Chapter 4—The special rules

Part 4‑3—Special rules mainly about importations

Note: The special rules in this Part mainly modify the operation of Part 2‑3, but they may affect other Parts of Chapter 2 in minor ways.

Division 114—Importations without entry for home consumption

114‑1 What this Division is about

This Division treats as taxable importations several kinds of importations of goods covered by the Customs Act 1901, even though the goods are not entered for home consumption. An entity that enters for home consumption warehoused goods imported by someone else is entitled to any input tax credit for the importation.

114‑5 Importations without entry for home consumption

(1) You make a taxable importation if:

(a) the circumstances referred to in the third column of the following table occur; and

(b) you are referred to in the fourth column of the table as the importer in relation to those circumstances.

However, there is not a taxable importation to the extent that the importation to which the circumstances relate is a *non‑taxable importation.

Importations without entry for home consumption |

Item | Topic | Circumstance | Importer |

1 | Personal or household effects of passengers or crew | Goods of a kind referred to in paragraph 68(1)(d) of the Customs Act 1901 are delivered into home consumption in accordance with an authorisation under section 71 of that Act. | The person to whom the authorisation was granted. |

2 | Low value consignments by post | Goods of a kind referred to in paragraph 68(1)(e) of the Customs Act 1901 are delivered into home consumption in accordance with an authorisation under section 71 of that Act. | The person to whom the authorisation was granted. |

3 | Other low value consignments | Goods of a kind referred to in paragraph 68(1)(f) of the Customs Act 1901 are delivered into home consumption in accordance with an authorisation under section 71 of that Act. | The person to whom the authorisation was granted. |

4 | Other goods exempt from entry | Goods of a kind referred to in paragraph 68(1)(i) of the Customs Act 1901 are delivered into home consumption in accordance with an authorisation under section 71 of that Act. | The person to whom the authorisation was granted. |

5 | Like customable goods | Goods are delivered into home consumption in accordance with a permission granted under section 69 of the Customs Act 1901. | The person to whom the permission was granted. |

6 | Special clearance goods | Goods are delivered into home consumption in accordance with a permission granted under section 70 of the Customs Act 1901. | The person to whom the permission was granted. |

10 | Return of seized goods | Goods that have been seized under a warrant issued under section 203 of the Customs Act 1901, or under section 203B or 203C of that Act, are delivered to a person on the basis that they are not forfeited goods. | The person to whom the goods are delivered. |

13 | Inwards duty free shops | Goods that are *airport shop goods purchased from an *inwards duty free shop by a *relevant traveller are removed from a *customs clearance area. | The relevant traveller. |

15 | Installations and goods on installations | Goods are deemed by section 49B of the Customs Act 1901 to be imported into the indirect tax zone. | The person who is the owner (within the meaning of the Customs Act 1901) of the goods when they are deemed to be so imported. |

16 | Goods not entered for home consumption when required | Goods not covered by any other item of this table are imported into the indirect tax zone, and: (a) if they are required to be entered under section 68 of the Customs Act 1901—they are not entered in accordance with that requirement; or (b) in any other case—a requirement under that Act relating to their importation has not been complied with | The person who fails to comply with that requirement. |

(2) This section has effect despite section 13‑5.

114‑10 Goods that have already been entered for home consumption etc.

Once goods have been:

(a) entered for home consumption within the meaning of the Customs Act 1901; or

(b) taken to be imported because of the application of an item in the table in section 114‑5;

they cannot subsequently be taken to be imported because of the application of an item in the table, unless they have been exported from the indirect tax zone since they were so entered or taken to be imported.

114‑15 Payments of amounts of assessed GST where security for payment of customs duty is forfeited

(1) If:

(a) a circumstance relating to goods is an importation of the goods into the indirect tax zone because of an item of the table in section 114‑5; and

(b) security has been given under the Customs Act 1901 for payment of *customs duty in respect of the goods; and

(c) the security is forfeited;

any *assessed GST payable on the importation is to be paid when the security is forfeited.

(2) This section has effect despite section 33‑15 (which is about payments of amounts of assessed GST on importations).

114‑20 Payments of amounts of assessed GST where delivery into home consumption is authorised under section 71 of the Customs Act

(1) If:

(a) the delivery of goods into home consumption in accordance with an authorisation under section 71 of the Customs Act 1901 is an importation into the indirect tax zone because of item 1, 2, 3 or 4 of the table in section 114‑5; and

(b) information was provided under section 71 of that Act in connection with the granting of the authorisation;

any *assessed GST payable on the importation is to be paid when the information was provided/on or before the granting of the authorisation.

(2) This section has effect despite sections 33‑15 (which is about payments of amounts of assessed GST on importations) and 114‑15.

114‑25 Warehoused goods entered for home consumption by an entity other than the importer

(1) If you enter for home consumption (within the meaning of the Customs Act 1901) goods that are warehoused goods (within the meaning of that Act) and that were imported by another person:

(a) you are treated, for the purposes of Division 15, as having imported the goods; and

(b) the extent (if any) to which you entered the goods for home consumption for a *creditable purpose is treated as the extent (if any) to which you imported the goods for a creditable purpose.

(2) This section has effect despite Division 15 (which is about creditable importations).

Division 117—Valuation of re‑imported goods

117‑1 What this Division is about

Taxable importations of goods that were exported, and then re‑imported, are in some cases given a lower value than would otherwise apply. The GST then applies only to the lower value, and not to the entire value, of the goods.

117‑5 Valuation of taxable importations of goods that were exported for repair or renovation

(1) The value of a *taxable importation of goods that were exported from the indirect tax zone for repair or renovation, or that are part of a *batch repair process, is the sum of:

(a) the cost, as determined by the *Comptroller‑General of Customs, of materials, labour and other charges involved in the repair or renovation; and

(b) the amount paid or payable:

(i) for the *international transport of the goods to their *place of consignment in the indirect tax zone; and

(ii) to insure the goods for that transport;

to the extent that the amount is not already included under paragraph (a); and

(ba) the amount paid or payable for a supply to which item 5A in the table in subsection 38‑355(1) applies, to the extent that the amount:

(i) is not an amount, the payment of which (or the discharging of a liability to make a payment of which), because of Division 81 or regulations made under that Division, is not the provision of *consideration; and

Note: Division 81 excludes certain taxes, fees and charges from the provision of consideration.

(ii) is not already included under paragraph (a) or (b); and

(c) any *customs duty payable in respect of the importation of the goods.

(1A) If an amount to be taken into account under paragraph (1)(b) or (ba) is not an amount in Australian currency, the amount so taken into account is the equivalent in Australian currency of that amount, ascertained in the way provided in section 161J of the Customs Act 1901.

(2) Goods are part of a batch repair process if:

(a) they are part of a process to replace goods that were exported from the indirect tax zone for repair or renovation; and

(b) they are not new or upgraded versions of the exported goods; and

(c) they are not replacing goods that have reached the end of their effective operational life.

(3) This section has effect despite subsection 13‑20(2) (which is about the value of taxable importations).

117‑10 Valuation of taxable importations of live animals that were exported

(1) If there is a *taxable importation of a live animal that was exported, and the difference between:

(a) what would have been the value of the importation if this section did not apply; and

(b) what would have been the value of a taxable importation of the animal if it had been imported immediately before the time of the exportation;

is greater than zero, the value of the *taxable importation is an amount equal to that difference.

(2) In any other case, the value of a *taxable importation of a live animal that was exported is nil.

(3) However, this section does not apply if the ownership of the animal when it is imported is different from its ownership when it was last exported.

(4) This section has effect despite subsection 13‑20(2) (which is about the value of taxable importations).

117‑15 Refunds of assessed GST on certain reimportations of live animals

(1) If:

(a) you were liable to pay the *assessed GST on a *taxable importation to which section 117‑10 applied; and

(b) the importation was not a *creditable importation; and

(c) the circumstances specified in the regulations occur;

the Commissioner must, on behalf of the Commonwealth, pay to you an amount equal to the amount of the assessed GST payable on the taxable importation.

