub-item 11(D) in the Schedule to the Excise Tariff Act 1921.

CASA means the Civil Aviation Safety Authority established by the Civil Aviation Act 1988.

eligible aviation fuel means:

(a) aviation gasoline entered for home consumption on or after 1 July 1988; and

(b) aviation kerosene entered for home consumption on or after 12 May 1999.

index number has the same meaning as in the Excise Tariff Act 1921.

relevant period has the same meaning as in section 6A of the Excise Tariff Act 1921.

relevant rate means:

(a) in relation to the relevant period that commenced on 1 February 1992—24.470 cents per litre; and

(b) in relation to a time in a relevant period to which section 5 applies—the rate applicable under that section in relation to that time; and

(c) in relation to any other relevant period—the relevant rate at the end of the last preceding relevant period.

statutory rate, in relation to an amount paid to the Commonwealth as duty of Excise or duty of Customs in relation to eligible aviation fuel, means the lowest of whichever of the following rates is applicable:

(a) in any case—the greater of:

(i) the relevant rate at the time duty was imposed on the eligible aviation fuel; and

(ii) if a determination under subsection 3A(1) was in force at the time duty was imposed on the eligible aviation fuel—the rate fixed by that determination;

(b) in the case of duty of Excise—the rate of duty imposed on the eligible aviation fuel under the Excise Tariff Act 1921;

(c) in the case of duty of Customs—the rate that would have been the rate of duty of Excise imposed on the eligible aviation fuel under the Excise Tariff Act 1921 if the eligible aviation fuel had been subject to duty of Excise instead of duty of Customs;

(d) if a determination under subsection 3A(2) was in force at the time duty was imposed on the eligible aviation fuel—the rate fixed by that determination.

(1) The Minister may make a written determination fixing a rate for the purposes of subparagraph (a)(ii) of the definition of statutory rate in section 3.

(2) The Minister may make a written determination fixing a rate for the purposes of paragraph (d) of the definition of statutory rate in section 3.

(3) A determination under subsection (1) or (2) may provide that a rate is to be fixed using a method of indexation which corresponds to the method provided for by this Act for indexing the relevant rate.

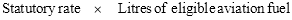

(1) For each amount paid to the Commonwealth as a duty of Excise or duty of Customs in relation to eligible aviation fuel, AA and CASA are each entitled to be paid a share of the amount calculated using the formula:

where:

Statutory rate means the statutory rate in relation to the amount paid to the Commonwealth.

Litres of eligible aviation fuel means the number of litres of eligible aviation fuel by reference to which the amount paid to the Commonwealth was calculated.

(1A) The respective shares of AA and CASA of a payment under subsection (1) are to be determined by the Minister.

(2) Where the whole or a part of an amount paid as duty of Excise or duty of Customs in relation to eligible aviation fuel is repaid by the Commonwealth to a person by way of rebate or otherwise, there shall be deducted from the sum of the amounts that would, but for this subsection, be paid under subsection (1) an amount calculated using the formula:

where:

Statutory rate means the statutory rate in relation to the amount paid to the Commonwealth.

Litres of eligible aviation fuel means the number of litres of eligible aviation fuel by reference to which the amount repaid by the Commonwealth was calculated.

(3) For the purposes of subsections (1) and (2), where 2 or more parts of an amount paid as duty were ascertained by reference to different rates of duty, each of the parts shall be taken to be a separate amount paid as duty.

(4) Amounts payable under subsection (1) are payable out of the Consolidated Revenue Fund, which is appropriated accordingly.

(1) If the factor ascertained under subsection 6A(5) of the Excise Tariff Act 1921 in relation to a relevant period commencing on or after 1 August 1992 is greater than one, then, subject to subsection (2), the relevant rate for the period is:

(a) the rate, calculated to 3 decimal places, ascertained by multiplying the relevant rate at the end of the last preceding relevant period by the factor; or

(b) if that rate would, if it were calculated to 4 decimal places, end in a number greater than 4—the rate increased by 0.001.

(2) If:

(a) an index number necessary for the calculation of the factor to be ascertained under subsection 6A(5) of the Excise Tariff Act 1921 in relation to a relevant period is not published by the Australian Statistician at least 5 days before the first day of the period; and

(b) the factor ascertained in relation to the period is greater than one;

then:

(c) subsection (1) applies only in relation to the part of the period commencing on the fifth day after the day on which the index number is published; and

(d) the relevant rate for the part of the period to which subsection (1) does not apply is the relevant rate at the end of the last preceding period.

Table A

Application, saving or transitional provisions

Aviation Fuel Revenues (Special Appropriation) Amendment Act 1999 (No. 97, 1999)

Schedule 1

5 Application

The amendments made by this Schedule apply in relation to amounts paid to the Commonwealth in respect of eligible aviation fuel on or after the day on which this Act receives the Royal Assent.

6 Adjustment of amounts payable to CASA

Definitions

(1) In this item:

commencement day means the day on which this Act receives the Royal Assent.

interim period means the period commencing on 12 May 1999 and ending immediately before the commencement day.

Principal Act means the Aviation Fuel Revenues (Special Appropriation) Act 1988.

retrospectivity assumptions means:

(a) the assumption that the amendments made by this Schedule to the Principal Act had had effect on and from 12 May 1999; and

(b) the assumption that the first determination that the Minister makes after the commencement day under section 3A of the Principal Act as amended by this Act had had effect on and from 12 May 1999.

Adjustment of amounts payable to CASA

(2) If:

(a) the amount that was actually payable to CASA under sections 4 and 6 of the Principal Act during the interim period;

exceeds:

(b) the total amount that would have been payable to CASA under section 4 of the Principal Act during the interim period if the retrospectivity assumptions applied;

the amount that is to be paid to CASA, after the commencement day, under the Principal Act as amended by this Act is to be reduced by an amount equal to the amount of the excess.