New Business Tax System (Integrity Measures) Act 2000

No. 90, 2000

New Business Tax System (Integrity Measures) Act 2000

No. 90, 2000

New Business Tax System (Integrity Measures) Act 2000

No. 90, 2000

An Act to amend the law about taxation to implement the New Business Tax System, and for related purposes

Contents

1 Short title...................................

2 Commencement...............................

3 Schedule(s)..................................

Schedule 1—Losses from non‑commercial business activities

Income Tax Assessment Act 1997

Schedule 2—Deducting prepayments

Part 1—Expenditure on and after 11 November 1999

Income Tax Assessment Act 1936

Part 2—2002 and later expenditure

Income Tax Assessment Act 1936

Part 3—Application provisions

New Business Tax System (Integrity Measures) Act 2000

No. 90, 2000

An Act to amend the law about taxation to implement the New Business Tax System, and for related purposes

[Assented to 30 June 2000]

The Parliament of Australia enacts:

This Act may be cited as the New Business Tax System (Integrity Measures) Act 2000.

This Act commences on the day on which it receives the Royal Assent.

Subject to section 2, each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Schedule 1—Losses from non‑commercial business activities

Income Tax Assessment Act 1997

1 At the end of subsection 8‑1(1)

Add:

Note: Division 35 prevents losses from non‑commercial business activities that may contribute to a tax loss being offset against other assessable income.

2 Section 12‑5 (after the table item headed “non‑cash transactions”)

Insert:

non‑commercial business activities |

|

deferral of non‑commercial losses........... | Division 35 |

3 Section 34‑65 (link note)

Repeal the link note, substitute:

Division 35—Deferral of losses from non‑commercial business activities

35‑1 What this Division is about

This Division prevents losses of individuals from non‑commercial business activities being offset against other assessable income in the year the loss is incurred. The loss is deferred.

It sets out a series of tests to determine whether a business activity is treated as being non‑commercial.

The deferred losses may be offset in later years against profits from the activity or, if one of the tests is satisfied or the Commissioner exercises a discretion, against other income.

Table of sections

Operative provisions

35‑5 Object

35‑10 Deferral of deductions from non‑commercial business activities

35‑15 Modification if you have exempt income

35‑20 Modification if you become bankrupt

35‑25 Application of Division to certain partnerships

35‑30 Assessable income test

35‑35 Profits test

35‑40 Real property test

35‑45 Other assets test

35‑50 Apportionment

35‑55 Commissioner’s discretion

[This is the end of the Guide.]

(1) The object of this Division is to improve the integrity of the taxation system by preventing losses from non‑commercial activities that are carried on as *businesses by individuals (alone or in partnership) being offset against other assessable income.

(2) This Division is not intended to apply to activities that do not constitute carrying on a *business, for example, the receipt of income from passive investments.

35‑10 Deferral of deductions from non‑commercial business activities

(1) The rule in subsection (2) applies for an income year to each *business activity you carried on in that year if you are an individual, either alone or in partnership (whether or not some other entity is a member of the partnership), unless:

(a) one of the tests set out in section 35‑30 (assessable income test), 35‑35 (profits test), 35‑40 (real property test) or 35‑45 (other assets test) is satisfied for the business activity for that year; or

(b) the Commissioner has exercised the discretion set out in section 35‑55 for the business activity for that year; or

(c) the exception in subsection (4) applies for that year.

Note: This section covers individuals carrying on a business activity as partners, but not individuals merely in receipt of income jointly. Compare the definition of partnership in subsection 995‑1(1).

Rule

(2) If the amounts attributable to the *business activity for that income year that you could otherwise deduct under this Act for that year exceed your assessable income (if any) from the business activity for that year, or your share of it, this Act applies to you as if the excess:

(a) were not incurred in that income year; and

(b) were an amount attributable to the activity that you can deduct from assessable income from the activity for the next income year in which the activity is carried on.

Note: There are modifications of this rule if you have exempt income (see section 35‑15) or you become bankrupt (see section 35‑20).

Example: Jennifer has a salaried job, and she also carries on a business activity consisting of selling lingerie.

Jennifer starts that activity on 1 July 2002, and for the 2002‑03 income year, the activity produces assessable income of $8,000 and deductions of $10,000. The activity does not pass any of the tests and the discretion is not exercised so the $2,000 excess is carried over to the next income year in which the activity is carried on.

For the 2003‑04 income year, the activity produces assessable income of $9,000 and deductions of $10,000 (excluding the $2,000 excess from 2002‑03). Again, no tests passed and no exercise of discretion.

$3,000 is carried over to the next income year (comprising the $1,000 excess for the current year, plus the previous year’s $2,000 excess) when the activity is carried on.

Grouping business activities

(3) In applying this Division, you may group together *business activities of a similar kind.

