An Act to provide for the payment of bounty on the production of certain machine tools, certain robots and related equipment, and for related purposes

Part I—Preliminary

1 Short title [see Note 1]

This Act may be cited as the Bounty (Machine Tools and Robots) Act 1985.

2 Commencement

This Act shall be deemed to have come into operation on 1 July 1985.

3 General administration of Act

The Chief Executive Officer of Customs has the general administration of this Act.

4 Interpretation

(1) In this Act, unless the contrary intention appears:

accounting period, in relation to a producer, has the meaning given by section 14.

advance means an advance on account of bounty under section 20.

advanced material means engineering ceramics, engineering composites or engineering polymers.

approved form means a form approved by the CEO in writing.

authorised officer means a person who is an authorised officer for the purposes of this Act by virtue of an appointment under section 31.

bountiable computer controller means a computer controller that:

(a) is designed for use solely or principally for the control of:

(i) a computer controlled machine;

(ii) a robotic machine; or

(iii) a flexible manufacturing system;

(b) if it were imported into Australia, would be goods to which heading 8537 or 9032 in Schedule 3 to the Tariff Act would apply; and

(c) if it were imported into Australia and were not goods the manufacture of a Preference Country or goods to which Schedule 4 of the Tariff Act applied, would be goods the duty of Customs in respect of which ascertained in accordance with Part II of the Tariff Act would be so ascertained by reference to a rate of duty that does not exceed 2%.

bountiable equipment means:

(a) bountiable equipment A; or

(b) bountiable equipment B.

bountiable equipment A means:

(a) bountiable equipment AA; or

(b) bountiable equipment AB.

bountiable equipment AA means:

(a) a computer controlled machine; or

(b) a numerically controlled machine; or

(c) bountiable goods AA; or

(d) a robotic machine; or

(e) goods designed for use solely or principally as a part, or an accessory, for a robotic machine; or

(f) a flexible manufacturing system; or

(g) a bountiable computer controller; or

(h) a machine included in a class of machines in respect of which a declaration under subsection 6(1) is in force; or

(j) a part or component included in a class of parts or components in respect of which a declaration under subsection 6(2) is in force; or

(k) goods:

(i) to which heading 8466 in Schedule 3 to the Tariff Act would apply if the goods were imported into Australia; and

(ii) that are designed for use solely or principally as a part for a computer controlled laser cutting machine or for a computer controlled plasma arc cutting machine;

but does not include exempt goods.

bountiable equipment AB means:

(a) an independent machine; or

(b) bountiable goods AB.

bountiable equipment B means:

(a) a computer controlled machine;

(b) a numerically controlled machine;

(c) a robotic machine;

(d) an independent machine;

(e) system equipment; or

(f) a machine included in a class of machines in respect of which a declaration under subsection 6(3) is in force;

but does not include equipment (whether imported into Australia or otherwise) that has not been used in Australia in the commercial production of goods.

bountiable goods AA means goods that:

(a) are designed for use solely or principally as a part for a computer controlled machine; and

(b) if they were imported into Australia, would be goods to which heading 8468, 8479 or 8515 in Schedule 3 to the Tariff Act would apply.

bountiable goods AB means goods that:

(a) are designed for use solely or principally as a part, or an accessory, for:

(i) a computer controlled machine;

(ii) a numerically controlled machine;

(iii) a robotic machine; or

(iv) an independent machine; and

(b) if they were imported into Australia, would be goods to which Item 48 in Part III of Schedule 4 to the Tariff Act would apply.

bounty means bounty under this Act.

bounty period means the period commencing on 1 July 1985 and ending on the terminating day.

CEO means the Chief Executive Officer of Customs.

Collector has the same meaning as in the Customs Act 1901.

computer controlled machine means a completely assembled power fed machine that is controlled by an integrated computer controller, is designed to operate independently of human control when the computer controller that controls it is programmed and:

(a) is designed solely or principally for the working of metal and, if it were imported into Australia, would be goods to which heading 8456, 8457, 8458, 8459, 8460, 8461, 8462, 8463, 8468, 8479 or 8515 in Schedule 3 to the Tariff Act would apply; or

(b) is designed solely or principally for the working of advanced materials and, if it were imported into Australia:

(i) would be goods to which heading 8464 or 8465 in Schedule 3 to the Tariff Act would apply; and

(ii) would be goods to which Schedule 4 of the Tariff Act would apply.

computer controller means a completely assembled unit that incorporates at least one electronic microcircuit, being a microcircuit that:

(a) is part of the microcircuitry of the unit, being microcircuitry than enables the unit:

(i) to store and process, or manipulate, data;

(ii) when programmed, to automatically control the operation of a machine independently of human control;

(iii) to wholly or substantially control the operation and movement of a machine by the use of a numeric‑servo closed loop; and

(iv) to be re‑programmable in respect of the unit’s control of a machine; and

(b) if it were imported into Australia, would be goods to which heading 8542 in Schedule 3 to the Tariff Act would apply.

equipment includes:

(a) a machine;

(b) a manufacturing system;

(c) computer hardware; and

(d) software.

exempt goods means goods that are:

(a) an industrial electric furnace;

(b) a laboratory electric furnace;

(c) an oven;

(d) induction or dielectric heating equipment; or

(e) a part for goods referred to in paragraph (a), (b), (c) or (d);

being goods that, if they were imported into Australia, would be goods to which heading 8515 in Schedule 3 to the Tariff Act would apply.

flexible manufacturing system means a system that:

(a) consists of power fed conveying and assembly equipment (which may be equipment that includes a robotic machine) controlled by an integrated computer controller; and

(b) is designed to systematically transfer or arrange materials or components, being materials or components that consist wholly or mainly of metal or advanced materials, for continuous sequential processing by 2 or more system machines.

independent machine means a completely assembled power operated or power fed machine that:

(a) is designed for use solely or principally for the working of metal; and

(b) if it were imported into Australia, would be a machine to which heading 8456, 8457, 8458, 8459, 8460, 8461, 8462, 8463 or 8479 in Schedule 3 to the Tariff Act would apply;

not being a computer controlled machine or a numerically controlled machine.

machine work station does not include:

(a) a computer controlled machine;

(b) a numerically controlled machine; or

(c) an independent machine.

manufacturer, in relation to bountiable equipment A, means:

(a) a person who, at premises registered under section 28 in the name of the person, carried out a substantial process or substantial processes in the manufacture of the equipment (whether as the intended supplier of the equipment, a contractor, a sub‑contractor or otherwise), not being a person whose only contribution to the manufacture of the equipment was the provision of a production service; or

(b) a person who engaged another manufacturer of the equipment for the carrying out at registered premises by the other manufacturer of a substantial process or substantial processes in the manufacture of the equipment.

metal means metal in its solid state.

modification, in relation to bountiable equipment B, means:

(a) a conversion of the equipment that, in the opinion of the Minister, will substantially improve the designed capability of the equipment; or

(b) the conversion of the equipment from equipment that is not designed to form part of a flexible manufacturing cell or system into equipment intended to form part of such a cell or system;

but does not include:

(c) the conversion of the equipment in the course of the normal manufacture of the equipment; or

(d) retrofit manufacture of, or involving the equipment.

modifier, in relation to bountiable equipment B, means:

(a) a person who, at premises registered under section 28 in the name of the person, carried out a substantial process or substantial processes in the modification of the equipment (whether as the intended supplier of the equipment when modified, a contractor, a sub‑contractor or otherwise), not being a person whose only contribution to the modification of the equipment was the provision of a production service; or

(b) a person who engaged another modifier of the equipment for the carrying out at registered premises by the other modifier of a substantial process or substantial processes in the modification of the equipment.

normal manufacture means manufacture other than retrofit manufacture.

numerically controlled machine means a completely assembled power fed machine that is controlled by an integrated numerical controller, is designed to operate independently of human control when the numerical controller that controls it is programmed and:

(a) is designed solely or principally for the working of metal and, if it were imported into Australia, would be goods to which heading 8456, 8457, 8458, 8459, 8460, 8461, 8462 or 8463 in Schedule 3 to the Tariff Act would apply; or

(b) is designed solely or principally for the working of advanced materials and, if it were imported into Australia:

(i) it would be goods to which heading 8464 or 8465 in Schedule 3 to the Tariff Act would apply; and

(ii) it would be goods to which Schedule 4 of the Tariff Act would apply.

