New Business Tax System (Consolidation and Other Measures) Act (No. 1) 2002

No. 117, 2002

An Act to implement a New Business Tax System, and for related purposes

New Business Tax System (Consolidation and Other Measures) Act (No. 1) 2002

No. 117, 2002

An Act to implement a New Business Tax System, and for related purposes

Contents

1 Short title...................................

2 Commencement...............................

3 Schedule(s)..................................

4 Amendment of income tax assessments.................

Schedule 1—Consolidation: assessable income and deductions spread over several membership or non‑membership periods

Income Tax Assessment Act 1997

Schedule 2—Consolidation: group continues when shelf company becomes new head company

Income Tax Assessment Act 1997

Schedule 3—Consolidation: effect on cost base rules etc. of loss of pre‑CGT status of membership interests

Part 1—Basic amendments

Income Tax Assessment Act 1997

Part 2—Consequential CGT amendments

Income Tax Assessment Act 1997

Part 3—Transitional provisions

Income Tax (Transitional Provisions) Act 1997

Schedule 4—Consolidation: new Subdivisions 705‑C (where a consolidated group is acquired by another) and 705‑D (where multiple entities are linked by membership interests)

Income Tax Assessment Act 1997

Schedule 5—Consolidation: allocable cost amount for a joining trust

Part 1—New provisions inserted in the Income Tax Assessment Act 1997

Part 2—Consequential amendment

Income Tax Assessment Act 1997

Income Tax (Transitional Provisions) Act 1997

Schedule 6—Consolidation: losses

Part 1—Maintaining same ownership to utilise transferred losses

Income Tax Assessment Act 1997

Part 2—Utilising losses head company transfers to itself

Income Tax Assessment Act 1997

Part 3—Effect of exit history rule

Income Tax Assessment Act 1997

Schedule 7—Consolidation: foreign tax credits and exit history rule

Income Tax Assessment Act 1997

Schedule 8—Consolidation: MEC groups

Income Tax Assessment Act 1997

Schedule 9—Consolidation: application provision and transitional provisions about trading stock and internally‑generated assets

Income Tax (Transitional Provisions) Act 1997

Schedule 10—Consolidation: transitional rules for MEC tax cost setting provisions

Income Tax (Transitional Provisions) Act 1997

Schedule 11—Consolidation: consequential provisions for research and development

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Taxation Administration Act 1953

Schedule 12—Consolidation: amendments relating to Division 170

Income Tax Assessment Act 1997

Income Tax (Transitional Provisions) Act 1997

Schedule 13—Consolidation: thin capitalisation

Income Tax Assessment Act 1997

Income Tax (Transitional Provisions) Act 1997

Schedule 14—Consolidation: consequential provisions for removal of grouping

Financial Corporations (Transfer of Assets and Liabilities) Act 1993

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Taxation Administration Act 1953

Wool Services Privatisation Act 2000

Schedule 15—Consolidation: foreign tax credits

Income Tax (Transitional Provisions) Act 1997

New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002

Schedule 16—Application of sections 46 and 46A of the Income Tax Assessment Act 1936 after 30 June 2002

Income Tax Assessment Act 1936

Schedule 17—Changes to the imputation system

Income Tax Assessment Act 1997

Schedule 18—Imputation system transitionals

Income Tax (Transitional Provisions) Act 1997

New Business Tax System (Consolidation and Other Measures) Act (No. 1) 2002

No. 117, 2002

An Act to implement a New Business Tax System, and for related purposes

[Assented to 2 December 2002]

The Parliament of Australia enacts:

This Act may be cited as the New Business Tax System (Consolidation and Other Measures) Act (No. 1) 2002.

(1) Each provision of this Act specified in column 1 of the table commences, or is taken to have commenced, on the day or at the time specified in column 2 of the table.

Commencement information | ||

Column 1 | Column 2 | Column 3 |

Provision(s) | Commencement | Date/Details |

1. Sections 1 to 4 and anything in this Act not elsewhere covered by this table | The day on which this Act receives the Royal Assent | 2 December 2002 |

2. Schedules 1 and 2 | Immediately after the commencement of Schedule 1 to the New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002 | 24 October 2002 |

3. Schedule 3, Parts 1 and 2 | Immediately after the commencement of Schedule 1 to the New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002 | 24 October 2002 |

4. Schedule 3, Part 3 | Immediately after the commencement of Schedule 10 to this Act | 24 October 2002 |

5. Schedule 4 | Immediately after the commencement of Schedule 1 to the New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002 | 24 October 2002 |

6. Schedule 5, items 1 to 12 | Immediately after the commencement of Schedule 1 to the New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002 | 24 October 2002 |

7. Schedule 5, item 13 | Immediately after the commencement of Schedule 10 to this Act | 24 October 2002 |

8. Schedule 5, item 14 | Immediately after the commencement of Schedule 1 to the New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002 | 24 October 2002 |

9. Schedules 6 to 15 | Immediately after the commencement of Schedule 1 to the New Business Tax System (Consolidation, Value Shifting, Demergers and Other Measures) Act 2002 | 24 October 2002 |

10. Schedule 16 | The day on which this Act receives the Royal Assent | 2 December 2002 |

11. Schedules 17 and 18 | Immediately after the commencement of the New Business Tax System (Imputation) Act 2002 | 29 June 2002 |

Note: This table relates only to the provisions of this Act as originally passed by the Parliament and assented to. It will not be expanded to deal with provisions inserted in this Act after assent.

(2) Column 3 of the table is for additional information that is not part of this Act. This information may be included in any published version of this Act.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

4 Amendment of income tax assessments

Section 170 of the Income Tax Assessment Act 1936 does not prevent the amendment of an assessment made before the commencement of this section for the purposes of giving effect to this Act.

Income Tax Assessment Act 1997

1 At the end of subsection 701‑30(3)

Add:

; and (c) so that each relevant item is either:

(i) allocated to only one of the non‑membership periods or to a period that is all or part of the rest of the income year; or

(ii) apportioned among such periods (for example, by Subdivision 716‑A (see note to this subsection)).

2 Subsection 701‑30(3) (note)

Repeal the note, substitute:

Note: Other provisions of this Part are to be applied in working out the taxable income or loss, for example:

Subdivision 716 also affects the tax position of the head company of a group of which the entity has been a subsidiary member for some but not all of the income year.

3 Before Division 717

Insert:

Division 716—Miscellaneous special rules

Table of Subdivisions

716‑A Assessable income and deductions spread over several membership or non‑membership periods

716‑1 What this Division is about

Some items of assessable income, and some deductions, are in effect spread over 2 or more income years. This Division apportions the assessable income or deduction for each of those income years among periods within the income year when an entity is, or is not, a subsidiary member of a consolidated group.

This Division also apportions in a similar way some items of assessable income, and some deductions, for a single income year.

Operative provisions

716‑15 Assessable income spread over 2 or more income years

716‑25 Deductions spread over 2 or more income years

716‑70 Capital expenditure that is fully deductible in one income year

Assessable income and deductions arising from share of net income of a partnership or trust, or from share of partnership loss

716‑75 Application

716‑80 Head company’s assessable income and deductions

716‑85 Entity’s assessable income and deductions for a non‑membership period

716‑90 Entity’s share of assessable income or deductions of partnership or trust

716‑95 Special rule if not all partnership or trust’s assessable income or deductions taken into account in working out amount

716‑100 Spreading period

[This is the end of the Guide.]

716‑15 Assessable income spread over 2 or more income years

(1) This section applies if, apart from this Part, a provision of this Act would spread an amount (the original amount) over 2 or more income years (whether or not because of a choice) by including part of the original amount in the same entity’s assessable income for each of those income years.