Exceptions

(4) The rule in subsection (2) does not apply to a *business activity for an income year if:

(a) the activity is a *primary production business, or a *professional arts business; and

(b) your assessable income for that year (except any *net capital gain) from other sources that do not relate to that activity is less than $40,000.

(5) A professional arts business is a *business you carry on as:

(a) the author of a literary, dramatic, musical or artistic work; or

Note: The expression “author” is a technical term from copyright law. In general, the “author” of a musical work is its composer and the “author” of an artistic work is the artist, sculptor or photographer who created it.

(b) a *performing artist; or

(c) a *production associate.

35‑15 Modification if you have exempt income

(1) The rule in section 35‑10 may be modified for an income year if you *derived *exempt income in that year.

(2) Any amount to which paragraph 35‑10(2)(b) would otherwise apply for an income year for you is reduced by so much of your *net exempt income as is not applied for that income year under section 36‑10 or 36‑15 (about tax losses). This reduction is made before you apply the paragraph 35‑10(2)(b) amount against assessable income from the *business activity.

35‑20 Modification if you become bankrupt

(1) The rule in section 35‑10 is modified as set out in subsection (3) for an income year if in that year (the current year) you become bankrupt or are released from a debt by the operation of an Act relating to bankruptcy.

(2) The rule is also modified as set out in subsection (3) if:

(a) you became bankrupt before the current year; and

(b) the bankruptcy is annulled in the current year under section 74 of the Bankruptcy Act 1966 because your creditors have accepted a proposal for a composition or scheme of arrangement; and

(c) under the composition or scheme of arrangement, you have been, will be or may be released from some or all of the debts from which you would have been released if you had instead been discharged from the bankruptcy.

(3) This Act applies to you as if any amount that:

(a) paragraph 35‑10(2)(b) had applied to for an income year before the current year for you; and

(b) you have not yet deducted;

were not an amount attributable to the *business activity that you can deduct for the current year or a later income year.

35‑25 Application of Division to certain partnerships

For the purpose of applying the tests in sections 35‑30, 35‑40 and 35‑45 where you carry on a *business activity in an income year as a partner, ignore:

(a) any part of the assessable income from the business activity for the year that is attributable to the interest of a partner that is not an individual in the partnership net income or partnership loss for the year; and

(b) any part of the assessable income from the business activity for the year that is derived from the activity by another partner otherwise than as a member of the partnership; and

(c) any part of the *reduced cost bases or other values of assets of the partnership used in carrying on the activity in that year that is attributable to the interest of a partner that is not an individual in those assets; and

(d) any part of the reduced cost bases or other values of assets owned or leased by another partner that are not partnership assets and used in carrying on the activity in that year.

The rule in section 35‑10 does not apply to a *business activity for an income year if:

(a) the amount of assessable income from the business activity for the year; or

(b) you started to carry on the business activity, or stopped carrying it on, during the year—a reasonable estimate of what would have been the amount of that assessable income if you had carried on that activity throughout the year;

is at least $20,000.

(1) The rule in section 35‑10 does not apply to a *business activity (except an activity carried on by one or more individuals as partners, whether or not some other entity is a member of the partnership) for an income year (the current year) if, for each of at least 3 of the past 5 income years (including the current year) the sum of the deductions attributable to that activity for that year (apart from the operation of subsection 35‑10(2)) is less than the assessable income from the activity for that year.

(2) For a *business activity you carried on with one or more others as partners, the rule in section 35‑10 does not apply to you for the current year if, for each of at least 3 of the past 5 income years (including the current year) the sum of your deductions (including your share of the partnership deductions) attributable to that activity for that year (apart from the operation of subsection 35‑10(2)) is less than your assessable income (including your share of the partnership’s assessable income) from the activity for that year.

(1) The rule in section 35‑10 does not apply to a *business activity for an income year if the total *reduced cost bases of real property or interests in real property used on a continuing basis in carrying on the activity in that year is at least $500,000.

(2) You may use the market value of the real property or interest if that value is more than its *reduced cost base.

(3) The *reduced cost base or market value is worked out:

(a) as at the end of the income year; or

(b) if you stopped carrying on the *business activity during the year:

(i) as at the time you stopped; or

(ii) if you disposed of the asset before that time in the course of stopping carrying on the activity—as at the time you disposed of it.

(4) However, these assets are not counted for this test:

(a) a *dwelling, and any adjacent land used in association with the dwelling, that is used mainly for private purposes;

(b) fixtures owned by you as a tenant.

(1) The rule in section 35‑10 does not apply to a *business activity for an income year if the total values of assets that are counted for this test (see subsections (2) and (4)) and that are used on a continuing basis in carrying on the activity in that year is at least $100,000.

(2) The assets counted for this test, and their values for this test, are set out in this table:

Assets counted for this test and their values | ||

Item | Asset | Value |

1 | An asset for which you can deduct an amount for depreciation | The *written down value of the asset |

2 | An item of *trading stock | Its value under subsection 70‑45(1) |

3 | An asset that you lease from another entity | The sum of the amounts of the future lease payments for the asset to which you are irrevocably committed, less an appropriate amount to reflect any interest component for those lease payments |

4 | Trademarks, patents, copyrights and similar rights | Their *reduced cost base |

(3) The value of such an asset is worked out:

(a) as at the end of the income year; or

(b) if you stopped carrying on the *business activity during the year:

(i) as at the time you stopped; or

(ii) if you disposed of the asset before that time in the course of stopping carrying on the activity—as at the time you disposed of it.

(4) However, these assets are not counted for this test:

(a) assets that are real property or interests in real property that are taken into account for that year under section 35‑40;

(b) *cars, motor cycles and similar vehicles.

If an asset that is being taken into account under section 35‑40 or 35‑45 is used during an income year partly in carrying on the relevant *business activity and partly for other purposes, only that part of its *reduced cost base, market value or other value that is attributable to its use in carrying on the business activity in that year is taken into account for that section.

35‑55 Commissioner’s discretion

(1) The Commissioner may decide that the rule in section 35‑10 does not apply to a *business activity for one or more income years if the Commissioner is satisfied that it would be unreasonable to apply that rule because:

(a) the business activity was or will be affected in that or those income years by special circumstances outside the control of the operators of the business activity, including drought, flood, bushfire or some other natural disaster; or

Note: This paragraph is intended to provide for a case where a business activity would have satisfied one of the tests if it were not for the special circumstances.

(b) the business activity has started to be carried on and:

(i) because of its nature, it has not yet satisfied one of the tests set out in section 35‑30, 35‑35, 35‑40 or 35‑45; and

(ii) there is an objective expectation, based on evidence from independent sources (where available) that, within a period that is commercially viable for the industry concerned, the activity will either meet one of those tests or will produce assessable income for an income year greater than the deductions attributable to it for that year (apart from the operation of subsection 35‑10(2)).

Note: This paragraph is intended to cover a business activity that has a lead time between the commencement of the activity and the production of any assessable income. For example, an activity involving the planting of hardwood trees for harvest, where many years would pass before the activity could reasonably be expected to produce income.

(2) The Commissioner must not exercise the discretion under paragraph (1)(b) for a *business activity at a time after the earlier of:

(a) the time at which it would be reasonable to expect the activity to first produce assessable income for an income year greater than the deductions attributable to it for that year (apart from the operation of subsection 35‑10(2)); or

(b) the time at which it would be reasonable to expect the activity to meet one of the tests set out in section 35‑30, 35‑35, 35‑40 or 35‑45.

3A Subsection 995-1(1)

Insert:

professional arts business has the meaning given by section 35-10.

4 Application of amendments

The amendments made by this Schedule apply to assessments for the 2000‑01 income year and later income years.

Schedule 2—Deducting prepayments

Part 1—Expenditure on and after 11 November 1999

Income Tax Assessment Act 1936

1 Subsection 82KZL(1)

Insert:

approved stock exchange has the meaning give by section 470.

2 Subsection 82KZL(1)

Insert:

associate has the meaning given by section 318.

3 Subsection 82KZMA(1) (note)

Omit “Note”, substitute “Note 1”.

4 At the end of subsection 82KZMA(1)

Add:

Note 2: Sections 82KZME and 82KZMF also cover expenditure with an eligible service period of up to 13 months under some managed agreements. If those sections apply, sections 82KZMB and 82KZMC do not: see subsection 82KZMF(3).

5 Subsection 82KZMB(1) (note)

Omit “Note”, substitute “Note 1”.

6 At the end of subsection 82KZMB(1)

Add:

Note 2: Section 82KZMF may apply instead of this section for expenditure incurred under some managed agreements.

7 After section 82KZMD

Insert:

82KZME Expenditure with eligible service period ending up to 13 months later under some agreements

(1) Section 82KZMF applies to set the amount and timing of deductions for expenditure that a taxpayer incurs in a year of income (the expenditure year) if:

(a) apart from sections 82KZMB, 82KZMC and 82KZMF, the taxpayer could deduct the expenditure under section 8‑1 of the Income Tax Assessment Act 1997 for the expenditure year; and

(b) the eligible service period for the expenditure ends not more than 13 months after the taxpayer incurs the expenditure; and

(c) the requirements of subsections (2) and (3) are met.

Note 1: Subsection 82KZL(1) explains what the eligible service period for expenditure is.

Note 2: There are some exceptions: see subsections (5), (6), (7), (8) and (9).

Note 3: If section 82KZMF applies to the expenditure, sections 82KZMB and 82KZMC do not: see subsection 82KZMF(3).

General requirements for expenditure

(2) The expenditure must be incurred:

(a) after 1 pm (by legal time in the Australian Capital Territory) on 11 November 1999 under an agreement; and

(b) in return for the doing of a thing under the agreement that is not to be wholly done within the expenditure year.

Requirements for agreement

(3) There are these requirements for the agreement:

(a) the taxpayer’s allowable deductions for the expenditure year that are attributable to the agreement must exceed the taxpayer’s assessable income (if any) for the expenditure year that is attributable to the agreement; and

(b) the taxpayer does not have day to day control over the operation of the agreement (whether or not the taxpayer has the right to be consulted or give directions); and

(c) at least one of these must be satisfied:

(i) there is more than one participant in the agreement in the same capacity as the taxpayer;

(ii) the person who manages, arranges or promotes the agreement, or an associate of that person, manages, arranges or promotes similar agreements for other taxpayers.

Activities that relate to the agreement

(4) Without affecting the operation of any other section in this Subdivision, an agreement referred to in this section includes all activities that relate to the agreement, including those that give rise to deductions or assessable income.

Exception 1: certain negatively geared investments

(5) The expenditure must not be:

(a) a premium for building insurance, contents insurance or rent protection insurance; or

(b) interest on money borrowed to acquire:

(i) real property or an interest in real property; or

(ii) shares that are listed for quotation in the official list of an approved stock exchange; or

(iii) units in a trust that has at least 300 beneficiaries and is a widely held unit trust as defined in section 272‑105 in Schedule 2F;

where:

(c) the taxpayer has obtained, or can reasonably be expected to obtain, rent, dividends or trust income from the agreement; and

(d) the taxpayer has not obtained and will not obtain any other kind of assessable income from the agreement (except a capital gain or an insurance receipt); and

(e) all aspects of the agreement have been conducted at arm’s length.

Exception 2: infrastructure borrowings

(6) The expenditure must not be an allowable deduction because of section 159GZZZZF in respect of an infrastructure borrowing as defined in subsection 93D(1) of the Development Allowance Authority Act 1992.

Exception 3: expenditure is excluded expenditure

(7) The expenditure must not be excluded expenditure (see subsection 82KZL(1)).

Exception 4: expenditure meets a pre‑existing obligation

(8) The expenditure by the taxpayer must not meet a contractual obligation that:

(a) exists under an agreement at or before 1 pm (by legal time in the Australian Capital Territory) on 11 November 1999; and

(b) requires the payment of an amount for the doing of a thing under the agreement; and

(c) requires the payment to be made before the doing of the thing; and

(d) cannot be escaped by unilateral action by the taxpayer.

Exception 5: agreement to which a product ruling applies

(9) The expenditure must not be under an agreement to which a product ruling applies, describing expenditure under the agreement as being allowable as a deduction.

(10) The product ruling must be made:

(a) on or before 1 pm (by legal time in the Australian Capital Territory) on 11 November 1999; or

(b) in response to an application for a product ruling where:

(i) the application was received by the Commissioner on or before the time specified in paragraph (a); and

(ii) the Commissioner acknowledged receiving the application.

(11) In this section:

product ruling means a public ruling made under Part IVAAA of the Taxation Administration Act 1953 about a particular investment product.

(1) If this section applies to expenditure incurred by a taxpayer in a year of income:

(a) the taxpayer cannot deduct all of the expenditure for the expenditure year; and

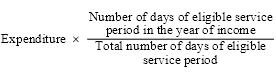

(b) instead, the taxpayer can deduct, for each year of income during which part of the eligible service period for the expenditure occurs, an amount worked out using this formula:

(2) This section has effect:

(a) despite section 8‑1 of the Income Tax Assessment Act 1997; and

(b) subject to Division 245 of Schedule 2C to this Act.

(3) If this section applies to expenditure incurred by a taxpayer, sections 82KZMB and 82KZMC do not apply to it.

Part 2—2002 and later expenditure

Income Tax Assessment Act 1936

8 Paragraph 82KZME(1)(a)

Omit “sections 82KZMB, 82KZMC and 82KZMF”, substitute “section 82KZMF”.

9 Subsection 82KZME(1) (note 3)

Repeal the note.

10 Subsection 82KZMF(3)

Repeal the subsection.

11 Application of amendments

(1) The amendments made by Part 1 of this Schedule apply to:

(a) expenditure incurred by a taxpayer after 1 pm (by legal time in the Australian Capital Territory) on 11 November 1999; and

(b) the taxpayer’s assessments for the year of income including that day and for later years of income.

(2) The amendments made by Part 2 of this Schedule apply to expenditure incurred by a taxpayer in a year of income after the taxpayer’s year of income that includes 21 September 2002.

[Minister’s second reading speech made in—

House of Representatives on 13 April 2000

Senate on 20 June 2000]

(67/00)