New Business Tax System (Alienation of Personal Services Income) Act 2000

No. 86, 2000

New Business Tax System (Alienation of Personal Services Income) Act 2000

No. 86, 2000

New Business Tax System (Alienation of Personal Services Income) Act 2000

No. 86, 2000

An Act to amend the law about taxation to implement the New Business Tax System in relation to personal services income, and for related purposes

Contents

1 Short title...................................

2 Commencement...............................

3 Schedule(s)..................................

Schedule 1—Personal services income

Part 1—Amendment of the Income Tax Assessment Act 1997

Part 2—Amendment of the Taxation Administration Act 1953

Part 3—Amendment of other Acts

Child Support (Registration and Collection) Act 1988

Fringe Benefits Tax Assessment Act 1986

Income Tax Assessment Act 1936

New Business Tax System (Alienation of Personal Services Income) Act 2000

No. 86, 2000

An Act to amend the law about taxation to implement the New Business Tax System in relation to personal services income, and for related purposes

[Assented to 30 June 2000]

The Parliament of Australia enacts:

This Act may be cited as the New Business Tax System (Alienation of Personal Services Income) Act 2000.

(1) Subject to this section, this Act commences on the day on which it receives the Royal Assent.

(2) Part 3 of Schedule 1 (other than items 61, 62 and 72) commences immediately after the commencement of item 2 of Schedule 5 to the A New Tax System (Tax Administration) Act 1999.

Subject to section 2, each Act that is specified in a Schedule to this Act is amended or repealed as set out in the applicable items in the Schedule concerned, and any other item in a Schedule to this Act has effect according to its terms.

Schedule 1—Personal services income

Part 1—Amendment of the Income Tax Assessment Act 1997

1 Section 10‑5 (after table item headed “accrued leave transfer payments”)

Insert:

alienated personal services income.............................86‑15 |

2 Section 12‑5 (after table item headed “penalties”)

Insert:

personal services income |

alienated personal services income....................Subdivision 86‑B |

general.........................................Division 85 |

3 Section 70‑120 (link note)

Repeal the link note, substitute:

[The next Part is Part 2‑42.]

Part 2‑42—Personal services income

This Part is about 2 issues relating to personal services income.

Division 85 limits the entitlements of individuals to deductions relating to their personal services income.

Division 86 sets out the tax consequences of individuals’ personal services income being diverted to other entities (often called alienation of the income).

These Divisions do not affect individuals or other entities that conduct personal services businesses. Division 87 defines personal services businesses.

Note: This Part may not apply until the 2002‑03 income year to participants in the prescribed payments system on 13 April 2000: see item 26 of Schedule 1 to the New Business Tax System (Alienation of Personal Services Income) Act 2000.

[This is the end of the Guide.]

Table of sections

84‑5 Meaning of personal services income

84‑10 This Part does not imply that individuals are employees

84‑5 Meaning of personal services income

(1) Your *ordinary income or *statutory income, or the ordinary income or statutory income of any other entity, is your personal services income if the income is mainly a reward for your personal efforts or skills (or would mainly be such a reward if it was your income).

Example 1: NewIT Pty. Ltd. provides computer programming services, but Ron does all the work involved in providing those services. Ron uses the clients’ equipment and software to do the work. NewIT’s ordinary income from providing the services is Ron’s personal services income because it is a reward for his personal efforts or skills.

Example 2: Trux Pty. Ltd. owns one semi‑trailer, and Tom is the only person who drives it. Trux’s ordinary income from transporting goods is not Tom’s personal services income because it is produced mainly by use of the semi‑trailer, and not mainly as a reward for Tom’s personal efforts or skills.

Example 3: Jim works as an accountant for a large accounting firm that employs many accountants. None of the firm’s ordinary income or statutory income is Jim’s personal services income because it is produced mainly by the firm’s business structure, and not mainly as a reward for Jim’s personal efforts or skills.

(2) Only individuals can have personal services income.

(3) This section applies whether the income is for doing work or is for producing a result.

(4) The fact that the income is payable under a contract does not stop the income being mainly a reward for your personal efforts or skills.

84‑10 This Part does not imply that individuals are employees

The application of this Part to an individual does not imply, for the purposes of any *Australian law or any instrument made under an Australian law, that the individual is an employee.

Division 85—Deductions relating to personal services income

85‑1 What this Division is about

This Division sets out amounts, relating to personal services income, that an individual cannot deduct. In particular, deductions that are unavailable to an employee are similarly unavailable to an individual who has personal services income and who is not an employee.

However, this Division does not apply if the individual is conducting a personal services business or receives the income as an employee or office holder.

Table of sections

85‑5 Object of this Division

85‑10 Deductions for non‑employees relating to personal services income

85‑15 Deductions for rent, mortgage interest, rates and land tax

85‑20 Deductions for payments to associates etc.

85‑25 Deductions for superannuation for associates

85‑30 Exception: personal services businesses

85‑35 Exception: employees

85‑40 Application of Subdivision 900‑B to individuals who are not employees

[This is the end of the Guide.]

The object of this Division is to ensure that individuals who are not conducting *personal services businesses cannot deduct certain amounts (such as amounts that employees cannot deduct).

Note: This Division also affects the extent to which a personal services entity is entitled to deductions relating to gaining or producing an individual’s personal services income: see section 86‑60.

85‑10 Deductions for non‑employees relating to personal services income

(1) You cannot deduct under this Act an amount to the extent that it relates to gaining or producing that part of your *ordinary income or *statutory income that is your *personal services income if:

(a) the income is not payable to you as an employee; and

(b) you would not be able to deduct the amount under this Act if the income were payable to you as an employee.

Example: Ruth is an architect who works as an independent contractor for one firm. She is not conducting a personal services business. On most days she travels from her home to the business premises of the firm, where she does her work. She also has a home office, where she does some of her work.

This section confirms that Ruth cannot deduct her expenses of travelling between her home and the firm’s premises because she could not deduct them if she were an employee.

(2) Subsection (1) does not stop you deducting an amount to the extent that it relates to:

(a) gaining work; or

Examples: Advertising, tendering and quoting for work.

(b) insuring against loss of your income or your income earning capacity; or

Examples: Sickness, accident and disability insurance.

(c) insuring against liability arising from your acts or omissions in the course of earning income; or

Examples: Public liability insurance and professional indemnity insurance.

(d) engaging an entity that is not your *associate to perform work; or

(e) engaging your *associate to perform work that forms part of the principal work for which you gain or produce your *personal services income; or

(f) contributing to a fund in order to obtain superannuation benefits for yourself or for your dependants in the event of your death; or

Note: For deductions for superannuation contributions: see Subdivision AB of Division 3 of Part III of the Income Tax Assessment Act 1936.

(g) meeting your obligations under a *workers’ compensation law to pay premiums, contributions or similar payments or to make payments to an employee in respect of *compensable work‑related trauma; or

(h) meeting your obligations, or exercising your rights, under the *GST law.

85‑15 Deductions for rent, mortgage interest, rates and land tax

You cannot deduct under this Act an amount of rent, mortgage interest, rates or land tax:

(a) for some or all of your residence; or

(b) for some or all of your *associate’s residence;

to the extent that the amount relates to gaining or producing your *personal services income.

85‑20 Deductions for payments to associates etc.

(1) You cannot deduct under this Act:

(a) any payment you make to your *associate; or

(b) any amount you incur arising from an obligation you have to your associate;

to the extent that the payment or amount relates to gaining or producing your *personal services income.

(2) Subsection (1) does not stop you deducting a payment or amount to the extent that it relates to engaging your *associate to perform work that forms part of the principal work for which you gain or produce your *personal services income.