(2) The amount is payable within the period and in the manner specified in the regulations.

Part 4‑4—Special rules mainly about net amounts and adjustments

Note: The special rules in this Part mainly modify the operation of Part 2‑4, but they may affect other Parts of Chapter 2 in minor ways.

Division 123—Simplified accounting methods for retailers and small enterprise entities

123‑1 What this Division is about

The Commissioner can create simplified accounting methods that some retailers and small enterprise entities can choose to apply with a view to reducing their costs of complying with the requirements of the GST.

123‑5 Commissioner may determine simplified accounting methods

(1) The Commissioner may determine in writing an arrangement (to be known as a simplified accounting method) that:

(a) specifies the kinds of *retailers to whom it is available and provides a method for working out *net amounts of retailers to whom the method applies; or

(b) specifies the kinds of *small enterprise entities to whom it is available and provides a method for working out *net amounts of small enterprise entities to whom the method applies.

(2) The kinds of *retailer specified under paragraph (1)(a) must all be kinds of retailers that:

(a) sell *food; or

(b) make supplies that are *GST‑free under Subdivision 38‑G (Non‑commercial activities of charities etc.);

in the course or furtherance of *carrying on their *enterprise.

(3) The kinds of *small enterprise entities specified under paragraph (1)(b) must all be kinds of small enterprise entities that, in the course or furtherance of *carrying on their *enterprises:

(a) make both:

(i) *taxable supplies; and

(ii) supplies that are *GST‑free; or

(b) make both:

(i) *creditable acquisitions; and

(ii) acquisitions that are not creditable acquisitions because the supplies, made to the small enterprise entities, to which the acquisitions relate are GST‑free.

123‑7 Meaning of small enterprise entity

(1) An entity is a small enterprise entity at a particular time if:

(a) the entity is a *small business entity (other than because of subsection 328‑110(4) of the *ITAA 1997) for the *income year in which the time occurs; or

(b) at that time, the entity does not carry on a business and its *GST turnover does not exceed the *small enterprise turnover threshold.

(2) The small enterprise turnover threshold is $2 million.

123‑10 Choosing to apply a simplified accounting method

(1) You may, by notifying the Commissioner in the *approved form:

(a) choose to apply a *simplified accounting method if you are a *retailer of the kind to whom the method is available; or

(aa) choose to apply a *simplified accounting method if you are a *small enterprise entity of the kind to whom the method is available; or

(b) revoke your choice under paragraph (a) or (aa).

(2) However, you:

(a) cannot revoke the choice within 12 months after the day on which you made the choice; and

(b) cannot make a further choice as a *retailer within 12 months after the day on which you revoked a previous choice as a retailer; and

(ba) cannot make a further choice as a *small enterprise entity within 12 months after the day on which you revoked a previous choice as a small enterprise entity; and

(c) cannot choose to apply a *simplified accounting method in addition to another simplified accounting method.

(3) Your choice to apply a *simplified accounting method has effect from the start of the tax period specified in your notice.

(4) Your choice to apply a *simplified accounting method ceases to have effect:

(a) if you made your choice as a *retailer and cease to be a retailer of the kind to whom the method is available—from the start of the tax period occurring after the day on which you cease to be such a retailer; or

(aa) if you made your choice as a *small enterprise entity and cease to be a small enterprise entity of the kind to whom the method is available—from the start of the tax period occurring after the day on which you cease to be such a small enterprise entity; or

(b) if you revoke your choice to apply the method—from the start of the tax period specified in your notice of revocation.

123‑15 Net amounts

(1) If you are a *retailer or a *small enterprise entity who has chosen to apply a *simplified accounting method, the net amount for a tax period during which the choice has effect is worked out using the method provided for by the simplified accounting method.

(1A) However, the *net amount worked out under subsection (1) for the tax period:

(a) may be increased or decreased under Subdivision 21‑A of the *Wine Tax Act; and

(b) may be increased or decreased under Subdivision 13‑A of the A New Tax System (Luxury Car Tax) Act 1999.

Note 1: Under Subdivision 21‑A of the Wine Tax Act, amounts of wine tax increase the net amount, and amounts of wine tax credits reduce the net amount.

Note 2: Under Subdivision 13‑A of the A New Tax System (Luxury Car Tax) Act 1999, amounts of luxury car tax increase the net amount, and luxury car tax adjustments alter the net amount.

(2) This section has effect despite section 17‑5 (which is about net amounts).

Division 126—Gambling

126‑1 What this Division is about

Gambling is dealt with under the GST by using a global accounting system that provides for an alternative way of working out your net amounts by incorporating your net profits from taxable supplies involving gambling.

126‑5 Global accounting system for gambling supplies

(1) If you are liable for the GST on a *gambling supply, your net amount for the tax period to which the GST on the supply is attributable is as follows:

where:

global GST amount is your *global GST amount for the tax period.

input tax credits is the sum of all of the input tax credits to which you are entitled on the *creditable acquisitions and *creditable importations that are attributable to the tax period.

Note: Any supplies under the global accounting system will not have attracted input tax credits.

other GST is the sum of all of the GST for which you are liable on the *taxable supplies that are attributable to the tax period, other than *gambling supplies.

For the basic rules on what is attributable to a particular period, see Division 29.

(2) However, the *net amount worked out under subsection (1) for the tax period:

(a) may be increased or decreased if you have any *adjustments for the tax period; and

(b) may be increased or decreased under Subdivision 21‑A of the *Wine Tax Act; and

(c) may be increased or decreased under Subdivision 13‑A of the A New Tax System (Luxury Car Tax) Act 1999.

Note 1: See Part 2‑4 for the basic rules on adjustments.

Note 2: Under Subdivision 21‑A of the Wine Tax Act, amounts of wine tax increase the net amount, and amounts of wine tax credits reduce the net amount.

Note 3: Under Subdivision 13‑A of the A New Tax System (Luxury Car Tax) Act 1999, amounts of luxury car tax increase the net amount, and luxury car tax adjustments alter the net amount.

(3) This section has effect despite section 17‑5 (which is about net amounts).

Note: If you are a *GST instalment payer your net amount is reduced by GST instalments you have paid: see section 162‑105.

126‑10 Global GST amounts

(1) Your global GST amount for a tax period is as follows:

where:

total amounts wagered is the sum of the *consideration for all of your *gambling supplies that are attributable to that tax period.

total monetary prizes is the sum of:

(a) the *monetary prizes you are liable to pay, during the tax period, on the outcome of gambling events (whether or not any of those gambling events, or the *gambling supplies to which the monetary prizes relate, take place during the tax period); and

(b) any amounts of *money or *digital currency you are liable to pay, during the tax period, under agreements between you and *recipients of your gambling supplies, to repay to them a proportion of their losses relating to those supplies (whether or not the supplies take place during the tax period).

For the basic rules on what is attributable to a particular period, see Division 29.

(2) However, your global GST amount is zero for any tax period in which total monetary prizes exceeds total amounts wagered.

(3) In working out the total monetary prizes for a tax period, disregard any *monetary prizes you are liable to pay, during the tax period, that relate to supplies that are *GST‑free.

(4) Your global GST amount for a tax period may be affected by sections 126‑15 and 126‑20.

126‑15 Losses carried forward

If, for any tax period, your total monetary prizes referred to in subsection 126‑10(1) exceed your total amounts wagered referred to in that subsection, the amount of that excess is to be added to your total monetary prizes, referred to in that subsection, for the next tax period.

126‑20 Bad debts

(1) You cannot have an *adjustment under Division 21 in relation to a *gambling supply.

