An Act to implement A New Tax System by providing assistance to families, and for related purposes

Part 1—Preliminary

1 Short title

This Act may be cited as the A New Tax System (Family Assistance) Act 1999.

2 Commencement

(1) This Act commences, or is taken to have commenced:

(a) after all the provisions listed in subsection (2) have commenced; and

(b) on the last day on which any of those provisions commenced.

(2) These are the provisions:

(a) section 1‑2 of the A New Tax System (Goods and Services Tax) Act 1999;

(b) section 2 of the A New Tax System (Goods and Services Tax Imposition—Excise) Act 1999;

(c) section 2 of the A New Tax System (Goods and Services Tax Imposition—Customs) Act 1999;

(d) section 2 of the A New Tax System (Goods and Services Tax Imposition—General) Act 1999;

(e) section 2 of the A New Tax System (Goods and Services Tax Administration) Act 1999.

2A Norfolk Island

This Act extends to Norfolk Island.

Part 2—Interpretation

Division 1—Definitions

3 Definitions

(1) In this Act, unless the contrary intention appears:

2020 economic support payment means:

(a) a first 2020 economic support payment; or

(b) a second 2020 economic support payment.

ACCS: see additional child care subsidy.

ACCS (child wellbeing): see additional child care subsidy.

ACCS (grandparent): see additional child care subsidy.

ACCS hourly rate cap has the meaning given by subclause 6(2) of Schedule 2.

ACCS (temporary financial hardship): see additional child care subsidy.

ACCS (transition to work): see additional child care subsidy.

activity test result has the meaning given by clause 11 of Schedule 2.

additional child care subsidy or ACCS means additional child care subsidy for which:

(a) an individual or an approved provider may become eligible under section 85CA (ACCS (child wellbeing)); or

(b) an individual may become eligible under section 85CG (ACCS (temporary financial hardship)); or

(c) an individual may become eligible under section 85CJ (ACCS (grandparent)); or

(d) an individual may become eligible under section 85CK (ACCS (transition to work)).

adjusted taxable income has the meaning given by Schedule 3.

aged care resident has the same meaning as in the Social Security Act 1991.

amount of rent paid or payable has the same meaning as in the Social Security Act 1991.

annual cap has the meaning given by subclause 1(2) of Schedule 2.

applicable percentage has the meaning given by clause 3 of Schedule 2.

application day has the meaning given by subsections 35K(2) and (3).

approved care organisation means an organisation approved by the Secretary under section 20.

approved course of education or study has the meaning given by subsection 541B(5) of the Social Security Act 1991 for the purposes of paragraph (1)(c) of that section.

Australia, when used in a geographical sense, includes Norfolk Island, the Territory of Cocos (Keeling) Islands and the Territory of Christmas Island.

Note: In Division 5 of Part 4 of the Family Assistance Administration Act (about departure prohibition orders), Australia has an extended meaning.

Australian Immunisation Handbook means the latest edition of the Australian Immunisation Handbook published by the Australian Government Publishing Service.

Australian resident has the same meaning as in the Social Security Act 1991.

Australian travel document has the same meaning as in the Australian Passports Act 2005.

authorised party, in relation to the adoption of a child, means a person or agency that, under the law of the State, Territory or foreign country whose courts have jurisdiction in respect of the adoption, is authorised to conduct negotiations or arrangements for the adoption of children.

back to school bonus means a payment to which an individual is entitled under section 95 or 98.

base FTB child rate, in relation to an FTB child of an individual whose Part A rate of family tax benefit is being worked out using Part 2 of Schedule 1, has the meaning given by clause 8 of that Schedule.

base rate, in relation to an individual whose Part A rate of family tax benefit is being worked out using Part 2 of Schedule 1, has the meaning given by clause 4 of that Schedule.

becomes entrusted: a child becomes entrusted to the care of an individual at a time if:

(a) any person entrusts the child to the individual’s care; and

(b) as a result, the child is in the individual’s care at that time; and

(c) the child was not in the individual’s care at any earlier time.

benefit received by an individual has a meaning affected by paragraph 19(2)(b).

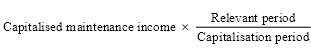

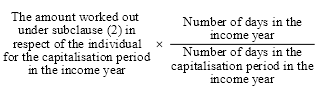

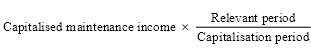

capitalised maintenance income, in relation to an individual, means maintenance income (other than child maintenance to which clause 20B, 20C or 20D of Schedule 1 applies) of the individual:

(a) that is neither a periodic amount nor a benefit provided on a periodic basis; and

(b) the amount or value of which exceeds $1,500.

Note: Periodic amount is defined in section 19.

care arrangement in relation to a child means:

(a) a written agreement between the parents of the child, or between a parent of the child and another person who cares for the child, that relates to the care of the child; or

(b) a parenting plan for the child; or

(c) any of the following orders relating to the child:

(i) a family violence order within the meaning of section 4 of the Family Law Act 1975;

(ii) a parenting order within the meaning of section 64B of that Act;

(iii) a State child order registered in accordance with section 70D of that Act;

(iv) an overseas child order registered in accordance with section 70G of that Act.

care period has the meaning given by subparagraph 35A(1)(a)(ii) or (2)(b)(ii) or paragraph 35B(1)(a) or (2)(b).

CCS: see child care subsidy.

CCS fortnight means a period of 2 weeks beginning on:

(a) Monday 2 July 2018; or

(b) every second Monday after that Monday.

CCS hourly rate cap has the meaning given by subclause 2(3) of Schedule 2.

change of care day for an individual who cares for a child means:

(a) if a determination of the individual’s percentage of care for the child has been revoked under Subdivision E of Division 1 of Part 3—the first day on which the care of the child that was actually taking place ceased to correspond with the individual’s percentage of care for the child under the determination; or

(b) if a determination of the individual’s percentage of care for the child has been suspended under Subdivision E of Division 1 of Part 3—the first day on which the care of the child that was actually taking place ceased to correspond with the individual’s percentage of care for the child determined for the purposes of subsection 35C(4) under the determination; or

(c) otherwise—the first day on which the care of the child that was actually taking place did not correspond with the individual’s extent of care under a care arrangement that applies in relation to the child (which might be the first day the care arrangement begins to apply in relation to the child).

child care subsidy or CCS means child care subsidy for which an individual may become eligible under section 85BA.

child support means financial support under the Child Support (Assessment) Act 1989 and includes financial support:

(a) by way of lump sum payment; or

(b) by way of transfer or settlement of property.

child support agreement has the meaning given by section 81 of the Child Support (Assessment) Act 1989.

child support care determination has the meaning given by paragraph 35T(1)(b).

child wellbeing result has the meaning given by clause 15 of Schedule 2.

clean energy advance means an advance to which an individual is entitled under Division 1 or 3 of Part 8.

compliance penalty period has the same meaning as in the Social Security Act 1991.

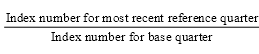

current figure, as at a particular time and in relation to an amount that is to be indexed or adjusted under Schedule 4, means:

(a) if the amount has not yet been indexed or adjusted under Schedule 4 before that time—the amount; and

(b) if the amount has been indexed or adjusted under Schedule 4 before that time—the amount most recently substituted for the amount under Schedule 4 before that time.

deemed activity test result has the meaning given by clause 16 of Schedule 2.

disability expenses maintenance has the meaning given by subsection 19(3).

disabled person means a person who is:

(a) receiving a disability support pension under Part 2.3 of the Social Security Act 1991; or

(b) receiving an invalidity pension under Division 4 of Part III of the Veterans’ Entitlements Act 1986; or

(c) participating in an independent living program provided by CRS Australia or such other body determined by the Minister, by legislative instrument, for the purposes of this paragraph; or

(d) diagnosed by a medical practitioner or a psychologist (see subsection 3(3)) as a person who is impaired to a degree that significantly incapacitates him or her; or

(e) included in a class of persons determined by the Minister, by legislative instrument, to be a disabled person for the purposes of this paragraph.

economic security strategy payment to families means a payment to which an individual is entitled under section 89 or 93.

eligible for parental leave pay has the same meaning as in the Paid Parental Leave Act 2010.