85‑25 Deductions for superannuation for associates

(1) You cannot deduct under this Act a contribution you make to a fund or an *RSA to provide for superannuation benefits payable for your *associate, to the extent that the associate’s work for you relates to gaining or producing your *personal services income.

(2) Subsection (1) does not stop you deducting a contribution to the extent that your *associate’s performance of work forms part of the principal work for which you gain or produce your *personal services income.

(3) However, if subsection (2) applies, your deduction cannot exceed the amount you would have to contribute, for the benefit of the *associate, to a *complying superannuation fund or an *RSA in order to ensure that you did not have an *individual superannuation guarantee shortfall in respect of the associate.

(4) To work out the amount you would have to contribute for the purposes of subsection (3), the *associate’s salary or wages, for the purposes of the Superannuation Guarantee (Administration) Act 1992, are taken to be the amount that neither section 85‑10 nor 85‑20 prevent you deducting for salary or wages you paid to the associate.

Note: See paragraph 85‑10(2)(e) for deductions relating to employment of associates.

85‑30 Exception: personal services businesses

This Division does not apply to an amount, payment or contribution to the extent that the amount, payment or contribution relates to income from you conducting a *personal services business.

85‑35 Exception: employees and office holders

This Division does not apply to an amount, payment or contribution to the extent that the amount, payment or contribution relates to *personal services income that you receive as:

(a) an employee; or

(b) an individual referred to in paragraph 12‑45(1)(a), (b), (c), (d) or (e) (about payments to office holders) in Schedule 1 to the Taxation Administration Act 1953.

85‑40 Application of Subdivision 900‑B to individuals who are not employees

This Division does not have the effect of applying Subdivision 900‑B (about substantiating work expenses) to an individual who is not an employee.

Division 86—Alienation of personal services income

Table of Subdivisions

Guide to Division 86

86‑A General

86‑B Entitlement to deductions

86‑1 What this Division is about

Income from the rendering of your personal services is treated as your assessable income if it is the income of another entity and is not promptly paid to you as salary.

However, this does not apply if the other entity is conducting a personal services business.

There are limits to the other entity’s entitlement to deductions to offset against the amount treated as your income.

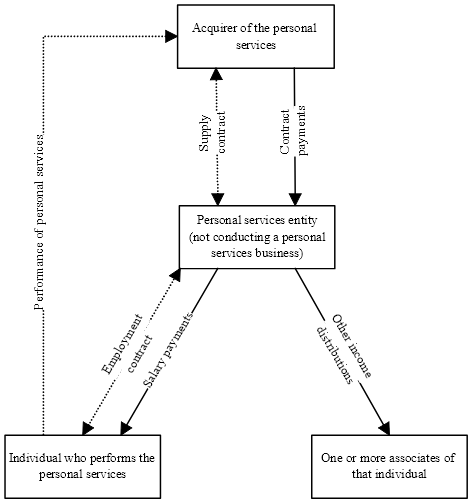

86‑5 A simple description of what this Division does

(1) This diagram shows an example of a simple arrangement for the alienation of personal services income.

Note 1: Solid lines indicate actual payments between the parties. Dotted lines indicate other interactions between the parties.

Note 2: This Division also applies to different and more complex arrangements.

(2) This Division has the effect of attributing the personal services entity’s income from the personal services to the individual who performed them (unless the income is promptly paid to the individual as salary). Certain deduction entitlements of the personal services entity can reduce the amount of the attribution.

Table of sections

86‑10 Object of this Division

86‑15 Effect of obtaining personal services income through a personal services entity

86‑20 Offsetting the personal services entity’s deductions against personal services income

86‑25 Apportionment of entity maintenance deductions among several individuals

86‑30 Assessable income etc. of the personal services entity

86‑35 Later payments of, or entitlements to, personal services income to be disregarded for income tax purposes

86‑40 Salary payments shortly after an income year

The object of this Division is to ensure that individuals cannot reduce or defer their income tax (and other liabilities) by alienating their *personal services income through companies, partnerships or trusts that are not conducting *personal services businesses.

Note: The general anti‑avoidance provisions of Part IVA of the Income Tax Assessment Act 1936 may still apply to cases of alienation of personal services income that fall outside this Division.

86‑15 Effect of obtaining personal services income through a personal services entity

Amounts included in your assessable income

(1) Your assessable income includes an amount of *ordinary income or *statutory income of a *personal services entity that is your *personal services income.

Example: Continuing example 1 in section 84‑5: Assume that NewIT only provides services to one client. Ron’s assessable income includes ordinary income of NewIT from providing the computer programming services, because the income is Ron’s personal services income.

Note: The amount included in your assessable income can be reduced by certain deductions to which the personal services entity is entitled: see section 86‑20.

(2) A personal services entity is a company, partnership or trust whose *ordinary income or *statutory income includes the *personal services income of one or more individuals.

Exception: personal services businesses

(3) This section does not apply if that amount is income from the *personal services entity conducting a *personal services business.

Note: Even if the entity is conducting a personal services business, it is possible that some of its income is not income from conducting that business.

Exception: amounts promptly paid to you as salary or wages

(4) This section does not apply to the extent that:

(a) the *personal services entity pays that amount to you, as an employee, as salary or wages; and

(b) the payment is made before the end of the 14th day after the *PAYG payment period during which the amount became *ordinary income or *statutory income of the entity.

Note: The entity is obliged to withhold amounts from salary or wages paid before the end of that day: see section 12‑35 in Schedule 1 to the Taxation Administration Act 1953.

Exception: exempt income etc.

(5) This section only applies to the extent that that amount would be assessable income of the personal services entity if this Division did not apply.

Example: If the entity’s income includes an amount that is your personal services income for a service on which GST is payable, the amount included in your assessable income will not include the GST, because the GST is neither assessable income nor exempt income of the entity: see section 17‑5.

86‑20 Offsetting the personal services entity’s deductions against personal services income

(1) The amount of your *personal services income included in your assessable income under section 86‑15 may be reduced (but not below nil) by the amount of certain deductions to which the *personal services entity is entitled.

Note 1: Subdivision 86‑B limits a personal services entity’s entitlement to deductions.

Note 2: For a personal services entity that is a partnership, if the amount of the deductions exceeds the amount of the personal services income, the partners may be entitled to a deduction under subsection 92(2) of the Income Tax Assessment Act 1936.

(2) Use this method statement to work out whether, and by how much, the amount is reduced:

Method statement

Step 1. Work out, for the income year, the amount of any deductions (other than *entity maintenance deductions) to which the *personal services entity is entitled that are deductions relating to your *personal services income.

Step 2. Work out, for the income year, the amount of any *entity maintenance deductions to which the *personal services entity is entitled.

Step 3. Work out the *personal services entity’s assessable income for that income year, disregarding any income it receives that is your *personal services income or the personal services income of anyone else.

Step 4. Subtract the amount under step 3 from the amount under step 2.

Note 1: Step 4 ensures that, before entity maintenance deductions can contribute to the reduction, they are first exhausted against any income of the entity that is not personal services income.

Note 2: If the personal services entity receives another individual’s personal services income, see section 86‑25.

Step 5. If the amount under step 4 is greater than zero, the amount of the reduction under subsection (1) is the sum of the amounts under steps 1 and 4.

Step 6. If the amount under step 4 is not greater than zero, the amount of the reduction under subsection (1) is the amount under step 1.

Example 1: Continuing example 1 in section 84‑5: Assume these additional facts:

Because the step 4 amount is less than zero (‑$12,000), step 5 does not apply and, under step 6, the amount of the reduction is $50,000. Therefore the amount included in Ron’s assessable income is:

![]()

Example 2: Assume, as an alternative set of facts, that NewIT’s assessable income under step 3 was only $2,000.