(2) If, in a tax period, you write off as bad the whole or part of the *consideration for a *gambling supply that is due as a debt, but has not been received, the amount written off is to be added to your total monetary prizes, referred to in subsection 126‑10(1), for that tax period.

(3) However, if, in a tax period, you recover the whole or part of the amount written off, the amount recovered is to be added to your total amounts wagered, referred to in subsection 126‑10(1), for that tax period.

(4) This section has effect despite sections 21‑5 and 21‑10 (which are about adjustments for writing off and recovering suppliers’ bad debts).

126‑25 Application of Subdivision 9‑C

Subdivision 9‑C does not apply to a *gambling supply.

126‑27 When gambling supplies are connected with the indirect tax zone

(1) A *gambling supply is connected with the indirect tax zone if the *recipient of the supply is an Australian resident (unless he or she is an Australian resident solely because the definition of Australia in the *ITAA 1997 includes the external Territories).

(2) This section has effect in addition to section 9‑25 (which is about when supplies are connected with the indirect tax zone).

126‑30 Gambling supplies do not give rise to creditable acquisitions

(1) An acquisition of a thing is not a *creditable acquisition if the supply of the thing acquired was a *gambling supply.

(2) This section has effect despite section 11‑5 (which is about what is a creditable acquisition).

126‑32 Repayments of gambling losses are not consideration

(1) A payment of *money or *digital currency is not the provision of *consideration to the extent that the payment:

(a) is made by a supplier of *gambling supplies to a *recipient of gambling supplies that the supplier makes; and

(b) is made, under an agreement between them, to repay to the recipient a proportion of his or her losses relating to those supplies.

(2) This section has effect despite section 9‑15 (which is about what is consideration).

126‑33 Tax invoices not required for gambling supplies

(1) You are not required to issue a *tax invoice for a *taxable supply that you make that is solely a *gambling supply.

(2) This section has effect despite section 29‑70 (which is about the requirement to issue tax invoices).

126‑35 Meaning of gambling supply and gambling event

(1) A gambling supply is a *taxable supply involving:

(a) the supply of a ticket (however described) in a lottery, raffle or similar undertaking; or

(b) the acceptance of a bet (however described) relating to the outcome of a *gambling event.

(2) A gambling event is:

(a) the conducting of a lottery or raffle, or similar undertaking; or

(b) a race, game, or sporting event, or any other event, for which there is an outcome.

Division 129—Changes in the extent of creditable purpose

Table of Subdivisions

129‑A General

129‑B Adjustment periods

129‑C When adjustments for acquisitions and importations arise

129‑D Amounts of adjustments for acquisitions and importations

129‑E Attributing adjustments under this Division

129‑1 What this Division is about

The extent to which an acquisition or importation is for a creditable purpose affects the amount of the resulting input tax credit. When the extent of creditable purpose is changed by later events, adjustments (for the purpose of working out net amounts under Part 2‑4) may need to be made.

Subdivision 129‑A—General

129‑5 Adjustments arising under this Division

(1) An *adjustment can arise under this Division for:

(a) an acquisition, even if it is not a *creditable acquisition; or

(b) an importation, even if it is not a *creditable importation;

in respect of any *adjustment period for the acquisition or importation.

(2) However, in determining:

(a) whether an adjustment under this Division arises; or

(b) the amount of such an *adjustment;

disregard any change in the extent to which the thing acquired or imported is *applied in making *financial supplies, unless you *exceed the financial acquisitions threshold.

129‑10 Adjustments do not arise under this Division for acquisitions and importations below a certain value

(1) Despite section 129‑5, an adjustment cannot arise under this Division for an acquisition or importation that *relates to business finance, unless the acquisition or importation had a *GST exclusive value of more than $10,000.

(2) Despite section 129‑5, an adjustment cannot arise under this Division for an acquisition or importation that does not *relate to business finance, unless the acquisition or importation had a *GST exclusive value of more than $1,000.

(3) An acquisition or importation relates to business finance if, at the time of the acquisition or importation, it:

(a) related solely or partly to making *financial supplies; and

(b) was not solely or partly of a private or domestic nature.

129‑15 Adjustments do not arise under this Division where there are adjustments under Division 130

Despite section 129‑5, you cannot have an adjustment under this Division for an acquisition if you have already had an *adjustment under Division 130 (goods applied solely to private or domestic use) for the acquisition.

Subdivision 129‑B—Adjustment periods

129‑20 Adjustment periods

(1) An adjustment period for an acquisition or importation is a tax period applying to you that:

(a) starts at least 12 months after the end of the tax period to which the acquisition or importation is attributable (or would be attributable if it were a *creditable acquisition or *creditable importation); and

(b) ends:

(i) on 30 June in any year; or

(ii) if none of the tax periods applying to you in a particular year ends on 30 June—closer to 30 June than any of the other tax periods applying to you in that year.

In addition, a tax period provided for under section 27‑39 or 27‑40 or subsection 151‑55(1) or 162‑85(1) is an adjustment period for the acquisition or importation.

Note: Section 27‑39 deals with an incapacitated entity’s tax periods. Section 27‑40 and subsections 151‑55(1) and 162‑85(1) deal with an entity’s concluding tax period.

(2) Despite subsection (1), for an acquisition or importation that *relates to business finance:

(a) if the *GST exclusive value of the acquisition or importation is $50,000 or less—only the first such tax period is an adjustment period; or

(b) if the GST exclusive value of the acquisition or importation is more than $50,000 but less than $500,000—only the first 5 such tax periods are adjustment periods; or

(c) if the GST exclusive value of the acquisition or importation is $500,000 or more—only the first 10 such tax periods are adjustment periods.

(3) Despite subsection (1), for an acquisition or importation that does not *relate to business finance:

(a) if the *GST exclusive value of the acquisition or importation is $5,000 or less—only the first 2 such tax periods are adjustment periods; or

(b) if the GST exclusive value of the acquisition or importation is more than $5,000 but less than $500,000—only the first 5 such tax periods are adjustment periods; or

(c) if the GST exclusive value of the acquisition or importation is $500,000 or more—only the first 10 such tax periods are adjustment periods.

However, the Commissioner may, having regard to record keeping requirements for the purposes of income tax, determine in writing that a fewer number of tax periods are adjustment periods for a particular class of acquisitions or importations that do not *relate to business finance.

129‑25 Effect on adjustment periods of things being disposed of etc.

(1) Despite section 129‑20, if:

(a) you dispose of a thing acquired or imported (other than in circumstances giving rise to a *decreasing adjustment under Division 132); or

(b) a thing acquired or imported is lost, stolen or destroyed; or

(c) a thing is acquired only for a particular period and that period expires;

the next tax period applying to you that ends:

(d) on 30 June in any year; or

(e) if none of the tax periods applying to you in a particular year ends on 30 June—closer to 30 June than any of the other tax periods applying to you in that year;

is the last *adjustment period for the acquisition or importation in question.

(2) Despite section 129‑20, if:

(a) you dispose of a thing acquired or imported; and

(b) the disposal takes place in circumstances giving rise to a *decreasing adjustment under Division 132;

then:

(c) the last *adjustment period to end before the disposal is the last adjustment period for the acquisition or importation in question; and

(d) if no such adjustment period ended before the disposal, there is no adjustment period for the acquisition or importation.

(3) This section does not apply to a disposal if this Division continues to apply to the acquisition or importation of the thing because of subsection 138‑17(2).

Subdivision 129‑C—When adjustments for acquisitions and importations arise

129‑40 Working out whether you have an adjustment

(1) This is how to work out whether you have an *increasing adjustment or a *decreasing adjustment under this Division, for an *adjustment period, for an acquisition or importation:

Method statement

Step 1. Work out the extent (if any) to which you have *applied the thing acquired or imported for a *creditable purpose during the period of time:

(a) starting when you acquired or imported the thing; and

(b) ending at the end of the *adjustment period.

This is the actual application of the thing.