Head company’s assessable income

(2) If:

(a) for some but not all of an income year, an entity is a *subsidiary member of a *consolidated group; and

(b) a part of the original amount:

(i) would have been included in the assessable income of the *head company of the group for that income year if the entity had been a subsidiary member of the group throughout that income year; but

(ii) would have been included in the entity’s assessable income for that income year if throughout that income year the entity had not been a subsidiary member of any *consolidated group;

the head company’s assessable income for that income year includes a proportion of that part.

Note 1: Examples of when paragraph (2)(b) could be satisfied are:

Note 2: If the entity is a subsidiary member of the group throughout the income year, the part of the original amount will be included in the head company’s assessable income for the income year, either:

(3) The proportion is worked out by multiplying that part of the original amount by:

• the number of days that are in both the income year and the *spreading period, and on which the entity was a *subsidiary member of the group;

divided by:

• the number of days that are in both the income year and the spreading period.

Entity’s assessable income for a non‑membership period

(4) If:

(a) for some but not all of an income year, an entity is a *subsidiary member of a *consolidated group; and

(b) a part of the original amount would have been included in the entity’s assessable income for that income year if throughout that income year the entity had not been a subsidiary member of any *consolidated group;

the assessable income of the entity for a part of the income year that is a non‑membership period for the purposes of section 701‑30 includes a proportion of that part.

Note 1: Section 701‑30 is about working out an entity’s tax position for a period when it is not a subsidiary member of any consolidated group.

Note 2: If throughout the income year the entity is not a subsidiary member of any consolidated group, this section does not affect the part of the original amount that is assessable income of the entity for the income year either:

(5) The proportion is worked out by multiplying that part of the original amount by:

• the number of days that are in both the non‑membership period and the *spreading period;

divided by:

• the number of days that are in both the income year and the spreading period.

Spreading period

(6) The spreading period for the original amount is the period by reference to which the respective parts of the original amount that, apart from this Part, would be included in an entity’s assessable income for the 2 or more income years are worked out.

716‑25 Deductions spread over 2 or more income years

(1) This section applies if, apart from this Part, a provision of this Act would spread an amount (the original amount) over 2 or more income years (whether or not because of a choice) by entitling the same entity to deduct part of the original amount for each of those income years.

(2) However, this section does not apply if the deductions would be for the decline in value of a *depreciating asset.

Note: Such deductions arise under Division 40 (Capital allowances) and Division 328 (Simplified tax system).

Head company’s deduction

(3) If for some but not all of an income year an entity is a *subsidiary member of a *consolidated group, and:

(a) the *head company of the group could have deducted for that income year a part of the original amount if the entity had been a subsidiary member of the group throughout that income year; but

(b) the entity could have deducted that part for that income year if throughout that income year the entity had not been a subsidiary member of any *consolidated group;

the head company can deduct for that income year a proportion of that part.

Note 1: Examples of when paragraphs (3)(a) and (b) could be satisfied are set out in note 1 to subsection 716‑15(2).

Note 2: If the entity is a subsidiary member of the group throughout the income year, the head company can deduct that part for the income year, either:

(4) The proportion is worked out by multiplying that part of the original amount by:

• the number of days that are in both the income year and the *spreading period, and on which the entity was a *subsidiary member of the group;

divided by:

• the number of days that are in both the income year and the spreading period.

Entity’s deduction for a non‑membership period

(5) If:

(a) for some but not all of an income year, an entity is a *subsidiary member of a *consolidated group; and

(b) the entity could have deducted for that income year a part of the original amount if throughout that income year the entity had not been a subsidiary member of any *consolidated group;

the entity can deduct a proportion of that part for a part of the income year that is a non‑membership period for the purposes of section 701‑30.

Note 1: Section 701‑30 is about working out an entity’s tax position for a period when it is not a subsidiary member of any consolidated group.

Note 2: If throughout the income year the entity is not a subsidiary member of any consolidated group or MEC group, this section does not affect the part of the original amount that the entity can deduct for the income year either:

(6) The proportion is worked out by multiplying that part of the original amount by:

• the number of days that are in both the non‑membership period and the *spreading period;

divided by:

• the number of days that are in both the income year and the spreading period.

Spreading period

(7) The spreading period for the original amount is the period by reference to which the respective parts of the original amount that, apart from this Part, an entity could deduct for the 2 or more income years are worked out.

Note: For example, under section 82KZMD of the Income Tax Assessment Act 1936 an item of expenditure on something is spread over the period over which that thing is to be provided, which is called the eligible service period. Deductions for the item for a sequence of income years are worked out by reference to how much of that period falls within each of those income years.

[The next section is section 716‑70]

716‑70 Capital expenditure that is fully deductible in one income year

(1) This section applies if, apart from this Part, an entity could deduct for a single income year the whole of an amount (the original amount) of capital expenditure by the entity.

(2) If for some but not all of an income year an entity is a *subsidiary member of a *consolidated group or *MEC group, and:

(a) the *head company of the group could have deducted the original amount for that income year if the entity had been a subsidiary member of the group throughout that income year; but

(b) the entity could have deducted the original amount for that income year if throughout that income year the entity had not been a subsidiary member of any consolidated group or MEC group;

the head company can deduct for that income year a proportion of the original amount.

Note 1: Examples of when paragraphs (2)(a) and (b) could be satisfied are set out in note 1 to subsection 716‑15(2).

Note 2: If the entity is a subsidiary member of the group throughout the income year, the head company can deduct the original amount for the income year, either:

(3) The proportion is worked out by multiplying the original amount by:

• the number of days that are in the *spreading period, and on which the entity was a *subsidiary member of the group;

divided by:

• the number of days that are in the spreading period.

Entity’s deduction for a non‑membership period

(4) If:

(a) for some but not all of an income year, an entity is a *subsidiary member of a *consolidated group or *MEC group; and

(b) the entity could have deducted the original amount for that income year if throughout that income year the entity had not been a subsidiary member of any consolidated group or MEC group;

the entity can deduct a proportion of the original amount for a part of the income year that is a non‑membership period for the purposes of section 701‑30.

Note 1: Section 701‑30 is about working out an entity’s tax position for a period when it is not a subsidiary member of any consolidated group.

Note 2: If throughout the income year the entity is not a subsidiary member of any consolidated group or MEC group, this section does not affect the entity’s ability to deduct the original amount for the income year either:

(5) The proportion is worked out by multiplying the original amount by:

• the number of days that are in both the non‑membership period and the *spreading period;

divided by:

• the number of days that are in the spreading period.

Spreading period

(6) The spreading period for the original amount:

(a) starts when, apart from this Part, an entity would become entitled to deduct the amount for an income year; and

(b) ends at the end of the income year.

Sections 716‑80 to 716‑100 apply if, apart from this Part:

(a) an amount would be included in an entity’s assessable income for an income year under section 92 (about income and deductions of partner) of the Income Tax Assessment Act 1936 in respect of a partnership; or

(b) an entity could deduct an amount for an income year under section 92 of that Act in respect of a partnership; or

(c) an amount would be included in an entity’s assessable income for an income year under section 97 (Beneficiary of a trust estate who is not under a legal disability) of that Act in respect of a trust; or

(d) an amount would be included in an entity’s assessable income for an income year under section 98A (Non‑resident beneficiaries assessable in respect of certain income) of that Act in respect of a trust.

716‑80 Head company’s assessable income and deductions

(1) If for some but not all of the income year the entity is a *subsidiary member of a *consolidated group or *MEC group:

(a) the assessable income for that income year of the head company of the group includes the entity’s share (worked out under section 716‑90) of each of these:

(i) the total assessable income of the partnership or trust for the income year so far as it is reasonably attributable to a period, during the income year, throughout which the entity was a *subsidiary member of the group but the partnership or trust was not;

(ii) a proportion (worked under subsection (2) of this section) of the total assessable income of the partnership or trust for the income year so far as it is not reasonably attributable to a particular period within the income year; and

(b) the head company of the group can deduct for that income year the entity’s share (worked out under section 716‑90) of each of these:

(i) the total deductions of the partnership or trust for the income year so far as they are reasonably attributable to a period covered by subparagraph (a)(i) of this subsection;

(ii) a proportion (worked under subsection (2) of this section) of the total deductions of the partnership or trust for the income year so far as they are not reasonably attributable to a particular period within the income year.

Note 1: If the entity is a subsidiary member of the group throughout the income year, the amount referred to in section 716‑75 will be included in the head company’s assessable income, or the head company can deduct that amount, for the income year because of section 701‑1 (Single entity rule).

Note 2: While the entity, and the partnership or trust, are both subsidiary members of the group, section 701‑1 (Single entity rule) attributes to the head company all assessable income and deductions giving rise to the amount referred to in section 716‑75.

(2) The proportion is worked out by multiplying the amount concerned by:

• the number of days that are in the *spreading period, and on which the entity was a *subsidiary member of the group but the partnership or trust was not;

divided by:

• the number of days that are in the spreading period.

716‑85 Entity’s assessable income and deductions for a non‑membership period

(1) The assessable income of the entity for a part of the income year that is a non‑membership period for the purposes of section 701‑30 includes the entity’s share (worked out under section 716‑90) of each of these:

(a) the total assessable income of the partnership or trust for the income year so far as it is reasonably attributable to the non‑membership period;

(b) a proportion (worked under subsection (3) of this section) of the total assessable income of the partnership or trust for the income year so far as it is not reasonably attributable to a particular period within the income year.

Note 1: Section 701‑30 is about working out an entity’s tax position for a period when it is not a subsidiary member of any consolidated group.

Note 2: If throughout the income year the entity is not a subsidiary member of any consolidated group or MEC group, this section does not affect the amount referred to in section 716‑75 being assessable income of the entity for the income year.

(2) For a part of the income year that is a non‑membership period for the purposes of section 701‑30, the entity can deduct the entity’s share (worked out under section 716‑90) of each of these:

(a) the total deductions of the partnership or trust for the income year so far as they are reasonably attributable to the non‑membership period;

(b) a proportion (worked under subsection (3) of this section) of the total deductions of the partnership or trust for the income year so far as they are not reasonably attributable to a particular period within the income year.

Note: If throughout the income year the entity is not a subsidiary member of any consolidated group or MEC group, this section does not affect the entity’s ability to deduct for the income year the amount referred to in section 716‑75.

(3) The proportion is worked out by multiplying the amount concerned by:

• the number of days that are in both the non‑membership period and the *spreading period;

divided by:

• the number of days that are in the spreading period.

716‑90 Entity’s share of assessable income or deductions of partnership or trust

(1) If paragraph 716‑75(a) or (b) applies, the entity’s share is worked out by dividing:

• the entity’s individual interest as a partner in the net income of the partnership or in the partnership loss;

by:

• the amount of that net income or partnership loss;

and expressing the result as a percentage.

(2) If paragraph 716‑75(c) or (d) applies, the entity’s share is worked out by dividing:

• the share of the income of the trust to which the entity is presently entitled;

by:

• the amount of that income;

and expressing the result as a percentage.

(1) To the extent that the assessable income of the partnership or trust for the income year was not taken into account in working out the amount referred to in section 716‑75, it is disregarded in applying paragraph 716‑80(1)(a) or subsection 716‑85(1).

Note: For example, if a trust’s net income for an income year must be worked out under section 268‑45 in Schedule 2F to the Income Tax Assessment Act 1936, the trust’s assessable income attributed to a period (in the income year) for which it has a notional loss under section 268‑30 of that Act is not taken into account.

(2) To the extent that the deductions of the partnership or trust for the income year were not taken into account in working out the amount referred to in section 716‑75, they are disregarded in applying paragraph 716‑80(1)(b) or subsection 716‑85(2).

Note: For example, in the case described in the note to subsection (1) of this section, the trust’s deductions attributed to that period are not taken into account in working out the trust’s net income for the income year.

The spreading period for the amount referred to in section 716‑75 is made up of each period:

(a) that is all or part of the income year; and

(b) throughout which the entity is a partner in the partnership or a beneficiary of the trust, as appropriate.

[The next Subdivision is Subdivision 716‑Z]

Table of sections

716‑800 Allocating amounts to periods if head company and subsidiary member have different income years

716‑850 Grossing up threshold amounts for periods of less than 365 days

(1) The principles in this section apply if:

(a) an entity becomes, or stops being, a *subsidiary member of a *consolidated group; and

(b) the entity has an income year that starts and ends at a different time from when the income year of the *head company of the group starts and ends.

(2) Items are to be allocated to, or apportioned among, periods (whether consisting of all or part of an income year of the entity or *head company):

(a) in the most appropriate way having regard to the objects of this Part, and of particular provisions of this Part; and

(b) in particular, so as to ensure that what is in substance the same item is recognised only once for what is in substance the same purpose.

716‑850 Grossing up threshold amounts for periods of less than 365 days

(1) Under some provisions of this Act, something that is relevant to working out:

(a) an entity’s taxable income (if any); or

(b) the income tax (if any) payable on an entity’s taxable income; or

(c) an entity’s loss (if any) of a particular *sort;

is determined on the basis of a comparison between an amount worked out for an income year, or an amount derived from 2 or more such amounts, and another amount.

Note: The other amount assumes an income year of 365 days.

(2) This section affects how such a provision (the threshold provision) operates for the purposes of subsection 701‑30(3), which requires each thing covered by paragraph (1)(a), (b) or (c) of this section to be worked out for an entity for a non‑membership period (under section 701‑30) during an income year.

Note: A non‑membership period is a period (of less than an income year) when the entity is not a subsidiary member of any consolidated group.

(3) An amount that would otherwise be worked out for the non‑membership period, for the purposes of the comparison under the threshold provision, is instead:

(a) to be worked out by reference to the period (the reference period) starting at the start of the income year and ending at the end of the non‑membership period; and

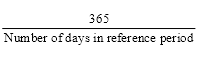

(b) then to be grossed up by multiplying it by this fraction:

4 Subsection 995‑1(1)

Insert:

spreading period for an amount has the meaning given by sections 716‑15, 716‑25, 716‑70 and 716‑100.

Note: Those sections deal with assessable income and deductions spread over several periods of membership or non‑membership of a consolidated group or MEC group.

Schedule 2—Consolidation: group continues when shelf company becomes new head company

Income Tax Assessment Act 1997

1 Paragraph 103‑25(3)(a)

Omit “124‑380(5)”, substitute “124‑380(7)”.

2 At the end of section 124‑360

Add:

(2) You are taken to have chosen to obtain the roll‑over if:

(a) immediately before the time referred to in section 124‑365 as the completion time, the original company is the *head company of a *consolidated group; and

(b) immediately after the completion time, the interposed company is the head company of the group.

Note: The consolidated group continues in existence because of section 703‑70.

3 After subsection 124‑370(1)

Insert:

(1A) You are taken to have chosen to obtain the roll‑over if:

(a) immediately before the time referred to in section 124‑375 as the completion time, the original company is the *head company of a *consolidated group; and

(b) immediately after the completion time, the interposed company is the head company of the group.

Note: The consolidated group continues in existence because of section 703‑70.

4 Subsection 124‑380(5)

Repeal the subsection, substitute:

Choice to be made by interposed company

(5) If:

(a) immediately before the completion time, the original company is the *head company of a *consolidated group; and

(b) immediately after the completion time, the interposed company is the head company of a *consolidatable group consisting only of itself and the *members of the group immediately before the completion time;

the interposed company must choose that the consolidated group is to continue in existence at and after the completion time.

Note: Sections 703‑65 to 703‑80 deal with the effects of the choice for the consolidated group.

(6) If subsection (5) of this section does not apply, the interposed company must choose that section 124‑385 apply.

(7) In either case, the interposed company must make the choice within 2 months after the completion time, or within such further time as the Commissioner allows. The choice cannot be revoked.

Note: This is an exception to the general rule about choices in section 103‑25.

5 Group heading before section 124‑385

Repeal the group heading, substitute:

Consequences for the interposed company unless consolidated group continues

6 Before subsection 124‑385(1)

Insert:

(1A) This section applies if the interposed company so chooses under subsection 124‑380(6).

7 At the end of Subdivision 124‑G

Add:

Additional consequences for member if shares are trading stock or revenue assets

124‑390 Deferral of profit or loss on shares

(1) There are additional consequences if:

(a) under subsection 124‑360(2), you are taken to obtain the roll‑over and, at the time immediately before you *dispose of your *shares in the original company, some or all of them are your *trading stock or *revenue assets; or

(b) under subsection 124‑370(1A), you are taken to obtain the roll‑over and, at the time immediately before the original company redeems or cancels your shares in it, some or all of them are your trading stock or revenue assets.

Trading stock

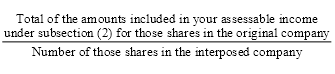

(2) The amount included in your assessable income because of the *disposal, redemption or cancellation of each of your *shares in the original company that is your *trading stock at that time is equal to:

(a) if the share has been your trading stock ever since the start of the income year in which that time occurs—the total of:

(i) its *value as trading stock at the start of the income year; and

(ii) the amount (if any) by which its cost has increased since the start of the income year; or

(b) otherwise—its cost at that time.

(3) For each of the *shares in the interposed company that you acquired in return for those of your shares in the original company that were your *trading stock at that time, you are taken to have paid:

Note: The amount worked out under the formula becomes the cost of each of those shares in the interposed company.

Revenue assets

(4) For each of your *shares in the original company that is a *revenue asset at that time, your assessable income includes the total of the amounts that (apart from this subsection) would be subtracted from the gross disposal proceeds in calculating any profit or loss on your disposing of, or ceasing to own, that share at that time.

(5) For each of the *shares in the interposed company that you acquired in return for those of your shares in the original company that were *revenue assets at that time, you are taken to have paid:

8 At the end of subsection 703‑5(2)

Add:

Note: The group does not cease to exist in some cases where a shelf company is interposed between the head company and its former members: see subsection 124‑380(5) and section 703‑70.

9 Subsection 703‑60(3) (link note)

Repeal the link note.

10 After section 703‑60

Insert:

Effects of choice to continue group after shelf company becomes new head company

Sections 703‑70 to 703‑80 set out the effects if a company (the interposed company) chooses under subsection 124‑380(5) that a *consolidated group is to continue in existence at and after the time referred to in that subsection as the completion time.

Note: The choice is one of the conditions for a compulsory roll‑over under Subdivision 124‑G on an exchange of shares in the head company of a consolidated group for shares in the interposed company.

(1) The *consolidated group is taken not to have ceased to exist under subsection 703‑5(2) because the company referred to in subsection 124‑380(5) as the original company ceases to be the *head company of the group.

(2) To avoid doubt, the interposed company is taken to have become the *head company of the *consolidated group at the completion time, and the original company is taken to have ceased to be the head company at that time.

Note: A further result is that the original company is taken to have become a subsidiary member of the group at that time. Section 703‑80 deals with the original company’s tax position for the income year that includes the completion time.

(3) A provision of this Part that applies on an entity becoming a *subsidiary member of a *consolidated group does not apply to an entity being taken to have become such a member as a result of this section, unless the provision is expressed to apply despite this subsection.

Note: An example of the effect of this subsection is that there is no resetting under section 701‑10 of the tax cost of assets of the original company that become assets of the interposed company because of subsection 701‑1(1) (the single entity rule).

(4) To avoid doubt, subsection (3) does not affect the application of subsection 701‑1(1) (the single entity rule).

(1) Everything that happened in relation to the original company before the completion time:

(a) is taken to have happened in relation to the interposed company instead of in relation to the original company; and

(b) is taken to have happened in relation to the interposed company instead of what would (apart from this section) be taken to have happened in relation to the interposed company before that time;

just as if, at all times before the completion time:

(c) the interposed company had been the original company; and

(d) the original company had been the interposed company.

Note: This section treats the original company and the interposed company as having in effect exchanged identities throughout the period before the completion time, but without affecting any of the original company’s other attributes.

(2) To avoid doubt, subsection (1) also covers everything that, immediately before the completion time, was taken, because of:

(a) section 701‑1 (Single entity rule); or

(b) section 701‑5 (Entry history rule); or

(c) one or more previous applications of this section; or

(d) section 719‑90 (about the effects of a change of head company of a MEC group);

to have happened in relation to the original company.

(3) Subsections (1) and (2) have effect:

(a) for the head company core purposes in relation to an income year ending after the completion time; and

(b) for the entity core purposes in relation to an income year ending after the completion time; and

(c) for the purposes of determining the respective balances of the *franking accounts of the original company and the interposed company at and after the completion time.

(4) Subsections (1) and (2) have effect subject to:

(a) section 701‑40 (Exit history rule); and

(b) a provision of this Act to which section 701‑40 is subject because of section 701‑85 (about exceptions to the core rules in Division 701).

Note: An example of provisions covered by paragraph (b) of this subsection is Subdivision 717‑E (about transferring to a company leaving a consolidated group various surpluses under the CFC and FIF rules in Parts X and XI of the Income Tax Assessment Act 1936).

703‑80 Effects on the original company’s tax position

In applying section 701‑30 to the original company for the income year that includes the completion time, disregard a non‑membership period that starts before the completion time.

Note 1: Section 701‑30 is about working out an entity’s tax position for a period when it is not a subsidiary member of any consolidated group. Its application can also affect the entity’s tax position in later income years.

Note 2: Under section 703‑75 the interposed company inherits the original company’s tax position for the part of the income year that ends before the completion time, with the consequence that the original company’s taxable income, income tax payable, and losses of any sort, for that part are each nil.

Because of section 703‑75 and this section, the only tax payable by the original company for the income year arises because of the application of section 701‑30 to non‑membership periods in the income year after the completion time.

[The next Division is Division 705.]

11 Application of certain amendments

The amendments made by items 1 to 7 apply on and after 1 July 2002.

Income Tax Assessment Act 1997

1 After section 705‑55

Insert:

Object

(1) The object of this section is to ensure that provisions that cause *membership interests in the joining entity to stop being *pre‑CGT assets, with a resultant increase in their *cost base and *reduced cost base, do not increase *tax cost setting amounts for *trading stock, *depreciating assets or *revenue assets of the joining entity, where those amounts are above the joining entity’s *terminating values for the assets.

When section applies

(2) This section applies if:

(a) a *membership interest that a *member of the joined group holds in the joining entity at the joining time had previously stopped being a *pre‑CGT asset in the circumstances covered by any of subsections (3) to (5); and

(b) the *cost base or *reduced cost base of the membership interest just after it stopped being a pre‑CGT asset exceeded (the excess being the loss of pre‑CGT status adjustment amount) its cost base or reduced cost base just before it stopped being a pre‑CGT asset; and

(c) an asset (a revenue etc. asset) that is *trading stock, a *depreciating asset or a *revenue asset becomes that of the *head company of the joined group because subsection 701‑1(1) (the single entity rule) applies when the joining entity becomes a *subsidiary member of the group; and

(d) the revenue etc. asset’s *tax cost setting amount (after any application of section 705‑40, 705‑45 or 705‑50) exceeds the joining entity’s *terminating value for the asset.

Loss of pre‑CGT status because Division 149 etc. applied while interest held by member

(3) The first circumstance for the purpose of paragraph (2)(a) is where Division 149 of this Act, subsection 160ZZS(1) of the Income Tax Assessment Act 1936 or Subdivision C of Division 20 of Part IIIA of that Act applied to cause the *membership interest to stop being a *pre‑CGT asset while the *member held the membership interest.

Loss of pre‑CGT status because Division 149 etc. applied before current holding by member

(4) The second circumstance for the purpose of paragraph (2)(a) is where:

(a) either:

(i) the *member *acquired the *membership interest directly from another entity; or

(ii) the member acquired the membership interest indirectly from another entity or from itself as a result of 2 or more acquisitions; and

(b) Division 149 of this Act, subsection 160ZZS(1) of the Income Tax Assessment Act 1936 or Subdivision C of Division 20 of Part IIIA of that Act applied to cause the membership interest to stop being a *pre‑CGT asset while the other entity held the membership interest or while the member held the membership interest on the previous occasion; and

(c) if subparagraph (a)(i) applies—at the time of the acquisition, the member *controlled (for value shifting purposes) the other entity, or vice versa, or a third entity controlled (for value shifting purposes) the member and the other entity; and

(d) if subparagraph (a)(ii) applies—the same entity:

(i) was a party to each acquisition and at the time of the acquisition controlled (for value shifting purposes) the other party; or

(ii) was a party to each acquisition and at the time of the acquisition was controlled (for value shifting purposes) by the other party; or

(iii) was not a party to each acquisition but, at the time of the acquisition, controlled (for value shifting purposes) the parties to the acquisition;

or any combination of subparagraphs (i) to (iii) occurred in relation to different acquisitions.

Loss of pre‑CGT status because of acquisition from another entity

(5) The third circumstance for the purpose of paragraph (2)(a) is where:

(a) either:

(i) the *member acquired the *membership interest after 16 May 2002 directly from another entity; or

(ii) the member acquired the membership interest indirectly from another entity or from itself as a result of 2 or more acquisitions, all of which took place after 16 May 2002; and

(b) the membership interest stopped being a *pre‑CGT asset because of the acquisition from the other entity or from the member while the member held the membership interest on a previous occasion; and

(c) if subparagraph (a)(i) applies—at the time of the acquisition, the member *controlled (for value shifting purposes) the other entity, or vice versa, or a third entity controlled (for value shifting purposes) the member and the other entity; and

(d) if subparagraph (a)(ii) applies—the same entity:

(i) was a party to each acquisition and at the time of the acquisition controlled (for value shifting purposes) the other parties; or

(ii) was a party to each acquisition and at the time of the acquisition was controlled (for value shifting purposes) by the other party; or

(iii) was not a party to each acquisition but, at the time of the acquisition, controlled (for value shifting purposes) the parties to the acquisition;

or any combination of subparagraphs (i) to (iii) occurred in relation to different acquisitions.

Reduction in revenue etc. asset’s tax cost setting amount

(6) The revenue etc. asset’s *tax cost setting amount (after any application of section 705‑40, 705‑45 or 705‑50) is instead the amount that would apply if, in working out the step 1 amount in the table in section 705‑60, the *cost base and *reduced cost base of the *membership interest were reduced by the sum of the loss of pre‑CGT status adjustment amounts for the membership interest and all other membership interests that have loss of pre‑CGT status adjustment amounts.

Limit on reduction

(7) However, the reduction only takes place to the extent that it does not result in the asset’s *tax cost setting amount being less than the joining entity’s *terminating value for the asset.

Note: The reduction under this section is converted into a capital loss available over a period of 5 income years starting with the income year in which the joining time occurs: see CGT event L1.

2 After section 705‑160

Insert:

705‑163 Modified application of section 705‑57

Object

(1) The object of this section is to ensure that, in working out *tax cost setting amounts for *trading stock, *depreciating assets or *revenue assets of entities that become *subsidiary members of the group at the formation time, section 705‑57 (about loss of pre‑CGT status of certain *membership interests) only applies if the *membership interests held directly by the *head company of the group are affected.

Modified application of section 705‑57—basic modification

(2) For the purposes of applying section 705‑57 in accordance with this Subdivision, a reference in that section to a *membership interest that a *member of the joined group holds in the joining entity at the joining time is taken to be a reference to a *membership interest that the *head company of the *consolidated group holds directly in an entity becoming a *subsidiary member at the formation time.

Modified application of section 705‑57—additional modifications where section 705‑145 applies

(3) Also, if an entity (the first entity) that becomes a *subsidiary member holds a *membership interest (the subject membership interest) in another entity (the second entity) that becomes a subsidiary member, section 705‑57 (as modified in accordance with subsection (2)) is to be applied in relation to the subject membership interest as follows.

(4) First work out whether there would be a reduction under that section in the *tax cost setting amount for the subject membership interest that is used as mentioned in subsection 705‑145(3) (the subsection 705‑145(3) tax cost setting amount) if:

(a) the subject membership interest, if it is not a revenue etc. asset of the first entity, were taken to be such an asset; and

(b) paragraphs 705‑57(2)(c) and (d) and subsection 705‑57(7) did not apply to the subject membership interest.

(5) Next, if there would be such a reduction (whose amount is the notional section 705‑57 reduction amount):

(a) apply section 705‑57 to reduce the *tax cost setting amount for any revenue etc. asset of the second entity; and

(b) if the second entity holds a *membership interest in another entity that becomes a *subsidiary member—apply section 705‑57 in relation to that interest in accordance with subsection (3) of this section;

and for those purposes:

(c) the subject membership interest is taken to be a membership interest that the *head company of the group holds directly in the second entity at the formation time; and

(d) the requirements of paragraphs 705‑57(2)(a) and (b) are taken to be satisfied in relation to the subject membership interest; and

(e) the subject membership interest is taken to have a *cost base and *reduced cost base equal to the subsection 705‑145(3) tax cost setting amount; and

(f) the subject membership interest is taken to have a loss of pre‑CGT status adjustment amount equal to the notional section 705‑57 reduction amount.

Note: If the head company actually held any membership interests in the second entity, or if other entities becoming subsidiary members held membership interests in the second entity to which this subsection also applied, those membership interests would also be taken into account in working out the reduction under paragraph (a) and in applying paragraph (b).

Section 705‑57 not to apply where membership interests effectively acquired on normal market basis

(6) If:

(a) apart from this subsection, subsection 705‑57(6) would apply in accordance with this Subdivision to the revenue etc. assets of an entity (the subject entity) that becomes a *subsidiary member of the group at the formation time; and

(b) at the formation time, the *head company of the group holds all of the *membership interests in the subject entity; and

(c) subsection 705‑57(6) would apply because a circumstance covered by subsection 705‑57(4) (about loss of pre‑CGT status because Division 149 etc. applied) existed; and

(d) the application of Division 149 of this Act, or the provision of the Income Tax Assessment Act 1936, as mentioned in paragraph 705‑57(4)(b) of this Act happened because the entity that became the *head company of the group (the potential head entity) *acquired all of the *membership interests in the other entity mentioned in that paragraph directly or indirectly from another entity (the vendor); and

(e) at the time of the acquisition, the potential head entity did not control (for value shifting purposes) the vendor, and vice‑versa, and another entity did not control (for value shifting purposes) the potential head entity and the vendor; and

(f) the acquisition, or each of the acquisitions, mentioned in subsection 705‑57(4) was a *same asset roll‑over or was one to which any of sections 160ZZN to 160ZZOC, 160ZZPA and 160ZZPJ of the Income Tax Assessment Act 1936 applied;

then subsection 705‑57(6) does not apply as mentioned in paragraph (a) of this subsection.

Part 2—Consequential CGT amendments

Income Tax Assessment Act 1997

3 Section 100‑15 (at the end of the note)

Add “or CGT event L1”.

4 Section 102‑30 (after table item 7)

Insert:

7A | The head company of a consolidated group | The head company of a consolidated group must apply the capital loss from CGT event L1 over at least 5 income years | section 104‑500 |

5 Section 104‑5 (after table row relating to event number K8)

Insert:

L1 Reduction under section 705‑57 in tax cost setting amount of assets of entity becoming subsidiary member of consolidated group [See section 104‑500] | Just after entity becomes subsidiary member | no capital gain | amount of reduction |

6 At the end of Division 104

Add:

Subdivision 104‑L—Consolidated groups

Table of sections

104‑500 Loss of pre‑CGT status of membership interests in entity becoming subsidiary member: CGT event L1

(1) CGT event L1 happens if, under section 705‑57 (including in its application in accordance with Subdivisions 705‑B to 705‑E), there is a reduction in the *tax cost setting amount of assets of an entity that becomes a *subsidiary member of a *consolidated group.

(2) The time of the event is just after the entity becomes a *subsidiary member of the group.

(3) For the head company core purposes mentioned in subsection 701‑1(2), the *head company makes a capital loss equal to the reduction.

(4) The amount of the capital loss that can be applied to reduce the head company’s *capital gains for the first income year ending after the entity becomes a *subsidiary member of the group (the first income year) cannot exceed 1/5 of the *capital loss.

(5) The amount of the *net capital loss from the first income year, to the extent the amount is attributable to the *capital loss (the extent being the event L1 attributable loss), that can be applied to reduce the head company’s *capital gains for a later income year cannot exceed the amount worked out for the year using the following table:

Limit on applying event L1 attributable loss | ||

Item | For this income year: | The amount of the event L1 attributable loss that can be applied cannot exceed: |

1 | For the second income year ending after the entity became a *subsidiary member | The difference between: (a) 2/5 of the *capital loss; and (b) the amount of the capital loss that was applied in accordance with subsection (4) for the first income year. |

2 | For the third income year ending after the entity became a *subsidiary member | The difference between: (a) 3/5 of the *capital loss; and (b) the sum of the amount mentioned in paragraph (b) of item 1 and the amount of the event L1 attributable loss that was applied to reduce the entity’s *capital gains for the next income year after the first income year. |

3 | For the fourth income year ending after the entity became a *subsidiary member | The difference between: (a) 4/5 of the *capital loss; and (b) the sum of the amount mentioned in paragraph (b) of item 1 and the amounts of the event L1 attributable loss that were applied to reduce the entity’s *capital gains for earlier income years ending after the first income year. |

4 | For the fifth income year ending after the entity became a *subsidiary member, or for any later income year | The difference between: (a) the *capital loss; and (b) the sum of the amount mentioned in paragraph (b) of item 1 and the amounts of the event L1 attributable loss that were applied to reduce the entity’s *capital gains for earlier income years ending after the first income year. |

7 Section 110‑10 (after table row relating to event number K7)

Insert:

L1 | Reduction under section 705‑57 in tax cost setting amount of assets of entity becoming subsidiary member of consolidated group | 104‑500 |

Part 3—Transitional provisions

Income Tax (Transitional Provisions) Act 1997

8 After Division 701A

Insert:

Division 701B—Other modifications of provisions of Income Tax Assessment Act 1997

Table of sections

701B‑1 Modified application of CGT Consolidation provisions to allow immediate availability of capital loss for CGT event L1

(1) This section applies if:

(a) CGT event L1 happens; and

(b) members of the consolidated group mentioned in subsection 104‑500(1) of the Income Tax Assessment Act 1997 held all of the membership interests in the entity mentioned in that subsection from the end of 30 June 2002 until the entity became a subsidiary member of the group; and

(c) before the end of the fourth income year of the head company of the group ending after the entity became a subsidiary member of the group, the entity ceases to be a subsidiary member; and

(d) all of the assets, other than those excepted under subsection (2), that the head company held when the entity became a subsidiary member, because the entity was taken by subsection 701‑1(1) (the single entity principle) of the Income Tax Assessment Act 1997 to be a part of the head company, continued to be held by the head company until the entity ceased to be a subsidiary member.

Excepted assets

(2) For the purposes of paragraph (1)(d), excepted assets are assets that:

(a) the head company disposed of in the ordinary course of a business that the head company carried on by virtue of the entity being taken by subsection 701‑1(1) of the Income Tax Assessment Act 1997 to be a part of the head company; and

(b) were minor assets, having regard to the nature and size of that business.

Immediate availability of capital loss or net capital loss

(3) If this section applies, neither subsection 104‑500(4) nor subsection 104‑500(5) of the Income Tax Assessment Act 1997 applies in relation to the head company for the income year in which the entity ceases to be a subsidiary member of any later income year.

Income Tax Assessment Act 1997

1 Subsection 701‑15(1)

Repeal the second sentence.

2 Subparagraph 705‑15(c)(i)

After “joined group”, insert “at the same time”.

3 Section 705‑165

Repeal the link note.

4 At the end of Division 705

Add:

Subdivision 705‑C—Case where a consolidated group is acquired by another

705‑170 What this Subdivision is about

When a consolidated group is acquired by another consolidated group, modifications are made to the operation of Division 701 (the core rules) and Subdivision 705‑A (tax cost setting amount where a single entity joins a consolidated group) basically to ensure that the tax cost setting amount for assets of the acquired group that become those of the acquiring group reflects the cost to the latter group of acquiring the former.

Table of sections

Application and object

705‑175 Application and object of this Subdivision

Modified application of Division 701 in relation to acquired group etc.

705‑180 Modifications of Division 701

Modified application of Subdivision 705‑A in relation to acquiring group

705‑185 Subdivision 705‑A has effect with modifications

Modifications of Subdivision 705‑A for the purposes of this Subdivision

705‑190 Modified application of section 705‑50

705‑195 Modified application of subsection 705‑65(6)

705‑200 Modified application of section 705‑85

705‑205 Modified application of section 705‑125

[This is the end of the Guide.]

705‑175 Application and object of this Subdivision

Application

(1) This Subdivision applies if all of the *members of a *consolidated group (the acquired group) become members of another consolidated group (the acquiring group) at a particular time (the acquisition time) as a result of the *acquisition of *membership interests in the *head company of the acquired group.

Object

(2) The object of this Subdivision is:

(a) to modify the rules in Division 701 (the core rules) to complement the treatment of the acquired group as a single entity that applied before the acquisition time; and

(b) to modify Subdivision 705‑A (which basically determines the tax cost setting amount for assets of an entity joining a consolidated group) to ensure that the *tax cost setting amount for assets of the acquired group that become those of the acquiring group reflects the cost to the latter group of acquiring the former.

Modified application of Division 701 in relation to acquired group etc.

705‑180 Modifications of Division 701

Certain provisions of Division 701 not to apply

(1) If, because an entity ceases to be a *subsidiary member of the acquired group when this Subdivision applies, a provision of Division 701 (other than section 701‑25) would otherwise apply, in relation to the acquired group for the head company core purposes set out in subsection 701‑1(2) or for the entity core purposes set out in subsection 701‑1(3), the provision does not so apply.

Modified application of section 701‑5

(2) Section 701‑5 (the entry history rule) applies in relation to the acquiring group for the head company core purposes set out in subsection 701‑1(2) as if entities that are or have been the *subsidiary members of the acquired group were or had been parts of the *head company of the acquired group.

Modified application of section 701‑25

(3) The application of section 701‑25 (which ensures tax‑neutral consequences for a head company ceasing to hold assets when an entity leaves a group), in relation to the acquired group for the head company core purposes set out in subsection 701‑1(2) and for the entity core purposes set out in subsection 701‑1(3), is modified as follows:

(a) the reference in subsection (4) of that section to the end of the income year is taken to be a reference to the end of the income year that ends or, if subsection 701‑30(3) as modified by subsection (4) of this section applies, of the income year that is taken to end, when the entity ceases to be a *subsidiary member of the acquired group;

(b) the section applies (as modified by paragraph (a) of this subsection) to the entity that is the *head company of the acquired group ceasing to be a *member of that group in the same way as it applies to an entity that is a subsidiary member of that group ceasing to be a subsidiary member.

Modified application of section 701‑30

(4) If the acquired group only exists for part of the income year, section 701‑30 (about an entity not being a subsidiary member of a group for a whole income year) applies in relation to the acquired group for the head company core purposes in the same way as it applies to work out the taxable income, tax payable on that taxable income and loss of each *sort for an entity for a non‑membership period.

Modified application of Subdivision 705‑A in relation to acquiring group

705‑185 Subdivision 705‑A has effect with modifications

(1) Subdivision 705‑A has effect in relation to the acquiring group for the head company core purposes set out in subsection 701‑1(2) as if:

(a) the only *member of the acquired group that is a joining entity of the acquiring group were the entity that, just before the acquisition time, was the *head company of the acquired group; and

(b) the operation of this Part for the head company core purposes in relation to the head company and the entities that were *subsidiary members of the acquired group continued to have effect for the purposes of Subdivision 705‑A.

Note 1: This means that for Subdivision 705‑A purposes the subsidiary members of the acquired group are treated as part of the head company of that group, and as a result their assets (other than e.g. internal membership interests) have their tax costs set at the acquisition time.

Note 2: It also means e.g. that for Subdivision 705‑A purposes the terminating values of the assets of those subsidiary members are worked out as if the assets were those of the head company at the acquisition time, and hence will be based (if applicable) on the tax cost setting amounts for assets that were set at the time entities became subsidiary members of the acquired group.

(2) However, that effect of Subdivision 705‑A is subject to modifications set out in this Subdivision.

Note: The modifications of Subdivision 705‑A made in this Subdivision constitute the second exception to Subdivision 705‑A: see paragraph 705‑15(b).

Modifications of Subdivision 705‑A for the purposes of this Subdivision

705‑190 Modified application of section 705‑50

Object

(1) The object of this section is to ensure that there is no reduction in the *tax cost setting amount of *over‑depreciated assets that were brought into the acquired group by an entity on becoming a *subsidiary member, where the over‑depreciation will already be corrected as a result of distributions made to the acquired group before that time.

Exclusion of pre‑joining distributions to members of acquired group

(2) If, before it became a *subsidiary member of the acquired group, an entity that is a subsidiary member of the acquired group at the acquisition time paid a dividend to which paragraph 705‑50(2)(b) applies, paragraph 705‑50(3)(b) also has effect as if the reference in that paragraph to a taxpayer who was not entitled to a rebate of income tax under section 46 or 46A of the Income Tax Assessment Act 1936 included a reference to:

(a) if the acquired group existed at that time—a *member of that group; or

(b) if not—an entity that later became a member of that group.

705‑195 Modified application of subsection 705‑65(6)

Object

(1) The object of this section is to ensure that certain rights or options held by *members of the acquiring group that are part of the cost of acquiring the acquired group are taken into account in working out the acquiring group’s *allocable cost amount for the acquired group.

Certain rights or options relating to the acquired group to be treated in same way as membership interests under step 1 of allocable cost amount

(2) Subsection 705‑65(6) has effect as if it also treated as a *membership interest in the *head company of the acquired group a right or option (including a contingent right or option), created or issued by a *subsidiary member of the acquired group, to acquire a membership interest in the subsidiary member, where that right or option was held at the acquisition time by a *member of the acquiring group.

705‑200 Modified application of section 705‑85

Object

(1) The object of this section is to ensure that if either of the following are not held by *members of either group:

(a) certain employee share interests in *subsidiary members of the acquired group;

(b) certain rights or options to acquire *membership interests in subsidiary members of the acquired group;

and are therefore part of the cost of acquiring the acquired group, they increase the acquiring group’s *allocable cost amount for the acquired group.

Increase for certain membership interests in subsidiary members of acquired group

(2) Subsections 705‑85(1) and (2) have effect as if a *membership interest in a *subsidiary member of the acquired group were a membership interest in the *head company of that group.

Increase for certain rights and options to acquire membership interests in subsidiary members of acquired group

(3) Paragraph 705‑85(3)(a) has effect as if it also increased the step 2 amount worked out under section 705‑70 by the *market value of any right or option (including a contingent right or option), created or issued by a *subsidiary member the acquired group, to acquire a *membership interest in the subsidiary member, where that right or option was held at the acquisition time by a person other than a *member of the acquiring group or acquired group.

705‑205 Modified application of section 705‑125

Object

(1) The object of this section is to make it clear that, in view of the fact that *pre‑CGT factors are worked out for assets of the acquired group on acquisition by the acquiring group, pre‑CGT factors formerly worked out for assets of entities when they became *subsidiary members of the acquired group cease to have any relevance.

Pre‑CGT factors for assets of members on joining acquired groups no longer relevant

(2) Section 705‑125 (which provides for a pre‑CGT factor to be worked out for assets of the acquired group) has effect as if a note were added at the end of the section stating that *pre‑CGT factors worked out for assets of entities when they became *subsidiary members of the acquired group cease to have any relevance when the acquired group ceases to exist in circumstances in which this Subdivision applies.

Subdivision 705‑D—Where multiple entities are linked by membership interests

705‑210 What this Subdivision is about

When entities that are linked by membership interests join a consolidated group, the tax cost setting amount for the assets of each entity that becomes a subsidiary member is worked out by modifying the rules in Subdivision 705‑A, so that the amount reflects the cost to the group of acquiring the entities.

Table of sections

Application and object

705‑215 Application and object of this Subdivision

Modified application of Subdivision 705‑A

705‑220 Subdivision 705‑A has effect with modifications

705‑225 Order in which tax cost setting amounts are to be worked out where linked entities have membership interests in other linked entities

705‑230 Adjustment in working out step 4 of allocable cost amount for successive distributions through interposed linked entities

705‑235 Adjustment to allocation of allocable cost amount to take account of owned losses of certain linked entities

705‑240 Modified application of section 705‑57

705‑245 Working out pre‑CGT factors where subsidiary members have membership interests in other subsidiary members

[This is the end of the Guide.]

705‑215 Application and object of this Subdivision

Application

(1) This Subdivision has effect for the head company core purposes set out in subsection 701‑1(2) if:

(a) 2 or more entities (each of which is a linked entity) become members of a *consolidated group at the same time as a result of an event that happens in relation to one of them; and

(b) the case is not covered by Subdivision 705‑C.

Note: This is the third exception to Subdivision 705‑A: see paragraph 705‑15(c). In order for this Subdivision to have effect, one of the entities would need to hold directly or indirectly, just before the joining time, membership interests in all of the other entities.

Example: Entities A and B are not members of a consolidated group, but members of such a group, together with entity A, jointly hold all the membership interests in entity B. Members of the group then acquire all the membership interests in entity A and as a result of this event both entities, which are linked by the membership interests that one holds in the other, become members of the group.

Object

(2) The object of this Subdivision is to modify the rules in Subdivision 705‑A (which basically determine the tax cost setting amount for assets of an entity joining an existing consolidated group) so that they take account of the different circumstances that apply where linked entities join.

Modified application of Subdivision 705‑A

705‑220 Subdivision 705‑A has effect with modifications

(1) Subdivision 705‑A has effect in relation to each linked entity becoming a *subsidiary member of the *consolidated group in the same way as that Subdivision operates in relation to an entity becoming a subsidiary member of a consolidated group in circumstances covered by that Subdivision.

(2) However, that effect of Subdivision 705‑A is subject to modifications set out in this Subdivision.

Object

(1) The object of this section is to ensure that where, on becoming *subsidiary members, linked entities hold assets consisting of *membership interests in other linked entities, the *head company’s cost of becoming the holder of the assets of all of the linked entities correctly reflects the group’s cost of acquiring the linked entities.

Tax cost setting amounts to be worked out from top down

(2) The *tax cost setting amounts for the assets of linked entities holding *membership interests must be worked out before the tax cost setting amounts for the assets of the linked entities in which the membership interests are held.

Note: The tax cost setting amount in respect of assets of any linked entity in which members of the group, but no linked entity, hold membership interests can be worked out in any order in relation to the calculations for other linked entities.

Tax cost setting amount for higher linked entity’s membership interests to be used in working out lower linked entity’s tax cost setting amount

(3) The *tax cost setting amount worked out for assets of a linked entity mentioned in subsection (2) consisting of *membership interests in another such entity is to be used as the amount for those interests under subsection 705‑65(1) (step 1 of allocable cost amount) in working out the tax cost setting amount for assets of that other linked entity.

Note 1: Subsection 705‑65(1) adds together amounts worked out in accordance with section 705‑65 representing the cost of the membership interests that each member of the group holds in the linked entity. If any of those membership interests is held by another linked entity, subsection (3) of this section will replace the amount otherwise applicable with the tax cost setting amount that will have been worked out for the interests in accordance with subsection (2) of this section.

Note 2: The tax cost setting amount worked out for the membership interests has no relevance other than for the purpose mentioned in subsection (3) of this subsection. This is because, under the single entity principle, intra group membership interests are ignored while entities are members of the group. If an entity ceases to be a member, section 701‑15 and Division 711 set the tax cost of membership interests in the entity at that time.

Value shifting etc. provisions not to apply to later CGT events involving membership interests

(4) However, despite subsection (3), subsection 705‑65(4) (which prevents the later operation of value shifting etc. provisions) still applies to the *membership interests.

Rights and options to acquire membership interests

(5) For the purposes of this section, if, on becoming a *subsidiary member, a linked entity holds a right or option (including a contingent right or option), created or issued by another linked entity, to acquire a *membership interest in that other linked entity, that right or option is treated as if it were a membership interest in that other linked entity.

Object

(1) The object of this section is to ensure that, in working out the group’s *allocable cost amount for the linked entities, there is only one reduction under step 4 in the table in section 705‑60 (about pre‑formation time distributions out of certain profits) for distributions of the same profits.

When section applies

(2) This section applies if, apart from this section:

(a) in working out the group’s *allocable cost amount for a linked entity, there would be a reduction under step 4 in the table in section 705‑60 for a distribution (the first distribution) made by the entity; and

(b) in working out the group’s allocable cost amount for a second linked entity, there would also be a reduction under that step for any of the first distribution that the second linked entity successively distributed as mentioned in paragraph 705‑95(a).

No step 4 reduction in respect of successive distribution of amount for which there has already been a step 4 reduction

(3) If this section applies, there is no reduction as mentioned in paragraph (2)(b).

Object

(1) The object of this section is to prevent a distortion under section 705‑35 in the allocation of *allocable cost amount to a linked entity where that entity has *membership interests in another linked entity that has certain tax losses.

Adjustment to allocation of allocable cost amount

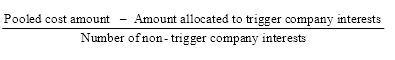

(2) If:

(a) a linked entity has *membership interests in a second linked entity; and

(b) in working out the group’s *allocable cost amount for the second linked entity, an amount is required to be subtracted (the loss subtraction amount) under step 5 in the table in section 705‑60 (about losses accruing before becoming a subsidiary member of the group);

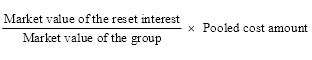

then, for the purposes of working out under section 705‑35 the *tax cost setting amount for the assets of the first linked entity, the *market value of the first linked entity’s membership interests in the second linked entity is increased by the first linked entity’s interest in the loss subtraction amount (see subsection (3)).

First entity’s interest in loss subtraction amount

(3) The first linked entity’s interest in the loss subtraction amount is worked out using the formula:

705‑240 Modified application of section 705‑57

Object

(1) The object of this section is to ensure that, in working out *tax cost setting amounts for *trading stock, *depreciating assets or *revenue assets of the linked entities, section 705‑57 (about loss of pre‑CGT status of certain membership interests) only applies if the *membership interests held directly by the *head company of the group are affected.

Modified application of section 705‑57—basic modification

(2) For the purposes of applying section 705‑57 in accordance with this Subdivision, a reference in that section to a *membership interest that a *member of the joined group holds in the joining entity at the joining time is taken to be a reference to a membership interest that the *head company of the *consolidated group holds directly in a linked entity at the time the linked entity becomes a *subsidiary member.

Modified application of section 705‑57—additional modifications where section 705‑225 applies

(3) Also, if a linked entity (the first linked entity) holds a *membership interest (the subject membership interest) in another linked entity (the second linked entity), section 705‑57 (as modified in accordance with subsection (2)) is to be applied in relation to the subject membership interest as follows.

(4) First work out whether there would be a reduction under that section in the *tax cost setting amount for the subject membership interest that is used as mentioned in subsection 705‑225(3) (the subsection 705‑225(3) tax cost setting amount) if:

(a) the subject membership interest, if it is not a revenue etc. asset of the first linked entity, were taken to be such an asset; and

(b) paragraphs 705‑57(2)(c) and (d) and subsection 705‑57(7) did not apply to the subject membership interest.

(5) Next, if there would be such a reduction (whose amount is the notional section 705‑57 reduction amount):

(a) apply section 705‑57 to reduce the *tax cost setting amount for any revenue etc. asset of the second linked entity; and

(b) if the second linked entity holds a *membership interest in another linked entity—apply section 705‑57 in relation to that interest in accordance with subsection (3) of this section;

and for those purposes:

(c) the subject membership interest is taken to be a membership interest that the *head company of the group holds directly in the second linked entity; and

(d) the requirements of paragraphs 705‑57(2)(a) and (b) are taken to be satisfied in relation to the subject membership interest; and

(e) the subject membership interest is taken to have a *cost base and *reduced cost base equal to the subsection 705‑225(3) tax cost setting amount; and

(f) the subject membership interest is taken to have a loss of pre‑CGT status adjustment amount equal to the notional section 705‑57 reduction amount.