The step 4 amount would have been $6,000, and, under step 5, the amount of the reduction would have been $56,000 (adding the amounts under steps 1 and 4). The amount included in Ron’s assessable income would then have been:

![]()

Note: The personal services entity’s deductions that do not relate to your personal services income and that are not entity maintenance deductions cannot reduce the amount included in your assessable income under section 86‑15.

86‑25 Apportionment of entity maintenance deductions among several individuals

If, in the income year:

(a) the amount worked out under step 4 of the method statement in section 86‑20 is greater than zero; and

Note: This happens if the entity has entity maintenance deductions that form some or all of the reduction under section 86‑20.

(b) the *ordinary income or *statutory income of the *personal services entity includes another individual’s *personal services income (as well as your personal services income); and

(c) the other individual’s personal services income is included in the other individual’s assessable income under section 86‑15;

the amount worked out under step 4 is taken to be:

where:

original step 4 amount is the amount that would be the amount worked out under step 4 if this section did not apply.

total personal services income is the sum of all the amounts of personal services income (whether your personal services income or someone else’s) that are included in the personal services entity’s ordinary income or statutory income for the income year.

your personal services income is the sum of all the amounts of your personal services income that are included in the personal services entity’s ordinary income or statutory income for the income year.

Example: Continuing example 2 in section 86‑20: Assume that Robyn, another computer consultant, joined NewIT, and NewIT’s ordinary income from providing the services also includes Robyn’s personal services income of $168,000.

Because NewIT now receives the personal services income of someone else, Ron’s step 4 amount is reduced as follows:

Under step 5 of the method statement in section 86‑20, the amount of the reduction under that section is therefore $52,500, and the amount included in Ron’s assessable income is $67,500.

86‑30 Assessable income etc. of the personal services entity

*Ordinary income or *statutory income of the *personal services entity is neither assessable income nor *exempt income of the entity, to the extent that it is *personal services income included in your assessable income under section 86‑15.

Note: Subsection 118‑20(4) prevents this income being treated as a capital gain.

86‑35 Later payments of, or entitlements to, personal services income to be disregarded for income tax purposes

(1) To the extent that a payment by the *personal services entity, or by your *associate, is a payment to you or any of your associates of:

(a) *personal services income included in your assessable income under section 86‑15; or

(b) any other amount that is attributable to that income;

the payment:

(c) is neither assessable income nor *exempt income of the entity receiving it; and

Note: Subsection 118‑20(4) prevents this income being treated as a capital gain.

(d) is not an amount that the entity making it can deduct.

Note: Section 118‑65 prevents this amount being treated as a capital loss.

Example: Continuing example 2 in section 86‑20: Assume that NewIT had paid Jill, Ron’s wife, an amount for work that is not the principal work of NewIT. The payment is made from money already included in Ron’s assessable income under section 86‑15.

The amount is neither assessable income nor exempt income of Jill, and NewIT cannot deduct the amount.

(2) To the extent that you are entitled, or any of your *associates are entitled, to a share of the net income of the *personal services entity, or of any of your associates, and that income is:

(a) *personal services income included in your assessable income under section 86‑15; or

(b) any other amount that is attributable to that income;

that share is neither assessable income nor *exempt income of the entity receiving it.

86‑40 Salary payments shortly after an income year

(1) If:

(a) before the end of 14 July in a particular income year, you receive, as salary or wages, *personal services income of yours from the *personal services entity; and

(b) failure to make the payment before the end of 14 July would have resulted in an amount of income being included in your assessable income under section 86‑15 for the preceding income year;

you are taken to have received the payment on 30 June of that preceding income year.

Example: Continuing example 2 in section 86‑20: Assume that NewIT is a small withholder for PAYG withholding purposes, and its PAYG payment period covering April 2001 to June 2001 is the quarter ending on 30 June 2001. NewIT’s income for that period (after taking into account any reductions under sections 86‑20 and 86‑25) includes $20,000 that is Ron’s personal services income, and NewIT pays this to Ron on 12 July 2001.

The $20,000 that Ron receives is assessable income for the income year ended on 30 June 2001.

(2) However, this section does not affect the time at which the *personal services entity is treated as having paid the salary or wages.

Note 1: Therefore neither the timing of the entity’s deduction for the payment, nor the timing of the obligation to withhold amounts under section 12‑35 in Schedule 1 to the Taxation Administration Act 1953, is affected.

Note 2: However, these payments are treated as relating to the preceding income year for the purposes of the rules relating to payment summaries and PAYG credits (see Subdivisions 16‑C and 18‑A in Schedule 1 to the Taxation Administration Act 1953).

Subdivision 86‑B—Entitlement to deductions

Table of sections

86‑60 General rule for deduction entitlements of personal services entities

86‑65 Entity maintenance deductions

86‑70 Car expenses

86‑75 Superannuation

86‑80 Salary or wages promptly paid

86‑85 Deduction entitlements of personal services entities for amounts included in an individual’s assessable income

86‑90 Application of Divisions 28 and 900 to personal services entities

86‑60 General rule for deduction entitlements of personal services entities

A *personal services entity cannot deduct under this Act an amount to the extent that it relates to gaining or producing an individual’s *personal services income, unless:

(a) the individual could have deducted the amount under this Act if the circumstances giving rise to the entity’s entitlement to deduct the amount had applied instead to the individual; or

Note: In particular, Division 85 specifies limits on an individual’s entitlements to deductions relating to the individual’s personal services income.

(b) the entity receives the individual’s *personal services income in the course of conducting a *personal services business.

86‑65 Entity maintenance deductions

(1) Section 86‑60 does not stop a *personal services entity deducting an amount to the extent that it is an *entity maintenance deduction.

Note: See section 86‑25 for how entity maintenance deductions are offset against a personal services entity’s income.

(2) Each of these is an entity maintenance deduction:

(a) any fee or charge payable by the entity for opening, operating or closing an account with an *ADI;

(b) any deduction under section 25‑5 (about tax‑related expenses);

(c) any loss or outgoing incurred in relation to preparation or lodgment of any document the entity is required to lodge under the Corporations Law;

(d) any fee or charge payable by the entity to an *Australian government agency for any licence, permission, approval, authorisation, registration or certification (however described) that is granted or given under an *Australian law.

(3) However, paragraph (2)(c) does not include any payment that the entity makes to an *associate.

Cars used solely for business

(1) Section 86‑60 does not stop a *personal services entity deducting a *car expense for a *car of which there is no *private use.

Other cars

(2) Section 86‑60 does not stop a *personal services entity deducting:

(a) a *car expense; or

(b) an amount of tax payable under the Fringe Benefits Tax Assessment Act 1986 for a *car fringe benefit;

for a *car of which there is *private use. However, there cannot be, at the same time, more than one car for which such deductions can arise in relation to gaining or producing the same individual’s *personal services income.

(3) If there is more than one *car to which subsection (2) could apply at the same time, the entity must choose the car to which subsection (2) applies at that time. The choice remains in effect until the entity ceases to *hold that car.

Example: Continuing example 2 in section 86‑20: Assume that NewIT provides 3 cars to Ron. Car 1 is used solely for business purposes and cars 2 and 3 are used for private purposes.

NewIT can deduct all the car expenses it incurs for car 1. It can also deduct all the car expenses it incurs for its choice of either car 2 or car 3, as well as the fringe benefits tax it pays for that car. However, it cannot deduct any car expenses or fringe benefits tax for the car that it does not choose.

Note: If car expenses for a car are not deductible because of section 86‑60, the car benefit being provided is an exempt benefit for the purposes of fringe benefits tax: see subsection 8(4) of the Fringe Benefits Tax Assessment Act 1986.

(1) Section 86‑60 does not stop a *personal services entity deducting a contribution the entity makes to a fund or an *RSA for the purpose of making provision for superannuation benefits payable for an individual whose *personal services income is included in the entity’s *ordinary income or *statutory income.