Step 2. Work out:

(a) if you have not previously had an *adjustment under this Division for the acquisition or importation—the extent (if any) to which you acquired or imported the thing for a *creditable purpose; or

(b) if you have previously had an *adjustment under this Division for the acquisition or importation—the *actual application of the thing in respect of the last adjustment.

This is the intended or former application of the thing.

Step 3. If the *actual application of the thing is less than its *intended or former application, you have an increasing adjustment, for the *adjustment period, for the acquisition or importation.

Step 4. If the *actual application of the thing is greater than its *intended or former application, you have a decreasing adjustment, for the *adjustment period, for the acquisition or importation.

Step 5. If the *actual application of the thing is the same as its *intended or former application, you have neither an increasing adjustment nor a decreasing adjustment, for the *adjustment period, for the acquisition or importation.

(2) *Actual applications and *intended or former applications are to be expressed as percentages.

(3) If the thing is acquired through a *reduced credit acquisition and, at the time of the acquisition, it was wholly for a *creditable purpose because of Division 70, the extent to which it was acquired for a creditable purpose is the reduced input tax credit percentage prescribed for the purposes of subsection 70‑5(2) for an acquisition of that kind.

129‑45 Gifts to gift‑deductible entities

(1) If you are or were entitled to an input tax credit for the *creditable acquisition of a thing, an *adjustment does not arise under this Subdivision merely because you supply the thing as a gift to an *endorsed charity or *gift‑deductible entity.

(3) Subsection (1) does not apply in relation to a thing that you supply to a *gift‑deductible entity endorsed as a deductible gift recipient (within the meaning of the *ITAA 1997) under section 30‑120 of the ITAA 1997, unless:

(a) the entity is:

(i) an *endorsed charity; or

(ii) a fund, authority or institution of a kind referred to in paragraph 30‑125(1)(b) of the ITAA 1997; or

(b) each purpose to which the supply relates is a *gift‑deductible purpose of the entity.

Note: This subsection excludes from this section supplies to certain (but not all) gift‑deductible entities that are only endorsed for the operation of a fund, authority or institution. However, supplies can be covered by this section if they relate to the principal purpose of the fund, authority or institution.

129‑50 Creditable purpose

(1) You *apply a thing for a creditable purpose to the extent that you apply it in *carrying on your *enterprise.

(2) However, you do not *apply a thing for a creditable purpose to the extent that:

(a) the application relates to making supplies that are *input taxed; or

(b) the application is of a private or domestic nature.

(3) To the extent that an *application relates to making *financial supplies through an *enterprise, or a part of an enterprise, that you *carry on outside the indirect tax zone, the application is not, for the purposes of paragraph (2)(a), treated as one that relates to making supplies that would be *input taxed.

129‑55 Meaning of apply

Apply, in relation to a thing acquired or imported, includes:

(a) supply the thing; and

(b) consume, dispose of or destroy the thing; and

(c) allow another entity to consume, dispose of or destroy the thing.

Subdivision 129‑D—Amounts of adjustments for acquisitions and importations

129‑70 The amount of an increasing adjustment

The amount of an *increasing adjustment that you have under Step 3 of the Method statement in section 129‑40 for the thing acquired or imported is worked out as follows:

where:

full input tax credit is the amount of the input tax credit to which you would have been entitled for acquiring or importing the thing for the purpose of your *enterprise if:

(a) the acquisition or importation had been solely for a *creditable purpose; and

(b) in the case where the supply to you was a *taxable supply because of section 72‑5 or 84‑5—the supply had been or is a *taxable supply under section 9‑5.

129‑75 The amount of a decreasing adjustment

The amount of a *decreasing adjustment that you have under Step 4 of the Method statement in section 129‑40 for the thing acquired or imported is worked out as follows:

where:

full input tax credit is the amount of the input tax credit to which you would have been entitled for acquiring or importing the thing for the purpose of your *enterprise if:

(a) the acquisition or importation had been solely for a *creditable purpose; and

(b) in the case where the supply to you was a *taxable supply because of section 72‑5 or 84‑5—the supply had been or is a *taxable supply under section 9‑5.

129‑80 Effect of adjustment under certain Divisions

For the purpose of working out under this Subdivision the amount of an *adjustment for an acquisition, any adjustments under Division 19, 21, 133 or 134 that you have had for the acquisition are to be taken into account in working out the full input tax credit for the purpose of section 129‑70 or 129‑75.

Subdivision 129‑E—Attributing adjustments under this Division

129‑90 Attributing your adjustments for changes in extent of creditable purpose

(1) An *adjustment that you have arising in respect of an *adjustment period under this Division is attributable to the tax period that is that adjustment period.

(2) This section has effect despite section 29‑20 (which is about attributing adjustments).

Division 130—Goods applied solely to private or domestic use

130‑1 What this Division is about

You may have an increasing adjustment if you apply solely to private or domestic use goods for which you had a full input tax credit.

130‑5 Goods applied solely to private or domestic use

(1) You have an increasing adjustment if:

(a) you made a *creditable acquisition or *creditable importation of goods; and

(b) the acquisition or importation was solely for a *creditable purpose; and

(c) you *apply the goods solely to private or domestic use.

(2) The amount of the increasing adjustment is an amount equal to the amount of the input tax credit to which you were entitled for the acquisition or importation, taking account of any *adjustments for the acquisition or importation.

(3) However, this section does not apply if you have previously had an adjustment under Division 129 for the acquisition or importation.

Division 131—Annual apportionment of creditable purpose

Table of Subdivisions

131‑A Electing to have annual apportionment

131‑B Consequences of electing to have annual apportionment

131‑1 What this Division is about

In some cases, you may be able to claim a full input tax credit for acquisitions that are only partly for a creditable purpose. You will then have an increasing adjustment for a later tax period (that better matches your obligation to lodge an income tax return).

Subdivision 131‑A—Electing to have annual apportionment

131‑5 Eligibility to make an annual apportionment election

(1) You are eligible to make an *annual apportionment election if:

(a) either:

(i) you are a *small business entity (other than because of subsection 328‑110(4) of the *ITAA 1997) for the *income year in which you make your election; or

(ii) you do not carry on a *business and your *GST turnover does not exceed the *annual apportionment turnover threshold; and

(b) you have not made any election under section 162‑15 to pay GST by instalments (other than such an election that is no longer in effect); and

(c) you have not made any *annual tax period election (other than such an election that is no longer in effect).

(2) The annual apportionment turnover threshold is:

(a) $2 million; or

(b) such higher amount as the regulations specify.

131‑10 Making an annual apportionment election

(1) You may make an *annual apportionment election if you are eligible under section 131‑5.

(2) Your election takes effect from:

(a) the start of the earliest tax period for which, on the day on which you make your election, your *GST return is not yet due (taking into account any further period the Commissioner allows under paragraph 31‑8(1)(b) or 31‑10(1)(b)); or

(b) the start of such other tax period as the Commissioner allows, in accordance with a request you make in the *approved form.

Note: Refusing a request to allow your election to take effect from the start of another tax period is a reviewable GST decision (see Subdivision 110‑F in Schedule 1 to the Taxation Administration Act 1953).

131‑15 Annual apportionment elections by representative members of GST groups

(1) A *representative member of a *GST group cannot make an *annual apportionment election unless each *member of the GST group is eligible under section 131‑5.

(2) If the *representative member makes such an election, or revokes such an election, each *member of the *GST group is taken to have made, or revoked, the election.

131‑20 Duration of an annual apportionment election

General rule

(1) Your election ceases to have effect if:

(a) you revoke it; or

(b) the Commissioner disallows it under subsection (3); or

(c) in a case to which subparagraph 131‑5(1)(a)(i) applied—you are not a *small business entity of the kind referred to in that subparagraph for an *income year; or

(d) in a case to which subparagraph 131‑5(1)(a)(ii) applied—on 31 July in a *financial year, you do not satisfy the requirements of that subparagraph.

Revocation

(2) A revocation of your election is taken to have had, or has, effect at the start of the earliest tax period for which, on the day of the revocation, your *GST return is not yet due.

Disallowance

(3) The Commissioner may disallow your election if, and only if, the Commissioner is satisfied that you have failed to comply with one or more of your obligations under a *taxation law.

Note: Disallowing your election is a reviewable GST decision (see Subdivision 110‑F in Schedule 1 to the Taxation Administration Act 1953).

(4) A disallowance of your election is taken to have had effect from the start of the tax period in which the Commissioner notifies you of the disallowance.

Not being a small business entity for an income year

(5) If paragraph (1)(c) applies, your election is taken to have ceased to have effect from the start of the tax period in which the first day of the *income year referred to in that paragraph falls.

Failing to satisfy the requirements of subparagraph 131‑5(1)(a)(ii)

(6) If paragraph (1)(d) applies, your election is taken to have ceased to have effect from the start of the tax period in which 31 July in the *financial year referred to in that paragraph falls.

Subdivision 131‑B—Consequences of electing to have annual apportionment

131‑40 Input tax credits for acquisitions that are partly creditable

(1) The amount of the input tax credit on an acquisition that you make that is *partly creditable is an amount equal to the GST payable on the supply of the thing acquired if:

(a) an *annual apportionment election that you have made has effect at the end of the tax period to which the input tax credit is attributable; and

(b) the acquisition is not an acquisition of a kind specified in the regulations.

(2) However, if one or both of the following apply to the acquisition:

(a) the acquisition relates to making supplies that would be *input taxed;

(b) you provide, or are liable to provide, only part of the *consideration for the acquisition;

the amount of the input tax credit on the acquisition is as follows:

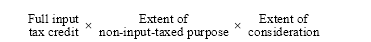

where:

extent of consideration is the extent to which you provide, or are liable to provide, the *consideration for the acquisition, expressed as a percentage of the total consideration for the acquisition.

extent of non‑input‑taxed purpose is the extent to which the acquisition does not relate to making supplies that would be *input taxed, expressed as a percentage of the total purpose of the acquisition.

full input tax credit is what would have been the amount of the input tax credit for the acquisition if it had been made solely for a *creditable purpose and you had provided, or had been liable to provide, all of the consideration for the acquisition.

(3) In determining for the purposes of subsection (2) whether, or the extent to which, an acquisition relates to making supplies that would be *input taxed, subsections 11‑15(3) to (5) apply in the same way that they apply for the purposes of paragraph 11‑15(2)(a).

(4) Determinations made by the Commissioner under subsection 11‑30(5) apply (so far as they are capable of applying) to working out the extent to which a *partly creditable acquisition does not relate to making supplies that would be *input taxed.

(5) This section does not apply to an input tax credit on an acquisition if the acquisition is, to any extent, a *reduced credit acquisition.

(6) This section has effect despite sections 11‑25 and 11‑30 (which are about amounts of input tax credits).

131‑45 Input tax credits for importations that are partly creditable

(1) The amount of the input tax credit on an importation that you make that is *partly creditable is an amount equal to the GST payable on the importation if:

(a) an *annual apportionment election that you have made has effect at the end of the tax period to which the input tax credit is attributable; and

(b) the importation is not an importation of a kind specified in the regulations.

(2) However, if the importation relates to making supplies that would be *input taxed, the amount of the input tax credit on the importation is as follows:

where:

extent of non‑input‑taxed purpose is the extent to which the importation does not relate to making supplies that would be *input taxed, expressed as a percentage of the total purpose of the importation.

full input tax credit is what would have been the amount of the input tax credit for the importation if it had been made solely for a *creditable purpose.

(3) In determining for the purposes of subsection (2) whether, or the extent to which, an importation relates to making supplies that would be *input taxed, subsections 15‑10(3) to (5) apply in the same way that they apply for the purposes of paragraph 15‑10(2)(a).

(4) Determinations made by the Commissioner under subsection 15‑25(4) apply (so far as they are capable of applying) to working out the extent to which a *partly creditable importation does not relate to making supplies that would be *input taxed.

(5) This section has effect despite sections 15‑20 and 15‑25 (which are about amounts of input tax credits).

131‑50 Amounts of input tax credits for creditable acquisitions or creditable importations of certain cars

(1) If:

(a) this Division applies to working out the amount of a *creditable acquisition or *creditable importation that you made; and

(b) the acquisition or importation is an acquisition or importation of a *car;

the amount of the input tax credit on the acquisition or importation under this Division must not exceed the amount (if any) of the input tax credit worked out under section 69‑10.

(2) However, if subsection 131‑40(2) or 131‑45(2) applies to the acquisition or importation:

(a) take into account the operation of section 69‑10 in working out the full input tax credit for the purposes of that subsection; but

(b) disregard subsection 69‑10(3).

131‑55 Increasing adjustments relating to annually apportioned acquisitions and importations

(1) You have an increasing adjustment if:

(a) an acquisition or importation that you made was *partly creditable; and

(b) the input tax credit on the acquisition or importation is attributable to a tax period ending in a particular *financial year; and

(c) the amount of the input tax credit is an amount worked out under this Division.

(2) The amount of the increasing adjustment is an amount equal to the difference between:

(a) the amount of the input tax credit worked out under this Division; and

(b) what would have been the amount of the input tax credit if this Division did not apply.

(3) In working out for the purposes of paragraph (2)(a) the amount of an input tax credit, take into account any change of circumstances that has given rise to:

(a) an adjustment for the acquisition under Division 19; or

(b) an adjustment for the acquisition under Division 21; or

(c) an adjustment for the acquisition under Division 134.

Note: Because of subsection 136‑10(3), the amount of the Division 21 adjustment will not be reduced under Division 136.

(4) In working out for the purposes of paragraph (2)(b) what would have been the amount of an input tax credit, take into account any change of circumstances that has given rise to:

(a) an adjustment for the acquisition under Division 19 (worked out as if this Division had not applied to working out the amount of the input tax credit); or

(b) an adjustment for the acquisition under Division 21; or

(c) an adjustment for the acquisition under Division 134.

Note: If this Division did not apply, the amount of the Division 21 adjustment would have been worked out under Division 136.

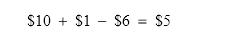

Example: While an annual apportionment election has effect, you make a partly creditable acquisition for $1,100, for which you have an input tax credit of $100. The extent of your creditable purpose is 10%.

During later tax periods, the price increases by $110, for which you have a decreasing adjustment under Division 19 of $10, and the supplier writes off $660 as a bad debt, for which you have an increasing adjustment under Division 21 of $60 (subsection 136‑10(3) prevents the amount from being reduced under Division 136).

The amount of your increasing adjustment under this section is $45. This is the difference between the amounts under paragraphs (2)(a) and (b).

The paragraph (2)(a) amount (which is effectively worked out on a fully creditable basis) is:

The paragraph (2)(b) amount (which is based on a 10% creditable purpose) is:

131‑60 Attributing adjustments under section 131‑55

(1) An *increasing adjustment under section 131‑55 is attributable to:

(a) the tax period worked out using the method statement; or

(b) such earlier tax period as you choose.

Method statement

Step 1. Work out the tax period (the ITC tax period) to which the input tax credit for the acquisition or importation to which the adjustment relates is attributable.

Step 2. Work out in which year of income that tax period starts.

Step 3. If you are required under section 161 of the *ITAA 1936 to lodge a return in relation to that year of income, work out the last day of the period, specified in the instrument made under that section, for you to lodge as required under that section.

Step 4. The *increasing adjustment is attributable to the tax period in which that last day occurs.

Step 5. If step 3 does not apply, the increasing adjustment is attributable to the tax period in which occurs 31 December in the next *financial year to start after the end of the ITC tax period.

Note: Section 388‑55 in Schedule 1 to the Taxation Administration Act 1953 allows the Commissioner to defer the time for giving the GST return.

(2) Despite subsection (1), if, during (but not from the start of) the *financial year in which the ITC tax period ended, your *annual apportionment election ceases to have effect because:

(a) you revoke your annual apportionment election, or the Commissioner disallows your election, during that financial year; and

(b) the revocation or disallowance takes effect before the end of that financial year;

the *increasing adjustment is attributable to the tax period in which the cessation takes effect, or to such earlier tax period as you choose.

(3) However, the *increasing adjustment is attributable to a tax period provided under section 27‑39 or 27‑40 if that tax period ends earlier than the end of the tax period to which the increasing adjustment would, but for this subsection, be attributable under subsections (1) and (2).

(4) This section has effect despite section 29‑20 (which is about attributing your adjustments).

Division 132—Supplies of things acquired etc. without full input tax credits

132‑1 What this Division is about

You may have a decreasing adjustment if you make a supply of something that you earlier acquired or imported, or subsequently applied, to make financial supplies or for a private or domestic purpose.

132‑5 Decreasing adjustments for supplies of things acquired, imported or applied for a purpose that is not fully creditable

(1) You have a decreasing adjustment under this Division if:

(a) you make a *taxable supply of a thing (or a supply of a thing that would have been a taxable supply had it not been *GST‑free under Subdivision 38‑J); and

(b) the supply is a supply by way of sale; and

(c) your acquisition, importation or subsequent *application of the thing, related solely or partly to making *financial supplies, or was solely or partly of a private or domestic nature.

(2) The amount of the *decreasing adjustment is as follows:

where:

adjusted input tax credit is:

(a) the amount of any input tax credit that was attributable to a tax period in respect of the acquisition or importation; minus

(b) the sum of:

(i) any *increasing adjustments, under Subdivision 19‑C or Division 129, that were previously attributable to a tax period in respect of the acquisition or importation; and

(ii) any increasing adjustment under Division 131 that has been previously, is or will be attributable to a tax period in respect of the acquisition or importation; plus

(c) the sum of any *decreasing adjustments, under Subdivision 19‑C or Division 129 or 133, that were previously attributable to a tax period in respect of the acquisition or importation.

full input tax credit is the amount of the input tax credit to which you would have been entitled for acquiring or importing the thing for the purpose of your *enterprise if:

(a) the acquisition or importation had been solely for a *creditable purpose; and

(b) in the case where the supply to you was a *taxable supply because of section 72‑5 or 84‑5—the supply had been or is a *taxable supply under section 9‑5.

price is the *price of the *taxable supply.

(3) However, if the amount worked out under subsection (2) is greater than the difference between the full input tax credit and the adjusted input tax credit, the amount of the *decreasing adjustment is an amount equal to that difference.

(4) In working out the adjusted input tax credit, the acquisition, importation or *application in question is treated as having been for a *creditable purpose except to the extent *that the acquisition, importation or application:

(a) relates to the making of *financial supplies; or

(b) is of a private or domestic nature.

132‑10 Attribution of adjustments under this Division

(1) A *decreasing adjustment under this Division is attributable to:

(a) the same tax period as the *taxable supply to which it relates; or

(b) if it relates to a supply that is not a taxable supply—the tax period to which the supply would be attributable if it were a taxable supply.

(2) This section has effect despite section 29‑20 (which is about attributing your adjustments).

Division 133—Providing additional consideration under gross‑up clauses

133‑1 What this Division is about

You may have a decreasing adjustment for an acquisition that you made if, to take account of a GST liability that the supplier is subsequently found to have, you provide additional consideration at a time when you can no longer claim an input tax credit.

133‑5 Decreasing adjustments for additional consideration provided under gross‑up clauses

(1) You have a decreasing adjustment if:

(a) you made an acquisition on the basis that:

(i) it was not a *creditable acquisition because the supply to which the acquisition relates was not a *taxable supply; or

(ii) it was *partly creditable because the supply to which the acquisition relates was only partly a taxable supply; and

(b) you provided *additional consideration for the acquisition in compliance with a contractual obligation that required you, or had the effect of requiring you, to provide additional consideration if:

(i) in a case where subparagraph (a)(i) applies—the supply was later found to be a taxable supply, or to be partly a taxable supply; or

(ii) in a case where subparagraph (a)(ii) applies—the supply was later found to be a taxable supply to a greater extent; and

(c) GST on the supply has not ceased to be payable (other than as a result of its payment); and

(d) at the time you provided the additional consideration, you were no longer entitled to an input tax credit for the acquisition.

Note: Section 93‑5 or 93‑15 may provide a time limit on your entitlement to an input tax credit.

(2) The amount of the *decreasing adjustment is the difference between:

(a) what would have been the *previously attributed input tax credit amount for the acquisition if:

(i) the *additional consideration for the acquisition had been provided as part of the original *consideration for the acquisition; and

(ii) in a case where you have not held a *tax invoice for the acquisition—you held such an invoice; and

(iii) subsection 29‑10(4) did not apply in relation to the acquisition; and

(b) the previously attributed input tax credit amount.

(3) To avoid doubt, additional consideration for an acquisition includes a part of the *consideration for the acquisition that:

(a) relates to the amount of GST payable on the *taxable supply to which the acquisition relates; and

(b) at the time of the acquisition, the parties to the transaction under which the acquisition was made assumed was not payable.

133‑10 Availability of adjustments under Division 19 for acquisitions

(1) If:

(a) you have a *decreasing adjustment under this Division for an acquisition; and

(b) the circumstances that gave rise to the adjustment also constitute an *adjustment event;

you do not have a decreasing adjustment under section 19‑70 for the acquisition in relation to those circumstances.

(2) This section has effect despite section 19‑70 (which is about adjustments for acquisitions arising because of adjustment events).

Division 134—Third party payments

134‑1 What this Division is about

You may have a decreasing adjustment if you make a payment to an entity that acquires something that you had supplied to another entity. The entity receiving the payment may have an increasing adjustment.

134‑5 Decreasing adjustments for payments made to third parties

(1) You have a decreasing adjustment if:

(a) you make a payment to an entity (the payee) that acquires a thing that you supplied to another entity (whether or not that other entity supplies the thing to the payee); and

(b) your supply of the thing to the other entity:

(i) was a *taxable supply; or

(ii) would have been a taxable supply but for a reason to which subsection (3) applies; and

(c) the payment is in one or more of the following forms:

(i) a payment of *money or *digital currency;

(ii) an offset of an amount of money or digital currency that the payee owes to you;

(iii) a crediting of an amount of money or digital currency to an account that the payee holds; and

(d) the payment is made in connection with, in response to or for the inducement of the payee’s acquisition of the thing; and

(e) the payment is not *consideration for a supply to you.

(1A) However, subsection (1) does not apply if:

(a) the supply of the thing to the payee is a *GST‑free supply, or is not *connected with the indirect tax zone; or

(b) the Commissioner is required to make a payment to the payee, under Division 168 (about the tourist refund scheme), related to the payee’s acquisition of the thing;

and you know, or have reasonable grounds to suspect, that the supply of the thing to the payee is a GST‑free supply or is not connected with the indirect tax zone, or that the Commissioner is so required.

(2) The amount of the *decreasing adjustment is an amount equal to the difference between:

(a) either:

(i) if your supply to the other entity was a *taxable supply—the amount of GST payable on the supply; or

(ii) if your supply to the other entity would have been a taxable supply but for a reason to which subsection (3) applies—the amount of GST that would have been payable on the supply had it been a taxable supply;

taking into account any other *adjustments that arose, or would have arisen, relating to the supply; and

(b) the amount of GST that would have been payable, or would (but for a reason to which subsection (3) applies) have been payable, for that supply:

(i) if the *consideration for the supply had been reduced by the amount of your payment to the payee; and

(ii) taking into account any other adjustments that arose, or would have arisen, relating to the supply, as they would have been affected (if applicable) by such a reduction in the consideration.

(3) This subsection applies to the following reasons why your supply of the thing to the other entity was not a *taxable supply:

(a) you and the other entity are *members of the same *GST group;

(b) you and the other entity are members of the same *GST religious group;

(c) you are the *joint venture operator for a *GST joint venture, and the other entity is a *participant in the GST joint venture.

(4) However:

(a) paragraph (3)(a) does not apply if you and the payee are *members of the same *GST group when the payment referred to in paragraph (1)(a) is made; and

(b) paragraph (3)(b) does not apply if you and the payee are members of the same *GST religious group when that payment is made.

134‑10 Increasing adjustments for payments received by third parties

(1) You have an increasing adjustment if:

(a) you receive a payment from an entity (the payer) that supplied a thing that you acquire from another entity (whether or not that other entity acquired the thing from the payer); and

(b) your acquisition of the thing from the other entity:

(i) was a *creditable acquisition; or

(ii) would have been a creditable acquisition but for a reason to which subsection (3) applies; and

(c) the payment is in one or more of the following forms:

(i) a payment of *money or *digital currency;

(ii) an offset of an amount of money or digital currency that you owe to the payer;

(iii) a crediting of an amount of money or digital currency to an account that you hold; and

(d) the payment is made in connection with, in response to or for the inducement of your acquisition of the thing; and

(e) the payment is not *consideration for a supply you make.

(1A) However, subsection (1) does not apply unless the supply of the thing by the payer:

(a) was a *taxable supply; or

(b) would have been a taxable supply but for any of the following:

(i) the payer and the entity that acquired the thing from the payer being *members of the same *GST group;

(ii) the payer and the entity that acquired the thing from the payer being members of the same *GST religious group;

(iii) the payer being the *joint venture operator for a *GST joint venture, and the entity that acquired the thing from the payer being a *participant in the GST joint venture.

(2) The amount of the *increasing adjustment is an amount equal to the difference between:

(a) either:

(i) if your acquisition from the other entity was a *creditable acquisition—the amount of the input tax credit entitlement for the acquisition; or

(ii) if your acquisition from the other entity would have been a creditable acquisition but for a reason to which subsection (3) applies—the amount that would have been the amount of the input tax credit entitlement for the acquisition had it been a creditable acquisition;

taking into account any other *adjustments that arose, or would have arisen, relating to the acquisition; and

(b) the amount of the input tax credit to which you would have been entitled, or would (but for a reason to which subsection (3) applies) have been entitled, for that acquisition:

(i) if the *consideration for the acquisition had been reduced by the amount of the payer’s payment to you; and

(ii) taking into account any other adjustments that arose, or would have arisen, relating to the acquisition, as they would have been affected (if applicable) by such a reduction in the consideration.

(3) This subsection applies to the following reasons why your acquisition of the thing from the other entity was not a *creditable acquisition:

(a) you and the other entity are *members of the same *GST group;

(b) you and the other entity are members of the same *GST religious group;

(c) you are the *joint venture operator for a *GST joint venture, and the other entity is a *participant in the GST joint venture.

(4) However:

(a) paragraph (3)(a) does not apply if you and the payer are *members of the same *GST group when the payment referred to in paragraph (1)(a) is made; and

(b) paragraph (3)(b) does not apply if you and the payer are members of the same *GST religious group when that payment is made.

134‑15 Attribution of decreasing adjustments

(1) If:

(a) you have a *decreasing adjustment under section 134‑5; and

(b) you do not hold a *third party adjustment note for the adjustment when you give to the Commissioner a *GST return for the tax period to which the adjustment (or any part of the adjustment) would otherwise be attributable;

then:

(c) the adjustment (including any part of the adjustment) is not attributable to that tax period; and

(d) the adjustment (or part) is attributable to the first tax period for which you give to the Commissioner a GST return at a time when you hold that third party adjustment note.

However, this subsection does not apply in circumstances of a kind determined by the Commissioner, by legislative instrument, to be circumstances in which the requirement for an adjustment note does not apply.

Note: For the giving of GST returns to the Commissioner, see Division 31.

(2) This section does not apply to a *decreasing adjustment of an amount that does not exceed the amount provided for under subsection 29‑80(2).

(3) This section has effect despite section 29‑20 (which is about attributing adjustments).

134‑20 Third party adjustment notes

(1) A third party adjustment note for a *decreasing adjustment that you have under section 134‑5 is a document:

(a) that is created by you; and

(b) a copy of which is given, in the circumstances set out in subsection (2), to the entity that received the payment that gave rise to the adjustment; and

(c) that sets out your *ABN; and

(d) that contains such other information as the Commissioner determines in writing; and

(e) that is in the *approved form.

However, the Commissioner may treat as a third party adjustment note a particular document that is not a third party adjustment note.

(2) You must give the copy of the document to the entity that received the payment:

(a) within 28 days after the entity requests you to give the copy; or

(b) if you become aware of the *adjustment before the copy is requested—within 28 days, or such other number of days as the Commissioner determines under subsection (4) or (6), after becoming aware of the adjustment.

(3) Subsection (2) does not apply to an *adjustment of an amount that does not exceed the amount provided for under subsection 29‑80(2).

(4) The Commissioner may determine in writing that paragraph (2)(b) has effect, in relation to a particular document, as if the number of days referred to in that paragraph is the number of days specified in the determination.

(5) A determination made under subsection (4) is not a legislative instrument.

(6) The Commissioner may determine, by legislative instrument, circumstances in which paragraph (2)(b) has effect, in relation to those circumstances, as if the number of days referred to in that paragraph is the number of days specified in the determination.

(7) A determination made under subsection (4) has effect despite any determination made under subsection (6).

134‑25 Adjustment events do not arise

To avoid doubt, a payment that gives rise to an *adjustment under this Division cannot give rise to an *adjustment event.

134‑30 Application of sections 48‑55 and 49‑50

(1) For the purposes of working out whether you have an adjustment under this Division, disregard sections 48‑55 and 49‑50.

(2) However, this section does not affect the application of sections 48‑55 and 49‑50 for the purposes of working out the amount of an adjustment under this Division.

Note: Sections 48‑55 and 49‑50 require GST groups and GST religious groups to be treated as single entities for the purposes of adjustments.

Division 135—Supplies of going concerns

135‑1 What this Division is about

The recipient of a supply of a going concern has an increasing adjustment to take into account the proportion (if any) of supplies that will be made in running the concern and that will not be taxable supplies or GST‑free supplies. Later adjustments are needed if this proportion changes over time.

135‑5 Initial adjustments for supplies of going concerns

(1) You have an increasing adjustment if:

(a) you are the *recipient of a *supply of a going concern, or a supply that is *GST‑free under section 38‑480; and

(b) you intend that some or all of the supplies made through the *enterprise to which the supply relates will be supplies that are neither *taxable supplies nor *GST‑free supplies.

(2) The amount of the increasing adjustment is as follows:

where:

proportion of non‑creditable use is the proportion of all the supplies made through the *enterprise that you intend will be supplies that are neither *taxable supplies nor *GST‑free supplies, expressed as a percentage worked out on the basis of the *prices of those supplies.

supply price means the *price of the supply in relation to which the increasing adjustment arises.

135‑10 Later adjustments for supplies of going concerns

(1) If you are the *recipient of a *supply of a going concern, or a supply that is *GST‑free under section 38‑480, Division 129 (which is about changes in the extent of creditable purpose) applies to that acquisition, in relation to:

(a) the proportion of all the supplies made through the *enterprise that you intend will be supplies that are neither *taxable supplies nor *GST‑free supplies; and

(b) the proportion of all the supplies made through the *enterprise that are supplies that are neither taxable supplies nor GST‑free supplies;

in the same way as that Division applies:

(c) in relation to the extent to which you made an acquisition for a *creditable purpose; and

(d) in relation to the extent to which a thing acquired is *applied for a creditable purpose.

(2) For the purpose of applying Division 129, the proportions referred to in paragraphs (1)(a) and (b) are to be expressed as percentages worked out on the basis of the *prices of the supplies in question.

(3) This section applies in relation to any *supply of a going concern, or a supply that is *GST‑free under section 38‑480, whether or not it is a supply in respect of which you have had an *increasing adjustment under section 135‑5.

Division 136—Bad debts relating to transactions that are not taxable or creditable to the fullest extent

Table of Subdivisions

136‑A Bad debts relating to partly taxable or creditable transactions

136‑B Bad debts relating to transactions that are taxable or creditable at less than 1/11 of the price

136‑1 What this Division is about

The amount of an adjustment that you have under Division 21 for a bad debt is reduced under this Division if the transaction to which the adjustment relates:

• was a supply that was partly taxable or an acquisition that was partly creditable; or

• was fully taxable or creditable, but not to the extent of 1/11 of the price or consideration for the transaction.

Subdivision 136‑A—Bad debts relating to partly taxable or creditable transactions

136‑5 Adjustments relating to partly taxable supplies

If you have an *adjustment under section 21‑5, 21‑10, 136‑30 or 136‑35 in relation to a supply that was partly a *taxable supply, the amount of that adjustment is reduced to the following amount:

where:

full adjustment is what would be the amount of the adjustment worked out under section 21‑5, 21‑10, 136‑30 or 136‑35 if this section did not apply.

taxable proportion is the proportion of the *value of the supply (worked out as if it were solely a taxable supply) that the taxable supply represents.

Example: If the amount of an adjustment under section 21‑5 would be $100 but the supply was only 80% taxable, the amount of the adjustment is $80.

136‑10 Adjustments in relation to partly creditable acquisitions

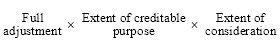

(1) If you have an *adjustment under section 21‑15, 21‑20, 136‑40 or 136‑45 in relation to a *creditable acquisition that was *partly creditable, the amount of that adjustment is reduced to the following amount:

where:

extent of consideration is the extent to which you provide, or are liable to provide, the *consideration for the acquisition, expressed as a percentage of the total consideration for the acquisition.

extent of creditable purpose is the extent of *creditable purpose last used to work out:

(a) the amount of the input tax credit for the acquisition; or

(b) the amount of any *adjustment under Division 129 in relation to the acquisition;

expressed as a percentage of the total purpose of the acquisition.

full adjustment is what would be the amount of the adjustment worked out under section 21‑15, 21‑20, 136‑40 or 136‑45 if this section did not apply.

(2) If you have an *adjustment under section 21‑15, 21‑20, 136‑40 or 136‑45 in relation to a *creditable acquisition that was a *reduced credit acquisition and that was not *partly creditable (that is, it is wholly for a *creditable purpose because of Division 70), the amount of that adjustment is reduced to the following amount:

where:

extent of consideration is the extent to which you provide, or are liable to provide, the *consideration for the acquisition, expressed as a percentage of the total consideration for the acquisition.

percentage credit reduction is the reduced input tax credit percentage prescribed for the purposes of subsection 70‑5(2) for an acquisition of that kind.

full adjustment is what would be the amount of the adjustment worked out under section 21‑15, 21‑20, 136‑40 or 136‑45 if this section did not apply.

(3) However, this section does not apply to an *adjustment that you have in relation to a *creditable acquisition if:

(a) the amount of the input tax credit for the acquisition is worked out under Division 131; and

(b) the adjustment is attributable to a tax period that is not later than the tax period to which an adjustment under section 131‑55 relating to the acquisition is attributable.

Subdivision 136‑B—Bad debts relating to transactions that are taxable or creditable at less than 1/11 of the price

136‑30 Writing off bad debts (taxable supplies)

(1) The amount of a *decreasing adjustment that you have under section 21‑5, relating to a *taxable supply that is *taxable at less than 1/11 of the price, is worked out under this section and not under section 21‑5.

(2) This is how to work out the amount:

Method statement

Step 1. Work out the amount of GST (if any) that was payable on the supply, taking into account any previous *adjustments for the supply. This amount is the previous GST amount.

Step 2. Add together:

(a) the amount or amounts written off as bad from the debt to which the decreasing adjustment relates; and

(b) the amount of the debt that has been *overdue for 12 months or more (other than amounts already written off).

Step 3. Subtract the step 2 amount from the *price of the supply.

Step 4. Work out the amount of GST (if any), taking into account any previous *adjustments for the supply (but not adjustments relating to bad debts or debts overdue), that would be payable on the supply if the *price of the supply were the step 3 amount. This amount of GST is the adjusted GST amount.

Step 5. Subtract the adjusted GST amount from the previous GST amount.

136‑35 Recovering amounts previously written off (taxable supplies)

(1) The amount of an *increasing adjustment that you have under section 21‑10, relating to a *taxable supply that is *taxable at less than 1/11 of the price, is worked out under this section and not under section 21‑10.

(2) This is how to work out the amount:

Method statement

Step 1. Work out the amount of GST (if any) that was payable on the supply, taking into account any previous *adjustments for the supply. This amount is the previous GST amount.

Step 2. Add together:

(a) the amount or amounts previously written off as bad from the debt to which the increasing adjustment relates; and

(b) the amount of the debt that has been *overdue for 12 months or more (other than amounts already written off).

Step 3. Subtract the step 2 amount from the *price of the supply.

Step 4. Add to the step 3 amount an amount equal to the amount or amounts, written off or overdue for 12 months or more, that have been recovered.

Step 5. Work out the amount of GST (if any), taking into account any previous *adjustments for the supply (but not adjustments relating to bad debts or debts overdue), that would be payable on the supply if the *price of the supply were the step 4 amount. This amount of GST is the adjusted GST amount.

Step 6. Subtract the previous GST amount from the adjusted GST amount.

136‑40 Bad debts written off (creditable acquisitions)

(1) The amount of an *increasing adjustment that you have under section 21‑15, relating to a *creditable acquisition that is *creditable at less than 1/11 of the consideration, is worked out under this section and not under section 21‑15.

(2) This is how to work out the amount:

Method statement

Step 1. Work out the amount of the input tax credit (if any) to which you were entitled for the acquisition, taking into account any previous *adjustments for the acquisition. This amount is the previous credit amount.

Step 2. Add together:

(a) the amount or amounts previously written off as bad from the debt to which the increasing adjustment relates; and

(b) the amount of the debt that has been *overdue for 12 months or more (other than amounts already written off).

Step 3. Subtract the step 2 amount from the total amount of the *consideration that you have either provided, or are liable to provide, for the acquisition.

Step 4. Work out the amount of the input tax credit (if any), taking into account any previous *adjustments for the acquisition (but not adjustments relating to bad debts or debts overdue), to which you would be entitled for the acquisition if the *consideration for the acquisition were the step 3 amount. This amount of GST is the adjusted credit amount.

Step 5. Subtract the adjusted credit amount from the previous credit amount.

136‑45 Recovering amounts previously written off (creditable acquisitions)

(1) The amount of a *decreasing adjustment that you have under section 21‑20, relating to a *creditable acquisition that is *creditable at less than 1/11 of the consideration, is worked out under this section and not under section 21‑20.

(2) This is how to work out the amount:

Method statement

Step 1. Work out the amount of the input tax credit (if any) to which you were entitled for the acquisition, taking into account any previous *adjustments for the acquisition. This amount is the previous credit amount.

Step 2. Add together:

(a) the amount or amounts previously written off as bad from the debt to which the decreasing adjustment relates; and