ETR payment (short for Education Tax Refund payment) means a payment to which an individual is entitled under Part 7A.

extended child wellbeing period has the meaning given by subclause 15(3) of Schedule 2.

family assistance means:

(a) family tax benefit; or

(b) stillborn baby payment; or

(d) child care subsidy; or

(da) additional child care subsidy; or

(e) family tax benefit advance; or

(f) single income family supplement.

family dispute resolution has the meaning given by section 10F of the Family Law Act 1975.

family law order means:

(a) a parenting order within the meaning of section 64B of the Family Law Act 1975; or

(b) a family violence order within the meaning of section 4 of that Act; or

(c) a State child order registered under section 70D of that Act; or

(d) an overseas child order registered under section 70G of that Act.

family tax benefit means the benefit for which a person is eligible under Division 1 of Part 3 (and includes any amount under section 58AA).

first 2020 economic support payment means a payment to which an individual is entitled under Division 1 of Part 9.

Foreign Affairs Minister means the Minister administering the Australian Passports Act 2005.

fourth income threshold has the meaning given by subclause 3(4) of Schedule 2.

FTB child:

(a) in relation to family tax benefit—has the meaning given in Subdivision A of Division 1 of Part 3; and

(b) in relation to child care subsidy and additional child care subsidy—has the meaning given in Subdivision A of Division 1 of Part 3 (except for section 24), but in applying Subdivision D of that Division to CCS or ACCS, a reference in Subdivision D to a claim for payment of family tax benefit is taken to be a reference to a claim for CCS; and

(c) in relation to stillborn baby payment—has the meaning given in Subdivision A of Division 1 of Part 3; and

(e) in relation to single income family supplement—has the meaning given in Subdivision A of Division 1 of Part 3 but, in applying Subdivision D of that Division to that supplement in a case where a claim for that supplement is required for there to be an entitlement to be paid that supplement, a reference in Subdivision D of that Division to a claim for payment of family tax benefit is to be read as a reference to a claim for payment of that supplement.

FTB child rate reduction period has the meaning given by subsection 61A(2) or 61B(2).

Note: The FTB child rate reduction period relates to a child who does not meet the health check or immunisation requirements under section 61A or 61B.

general practitioner has the same meaning as in the Health Insurance Act 1973.

holder, in relation to a visa, has the same meaning as in the Migration Act 1958.

Home Affairs Minister means the Minister administering the Australian Security Intelligence Organisation Act 1979.

hourly rate of ACCS:

(b) for an individual—has the meaning given by subclause 6(1) of Schedule 2; or

(c) for an approved provider—has the meaning given by subclause 9(1) of Schedule 2.

hourly rate of CCS has the meaning given by subclause 2(1) of Schedule 2.

hourly session fee:

(a) for an individual—has the meaning given by subclause 2(2) of Schedule 2; and

(b) for an approved provider—has the meaning given by subclause 9(2) of Schedule 2.

Human Services Secretary means the Secretary of the Department administered by the Minister administering the Human Services (Centrelink) Act 1997.

illness separated couple has the same meaning as in the Social Security Act 1991.

immunised, in relation to a child, means the child is immunised in accordance with:

(a) a standard vaccination schedule determined under section 4; or

(b) a catch up vaccination schedule determined under section 4.

income support supplement has the same meaning as in the Social Security Act 1991.

Income Tax Assessment Act means the Income Tax Assessment Act 1997.

income year has the same meaning as in the Income Tax Assessment Act.

increased care of a child has the meaning given by section 35GA.

index number has the same meaning as in the Social Security Act 1991.

ineligible homeowner has the same meaning as in the Social Security Act 1991.

interim period has the meaning given by section 35FA.

lower income threshold has the meaning given by subclause 3(4) of Schedule 2.

low income result has the meaning given by clause 13 of Schedule 2.

maintenance includes child support.

maintenance agreement means a written agreement (whether made within or outside Australia) that provides for the maintenance of a person (whether or not it also makes provision in relation to other matters), and includes such an agreement that varies an earlier maintenance agreement.

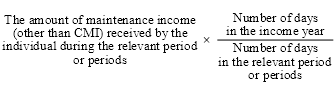

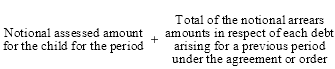

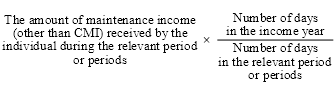

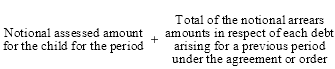

maintenance income, in relation to an individual, means:

(a) child maintenance—any one or more of the following amounts:

(i) if clause 20B of Schedule 1 applies (notional assessments for child support agreements)—the amount worked out under that clause;

(ii) if clause 20C of Schedule 1 applies (lump sum payments)—the amount worked out under that clause;

(iia) if clause 20D of Schedule 1 applies (deemed receipt for administrative assessments privately collected)—the amount worked out under that clause;

(iii) otherwise—the amount of a payment or the value of a benefit that is received by the individual for the maintenance of an FTB child of the individual and is received from a parent or relationship parent of the child, or the former partner of a parent or relationship parent of the child; or

(b) partner maintenance—that is, the amount of a payment or the value of a benefit that is received by the individual for the individual’s own maintenance and is received from the individual’s former partner; or

(c) direct child maintenance—that is, the amount of a payment or the value of a benefit that is received by an FTB child of the individual for the child’s own maintenance and is received from:

(i) a parent or relationship parent of the child; or

(ii) the former partner of a parent or relationship parent of the child;

but does not include disability expenses maintenance.

Note: This definition is affected by section 19.

maintenance income credit balance has the meaning given by clause 24A of Schedule 1.

maximum interim period for a determination under section 35A or 35B of an individual’s percentage of care for a child is the period beginning on the change of care day for the individual and ending at:

(a) for a determination relating to a court order—the later of:

(i) the end of the period of 52 weeks starting on the day the court order first takes effect; or

(ii) the end of the period of 26 weeks starting on the change of care day; or

(b) for a determination relating to a written agreement or parenting plan—the end of the period of 14 weeks starting on the change of care day.

medical practitioner means a person registered or licensed as a medical practitioner under a State or Territory law that provides for the registration or licensing of medical practitioners.

meets the immunisation requirements has the meaning given by section 6.

member of a couple has the same meaning as in the Social Security Act 1991.

member of the same couple has the same meaning as member of a couple has.

Military Rehabilitation and Compensation Act Education and Training Scheme means the scheme determined under section 258 of the Military Rehabilitation and Compensation Act 2004 (as the scheme is in force at the commencement of this definition).

Minister’s rules has the meaning given by subsection 85GB(1).