For deductions for superannuation contributions: see Subdivision AA of Division 3 of Part III of the Income Tax Assessment Act 1936.

(2) However, if:

(a) the individual performs less than 20% (by market value) of the entity’s principal work; and

(b) the individual is an *associate of another individual whose *personal services income is included in the entity’s *ordinary income or *statutory income;

the entity’s deduction cannot exceed the amount it would have to contribute, for the benefit of the individual, to a *complying superannuation fund or an *RSA in order to ensure that it did not have an *individual superannuation guarantee shortfall in respect of the individual.

(3) To work out the amount the entity would have to contribute for the purposes of subsection (2), the individual’s salary or wages, for the purposes of the Superannuation Guarantee (Administration) Act 1992, are taken to be the amount that section 86‑60 does not prevent the entity deducting for salary or wages it paid to the individual.

Note: Section 86‑60 will apply the limitations under sections 85‑10 and 85‑20 on an individual’s entitlement to deductions (but see paragraph 85‑10(2)(e) on employment of associates).

86‑80 Salary or wages promptly paid

Section 86‑60 does not stop a *personal services entity deducting an amount for salary or wages it pays to the individual referred to in that section before the end of the 14th day after the *PAYG payment period during which the amount became *ordinary income or *statutory income of the entity.

86‑85 Deduction entitlements of personal services entities for amounts included in an individual’s assessable income

The fact that a *personal services entity:

(a) incurs an amount in gaining or producing an individual’s assessable income; or

(b) uses a unit of *plant, or has it installed ready for use, for the *purpose of producing assessable income of an individual;

does not stop the entity deducting the loss or outgoing, or deducting an amount for depreciation of the plant, under this Act if:

(c) the entity incurs the amount in gaining or producing, or uses or installs the plant for the purpose of producing, its *ordinary income or *statutory income; and

(d) the income is included in the individual’s assessable income under section 86‑15.

86‑90 Application of Divisions 28 and 900 to personal services entities

This Division does not have the effect of applying Division 28 (about car expenses) or Division 900 (about substantiation rules) to a *personal services entity.

Note: Divisions 28 and 900 can still apply to a personal services entity that is a partnership: see subsections 28‑10(2) and 900‑5(2).

Division 87—Personal services businesses

Table of Subdivisions

Guide to Division 87

87‑A General

87‑B Personal services business determinations

87‑1 What this Division is about

Divisions 85 and 86 do not apply to personal services income that is income from conducting a personal services business.

There are 3 tests for what is a personal services business, but, if 80% or more of your personal services income is from one source, the Commissioner must have made a personal services business determination.

87‑5 Diagram showing the operation of this Division

This diagram shows how this Division operates to ascertain whether personal services income is income from conducting a personal services business.

Table of sections

87‑10 Object of this Division

87‑15 What is a personal services business

87‑20 The unrelated clients test for a personal services business

87‑25 The employment test for a personal services business

87‑30 The business premises test for a personal services business

87‑35 Personal services income from Australian government agencies

The object of this Division is to define *personal services businesses in a way that ensures that it covers genuine businesses but not situations that are merely arrangements for dealing with the *personal services income of individuals.

87‑15 What is a personal services business

(1) An individual or a *personal services entity conducts a personal services business during an income year if the individual or entity meets at least one of the 3 *personal services business tests.

(2) The 3 personal services business tests are:

(a) the unrelated clients test under section 87‑20;

(b) the employment test under section 87‑25;

(c) the business premises test under section 87‑30.

(3) However, if 80% or more of an individual’s *personal services income during the income year is income from the same entity (or from the same entity and that entity’s *associates), the individual’s personal services income is not taken to be from conducting a *personal services business unless:

(a) when the personal services income is gained or produced, a *personal services business determination is in force relating to the individual’s personal services income; and

(b) if the determination was made on the application of a *personal services entity—the individual’s personal services income is income from the entity conducting the personal services business.

Note: For personal services business determinations, see Subdivision 87‑B.

87‑20 The unrelated clients test for a personal services business

(1) An individual or a *personal services entity meets the unrelated clients test in an income year if:

(a) during the year, the individual or personal services entity gains or produces income from providing services to 2 or more entities that are not *associates of each other, and are not associates of the individual or of the personal services entity; and

(b) the services are provided as a direct result of the individual or personal services entity making offers or invitations (for example, by advertising), to the public at large or to a section of the public, to provide the services.

(2) The individual or *personal services entity is not treated, for the purposes of paragraph (1)(b), as having made offers or invitations to provide services merely by being available to provide the services through an entity that conducts a *business of arranging for persons to provide services directly for clients of the entity.

87‑25 The employment test for a personal services business

(1) An individual meets the employment test in an income year if:

(a) the individual engages one or more entities (other than *associates of the individual that are not individuals) to perform work; and

(b) that entity performs, or those entities together perform, at least 20% (by market value) of the individual’s principal work for that year.

(2) A *personal services entity meets the employment test in an income year if:

(a) the entity engages one or more other entities to perform work, other than:

(i) individuals whose *personal services income is included in the entity’s *ordinary income or *statutory income; or

(ii) *associates of the entity that are not individuals; and

(b) that other entity performs, or those other entities together perform, at least 20% (by market value) of the entity’s principal work for that year.

(3) An individual or a *personal services entity also meets the employment test in an income year if, for at least half the income year, the individual or entity has one or more apprentices.

87‑30 The business premises test for a personal services business

(1) An individual or a *personal services entity meets the business premises test in an income year if, at all times during the income year, the individual or entity maintains and uses business premises:

(a) at which the individual or entity mainly conducts activities from which *personal services income is gained or produced; and

(b) of which the individual or entity has exclusive use; and

(c) that are physically separate from any premises that the individual or entity, or any *associate of the individual or entity, uses for private purposes; and

(d) that are physically separate from the premises of the entity to which the individual or entity provides services and from the premises of any associate of the entity to which the individual or entity provides services.

(2) The individual or entity need not maintain and use the same business premises throughout the income year.

87‑35 Personal services income from Australian government agencies

(1) *Australian government agencies are not treated as *associates of each other for the purposes of subsection 87‑15(3) and paragraph 87‑20(1)(a).

Example: You receive 60% of your personal services income from a Department of a State government and 40% of your personal services income from a corporation in which that State has a majority shareholding.

You are not treated as if 80% or more of your personal services income is income from the same entity and that entity’s associates, and therefore you will not need a personal services business determination to satisfy subsection 87‑15(3).

In addition, you satisfy the first limb (but not necessarily the second limb) of the unrelated clients test in subsection 87‑20(1), because you receive your personal services income from 2 entities that are not treated as associates of each other.

(2) Each Agency within the meaning of the Public Service Act 1999:

(a) is treated as a separate entity; and

(b) is not treated as an *associate of any other such Agency, or of any *Australian government agency;

for the purposes of subsection 87‑15(3) and paragraph 87‑20(1)(a).

Example: You receive 70% of your personal services income from the Commonwealth Department of Treasury and 30% of your personal services income from the Australian Taxation Office (neither body has a legal identity separate from the Commonwealth Government).

You are not treated as if 80% or more of your personal services income is income from the same entity, or from the same entity and that entity’s associates, and therefore you will not need a personal services business determination to satisfy subsection 87‑15(3).

In addition, you satisfy the first limb (but not necessarily the second limb) of the unrelated clients test in subsection 87‑20(1), because you receive your personal services income from 2 bodies that are treated as separate entities and that are not treated as associates of each other.

(3) Each part of the government of a State or Territory, and each part of an authority of the State or Territory, that has, under a law of the State or Territory, a status corresponding to an Agency within the meaning of the Public Service Act 1999:

(a) is treated as a separate entity; and

(b) is not treated as an *associate of any other part of such a government or authority, or of any *Australian government agency;

for the purposes of subsection 87‑15(3) and paragraph 87‑20(1)(a).

Subdivision 87‑B—Personal services business determinations

Table of sections

87‑55 Effect of personal services business determinations

87‑60 Personal services business determinations for individuals

87‑65 Personal services business determinations for personal services entities

87‑70 Applying etc. for personal services business determinations

87‑75 When personal services business determinations have effect

87‑80 Revoking personal services business determinations

87‑85 Review of decisions

87‑55 Effect of personal services business determinations

(1) An individual conducts a personal services business during an income year if a *personal services business determination is in force relating to the individual.

(2) A *personal services entity conducts a personal services business during an income year if a *personal services business determination is in force relating to an individual whose *personal services income is included in the entity’s *ordinary income or *statutory income.

87‑60 Personal services business determinations for individuals

Making etc. personal services business determinations

(1) The Commissioner may, by giving written notice to an individual:

(a) make a personal services business determination relating to the individual; or

(b) vary such a determination.

(2) The Commissioner may, in the notice, specify:

(a) the day on which the determination or variation takes effect, or took effect;

(b) the period for which the determination has effect;

(c) conditions to which the determination is subject.

Matters about which the Commissioner must be satisfied

(3) The Commissioner must not make the determination unless satisfied that, in the income year during which the determination first has effect, or is taken to have first had effect:

(a) the individual:

(i) could reasonably be expected to meet, or met, the employment test under section 87‑25 or the business premises test under section 87‑30, or both; or

(ii) but for unusual circumstances applying to the individual in that year, could reasonably have been expected to meet, or would have met, at least one of the 3 *personal services business tests; and

(b) the individual’s *personal services income could reasonably be expected to be, or was, from the individual conducting activities that met:

(i) if subparagraph (a)(i) applies—the employment test under section 87‑25 or the business premises test under section 87‑30, or both; or

(ii) if subparagraph (a)(ii) applies—at least one of the 3 personal services business tests; and

(c) 80% or more of the individual’s personal services income could reasonably be expected to be, or was, income from the same entity, or from the same entity and that entity’s *associates.

(4) For the purposes of subparagraph (3)(a)(ii) but without limiting the scope of that subparagraph, unusual circumstances include providing services to an insufficient number of entities to meet the unrelated clients test under section 87‑20 if:

(a) the individual starts a *business during the income year, and can reasonably be expected to meet the test in subsequent income years; or

(b) the individual provides services to only one entity during the income year, but met the test in one or more preceding income years and can reasonably be expected to meet the test in subsequent income years.

Further grounds for making the determination

(5) However, the Commissioner may make the determination if satisfied that:

(a) the individual’s *personal services income is for producing a result; and

(b) the individual is required to supply the *plant and equipment, or tools of trade, needed to perform the work from which the individual produces the result; and

(c) the individual is, or would be, liable for the cost of rectifying any defect in the work performed; and

(d) 80% or more of the individual’s personal services income could reasonably be expected to be, or was, income from the same entity, or from the same entity and that entity’s *associates.

(6) In determining whether the individual meets paragraph (5)(a), (b) or (c), the Commissioner may have regard to whether it is the custom or practice, when work of that kind is performed by an entity other than an employee:

(a) for the personal services income from the work to be for producing a result; and

(b) for the entity to be required to supply the plant and equipment, or tools of trade, needed to perform the work; and

(c) for the entity to be liable for the cost of rectifying any defect in the work performed;

as the case requires.

(7) Subsection (5) can apply whether or not the Commissioner is satisfied that the individual meets the requirements of paragraphs (3)(a) and (b).

87‑65 Personal services business determinations for personal services entities

Making etc. personal services business determinations

(1) The Commissioner may, by giving written notice to a *personal services entity whose *ordinary income or *statutory income includes some or all of an individual’s *personal services income:

(a) make a personal services business determination relating to the individual’s personal services income included in the entity’s ordinary income or statutory income; or

(b) vary such a determination.

(2) The Commissioner may, in the notice, specify:

(a) the day on which the determination or variation takes effect, or took effect;

(b) the period for which the determination has effect;

(c) conditions to which the determination is subject.

Matters about which the Commissioner must be satisfied

(3) The Commissioner must not make the determination unless satisfied that, in the income year during which the determination first has effect, or is taken to have first had effect:

(a) the entity:

(i) could reasonably be expected to meet, or met, the employment test under section 87‑25 or the business premises test under section 87‑30, or both; or

(ii) but for unusual circumstances applying to the entity in that year, could reasonably have been expected to meet, or would have met, at least one of the 3 *personal services business tests; and

(b) the individual’s *personal services income included in the entity’s *ordinary income or *statutory income could reasonably be expected to be, or was, from the entity conducting activities that met:

(i) if subparagraph (a)(i) applies—the employment test under section 87‑25 or the business premises test under section 87‑30, or both; or

(ii) if subparagraph (a)(ii) applies—at least one of the 3 personal services business tests; and

(c) 80% or more of the individual’s personal services income could reasonably be expected to be, or was, income from the same entity, or from the same entity and that entity's *associates.

(4) For the purposes of subparagraph (3)(a)(ii) but without limiting the scope of that subparagraph, unusual circumstances include providing services to an insufficient number of entities to meet the unrelated clients test under section 87‑20 if:

(a) the*personal services entity starts a *business during the income year, and can reasonably be expected to meet that test in subsequent income years; or

(b) the personal services entity provides services to only one entity during the income year, but met the test in one or more preceding income years and can reasonably be expected to meet the test in subsequent income years.

Further grounds for making the determination

(5) However, the Commissioner may make the determination if satisfied that:

(a) the *personal services entity’s *ordinary income or *statutory income, that is an individual’s *personal services income, is income for producing a result; and

(b) the personal services entity is required to supply the *plant and equipment, or tools of trade, needed to perform the work from which the personal services entity produces the result; and

(c) the personal services entity is, or would be, liable for the cost of rectifying any defect in the work performed; and

(d) 80% or more of the individual’s personal services income could reasonably be expected to be, or was, income from the same entity, or from the same entity and that entity’s *associates.

(6) In determining whether the *personal services entity meets paragraph (5)(a), (b) or (c), the Commissioner may have regard to whether it is the custom or practice, when work of that kind is performed by an entity other than an employee:

(a) for the personal services income from the work to be for producing a result; and

(b) for the entity to be required to supply the plant and equipment, or tools of trade, needed to perform the work; and

(c) for the entity to be liable for the cost of rectifying any defect in the work performed;

as the case requires.

(7) Subsection (5) can apply whether or not the Commissioner is satisfied that the*personal services entity and the individual meet the requirements of paragraphs (3)(a) and (b).

87‑70 Applying etc. for personal services business determinations

(1) An individual or a *personal services entity may apply to the Commissioner, in the *approved form:

(a) for a *personal services business determination; or

(b) for a variation of a personal services business determination.

(2) The Commissioner may request the applicant to give the Commissioner specified information, or a specified document, that the Commissioner needs to decide the application.

(3) If the Commissioner has not decided the application within 60 days after it is made, the applicant may, at any time, give the Commissioner written notice that the applicant wishes to treat the application as having been refused.

(4) If the applicant gives notice under subsection (3), the Commissioner is taken, for the purposes of section 87‑85, to have refused the application on the day on which the notice is given.

(5) For the purposes of measuring the 60 days mentioned in subsection (3), disregard each period (if any):

(a) starting on the day when the Commissioner requests the applicant under subsection (2) to give the Commissioner specified information or a specified document; and

(b) ending at the end of the day the applicant gives the Commissioner the specified information or document.

87‑75 When personal services business determinations have effect

(1) The determination, or a variation of the determination, has effect, or is taken to have had effect, on and from:

(a) the day specified in the notice as the day on which the determination or variation takes effect, or took effect; or

(b) if a day is not specified—the day on which the notice is given.

(2) The determination ceases to have effect at the end of the earliest day on which one or more of these occurs:

(a) one or more conditions to which the determination is subject are not met;

(b) the Commissioner revokes the determination;

(c) the period for which the determination has effect comes to an end.

87‑80 Revoking personal services business determinations

The Commissioner must, by giving written notice to the individual or *personal services entity on whose application a *personal services business determination was made, revoke the determination if the Commissioner is no longer satisfied that there are grounds on which the determination could be made.

A person who is dissatisfied with;

(a) a decision of the Commissioner to make, vary or revoke a *personal services business determination; or

(b) the Commissioner’s refusal of an application for a personal services business determination or for a variation of a personal services business determination;

may object against the decision in the manner set out in Part IVC of the Taxation Administration Act 1953.

[The next Chapter is Chapter 3.]

3A At the end of subsection 104‑70(2)

Add:

; or (d) paid from an amount that is *personal services income included in your assessable income, or another entity’s assessable income, under section 86‑15.

3B At the end of section 104‑135

Add:

(7) You also disregard a payment that is *personal services income included in your assessable income, or another entity’s assessable income, under section 86‑15.

4 At the end of Subdivision 118‑A

Add:

118‑65 Later distributions of personal services income

A *capital loss you make from a payment is disregarded if it is a payment to any entity of:

(a) *personal services income included in an individual’s assessable income under section 86‑15; or

(b) any other amount that is attributable to that income.

5 At the end of section 960‑100

Add:

Note: Under section 87‑35, certain parts of Australian governments and authorities are treated as separate entities for the purposes of ascertaining whether another entity is conducting a personal services business.

6 Subsection 995‑1(1)

Insert:

ADI (authorised deposit‑taking institution) means a body corporate that is an ADI for the purposes of the Banking Act 1959.

7 Subsection 995‑1(1)

Insert:

alienated personal services payment has the meaning given by section 13‑10 in Schedule 1 to the Taxation Administration Act 1953.

8 Subsection 995‑1(1) (after paragraph (a) of the definition of amount required to be withheld)

Insert:

(aa) the amount that Division 13 in that Schedule requires the entity to pay to the Commissioner in respect of the *alienated personal services payment to which the withholding payment relates; or

9 Subsection 995‑1(1) (after paragraph (a) of the definition of amount withheld)

Insert:

(aa) an amount that the entity paid to the Commissioner under Division 13 in that Schedule in respect of the *alienated personal services payment to which the withholding payment relates; or

10 Subsection 995‑1(1) (at the end of the definition of associate)

Add:

Note: Under section 87‑35, Australian government agencies, and certain parts of Australian governments and authorities, are not treated as associates for the purposes of ascertaining whether an entity is conducting a personal services business.

11 Subsection 995‑1(1)

Insert:

car fringe benefit has the meaning given by subsection 136(1) of the Fringe Benefits Tax Assessment Act 1986.

12 Subsection 995‑1(1)

Insert:

compensable work‑related trauma has the meaning given by subsection 136(1) of the Fringe Benefits Tax Assessment Act 1986.

13 Subsection 995‑1(1)

Insert:

entity maintenance deduction has the meaning given by subsection 86‑65(2).

14 Subsection 995‑1(1)

Insert:

individual superannuation guarantee shortfall has the meaning given by section 19 of the Superannuation Guarantee (Administration) Act 1992.

15 Subsection 995‑1(1)

Insert:

PAYG payment period means:

(a) for a *personal services entity that is a *small withholder—any *quarter; or

(b) for any other personal services entity—any month.

16 Subsection 995‑1(1)

Insert:

personal services business has the meanings given by subsection 87‑15(1) and section 87‑55.

17 Subsection 995‑1(1)

Insert:

personal services business determination means a determination under section 87‑60 or 87‑65.

18 Subsection 995‑1(1)

Insert:

personal services business test has the meaning given by subsection 87‑15(2).

19 Subsection 995‑1(1)

Insert:

personal services entity has the meaning given by subsection 86‑15(2).

20 Subsection 995‑1(1)

Insert:

personal services income has the meaning given by section 84‑5.

21 Subsection 995‑1(1)

Insert:

personal services payment remitter has the meaning given by section 13‑15 in Schedule 1 to the Taxation Administration Act 1953.

23 Subsection 995‑1(1)

Insert:

private use, of a *car, has the meaning given by subsection 136(1) of the Fringe Benefits Tax Assessment Act 1986.

24 Subsection 995‑1(1) (definition of withholding payment, first occurring)

Repeal the definition, substitute:

withholding payment means:

(a) a payment from which an amount must be withheld under Division 12 in Schedule 1 to the Taxation Administration Act 1953 (even if the amount is not withheld); or

(b) an *alienated personal services payment in respect of which Division 13 in that Schedule requires an amount to be paid to the Commissioner; or

(c) a *non‑cash benefit in respect of which Division 14 in that Schedule requires an amount to be paid to the Commissioner.

Note 1: A withholding payment that consists of a non‑cash benefit is made when the benefit is provided. The amount of the withholding payment is taken to be the market value of the benefit at that time.

Note 2: Divisions 12, 13 and 14 in Schedule 1 to the Taxation Administration Act 1953 deal with collecting amounts on account of income tax payable by the recipient of the payment, alienated personal services payment or non‑cash benefit.

25 Subsection 995‑1(1)

Insert:

workers’ compensation law has the meaning given by subsection 136(1) of the Fringe Benefits Tax Assessment Act 1986.

26 Application

(1) The amendments made by this Part of this Schedule apply to assessments for the 2000‑2001 income year and later income years.

(2) However, the Commissioner may, before 1 July 2000, declare in writing that the amendments made by this Part of this Schedule apply to an assessment that:

(a) is an assessment for the 2000‑2001 income year or the 2001‑2002 income year; and

(b) relates to a PPS entity that is included in a class of entities specified in the declaration;

as if the entity were conducting a personal services business and subsection 87‑15(3) of the Income Tax Assessment Act 1997 did not apply. The declaration has effect accordingly.

(3) An entity is a PPS entity for the purposes of paragraph (2)(b) if:

(a) on or before 13 April 2000, the entity was entitled to make, and had made, a payee declaration to an eligible paying authority under section 221YHB of the Income Tax Assessment Act 1936; and

(b) the Commissioner had received the payee declaration for the entity from the eligible paying authority before the end of that day; and

(c) the declaration was in force at the end of that day.

(4) In subitem (3), eligible paying authority and payee declaration have the same meanings as in Division 3A of Part VI of the Income Tax Assessment Act 1936.

Part 2—Amendment of the Taxation Administration Act 1953

26A Section 10‑1 in Schedule 1

After “Commissioner” (first occurring), insert:

If the payment is personal services income that is included in the assessable income of someone else under Division 86 of the Income Tax Assessment Act 1997, the payer must pay such an amount to the Commissioner at a later date.

26B At the end of section 10‑5 in Schedule 1

Add:

(2) These can also be treated as withholding payments:

(a) alienated personal services payments (see Division 13);

(b) non‑cash benefits (see Division 14).

Note: The obligation to pay an amount to the Commissioner is imposed on the entity receiving the alienated personal services payment or providing the non‑cash benefit.

27 After section 12‑5 in Schedule 1

Insert:

12‑7 Division does not apply to alienated personal services payments

This Division does not apply to a payment in so far as the payment:

(a) is an *alienated personal services payment; or

(b) was received, by the entity making the payment, as an *alienated personal services payment.

Note: An entity that receives an alienated personal services payment may be obliged to pay an amount to the Commissioner: see Division 13.

28 After Division 12 in Schedule 1

Insert:

Division 13—Alienated personal services payments

Table of sections

13‑1 Object of this Division

13‑5 Payment to the Commissioner in respect of alienated personal services payments

13‑10 Alienated personal services payments

13‑15 Personal services payment remitters

13‑20 Time for payments to Commissioner for alienated personal services payments made during 2000‑01

The object of this Division is to ensure the efficient collection of income tax (and other liabilities) on any *personal services income included in an individual’s assessable income under Division 86 of the Income Tax Assessment Act 1997 by:

(a) putting *personal services entities receiving *alienated personal services payments in a position similar to their position if amounts were withheld from the payments under Division 12; but

(b) doing so in a way that enables them to comply with their obligations without having to withhold amounts separately from each payment.

Note: Under Division 86 of the Income Tax Assessment Act 1997 (about alienation of personal services income), an individual’s personal services income that is gained or produced by another entity is in some cases included in the individual’s assessable income. Payments of this income by the entity might not be caught by Division 12.

13‑5 Payment to the Commissioner in respect of alienated personal services payments

Obligation to pay amounts

(1) A *personal services entity must pay an amount of tax to the Commissioner if:

(a) it receives an *alienated personal services payment that relates to an individual’s personal services income; and

(b) it receives the payment during a *PAYG payment period for which it is a *personal services payment remitter.

Working out the amounts

(2) Use this method statement to work out the amount:

Method statement

Step 1. Identify the payments that the *personal services entity makes to the individual during the period mentioned in paragraph (1)(b) that are *withholding payments covered by section 12‑35.

Step 2. Identify the amounts that:

(a) are included in the individual’s assessable income under section 86‑15 of the Income Tax Assessment Act 1997; and

(b) relate to *alienated personal services payments the entity receives during that period.

Step 3. Work out the sum of all the amounts that Division 12 would require the entity to withhold in respect of that period if both of these were taken into account:

(a) the payments identified in step 1; and

(b) the amounts identified in step 2, as if they were payments of salary covered by section 12‑35.

Step 4. Work out the sum of all the amounts withheld under section 12‑35 from the payments identified in step 1.

Step 5. Subtract the sum under step 4 from the sum under step 3.

Example: For the PAYG payment period of 1 April 2001 to 30 June 2001, NewIT Pty. Ltd. received amounts totalling $18,000 that were Ron’s personal services income. NewIT does not conduct a personal services business.

During the period, NewIT paid Ron $3,000 in salary. This is a withholding payment covered by section 12‑35 (step 1).

$15,000 of the amount NewIT received is included in Ron’s assessable income under section 86‑15 of the Income Tax Assessment Act 1997 (step 2).

If NewIT had paid the $15,000 in salary to Ron within 14 days after the end of the PAYG payment period, the amount that NewIT would have had to withhold under Division 12 on the total amount of $18,000 would have been $4,000 (step 3).

NewIT withheld $500 from the salary payment of $3,000, as required by section 12‑35 (step 4).

On the basis of these facts, the amount NewIT must pay to the Commissioner (step 5) is:

![]()

When to pay

(3) The *personal services entity must pay the amount by the end of the 21st day after the end of the *PAYG payment period.

Note: A different rule applies for alienated personal services payments that large withholders and medium withholders make during 2000‑01. See section 13‑20.

13‑10 Alienated personal services payments

An alienated personal services payment is a payment (including a payment in the form of a *non‑cash benefit) that a *personal services entity receives and that relates to an amount that:

(a) is included in an individual’s assessable income under Division 86 of the Income Tax Assessment Act 1997; or

(b) would be so included but for the fact that the entity received the income in the course of conducting a *personal services business.

For valuation of non‑cash benefits, see sections 21 and 21A of the Income Tax Assessment Act 1936.

13‑15 Personal services payment remitters

General

(1) A *personal services entity is a personal services payment remitter for a *PAYG payment period if, in the income year preceding that period:

(a) the entity’s *ordinary income or *statutory income included a person’s *personal services income; and

(b) the entity was not conducting a *personal services business.

Businesses not previously receiving personal services income

(2) A *personal services entity is a personal services payment remitter for a *PAYG payment period if:

(a) the entity’s *ordinary income or *statutory income did not include an individual’s *personal services income in any income year preceding that period; and

(b) it is reasonable to expect that, in the income year during which the period occurs, the entity’s income will include a person’s *personal services income that the entity will not have received in the course of conducting a *personal services business.

(3) It is not reasonable to expect that the *personal services entity will receive a person’s *personal services income in the course of conducting a *personal services business if it is reasonable to expect that the entity will receive at least 80% of that income from one entity and that entity’s *associates.

Personal services business determinations taking effect

(4) However, a *personal services entity is not a personal services payment remitter for a *PAYG payment period if, during that period or an earlier PAYG payment period in the same income year, a *personal services business determination relating to the entity takes effect.

13‑20 Time for payments to Commissioner for alienated personal services payments made during 2000‑01

If:

(a) a *personal services entity must, under section 13‑5, pay an amount for *alienated personal services payments it received during a particular *PAYG payment period; and

(b) the period ends in a *quarter in the *financial year starting on 1 July 2000;

the payment must be paid to the Commissioner by the end of the 21st day after the end of the quarter.

29 Subsection 15‑25(1) in Schedule 1

Omit all the words after “to be withheld”, substitute:

by an entity:

(a) from a *withholding payment covered by Subdivision 12‑B, 12‑C or 12‑D; or

(b) an *alienated personal services payment to which Division 13 applies.

30 Paragraph 15‑50(1)(a) in Schedule 1

After “12‑D”, insert “, or an *alienated personal services payment to which Division 13 applies,”.

31 Section 16‑1 in Schedule 1

Omit “Division 14”, substitute “Division 13 or 14”.

32 Paragraph 16‑20(b) in Schedule 1

Omit “Division 14”, substitute “Division 13 or 14”.

33 Subsection 16‑25(2) in Schedule 1

Omit “Division 14”, substitute “Division 13 or 14”.

34 Paragraphs 16‑25(4)(b) and 16‑30(1)(b) in Schedule 1

Omit “Division 14”, substitute “Division 13 or 14”.

35 Subsection 16‑70(2) in Schedule 1

Omit “Division 14”, substitute “Division 13 or 14”.

36 Paragraphs 16‑85(1)(b) and (2)(b) in Schedule 1

Omit “Division 14”, substitute “Division 13 or 14”.

37 After paragraph 16‑140(1)(a) in Schedule 1

Insert:

(aa) Division 13 (about payments in respect of alienated personal services payments); or

38 Paragraph 16‑140(2)(b) in Schedule 1

Omit “Division 14”, substitute “Division 13 or 14”.

39 After paragraph 16‑143(2)(a) in Schedule 1

Insert:

(aa) all *alienated personal services payments received through the branch, in respect of which Division 13 requires an amount to be paid to the Commissioner, were received by that separate entity; and

40 After paragraph 16‑150(1)(a) in Schedule 1

Insert:

(aa) Division 13 (about payments in respect of alienated personal services payments); or

41 After paragraph 16‑153(2)(a) in Schedule 1

Insert:

(aa) the entity received any *alienated personal services payment in respect of which an amount was required to be paid to the Commissioner under Division 13; or

42 Subparagraph 16‑153(3)(b)(i) in Schedule 1

After “*non‑cash benefits”, insert “, *alienated personal services payments”.

43 After paragraph 16‑155(1)(b) in Schedule 1

Insert:

(ba) during the year the payer received one or more withholding payments covered by Division 13 and, in relation to each of them, an amount is included in the recipient’s assessable income under Division 86 of the Income Tax Assessment Act 1997; or

(bb) because of section 86‑40 of the Income Tax Assessment Act 1997, the payer is taken to have paid salary to the recipient on the last day of the year; or

44 Paragraph 16‑155(2)(a) in Schedule 1

Omit “paragraph (1)(a) or (b)”, substitute “paragraph (1)(a), (b) or (ba)”.

45 After paragraph 16‑155(2)(a) in Schedule 1

Insert:

(aa) if paragraph (1)(bb) applies—each of the withholding payments constituted by the salary mentioned in that paragraph, except one covered by a previous payment summary (and a copy of it) given by the payer to the recipient under section 16‑160; and

46 After paragraph 16‑160(1)(b) in Schedule 1

Insert:

or (c) one or more withholding payments covered by Division 13 that the payer received during the year and that are included in the recipient’s assessable income for the income year under section 86‑15 of the Income Tax Assessment Act 1997;

47 After subsection 16‑170(1) in Schedule 1

Insert:

(1A) For any of the *withholding payments to which paragraph 16‑155(2)(aa) applies, paragraph (1)(d) is taken to refer to the *financial year preceding the financial year in which the withholding payments were received.

48 Section 18‑10 in Schedule 1

Omit “or section 12‑320 (about mining payments)”, substitute “, section 12‑320 (about mining payments) or Division 13 (about alienated personal services payments)”.

49 At the end of section 18‑15 in Schedule 1

Add:

(2) To the extent that the entitlement to a credit is in respect of an *amount withheld from a *withholding payment to which paragraph 16‑155(2)(aa) applies, the entitlement is treated as arising for the income year preceding the income year in which the withholding payment is made.

50 After section 18‑25 in Schedule 1

Insert:

18‑27 Tax credit for alienated personal services payments

A person is entitled to a credit equal to the total of the amounts paid under Division 13 in respect of amounts included in the person’s assessable income for an income year under section 86‑15 of the Income Tax Assessment Act 1997 if:

(a) an assessment has been made of the income tax payable by the person for the income year; or

(b) the Commissioner is satisfied that no income tax is payable by the person for the income year.

51 After subparagraph 18‑65(1)(a)(i) in Schedule 1

Insert:

(ia) paid the amount to the Commissioner purportedly under Division 13 for an *alienated personal services payment in relation to which an amount is included in the recipient’s assessable income year under section 86‑15 of the Income Tax Assessment Act 1997; or

52 Paragraph 18‑65(3)(d) in Schedule 1

After “the payment”, insert “, *alienated personal services payment”.

53 Paragraphs 18‑65(5)(a) and (6)(b) in Schedule 1

Omit “subparagraph (1)(a)(ii)”, substitute “subparagraph (1)(a)(ia) or (ii)”.

54 Paragraph 18‑65(6)(c) in Schedule 1

Omit “Division 14”, substitute “Division 13 or 14”.

55 After subparagraph 18‑70(1)(a)(i) in Schedule 1

Insert:

(ia) paid the amount to the Commissioner purportedly under Division 13 for an *alienated personal services payment in relation to which an amount is included in the recipient’s assessable income year under section 86‑15 of the Income Tax Assessment Act 1997; or

56 Subsection 45‑120(3) in Schedule 1

Repeal the subsection, substitute:

Exclusion: amounts in respect of withholding payments

(3) Your instalment income for a period does not include amounts in respect of:

(a) *withholding payments (except *non‑quotation withholding payments) made to you during that period; and

(b) amounts included in your assessable income under section 86‑15 of the Income Tax Assessment Act 1997 for which there are *amounts required to be paid under Division 13.

57 Subsection 45‑365(3) in Schedule 1

Repeal the subsection, substitute:

(3) It is reduced (but not below nil) by the sum of:

(a) the total amount of the credits to which you are entitled for the variation year under section 18‑15 (for amounts withheld from withholding payments made to you during the variation year); and

(b) the total amount of the credits to which you are entitled for the variation year under section 18‑27 (for amounts paid under Division 13 in respect of amounts included in your assessable income under section 86‑15 of the Income Tax Assessment Act 1997).

58 Application

The amendments made by this Part of this Schedule apply to an amount received, or a non‑cash benefit provided, on or after 1 July 2000.

Part 3—Amendment of other Acts

Child Support (Registration and Collection) Act 1988

59 Subsection 4(1) (definition of work and income support related withholding payments)

After “or 12‑D”, insert “or Division 13”.

60 Subsection 4(1) (definition of work and income support related withholding payments, note)

Omit “and payments specified by regulations”, substitute “, payments specified by regulations and alienated personal services payments”.

Fringe Benefits Tax Assessment Act 1986

61 At the end of section 8

Add:

(4) A car benefit is an exempt benefit in relation to a year of tax if:

(a) the car benefit is provided in the year of tax in respect of the employment of a current employee; and

(b) the person providing the benefit cannot deduct an amount under the Income Tax Assessment Act 1997 for providing the benefit because of section 86‑60 of that Act.

Note: Section 86‑60 of the Income Tax Assessment Act 1997 (read together with section 86‑70 of that Act) limits the extent to which personal service entities can deduct car expenses. Deductions are not allowed for more than one car for private use.

Income Tax Assessment Act 1936

62 At the end of subsection 82AAC(1)

Add:

Note 1: A deduction may be denied by section 85‑25 of the Income Tax Assessment Act 1997 if the eligible employee is an associate of the taxpayer.

Note 2: Section 86‑60 of the Income Tax Assessment Act 1997 (read together with section 86‑75 of that Act) limits the extent to which superannuation contributions by personal service entities are allowable deductions.

63 Section 202A

Insert:

alienated personal services payment has the meaning given by section 13‑10 in Schedule 1 to the Taxation Administration Act 1953.

64 Section 202A (after paragraph (a) of the definition of eligible PAYG payment)

Insert:

(aa) an alienated personal services payment in respect of which Division 13 in Schedule 1 to the Taxation Administration Act 1953 requires an amount to be paid to the Commissioner; or

65 Subsection 221A(1) (after paragraph (a) of the definition of work and income support related withholding payments and benefits)

Insert:

(aa) amounts included in a person’s assessable income under section 86‑15 of the Income Tax Assessment Act 1997 in respect of which an amount must be paid under Division 13 in Schedule 1 to the Taxation Administration Act 1953 (even if the amount is not paid); and

66 After paragraph 222AHE(4)(c)

Insert:

(ca) the sum of all amounts required to be paid under Division 13 in Schedule 1 to the Taxation Administration Act 1953 during the relevant period, or the fact that no amounts were so paid during the period;

67 After paragraph 222AID(4)(c)

Insert:

(ca) the sum of all amounts required to be paid under Division 13 in Schedule 1 to the Taxation Administration Act 1953 during the relevant period, or the fact that no amounts were so paid during the period;

68 After paragraph 222AIH(3)(c)

Insert:

(ca) the sum of all amounts required to be paid under Division 13 in Schedule 1 to the Taxation Administration Act 1953 during the relevant period, or the fact that no amounts were so paid during the period;

69 After paragraph 222AOA(1)(b)

Insert:

(ba) received one or more alienated personal services payments on a particular day in relation to which it is required to pay an amount to the Commissioner under Division 13 in Schedule 1 to the Taxation Administration Act 1953, and has not paid that amount or those amounts.

70 Subsection 222AOA(2)

Omit “Division 14”, substitute “Division 13 or 14”.

71 At the end of section 222AOA

Add:

(3) In this section, alienated personal services payment and non‑cash benefit have the meanings given by subsection 995‑1(1) of the Income Tax Assessment Act 1997.

72 Subsection 262A(2A)

Omit “Division 14”, substitute “Division 13 or 14”.

(68/00)

[Minister’s second reading speech made in—

House of Representatives on 13 April 2000

Senate on 5 June 2000]