Preference Country has the same meaning as in the Tariff Act.

producer means:

(a) a manufacturer of bountiable equipment A; or

(b) a modifier of bountiable equipment B.

production service includes:

(a) the provision of, or a service relating to, software;

(b) a service by way of design, system engineering, testing, research or development;

(c) heat treatment; and

(d) a service declared by the regulations to be a production service for the purposes of this Act.

registered premises means premises registered under section 28.

retrofit manufacture means:

(a) the manufacture of a computer controlled machine by the conversion into such a machine of a numerically controlled machine or of an independent machine; or

(b) the manufacture of bountiable equipment A included in a class of bountiable equipment A in respect of which a declaration under subsection 6(4) is in force by the conversion into such equipment of other equipment (whether or not bountiable equipment A).

robotic machine means a completely assembled power fed machine that:

(a) is controlled by an integrated computer controller; and

(b) consists of:

(i) a structure with mechanical linkages and joints capable of handling objects by simultaneous movements in 2 or more axes; or

(ii) a prescribed structure; and

(c) is designed to operate independently of human control when the computer controller that controls it is programmed; and

(d) utilises:

(i) a system known as pick and place;

(ii) a system known as playback (point to point);

(iii) a system known as playback (continuous path); or

(iv) a prescribed system; and

(e) if it were imported into Australia, would be goods to which:

(i) a heading in Chapter 84 or 85 in Schedule 3 to the Tariff Act; or

(ii) a heading in Schedule 3 to the Tariff Act determined by the Minister by instrument in writing;

would apply;

not being:

(f) an automatic guided vehicle; or

(g) teleoperated equipment; or

(h) a machine included in a class of machines in respect of which a declaration under subsection 6(5) is in force; or

(i) lifting and handling machinery, known as a skip handling machine, to which subheading 8422.30.00 in Schedule 3 to the Tariff Act would apply if the machinery were imported into Australia.

system equipment means:

(a) conveying equipment;

(b) assembly equipment;

(c) computer hardware; or

(d) software.

system machine means:

(a) a computer controlled machine;

(b) a numerically controlled machine;

(c) a robotic machine that is of a kind used for the working of metal or advanced materials;

(d) an independent machine; or

(e) a machine included in a class of machines in respect of which a declaration under subsection 6(6) is in force.

Tariff Act means the Customs Tariff Act 1995.

terminating day means 30 June 1997.

variable definition means a definition in this subsection of:

(a) a kind or class of equipment;

(b) a kind or class of goods, including metal;

(c) a kind of process; or

(d) a person who carries out a kind of process.

variable provision means subsection 4(6), 4(7), 10(1) or 11(1) or section 12 or 16.

(1A) For greater certainty, and without, by implication, affecting the application of paragraph (c) of the definition of a variable definition in any other respect, the modification of bountiable equipment B is declared to be a kind of process within the meaning of that paragraph.

(2) A reference in this Act to the production of bountiable equipment shall be read as a reference to the manufacture of bountiable equipment A or the modification of bountiable equipment B.

(3) Where a declaration under subsection 6(7) in respect of a variable definition is in force, this Act has effect as if there were substituted for that definition the definition set out in the notice containing the declaration.

(4) Where a declaration under subsection 7(1) in respect of a variable provision, or part of a variable provision, is in force, this Act has effect as if there were substituted for that provision, or that part of a provision, as the case may be, the provision, or part of a provision, as the case may be, set out in the notice containing the declaration.

(5) Where the Tariff Act is proposed to be altered by a Customs Tariff alteration proposed in the Parliament in such a way that Schedule 3 to that Act would be amended, or would be deemed to have been amended, on a particular day, that Act shall, for the purposes of this Act, be deemed to have been so amended on that day.

(6) For the purposes of this Act, the following shall be taken to form part of a flexible manufacturing system:

(a) computer hardware, and software, used in the computer controller that controls the conveying and assembly equipment that forms part of the system;

(b) a machine work station associated with the system.

(7) For the purposes of this Act, where:

(a) the manufacture of bountiable equipment A has been completed except for the connection of 2 or more components of the equipment;

(b) the manufacture of each of those components was completed at registered premises; and

(c) a manufacturer of the equipment intends to connect those components at a place other than registered premises;

the manufacture of the equipment shall be deemed to have been completed on the last day on which the manufacture of a component of the equipment was completed.

(8) For the purposes of this Act, where:

(a) the modification of bountiable equipment B has been completed except for the connection of 2 or more components of the equipment;

(b) the modification of each of those components that was modified was completed at registered premises; and

(c) a modifier of the equipment intends to connect those components at a place other than registered premises;

the modification of the equipment shall be deemed to have been completed on the last day on which the modification of a component of the equipment was completed.

(9) For the purposes of this Act, the following shall not be taken to be a process in the modification of bountiable equipment B:

(a) the re‑conditioning or repair of used parts or materials;

(b) the supply of tooling.

(10) For the purposes of this Act, 2 persons shall be deemed to be associates of each other if, and only if:

(a) both being natural persons:

(i) they are connected by a blood relationship or by marriage or by adoption; or

(ii) one of them is an officer or director of a body corporate controlled, directly or indirectly, by the other;

(b) both being bodies corporate:

(i) both of them are controlled, directly or indirectly, by a third person (whether or not a body corporate);

(ii) both of them together control, directly or indirectly, a third body corporate; or

(iii) the same person (whether or not a body corporate) is in a position to cast, or control the casting of, 5% or more of the maximum number of votes that might be cast at a general meeting of each of them;

(c) one of them, being a body corporate, is, directly or indirectly, controlled by the other (whether or not a body corporate);

(d) one of them, being a natural person, is an employee, officer or director of the other (whether or not a body corporate);

(e) they are members of the same partnership; or

(f) they are trustees or beneficiaries, or one of them is a trustee and the other is a beneficiary, of the same trust.

5 Amendments of Tariff Act

(1) Where:

(a) the Tariff Act is amended on a day; and

(b) the amendment results in goods of a particular kind ceasing to be bountiable equipment A;

the manufacture of goods of that kind the manufacture of which was commenced before and completed after that day shall, for the purposes of this Act, be deemed to have been completed on the day immediately preceding that day.

(2) Where:

(a) the Tariff Act is amended on a day (in this subsection referred to as the operative day);

(b) the amendment results in goods of a particular kind ceasing to be bountiable equipment A; and

(c) the operative day is earlier than:

(i) the day (if any) on which notice of intention to propose a Customs Tariff alteration by way of that amendment was published in the Gazette in accordance with section 273EA of the Customs Act 1901;

(ii) the day (if any) on which a Customs Tariff alteration by way of that amendment was proposed in the Parliament; or

(iii) the day on which the Bill for the Act making that amendment was introduced into the Parliament;

whichever occurred first;

the manufacture of goods of that kind the manufacture of which was:

(d) completed after the operative day and before the day referred to in subparagraph (c)(i), (ii) or (iii) that occurred first; or

(e) commenced, and undertaken in pursuance of a firm order placed before, and completed after, the last‑mentioned day;

shall, for the purposes of this Act, be deemed to have been completed on the day immediately preceding the operative day.

(3) For the purposes of subsections (1) and (2), the manufacture of goods shall not be taken to have commenced unless and until a process in the manufacture of the goods has been commenced at registered premises.

(4) Where:

(a) the Tariff Act is amended on a day; and

(b) the amendment results in goods of a particular kind ceasing to be bountiable equipment B;

the modification of goods of that kind the modification of which was commenced before and completed after that day shall, for the purposes of this Act, be deemed to have been completed on the day immediately preceding that day.

(5) Where:

(a) the Tariff Act is amended on a day (in this subsection referred to as the operative day);

(b) the amendment results in goods of a particular kind ceasing to be bountiable equipment B; and

(c) the operative day is earlier than:

(i) the day (if any) on which notice of intention to propose a Customs Tariff alteration by way of that amendment was published in the Gazette in accordance with section 273EA of the Customs Act 1901;

(ii) the day (if any) on which a Customs Tariff alteration by way of that amendment was proposed in the Parliament; or

(iii) the day on which the Bill for the Act making that amendment was introduced into the Parliament;

whichever occurred first;

the modification of goods of that kind the modification of which was:

(d) completed after the operative day and before the day referred to in subparagraph (c)(i), (ii) or (iii) that occurred first; or

(e) commenced and undertaken in pursuance of a firm order placed before, and completed after, the last‑mentioned day;

shall, for the purposes of this Act, be deemed to have been completed on the day immediately preceding the operative day.

(6) For the purposes of this section, the modification of goods shall not be taken to have commenced unless and until a process in the modification of the goods has been commenced at registered premises.

6 Declarations relating to definitions

(1) The Minister may, by notice in writing published in the Gazette, declare a class of machines to be a class of machines to which paragraph (h) of the definition of bountiable equipment AA in subsection 4(1) applies.

(2) The Minister may, by notice in writing published in the Gazette, declare a class of parts or components for bountiable equipment AA or bountiable equipment AB to be a class of parts or components to which paragraph (j) of the definition of bountiable equipment AA in subsection 4(1) applies.

(3) The Minister may, by notice in writing published in the Gazette, declare a class of machines to be a class of machines to which paragraph (f) of the definition of bountiable equipment B in subsection 4(1) applies.

(4) The Minister may, by notice in writing published in the Gazette, declare a class of bountiable equipment to be a class of bountiable equipment to which paragraph (b) of the definition of retrofit manufacture in subsection 4(1) applies.

(5) The Minister may, by notice in writing published in the Gazette, declare a class of machines to be a class of machines to which paragraph (h) of the definition of robotic machine in subsection 4(1) applies.

(6) The Minister may, by notice in writing published in the Gazette, declare a class of machines to be a class of machines to which paragraph (e) of the definition of system machine in subsection 4(1) applies.

(7) The Minister may, by notice in writing published in the Gazette, declare that this Act is to have effect as if there were substituted for a specified variable definition a definition set out in the notice.

(8) The Minister may, by notice in writing published in the Gazette, revoke or amend a declaration in force under subsection (1), (2), (3), (4), (5), (6) or (7).

(9) A declaration under subsection (1), (2), (3), (4), (5), (6) or (7) or the revocation or amendment of such a declaration has effect from and including such day (which, except in the case of a revocation or amendment that has the result that goods of a kind cease to be bountiable equipment, may be a day earlier than the publication in the Gazette of the notice containing the declaration, revocation or amendment) as is specified in the notice.

(10) Where, by virtue of the revocation or amendment of a declaration under subsection (1), (2), (3), (4), (5), (6) or (7), goods of a kind cease to be bountiable equipment A on a day, the manufacture of goods of that kind the manufacture of which was commenced before and completed after that day shall, for the purposes of this Act, be deemed to have been completed on the day immediately preceding that day.

(11) Where, by virtue of the revocation or amendment of a declaration under subsection (1), (2), (3), (4), (5), (6) or (7), goods of a kind cease to be bountiable equipment B on a day, the modification of goods of that kind the modification of which was commenced before and completed after that day shall, for the purposes of this Act, be deemed to have been completed on the day immediately preceding that day.

(12) The provisions of sections 48 (other than paragraphs (1)(a) and (b) and subsection (2)), 48A, 48B, 49, 49A and 50 of the Acts Interpretation Act 1901 apply in relation to notices under this section as if in those provisions references to regulations were references to notices, references to a regulation were references to a notice and references to a repeal were a reference to a revocation.

(13) For the purposes of this section, the manufacture of goods shall not be taken to have commenced unless and until the assembly of the goods, or of part of the goods, has commenced.

7 Declarations relating to specification, value or costs

(1) Subject to subsection (2), the Minister may, by notice in writing published in the Gazette, declare that this Act is to have effect as if there were substituted for a specified variable provision, or a specified part of a specified variable provision, a provision, or part of a provision, as the case may be, set out in the notice.

(2) The Minister shall not make a declaration under subsection (1) that would result in this Act having effect as if there were a change to subsection 16(1).

(3) The Minister may, by notice in writing published in the Gazette, revoke or amend a declaration in force under subsection (1).

(4) A declaration under subsection (1) or the revocation or amendment of such a declaration has effect from and including such day (which may be a day earlier than the publication in the Gazette of the notice containing the declaration, revocation or amendment) as is specified in the notice.

(5) Where, but for this subsection, a declaration under subsection (1) or the revocation or amendment of such a declaration would result in the amount of the bounty payable in respect of the manufacture or modification of particular bountiable equipment the manufacture or modification, as the case may be, of which was commenced before the day on which the notice containing the declaration, revocation or amendment was published in the Gazette being reduced, that declaration, revocation or amendment does not apply in relation to that particular bountiable equipment.

(6) Where, but for this subsection, a declaration under subsection (1) or the revocation or amendment of such a declaration would result in bounty ceasing to be payable in respect of the manufacture or modification of particular bountiable equipment the manufacture or modification, as the case may be, of which was commenced before the day on which the notice containing the declaration, revocation or amendment was published in the Gazette, that declaration, revocation or amendment does not apply in relation to that particular bountiable equipment.

(7) The provisions of sections 48 (other than paragraphs (1)(a) and (b) and subsection (2)), 48A, 48B, 49, 49A and 50 of the Acts Interpretation Act 1901 apply in relation to notices under this section as if in those provisions references to regulations were references to notices, references to a regulation were references to a notice and references to a repeal were a reference to a revocation.

(8) For the purposes of this section, the manufacture of goods shall not be taken to have commenced unless and until the assembly of the goods, or of part of the goods, has commenced.

8 Declarations of percentages

(2) The Minister may, by notice in writing published in the Gazette, declare a percentage specified in the notice to be prescribed percentage 2 for the purposes of section 17.

(4) The Minister may, by notice in writing published in the Gazette, declare a percentage specified in the notice to be prescribed percentage 4 for the purposes of section 17.

(5) The Minister may, by notice in writing published in the Gazette, revoke a declaration in force under subsection (2) or (4).

(6) A declaration under subsection (2) or (4) or the revocation of such a declaration has effect from and including such day (which may be a day earlier than the publication in the Gazette of the notice containing the declaration or revocation) as is specified in the notice.

(7) Where, but for this subsection, a declaration under subsection (2) or (4) or the revocation of such a declaration would result in the amount of the bounty payable under section 16 in respect of the manufacture or modification of particular bountiable equipment the manufacture or modification, as the case may be, of which was commenced before the day on which the notice containing the declaration or revocation was published in the Gazette being reduced, that declaration or revocation does not apply in relation to that bounty.

(8) The provisions of sections 48 (other than paragraphs (1)(a) and (b) and subsection (2)), 48A, 48B, 49, 49A and 50 of the Acts Interpretation Act 1901 apply in relation to notices under this section as if in those provisions references to regulations were references to notices, references to a regulation were references to a notice and references to a repeal were a reference to a revocation.

(9) For the purposes of this section, the manufacture of goods shall not be taken to have commenced unless and until the assembly of the goods, or of part of the goods, has commenced.

10 Value added—manufacture

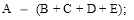

(1) For the purposes of this Act, the value added to bountiable equipment A by a manufacturer of the equipment in the course of the manufacture of the equipment shall be deemed to be an amount ascertained in accordance with the formula:

where:

A is the factory cost incurred by the manufacturer:

(a) in carrying out a process or processes in the manufacture of the equipment; or

(b) in preparing for, or arranging, the carrying out by another manufacturer of the equipment of a process or processes in the manufacture of the equipment;

B is the cost (included in that factory cost) of parts and materials delivered into the store of the manufacturer, being parts and materials supplied to the manufacturer for use in the manufacture or packaging of the equipment;

C is the cost (included in that factory cost) of any process carried out, or any production service provided by:

(a) the manufacturer, or a person employed by the manufacturer, otherwise than at premises registered under section 28 in the name of the manufacturer; or

(b) a person other than:

(i) the manufacturer; or

(ii) a person employed by the manufacturer;

not being a production service carried out in Australia by or on behalf of the manufacturer;

D is interest (included in that factory cost) on money borrowed from another person for the purpose of financing research or development other than research and development carried out in Australia by or on behalf of the manufacturer;

E is such costs (if any) as are prescribed.

(2) For the purposes of this Act, where bountiable equipment A (in this subsection referred to as the relevant equipment) is manufactured from other bountiable equipment A or from goods in respect of which bounty under this Act or another Act has, or will become payable:

(a) the value added to the relevant equipment by a manufacturer of the relevant equipment in the course of the manufacture of the relevant equipment does not include any value added by the manufacturer to the other equipment or goods; and

(b) the factory cost incurred by a manufacturer of the relevant equipment in the course of the manufacture of the relevant equipment does not include any factory cost incurred by the manufacturer in respect of the other equipment or goods.

(3) For the purposes of this Act, where bountiable equipment A is retrofit manufactured:

(a) the value added to that equipment by the manufacturer of that equipment in the course of the retrofit manufacture of that equipment does not include any value added by that manufacturer to the equipment from which the first‑mentioned equipment was retrofit manufactured; and

(b) the factory cost incurred by a manufacturer of the first‑mentioned equipment in the course of the retrofit manufacture of that first‑mentioned equipment does not include any factory cost incurred by that manufacturer in the manufacture of the equipment from which the first‑mentioned equipment was retrofit manufactured.

11 Value added—modification

(1) For the purposes of this Act, the value added to bountiable equipment B by a modifier of the equipment in the course of the modification of the equipment shall be deemed to be an amount ascertained in accordance with the formula:

where:

F is the factory cost incurred by the modifier:

(a) in carrying out a process or processes in the modification of the equipment; or

(b) in preparing for, or arranging, the carrying out by another modifier of the equipment of a process or processes in the modification of the equipment;

G is the cost (included in that factory cost) of parts and materials delivered into the store of the modifier, being parts and materials supplied to the modifier for use in the modification or packaging of the equipment;

H is the cost (included in that factory cost) of any process carried out, or any production service provided by:

(a) the modifier, or a person employed by the modifier, otherwise than at premises registered under section 28 in the name of the modifier; or

(b) a person other than:

(i) the modifier; or

(ii) a person employed by the modifier;

not being a production service carried out in Australia by or on behalf of the modifier;

I is interest (included in that factory cost) on money borrowed from another person for the purpose of financing research or development other than research and development carried out in Australia by or on behalf of the modifier;

J is such costs (if any) as are prescribed.

(2) For the purposes of this Act, where bountiable equipment B is modified:

(a) the value added to the equipment by a modifier of the equipment in the course of the modification of the equipment does not include any value added by the modifier to the equipment before the modification; and

(b) the factory cost incurred by a modifier in the course of the modification of the equipment does not include any factory cost incurred by the modifier in respect of the equipment before the modification.

12 Factory cost

(1) For the purposes of this Act, the factory cost incurred by a producer in the course of the manufacture of bountiable equipment A or the modification of bountiable equipment B includes:

(a) overhead charges (including rent, hire or leasing costs in relation to factory buildings, plant or equipment) apportioned on the basis of a full accounting period of the producer; and

(b) other costs incurred by the producer in connection with the manufacture or modification, as the case may be, and packaging of the equipment including:

(i) salaries, wages and other remunerations;

(ii) costs of parts and materials (including the cost of wastage) delivered into the store of the producer; and

(iii) the cost of any process carried out, or any production service provided, by the producer or another person.

(2) For the purposes of this Act, where, in an accounting period of a producer who is a manufacturer of bountiable equipment A, the producer:

(a) meets expenditure on research and development; or

(b) incurs design, system engineering, software or testing costs;

in respect of bountiable equipment A of a kind that is, or is likely to be, manufactured in Australia, by the producer, the factory cost incurred by the producer in that period in connection with the process or processes in the manufacture of bountiable equipment A carried out at registered premises shall include that expenditure or those costs, as the case may be, but no other factory costs shall include that expenditure or those costs, as the case may be.

(3) For the purposes of this Act, where, in an accounting period of a producer who is a modifier of bountiable equipment B, the producer:

(a) meets expenditure on research; or

(b) incurs design, system engineering, software or testing costs;

in respect of bountiable equipment B of a kind that is, or is likely to be, modified in Australia by the producer, the factory cost incurred by the producer in that period in connection with the process or processes in the modification of bountiable equipment B carried out at registered premises shall include that expenditure or those costs, as the case may be, but no other factory costs shall include that expenditure or those costs, as the case may be.

(4) For the purposes of this Act, where, in an accounting period of a producer who is a manufacturer of bountiable equipment A, the producer receives from the Commonwealth, from a State, from a Territory or from an authority of the Commonwealth, of a State or of a Territory, a grant in respect of the manufacture of, of research relating to the manufacture of, or of development relating to the manufacture of, bountiable equipment A of a particular kind, the factory cost incurred by the producer in that period in connection with the process or processes in the manufacture of bountiable equipment A of that kind carried out at registered premises shall be reduced by the amount of that grant.

(5) For the purposes of this Act, where, in an accounting period of a producer who is a modifier of bountiable equipment B, the producer receives from the Commonwealth, from a State, from a Territory or from an authority of the Commonwealth, of a State or of a Territory, a grant in respect of the modification of, of research relating to the modification of, or of development relating to the modification of, bountiable equipment B of a particular kind, the factory cost incurred by the producer in that period in connection with the process or processes in the modification of bountiable equipment B of that kind carried out at registered premises shall be reduced by the amount of that grant.

