Dairy Produce Legislation Amendment (Supplementary Assistance) Act 2001

No. 94, 2001

Dairy Produce Legislation Amendment (Supplementary Assistance) Act 2001

No. 94, 2001

Dairy Produce Legislation Amendment (Supplementary Assistance) Act 2001

No. 94, 2001

An Act to amend the Dairy Produce Act 1986, and for related purposes

Contents

1 Short title...................................

2 Commencement...............................

3 Schedule(s)..................................

Schedule 1—Amendments

Dairy Produce Act 1986

Farm Household Support Act 1992

Dairy Produce Legislation Amendment (Supplementary Assistance) Act 2001

No. 94, 2001

An Act to amend the Dairy Produce Act 1986, and for related purposes

[Assented to 20 July 2001]

The Parliament of Australia enacts:

This Act may be cited as the Dairy Produce Legislation Amendment (Supplementary Assistance) Act 2001.

This Act commences on the day on which it receives the Royal Assent.

Each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

1 After paragraph 119(2B)(a)

Insert:

(aa) the SDA scheme (within the meaning of Schedule 2); or

2 Clause 1 of Schedule 2

Omit:

• The main object of the Dairy Industry Adjustment Program is to help the dairy industry adjust to deregulation by providing for 2 types of grants, as follows:

(a) DSAP payments (made under this Schedule);

(b) dairy exit payments (made under Part 9C of the Farm Household Support Act 1992).

substitute:

• The main object of the Dairy Industry Adjustment Program is to help the dairy industry or dairy communities adjust to deregulation by providing for 4 types of grants, as follows:

(a) DSAP payments (made under this Schedule);

(b) SDA payments (made under this Schedule);

(c) dairy exit payments (made under Part 9C of the Farm Household Support Act 1992);

(d) payments under the Dairy Regional Assistance Programme (see clause 86).

3 Clause 1 of Schedule 2

After:

• Generally, DSAP payments are calculated by reference to 1998‑1999 milk deliveries at a rate of 46.23 cents per litre for market milk and a national average rate of 8.96 cents per litre for manufacturing milk.

insert:

• There are 3 types of SDA payment rights: basic market milk payment rights, additional market milk payment rights and discretionary payment rights.

4 Clause 1 of Schedule 2

Omit:

• The Dairy Adjustment Authority will administer DSAP payment rights.

substitute:

• The Dairy Adjustment Authority will administer DSAP and SDA payment rights.

5 Clause 1 of Schedule 2

Omit:

• The levy will be paid into a Dairy Structural Adjustment Fund, and DSAP payments and dairy exit payments will be paid out of that Fund.

substitute:

• The levy will be paid into a Dairy Structural Adjustment Fund, and DSAP payments, SDA payments, dairy exit payments and payments under the Dairy Regional Assistance Programme will be paid out of that Fund.

6 Clause 2 of Schedule 2 (definition of payment right)

After “DSAP scheme”, insert “or the SDA scheme”.

7 Clause 2 of Schedule 2

Insert:

SDA payment means a payment under the SDA scheme.

8 Clause 2 of Schedule 2

Insert:

SDA scheme means the scheme referred to in clause 37B.

9 Part 2 of Schedule 2 (heading)

Repeal the heading, substitute:

Part 2—DSAP payments and SDA payments

10 After Division 1 of Part 2 of Schedule 2

Insert:

Division 1A—Supplementary Dairy Assistance (SDA) scheme

The following is a simplified outline of this Division:

• This Division provides a framework for the making of SDA payments.

• The Minister is required to formulate a scheme (the SDA scheme) for the grant of the following types of payment rights to entities:

(aa) basic market milk payment rights;

(a) additional market milk payment rights;

(b) discretionary payment rights.

• Additional market milk payment rights will be based on market milk deliveries in 1998‑1999, and will range from 0.12 cents per litre to 12 cents per litre depending on the percentage of market milk deliveries in that year.

• Discretionary payment rights may be granted to entities in the circumstances set out in clause 37G.

• Payment rights will be divided into units, where each unit has a face value of $32.

• Payments will be made to registered owners of units in accordance with the SDA scheme.

The Minister must, by writing, formulate a scheme (the SDA scheme) for:

(a) the grant of payment rights to entities who satisfy the conditions set out in the scheme; and

(b) the division of payment rights into units; and

(c) the registration of units; and

(d) the making of payments by the Corporation to registered owners of units.

37C General policy objectives for the SDA scheme

The SDA scheme must be directed towards ensuring the achievement of the policy objectives set out in clauses 37D to 37P.

(1) It is a policy objective that there are to be 3 types of payment rights, as follows:

(aa) a type called basic market milk payment rights;

(a) a type called additional market milk payment rights;

(b) a type called discretionary payment rights.

(2) It is a policy objective that, if an entity is eligible to be granted a basic market milk payment right and an additional market milk payment right, the entity is eligible to be granted the payment right with the higher face value and is not eligible to be granted the other payment right.

37DA Basic market milk payment rights—eligibility etc.

Basic eligibility criteria

(1) It is a policy objective that an entity is not eligible to be granted a basic market milk payment right unless:

(a) the entity has been granted a payment right under the DSAP scheme in respect of a dairy farm enterprise (the qualifying enterprise); and

(b) the entity held an interest (of a kind referred to in the SDA scheme) in that enterprise, or in any other dairy farm enterprise, at a time referred to in the SDA scheme; and

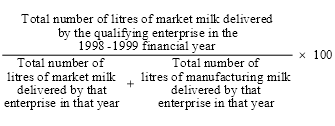

(c) the number (the market milk number) worked out in accordance with the following formula is at least 25.1 (rounding to 1 decimal place and rounding up if the second decimal place is 5 or more):

Note: See also subclause (4) for how those delivery numbers are worked out.

Calculation of face value

(2) It is a policy objective that the face value of an entity’s basic market milk payment right is to be a share (worked out in accordance with the SDA scheme) of the overall market milk amount for the qualifying enterprise.

Interpretation

(3) For the purposes of this clause, the overall market milk amount for the qualifying enterprise is:

(a) if the market milk number is at least 25.1 and less than 30.1—$10,000; or

(b) if the market milk number is at least 30.1—$15,000.

(4) A reference in this clause to the total number of litres of market milk, or the total number of litres of manufacturing milk, delivered by the qualifying enterprise in the 1998‑1999 financial year is a reference to that number as determined by the DAA to have taken to have been delivered by that enterprise in that year.

(5) This clause is subject to clause 37V (about the effect of death on eligibility etc. for the grant of payment rights).

37E Additional market milk payment rights—eligibility etc.

Basic eligibility criteria

(1) It is a policy objective that an entity is not eligible to be granted an additional market milk payment right unless:

(a) the entity has been granted a payment right under the DSAP scheme in respect of a dairy farm enterprise (the qualifying enterprise); and

(b) the entity held an interest (of a kind referred to in the SDA scheme) in that enterprise, or in any other dairy farm enterprise, at a time referred to in the SDA scheme; and

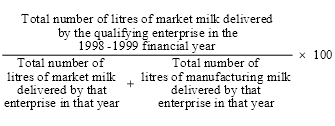

(c) the number (the market milk number) worked out in accordance with the following formula is at least 35.1 (rounding to 1 decimal place and rounding up if the second decimal place is 5 or more):

Note: See also subclause (5) for how those delivery numbers are worked out.

Calculation of face value

(2) It is a policy objective that the face value of an entity’s additional market milk payment right is to be a share (worked out in accordance with the SDA scheme) of the overall market milk amount for the qualifying enterprise.

Interpretation

(3) For the purposes of this clause, the overall market milk amount for the qualifying enterprise is the amount worked out in accordance with the following formula:

where:

relevant cents means:

(a) if the market milk number is at least 45—12 cents; or

(b) if the market milk number is at least 35.1 and less than 45—the number of cents worked out in accordance with the following formula:

![]()

(4) However, if the amount calculated under subclause (3) is more than $60,000, then the overall market milk amount for the qualifying enterprise is taken to be $60,000.

(5) A reference in this clause to the total number of litres of market milk, or the total number of litres of manufacturing milk, delivered by the qualifying enterprise in the 1998‑1999 financial year is a reference to that number as determined by the DAA to have taken to have been delivered by that enterprise in that year.

(6) This clause is subject to clause 37V (about the effect of death on eligibility etc. for the grant of payment rights).

37F Market milk payment rights—offsetting

(1) It is a policy objective that the face value of an entity’s basic market milk payment right or additional market milk payment right is to be reduced if:

(a) the entity has been granted a payment right (the DSAP payment right) under the DSAP scheme; and

(b) the conditions in paragraphs 51(1)(a), (b) and (c) of this Schedule are satisfied (about the DAA having made an error); and

(c) the DAA has been unable to cancel a number of units (the protected units) in the DSAP payment right because of the operation of subclause 51(2).

(2) It is a policy objective that the amount of the reduction is to be equal to the total face value of the protected units.

(3) If the amount of the reduction would exceed the face value of the entity’s basic market milk payment right or additional market milk payment right, then it is a policy objective that the face value of that payment right is to be reduced to zero.

37G Discretionary payment rights—eligibility

(1) It is a policy objective that an entity is not eligible to be granted a discretionary payment right unless the entity satisfies clause 37H or 37J.

(2) This clause is subject to clause 37V (about the effect of death on eligibility etc. for the grant of payment rights).

(1) An entity satisfies this clause if:

(a) the entity held an interest (of a kind referred to in the SDA scheme) in a dairy farm enterprise at any time during the period (the qualifying period) beginning on 1 July 1998 and ending at 6.30 pm on 28 September 1999; and

(b) the entity is taken, under the SDA scheme, to have been affected by a significant event, a significant crisis or significant anomalous circumstances.

(2) For the purposes of this clause, dairy farm enterprise includes a business in Australia that is carried on with a view to delivering market milk and/or manufacturing milk during the qualifying period, but that did not deliver such milk during that period.

37J Discretionary payment rights—entity suffered a fall in lease income etc.

(1) An entity satisfies this clause if:

(a) the entity was granted a payment right under the DSAP scheme in respect of a lessor interest the entity held in a dairy farm enterprise; and

(b) the entity is not taken, under the SDA scheme, to have been affected by a significant event, a significant crisis or significant anomalous circumstances; and

(c) the entity passes the lease income test.

Cap

(2) It is a policy objective that the total face value of discretionary payment rights, granted in respect of a dairy farm enterprise to entities who satisfy this clause in relation to that enterprise, must not exceed an amount specified in the SDA scheme.

Interpretation

(3) For the purposes of this clause, an entity held a lessor interest in a dairy farm enterprise if:

(a) under the DSAP scheme, the enterprise was taken to be subject to an eligible dairy leasing arrangement; and

(b) under the DSAP scheme, the entity was taken to be a party to that arrangement as the lessor of land.

(4) For the purposes of this clause, an entity passes the lease income test if:

(a) both:

(i) more than 50% of the total gross income derived by the entity in the 1999‑2000 financial year consisted of eligible lease income; and

(ii) the eligible lease income derived by the entity in the 2000‑2001 financial year is at least 20% less than the eligible lease income derived by the entity in the 1999‑2000 financial year; or

(b) both:

(i) more than 50% of the total gross income derived by the entity in the 1999‑2000, 1998‑1999 and 1997‑1998 financial years consisted of eligible lease income; and

(ii) the eligible lease income derived by the entity in the 2000‑2001 financial year is at least 20% less than the average of the eligible lease income derived by the entity in the 1999‑2000, 1998‑1999 and 1997‑1998 financial years.

(5) For the purposes of this clause, the gross income derived by an entity is to be worked out in accordance with:

(a) generally accepted accounting principles; or

(b) if, under the SDA scheme, the generally accepted accounting principles are taken to be modified for the purposes of the scheme—those principles as so modified.

(6) For the purposes of this clause, eligible lease income has the same meaning as in the SDA scheme.

(1) It is a policy objective that each payment right under the SDA scheme is to be divided into units, where each unit has a face value of $32.

(2) It is a policy objective that the number of units into which a payment right is divided is to be worked out as follows:

(a) divide the number of dollars in the face value of the payment right by 32;

(b) if the result of the division is a whole number—that number is the number of units in the payment right;

(c) if the result of the division is less than 1—there is 1 unit in the payment right;

(d) if the result of the division is greater than 1, but is not a whole number:

(i) round the result of the division up or down to the nearest whole number (rounding up in the case exactly half‑way between 2 whole numbers); and

(ii) the rounded number is the number of units in the payment right.

It is a policy objective that a payment right under the SDA scheme is to be granted subject to the powers of cancellation conferred on the DAA under the authority of clauses 50, 51, 52 and 53.

Note 1: Clause 50 deals with cancellation of units because of the making of a false statement.

Note 2: Clause 51 deals with cancellation of units because of an error made by the DAA.

Note 3: Clause 52 deals with cancellation of units because of a breach of an undertaking to dispose of the units.

Note 4: Clause 53 deals with cancellation of units when a dairy exit payment becomes payable.

It is a policy objective that SDA payments are not to be made in respect of a quarter that is later than the quarter ending on 30 June 2008.

Register

(1) It is a policy objective that the DAA is to include particulars of units in payment rights under the SDA scheme on the register referred to in clause 21.

Registration of ownership

(2) It is a policy objective that an entity’s ownership of a unit is not to be counted for the purposes of the SDA scheme unless that ownership is entered on the register.

(3) It is a policy objective that the transfer of the ownership of a unit is not to be registered unless:

(a) the transferee is an eligible entity; or

(b) the transferee gives the DAA a written undertaking to assign the unit to an eligible entity within 60 days after the transfer is registered.

Note: For enforcement of the undertaking, see clause 52.

Registration of charges

(4) It is a policy objective that the SDA scheme may provide for the registration of charges over units.

Inspection of register

(5) It is a policy objective that an entry on the register relating to a unit is to be open for inspection in the following circumstances:

(a) the owner of the unit consents to the entry being open for inspection;

(b) such circumstances as are set out in the SDA scheme.

No declaration of trust in respect of unit

(6) It is a policy objective that:

(a) the owner of a unit must not dispose of a unit by way of declaration of trust; and

(b) if a purported disposal contravenes the rule in paragraph (a), it is of no effect.

Beneficial interest in unit must not be transferred independently of legal interest

(7) It is a policy objective that:

(a) a beneficial interest in a unit must not be transferred independently of the legal interest in the unit; and

(b) if a purported transfer contravenes the rule in paragraph (a), it is of no effect.

Definition

(8) In this clause:

eligible entity means an entity included in a class of entities declared by the SDA scheme to be entities who are eligible to become transferees of units.

(1) It is a policy objective that, in accordance with the SDA scheme, lump sum payments or quarterly payments will be paid to registered owners of units in payment rights under the scheme.

(2) It is a policy objective that, if an SDA payment is due to be paid to an entity, the payment may be recovered, as a debt due to the entity, by action in a court of competent jurisdiction.

(3) It is a policy objective that, if an individual is entitled to receive an SDA payment and the payment has not been made at the date of the death of the individual, the amount of that payment is payable to the legal personal representative of the individual.

37Q Conferral of administrative powers etc.

(1) The SDA scheme may make provision with respect to a matter by conferring on the DAA, or the Minister, a power to make a decision of an administrative character.

(2) If the SDA scheme confers on the Minister a power to make a decision of an administrative character, the scheme may also make provision for and in relation to the Minister delegating that power to the DAA.

(1) The SDA scheme must contain provisions for and in relation to the review of decisions of the DAA, or the Minister, under the scheme that affect an entity.

(2) Those provisions must provide for review by the Administrative Appeals Tribunal or the Administrative Review Tribunal (as the case may be).

(3) Subclause (2) does not limit subclause (1).

(1) The SDA scheme may provide for fees.

(2) The amount of a fee under the SDA scheme must not be such as to amount to taxation.

The SDA scheme may provide for statements in claims to be verified by statutory declaration.

37U Methods by which SDA payments may be made

(1) The SDA scheme may make provision for the methods by which SDA payments may be made.

(2) The SDA scheme may require that SDA payments be made using an electronic funds transfer system.

(3) Subclause (2) does not limit subclause (1).

37V Adjustment of eligibility for payment rights etc.—death

The SDA scheme may make provision for and in relation to the adjustment of:

(a) eligibility for the grant of payment rights under the scheme; and

(b) the calculation of the face value of payment rights under the scheme;

in relation to the death of an individual who would have otherwise been eligible to be granted a payment right under the SDA scheme.

Note: For example, the SDA scheme may contain provisions setting out the eligibility of the trustee of the deceased estate, or of one or more beneficiaries in the estate, to be granted a payment right under the scheme and setting out the calculation of the face value of that right.

37W Ancillary or incidental provisions

The SDA scheme may contain such ancillary or incidental provisions as the Minister considers appropriate.

37X Scheme‑making power not limited

Clauses 37C to 37W do not, by implication, limit clause 37B.

(1) The SDA scheme may be varied, but not revoked, in accordance with subsection 33(3) of the Acts Interpretation Act 1901.

(2) Subclause (1) does not limit the application of subsection 33(3) of the Acts Interpretation Act 1901 to other instruments under this Act.

37Z Scheme to be a disallowable instrument

An instrument under clause 37B is a disallowable instrument for the purposes of section 46A of the Acts Interpretation Act 1901.

37ZA Application to things happening before commencement

The use of the present tense in a provision of this Division does not imply that the provision does not apply to things happening before the commencement of this Division.

37ZB Use and disclosure of information obtained under the DSAP scheme

(1) A record keeper who has possession or control of a record that contains personal information that was obtained for the purposes of the administration of the DSAP scheme may use the information, or disclose the information to a person, body or agency, for the purposes of the administration of the SDA scheme.

(2) Unless the contrary intention appears, an expression used in this clause has the same meaning as in the Privacy Act 1988.

11 Paragraph 38(1)(a) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme”.

12 Paragraph 38(1)(b) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme”.

13 Paragraph 43(3)(a) of Schedule 2

Omit “or the DSAP scheme”, substitute “, the DSAP scheme or the SDA scheme”.

14 Subclause 43(5) of Schedule 2

Omit “or the DSAP scheme”, substitute “, the DSAP scheme or the SDA scheme”.

15 Subclause 43(6) of Schedule 2 (definition of protected document)

Omit “or the DSAP scheme”, substitute “, the DSAP scheme or the SDA scheme”.

16 Subclause 43(6) of Schedule 2 (paragraph (c) of the definition of protected information)

Omit “or the DSAP scheme”, substitute “, the DSAP scheme or the SDA scheme”.

17 Clause 44 of Schedule 2

After “DSAP payment”, insert “or an SDA payment”.

18 Clause 47 of Schedule 2

After “DSAP payments”, insert “or SDA payments”.

19 Clause 47 of Schedule 2

After “DSAP payment”, insert “or SDA payment (as the case may be)”.

20 Subclause 49(5) of Schedule 2

After “DSAP payment”, insert “or SDA payment”.

21 Subclause 49(6) of Schedule 2

After “DSAP payment”, insert “or SDA payment”.

22 Subclause 49(7) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme (as the case may be)”.

23 Paragraph 50(1)(a) of Schedule 2

Omit “or the DSAP scheme”, substitute “, the DSAP scheme or the SDA scheme”.

24 Subclause 50(1) of Schedule 2

Omit “DSAP scheme must authorise the DAA”, substitute “DSAP scheme or the SDA scheme (as the case may be) must authorise the DAA”.

25 Subclause 50(2) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme (as the case may be)”.

26 Subclause 51(1) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme (as the case may be)”.

27 Subclause 51(2) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme (as the case may be)”.

28 Subclause 51(2) of Schedule 2

After “DSAP payment”, insert “or an SDA payment”.

29 Subclause 51(3) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme (as the case may be)”.

30 Paragraph 52(1)(a) of Schedule 2

After “unit”, insert “in a payment right under the DSAP scheme”.

Note: The following heading to subclause 52(1) of Schedule 2 is inserted “DSAP scheme”.

31 After subclause 52(1) of Schedule 2

Insert:

(1A) For the purposes of subclause (1), eligible entity has the same meaning as in clause 21.

SDA scheme

(1B) If:

(a) an entity (the first entity) has given the DAA an undertaking to assign a unit in a payment right under the SDA scheme to an eligible entity as mentioned in paragraph 37N(3)(b); and

(b) the first entity breaches the undertaking; and

(c) the DAA gives the first entity a written notice directing the first entity to comply with the undertaking before the end of the period of 60 days beginning when the direction is given; and

(d) the first entity contravenes the direction;

the SDA scheme must authorise the DAA to cancel the unit.

(1C) For the purposes of subclause (1B), eligible entity has the same meaning as in clause 37N.

When cancellation takes effect

32 Subclause 52(3) of Schedule 2

Repeal the subclause.

33 Subclause 53(1) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme (as the case may be)”.

34 Subparagraph 56(a)(i) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme”.

35 Clause 75 of Schedule 2

After “DSAP payment”, insert “or an SDA payment”.

Note: The heading to clause 75 of Schedule 2 is altered by inserting “and SDA” after “DSAP”.

36 Subclause 76(1) of Schedule 2

Omit “and dairy exit payments”, substitute “, SDA payments and dairy exit payments”.

37 Paragraph 78(b) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme”.

38 Paragraph 78(c) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme”.

39 After paragraph 79(a) of Schedule 2

Insert:

(aa) in making SDA payments; and

40 Paragraph 79(c) of Schedule 2

Omit “known as the Dairy Industry Adjustment Package (including expenses in relation to the Dairy Adjustment Panel)”, substitute “that from time to time form part of the Dairy Industry Adjustment Package”.

41 Subparagraph 79(i)(i) of Schedule 2

Omit “or the DSAP scheme”, substitute “, the DSAP scheme or the SDA scheme”.

42 Paragraph 80(a) of Schedule 2

Omit “and dairy exit payments”, substitute “, SDA payments and dairy exit payments”.

43 Subclause 84(1) of Schedule 2

After “DSAP scheme”, insert “or the SDA scheme”.

Note 1: The heading to clause 84 of Schedule 2 is altered by inserting “and SDA” after “DSAP”.

Note 2: The heading to clause 85 of Schedule 2 is altered by inserting “and SDA scheme” after “DSAP scheme”.

44 Subclause 86(3) of Schedule 2

Repeal the subclause.

45 Subclause 86(4) of Schedule 2

Omit “$45 million”, substitute “$65 million”.

46 Subclause 86(5) of Schedule 2

Repeal the subclause.

47 After paragraph 94(2)(a) of Schedule 2

Insert:

(aa) making SDA payments;

48 Subparagraph 135(1)(c)(i) of Schedule 2

Omit “or this Schedule”, substitute “, the SDA scheme or this Schedule”.

49 Subparagraph 135(1)(c)(ii) of Schedule 2

Omit “or this Schedule”, substitute “, the SDA scheme or this Schedule”.

50 Paragraph 136(1)(c) of Schedule 2

Omit “or this Schedule”, substitute “, the SDA scheme or this Schedule”.

Farm Household Support Act 1992

51 After subparagraph 52C(5)(a)(i)

Insert:

(ia) the SDA scheme (within the meaning of Schedule 2 to the Dairy Produce Act 1986); or

[Minister’s second reading speech made in—

House of Representatives on 24 May 2001

Senate on 20 June 2001]

(73/01)