Minister’s rules result has the meaning given by clause 14 of Schedule 2.

notional assessment has the meaning given by section 146E of the Child Support (Assessment) Act 1989.

one‑off payment to families means a payment to which an individual is entitled under section 86.

paid work (other than in paragraph 12(2)(a) of Schedule 2) has the meaning given by section 3B.

parenting plan has the meaning given by the Family Law Act 1975.

partner has the same meaning as in the Social Security Act 1991.

partnered (partner in gaol) has the same meaning as in the Social Security Act 1991.

passive employment income of an individual, in respect of a period, means:

(a) income that is earned by the individual in respect of the period as a result of the individual being on paid leave for the period; or

(b) a payment of compensation, or a payment under an insurance scheme, in respect of the individual’s inability to earn, derive or receive income from paid work during the period; or

(c) if the individual stops paid work as a self‑employed individual—income that is derived by the individual in respect of the period from an interest, or from investments, held in connection with the individual’s previous self‑employment.

payment or benefit received from an individual has a meaning affected by paragraph 19(2)(c).

percentage of care, in relation to an individual who cares for a child, means the individual’s percentage of care for the child that is determined by the Secretary under Subdivision D of Division 1 of Part 3.

percentage range: each of the following is a percentage range:

(a) 0% to less than 14%;

(b) 14% to less than 35%;

(c) 48% to 52%;

(d) more than 65% to 86%;

(e) more than 86% to 100%.

percentage range has the meaning given by subsection 35P(2).

permanent visa has the same meaning as in the Migration Act 1958.

PPL period has the same meaning as in the Paid Parental Leave Act 2010.

prescribed educational scheme has the same meaning as in the Social Security Act 1991.

principal home has the same meaning as in the Social Security Act 1991.

provide, in relation to a session of care, has the meaning given by section 10.

received from has a meaning affected by paragraph 19(2)(a).

receiving:

(a) in relation to a social security payment—has the same meaning as in subsections 23(1D), 23(2) and (4) of the Social Security Act 1991; and

(b) for the purposes of a reference in section 85CJ of this Act or clause 1, 28B or 38L of Schedule 1 to this Act, or in section 32AI of the Family Assistance Administration Act, to a person receiving a social security pension or social security benefit:

(i) except in relation to clauses 1 and 38L of Schedule 1 to this Act—is taken to include the meaning provided in subsection 23(4A) of the Social Security Act 1991 as if those sections and clauses were specified in provisions of that Act referred to in subsection 23(4AA) of that Act; and

(ii) subject to subsection (8) of this section, is taken to include a reference to a person being prevented from receiving a social security pension or social security benefit because of the application of a compliance penalty period; and

(c) in relation to a social security pension, a social security benefit, a service pension, income support supplement or a veteran payment—has a meaning affected by section 3AA (which deals with the suspension of payments under Part 3C (schooling requirements) of the Social Security (Administration) Act 1999).

recognised activity has the meaning given by subclause 12(2) of Schedule 2.

recognised activity result has the meaning given by subclause 12(1) of Schedule 2.

recognised immunisation provider has the same meaning as recognised vaccination provider in the Australian Immunisation Register Act 2015.

reduced care of a child has the meaning given by section 35H.

registered entitlement, of an individual, means the individual’s entitlement to receive maintenance income from a particular payer, if the payer’s liability to pay that maintenance income is an enforceable maintenance liability within the meaning of the Child Support (Registration and Collection) Act 1988.

registered parenting plan means a parenting plan registered under section 63E of the Family Law Act 1975.

regular care child, of an individual (the adult), means an individual:

(a) who would be an FTB child of the adult but for the operation of section 25 (adult’s percentage of care for the child during a care period is less than 35%); and

(b) for whom the adult has a percentage of care during a care period that is at least 14%.

Note: See also section 25A.

reimbursement fringe benefit has the meaning given by subclause 2(5) of Schedule 2.

relationship child has the same meaning as in the Social Security Act 1991.

relationship parent has the same meaning as in the Social Security Act 1991.

relevant shared carer means an individual who has a shared care percentage for each of his or her FTB children.

rent has the same meaning as in the Social Security Act 1991.

rent assistance child has the meaning given by clause 38B of Schedule 1.

repayment period, in relation to a family tax benefit advance that is paid to an individual, has the meaning given by subclause 40(3) of Schedule 1.

resides in Australia has the same meaning as in the Social Security Act 1991.

respite care couple has the same meaning as in the Social Security Act 1991.

returns to paid work has the meaning given by section 3B.

second 2020 economic support payment means a payment to which an individual is entitled under Division 2 of Part 9.

secondary earner of a couple, in respect of an income year, means:

(a) unless paragraph (b) applies:

(i) the member of the couple who has the lower adjusted taxable income for the year; or

(ii) if both members of the couple have the same adjusted taxable income for the year—the member of the couple who returns to paid work first during the year; or

(b) if the rate of family tax benefit for a member of the couple is determined on the basis of an estimate of adjusted taxable income for the year, and only one member of the couple returns to paid work during the year—the member of the couple whose original estimate of adjusted taxable income is the lower estimate for the couple for the year (disregarding subclause 3(2) of Schedule 3).

second income threshold has the meaning given by subclause 3(4) of Schedule 2.

Secretary’s rules has the meaning given by subsection 85GB(2).

security notice means a notice under section 57GJ.

senior secondary school child has the meaning given by section 22B.

service pension has the same meaning as in the Social Security Act 1991.

session of care has the meaning given by Minister’s rules made for the purposes of section 9.

shared care percentage for an individual for an FTB child has the meaning given by section 59.

single income family bonus means a payment to which an individual is entitled under section 101.

single income family supplement means the supplement for which an individual is eligible under Division 6 of Part 3.

social security benefit has the same meaning as in the Social Security Act 1991.

social security payment has the same meaning as in the Social Security Act 1991.

social security pension has the same meaning as in the Social Security Act 1991.

special category visa has the same meaning as in the Migration Act 1958.

standard reduction, in relation to a family tax benefit advance, has the meaning given by clause 41 of Schedule 1.

State/Territory child welfare law has the meaning given by subsection 85ED(2).

stillborn baby payment means the payment for which an individual is eligible under Division 2 of Part 3.

stillborn child means a child:

(a) who weighs at least 400 grams at delivery or whose period of gestation was at least 20 weeks; and

(b) who has not breathed since delivery; and

(c) whose heart has not beaten since delivery.

studying overseas full‑time: see section 3C.

takes reasonable action to participate in family dispute resolution has the meaning given by subsection 35FA(3).

taxable income has the same meaning as in the Income Tax Assessment Act.

temporarily separated couple has the same meaning as in the Social Security Act 1991.

third income threshold has the meaning given by subclause 3(4) of Schedule 2.

transition to work payment has the meaning given by subsection 85CK(3).

undertaking full‑time study has the same meaning as in the Social Security Act 1991.

upper income threshold has the meaning given by subclause 3(4) of Schedule 2.

veteran payment means a veteran payment made under an instrument made under section 45SB of the Veterans’ Entitlements Act 1986.

Veterans’ Children Education Scheme means the scheme prepared under section 117 of the Veterans’ Entitlements Act 1986 (as the scheme is in force at the commencement of this definition).

week, in relation to child care subsidy and additional child care subsidy, has the meaning given in subsection (6).

youth allowance means a payment under Part 2.11 of the Social Security Act 1991.

(2) Expressions used in this Act that are defined in the A New Tax System (Family Assistance) (Administration) Act 1999 have the same meaning as in that Act.

(3) For the purposes of paragraph (d) of the definition of disabled person, the reference to a psychologist is a reference to a psychologist who:

(a) is registered with a Board established under a law of a State or Territory that registers psychologists in that State or Territory; and

(b) has qualifications or experience in assessing impairment in adults.

(6) A week, for the purposes of child care subsidy and additional child care subsidy, begins on a Monday.

(8) Subparagraph (b)(ii) of the definition of receiving in subsection (1) does not apply in relation to a compliance penalty period if:

(a) the duration of the period is more than 8 weeks; or

(b) in a case where the compliance penalty period immediately succeeded another compliance penalty period—it has been more than 8 weeks since any compliance penalty period did not apply to the person.

(9) However, if:

(a) the compliance penalty period; or

(b) in a case where the compliance penalty period immediately succeeded another compliance penalty period—the period since any compliance penalty period did not apply to the person;

started in the income year preceding the income year in which the 8 weeks referred to in subsection (8) elapsed, that subsection does not apply in relation to the compliance penalty period until the start of the later income year.

3AA Meaning of receiving affected by suspension of certain schooling requirement payments

Scope

(1) This section applies for the purposes of a reference in section 85CJ or 85CK of this Act, or clause 1, 28B or 38L of Schedule 1 to this Act, to a person receiving payments (affected schooling requirement payments) covered by subsection (2).

(2) The affected schooling requirement payments are the following:

(a) a social security pension;

(b) a social security benefit;

(c) a service pension;

(d) income support supplement;

(e) a veteran payment.

Note: These payments are schooling requirement payments within the meaning of the Social Security (Administration) Act 1999 (see section 124D of that Act).

General rule—person taken to receive payment during suspension

(3) In this Act, subject to subsections (4) and (5):

receiving is taken to include a reference to a person being prevented from receiving an affected schooling requirement payment because the payment is suspended under Part 3C (schooling requirements) of the Social Security (Administration) Act 1999.

Note: See also the definition of receiving in subsection 3(1), and subsections 3(8) and (9).

Exception—more than 13 weeks continuous suspension

(4) Subsection (3) does not apply in relation to the suspension of an affected schooling requirement payment if the payment has been suspended for a continuous period of more than 13 weeks.

(5) However, if the period of suspension referred to in subsection (4) started in the income year preceding the income year in which the 13 weeks referred to in that subsection elapsed, that subsection does not apply in relation to the suspension until the start of the later income year.

3A An individual may be in the care of 2 or more other individuals at the same time

For the avoidance of doubt, except where express provision is made to the contrary, an individual may be taken, for the purposes of this Act, to be in the care of 2 or more other individuals at the same time.

3B Meaning of paid work and returns to paid work

Meaning of paid work

(1) Paid work (other than in paragraph 12(2)(a) of Schedule 2) means any work for financial gain or any other reward (whether as an employee, a self‑employed individual or otherwise) that involves a substantial degree of personal exertion on the part of the individual concerned.

Note: The ordinary meaning of paid work applies to paragraph 12(2)(a) of Schedule 2.

Meaning of returns to paid work

(2) An individual returns to paid work during an income year if:

(a) the individual is not engaging in paid work during that year; and

(b) the individual later engages in paid work for an average of at least 10 hours per week for 4 consecutive weeks that start during that year.

(3) An individual returns to paid work during an income year if:

(a) the individual is not engaging in paid work during that year; and

(b) the individual later engages in paid work during that year, but not for an average of at least 10 hours per week for 4 consecutive weeks that start during that year; and

(c) the Secretary is notified in writing that the individual returned to paid work during that year:

(i) during the income year following that year and in accordance with subsection (4); or

(ii) if a claim is made under the Family Assistance Administration Act for payment of family tax benefit for a past period that occurs in that year and the claim is made during the second income year following that year—in accordance with subsection (5).

(4) For the purposes of subparagraph (3)(c)(i), if the individual is a member of a couple at any time, during the income year, before the individual engages in paid work as mentioned in paragraph (3)(b), the Secretary is notified in accordance with this subsection if the Secretary is notified by:

(a) if:

(i) both members of the couple are eligible for family tax benefit at any time, during that income year, before the individual engages in paid work (whether the members of the couple are eligible at the same time or at different times); and

(ii) the individual is a member of the same couple at the time of the notification;

both members of the couple; and

(b) if:

(i) both members of the couple are eligible for family tax benefit at any time, during that income year, before the individual engages in paid work (whether the members of the couple are eligible at the same time or at different times); and

(ii) the individual is no longer a member of the same couple at the time of the notification;

the individual who engages in the paid work; and

(c) if at all times, during that income year, before the individual engages in paid work, only one member of the couple is eligible for family tax benefit—the member of the couple who is eligible for family tax benefit.

(5) For the purposes of subparagraph (3)(c)(ii), the Secretary is notified in accordance with this subsection if the Secretary is notified in the claim that the individual returned to paid work during that year.

3C Meaning of studying overseas full‑time

For the purposes of this Act, studying overseas full‑time has the meaning given by a legislative instrument made by the Minister for the purposes of this section.

Division 2—Immunisation rules

4 Minister’s power to make determinations for the purposes of the definition of immunised

(1) The Minister must, for the purpose of the definition of immunised in section 3, by legislative instrument, determine:

(a) one or more standard vaccination schedules for the immunisation of children; and

(b) one or more catch up vaccination schedules for the immunisation of children who have not been immunised in accordance with a standard vaccination schedule.

(2) Despite subsection 14(2) of the Legislation Act 2003, a determination made for the purposes of subsection (1) of this section may make provision in relation to a matter by applying, adopting or incorporating any matter contained in an instrument or other writing as in force or existing from time to time.

6 Immunisation requirements

(1) This section states when the child of an individual (the adult) meets the immunisation requirements for the purposes of determining:

(a) whether the adult is eligible for child care subsidy under Division 2 of Part 4A; or

(b) whether an approved provider is eligible for ACCS (child wellbeing) for sessions of care provided to the child; or

(c) whether the adult’s FTB child rate in relation to the child is reduced under subclause 7(2) or (3) or 26(3) or (4) of Schedule 1 (see sections 61A and 61B).

Child immunised

(2) The child meets the immunisation requirements if the child has been immunised.

Medical contraindication, natural immunity and vaccine study

(3) The child meets the immunisation requirements if:

(a) a general practitioner, a paediatrician, a public health physician, an infectious diseases physician or a clinical immunologist has certified in writing that the immunisation of the child would be medically contraindicated under the specifications set out in the Australian Immunisation Handbook; or

(b) a general practitioner, a paediatrician, a public health physician, an infectious diseases physician or a clinical immunologist has certified in writing that the child does not require immunisation because the child has contracted a disease or diseases and as a result has developed a natural immunity; or

(c) the child is a participant in a vaccine study approved by a Human Research Ethics Committee registered with the National Health and Medical Research Council.

Temporary unavailability of vaccine

(4) The child meets the immunisation requirements if:

(a) the child has not received a vaccination at a particular age; and

(b) the person who occupies, or is acting in, the position of Commonwealth Chief Medical Officer has certified in writing that the vaccine for that vaccination is, or all of the vaccines for that vaccination are, temporarily unavailable; and

(c) if that vaccine, or one of those vaccines, had been available, the Secretary is satisfied that the child would have been immunised; and

(d) that vaccine has not, or none of those vaccines have, become available.

Child vaccinated overseas

(5) The child meets the immunisation requirements if:

(a) the child has received one or more vaccinations while outside Australia; and

(b) a recognised immunisation provider has certified in writing that those vaccinations have provided the child with the same level of immunisation that the child would have acquired if the child had been vaccinated in accordance with a standard vaccination schedule, or a catch up vaccination schedule, determined under section 4; and

(c) the child has received, whether in or outside Australia, all the other vaccinations in accordance with a standard vaccination schedule, or a catch up vaccination schedule, determined under section 4.

Secretary’s decision

(6) The child meets the immunisation requirements if the Secretary determines in writing that the child meets the immunisation requirements.

(7) In making a determination under subsection (6), the Secretary must comply with any decision‑making principles set out in a legislative instrument made by the Minister for the purposes of this subsection.