(6) For the purposes of this Act, the factory cost incurred by a producer in connection with processes in the manufacture of bountiable equipment A or in the modification of bountiable equipment B does not include:

(a) costs of general administration (other than factory administration), including, where the producer is a body corporate, corporate expenses;

(b) selling and service charges;

(c) sales tax in respect of completed equipment or equipment that has been modified, as the case may be;

(d) tax on income, other than tax on income deducted in respect of the wages, salaries or other remuneration of employees;

(e) costs incurred after the completion of the manufacture or modification, as the case may be, of the equipment, other than costs of, or relating to, the testing or packaging of the equipment at registered premises;

(f) without limiting paragraph (e), the commissioning and installation of completed equipment or equipment that has been modified, as the case may be, for the intended user of the equipment, whether or not the user is the producer;

(g) the value of perquisites provided to employees of the producer (including, where the producer is a body corporate, staff of that body corporate) that does not form part of their taxable income;

(h) profit;

(j) bonuses paid out of profits;

(k) costs charged or levied on the producer by an associate of the producer that are not costs actually incurred by the associate;

(m) interest, other than interest on money borrowed from another person for the purpose of financing:

(i) bought‑in material and stock;

(ii) work in progress;

(iii) research and development; or

(iv) the purchase of production plant, production equipment, or factory buildings, owned by the producer;

(n) depreciation of buildings, other than depreciation at a rate of 4% per annum, or, if another rate is prescribed, that other rate, on the historic cost of factory buildings owned by the producer;

(p) depreciation of machinery, plant or equipment other than depreciation of machinery, plant or equipment, owned by the producer that is:

(i) depreciation allowed by the Commissioner of Taxation for the purposes of a law of the Commonwealth relating to taxation; or

(ii) depreciation for which the producer can deduct amounts under Division 40 of the Income Tax Assessment Act 1997;

(q) losses incurred on the sale or other disposal of buildings, machinery, plant or equipment;

(r) long service leave, other than provision for such leave;

(s) severance pay, other than severance pay in relation to service during a period that is within the bounty period and during which the producer was a manufacturer of bountiable equipment A or a modifier of bountiable equipment B, as the case may be;

(t) freight, and costs relating to vehicles, incurred in respect of the delivery of completed equipment or equipment that has been modified, as the case may be;

(u) royalties;

(w) the cost of the right to use a patent, manufacturing design or process including software;

(x) the cost of superannuation and similar schemes, other than such cost allowed by the Commissioner of Taxation for the purposes of a law of the Commonwealth relating to Taxation;

(y) workers’ compensation, other than insurance premiums for such compensation;

(z) the cost to acquire, recondition or repair any used machine, components, parts or materials that form part of the equipment;

(za) the cost of any parts or materials on which bounty has been paid or is to become payable to the manufacturer under the Bounty (Computers) Act 1984 or the Bounty (Metal‑working Machine Tools) Act 1978;

(zb) the cost of tooling that is a part or an accessory for bountiable equipment; and

(zc) such costs (if any) as are prescribed.

13 Determination of factory cost etc.

(1) Where, in relation to a claim for bounty or to a return in accordance with section 24 or otherwise for the purposes of this Act, the CEO:

(a) is unable to verify the factory cost incurred by a producer in respect of bountiable equipment; or

(b) forms the opinion that, having regard to sound accounting principles, costs included in the factory cost incurred by a producer in respect of bountiable equipment:

(i) are incorrect or overestimated;

(ii) are higher than would have been the case if the producer had not marginally costed or similarly disproportionately costed the production of goods in respect of which bounty is not payable;

(iii) have been fixed in order to obtain an increase in bounty;

(iv) are unduly higher than similar costs incurred by other producers of similar equipment;

(v) have been increased as the result of the influence of a relationship between the producer and an associate of the producer; or

(vi) are higher than would have been the case if the producer had provided services that were provided, and charged for, by an associate of the producer;

the CEO may, by instrument in writing signed by him or her, determine, for the purposes of this Act, the factory cost incurred by a producer in respect of the equipment, being the cost that, having regard to all relevant circumstances, the CEO considers to be appropriate, and that determination shall have effect accordingly.

(2) Where, in relation to a claim for bounty or to a return in accordance with section 24 or otherwise for the purposes of this Act, the CEO:

(a) is unable to verify a cost referred to in section 10, 11 or 12 in respect of bountiable equipment; or

(b) forms the opinion that, having regard to sound accounting principles, such a cost:

(i) is incorrect or underestimated;

(ii) is lower than would have been the case if the relevant producer had not marginally costed or similarly disproportionately costed the production of goods in respect of which bounty is not payable;

(iii) has been fixed in order to obtain an increase in bounty;

(iv) is unduly lower than a similar cost incurred by other producers of similar equipment;

(v) has been reduced as the result of the influence of a relationship between the producer and an associate of the producer; or

(vi) is lower than would have been the case if the producer had provided services that were provided, and charged for, by an associate of the producer;

the CEO may, by instrument in writing signed by him or her, determine that cost for the purposes of this Act, being the cost that, having regard to all relevant circumstances, the CEO considers to be appropriate, and that determination shall have effect accordingly.

(3) When making a determination under subsection (1) or (2) in relation to a bountiable equipment A or bountiable equipment B, the CEO may, if he or she considers it appropriate, disregard any costs charged to, or levied on, the manufacturer of the bountiable equipment A or the modifier of the bountiable equipment B, as the case may be, by an associate of the manufacturer or modifier, as the case may be, other than costs actually incurred by the associate.

14 Accounting period

For the purposes of this Act, an accounting period of a manufacturer of bountiable equipment is:

(a) where the manufacturer has an accounting year that relates to the equipment (not being an accounting year that is longer or shorter than 12 months)—that accounting year; or

(b) in any other case—a financial year.

15 Uniformity

A power conferred on the Governor‑General, the Minister or the CEO by this Act shall not be exercised in such a manner that bounty under this Act would not be uniform throughout the Commonwealth, within the meaning of paragraph 51(iii) of the Constitution.

15A Application of the Criminal Code

Chapter 2 of the Criminal Code applies to all offences created by this Act.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Part II—Bounty

16 Specification of bounty

(1) Bounty is payable in accordance with this Act on the production in Australia of bountiable equipment.

(2) Bounty in respect of the manufacture of bountiable equipment A is payable to the manufacturer, or the manufacturers, of the equipment.

(3) Bounty in respect of the modification of bountiable equipment B is payable to the modifier, or the modifiers, of the equipment.

(4) A manufacturer of bountiable equipment A is not entitled to receive payment of bounty in respect of the manufacture of bountiable equipment A unless:

(a) all the processes in the manufacture of the equipment carried out in Australia by the manufacturer (if any) were carried out at registered premises;

(b) the last substantial process in the manufacture of the equipment was carried out at registered premises;

(c) the manufacture of the equipment was completed during the bounty period; and

(d) the amount that is the value added to the equipment by the manufacturer in the course of the manufacture of the equipment is not less than the amount that is 20% of the factory cost incurred by the manufacturer in respect of the manufacture of the equipment.

(5) A manufacturer of bountiable equipment A is not entitled to receive a payment of bounty in respect of the manufacture of bountiable equipment A (other than bountiable goods AB) unless, during the bounty period, the equipment:

(a) was sold, or otherwise disposed of, by the manufacturer for use in the production of other goods; or

(b) was sold, or otherwise disposed of, to the Commonwealth.

(6) A manufacturer of bountiable equipment A is not entitled to receive a payment of bounty in respect of the manufacture of bountiable goods AB, unless, during the bounty period, the goods were sold, or otherwise disposed of, by the manufacturer for use by another manufacturer of bountiable equipment A as an original component in other equipment manufactured at registered premises.

(7) A manufacturer of bountiable equipment A is not entitled to receive a payment of bounty in respect of the retrofit manufacture of bountiable equipment A unless the amount that is the factory cost incurred by the manufacturer in carrying out a process or processes in the retrofit manufacture of the equipment is not less than $20,000 or, if another amount is prescribed, that other amount.

(8) A modifer of bountiable equipment B is not entitled to receive a payment of bounty in respect of the modification of bountiable equipment B unless:

(a) all the processes in the modification of the equipment carried out in Australia by the modifier (if any) were carried out at registered premises;

(b) the last substantial process in the modification of the equipment was carried out at registered premises;

(c) the modification of the equipment was completed during the bounty period;

(d) the amount that is the value added to the equipment by the modifier in the course of the modification is not less than the amount that is 20% of the factory cost incurred by the modifier in respect of the modification of the equipment;

(e) during the bounty period, the equipment:

(i) was sold, or otherwise disposed of, by the modifier or a modifier of the equipment for use in the production of other goods; or

(ii) was sold, or otherwise disposed of, to the Commonwealth;

(f) where the modification of the equipment was by way of the conversion of the equipment from equipment that was not designed to form part of a flexible manufacturing system into equipment designed to form part of such a system—during the bounty period, the equipment:

(i) was sold, or otherwise disposed of, by the modifier or a modifier of the equipment for use in such a system; or

(ii) was sold, or otherwise disposed of, to the Commonwealth; and

(g) the amount that is the factory cost incurred by the modifier in carrying out the processes in the modification of the equipment is not less than $20,000 or, if another amount is prescribed for the purposes of this paragraph, that other amount.

(9) Bounty is not payable to the Commonwealth, a State, a Territory or an authority of the Commonwealth, of a State or of a Territory (including an educational institution established by the Commonwealth, a State or a Territory).

(10) Bounty is not payable in respect of any equipment designed to carry out a task on a work piece if the carrying out of that task requires the equipment to be held in the hand of a human being.

(11) Bounty is not payable in respect of equipment on which bounty has become, or will become, payable (whether or not it has been paid) under the Bounty (Metal‑working Machine Tools) Act 1978 or the Bounty (Computers) Act 1984.

(11A) Bounty is not payable in respect of bountiable equipment that the CEO is satisfied was, or will be, after 1 July 1990, exported, either directly or indirectly through another country or other countries, to New Zealand.

(12) Where:

(a) by virtue of subsection 28(4), the CEO determines that the registration of premises shall be deemed to have taken effect on and from 1 July 1985; and

(b) on that day, the person who applied for the registration of the premises is the owner of bountiable equipment A, being equipment that:

(i) is a machine‑tool within the meaning of the Bounty (Metal‑working Machine Tools) Act 1978 on which bounty under that Act has not, and will not, become payable; or

(ii) was not manufactured in pursuance of a firm order placed before 30 May 1985;

the equipment shall, for the purposes of this Act, be deemed to have been manufactured by the first‑mentioned person at the registered premises on 1 July 1985.

(13) Where:

(a) by virtue of subsection 28(4), the CEO determines that the registration of premises shall be deemed to have taken effect on and from 1 July 1985; and

(b) on that day, the person who applied for the registration of the premises is the owner of partly manufactured bountiable equipment A, being equipment that:

(i) when completed, will be a machine‑tool within the meaning of the Bounty (Metal‑working Machine Tools) Act 1978 on which bounty under that Act will not become payable; or

(ii) is not being manufactured in pursuance of a firm order placed before 30 May 1985;

the manufacture of that equipment shall, for the purposes of this Act, be deemed to have been commenced on 1 July 1985.

17 Amount of bounty

(1) The bounty payable to a manufacturer of bountiable equipment A in respect of the normal manufacture of bountiable equipment AA is:

(b) where the manufacture of the equipment is completed on or after 1 July 1986 and before 1 July 1991—an amount equal to prescribed percentage 2 of the value added to the equipment by the manufacturer in the course of the normal manufacture of the equipment; or

(c) where the condition specified in subsection 16(5) is satisfied during a financial year beginning on a day specified in column 1 of the table set out in subsection (4A)—an amount equal to the percentage appearing in column 2 of that table opposite the financial year of the value added to the equipment by the manufacturer in the course of the normal manufacture of the equipment.

(1A) Bounty is not payable to a manufacturer of bountiable equipment A in respect of the normal manufacture of bountiable equipment AA under paragraph (1)(b) where bounty is payable to the manufacturer of bountiable equipment A in respect of bountiable equipment AA under paragraph (1)(c).

(2) The bounty payable to a manufacturer of bountiable equipment A in respect of the retrofit manufacture of bountiable equipment that is:

(a) a computer controlled machine;

(b) a numerically controlled machine;

(c) a robotic machine;

(d) a machine included in a class of machines in respect of which a declaration under subsection 6(4) is in force; or

(e) an independent machine;

is:

(g) where such a condition is satisfied in relation to the equipment on a day on or after 1 July 1986 and before 1 July 1991—an amount equal to prescribed percentage 4 of the value added to the equipment by the manufacturer in the course of manufacture of the equipment; or

(h) during a financial year beginning on a day specified in column 1 of the table set out in subsection (4A)—an amount equal to the percentage appearing in column 3 of that table opposite the financial year of the value added to the equipment by the manufacturer in the course of the retrofit manufacture of the equipment.

(3) The bounty payable to a manufacturer of bountiable equipment A in respect of the manufacture of bountiable equipment AB is:

(b) where a condition specified:

(i) in the case of equipment that is an independent machine—in subsection 16(5); or

(ii) in the case of bountiable goods AB—in subsection 16(6);

is satisfied in relation to the equipment on a day on or after 1 July 1986 and before 1 July 1991—an amount equal to prescribed percentage 4 of the value added to the equipment by the manufacturer in the course of manufacture of the equipment; or

(c) where a condition specified:

(i) in the case of equipment that is an independent machine—in subsection 16(5); or

(ii) in the case of bountiable goods AB—in subsection 16(6);

is satisfied in relation to the equipment on a day during a financial year beginning on a day specified in column 1 of the table set out in subsection (4A)—an amount equal to the percentage appearing in column 3 of that table opposite the financial year of the value added to the equipment by the manufacturer in the course of the manufacture of the equipment.

(4) The bounty payable to a modifier of bountiable equipment B in respect of the modification of bountiable equipment B is:

(b) where such a condition is satisfied in relation to the equipment on a day on or after 1 July 1986 and before 1 July 1991—an amount equal to prescribed percentage 4 of the value added to the equipment by the modifier in the course of the modification of the equipment; or

(c) where such a condition is satisfied in relation to the equipment on a day during a financial year beginning on a day specified in column 1 of the table set out in subsection (4A)—an amount equal to the percentage appearing in column 3 of that table opposite the financial year of the value added to the equipment by the modifier in the course of the modification of the equipment.

(4A) In relation to each financial year which begins with a day specified in column 1 of the following Table, the percentages appearing opposite a financial year in columns 2 and 3 are to be used in accordance with this section:

Column 1 | Column 2 | Column 3 |

1 July 1991 | 24% | 20% |

1 July 1992 | 20% | 17% |

1 July 1993 | 16% | 14% |

1 July 1994 | 12% | 11% |

1 July 1995 | 8% | 8% |

1 July 1996 | 5% | 5% |

(5) In this section:

prescribed percentage 2 means 35% or, if a declaration under subsection 8(2) is in force, the percentage specified in that declaration.

prescribed percentage 4 means 25% or, if a declaration under subsection 8(4) is in force, the percentage specified in that declaration.

18 Availability of bounty

(1) Notwithstanding any other provision of this Act, if the CEO is of the opinion that the amount available in a financial year for payment of bounty will be insufficient to meet all valid claims for bounty payable in that year, the CEO may, subject to the regulations:

(a) defer the making of such payments of bounty as the CEO considers appropriate; and

(b) make payments of bounty in such order as the CEO considers appropriate.

(2) Notwithstanding any other provision of this Act, if money is not appropriated by the Parliament for the purpose of the payment of bounty in a financial year, a person is not entitled to be paid bounty in that year.

19 Good quality of bountiable equipment

Bounty is not payable in respect of bountiable equipment if the CEO declares in writing that, in his or her opinion, the equipment is not of good and merchantable quality.

Part III—Payment of Bounty

20 Advances on account of bounty

(1) An advance on account of bounty may be made to a person on such terms and conditions as are approved by the CEO in writing.

(2) If a person receives, by way of advances on account of bounty in respect of particular bountiable goods, an amount that exceeds the amount of bounty payable to the person in respect of those goods, the person is liable to repay to the Commonwealth the amount of the excess.

(3) If a person receives an amount by way of advances on account of bounty that may become payable to the person and the bounty does not become payable to the person, the person is liable to repay to the Commonwealth the amount so received.

(4) If, at the expiration of an accounting period of a producer, the producer has received, by way of advances on account of bounty that may become payable to the producer during that period in respect of bountiable equipment, an amount that exceeds the sum of:

(a) the amount of bounty that became payable to the producer during that period in respect of bountiable equipment; and

(b) the amount or amounts (if any) paid to the producer during that period in respect of bountiable equipment that the producer is liable to repay to the Commonwealth by virtue of subsection (2) or (3);

the producer is liable to repay to the Commonwealth the amount of the excess.

21 Claims for payment of bounty

(1) A person who claims to be entitled to be paid an amount of bounty in respect of bountiable equipment may lodge a claim for payment to the person of the amount.

(2) A claim under subsection (1) in respect of bountiable equipment shall:

(a) be in accordance with the appropriate approved form;

(b) include such information as is, and such estimates as are, required by the form;

(c) be signed and witnessed as required by the form; and

(d) be lodged with a Collector for a State or Territory, or with the CEO:

(i) in the case of bountiable equipment AA—within 12 months after the day on which the condition specified in subsection 16(5) was complied with in respect of that equipment;

(ii) in the case of a claim in respect of bountiable equipment AB—within 12 months after the day on which the condition specified in subsection 16(5) or (6) was complied with in respect of that equipment; or

(iii) in the case of a claim in respect of bountiable equipment B—within 12 months after the day on which the condition specified in paragraph 16(8)(e) or (f) was complied with in respect of that equipment.

(3) As soon as practicable after the lodgment of the claim, the CEO shall, after examining the claim and causing such inquiries as the CEO considers necessary to be made (including inquiries under sections 32 and 33):

(a) if the CEO is satisfied that the claim complies with subsection (2) and that the claimant is, or, if certain estimates are correct, is, otherwise entitled to be paid an amount of bounty in respect of bountiable equipment to which the claim relates—approve, in writing, payment of the amount; or

(b) if the CEO is not so satisfied—refuse, in writing, to approve payment of bounty in respect of the equipment to which the claim relates.

(4) Where the CEO makes a decision under subsection (3) in relation to a claim approving, or refusing to approve, payment of bounty, not being a decision made within 30 days after the lodging of the claim and approving payment of the amount of bounty claimed, the CEO shall cause to be served on the person who lodged the claim, a notice in writing setting out the decision.

22 Variation of inadequate claims

(1) Where a person who has lodged a claim under section 21 (whether or not the claim has been dealt with under subsection 21(3)) considers that the claim was, by reason of an inadvertent error, a claim for an amount of bounty in respect of bountiable equipment that was less than the amount of bounty that the person was entitled to claim in respect of that equipment, the person may lodge a claim for payment to the person of the difference between the 2 amounts.

(2) A claim under subsection (1) in respect of bountiable equipment shall:

(a) be in accordance with the appropriate approved form;

(b) include such information as is, and such estimates as are, required by the form;

(c) be signed and witnessed as required by the form; and

(d) be lodged with a Collector for a State or Territory, or with the CEO, within 12 months after the day on which the condition specified in subsection 16(5) or (6) or paragraph 16(8)(e) or (f), as the case requires, was complied with in respect of the bountiable equipment.

(3) Where a claim under subsection (1) relates to a claim under section 21 that has not been dealt with under subsection 21(3), the 2 claims shall be dealt with under subsection 21(3) as if they were one claim under section 21.

(4) As soon as practicable after the lodgment of a claim under subsection (1) to which subsection (3) does not apply, the CEO shall, after examining the claim and causing such inquiries as the CEO considers necessary to be made (including inquiries under sections 32 and 33):

(a) if the CEO is satisfied that the claim complies with subsection (2) and that the claimant is, or, if certain estimates are correct, is, otherwise entitled to be paid an additional amount of bounty in respect of bountiable equipment to which the claim relates—approve, in writing, payment of the additional amount; or

(b) if the CEO is not so satisfied—refuse, in writing, to approve payment of an additional amount of bounty in respect of the equipment to which the claim relates.

(5) Where the CEO makes a decision under subsection (4) in relation to a claim approving, or refusing to approve, payment of an additional amount of bounty, not being a decision made within 30 days after the lodging of the claim and approving payment of the additional amount claimed, the CEO shall cause to be served on the person who lodged the claim, a notice in writing setting out the decision.

23 Variation of excessive claims

(1) Where a person who has lodged a claim under section 21 (whether or not the claim has been dealt with under subsection 21(3)) subsequently knows that the claim is, by reason of an inadvertent error, a claim for an amount of bounty in respect of bountiable equipment that exceeds the amount of bounty that the person was entitled to claim in respect of that equipment by more than $100, the person shall, within 28 days after discovering the error, lodge an acknowledgement of the error, being an acknowledgement that complies with subsection (2).

Penalty for contravention of this subsection: $1,000.

(2) An acknowledgement under subsection (1) in respect of bountiable equipment shall:

(a) be in accordance with the appropriate approved form;

(b) include such information as is, and such estimates as are, required by the form;

(c) be signed and witnessed as required by the form; and

(d) be lodged with a Collector for a State or Territory or with the CEO.

(3) Where an acknowledgement relates to a claim under section 21 that has not been dealt with under subsection 21(3), the claim shall be dealt with under that subsection as if it had been amended in accordance with the acknowledgement.

(4) Where the CEO, after examining an acknowledgement under subsection (1) to which subsection (3) does not apply and causing such inquiries as the CEO considers necessary to be made (including inquiries under sections 32 and 33), is satisfied that there has been an overpayment of a claim by more than $100, the CEO shall cause to be served on the person who lodged the claim a demand for the repayment of the amount of the overpayment, and that person is liable to repay that amount to the Commonwealth.

24 Producers to furnish returns of costs

(1) A producer shall, within 6 months after the end of each accounting period of the producer that falls, or part of which falls, within the bounty period, furnish a return setting out particulars of the factory cost incurred by the producer in relation to bountiable equipment A manufactured, and bountiable equipment B modified, in that accounting period by the producer.

(2) A return under subsection (1) in respect of bountiable equipment shall:

(a) be in accordance with the appropriate approved form;

(b) include such information as is, and such estimates as are, required by the form;

(c) be signed and witnessed as required by the form; and

(d) be lodged with a Collector for a State or Territory or with the CEO.

(3) The CEO may, by notice signed by the CEO, require a producer who has furnished a return under subsection (1) to provide, within a period specified in the notice (not being a period of less than one month), a certificate, signed by a qualified accountant approved by the CEO for the purpose, to the effect that the particulars set out in the return are correct.

(4) Without limiting the generality of subsection (3), the CEO, in considering whether a producer should be required to furnish a certificate under that subsection, shall have regard to:

(a) the extent of the claims for bounty made by the producer in the relevant accounting period of the producer;

(b) the expense involved in obtaining the certificate; and

(c) the relativity of those claims with that expense.

(5) The CEO shall not refuse to approve a qualified accountant for the purposes of subsection (3) in relation to a producer of bountiable equipment unless the CEO is satisfied that it is not appropriate to approve the accountant because of an association between the accountant and the producer.

(6) A producer shall not refuse or fail to comply with subsection (1) or (2) to the extent that the producer is capable of complying with it.

Penalty for contravention of this subsection: $1,000.

25 Adjustment of claims following returns

(1) Where the particulars of factory cost set out in a return under section 24 in relation to an accounting period of a producer show a difference between that cost and the factory cost, or an estimate of factory cost, on which claims for bounty lodged in respect of that period by the producer were based, not being a cost determined under section 13, the producer shall lodge with the return a statement in respect of the difference.

Penalty for contravention of this subsection: $1,000.

(2) The statement shall:

(a) be in accordance with the appropriate approved form;

(b) include such information as is required by the form; and

(c) be signed and witnessed as required by the form.

(3) Where a statement is lodged by a producer in relation to an accounting period of the producer, the CEO shall, after examining the statement and causing such inquiries as the CEO considers necessary to be made (including inquiries under sections 32 and 33):

(a) if the CEO is satisfied that the statement complies with subsection (2) and that the producer is entitled to be paid an additional amount of bounty in respect of the bountiable equipment for which claims for bounty were lodged in respect of that period—approve, in writing, payment of the additional amount;

(b) if the CEO is satisfied that there has been an overpayment of bounty by more than $100 in respect of the bountiable equipment for which claims for bounty were lodged in respect of that period—cause to be served on the producer a demand for the repayment of the amount of the overpayment, and the producer is liable to repay that amount to the Commonwealth; or

(c) if paragraph (a) or (b) do not apply—decline, in writing, to adjust payments of bounty made in respect of claims lodged by the producer in respect of that period.

(4) Where the CEO makes a decision under subsection (3) in relation to a statement under subsection (1), the CEO shall cause to be served on the producer who lodged the statement a notice in writing setting out the decision.

26 Other adjustments of claims

If the CEO becomes satisfied, otherwise than after examining:

(a) an acknowledgement under subsection 23(1); or

(b) a statement under subsection 25(1);

that there has been an overpayment of a claim for bounty by more than $100, the CEO shall cause to be served on the person who lodged the claim a demand for repayment of the amount of the overpayment, and that person is liable to repay that amount to the Commonwealth.

27 Recovery of repayments

(1) Where a person is liable to repay an amount to the Commonwealth under section 20, 23, 25 or 26, the Commonwealth may recover that amount as a debt due to the Commonwealth by action in a court of competent jurisdiction.

(2) Where a person is liable to repay an amount to the Commonwealth under section 20, 23, 25 or 26, that amount may be deducted from any other amount that is payable to the person under this Act and, where the first‑mentioned amount is so deducted, the other amount shall, notwithstanding the deduction, be deemed to have been paid in full to the person.

Part IV—Administration

28 Registration of premises

(1) Subject to this section, premises that are used solely or principally for industrial or commercial purposes may be registered under this section for the purposes of this Act.

(2) An application for the registration of premises under this section may be made to the CEO, in writing, by a person who carries on, or proposes to carry on, the production of bountiable equipment at those premises.

(3) Subject to subsections (6), (7) and (8), where an application for the registration of premises is made under subsection (2) by a person who, in the opinion of the CEO, carries on, or proposes to carry on, the production of bountiable equipment at those premises, the CEO shall:

(a) register those premises in the name of the applicant by signing a notice, in writing, specifying the date on which it was signed and stating that the premises have been so registered and causing that notice to be served, either personally or by post, on the applicant; or

(b) refuse to register those premises and cause a notice, in writing, stating that the CEO has refused to register those premises to be served, either personally or by post, on the applicant.

(4) The registration of premises under this section has effect from the day on which the notice under paragraph (3)(a), in relation to the premises, is signed, or such earlier day, not being a day earlier than 1 July 1985, as is determined by the CEO and specified in that notice.

(5) A notice under subsection (3) in relation to premises shall specify whether the premises are registered under this section in relation to:

(a) all bountiable equipment; or

(b) a specified class, or specified classes, of bountiable equipment;

and may specify a period as the period during which the premises are registered under this section.

(6) The regulations may prescribe conditions to be complied with in connection with the production of bountiable equipment at registered premises.

(7) If conditions have been prescribed under subsection (6), the CEO shall not register premises under this section unless the CEO is satisfied that the conditions have been, or will be, complied with in respect of those premises.

(8) The CEO may require an applicant for the registration of premises under this section to furnish such information as the CEO considers necessary for the purposes of this Act and may refuse to register the premises until the information is furnished to the satisfaction of the CEO.

(10) The regulations may prescribe conditions to be met by an applicant for the registration of premises under this section, including, without limiting the generality of the foregoing, the condition requiring the applicant to be a person of a specified kind.

(11) If conditions have been prescribed for the purposes of subsection (10), the CEO shall not register premises under this section unless:

(a) the CEO is satisfied that the conditions are, or will be, met by the applicant for the registration of the premises; or

(b) registration of the premises is otherwise permitted under the regulations.

(12) Where:

(a) premises are registered under this section; and

(b) the person in whose name the premises are so registered and a person who carries on, or proposes to carry on, the production of bountiable equipment at those premises (in this subsection referred to as the transferee) make a joint application in writing to the CEO for the transfer of the registration of the premises to the name of the transferee;

the CEO shall transfer the registration of those premises to the name of the transferee by causing a notice, in writing, stating that the registration has been so transferred to be served, either personally or by post, on the transferee.

(13) If conditions have been prescribed for the purposes of subsection (10), the CEO shall not transfer the registration of premises to the name of the transferee unless the CEO is satisfied that, if the transferee were an applicant for the registration of the premises, the CEO would be authorised to register the premises in the name of the transferee.

(14) A transfer under subsection (12) has effect from such day as is specified in the notice under that subsection in relation to the transfer, being a day after the commencement of the bounty period and not earlier than 6 months before the day on which the application for the transfer was made.

(15) Where the CEO becomes satisfied, at any time, in respect of premises registered under this section:

(a) that the production of bountiable equipment is not being carried on at those premises;

(b) in a case where the premises are registered in relation to a class of bountiable equipment—bountiable equipment included in that class of bountiable equipment is not being manufactured at those premises;

(c) that the production of bountiable equipment at those premises is being carried on by a person other than:

(i) the person in whose name the premises are registered; or

(ii) a person who has made an application under paragraph (12)(b) in relation to the premises;

(d) in a case where conditions have been prescribed under subsection (6) or (10)—that, if the person in whose name the premises are registered was, at that time, an applicant for the registration of the premises, the CEO would not be authorised to register the premises in the name of the person; or

(e) those premises are not being used solely or principally for industrial or commercial purposes;

the CEO may cancel the registration of those premises by causing a notice, in writing, stating that the registration of those premises has been cancelled to be served, either personally or by post, on:

(f) the occupier of those premises; and

(g) if the occupier is not the person in whose name those premises are registered, on the person in whose name the premises are registered.

(16) For the purposes of the application of section 29 of the Acts Interpretation Act 1901 to the service on a person by post of a notice under this section in relation to premises, such a notice posted as a letter addressed to that person at the premises shall be deemed to be properly addressed.

29 Accounts

(1) A person is not entitled to bounty unless:

(a) the person keeps, in writing in the English language, such accounts, books, documents and other records as correctly record and explain: