An Act to make provision in relation to corporations and financial products and services, and for other purposes

Chapter 1—Introductory

Part 1.1—Preliminary

1 Short title

This Act may be cited as the Corporations Act 2001.

2 Commencement

This Act commences on a day to be fixed by Proclamation.

3 Constitutional basis for this Act

(1) The operation of this Act in the referring States is based on:

(a) the legislative powers that the Commonwealth Parliament has under section 51 of the Constitution (other than paragraph 51(xxxvii)); and

(b) the legislative powers that the Commonwealth Parliament has in respect of matters to which this Act relates because those matters are referred to it by the Parliaments of the referring States under paragraph 51(xxxvii) of the Constitution.

Note: The State referrals fully supplement the Commonwealth Parliament’s other powers by referring the matters to the Commonwealth Parliament to the extent to which they are not otherwise included in the legislative powers of the Commonwealth Parliament.

(2) The operation of this Act in the Territories is based on:

(a) the legislative powers that the Commonwealth Parliament has under section 122 of the Constitution to make laws for the government of those Territories; and

(b) the legislative powers that the Commonwealth Parliament has under section 51 of the Constitution.

Despite subsection 22(3) of the Acts Interpretation Act 1901, this Act as applying in those Territories is a law of the Commonwealth.

(3) The operation of this Act outside Australia is based on:

(a) the legislative power the Commonwealth Parliament has under paragraph 51(xxix) of the Constitution; and

(b) the other legislative powers that the Commonwealth Parliament has under section 51 of the Constitution; and

(c) the legislative powers that the Commonwealth Parliament has under section 122 of the Constitution to make laws for the government of the external Territories.

(4) The operation of this Act in a State that is not a referring State is based on:

(a) the legislative powers that the Commonwealth Parliament has under section 51 (other than paragraph 51(xxxvii)) and section 122 of the Constitution; and

(b) the legislative powers that the Commonwealth Parliament has in respect of matters to which this Act relates because those matters are referred to it by the Parliaments of the referring States under paragraph 51(xxxvii) of the Constitution.

4 Referring States

Reference of matters by State Parliament to Commonwealth Parliament

(1) A State is a referring State if the Parliament of the State has referred the matters covered by subsections (4) and (5) to the Parliament of the Commonwealth for the purposes of paragraph 51(xxxvii) of the Constitution:

(a) if and to the extent that the matters are not otherwise included in the legislative powers of the Parliament of the Commonwealth (otherwise than by a reference under paragraph 51(xxxvii) of the Constitution); and

(b) if and to the extent to which the matters are included in the legislative powers of the Parliament of the State.

This subsection has effect subject to subsections (6) and (7).

(2) A State is a referring State even if the State reference Act includes a provision to the effect that nothing in the State reference Act is intended to enable the making of laws pursuant to the amendment reference with the sole or main underlying purpose or object of regulating industrial relations matters even if, but for that provision in the State reference Act, the law would be a law with respect to a matter referred to the Parliament of the Commonwealth by the amendment reference.

(3) A State is a referring State even if a law of the State provides that the reference to the Commonwealth Parliament of either or both of the matters covered by subsections (4) and (5) is to terminate in particular circumstances.

Reference covering initial Corporations Act and ASIC Act

(4) This subsection covers the matters to which the referred provisions relate to the extent of making laws with respect to those matters by including the referred provisions in the initial Corporations Act and the initial ASIC Act.

Reference covering amendments of this Act and ASIC Act

(5) This subsection covers the matters of the formation of corporations, corporate regulation and the regulation of financial products and services to the extent of the making of laws with respect to those matters by making express amendments of this Act or the ASIC Act.

Effect of termination of reference

(6) A State ceases to be a referring State if the State’s initial reference terminates.

(7) A State ceases to be a referring State if:

(a) the State’s amendment reference terminates; and

(b) subsection (8) does not apply to the termination.

(8) A State does not cease to be a referring State because of the termination of its amendment reference if:

(a) the termination is effected by the Governor of that State fixing a day by proclamation as the day on which the reference terminates; and

(b) the day fixed is no earlier than the first day after the end of the period of 6 months beginning on the day on which the proclamation is published; and

(c) that State’s amendment reference, and the amendment reference of every other State, terminates on the same day.

Definitions

(9) In this section:

amendment reference of a State means the reference by the Parliament of the State to the Parliament of the Commonwealth of the matters covered by subsection (5).

express amendment of this Act or the ASIC Act means the direct amendment of the text of this Act or the ASIC Act (whether by the insertion, omission, repeal, substitution or relocation of words or matter) by Commonwealth Acts, but does not include the enactment by a Commonwealth Act of a provision that has, or will have, substantive effect otherwise than as part of the text of this Act or the ASIC Act.

initial ASIC Act means the ASIC Act as originally enacted.

initial Corporations Act means this Act as originally enacted.

initial reference of a State means the reference by the Parliament of the State to the Parliament of the Commonwealth of the matters covered by subsection (4).

referred provisions means:

(a) the initial Corporations Act; and

(b) the initial ASIC Act;

to the extent to which they deal with matters that are included in the legislative powers of the Parliaments of the States.

State reference Act for a State is the law under which the initial reference and the amendment reference are given.

5 General territorial application of Act

Geographical coverage of “this jurisdiction”

(1) Section 9 defines this jurisdiction as the area that includes:

(a) each referring State (including its coastal sea); and

(b) each Territory (including its coastal sea, if any); and

(d) also, for the purposes of the application of a provision of Chapter 7 or an associated provision (see subsection (10))—any external Territory in which the provision applies because of subsection (9) (but only to the extent provided for in that subsection).

(2) Throughout this Act, this jurisdiction therefore consists of:

(a) either:

(i) the whole of Australia (if all the States are referring States); or

(ii) Australia (other than any State that is not a referring State) if one or more States are not referring States; and

(b) also, when used in or in relation to a provision of Chapter 7 or an associated provision (see subsection (10))—any external Territory in which the provision applies because of subsection (9) (but only to the extent provided for in that subsection).

Operation in this jurisdiction

(3) Each provision of this Act applies in this jurisdiction.

Operation outside this jurisdiction

(4) Subject to subsection (8), each provision of this Act also applies, according to its tenor, in relation to acts and omissions outside this jurisdiction.

Residence, place of formation etc.

(7) Each provision of this Act applies according to its tenor to:

(a) natural persons whether:

(i) resident in this jurisdiction or not; and

(ii) resident in Australia or not; and

(iii) Australian citizens or not; and

(b) all bodies corporate and unincorporated bodies whether:

(i) formed or carrying on business in this jurisdiction or not; and

(ii) formed or carrying on business in Australia or not.

Note: Paragraph (b)—many of the provisions in this Act apply only in relation to companies (that is, to companies that are registered under this Act).

Operation in non‑referring States

(8) This Act does not apply to an act or omission in a State that is not a referring State to the extent to which that application would be beyond the legislative powers of the Parliament (including powers it has under paragraphs 51(xxxvii) and (xxxix) of the Constitution).

Expanded application of provisions of Chapter 7 and associated provisions

(9) The regulations may provide that, in specified circumstances, a specified external Territory is included in this jurisdiction for the purposes of a specified provision of Chapter 7 (the applicable provision). If the regulations do so:

(a) the applicable provision applies in that external Territory in those circumstances; and

(b) the associated provisions (see subsection (10)) in relation to the applicable provision apply in that external Territory in relation to the applicable provision as so applying.

Meaning of associated provisions

(10) For the purposes of this section, the associated provisions in relation to a provision of Chapter 7 are:

(a) the provisions of Chapters 1, 9 (including the provisions of Division 2 of Part 9.4 that create offences and of Part 9.4B that allow for pecuniary penalty orders) and 10 as they apply or have effect in relation to, or for the purposes of, the provision; and

(b) any regulations or other instruments (including any that create offences or allow for pecuniary penalty orders) made under this Act for the purposes of any of the provisions covered by paragraph (a); and

(c) if regulations made for the purposes of subsection (9) have been made in relation to the provision—any other provisions of this Act, or any regulations or other instruments made under this Act (including any that create offences or allow for pecuniary penalty orders), specified in those regulations.

5A Application to the Crown

(1) To avoid doubt, a reference in this section to the Crown in a particular right includes a reference to an instrumentality or agency (whether a body corporate or not) of the Crown in that right.

(2) Chapter 5 (except Part 5.8) binds the Crown in right of the Commonwealth, of each of the States, of the Australian Capital Territory and of the Northern Territory.

(3) Chapters 6, 6A, 6B, 6C and 6D:

(a) bind the Crown in right of the Commonwealth; and

(b) do not bind the Crown in right of any State, of the Australian Capital Territory or of the Northern Territory.

(4) A provision of Chapter 5D, 6CA or 7 only binds the Crown in a particular capacity in circumstances (if any) specified in the regulations.

(5) Nothing in this Act makes the Crown in any right liable to a pecuniary penalty or to be prosecuted for an offence.

5B ASIC has general administration of this Act

Subject to the ASIC Act, ASIC has the general administration of this Act.

5C Application of the Acts Interpretation Act 1901

(1) Until the date of commencement of section 4 of the Legislative Instruments (Transitional and Consequential Amendments) Act 2003 (the Legislative Instruments commencement day), the Acts Interpretation Act 1901 as in force on 1 November 2000 applies to this Act.

(2) On and after the Legislative Instruments commencement day, the Acts Interpretation Act 1901 as in force on that day applies to this Act.

(3) Amendments of the Acts Interpretation Act 1901 made after the Legislative Instruments commencement day do not apply to this Act.

Part 1.1A—Interaction between Corporations legislation and State and Territory laws

5D Coverage of Part

(1) This Part applies only to laws of a State or Territory that is in this jurisdiction.

(2) This Part applies only to the following Corporations legislation:

(a) this Act (including the regulations made under this Act); and

(b) Part 3 of the ASIC Act; and

(c) regulations made under the ASIC Act for the purposes of Part 3 of that Act.

Note: This Part does not apply in relation to the trustee company provisions: see section 601RAE.

(3) This Part does not apply to Part 3 of the ASIC Act, or regulations made under that Act for the purposes of Part 3 of that Act, to the extent to which they operate in relation to a contravention of Division 2 of Part 2 of that Act.

5E Concurrent operation intended

(1) The Corporations legislation is not intended to exclude or limit the concurrent operation of any law of a State or Territory.

(2) Without limiting subsection (1), the Corporations legislation is not intended to exclude or limit the concurrent operation of a law of a State or Territory that:

(a) imposes additional obligations or liabilities (whether criminal or civil) on:

(i) a director or other officer of a company or other corporation; or

(ii) a company or other body; or

(b) confers additional powers on:

(i) a director or other officer of a company or other corporation; or

(ii) a company or other body; or

(c) provides for the formation of a body corporate; or

(d) imposes additional limits on the interests a person may hold or acquire in a company or other body; or

(e) prevents a person from:

(i) being a director of; or

(ii) being involved in the management or control of;

a company or other body; or

(f) requires a company:

(i) to have a constitution; or

(ii) to have particular rules in its constitution.

Note: Paragraph (a)—this includes imposing additional reporting obligations on a company or other body.

(3) Without limiting subsection (2), a reference in that subsection to a law of a State or Territory imposing obligations or liabilities, or conferring powers, includes a reference to a law of a State or Territory imposing obligations or liabilities, or conferring powers, by reference to the State or Territory in which a company is taken to be registered.

(4) This section does not apply to the law of the State or Territory if there is a direct inconsistency between the Corporations legislation and that law.

Note: Section 5G prevents direct inconsistencies arising in some cases by limiting the operation of the Corporations legislation.

(5) If:

(a) an act or omission of a person is both an offence against the Corporations legislation and an offence under the law of a State or Territory; and

(b) the person is convicted of either of those offences;

the person is not liable to be convicted of the other of those offences.

5F Corporations legislation does not apply to matters declared by State or Territory law to be an excluded matter

(1) Subsection (2) applies if a provision of a law of a State or Territory declares a matter to be an excluded matter for the purposes of this section in relation to:

(a) the whole of the Corporations legislation; or

(b) a specified provision of the Corporations legislation; or

(c) the Corporations legislation other than a specified provision; or

(d) the Corporations legislation otherwise than to a specified extent.

(2) By force of this subsection:

(a) none of the provisions of the Corporations legislation (other than this section) applies in the State or Territory in relation to the matter if the declaration is one to which paragraph (1)(a) applies; and

(b) the specified provision of the Corporations legislation does not apply in the State or Territory in relation to the matter if the declaration is one to which paragraph (1)(b) applies; and

(c) the provisions of the Corporations legislation (other than this section and the specified provisions) do not apply in the State or Territory in relation to the matter if the declaration is one to which paragraph (1)(c) applies; and

(d) the provisions of the Corporations legislation (other than this section and otherwise than to the specified extent) do not apply in the State or Territory in relation to the matter if the declaration is one to which paragraph (1)(d) applies.

(3) Subsection (2) does not apply to the declaration to the extent to which the regulations provide that that subsection does not apply to that declaration.

(4) By force of this subsection, if:

(a) the Corporations Law, ASC Law or ASIC Law of a State or Territory; or

(b) a provision of that Law;

did not apply to a matter immediately before this Act commenced because a provision of a law of the State or Territory provided that that Law, or that provision, did not apply to the matter, the Corporations legislation, or the provision of the Corporations legislation that corresponds to that provision of that Law, does not apply in the State or Territory to the matter until that law of the State or Territory is omitted or repealed.

(5) Subsection (4) does not apply to the application of the provisions of the Corporations legislation to the matter to the extent to which the regulations provide that that subsection does not apply to the matter.

(6) In this section:

matter includes act, omission, body, person or thing.

5G Avoiding direct inconsistency arising between the Corporations legislation and State and Territory laws

Section overrides other provisions of the Corporations legislation

(1) This section has effect despite anything else in the Corporations legislation.

Section does not deal with provisions capable of concurrent operation

(2) This section does not apply to a provision of a law of a State or Territory that is capable of concurrent operation with the Corporations legislation.

Note: This kind of provision is dealt with by section 5E.

When this section applies to a provision of a State or Territory law

(3) This section applies to the interaction between:

(a) a provision of a law of a State or Territory (the State provision); and

(b) a provision of the Corporations legislation (the Commonwealth provision);

only if the State provision meets the conditions set out in the following table:

Conditions to be met before section applies | [operative] |

Item | Kind of provision | Conditions to be met |

1 | a pre‑commencement (commenced) provision | (a) the State provision operated, immediately before this Act commenced, despite the provision of: (i) the Corporations Law of the State or Territory (as in force at that time); or (ii) the ASC or ASIC Law of the State or Territory (as in force at that time); that corresponds to the Commonwealth provision; and (b) the State provision is not declared to be one that this section does not apply to (either generally or specifically in relation to the Commonwealth provision) by: (i) regulations made under this Act; or (ii) a law of the State or Territory. |

2 | a pre‑commencement (enacted) provision | (a) the State provision would have operated, immediately before this Act commenced, despite the provision of: (i) the Corporations Law of the State or Territory (as in force at that time); or (ii) the ASC or ASIC Law of the State or Territory (as in force at that time); that corresponds to the Commonwealth provision if the State provision had commenced before the commencement of this Act; and (b) the State provision is not declared to be one that this section does not apply to (either generally or specifically in relation to the Commonwealth provision) by: (i) regulations made under this Act; or (ii) a law of the State or Territory. |

3 | a post‑commencement provision | the State provision is declared by a law of the State or Territory to be a Corporations legislation displacement provision for the purposes of this section (either generally or specifically in relation to the Commonwealth provision) |

4 | a provision that is materially amended on or after this Act commenced if the amendment was enacted before this Act commenced | (a) the State provision as amended would have operated, immediately before this Act commenced, despite the provision of: (i) the Corporations Law of the State or Territory (as in force at that time); or (ii) the ASC or ASIC Law of the State or Territory (as in force at that time); that corresponds to the Commonwealth provision if the amendment had commenced before the commencement of this Act; and (b) the State provision is not declared to be one that this section does not apply to (either generally or specifically in relation to the Commonwealth provision) by: (i) regulations made under this Act; or (ii) a law of the State or Territory. |

5 | a provision that is materially amended on or after this Act commenced if the amendment is enacted on or after this Act commenced | the State provision as amended is declared by a law of the State or Territory to be a Corporations legislation displacement provision for the purposes of this section (either generally or specifically in relation to the Commonwealth provision) |

| | | |

Note 1: Item 1—subsection (12) tells you when a provision is a pre‑commencement (commenced) provision.

Note 2: Item 1 paragraph (a)—For example, a State or Territory provision enacted after the commencement of the Corporations Law might not have operated despite the Corporations Law if it was not expressly provided that the provision was to operate despite a specified provision, or despite any provision, of the Corporations Law (see, for example, section 5 of the Corporations (New South Wales) Act 1990).

Note 3: Item 2—subsection (13) tells you when a provision is a pre‑commencement (enacted) provision.

Note 4: Item 3—subsection (14) tells you when a provision is a post‑commencement provision.

Note 5: Subsections (15) to (17) tell you when a provision is materially amended after commencement.

State and Territory laws specifically authorising or requiring act or thing to be done

(4) A provision of the Corporations legislation does not:

(a) prohibit the doing of an act; or

(b) impose a liability (whether civil or criminal) for doing an act;

if a provision of a law of a State or Territory specifically authorises or requires the doing of that act.

Instructions given to directors under State and Territory laws

(5) If a provision of a law of a State or Territory specifically:

(a) authorises a person to give instructions to the directors or other officers of a company or body; or

(b) requires the directors of a company or body to:

(i) comply with instructions given by a person; or

(ii) have regard to matters communicated to the company or body by a person; or

(c) provides that a company or body is subject to the control or direction of a person;

a provision of the Corporations legislation does not:

(d) prevent the person from giving an instruction to the directors or exercising control or direction over the company or body; or

(e) without limiting subsection (4):

(i) prohibit a director from complying with the instruction or direction; or

(ii) impose a liability (whether civil or criminal) on a director for complying with the instruction or direction.

The person is not taken to be a director of a company or body for the purposes of the Corporations legislation merely because the directors of the company or body are accustomed to act in accordance with the person’s instructions.

Use of names authorised by State and Territory laws

(6) The provisions of Part 2B.6 and Part 5B.3 of this Act do not:

(a) prohibit a company or other body from using a name if the use of the name is expressly provided for, or authorised by, a provision of a law of a State or Territory; or

(b) require a company or other body to use a word as part of its name if the company or body is expressly authorised not to use that word by a provision of a law of a State or Territory.

Meetings held in accordance with requirements of State and Territory laws

(7) The provisions of Chapter 2G of this Act do not apply to the calling or conduct of a meeting of a company to the extent to which the meeting is called or conducted in accordance with a provision of a law of a State or Territory. Any resolutions passed at the meeting are as valid as if the meeting had been called and conducted in accordance with this Act.

External administration under State and Territory laws

(8) The provisions of Chapter 5 of this Act do not apply to a scheme of arrangement, receivership, winding up or other external administration of a company to the extent to which the scheme, receivership, winding up or administration is carried out in accordance with a provision of a law of a State or Territory.

State and Territory laws dealing with company constitutions

(9) If a provision of a law of a State or Territory provides that a provision is included, or taken to be included, in a company’s constitution, the provision is included in the company’s constitution even though the procedures and other requirements of this Act are not complied with in relation to the provision.

(10) If a provision of a law of a State or Territory provides that additional requirements must be met for an alteration of a company’s constitution to take effect, the alteration does not take effect unless those requirements are met.

Other cases

(11) A provision of the Corporations legislation does not operate in a State or Territory to the extent necessary to ensure that no inconsistency arises between:

(a) the provision of the Corporations legislation; and

(b) a provision of a law of the State or Territory that would, but for this subsection, be inconsistent with the provision of the Corporations legislation.

Note 1: A provision of the State or Territory law is not covered by this subsection if one of the earlier subsections in this section applies to the provision: if one of those subsections applies there would be no potential inconsistency to be dealt with by this subsection.

Note 2: The operation of the provision of the State or Territory law will be supported by section 5E to the extent to which it can operate concurrently with the provision of the Corporations legislation.

Pre‑commencement (commenced) provision

(12) A provision of a law of a State or Territory is a pre‑commencement (commenced) provision if it:

(a) is enacted, and comes into force, before the commencement of this Act; and

(b) is not a provision that has been materially amended after commencement (see subsections (15) to (17)).

Pre‑commencement (enacted) provision

(13) A provision of a law of a State or Territory is a pre‑commencement (enacted) provision if it:

(a) is enacted before, but comes into force on or after, the commencement of this Act; and

(b) is not a provision that has been materially amended after commencement (see subsections (15) to (17)).

Post‑commencement provision

(14) A provision of a law of a State or Territory is a post‑commencement provision if it:

(a) is enacted, and comes into force, on or after the commencement of this Act; and

(b) is not a provision that has been materially amended after commencement (see subsections (15) to (17)).

Provision materially amended after commencement

(15) A provision of a law of a State or Territory is materially amended after commencement if:

(a) an amendment of the provision commences on or after the commencement of this Act; and

(b) neither subsection (16) nor subsection (17) applies to the amendment.

(16) A provision of a law of a State or Territory is not materially amended after commencement under subsection (15) if the amendment merely:

(a) changes:

(i) a reference to the Corporations Law or the ASC or ASIC Law, or the Corporations Law or the ASC or ASIC Law of a State or Territory, to a reference to the Corporations Act or the ASIC Act; or

(ii) a reference to a provision of the Corporations Law or the ASC or ASIC Law, or the Corporations Law or ASC or ASIC Law of a State or Territory, to a reference to a provision of the Corporations Act or the ASIC Act; or

(iii) a penalty for a contravention of a provision of a law of a State or Territory; or

(iv) a reference to a particular person or body to a reference to another person or body; or

(b) adds a condition that must be met before a right is conferred, an obligation imposed or a power conferred; or

(c) adds criteria to be taken into account before a power is exercised; or

(d) amends the provision in way declared by the regulations to not constitute a material amendment for the purposes of this subsection.

(17) A provision of a law of a State or Territory is not materially amended after commencement under subsection (15) if:

(a) the provision as amended would be inconsistent with a provision of the Corporations legislation but for this section; and

(b) the amendment would not materially reduce the range of persons, acts and circumstances to which the provision of the Corporations legislation applies if this section applied to the provision of the State or Territory law as amended.

5H Registration of body as company on basis of State or Territory law

(1) A body is taken to be registered under this Act as a company of a particular type under section 118 if a law of a State or Territory in this jurisdiction:

(a) provides that the body is a deemed registration company for the purposes of this section; and

(b) specifies:

(i) the day on which the body is to be taken to be registered (the registration day) or the manner in which that day is to be fixed; and

(ii) the type of company the body is to be registered as under this Act;

(iii) the company’s proposed name (unless the ACN is to be used in its name);

and subsections (2) and (3) are satisfied.

(2) A notice setting out the following details must be lodged before the registration day:

(a) the name and address of each person who is to be a member on registration;

(b) the present given and family name, all former given and family names and the date and place of birth of each person who is to be a director on registration;

(c) the present given and family name, all former given and family names and the date and place of birth of each person who consents in writing to become a company secretary;

(d) the address of each person who is to be a director or company secretary on registration;

(e) the address of the company’s proposed registered office;

(f) for a public company—the proposed opening hours of its registered office (if they are not the standard opening hours);

(g) the address of the company’s proposed principal place of business (if it is not the address of the proposed registered office);

(h) for a company limited by shares or an unlimited company—the following:

(i) the number and class of shares each member agrees in writing to take up;

(ii) the amount (if any) each member agrees in writing to pay for each share;

(iii) if that amount is not to be paid in full on registration—the amount (if any) each member agrees in writing to be unpaid on each share;

(i) for a public company that is limited by shares or is an unlimited company, if shares will be issued for non‑cash consideration—the prescribed particulars about the issue of the shares, unless the shares will be issued under a written contract and a copy of the contract is lodged with the application;

(j) for a company limited by guarantee—the proposed amount of the guarantee that each member agrees to in writing.

(3) If the company:

(a) is to be a public company; and

(b) is to have a constitution on registration;

a copy of the constitution must be lodged before the registration day.

(4) On the registration day, the body is taken:

(a) to be registered as a company under this Act; and

(b) to be registered in the State or Territory referred to in subsection (1).

(5) The regulations may modify the operation of this Act to facilitate the registration of the company.

(6) Without limiting subsection (5), the regulations may make provision in relation to:

(a) the share capital of the company on registration; and

(b) the issue of a certificate of registration on the basis of the company’s registration.

5I Regulations may modify operation of the Corporations legislation to deal with interaction between that legislation and State and Territory laws

(1) The regulations may modify the operation of the Corporations legislation so that:

(a) provisions of the Corporations legislation do not apply to a matter that is dealt with by a law of a State or Territory specified in the regulations; or

(b) no inconsistency arises between the operation of a provision of the Corporations legislation and the operation of a provision of a State or Territory law specified in the regulations.

(2) Without limiting subsection (1), regulations made for the purposes of that subsection may provide that the provision of the Corporations legislation:

(a) does not apply to:

(i) a person specified in the regulations; or

(ii) a body specified in the regulations; or

(iii) circumstances specified in the regulations; or

(iv) a person or body specified in the regulations in the circumstances specified in the regulations; or

(b) does not prohibit an act to the extent to which the prohibition would otherwise give rise to an inconsistency with the State or Territory law; or

(c) does not require a person to do an act to the extent to which the requirement would otherwise give rise to an inconsistency with the State or Territory law; or

(d) does not authorise a person to do an act to the extent to which the conferral of that authority on the person would otherwise give rise to an inconsistency with the State or Territory law; or

(e) does not impose an obligation on a person to the extent to which complying with that obligation would require the person to not comply with an obligation imposed on the person under the State or Territory law; or

(f) authorises a person to do something for the purposes of the Corporations legislation that the person:

(i) is authorised to do under the State or Territory law; and

(ii) would not otherwise be authorised to do under the Corporations legislation; or

(g) will be taken to be satisfied if the State or Territory law is satisfied.

(3) In this section:

matter includes act, omission, body, person or thing.

Part 1.2—Interpretation

Division 1—General

6 Effect of this Part

(1) The provisions of this Part have effect for the purposes of this Act, except so far as the contrary intention appears in this Act.

(2) This Part applies for the purposes of:

(a) Part 5.7; and

(b) Chapter 5 as applying by virtue of Part 5.7; and

(c) Part 9.2;

as if a reference in this Part to a person or to a body corporate included a reference to a Part 5.7 body.

(4) Where, because of Part 11.2, provisions of this Act, as in force at a particular time, continue to apply:

(a) in relation to someone or something; or

(b) for particular purposes;

then, for the purposes of those provisions as so applying:

(c) this Part as in force at that time continues to have effect; and

(d) this Part as in force at a later time does not have effect.

7 Location of other interpretation provisions

(1) Most of the interpretation provisions for this Act are in this Part.

(2) However, interpretation provisions relevant only to Chapter 7 are to be found at the beginning of that Chapter.

(3) Also, interpretation provisions relevant to a particular Part, Division or Subdivision may be found at the beginning of that Part, Division or Subdivision.

(4) Occasionally, an individual section contains its own interpretation provisions, not necessarily at the beginning.

9 Dictionary

Unless the contrary intention appears:

2‑part simple corporate bonds prospectus has the meaning given by section 713B.

AASB means the Australian Accounting Standards Board.

ABN (short for “Australian Business Number”) has the meaning given by section 41 of the A New Tax System (Australian Business Number) Act 1999.

Aboriginal and Torres Strait Islander corporation means a corporation registered under the Corporations (Aboriginal and Torres Strait Islander) Act 2006.

accounting standard means:

(a) an instrument in force under section 334; or

(b) a provision of such an instrument as it so has effect.

ACN (short for “Australian Company Number”) is the number given by ASIC to a company on registration (see sections 118 and 601BD).

acquire, in relation to financial products, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

act includes thing.

administration, in relation to a company, has the meaning given by section 435C.

administrator:

(a) in relation to a body corporate but not in relation to a deed of company arrangement:

(i) means an administrator of the body or entity appointed under Part 5.3A; and

(iii) if 2 or more persons are appointed under that Part as administrators of the body or entity—has a meaning affected by paragraph 451A(2)(b); or

(b) in relation to a deed of company arrangement:

(i) means an administrator of the deed appointed under Part 5.3A; and

(ii) if 2 or more persons are appointed under that Part as administrators of the deed—has a meaning affected by paragraph 451B(2)(b).

admit to quotation: financial products are admitted to quotation on a market if the market operator has given unconditional permission for quotation of the financial products on the market.

affairs, in relation to a body corporate, has, in the provisions referred to in section 53, a meaning affected by that section.

affidavit includes affirmation.

agency means an agency, authority, body or person.

aggregated turnover has the same meaning as in the Income Tax Assessment Act 1997.

AGM means an annual general meeting of a company that section 250N requires to be held.

agreement, in Chapter 6 or 7, means a relevant agreement.

amount includes a nil amount and zero.

ancillary offence, in relation to another offence, means an offence against:

(a) section 5, 6, 7 or 7A of the Crimes Act 1914; or

(b) subsection 86(1) of that Act by virtue of paragraph 86(1)(a) of that Act;

being an offence that is related to that other offence.

annual transparency report has the meaning given by subsection 332A(2).

annual turnover, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

application facility, in relation to a CSF offer, has the meaning given by subsection 738ZA(3).

approved code of conduct means a code of conduct approved by ASIC by legislative instrument under section 1101A, and includes a replacement code of conduct approved under that section.

approved stock exchange has the same meaning as in the Income Tax Assessment Act 1997.

APRA means the Australian Prudential Regulation Authority.

arbitrage transaction means a purchase or sale of financial products effected in the ordinary course of trading on a financial market together with an offsetting sale or purchase of those financial products effected at the same time, or at as nearly the same time as practicable, in the ordinary course of trading on another financial market for the purpose of obtaining a profit from the difference between the prices of those financial products in the 2 financial markets.

ARBN (short for “Australian Registered Body Number”) is the number given by ASIC to a registrable body on registration under Part 5B.2.

arrangement, in Part 5.1, includes a reorganisation of the share capital of a body corporate by the consolidation of shares of different classes, by the division of shares into shares of different classes, or by both of those methods.

ARSN (short for “Australian Registered Scheme Number”) is the number given by ASIC to a registered scheme on registration (see section 601EB).

ASIC means the Australian Securities and Investments Commission.

ASIC Act means the Australian Securities and Investments Commission Act 2001 and includes the regulations made under that Act.

ASIC database means so much of the national companies database kept by ASIC as consists of:

(a) some or all of a register kept by ASIC under this Act; or

(b) information set out in a document lodged under this Act;

but does not include ASIC’s document imaging system.

ASIC delegate has the same meaning as in the ASIC Act.

assets, in relation to a financial services licensee, means all the licensee’s assets (whether or not used in connection with the licensee’s Australian financial services licence).

associate has the meaning given by sections 10 to 17.

associated entity has the meaning given by section 50AAA.

AUASB means the Auditing and Assurance Standards Board.

audit means an audit conducted for the purposes of this Act and includes a review of a financial report for a financial year or a half‑year conducted for the purposes of this Act.

audit activity: see the definition of engage in audit activity.

audit company means a company that consents to be appointed, or is appointed, as auditor of a company or registered scheme.

audit‑critical employee, in relation to a company, or the responsible entity for a registered scheme, that is the audited body for an audit, means a person who:

(a) is an employee of the company or of the responsible entity for the registered scheme; and

(b) is able, because of the position in which the person is employed, to exercise significant influence over:

(i) a material aspect of the contents of the financial report being audited; or

(ii) the conduct or efficacy of the audit.

audited body, in relation to an audit of a company or registered scheme, means the company or registered scheme in relation to which the audit is, or is to be, conducted.

audit firm means a firm that consents to be appointed, or is appointed, as auditor of a company or registered scheme.

auditing standard means:

(a) a standard in force under section 336; or

(b) a provision of such a standard as it so has effect.

auditor independence requirements of this Act means the requirements of Divisions 3, 4 and 5 of Part 2M.4.

Australia means the Commonwealth of Australia and, when used in a geographical sense, includes each Territory.

Note: The Australian Capital Territory, the Jervis Bay Territory, the Northern Territory, Norfolk Island and the Territories of Christmas Island and of Cocos (Keeling) Islands are covered by the definition of Territory in this section.

Australian ADI means:

(a) an ADI (authorised deposit‑taking institution) within the meaning of the Banking Act 1959; and

(b) a person who carries on State banking within the meaning of paragraph 51(xiii) of the Constitution.

Australian bank means an Australian ADI that is permitted under section 66 of the Banking Act 1959 to assume or use:

(a) the word bank, banker or banking; or

(b) any other word (whether or not in English) that is of like import to a word referred to in paragraph (a).

Australian business law means a law of the Commonwealth, or of a State or Territory, that is a law that regulates, or relates to the regulation of, business or persons engaged in business.

Australian carbon credit unit has the same meaning as in the Carbon Credits (Carbon Farming Initiative) Act 2011.

Australian court means a federal court or a court of a State or Territory.

Australian CS facility licence, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

Australian derivative trade repository licence, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

Australian financial services licence, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

Australian law means a law of the Commonwealth or of a State or Territory.

Australian market licence, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

Australian member: a person is an Australian member of a notified foreign passport fund if:

(a) the person holds an interest in the fund that was acquired in this jurisdiction; or

(b) the person is ordinarily resident in this jurisdiction and holds an interest in the fund.

Australian passport fund means a managed investment scheme:

(a) that is registered under section 601EB as a registered scheme and also registered as an Australian passport fund under Part 8A.3; and

(b) that is not deregistered as a registered scheme and an Australian passport fund under Division 2 of Part 5C.10, or deregistered as an Australian passport fund under Division 1 of Part 8A.7.

Australian register of a foreign company means a branch register of members kept under section 601CM.

authorised audit company means a company registered under Part 9.2A.

bank or banker includes, but is not limited to, a body corporate that is an ADI (authorised deposit‑taking institution) for the purposes of the Banking Act 1959.

banking corporation means a body corporate that carries on, as its sole or principal business, the business of banking (other than State banking not extending beyond the limits of the State concerned).

banning order means an order made under subsection 920A(1).

base prospectus has the meaning given by subsection 713C(1).

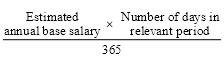

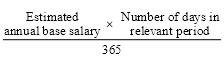

base salary has the meaning specified in regulations made for the purposes of this definition.

begin, in relation to a winding up, has the meaning given by Division 1A of Part 5.6.

benchmark administrator licence means a licence granted under section 908BC.

benchmark administrator licensee means a person who holds a benchmark administrator licence.

benefit:

(a) means any benefit, whether by way of payment of cash or otherwise; and

(b) when used in Division 2 of Part 2D.2 (sections 200 to 200J)—has the meaning given by section 200AB.

benefit derived and detriment avoided:

(a) because of an offence—has the meaning given by section 1311D; and

(b) because of a contravention of a civil penalty provision—has the meaning given by section 1317GAD.

bid class of securities for a takeover bid is the class of securities to which the securities being bid for belong.

bidder for a takeover bid means the person who makes or proposes to make, or each of the people who make or propose to make, the offers under the bid (whether personally or by an agent or nominee).

Note: A person who announces a bid on behalf of another person is not making the bid, the other person is making the bid.

bidder’s statement means a bidder’s statement under sections 636 and 637 as supplemented.

bid period:

(a) for an off‑market bid—starts when the bidder’s statement is given to the target and ends:

(i) 1 month later if no offers are made under the bid; or

(ii) at the end of the offer period; and

(b) for a market bid—starts when the bid is announced to the relevant financial market and ends at the end of the offer period.

Board, when used in Part 9.2, means the Companies Auditors Disciplinary Board.

board limit means a limit described in section 201N.

board limit resolution means a resolution described in paragraph 201P(1)(a).

body means a body corporate or an unincorporated body and includes, for example, a society or association.

body corporate:

(a) includes a body corporate that is being wound up or has been dissolved; and

(b) in this Chapter (except section 66A) and section 206E includes an unincorporated registrable body.

body regulated by APRA has the meaning given by subsection 3(2) of the Australian Prudential Regulation Authority Act 1998.

books includes:

(a) a register; and

(b) any other record of information; and

(c) financial reports or financial records, however compiled, recorded or stored; and

(d) a document;

but does not include an index or recording made under Subdivision D of Division 5 of Part 6.5.

borrower, in relation to a debenture, means the body that is or will be liable to repay money under the debenture.

business affairs, in relation to an entity, has a meaning affected by sections 53AA, 53AB, 53AC and 53AD.

business day means a day that is not a Saturday, a Sunday or a public holiday or bank holiday in the place concerned.

Business Names Register means the Register established and maintained under section 22 of the Business Names Registration Act 2011.

buy‑back by a company means the acquisition by the company of shares in itself.

buy‑back agreement by a company means an agreement by the company to buy back its own shares (whether the agreement is conditional or not).

carry on has a meaning affected by Division 3.

cash management trust interest means an interest that:

(a) is an interest in a registered scheme or a notified foreign passport fund; and

(b) relates to an undertaking of the kind commonly known as a cash management trust.

cause includes procure.

certified means:

(a) in relation to a copy of, or extract from, a document—certified by a statement in writing to be a true copy of, or extract from, the document; or

(b) in relation to a translation of a document—certified by a statement in writing to be a correct translation of the document into English.

Chapter 5 body corporate means a body corporate:

(a) that is being wound up; or

(b) in respect of property of which a receiver, or a receiver and manager, has been appointed (whether or not by a court) and is acting; or

(c) that is under administration; or

(d) that has executed a deed of company arrangement that has not yet terminated; or

(da) that is under restructuring; or

(db) that has made a restructuring plan that has not yet terminated; or

(e) that has entered into a compromise or arrangement with another person the administration of which has not been concluded.

charge means a charge created in any way and includes a mortgage and an agreement to give or execute a charge or mortgage, whether on demand or otherwise.

chargeable matter has the same meaning as in the Corporations (Fees) Act 2001.

chargee means the holder of a charge and includes a person in whose favour a charge is to be given or executed, whether on demand or otherwise, under an agreement.

child: without limiting who is a child of a person for the purposes of this Act, someone is the child of a person if he or she is a child of the person within the meaning of the Family Law Act 1975.

circulating security interest has the meaning given by section 51C.

civil matter means a matter other than a criminal matter.

civil penalty order means any of the following:

(a) a declaration of contravention under section 1317E;

(b) a pecuniary penalty order under section 1317G;

(baa) a relinquishment order under section 1317GAB;

(ba) a refund order under section 1317GA or 1317GB;

(c) a compensation order under section 961M, 1317H, 1317HA, 1317HB, 1317HC or 1317HE;

(d) an order under section 206C disqualifying a person from managing corporations.

civil penalty provision has the meaning given in subsection 1317E(3).

claims handling and settling service, when used in a provision outside Chapter 7, has the same meaning as in Chapter 7.

class has:

(b) in relation to shares or interests in a managed investment scheme—a meaning affected by section 57; and

(c) when used in relation to securities for the purposes of Chapter 6, 6A or 6C—a meaning affected by subsection 605(2).

clearing and settlement facility, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

close associate of a director means:

(a) a relative of the director; or

(b) a relative of a spouse of the director.

closed, in relation to a CSF offer, has the meaning given by subsection 738N(3).

closely related party of a member of the key management personnel for an entity means:

(a) a spouse or child of the member; or

(b) a child of the member’s spouse; or

(c) a dependant of the member or of the member’s spouse; or

(d) anyone else who is one of the member’s family and may be expected to influence the member, or be influenced by the member, in the member’s dealings with the entity; or

(e) a company the member controls; or

(f) a person prescribed by the regulations for the purposes of this paragraph.

coastal sea:

(a) in relation to Australia—means:

(i) the territorial sea of Australia; and

(ii) the sea on the landward side of the territorial sea of Australia and not within the limits of a State or internal Territory;

and includes the airspace over, and the sea‑bed and subsoil beneath, any such sea; and

(b) in relation to a State or Territory—means so much of the coastal sea of Australia as is within the area described in Schedule 1 to the Offshore Petroleum and Greenhouse Gas Storage Act 2006 under the heading that refers to that State or Territory.

code of conduct means a code of conduct that relates to any aspect of the activities of:

(a) financial services licensees; or

(b) authorised representatives of financial services licensees; or

(c) issuers of financial products;

being activities in relation to which ASIC has a regulatory responsibility.

commence, in relation to a winding up, has the meaning given by Division 1A of Part 5.6.

commencement, in relation to an accounting standard, means:

(a) in the case of an accounting standard as originally in effect—the time when the accounting standard took effect; or

(b) in the case of an accounting standard as varied by a particular provision of an instrument made under section 334—the time when that provision took effect.

Commonwealth means the Commonwealth of Australia and, when used in a geographical sense, includes each Territory.

Note: The Australian Capital Territory, the Jervis Bay Territory, the Northern Territory, Norfolk Island and the Territories of Christmas Island and of Cocos (Keeling) Islands are covered by the definition of Territory in this section.

Commonwealth authority means an authority or other body (whether incorporated or not) that is established or continued in existence by or under an Act.

Commonwealth body means:

(a) an Agency (within the meaning of the Public Service Act 1999); or

(b) a body, whether incorporated or not, established for a public purpose by or under a law of the Commonwealth; or

(c) a person:

(i) holding or performing the duties of an office established by or under a law of the Commonwealth; or

(ii) holding an appointment made under a law of the Commonwealth.

communication facility, in relation to a CSF offer, has the meaning given by subsection 738ZA(5).

company means a company registered under this Act and:

(c) in Parts 5.7B and 5.8 (except sections 595 and 596), includes a Part 5.7 body; and

(d) in Part 5B.1, includes an unincorporated registrable body.

company limited by guarantee means a company formed on the principle of having the liability of its members limited to the respective amounts that the members undertake to contribute to the property of the company if it is wound up.

company limited by shares means a company formed on the principle of having the liability of its members limited to the amount (if any) unpaid on the shares respectively held by them.

compelled financial benchmark rules means rules made under section 908CD.

complete, in relation to a CSF offer, has the meaning given by subsection 738N(7).

condition, in relation to a licence, means a condition or restriction to which the licence is subject, or will be subject, as the case requires.

connected entity, in relation to a corporation, means:

(a) a body corporate that is, or has been, related to the corporation; or

(b) an entity that is, or has been, connected (as defined by section 64B) with the corporation.

consolidated entity means a company, registered scheme or disclosing entity together with all the entities it is required by the accounting standards to include in consolidated financial statements.

constitution means (depending on the context):

(a) a company’s constitution, which (where relevant) includes rules and consequential amendments that are part of the company’s constitution because of the Life Insurance Act 1995; or

(b) a managed investment scheme’s constitution; or

(c) in relation to any other kind of body:

(i) the body’s charter or memorandum; or

(ii) any instrument or law (other than this Act) constituting, or defining the constitution of, the body or governing the activities of the body or its members.

Note 1: The Life Insurance Act 1995 has rules about how benefit fund rules become part of a company’s constitution. They override this Act. See Subdivision 2 of Division 4 of Part 2A of that Act.

Note 2: The constituent document (as defined in the Passport Rules for this jurisdiction) for a notified foreign passport fund is taken under section 1213E to be the constitution of the fund as a managed investment scheme.

continuous disclosure notice means:

(a) a document used to notify a market operator of information relating to a body under provisions of the market’s listing rules referred to in subsection 674(1); or

(b) a document under section 675 lodged in relation to the body.

continuously quoted securities are securities that:

(a) are in a class of securities that were quoted ED securities at all times in the 3 months before the date of the prospectus or Product Disclosure Statement; and

(b) are securities of an entity in relation to which the following subparagraphs are satisfied during the shorter of the period during which the class of securities were quoted, and the period of 12 months before the date of the prospectus or Product Disclosure Statement:

(i) no exemption under section 111AS or 111AT, or modification under section 111AV, covered the entity, or any person as director or auditor of the entity;

(ii) no exemption under paragraph 741(1)(a), or declaration under paragraph 741(1)(b), relating to a provision that is a disclosing entity provision for the purposes of Division 4 of Part 1.2A covered the entity, or any person as director or auditor of the entity;

(iii) no order under section 340, 340A, 341 or 341A covered the entity, or any person as director or auditor of the entity;

and, for these purposes, securities are not in different classes merely because of a temporary difference in the dividend, or distribution rights, attaching to the securities or because different amounts have been paid up on the securities.

contravene, in relation to a civil penalty provision, has a meaning affected by subsection 1317E(4).

contribution plan means a plan in respect of which the following conditions are met:

(a) regular deductions are made from the wages or salary of an employee or director (the contributor) to acquire financial products that are offered for issue or sale to the contributor under an eligible employee share scheme;

(b) the deductions are authorised by the contributor in a form which is included in, or accompanies, the disclosure document or the Product Disclosure Statement for the scheme;

(c) before acquiring the financial products under the scheme, the deductions are held on trust in an account with an Australian ADI that is kept solely for that purpose;

(d) the contributor may elect to discontinue the deductions at any time;

(e) if the contributor so elects, the amount of the deductions standing, at that time, to the credit of the account for the contributor, and any interest on that amount, is repaid to the contributor;

(f) the scheme does not involve the offer to the contributor of a loan or similar financial assistance for the purpose of, or in connection with, the acquisition of the financial products that are offered under the scheme.

contributory means:

(a) in relation to a company (other than a no liability company):

(i) a person liable as a member or past member to contribute to the property of the company if it is wound up; and

(ii) for a company with share capital—a holder of fully paid shares in the company; and

(iii) before the final determination of the persons who are contributories because of subparagraphs (i) and (ii)—a person alleged to be such a contributory; and

(b) in relation to a Part 5.7 body:

(i) a person who is a contributory by virtue of section 586; and

(ii) before the final determination of the persons who are contributories by virtue of that section—a person alleged to be such a contributory; and

(c) in relation to a no liability company—subject to subsection 254M(2), a member of the company.

control:

(a) unless paragraph (b) applies—has the meaning given by section 50AA; and

(b) when used in Part 7.6—has the meaning given by section 910B.

control day, in relation to a controller of property of a corporation, means:

(a) unless paragraph (b) applies:

(i) in the case of a receiver, or receiver and manager, of that property—the day when the receiver, or receiver and manager, was appointed; or

(ii) in the case of any other person who is in possession, or has control, of that property for the purpose of enforcing a security interest—the day when the person entered into possession, or took control, of property of the corporation for the purpose of enforcing that security interest; or

(b) if the controller became a controller of property of the corporation:

(i) to act with an existing controller of such property; or

(ii) in place of a controller of such property who has died or ceased to be a controller of such property;

the day that is, because of any other application or applications of this definition, the control day in relation to the controller referred to in subparagraph (i) or (ii).

controller, in relation to property of a corporation, means:

(a) a receiver, or receiver and manager, of that property; or

(b) anyone else who (whether or not as agent for the corporation) is in possession, or has control, of that property for the purpose of enforcing a security interest;

and has a meaning affected by paragraph 434F(b) (which deals with 2 or more persons appointed as controllers).

convertible note has the same meaning as in Division 3A of Part III of the Income Tax Assessment Act 1936.

convertible securities: securities are convertible into another class of securities if the holder may have the other class of securities issued to them by the exercise of rights attached to those securities. An option may be a convertible security even if it is non‑renounceable.

corporation has the meaning given by section 57A.

corporation/scheme civil penalty provision has the meaning given by subsection 1317E(3).

Corporations legislation means:

(a) this Act; and

(b) the ASIC Act; and

(c) rules of court made by the Federal Court, the Supreme Court of the Australian Capital Territory, or the Family Court, because of a provision of this Act; and

(d) rules of court applied by the Supreme Court, or a State Family Court, of a State, or by the Supreme Court of the Northern Territory or of Norfolk Island, when exercising jurisdiction conferred by Division 1 of Part 9.6A (including jurisdiction conferred by virtue of any previous application or applications of this paragraph).

court has the meaning given by section 58AA.

Court has the meaning given by section 58AA.

court of summary jurisdiction means any justice or justices of the peace or other magistrate sitting as a court for the making of summary orders or the summary punishment of offences:

(a) under a law of the Commonwealth or of a State or Territory; or

(b) by virtue of his or her commission or their commissions.

creditor‑defeating disposition has the meaning given by section 588FDB.

creditors’ voluntary winding up means a winding up under Part 5.5, other than a members’ voluntary winding up.

CSF is short for crowd‑sourced funding.

Note: Crowd‑sourced funding is dealt with in Part 6D.3A.

CSF audit threshold means:

(a) unless paragraph (b) applies—$3 million; or

(b) any amount prescribed by the regulations for the purposes of this paragraph.

CSF intermediary has the meaning given by section 738C.

CSF offer has the meaning given by section 738B.

CSF offer document, in relation to a CSF offer, has the meaning given by subsection 738J(1).

CSF shareholder, of a proprietary company, means an entity that holds one or more securities of the company due to being issued with the securities pursuant to a CSF offer by the company.

current market bid price for securities covered by a market bid is the price specified in the announcement of the bid as increased or decreased during the offer period.

custodial or depository service that a person provides has the meaning given by section 766E.

daily newspaper means a newspaper that is ordinarily published on each day that is a business day in the place where the newspaper is published, whether or not the newspaper is ordinarily published on other days.

data standards means standards made by the Registrar under section 1270G.

date of a takeover bid is:

(a) for an off‑market bid—the date on which offers are first made under the bid; or

(b) for a market bid—the date on which the bid is announced to the relevant financial market.

deal:

(a) in relation to a futures contract—has the meaning given by Division 4; and

(b) in relation to securities—subject to subsection 93(4), means (whether as principal or agent) acquire, dispose of, subscribe for or underwrite the securities, or make or offer to make, or induce or attempt to induce a person to make or to offer to make, an agreement:

(i) for or with respect to acquiring, disposing of, subscribing for or underwriting the securities; or

(ii) the purpose or purported purpose of which is to secure a profit or gain to a person who acquires, disposes of, subscribes for or underwrites the securities or to any of the parties to the agreement in relation to the securities.

dealing, in relation to financial products, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

debenture of a body means a chose in action that includes an undertaking by the body to repay as a debt money deposited with or lent to the body. The chose in action may (but need not) include a security interest over property of the body to secure repayment of the money. However, a debenture does not include:

(a) an undertaking to repay money deposited with or lent to the body by a person if:

(i) the person deposits or lends the money in the ordinary course of a business carried on by the person; and

(ii) the body receives the money in the ordinary course of carrying on a business that neither comprises nor forms part of a business of borrowing money and providing finance; or

(b) an undertaking by an Australian ADI to repay money deposited with it, or lent to it, in the ordinary course of its banking business; or

Note: This paragraph has an extended meaning in relation to Chapter 8 (see subsection 1200A(2)).

(c) an undertaking to pay money under:

(i) a cheque; or

(ii) an order for the payment of money; or

(iii) a bill of exchange; or

(e) an undertaking by a body corporate to pay money to a related body corporate; or

(f) an undertaking to repay money that is prescribed by the regulations.

For the purposes of this definition, if a chose in action that includes an undertaking by a body to pay money as a debt is offered as consideration for the acquisition of securities under an off‑market takeover bid, or is issued under a compromise or arrangement under Part 5.1, the undertaking is taken to be an undertaking to repay as a debt money deposited with or lent to the body.

decision period, for a secured party in relation to a security interest in property (including PPSA retention of title property) of a company means:

(a) in relation to a company under administration—the period beginning on the day when:

(i) a notice of appointment of the administrator must be given to the secured party under subsection 450A(3)—such notice is so given; or

(ii) otherwise—the administration begins;

and ending at the end of the thirteenth business day after that day; and

(b) in relation to a company under restructuring—the period beginning on the day when:

(i) a notice of appointment of the restructuring practitioner must be given to the secured party under the regulations—such notice is so given; or

(ii) otherwise—the restructuring begins;

and ending at the end of the thirteenth business day after that day.

declaration of indemnities, in relation to an administrator of a company under administration, means a written declaration:

(a) stating whether the administrator has, to any extent, been indemnified (otherwise than under section 443D), in relation to that administration, for:

(i) any debts for which the administrator is, or may become, liable under Subdivision A of Division 9 of Part 5.3A; or

(ii) any debts for which the administrator is, or may become, liable under a remittance provision as defined in section 443BA; or

(iii) the remuneration to which he or she is entitled under section 60‑5 of Schedule 2 (external administrator’s remuneration); and

(b) if so, stating:

(i) the identity of each indemnifier; and

(ii) the extent and nature of each indemnity.

declaration of relevant relationships has the meaning given by section 60.

deductible gift recipient has the same meaning as in the Income Tax Assessment Act 1997.

deed includes a document having the effect of a deed.

deed of company arrangement means a deed of company arrangement executed under Part 5.3A or such a deed as varied and in force from time to time.

defeating condition for a takeover bid means a condition that:

(a) will, in circumstances referred to in the condition, result in the rescission of, or entitle the bidder to rescind, a takeover contract; or

(b) prevents a binding takeover contract from resulting from an acceptance of the offer unless or until the condition is fulfilled.

defect, in relation to a statutory demand, includes:

(a) an irregularity; and

(b) a misstatement of an amount or total; and

(c) a misdescription of a debt or other matter; and

(d) a misdescription of a person or entity.

defective, in relation to a CSF offer document, has the meaning given by subsection 738U(1).

deregistered means:

(a) in relation to a company—deregistered under Chapter 5A; and

(b) in relation to any other body corporate—deregistered in a way that results in the body corporate ceasing to exist.

derivative, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

derivative trade repository rules, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

derivative transaction rules, when used in a provision outside Chapter 7, has the same meaning as it has in Chapter 7.

designated secrecy provision has the meaning given by subsection 1270M(3).

director of a company or other body means:

(a) a person who:

(i) is appointed to the position of a director; or

(ii) is appointed to the position of an alternate director and is acting in that capacity;

regardless of the name that is given to their position; and

(b) unless the contrary intention appears, a person who is not validly appointed as a director if:

(i) they act in the position of a director; or

(ii) the directors of the company or body are accustomed to act in accordance with the person’s instructions or wishes.

Subparagraph (b)(ii) does not apply merely because the directors act on advice given by the person in the proper performance of functions attaching to the person’s professional capacity, or the person’s business relationship with the directors or the company or body.

Note: Paragraph (b)—Contrary intention—Examples of provisions for which a person referred to in paragraph (b) would not be included in the term “director” are:

- section 249C (power to call meetings of a company’s members)

- subsection 251A(3) (signing minutes of meetings)

- section 205B (notice to ASIC of change of address).

director identification number means a director identification number given under:

(a) section 1272; or

(b) section 308‑5 of the Corporations (Aboriginal and Torres Strait Islander) Act 2006.

disclosing entity has the meaning given by section 111AC.

disclosure document for an offer of securities means:

(a) a prospectus for the offer; or

(b) a profile statement for the offer; or

(c) an offer information statement for the offer.

disclosure framework means the disclosure framework made by the Registrar under section 1270K.

dishonest means dishonest according to the standards of ordinary people.

dispose has a meaning affected by the following paragraphs:

(a) when used in relation to financial products in a provision outside Chapter 7, otherwise than in a situation to which paragraph (b) applies, dispose has the same meaning as it has in Chapter 7;

(b) for the purposes of Chapter 6, a person who has a relevant interest in securities disposes of the securities if, and only if, they cease to have a relevant interest in the securities.

document means any record of information, and includes:

(a) anything on which there is writing; and

(b) anything on which there are marks, figures, symbols or perforations having a meaning for persons qualified to interpret them; and

(c) anything from which sounds, images or writings can be reproduced with or without the aid of anything else; and

(d) a map, plan, drawing or photograph.

domestic corporation means a corporation that is incorporated or formed in Australia or an external Territory.

ED securities has the meaning given by section 111AD.

electronic communication means:

(a) a communication of information in the form of data, text or images by means of guided and/or unguided electromagnetic energy; or

(b) a communication of information in the form of speech by means of guided and/or unguided electromagnetic energy, where the speech is processed at its destination by an automated voice recognition system.

eligibility criteria for restructuring a company: see section 453C.

eligibility criteria for the simplified liquidation process: see section 500AA.

eligible applicant, in relation to a corporation, means:

(a) ASIC; or

(b) a liquidator or provisional liquidator of the corporation; or

(c) an administrator of the corporation; or

(d) an administrator of a deed of company arrangement executed by the corporation; or

(da) a restructuring practitioner for the corporation; or

(db) a restructuring practitioner for a restructuring plan made by the corporation; or

(e) a person authorised in writing by ASIC to make:

(i) applications under the Division of Part 5.9 in which the expression occurs; or

(ii) such an application in relation to the corporation.

eligible CSF company has the meaning given by section 738H.

eligible employee creditor, in relation to a company, means a creditor whose debt or claim would, in a winding up of the company, be payable in priority to other unsecured debts and claims in accordance with paragraph 556(1)(e), (g) or (h) or section 560 or 561.

eligible employee share scheme means an employee share scheme for a body corporate in respect of which the following conditions are met:

(a) the scheme is offered only to employees or directors mentioned in paragraph (a) of the definition of employee share scheme;

(b) the financial products that are offered under the scheme are offered:

(i) under a disclosure document or Product Disclosure Statement; or

(ii) without disclosure under Part 6D.2 in accordance with subsection 708(12);

(c) the financial products which may be acquired under the scheme are the following:

(i) fully paid ordinary shares;

(ii) options, offered for no more than nominal consideration, for the issue or transfer of fully paid ordinary shares;

(iii) units in fully paid ordinary shares.

eligible for temporary restructuring relief has the meaning given by section 458E.

eligible international emissions unit has the same meaning as in the Australian National Registry of Emissions Units Act 2011.

eligible money market dealer means a body corporate in respect of which a declaration is in force under section 65.

eligible officer has the meaning given by section 1272B.

eligible recipient has the meaning given by section 1317AAC.

eligible whistleblower has the meaning given by section 1317AAA.