Requirements for certifications and applications for determinations

(8) The following must be made in the form and manner, contain any information, and be accompanied by any documents, required by the Secretary:

(a) a certification under paragraph (3)(a) or (b), (4)(b) or (5)(b);

(b) an application for a determination under subsection (6).

Division 3—Various interpretative provisions

8 Extended meaning of Australian resident—hardship and special circumstances

(1) The Secretary may, in accordance with the Minister’s rules, determine:

(a) that an individual who is not an Australian resident is taken to be an Australian resident for the purposes of Division 2 of Part 4A (eligibility for CCS); and

(b) if the determination is for a period—the period in respect of which the person is taken to be an Australian resident.

(2) The Secretary may make a determination under subsection (1) if the Secretary is satisfied that:

(a) hardship would be caused to the individual if the individual were not treated as an Australian resident for a period or indefinitely; or

(b) because of the special circumstances of the particular case, the individual should be treated as an Australian resident for a period or indefinitely.

(3) Minister’s rules made for the purposes of subsection (1) may prescribe matters to which the Secretary must have regard in making determinations under subsection (1), including time limits for periods referred to in paragraph (1)(b).

9 Session of care

(1) The Minister’s rules must prescribe what constitutes a session of care for the purposes of this Act.

(2) Minister’s rules made for the purposes of subsection (1) may also deal with how a session of care that starts on one day and ends on another day is to be treated for the purposes of this Act.

10 When a session of care is provided

Basic rule about when a session of care is provided

(1) For the purposes of this Act and the Family Assistance Administration Act, a child care service provides a session of care to a child if:

(a) the child is enrolled for care by the service and the child attends the session of care or any part of it; or

(b) if the child does not attend any part of the session of care—the service is taken to have provided the session of care to the child under subsection (2) or (3).

Note: Enrolled is defined in section 200B of the Family Assistance Administration Act.

Allowable absences

(2) A child care service is taken to have provided a session of care to a child on a day in a financial year if:

(a) had the child attended the session of care, one or more of the hours in the session would have been taken into account in accordance with paragraph 4(1)(a) of Schedule 2; and

(b) the day is:

(i) a day on which the child is enrolled for care by the service; and

(ii) after the day the child first attended a session of care provided by the service; and

(iii) not after the last day the child attended a session of care provided by the service before the child ceased to be enrolled for care by the service; and

(iv) not a day prescribed by the Minister’s rules; and

(c) either:

(i) there have been no more than 41 days in the financial year on which an approved child care service is taken to have provided a session of care to the child under this subsection as a result of this subparagraph; or

(ii) if the Minister’s rules prescribe a particular event or circumstance—the conditions referred to in subsection (2AA) are met.

Note: Ceases to be enrolled is defined in section 200B of the Family Assistance Administration Act.

(2AA) For the purposes of subparagraph (2)(c)(ii), the conditions are that:

(a) any conditions prescribed by the Minister’s rules for the prescribed event or circumstance are met; and

(b) if the Minister’s rules prescribe a number of days for the event or circumstance for all or part of the financial year—there have been no more than that number of days, in the financial year or the part of the financial year, on which an approved child care service is taken to have provided a session of care to the child under subsection (2) as a result of subparagraph (2)(c)(ii) in relation to that event or circumstance.

(2A) The Minister’s rules may prescribe circumstances in which subparagraph (2)(b)(ii) or (iii) does not apply.

More than the number of allowable absences

(3) A child care service is taken to have provided a session of care to a child on a day in a financial year if:

(a) the service is not taken to have provided the session of care to the child on the day under subsection (2); and

(b) had the child attended the session of care, one or more of the hours in the session would have been taken into account in accordance with paragraph 4(1)(a) of Schedule 2; and

(c) the day is:

(i) a day on which the child is enrolled for care by the service; and

(ii) after the day the child first attended a session of care provided by the service; and

(iii) not after the last day the child attended a session of care provided by the service before the child ceased to be enrolled for care by the service; and

(iv) not a day prescribed by the Minister’s rules; and

(d) the absence is for a reason specified in subsection (4); and

(e) if the absence is for an illness referred to in paragraph (4)(a) or (b)—the service has been given a certificate that was issued by a medical practitioner in relation to the illness.

Note: Ceases to be enrolled is defined in section 200B of the Family Assistance Administration Act.

(3A) The Minister’s rules may prescribe circumstances in which subparagraph (3)(c)(ii) or (iii) or paragraph (3)(e) does not apply.

(4) For the purposes of paragraph (3)(d), the reasons are the following:

(a) the child is ill;

(b) any of the following persons is ill:

(i) the individual in whose care the child is;

(ii) the partner of the individual in whose care the child is;

(iii) an individual with whom the child lives;

(c) the child is attending preschool;

(d) alternative care arrangements have been made for the child on a pupil‑free day;

(e) a reason prescribed by the Minister’s rules.

19 Maintenance income

(1) For the purposes of the definition of capitalised maintenance income in section 3, an amount is a periodic amount if it is:

(a) the amount of one payment in a series of related payments, even if the payments are irregular in time and amount; or

(b) the amount of a payment making up for arrears in such a series.

(2) For the purposes of the definitions of maintenance income and disability expenses maintenance in section 3:

(a) a payment received under subsection 76(1) of the Child Support (Registration and Collection) Act 1988 in relation to a registered maintenance liability (within the meaning of that Act) is taken to be received from the individual who is the payer (within the meaning of that Act) in relation to the liability; and

(b) a reference to a benefit received by an individual includes a reference to a benefit received by the individual because of a payment made to, or a benefit conferred on, another individual (including a payment made or benefit conferred under a liability owed to the other individual); and

(c) a reference to a payment or benefit received from an individual includes a reference to a payment or benefit received:

(i) directly or indirectly from the individual; and

(ii) out of any assets of, under the control of, or held for the benefit of, the individual; and

(iii) from the individual under or as a result of a court order, a court registered or approved maintenance agreement, a financial agreement (within the meaning of the Family Law Act 1975), a Part VIIIAB financial agreement (within the meaning of that Act) or otherwise.

(3) A payment or benefit is disability expenses maintenance of an individual if:

(a) the payment or benefit is provided for expenses arising directly from:

(i) a physical, intellectual or psychiatric disability; or

(ii) a learning difficulty;

of an FTB child of the individual; and

(b) the disability or difficulty is likely to be permanent or to last for an extended period; and

(c) the payment or benefit is received:

(i) by the individual for the maintenance of the FTB child; or

(ii) by the FTB child for the child’s own maintenance; and

(d) the payment or benefit is received from:

(i) a parent or relationship parent of the child; or

(ii) the former partner of a parent or relationship parent of the child.

Division 4—Approved care organisations

20 Approval of organisations providing residential care services to young people

(1) The Secretary may approve an organisation that co‑ordinates or provides residential care services to young people in Australia as an approved care organisation for the purposes of this Act.

Revocation

(2) The Secretary may revoke an approval under subsection (1).

Part 3—Eligibility for family assistance (other than child care subsidy and additional child care subsidy)

Division 1—Eligibility for family tax benefit

Subdivision A—Eligibility of individuals for family tax benefit in normal circumstances

21 When an individual is eligible for family tax benefit in normal circumstances

(1) An individual is eligible for family tax benefit if:

(a) the individual:

(i) has at least one FTB child; or

(ii) has at least one regular care child who is also a rent assistance child; and

(b) the individual:

(i) is an Australian resident; or

(ia) is a special category visa holder residing in Australia; or

(ii) satisfies subsection (1A); and

(c) the individual’s rate of family tax benefit, worked out under Division 1 of Part 4 but disregarding reductions (if any) under clause 5 or 25A of Schedule 1 and disregarding section 58A and subclauses 31B(3), 38AA(3) and 38AF(3) of Schedule 1, is greater than nil.

When individual satisfies this subsection

(1A) An individual satisfies this subsection if:

(a) the individual is the holder of a visa determined by the Minister for the purposes of subparagraph 729(2)(f)(v) of the Social Security Act 1991; and

(b) either:

(i) the individual is in Australia; or

(ii) the individual is temporarily absent from Australia for a period not exceeding 6 weeks and the absence is an allowable absence in relation to special benefit within the meaning of Part 4.2 of that Act.

Exception

(2) However, the individual is not eligible for family tax benefit if another provision of this Subdivision so provides.

22 When an individual is an FTB child of another individual

(1) An individual is an FTB child of another individual (the adult) in any of the cases set out in this section.

Individual aged under 16

(2) An individual is an FTB child of the adult if:

(a) the individual is aged under 16; and

(b) the individual is in the adult’s care; and

(c) the individual is an Australian resident, is a special category visa holder residing in Australia or is living with the adult; and

(d) the circumstances surrounding legal responsibility for the care of the individual are those mentioned in paragraph (5)(a), (b) or (c).

Individual aged 16‑17

(3) An individual is an FTB child of the adult if:

(a) the individual has turned 16 but is aged under 18; and

(b) the individual is in the adult’s care; and

(c) the individual is an Australian resident, is a special category visa holder residing in Australia or is living with the adult; and

(d) the circumstances surrounding legal responsibility for the care of the individual are those mentioned in paragraph (5)(a), (b) or (c); and

(e) the individual is a senior secondary school child.

Individual aged 18‑19

(4) An individual is an FTB child of the adult if:

(a) the individual is aged 18 or is aged 19 and the calendar year in which the individual turned 19 has not ended; and

(b) the individual is in the adult’s care; and

(c) the individual is an Australian resident, is a special category visa holder residing in Australia or is living with the adult; and

(d) the individual is a senior secondary school child.

Legal responsibility for the individual

(5) The circumstances surrounding legal responsibility for the care of the individual are:

(a) the adult is legally responsible (whether alone or jointly with someone else) for the day‑to‑day care, welfare and development of the individual; or

(b) under a family law order, registered parenting plan or parenting plan in force in relation to the individual, the adult is someone with whom the individual is supposed to live or spend time; or

(c) the individual is not in the care of anyone with the legal responsibility for the day‑to‑day care, welfare and development of the individual.

Percentage of care at least 35%

(7) If an individual’s percentage of care for a child during a care period is at least 35%, the child is taken to be an FTB child of that individual for the purposes of this section on each day in that period, whether or not the child was in that individual’s care on that day.

Note: If an individual’s percentage of care for a child during a care period is less than 35%, the child is taken not to be an FTB child (see section 25).

22A Exceptions to the operation of section 22

Exceptions

(1) Despite section 22, an individual cannot be an FTB child of another individual (an adult) in the cases set out in this table:

When the individual is not an FTB child of the adult at a particular time |

| If the individual is aged: | then the individual cannot be an FTB child of the adult if: |

1 | 5 or more and less than 16 | the adult is the individual’s partner, or would be if the individual were over the age of consent applicable in the State or Territory in which the individual lives. |

2 | 16 or more | (b) the adult is the individual’s partner; or (c) the individual, or someone on behalf of the individual, is, at the particular time, receiving payments under a prescribed educational scheme, unless subsection (2) applies to the individual. |

3 | any age | the individual, or someone on behalf of the individual, is, at the particular time, receiving: (a) a social security pension; or (b) a social security benefit; or (c) payments under a program included in the programs known as Labour Market Programs. |

Interaction with ABSTUDY

(2) This subsection applies to an individual if:

(a) the individual, or someone on behalf of the individual, is, at the particular time, receiving payments under the ABSTUDY scheme; and

(b) the payments are being paid on the basis that the individual:

(i) is undertaking full‑time study at a secondary school (within the meaning of the Student Assistance Act 1973); and

(ii) is, in accordance with the ABSTUDY scheme, a student approved to live away from home; and

(iii) is boarding away from home for the purposes of attending the school.

Note: For undertaking full‑time study, see subsection 3(1).

22B Meaning of senior secondary school child

(1) An individual is a senior secondary school child if:

(a) the following requirement is satisfied:

(i) for the purposes of subclause 29(3) or 36(2) of Schedule 1—the individual is aged 16 or 17 or is aged 18 and the calendar year in which the individual turned 18 has not ended;

(ii) for the purposes of any other provision of this Act—the individual is aged 16, 17 or 18 or is aged 19 and the calendar year in which the individual turned 19 has not ended; and

(b) one of the following applies:

(i) the individual is undertaking full‑time study in an approved course of education or study that would, in the Secretary’s opinion, assist or allow the individual to complete the final year of secondary school or an equivalent level of education;

(ia) the individual is studying overseas full‑time in a way that would, in the Secretary’s opinion, assist or allow the individual to complete the final year of secondary school or an equivalent level of education;

(ii) subsection (2) applies in relation to the individual.

Exemption from full‑time study requirement

(2) This subsection applies in relation to the individual if:

(a) there is no locally accessible approved course of education or study (including any such course available by distance education); or

(b) where there is such a course:

(i) there is no place available on the course for the individual; or

(ii) the individual is not qualified to undertake the course; or

(iii) the individual lacks capacity to undertake the course because the individual has a physical, psychiatric or intellectual disability or a learning disability such as attention deficit disorder; or

(c) in the Secretary’s opinion, special circumstances exist that make it unreasonable to require the individual to undertake an approved course of education or study.

Determination of full‑time study hours

(2A) For the purposes of subparagraph (1)(b)(i) or (ia), if the Secretary determines that it is appropriate to do so having regard to an individual’s circumstances, the Secretary may determine that the normal amount of full‑time study for the individual in respect of a course is to be a number of hours per week specified in the determination, averaged over the duration of the period for which the individual is enrolled in the course.

Continued status of senior secondary school child

(3) If, apart from this subsection, an individual would cease to be a senior secondary school child because the individual completes the final year of secondary school or an equivalent level of education, then the individual is taken to be a senior secondary school child until the end of:

(a) if the day the individual completes that final year of secondary school or equivalent level of education is in November or December in a calendar year—31 December of that year; or

(b) if the day the individual completes that final year of secondary school or equivalent level of education is before November—the period of 28 days beginning on the day after that day.

Interpretation

(4) An individual completes the final year of secondary school or an equivalent level of education on the day worked out in accordance with the following table:

Completion day | |

Item | In this situation: | The day is: |

1 | The individual was not required to sit an examination in relation to that final year or that equivalent level of education | The day determined by the secondary school to be the last day of classes for that year or by the provider of that education to be the last day of classes for that level of education (as the case may be) |

2 | The individual was required to sit an examination in relation to that final year or that equivalent level of education | The later of: (a) the day determined by the secondary school to be the last day of the period of examinations for that final year or by the provider of that education to be the last day of the period of examinations for that level of education (as the case may be); and (b) the day determined by the secondary school to be the last day of classes for that final year or by the provider of that education to be the last day of classes for that level of education (as the case may be) |

| | | |

(5) To avoid doubt, if an individual ceases to be a senior secondary school child, nothing in this section prevents the individual again becoming a senior secondary school child.

23 Effect of FTB child ceasing to be in individual’s care without consent

(1) This section applies if:

(a) an individual is an FTB child of another individual (the adult) under subsection 22(2) or (3); and

(aa) the circumstances surrounding legal responsibility for the care of the individual are those mentioned in paragraph 22(5)(a) or (b); and

(b) an event occurs in relation to the child without the adult’s consent that prevents the child being in the adult’s care; and

(c) the adult takes reasonable steps to have the child again in the adult’s care.

When the child remains an FTB child of the adult

(2) Subject to subsection (4A), the child is an FTB child of the adult for that part of the qualifying period (see subsection (5)) for which:

(a) the child would have been an FTB child of the adult under subsection 22(2) or (3) if the child had not ceased to be in the adult’s care; and

(b) the circumstances surrounding legal responsibility for the care of the child are those mentioned in paragraph 22(5)(a) or (b).

(3) The reference, in paragraphs (1)(a) and (2)(a), to an FTB child of an individual or adult under subsection 22(2) or (3) includes a reference to:

(a) a child who is an FTB child under subsection 22(2) or (3) in its application by virtue of subsection 22(7); and

(b) a child who is an FTB child under subsection 22(2) or (3), but who is taken not to be an FTB child under section 25.

Note: As a result of subsection (2) of this section, a child who is taken not to be an FTB child under section 25, but who is a regular care child, will remain a regular care child for the part of the qualifying period referred to in subsection (2) of this section.

(4) Except as provided in subsection (2), the child cannot (in spite of section 22) be an FTB child of any individual during the qualifying period.

When subsection (2) does not apply

(4A) If the Secretary is satisfied that special circumstances exist in relation to the child, the Secretary may determine that subsection (2) does not apply in relation to the child and the adult.

Definition of parent and qualifying period

(5) In this section:

parent includes a relationship parent.

qualifying period means the period beginning when the child ceases to be in the adult’s care and ending at the earliest of the following times:

(a) if the child again comes into the adult’s care at a later time—that later time;

(b) either:

(i) after 14 weeks pass since the child ceased to be in the adult’s care; or

(ii) if the Secretary specifies, under subsection (5A), a day that is earlier than the last day in that 14‑week period—the end of that earlier day;

(c) if:

(i) the adult is a parent of the child; and

(ii) no family law order, registered parenting plan or parenting plan is in force in relation to the child; and

(iii) the child comes into the care of the other parent at a later time;

that later time.

Shorter qualifying period

(5A) If the Secretary is satisfied that special circumstances exist in relation to the child, the Secretary may specify a day for the purposes of subparagraph (b)(ii) of the definition of qualifying period in subsection (5).

Parents of relationship children

(6) If a child (other than an adopted child) is a relationship child of a person because he or she is a child of the person, and of another person, within the meaning of the Family Law Act 1975, the person and the other person are taken to be the child’s only parents for the purposes of paragraph (c) of the definition of qualifying period in subsection (5).

24 Effect of certain absences of FTB child etc. from Australia

Absence from Australia of FTB or regular care child

(1) If:

(a) any of the following applies:

(i) an FTB child leaves Australia;

(ii) a child born outside Australia is an FTB child at birth;

(iii) a regular care child leaves Australia;

(iv) a child born outside Australia is a regular care child at birth; and

(b) the child continues to be absent from Australia for more than 6 weeks;

during that absence from Australia, the child is neither an FTB child, nor a regular care child, at any time after the period of 6 weeks beginning on the first day of the child’s absence from Australia.

(3) If:

(a) a child is neither an FTB child nor a regular care child because of the application of subsection (1) or a previous application of this subsection; and

(b) the child comes to Australia; and

(c) the child leaves Australia less than 6 weeks after coming to Australia;

the child is neither an FTB child nor a regular care child at any time during the absence from Australia referred to in paragraph (c).

Maximum period of eligibility for family tax benefit while individual overseas

(4) If an individual leaves Australia, the maximum period for which the individual can be eligible for family tax benefit during that absence from Australia is the period of 6 weeks beginning on the first day of that absence.

(6) If:

(a) an individual is eligible for family tax benefit while the individual is absent from Australia; and

(b) the individual then ceases to be eligible for family tax benefit because of the application of subsection (4) or a previous application of this subsection; and

(c) the individual returns to Australia; and

(d) the individual leaves Australia again less than 6 weeks after returning to Australia;

the individual is not eligible for family tax benefit at any time during the absence from Australia referred to in paragraph (d).

Extension of 6‑week period in certain circumstances

(7) The Secretary may extend the 6‑week period (the initial period) referred to in subsection (1) or (4), to a period of no more than 3 years, if the Secretary is satisfied that the child mentioned in subsection (1), or the individual mentioned in subsection (4), (in each case, the person) is unable to return to Australia within the initial period because of any of the following events:

(a) a serious accident involving the person or a family member of the person;

(b) a serious illness of the person or a family member of the person;

(c) the hospitalisation of the person or a family member of the person;

(d) the death of a family member of the person;

(e) the person’s involvement in custody proceedings in the country in which the person is located;

(f) a legal requirement for the person to remain outside Australia in connection with criminal proceedings (other than criminal proceedings in respect of a crime alleged to have been committed by the person);

(g) robbery or serious crime committed against the person or a family member of the person;

(h) a natural disaster in the country in which the person is located;

(i) political or social unrest in the country in which the person is located;

(j) industrial action in the country in which the person is located;

(k) a war in the country in which the person is located.

(8) The Secretary must not extend the initial period under subsection (7) unless:

(a) the event occurred or began during the initial period; and

(b) if the event is political or social unrest, industrial action or war—the person is not willingly involved in, or willingly participating in the event.

(9) The Secretary may extend the 6‑week period referred to in subsection (1) or (4), to a period of no more than 3 years, if the Secretary is satisfied that, under the Medical Treatment Overseas Program administered by the Minister who administers the National Health Act 1953, financial assistance is payable in respect of the absence from Australia of the child mentioned in subsection (1) or the individual mentioned in subsection (4).

(10) The Secretary may extend the 6‑week period referred to in subsection (4), to a period of no more than 3 years, if the Secretary is satisfied that the individual mentioned in subsection (4) is unable to return to Australia within the 6‑week period because the individual is:

(a) deployed outside Australia as a member of the Defence Force, under conditions specified in a determination made under the Defence Act 1903 that relates to such deployment; or

(b) deployed outside Australia, for the purpose of capacity‑building or peacekeeping functions, as:

(i) a member or a special member of the Australian Federal Police; or

(ii) a protective service officer within the meaning of the Australian Federal Police Act 1979.

25 Effect of an individual’s percentage of care for a child being less than 35%

If an individual’s percentage of care for a child during a care period is less than 35%, the child is taken, despite section 22, not to be an FTB child of that individual for any part of the period.

25A Regular care child for each day in care period

If an individual’s percentage of care for a child during a care period is at least 14% but less than 35%, the child is taken to be a regular care child of that individual for the purposes of this Act on each day in that period, whether or not the child was in that individual’s care on that day.

26 Only 1 member of a couple eligible for family tax benefit

(1) For any period when 2 individuals who are members of a couple would otherwise be eligible at the same time for family tax benefit in respect of one or more FTB children or regular care children, only one member is eligible.

(2) The member who is eligible is the one determined by the Secretary to be eligible, having regard to:

(a) whether one member of the couple is the primary carer for the child or children; and

(b) whether the members have made a written agreement nominating one of them as the member who can make a claim under Part 3 of the A New Tax System (Family Assistance) (Administration) Act 1999 for payment of family tax benefit in respect of the child or children.

27 Extension of meaning of FTB or regular care child in a blended family case

(1) This section applies if:

(a) 2 individuals are members of the same couple; and

(b) either or both of the individuals have a child (the qualifying child) from another relationship (whether before or after the 2 individuals became members of that couple).

(2) While the 2 individuals are members of that couple:

(a) each qualifying child that is an FTB child, or regular care child, of one member of the couple is taken also to be an FTB child, or regular care child, (as the case requires) of the other member of the couple; and

(b) if the Secretary has determined, under section 35A or 35B, one individual’s percentage of care for the qualifying child during a care period (whether before or after the 2 individuals became members of that couple)—the Secretary is taken to have determined the same percentage to be the other individual’s percentage of care for the child during that period.

28 Eligibility for family tax benefit of members of a couple in a blended family

(1) If the Secretary is satisfied that:

(a) 2 individuals who are members of the same couple (person A and person B) would each be eligible for family tax benefit for 2 or more FTB children during a period but for subsection 26(1); and

(b) at least one of the children is a child of a previous relationship of person A; and

(c) at least one of the other children is:

(i) a child of the relationship between person A and person B; or

(ii) a child of a previous relationship of person B;

the Secretary may:

(d) determine that person A and person B are both eligible for family tax benefit for the children for the period; and

(e) determine person A’s and person B’s percentage of the family tax benefit for the children.

(2) The Secretary cannot make a determination under subsection (1) for a past period if person A or person B has been paid family tax benefit for the period.

(3) For the purposes of this section:

(a) an FTB child of an individual is a child of a previous relationship of an individual who is a member of a couple if the child is an immediate child of that individual but not of the individual’s partner; and

(b) a child is a child of the relationship of 2 individuals who are members of a couple if the child is an immediate child of both members of the couple; and

(c) an FTB child of an individual is an immediate child of the individual if:

(i) the child is the natural child, adopted child or relationship child of the individual; or

(ii) the individual is legally responsible for the child.

29 Eligibility for family tax benefit of separated members of a couple for period before separation

If the Secretary is satisfied that:

(a) 2 individuals are not members of the same couple (person A and person B); and

(b) during a period in the past when person A and person B were members of the same couple, they had an FTB child or children; and

(c) but for subsection 26(1), person A and person B would both be eligible for family tax benefit for the FTB child or children for that period;

the Secretary may:

(d) determine that person A and person B are both eligible for family tax benefit for the child or children for that period; and

(e) determine person A’s and person B’s percentage of the family tax benefit for the child or children for that period.

Subdivision B—Eligibility of individuals for family tax benefit where death occurs

31 Continued eligibility for family tax benefit if an FTB or regular care child dies

(1) This section applies if:

(a) an individual is eligible for family tax benefit (except under section 33) in respect of one or more FTB children or regular care children; and

(b) one of the children dies; and

(c) in a case where the individual is eligible for family tax benefit in respect of more than one child immediately before the child mentioned in paragraph (1)(b) died—the individual’s rate of family tax benefit would decrease as a result of the child’s death.

Individual remains eligible for family tax benefit for 14 weeks after the death of the child

(2) The individual is eligible for family tax benefit, at a rate worked out under section 64, for each day in the period of 14 weeks beginning on the day the child died. This subsection has effect subject to subsection (3) of this section and to section 32.

14 weeks reduced in certain circumstances

(3) The period for which the individual is eligible for family tax benefit under subsection (2) does not include:

(a) if the child had turned 16 when the child died—any day on which the Secretary is satisfied the child would not have been a senior secondary school child if the child had not died; or

(b) if the child had not turned 16 when the child died—any day on which the child would have been aged 16, and on which the Secretary is satisfied the child would not have been a senior secondary school child, if the child had not died.

Eligibility during the period to which subsection (2) applies is sole eligibility

(4) Except as mentioned in subsection (2), the individual is not eligible for family tax benefit in respect of any FTB children, or regular care children, of the individual during the period to which subsection (2) applies.

32 Eligibility for a single amount of family tax benefit if an FTB or regular care child dies

Instalment case

(1) If:

(a) the individual to whom section 31 applies was, immediately before the child concerned died, entitled to be paid family tax benefit by instalment; and

(b) the individual, on any day (the request day) during the period (the section 31 accrual period) for which the individual is eligible for family tax benefit under that section, makes a claim, under Part 3 of the A New Tax System (Family Assistance) (Administration) Act 1999, for payment of family tax benefit because of the death of a person, stating that the individual wishes to become eligible for a single amount of family tax benefit under this subsection;

then:

(c) the individual is eligible for a single amount of family tax benefit worked out under subsection 65(1); and

(d) the period for which the individual is eligible for family tax benefit under subsection 31(2) does not include the lump sum period mentioned in subsection 65(1).

Other cases

(2) If:

(a) the individual to whom section 31 applies was, immediately before the child concerned died, not entitled to be paid family tax benefit by instalment; and

(b) apart from this subsection, the period for which the individual is eligible for family tax benefit under subsection 31(2) extends over 2 income years;

then:

(c) the individual is eligible for a single amount of family tax benefit for the period falling in the second of those income years worked out under subsection 65(3); and

(d) the period for which the individual is eligible for family tax benefit under subsection 31(2) does not include the period falling in the second of those income years.

33 Eligibility for family tax benefit if an eligible individual dies

Eligibility other than because of the death of an FTB or regular care child

(1) If:

(a) an individual is eligible for an amount (the subject amount) of family tax benefit (except because of section 31 or 32 applying in relation to the death of an FTB child or a regular care child); and

(b) the individual dies; and

(c) before the individual died, the subject amount had not been paid to the individual (whether or not a claim under Part 3 of the A New Tax System (Family Assistance) (Administration) Act 1999 had been made); and

(d) another individual makes a claim under that Part for payment of family tax benefit because of the death of a person, stating that he or she wishes to become eligible for so much of the subject amount as does not relate to any period before the beginning of the income year preceding the income year in which the individual died; and

(e) the Secretary considers that the other individual ought to be eligible for that much of the subject amount;

the other individual is eligible for that much of the subject amount and no‑one else is, or can become, eligible for or entitled to be paid any of the subject amount.

Eligibility because of the death of an FTB or regular care child

(2) If:

(a) an individual dies; and

(b) either:

(i) before the individual’s death, the individual was eligible for an amount (the subject amount) of family tax benefit under section 31 or 32 in relation to the death of an FTB child or regular care child, and the subject amount had not been paid to the individual (whether or not a claim under Part 3 of the A New Tax System (Family Assistance) (Administration) Act 1999 had been made); or

(ii) the individual died at the same time as the FTB child or regular care child, and would have been so eligible for the subject amount if the individual had not died; and

(c) another individual makes a claim under that Part for payment of family tax benefit because of the death of a person, stating that the individual wishes to become eligible for so much of the subject amount as does not relate to any period before the beginning of the income year preceding the income year in which the individual died; and

(d) the Secretary considers that the other individual ought to be eligible for that much of the subject amount;

the other individual is eligible for that much of the subject amount and no‑one else is, or can become, eligible for or entitled to be paid any of the subject amount.

Subdivision C—Eligibility of approved care organisations for family tax benefit

34 When an approved care organisation is eligible for family tax benefit

(1) An approved care organisation is eligible for family tax benefit in respect of an individual if:

(a) the individual:

(i) is aged under 16; or

(ii) has turned 16 and is a senior secondary school child; and

(b) the individual is a client of the organisation; and

(c) the individual is an Australian resident.

(2) However, an approved care organisation is not eligible for family tax benefit in respect of an individual in the cases set out in section 35.

Expanded meaning of client of an organisation

(3) For the purposes of paragraph (1)(b), if:

(a) an organisation that is not an approved care organisation is providing residential care services to young people in Australia; and

(b) an approved care organisation is co‑ordinating the provision of those services;

the young people are taken to be clients of the approved care organisation.

35 When an approved care organisation is not eligible for family tax benefit

(1) An approved care organisation is not eligible for family tax benefit in respect of an individual in the cases set out in this table: