An Act about telecommunications, and for related purposes

Part 1—Preliminary

1 Short title

This Act may be cited as the Telecommunications (Consumer Protection and Service Standards) Act 1999.

2 Commencement

(1) Subject to this section, this Act commences on the 28th day after the day on which it receives the Royal Assent.

(2) Part 3 commences on 1 July 1999.

3 Objects and regulatory policy

The following provisions of the Telecommunications Act 1997 apply to this Act in a corresponding way to the way in which they apply to that Act:

(a) section 3 (objects);

(b) section 4 (regulatory policy).

4 Simplified outline

The following is a simplified outline of this Act:

• A universal service regime is established. The main object of the universal service regime is to ensure that all people in Australia, wherever they reside or carry on business, should have reasonable access, on an equitable basis, to:

(a) standard telephone services; and

(b) payphones.

• The universal service regime established by this Act is to be phased out and replaced by alternative contractual arrangements under the Telecommunications Universal Service Management Agency Act 2012.

• Provision is made for the National Relay Service (NRS). The NRS provides persons who are deaf or who have a hearing and/or speech impairment with access to a standard telephone service on terms, and in circumstances, that are comparable to the access other Australians have to a standard telephone service.

• The NRS provisions in this Act are to be replaced by alternative contractual arrangements under the Telecommunications Universal Service Management Agency Act 2012.

• Local calls are to be charged for on an untimed basis.

• The ACMA may make performance standards to be complied with by carriage service providers in relation to customer service.

• Certain carriers and carriage service providers must enter into the Telecommunications Industry Ombudsman scheme.

• Provision is made for the protection of residential customers of carriage service providers against failure by the providers to supply standard telephone services.

• The ACMA may impose requirements on carriers, carriage service providers and certain other persons in relation to emergency call services.

• Telstra is subject to price control arrangements.

• This Act regulates telephone sex services.

• The Minister may direct Telstra to take action directed towards ensuring that Telstra complies with this Act.

5 Definitions

(1) Unless the contrary intention appears, expressions used in this Act and in the Telecommunications Act 1997 have the same meaning in this Act as they have in that Act.

(2) In this Act:

alternative telecommunications services, or ATS, in Part 2 has the meaning given by section 8E.

approved ATS marketing plan:

(a) for a primary universal service provider has the meaning given by subsection 12P(2); and

(b) for a competing universal service provider, or applicant for approval as a competing universal service provider, has the meaning given by subsection 13M(2).

approved policy statement:

(a) for a primary universal service provider has the meaning given by subsection 12F(2); and

(b) for a competing universal service provider, or applicant for approval as a competing universal service provider, has the meaning given by subsection 13F(2).

approved standard marketing plan:

(a) for a primary universal service provider has the meaning given by subsection 12F(4); and

(b) for a competing universal service provider, or applicant for approval as a competing universal service provider, has the meaning given by subsection 13F(4).

claim period in Part 2 has the meaning given by section 8D.

competing universal service provider has the meaning given by section 13A.

contestable service obligation has the meaning given by section 11C.

default arrangements has the meaning given by section 12.

designated STS area has the meaning given by section 8H.

draft ATS marketing plan:

(a) for a primary universal service provider has the meaning given by subsection 12P(1); and

(b) for a competing universal service provider, or applicant for approval as a competing universal service provider, has the meaning given by subsection 13M(1).

draft policy statement:

(a) for a primary universal service provider has the meaning given by subsection 12F(1); and

(b) for an applicant for approval as a competing universal service provider has the meaning given by subsection 13F(1).

draft standard marketing plan:

(a) for a primary universal service provider has the meaning given by subsection 12F(3); and

(b) for a competing universal service provider, or applicant for approval as a competing universal service provider, has the meaning given by subsection 13F(3).

eligible revenue for an eligible revenue period has the meaning given by section 20B.

eligible revenue period has the meaning given by section 20C.

levy means levy imposed by the Telecommunications (Universal Service Levy) Act 1997.

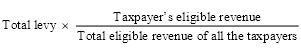

levy contribution factor has the meaning given by section 20H.

levy credit has the meaning given by subsection 20J(2).

levy debit has the meaning given by subsection 20R(2).

NBN Co has the same meaning as in the National Broadband Network Companies Act 2011.

participating person for an eligible revenue period has the meaning given by section 20A.

payphone carriage service means a carriage service supplied by means of a payphone.

price‑related terms and conditions means terms and conditions relating to price or a method of ascertaining price.

primary universal service provider has the meaning given by section 12A.

RTIRC means the Regional Telecommunications Independent Review Committee established by section 158R.

RTIRC Chair means the Chair of the Regional Telecommunications Independent Review Committee.

RTIRC member means a member of the Regional Telecommunications Independent Review Committee, and includes the RTIRC Chair.

service area has the meaning given by section 8C.

service obligation has the meaning given by section 9B.

standard contestability arrangements has the meaning given by section 13.

standard telephone service has the meaning given by section 6.

Telecommunications Industry Ombudsman means the Telecommunications Industry Ombudsman appointed under the Telecommunications Industry Ombudsman scheme.

Telecommunications Industry Ombudsman scheme means the scheme referred to in section 128.

this Act includes the regulations.

universal service area has the meaning given by section 9G.

universal service charge has the meaning given by section 18.

universal service contractor means a person who is a contractor (within the meaning of the Telecommunications Universal Service Management Agency Act 2012).

universal service grant recipient means a person who is a grant recipient (within the meaning of the Telecommunications Universal Service Management Agency Act 2012).

universal service obligation has the meaning given by section 9.

universal service provider has the meaning given by section 11A.

universal service subsidy has the meaning given by section 16.

VOIP service means a carriage service that enables a voice call to originate on customer equipment by means of the internet protocol.

6 Standard telephone service

(1) A reference in a particular provision of this Act to a standard telephone service is a reference to a carriage service for each of the following purposes:

(a) the purpose of voice telephony;

(b) if:

(i) voice telephony is not practical for a particular end‑user with a disability (for example, because the user is deaf or has a hearing and/or speech impairment); and

(ii) another form of communication that is equivalent to voice telephony (for example, communication by means of a device that enables text‑based communication) would be required to be supplied to the end‑user in order to comply with the Disability Discrimination Act 1992;

the purpose of that form of communication;

(c) a purpose declared by the regulations to be a designated purpose for the purposes of that provision;

where:

(d) the service passes the connectivity test set out in subsection (2); and

(e) to the extent that the service is for the purpose referred to in paragraph (a)—the service has the characteristics (if any) declared by the regulations to be the designated characteristics in relation to that service for the purposes of that provision; and

(f) to the extent that the service is for the purpose referred to in paragraph (b)—the service has the characteristics (if any) declared by the regulations to be the designated characteristics in relation to that service for the purposes of that provision; and

(g) to the extent that the service is for a particular purpose referred to in paragraph (c)—the service has the characteristics (if any) declared by the regulations to be the designated characteristics in relation to that service for the purposes of that provision.

(2) A service passes the connectivity test if an end‑user supplied with the service for a purpose mentioned in paragraph (1)(a), (b) or (c) is ordinarily able to communicate, by means of the service, with each other end‑user who is supplied with the same service for the same purpose, whether or not the end‑users are connected to the same telecommunications network.

(3) The following are examples of purposes that could be declared by regulations made for the purposes of paragraph (1)(c):

(a) the purpose of the carriage of data;

(b) the purpose of tone signalling.

(4) In making a recommendation to the Governor‑General at a particular time about the making of regulations for the purposes of paragraph (1)(c), the Minister must have regard to the following matters:

(a) whether a carriage service for the purpose proposed to be declared by the regulations can be supplied using the same infrastructure as is, at that time, being used by universal service providers, universal service contractors or universal service grant recipients to supply a standard telephone service for the purpose referred to in paragraph (1)(a);

(b) such other matters (if any) as the Minister considers relevant.

(5) This section does not prevent a characteristic declared by regulations made for the purposes of paragraph (1)(e), (f) or (g) from being a performance characteristic.

(6) In this section:

this Act includes:

(a) the Telecommunications Act 1997; and

(b) the Telecommunications Universal Service Management Agency Act 2012.

6A When a standard telephone service is supplied in fulfilment of the universal service obligation

Mobile and VOIP services

(1) For the purposes of this Act, if:

(a) a standard telephone service is supplied, or proposed to be supplied, to a customer by a primary universal service provider; and

(b) the service is:

(i) a public mobile telecommunications service; or

(ii) a VOIP service;

the service is taken not to be supplied in fulfilment of the universal service obligation unless, before the customer entered into an agreement with the primary universal service provider for the supply of the service:

(c) the provider notified the customer, in writing, that the service is supplied in fulfilment of the universal service obligation; and

(d) the notice complied with such requirements (if any) as are specified in a determination under subsection (2).

(2) The ACMA may, by legislative instrument, determine requirements for the purposes of paragraph (1)(d).

Other services

(3) For the purposes of this Act, if:

(a) a standard telephone service (the relevant service) is supplied, or proposed to be supplied, to a customer by a primary universal service provider; and

(b) the relevant service is not:

(i) a public mobile telecommunications service; or

(ii) a VOIP service;

the relevant service is taken not to be supplied in fulfilment of the universal service obligation if, before the customer entered into an agreement with the primary universal service provider for the supply of the relevant service:

(c) the customer was given the option of being supplied with another standard telephone service by the provider on the basis that the other standard telephone service would be supplied in fulfilment of the universal service obligation; and

(d) the customer has, by written notice given to the provider, acknowledged that the relevant service is not supplied in fulfilment of the universal service obligation; and

(e) the notice complied with such requirements (if any) as are specified in a determination under subsection (4).

(4) The ACMA may, by legislative instrument, determine requirements for the purposes of paragraph (3)(e).

7 Application of this Act

The following provisions of the Telecommunications Act 1997 apply to this Act in a corresponding way to the way in which they apply to that Act:

(a) section 8 (Crown to be bound);

(b) section 9 (extra‑territorial application);

(c) section 10 (extension to external Territories);

(d) section 11 (extension to offshore areas);

(e) section 12 (Act subject to Radiocommunications Act);

(f) section 13 (continuity of partnerships).

7A Application of the Criminal Code

Chapter 2 of the Criminal Code (except for Part 2.5) applies to all offences against this Act.

Note 1: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Note 2: For criminal liability of corporations under this Act, see sections 574A and 575 of the Telecommunications Act 1997.

Part 2—Universal Service Regime

Division 1—Introduction

8 Simplified outline

This is a simplified outline of this Part:

This Part establishes a universal service regime.

The universal service regime established by this Part is to be phased out and replaced by alternative contractual arrangements under the Telecommunications Universal Service Management Agency Act 2012.

In general terms, the universal service regime involves:

(a) the universal service obligation and universal service subsidy; and

(c) arrangements for collecting and distributing universal service levy.

The main object of the universal service regime is to ensure that all people in Australia, wherever they reside or carry on business, should have reasonable access, on an equitable basis, to:

(a) standard telephone services; and

(b) payphones.

The key elements of the universal service regime are as follows:

(a) the specification of the universal service obligation;

(b) the determination of universal service areas;

(c) the specification of arrangements for the fulfilment of the universal service obligation;

(d) the determination of primary universal service providers;

(e) the determination of contestable service obligations for particular universal service areas;

(f) requirements for the approval of, and compliance with, policy statements and marketing plans of universal service providers;

(h) the determination of the universal service subsidy payable for supplying services in fulfilment of the universal service obligation;

(j) the regulation of universal service charges;

(k) the assessment, collection, recovery and distribution of the levy imposed by the Telecommunications (Universal Service Levy) Act 1997;

(l) the disclosure of information on which certain decisions under this Part are based;

(m) the maintenance by the ACMA of Registers, and the delegation of the Minister’s powers under this Part to the ACMA.

8A Objects

The objects of this Part, when read together with the Telecommunications Universal Service Management Agency Act 2012, are to give effect to the following policy principles:

(a) all people in Australia, wherever they reside or carry on business, should have reasonable access, on an equitable basis, to:

(i) standard telephone services; and

(ii) payphones;

(b) the universal service obligation described in section 9 should be fulfilled:

(i) effectively, efficiently and economically; and

(ii) in ways that are consistent with Australia’s open and competitive telecommunications regime; and

(iii) in ways that are, as far as practicable, responsive to the needs of consumers;

(c) the fulfilment of the universal service obligation described in section 9 should generally be open to competition among carriers and carriage service providers;

(d) specific and predictable funding arrangements to advance the fulfilment of the universal service obligation, particularly in high cost areas, should be available;

(e) providers of telecommunications services should contribute, in a way that is equitable and reasonable, to the funding of the universal service obligation;

(f) information on the basis on which decisions are made for the purposes of the universal service regime should generally be open to public scrutiny;

(g) the universal service regime should be flexible and able to deal with rapid changes in both the telecommunications industry and the needs of consumers.

8B Special meaning of Australia

(1) A reference in this Part to Australia includes a reference to:

(a) the Territory of Christmas Island; and

(b) the Territory of Cocos (Keeling) Islands; and

(c) an external Territory specified in the regulations.

(2) The definition of Australia in section 7 of the Telecommunications Act 1997 does not apply to this Part.

8BA Special meaning of standard telephone service

(1) A reference in this Part to a standard telephone service is a reference to a standard telephone service (within the meaning of section 6) that has the characteristics (if any) specified in a determination under subsection (2).

(2) The Minister may, by legislative instrument, determine specified characteristics for the purposes of subsection (1).

8C Meaning of service area

For the purposes of this Part, a service area is:

(a) a geographical area within Australia; or

(b) any area of land; or

(c) any premises or part of premises;

regardless of size.

8D Meaning of claim period

(1) For the purposes of this Part, a claim period is:

(a) the 2000‑2001 financial year and each of the next 11 financial years; or

(b) if the Minister determines in writing another period—the other period.

(2) The Minister may determine different periods under paragraph (1)(b) in respect of one or more universal service subsidies.

(3) A period determined by the Minister under paragraph (1)(b) must not be a part of more than one financial year.

(3A) A period determined by the Minister under paragraph (1)(b) must not end after 30 June 2012.

(4) If the Minister determines a period under paragraph (1)(b), the determination may modify the way this Part applies to carriers and carriage service providers. The modifications may include additions, omissions and substitutions.

(5) A determination under paragraph (1)(b) is a legislative instrument.

8E Meaning of alternative telecommunications services, or ATS

For the purposes of this Part, alternative telecommunications services, or ATS, are services the supply of which by a particular universal service provider the ACMA authorises for the purposes of this section.

8F Meaning of approved auditor

(1) A reference in this Part to an approved auditor is a reference to a person included in a class of persons specified in a written determination made by the ACMA for the purposes of this section.

(2) A copy of the determination must be published in the Gazette.

8G Meaning of disability

In this Part:

disability has the same meaning as in the Disability Discrimination Act 1992.

8H Meaning of designated STS area

(1) For the purposes of this Act, designated STS area means:

(a) a non‑fibre designated STS area; or

(b) a fibre designated STS area.

Note 1: For non‑fibre designated STS area, see subsection (2).

Note 2: For fibre designated STS area, see subsection (6).

Non‑fibre designated STS area

(2) The Minister may, by writing, declare that a specified service area is a non‑fibre designated STS area for the purposes of this Act.

(3) The Minister must not make a declaration under subsection (2) in relation to a service area unless:

(a) a final migration plan is in force; and

(b) the Minister is satisfied that no NBN corporation has installed, is installing, or proposes to install, optical fibre lines to premises in the service area; and

(c) the Minister has made a declaration under section 8J that, in the Minister’s opinion, there are satisfactory alternative contractual arrangements relating to standard telephone services.

(4) A declaration under subsection (2) comes into force at the later of the following times:

(a) when the declaration is made;

(b) the start of the day immediately after the last day on which a resolution referred to in subsection 42(1) of the Legislative Instruments Act 2003 disallowing the section 8J declaration could be passed.

(5) Before making a declaration under subsection (2), the Minister must consult NBN Co.

Fibre designated STS area

(6) The Minister may, by writing, declare that a specified service area is a fibre designated STS area for the purposes of this Act.

(7) The Minister must not make a declaration under subsection (6) in relation to a service area unless:

(a) a final migration plan is in force; and

(b) the Minister is satisfied that an NBN corporation has installed, or is installing, optical fibre lines to premises in the service area; and

(c) the Minister has made a declaration under section 8J that, in the Minister’s opinion, there are satisfactory alternative contractual arrangements relating to standard telephone services.

(8) A declaration under subsection (6) comes into force at the later of the following times:

(a) when the declaration is made;

(b) the start of the day immediately after the last day on which a resolution referred to in subsection 42(1) of the Legislative Instruments Act 2003 disallowing the section 8J declaration could be passed.

(9) Before making a declaration under subsection (6), the Minister must consult NBN Co.

Duty to make declaration

(10) If:

(a) the Minister has made a declaration under section 8J that, in the Minister’s opinion, there are satisfactory alternative contractual arrangements relating to standard telephone services; and

(b) the Minister has the power to make one or more declarations under subsection (2) or (6), or both, of this section;

the Minister must ensure that at least one of those declarations is made within 90 days after the section 8J declaration comes into force.

Consideration of whether to make a declaration

(11) The Minister must, at least once every 6 months during the period:

(a) beginning when the first declaration is made under this section; and

(b) ending at the earliest of the following times:

(i) if Telstra has entered into a contract under section 13 of the Telecommunications Universal Service Management Agency Act 2012 for a purpose relating to the achievement of the policy objective set out in paragraph 11(a) of that Act—when the contract ceases to be in force;

(ii) if any of the provisions of a final migration plan cease to have effect in compliance with the migration plan principles (see section 577BB of the Telecommunications Act 1997)—at the time of that cessation;

(iii) if the Minister makes a declaration under section 48 of the National Broadband Network Companies Act 2011 that, in his or her opinion, the national broadband network should be treated as built and fully operational—when the declaration is made;

consider whether to make a declaration under subsection (2) or (6) of this section.

(12) Subsection (11) does not limit the power of the Minister to make a declaration under this section at any other time.

Declarations

(13) The Minister must cause a declaration under this section to be published on the Department’s website.

(14) A declaration under this section cannot be varied or revoked.

(15) A declaration under this section is not a legislative instrument.

8J Declaration about alternative contractual arrangements relating to standard telephone services

Initial declaration

(1) During the period:

(a) beginning 18 months after the commencement of this section; and

(b) ending 23 months after the commencement of this section;

the Minister must make either of the following declarations:

(c) a declaration that, in his or her opinion, there are satisfactory alternative contractual arrangements relating to standard telephone services;

(d) a declaration that the 18‑month period starting immediately after the declaration is made is the first declaration deferral period for the purposes of this section.

(2) If:

(a) a declaration is made under paragraph (1)(c) or (d); and

(b) the declaration is not in force as at the later of the following times:

(i) the end of the period of 26 months that began at the commencement of this section;

(ii) the start of the day immediately after the last day on which a resolution referred to in subsection 42(1) of the Legislative Instruments Act 2003 disallowing the declaration could be passed;

the 18‑month period starting immediately after the declaration was made is the first declaration deferral period for the purposes of this section.

Subsequent declarations

(3) Before the end of the first declaration deferral period, the Minister must make either of the following declarations:

(a) a declaration that, in his or her opinion, there are satisfactory alternative contractual arrangements relating to standard telephone services;

(b) a declaration that the 18‑month period starting immediately after the declaration is made is the second declaration deferral period for the purposes of this section.

(4) If:

(a) a declaration is made under paragraph (3)(a) or (b); and

(b) the declaration is not in force as at the later of the following times:

(i) the end of the 3‑month period starting immediately after the end of the first declaration deferral period;

(ii) the start of the day immediately after the last day on which a resolution referred to in subsection 42(1) of the Legislative Instruments Act 2003 disallowing the declaration could be passed;

the 18‑month period starting immediately after the declaration was made is the second declaration deferral period for the purposes of this section.

(5) Before the end of the second declaration deferral period, the Minister must make either of the following declarations:

(a) a declaration that, in his or her opinion, there are satisfactory alternative contractual arrangements relating to standard telephone services;

(b) a declaration that, in his or her opinion, there are no satisfactory alternative contractual arrangements relating to standard telephone services.

Criteria for making declaration

(6) The Minister must not make a declaration under paragraph (1)(c), (3)(a) or (5)(a) unless:

(a) Telstra has entered into a contract under section 13 of the Telecommunications Universal Service Management Agency Act 2012; and

(b) the contract was entered into for a purpose relating to the achievement of the policy objective set out in paragraph 11(a) of that Act; and

(c) the contract is in force; and

(d) neither party to the contract has given notice of termination of the contract; and

(e) the Minister is satisfied that Telstra is likely to substantially comply with the contract, having regard to:

(i) Telstra’s record of compliance with its obligations under the contract; and

(ii) the nature of Telstra’s obligations under the contract; and

(iii) Telstra’s record of compliance with its obligations under this Part, to the extent that the obligations relate to the service obligation mentioned in paragraph 9(1)(a); and

(iv) Telstra’s record of compliance with its obligations under Part 5; and

(v) such other matters (if any) as the Minister considers relevant; and

(f) the Minister has obtained advice from:

(i) the ACMA; and

(ii) TUSMA;

about the making of the declaration.

(7) Subparagraphs (6)(e)(iii) and (iv) do not apply to an act, omission, matter or thing that occurs before the commencement of this section.

(8) Subsection (6) does not limit the matters to which the Minister may have regard in making a declaration under this section.

Declarations

(9) A declaration under this section cannot be varied or revoked.

(10) A declaration under this section is a legislative instrument.

8K Declaration about alternative contractual arrangements relating to payphones

Initial declaration

(1) During the period:

(a) beginning 18 months after the commencement of this section; and

(b) ending 23 months after the commencement of this section;

the Minister must make either of the following declarations:

(c) a declaration that, in his or her opinion, there are satisfactory alternative contractual arrangements relating to payphones;

(d) a declaration that the 18‑month period starting immediately after the declaration is made is the first declaration deferral period for the purposes of this section.

(2) If:

(a) a declaration is made under paragraph (1)(c) or (d); and

(b) the declaration is not in force as at the later of the following times:

(i) the end of the period of 26 months that began at the commencement of this section;

(ii) the start of the day immediately after the last day on which a resolution referred to in subsection 42(1) of the Legislative Instruments Act 2003 disallowing the declaration could be passed;

the 18‑month period starting immediately after the declaration was made is the first declaration deferral period for the purposes of this section.

Subsequent declarations

(3) Before the end of the first declaration deferral period, the Minister must make either of the following declarations:

(a) a declaration that, in his or her opinion, there are satisfactory alternative contractual arrangements relating to payphones;

(b) a declaration that the 18‑month period starting immediately after the declaration is made is the second declaration deferral period for the purposes of this section.

(4) If:

(a) a declaration is made under paragraph (3)(a) or (b); and

(b) the declaration is not in force as at the later of the following times:

(i) the end of the 3‑month period starting immediately after the end of the first declaration deferral period;

(ii) the start of the day immediately after the last day on which a resolution referred to in subsection 42(1) of the Legislative Instruments Act 2003 disallowing the declaration could be passed;

the 18‑month period starting immediately after the declaration was made is the second declaration deferral period for the purposes of this section.

(5) Before the end of the second declaration deferral period, the Minister must make either of the following declarations:

(a) a declaration that, in his or her opinion, there are satisfactory alternative contractual arrangements relating to payphones;

(b) a declaration that, in his or her opinion, there are no satisfactory alternative contractual arrangements relating to payphones.

Criteria for making declaration

(6) The Minister must not make a declaration under paragraph (1)(c), (3)(a) or (5)(a) unless:

(a) Telstra has entered into a contract under section 13 of the Telecommunications Universal Service Management Agency Act 2012; and

(b) the contract was entered into for a purpose relating to the achievement of the policy objective set out in paragraph 11(b) of that Act; and

(c) the contract is in force; and

(d) neither party to the contract has given notice of termination of the contract; and

(e) the Minister is satisfied that Telstra is likely to substantially comply with the contract, having regard to:

(i) Telstra’s record of compliance with its obligations under the contract; and

(ii) the nature of Telstra’s obligations under the contract; and

(iii) Telstra’s record of compliance with its obligations under this Part, to the extent that the obligations relate to the service obligation mentioned in paragraph 9(1)(b); and

(iv) such other matters (if any) as the Minister considers relevant; and

(f) the Minister has obtained advice from:

(i) the ACMA; and

(ii) TUSMA;

about the making of the declaration.

(7) Subparagraph (6)(e)(iii) does not apply to an act, omission, matter or thing that occurs before the commencement of this section.

(8) Subsection (6) does not limit the matters to which the Minister may have regard in making a declaration under this section.

Declarations

(9) A declaration under this section cannot be varied or revoked.

(10) A declaration under this section is a legislative instrument.

Division 2—Universal service obligation

Subdivision A—What is the universal service obligation?

9 Universal service obligation

(1) For the purposes of this Act, the universal service obligation is the obligation:

(a) to ensure that standard telephone services are reasonably accessible to all people in Australia (other than people in designated STS areas) on an equitable basis, wherever they reside or carry on business; and

(b) to ensure that payphones are reasonably accessible to all people in Australia on an equitable basis, wherever they reside or carry on business.

(2) The obligation mentioned in paragraph (1)(a) includes the obligation to supply standard telephone services to people in Australia (other than people in designated STS areas) on request.

(2A) The obligation mentioned in paragraph (1)(b) includes the obligation to supply, install and maintain payphones in Australia.

(2AA) If:

(a) the Minister makes a declaration under section 8K that, in the Minister’s opinion, there are satisfactory alternative contractual arrangements relating to payphones; and

(b) neither House of the Parliament passes a resolution under section 42 of the Legislative Instruments Act 2003 disallowing the declaration;

an obligation does not arise under paragraph (1)(b) or subsection (2A) of this section after the last day on which such a resolution could have been passed by a House of the Parliament.

(2C) An obligation does not arise under paragraph (1)(a) or subsection (2) in relation to the supply of a standard telephone service to a person on request unless the request complies with the requirements (if any) set out in a determination under subsection (2D).

(2D) The Minister may, by legislative instrument, determine requirements for the purposes of subsection (2C).

(2E) An obligation does not arise under paragraph (1)(a) or subsection (2) in relation to the supply of a standard telephone service in the circumstances (if any) specified in a determination under subsection (3).

(3) The Minister may, by legislative instrument, determine circumstances for the purposes of subsection (2E).

(4) An obligation does not arise under paragraph (1)(a) or subsection (2) in relation to particular equipment, goods or services the supply of which is treated under section 9E as the supply of a standard telephone service if the customer concerned requests not to be supplied with the equipment, goods or services.

(6) To avoid doubt, an obligation arising under paragraph (1)(a) or subsection (2) in relation to customer equipment requires the customer concerned to be given the option of hiring the equipment.

9B What is a service obligation?

(1) Unless the Minister makes a determination under subsection (2), each of the following is a service obligation:

(a) the obligation referred to in paragraph 9(1)(a) (dealing with the standard telephone services);

(b) the obligation referred to in paragraph 9(1)(b) (dealing with payphones).

(2) The Minister may, by legislative instrument, determine the service obligations by dividing the universal service obligation in another way.

(3) The determination must also specify, in respect of each service obligation, what must be supplied or done in order to fulfil the service obligation.

9C Payphones

For the purposes of this Part, a payphone is a fixed telephone that:

(a) is a means by which a standard telephone service is supplied; and

(b) when in normal working order, cannot be used to make a telephone call (other than a free call or a call made with operator assistance) unless, as payment for the call, or to enable payment for the call to be collected:

(i) money, or a token, card or other object, has been put into a device that forms part of, is attached to, or is located near, the telephone; or

(ii) an identification number, or a code or other information (in numerical or any other form) has been input into a device that forms part of, is attached to, or is located near, the telephone; or

(iii) a prescribed act has been done.

9E Supply of standard telephone services

(1) A reference in this Part to the supply of a standard telephone service includes a reference to the supply of:

(a) if the regulations prescribe customer equipment for the purposes of this paragraph—whichever of the following is applicable:

(i) that customer equipment;

(ii) if other customer equipment is supplied, instead of the first‑mentioned customer equipment, in order to comply with the Disability Discrimination Act 1992—that other customer equipment; and

(b) if paragraph (a) does not apply—whichever of the following is applicable:

(i) a telephone handset that does not have switching functions;

(ii) if other customer equipment is supplied, instead of such a handset, in order to comply with the Disability Discrimination Act 1992—that other customer equipment; and

(c) other goods of a kind specified in the regulations; and

(d) services of a kind specified in the regulations;

where the equipment, goods or services, as the case may be, are for use in connection with the standard telephone service.

(2) A reference in this Part to the supply of a standard telephone service includes a reference to the supply, to a person with a disability, of:

(a) customer equipment of a kind specified in the regulations; and

(b) other goods of a kind specified in the regulations; and

(c) services of a kind specified in the regulations;

where the equipment, goods or services, as the case may be, are for use in connection with the standard telephone service.

Subdivision B—Universal service areas

9G Universal service areas

(1) The Minister may make a written determination that a service area, determined in any way the Minister considers appropriate, is a universal service area in respect of one or more specified service obligations.

Note: In some circumstances, the Minister will be taken to have made a determination under this section: see subsections (3), (4), (5) and (6), and section 12E.

(2) In determining universal service areas, the Minister must ensure that no universal service area in respect of a service obligation overlaps to any extent with any other universal service area in respect of that service obligation.

(3) If, at a particular time, any areas of Australia (other than designated STS areas) are not within a universal service area, covered by a determination under subsection (1), in respect of the service obligation mentioned in paragraph 9B(1)(a):

(a) those areas together constitute at that time a single universal service area in respect of that service obligation; and

(b) the Minister is taken to have made a determination under subsection (1) to that effect.

(4) If, at a particular time, one or more of the universal service areas, in respect of which the Minister is taken to have made a determination because of subsection (3), cover the same areas of Australia, then despite that subsection:

(a) those areas together constitute at that time a single universal service area in respect of the service obligation mentioned in paragraph 9B(1)(a); and

(b) the Minister is taken to have made a determination under subsection (1) to that effect.

(5) If, at a particular time, any areas of Australia are not within a universal service area, covered by a determination under subsection (1), in respect of the service obligation mentioned in paragraph 9B(1)(b):

(a) those areas together constitute at that time a single universal service area in respect of that service obligation; and

(b) the Minister is taken to have made a determination under subsection (1) to that effect.

(6) If, at a particular time, one or more of the universal service areas, in respect of which the Minister is taken to have made a determination because of subsection (5), cover the same areas of Australia, then despite that subsection:

(a) those areas together constitute at that time a single universal service area in respect of the service obligation mentioned in paragraph 9B(1)(b); and

(b) the Minister is taken to have made a determination under subsection (1) to that effect.

(7) A determination under this section is a legislative instrument.

(8) Despite subsection (7), a determination that the Minister is taken to have made is not a legislative instrument.

(9) The Minister must cause a determination that the Minister is taken to have made to be published on the Department’s website.

9H Effect of determination

(1) A determination under section 9G takes effect on the day specified in the determination. That day must not be before the day on which notice of the determination is published in the Gazette.

(2) If the determination is expressed to cease to have effect at a specified time, the determination ceases to have effect at that time.

(3) A variation or revocation of a determination under section 9G takes effect on the day specified for the purpose in the instrument of variation or revocation. That day must not be before notice of the instrument is published in the Gazette.

9J Transitional arrangements may be determined

(1) If the Minister revokes a determination under section 9G, the Minister may determine in writing arrangements to deal with any issues of a transitional nature that may arise as a result of the revocation.

(2) A copy of a determination under subsection (1) must be published in the Gazette.

Division 4—The arrangements for fulfilling the universal service obligation

11 The arrangements that apply to universal service areas

(1) This section sets out the arrangements for the fulfilment of the universal service obligation by universal service providers.

(2) The default arrangements set out in Division 5 apply to each universal service area in respect of a service obligation.

(3) If the Minister determines under section 11C, for a universal service area in respect of a service obligation, that the obligation is a contestable service obligation, then:

(a) the default arrangements set out in Division 5 apply to the area; and

(b) the standard contestability arrangements set out in Division 6 apply to the area in respect of the contestable service obligation.

(4) If the Minister determines under Division 7 that alternative arrangements apply to a universal service area in respect of a service obligation (whether or not it is a contestable service obligation), then:

(a) those alternative arrangements apply to the area; and

(b) the default arrangements set out in Division 5 apply to the area except to the extent that the determination modifies the way those arrangements apply, or excludes them from applying, to the area.

11A Universal service providers

(1) For the purposes of this Part, a universal service provider means:

(a) a primary universal service provider (see section 12A); or

(b) a competing universal service provider (see section 13A).

(2) For the purposes of this Part, a person who is a primary universal service provider under a determination that is in force under section 12A, at any time during a claim period, is:

(a) a universal service provider for the claim period; and

(b) a primary universal service provider for the claim period.

(3) For the purposes of this Part, a person who is approved as a competing universal service provider under section 13B, at any time during a claim period, is:

(a) a universal service provider for the claim period; and

(b) a competing universal service provider for the claim period.

11B Former universal service provider may be required to provide information to current universal service provider

(1) This section applies if:

(a) either:

(i) the Minister determines under section 12A that a carrier or carriage service provider (the current provider) is the primary universal service provider for a universal service area (the relevant area) in respect of a service obligation; or

(ii) the ACMA approves a carrier or carriage service provider (the current provider) under section 13B as a competing universal service provider for a universal service area (the relevant area) in respect of a contestable service obligation; and

(b) another person, who is or was a universal service provider for the area in respect of the obligation, is determined to be a former provider under subsection (2B).

Note: The Minister may be taken to have made a determination under section 12A if an agreement is made under section 56 or 57 of the Telstra Corporation Act 1991: see section 12E.

(2) This section also applies if:

(a) any of the following applies:

(i) the Minister revokes or varies a determination under section 12A so that a person (the former provider) ceases to be a universal service provider for a universal service area (the relevant area) in respect of a service obligation; or

(ii) the ACMA revokes or varies an approval under section 13B so that a person (the former provider) ceases to be a universal service provider for a universal service area (the relevant area) in respect of a service obligation; or

(iii) a person (the former provider) otherwise ceases to be a universal service provider for a universal service area (the relevant area) in respect of a service obligation; and

(b) another person (the current provider), who was also a universal service provider for the relevant area in respect of the service obligation, continues to be a universal service provider for the area in respect of that obligation:

(i) if subparagraph (a)(i) or (ii) applies—after the revocation or variation; or

(ii) if subparagraph (a)(iii) applies—after the cessation.

(2A) Subsections (1) and (2) can apply before the determination, revocation or variation under section 12A or the approval, revocation or variation under section 13B takes effect.

(2B) The Minister may determine in writing that a person is a former provider for the purposes of this section.

(3) The current provider may, by written notice given to the former provider, require the former provider to give to the current provider specified information of the kind referred to in subsection (4). A notice of this kind cannot be given more than 6 months after:

(a) if subsection (1) applies—the later of the following days:

(i) the day on which the current provider became a universal service provider for the relevant area; or

(ii) the day on which the determination under section 12A was made, or the approval under section 13B was given, (as the case may be) in respect of the current provider; or

(b) if subsection (2) applies—the day on which the former provider ceases to be a universal service provider for the relevant area.

(4) The information that may be required to be given must be information that will assist the current provider in doing something that the current provider is or will be required or permitted to do by or under a provision of this Part. The notice must identify the doing of that thing as the purpose for which the information is required.

Note 1: If, for example, information about service location and customer contact details will assist the current provider in fulfilling its obligation under subsection 12C(1), the former provider may be required to provide that kind of information.

Note 2: See also subsection (6), which allows the Minister to determine that a specified kind of information is information referred to in this subsection.

(5) If a requirement made by a notice under subsection (3) is reasonable, the former provider must comply with the requirement as soon as practicable after receiving the notice. However, if the requirement is unreasonable, the former provider does not have to comply with it.

(6) The Minister may, by legislative instrument, make a determination to the effect that, either generally or in a particular case, information of a kind specified in the determination is taken to be information that will assist a person in doing a specified thing that the person is or will be required or permitted to do by or under a provision of this Part. The determination has effect accordingly.

(6A) If a former provider has been given notice of a requirement under subsection (3), the ACMA may, in writing, direct the former provider to comply with the requirement or with specified aspects of the requirement. The former provider must comply with the direction.

(6B) In deciding whether to give a direction under subsection (6A), the ACMA must consider whether the requirement under subsection (3) is reasonable.

11C Determination of contestable service obligation

(1) The Minister may, by legislative instrument, determine, for a universal service area in respect of a service obligation, that the obligation is a contestable service obligation.

Note 1: This means that the standard contestability arrangements apply to the area in respect of the contestable service obligation (see subsection 11(3)).

Note 2: The Minister can make determinations under this section initially only in relation to pilot areas (see section 11F).

(2) The Minister must give to the ACMA a copy of each determination made under this section.

11D Effect of determination

(1) A determination under section 11C takes effect on the day specified in the determination. That day must not be before the day on which notice of the determination is published in the Gazette.

(2) If a determination under section 11C is expressed to cease to have effect at a specified time, the determination ceases to have effect at that time.

(3) A variation or revocation of a determination under section 11C takes effect on the day specified for the purpose in the instrument of variation or revocation. That day must not be before the day on which notice of the instrument is published in the Gazette.

11E Transitional arrangements may be determined

(1) If the Minister revokes a determination under section 11C, the Minister may determine in writing arrangements to deal with any issues of a transitional nature that may arise as a result of the revocation.

(2) A copy of a determination under subsection (1) must be published in the Gazette.

11F Section 11C temporarily limited to pilot areas

(1) Until the Minister has done both of the following, the Minister can make determinations under section 11C only in relation to pilot areas (as defined in subsection (2)):

(a) received a comprehensive report, following a public inquiry by the ACMA, on whether a net benefit has accrued from the operation, for a period not less than 12 months, of the standard contestability arrangements in each of the pilot areas;

(b) caused the report to be tabled in each House of the Parliament within 10 sitting days of that House after the Minister receives the report.

(2) A pilot area is an area determined in writing by the Minister for the purposes of this section. The Minister may determine a maximum of 2 pilot areas and cannot later change the boundaries of a pilot area.

(3) Before the Minister can make any determination under section 11C in relation to a pilot area, the Minister must have determined under section 9G one or more universal service areas that cover the whole of the pilot area.

(4) A copy of a determination under subsection (2) must be published in the Gazette.

Division 5—The default arrangements: primary universal service providers

Subdivision A—What are the default arrangements?

12 The default arrangements

The default arrangements consist of the arrangements set out in this Division.

Note: These apply to each universal service area except to the extent that a determination of alternative arrangements modifies the way they apply, or excludes them from applying, to the area (see subsection 11(4)).

Subdivision B—Primary universal service providers

12A Determination of primary universal service providers

(1) The Minister may determine in writing that a specified carrier or carriage service provider is the primary universal service provider for a universal service area in respect of a service obligation.

(2) The Minister may determine:

(a) different primary universal service providers in respect of different service obligations for the same universal service area; and

(b) the same person as the primary universal service provider for one or more universal service areas in respect of one or more service obligations.

(3) In exercising his or her powers under this section, the Minister must ensure that at all times there is one primary universal service provider, in respect of each service obligation, for each universal service area.

(4) In deciding whether to make a determination that a person is a primary universal service provider, the Minister is limited to considering factors that are relevant to achieving the objects of this Act.

(5) The Minister must give to the person and to the ACMA a copy of the determination.

(6) A determination under this section is a legislative instrument.

Note: A determination that the Minister is taken to have made under this section because of section 12D or 12E is not a legislative instrument (see subsections 12D(2) and 12E(6)).

12B Effect of determination

(1) A determination under section 12A takes effect on the day specified in the determination. That day must not be before the day on which notice of the determination is published in the Gazette.

(2) If such a determination is expressed to cease to have effect at a specified time, the determination ceases to have effect at that time.

(3) A variation or revocation of a determination under section 12A takes effect on the day specified for the purpose in the instrument of variation or revocation. That day must not be before notice of the instrument is published in the Gazette.

(4) If the Minister revokes a determination under section 12A, the Minister may determine in writing arrangements to deal with any issues of a transitional nature that may arise as a result of the revocation.

(5) A copy of a determination under subsection (4) must be published in the Gazette.

12C Obligations of primary universal service providers

(1) A primary universal service provider for a universal service area in respect of a service obligation must:

(a) fulfil that service obligation, so far as it relates to that area; and

(b) comply with:

(i) the provider’s approved policy statement; and

(ii) the approved standard marketing plan of the provider that covers that area in respect of that service obligation; and

(iii) the approved ATS marketing plan (if any) of the provider that covers that area in respect of that service obligation.

Note 1: For the meaning of approved policy statement and approved standard marketing plan, see section 12F.

Note 2: For the meaning of approved ATS marketing plan, see section 12P.

(1A) A primary universal service provider for a universal service area in respect of a service obligation, who fulfils that service obligation by supplying alternative telecommunications services in accordance with an approved ATS marketing plan, is taken to have fulfilled any other obligation that arises under this Act because of that service obligation to the extent that the other obligation applies to the supply of alternative telecommunications services.

(2) The ACMA may determine in writing requirements that a primary universal service provider must comply with if the provider intends to cease supplying alternative telecommunications services in accordance with an approved ATS marketing plan. A copy of the determination must be given to the provider.

(3) The provider must comply with those requirements (as well as any requirements in the plan).

12D Transitional: when Telstra is taken to be a primary universal service provider

(1) Until:

(a) a determination of a primary universal service provider under section 12A; or

(b) a deemed determination of a primary universal service provider under section 12E;

takes effect for the first time for a universal service area in respect of a service obligation, the Minister is taken to have made a determination under section 12A that Telstra is the primary universal service provider for that area in respect of that service obligation.

(2) Despite subsection 12A(6), the determination that the Minister is taken to have made is not a legislative instrument. Instead, a notice must be published in the Gazette to the effect that Telstra is the primary universal service provider for the area in respect of that service obligation.

12E Effect of certain agreements under the Telstra Corporation Act 1991

(1) This section applies to agreements under section 56 or 57 of the Telstra Corporation Act 1991 made between the Commonwealth and a person (including a State or Territory) that are expressed to also have effect for the purposes of:

(a) this subsection; or

(b) subsection 20(2B) of this Act as in force immediately before the commencement of Schedule 1 to the Telecommunications (Consumer Protection and Service Standards) Amendment Act (No. 2) 2000.

(2) The Minister is taken to have properly made:

(a) a determination under section 9G that each of the areas, specified in the agreement as a universal service area in respect of a service obligation, is a universal service area in respect of that service obligation for the purposes of this Act; and

(b) a determination under section 12A that the person is a primary universal service provider for each of the areas, in respect of the service obligation or obligations, specified in the agreement.

Those determinations are referred to in this section as deemed determinations.

(3) The deemed determinations take effect as follows:

(a) if the commencement date (see subsection (4)) is the same for each of the areas—they take effect on that commencement date; or

(b) if there are different commencement dates for different areas—they take effect for those different areas on those different dates.

(4) The commencement date or dates for an area is or are as follows:

(a) if the agreement specifies a single date as the commencement date for the area—subject to paragraph (c), the commencement date for the area is the specified date;

(b) if the agreement specifies different dates as the commencement dates for different areas—subject to paragraph (c), the commencement dates for those areas are the specified dates;

(c) if a determination under subsection (5) specifies a date as the commencement date for the area or areas—the commencement date for the area or areas is the specified date (regardless of any dates specified in the agreement).

A commencement date cannot be a date before the agreement is made, or before the commencement of this subsection or the subsection referred to in paragraph (1)(a).

(5) The Minister may make a written determination specifying a date as the commencement date for the area or areas specified in the agreement as universal service areas. A copy of the determination must be published in the Gazette.

(6) Despite subsections 9G(7) and 12A(6), the deemed determinations are not legislative instruments. Instead, a notice must be published in the Gazette that:

(a) states that the person is a primary universal service provider for the area or areas concerned, in respect of the service obligation or obligations concerned; and

(b) includes the relevant commencement date or dates.

(7) However, a variation or revocation of a deemed determination is a legislative instrument.

(8) This section applies to an agreement whether made before, on or after the commencement of Schedule 1 to the Telecommunications (Consumer Protection and Service Standards) Amendment Act (No. 2) 2000.

12EA Exclusive access to universal service subsidy

(1) If a person is a primary universal service provider for a universal service area in respect of a service obligation because of subsection 12E(2):

(a) the Minister must not determine any other person to be a primary universal service provider; and

(b) the ACMA must not approve any other person as a competing universal service provider;

for that area in respect of that service obligation.

(2) Subsection (1) applies while the agreement referred to in subsection 12E(2) remains in force in relation to that area but no longer than 3 years after the commencement date for the area.

(3) This section applies despite anything else in this Part.

Subdivision BA—Standard telephone service requirements

12EB Performance standards

Determination

(1) The Minister may make a written determination setting out standards to be complied with by a primary universal service provider in relation to any or all of the following matters:

(a) the terms and conditions of the supply of a standard telephone service to a customer, other than price‑related terms and conditions;

(b) the reliability of a standard telephone service supplied to a customer;

(c) the supply of a temporary standard telephone service to a customer;

(d) the maximum period within which a primary universal service provider must supply a standard telephone service following the making of a request by a prospective customer;

(e) the maximum period within which a primary universal service provider must rectify a fault or service difficulty relating to a standard telephone service following the making of a report by a customer about the fault or service difficulty;

(f) any other matter concerning the supply, or proposed supply, of a standard telephone service to a customer or prospective customer.

(2) A determination under subsection (1) may be of general application or may be limited as provided in the determination.

(3) Subsection (2) does not, by implication, limit subsection 33(3A) of the Acts Interpretation Act 1901.

Compliance

(4) A primary universal service provider must comply with a standard in force under subsection (1).

Determination prevails over inconsistent instruments

(5) Each of the following instruments:

(a) an approved policy statement for a primary universal service provider;

(b) an approved standard marketing plan for a primary universal service provider;

has no effect to the extent to which the instrument is inconsistent with a determination in force under subsection (1).

Service supplied in fulfilment of the universal service obligation

(6) This section does not apply to a standard telephone service unless the service is supplied, or proposed to be supplied, in fulfilment of the universal service obligation.

Note: See also section 6A (when a standard telephone service is supplied in fulfilment of the universal service obligation).

Determination is a legislative instrument

(7) A determination under subsection (1) is a legislative instrument.

12EC Performance benchmarks

Determination

(1) The Minister may make a written determination setting out standards to be complied with by a primary universal service provider in relation to any or all of the following matters:

(a) the terms and conditions of the supply of a standard telephone service to a customer, other than price‑related terms and conditions;

(b) the reliability of a standard telephone service supplied to a customer;

(c) the supply of a temporary standard telephone service to a customer;

(d) the maximum period within which a primary universal service provider must supply a standard telephone service following the making of a request by a prospective customer;

(e) the maximum period within which a primary universal service provider must rectify a fault or service difficulty relating to a standard telephone service following the making of a report by a customer about the fault or service difficulty;

(f) any other matter concerning the supply, or proposed supply, of a standard telephone service to a customer or prospective customer.

(2) A determination under subsection (1) may be of general application or may be limited as provided in the instrument.

(3) Subsection (2) does not, by implication, limit subsection 33(3A) of the Acts Interpretation Act 1901.

Determination prevails over inconsistent instruments

(4) Each of the following instruments:

(a) an approved policy statement for a primary universal service provider;

(b) an approved standard marketing plan for a primary universal service provider;

has no effect to the extent to which the instrument is inconsistent with a determination in force under subsection (1).

Determination is a legislative instrument

(5) A determination under subsection (1) is a legislative instrument.

Performance benchmarks

(6) The Minister may, by legislative instrument, set minimum benchmarks in relation to compliance by a primary universal service provider with a standard in force under subsection (1).

(7) An instrument under subsection (6) may be of general application or may be limited as provided in the instrument.

(8) Subsection (7) does not, by implication, limit subsection 33(3A) of the Acts Interpretation Act 1901.

Provider must meet or exceed minimum benchmarks

(9) A primary universal service provider must meet or exceed a minimum benchmark set by an instrument under subsection (6).

Clause 1 of Schedule 1 to the Telecommunications Act 1997 does not apply to a breach of a standard

(10) Clause 1 of Schedule 1 to the Telecommunications Act 1997 does not apply to a contravention of a standard in force under subsection (1).

Note: Clause 1 of Schedule 1 to the Telecommunications Act 1997 requires carriers to comply with this Act.

Clause 1 of Schedule 2 to the Telecommunications Act 1997 does not apply to a breach of a standard

(11) Clause 1 of Schedule 2 to the Telecommunications Act 1997 does not apply to a contravention of a standard in force under subsection (1).

Note: Clause 1 of Schedule 2 to the Telecommunications Act 1997 requires carriage service providers to comply with this Act.

Subdivision BB—Payphone requirements

12ED Performance standards

Determination

(1) The Minister may make a written determination setting out standards to be complied with by a primary universal service provider in relation to any or all of the following matters:

(a) the characteristics of a payphone carriage service;

(b) the supply, installation or maintenance of a payphone;

(c) the supply of a payphone carriage service;

(d) the reliability of a payphone;

(e) the reliability of a payphone carriage service;

(f) the maximum period within which a primary universal service provider must rectify a fault or service difficulty relating to a payphone following the making of a report about a fault or service difficulty;

(g) the maximum period within which a primary universal service provider must rectify a fault or service difficulty relating to a payphone carriage service following the making of a report about a fault or service difficulty;

(h) the handling of requests for the removal of a payphone;

(i) any other matter concerning:

(i) the supply, installation or maintenance of a payphone; or

(ii) the supply of a payphone carriage service.

(2) A determination under subsection (1) may be of general application or may be limited as provided in the determination.

(3) Subsection (2) does not, by implication, limit subsection 33(3A) of the Acts Interpretation Act 1901.

Compliance

(4) A primary universal service provider must comply with a determination under subsection (1).

Determination prevails over inconsistent instruments

(5) Each of the following instruments:

(a) an approved policy statement for a primary universal service provider;

(b) an approved standard marketing plan for a primary universal service provider;

has no effect to the extent to which the instrument is inconsistent with a determination in force under subsection (1).

Determination is a legislative instrument

(6) A determination under subsection (1) is a legislative instrument.

12EE Performance benchmarks

Determination

(1) The Minister may make a written determination setting out standards to be complied with by a primary universal service provider in relation to any or all of the following matters:

(a) the characteristics of a payphone carriage service;

(b) the supply, installation or maintenance of a payphone;

(c) the supply of a payphone carriage service;

(d) the reliability of a payphone;

(e) the reliability of a payphone carriage service;

(f) the maximum period within which a primary universal service provider must rectify a fault or service difficulty relating to a payphone following the making of a report about a fault or service difficulty;

(g) the maximum period within which a primary universal service provider must rectify a fault or service difficulty relating to a payphone carriage service following the making of a report about a fault or service difficulty;

(h) the handling of requests for the removal of a payphone;

(i) any other matter concerning:

(i) the supply, installation or maintenance of a payphone; or

(ii) the supply of a payphone carriage service.

(2) A determination under subsection (1) may be of general application or may be limited as provided in the determination.

(3) Subsection (2) does not, by implication, limit subsection 33(3A) of the Acts Interpretation Act 1901.

Determination prevails over inconsistent instruments

(4) Each of the following instruments:

(a) an approved policy statement for a primary universal service provider;

(b) an approved standard marketing plan for a primary universal service provider;

has no effect to the extent to which the instrument is inconsistent with a determination in force under subsection (1).

Determination is a legislative instrument

(5) A determination under subsection (1) is a legislative instrument.

Performance benchmarks

(6) The Minister may, by legislative instrument, set minimum benchmarks in relation to compliance by a primary universal service provider with a standard in force under subsection (1).

(7) An instrument under subsection (6) may be of general application or may be limited as provided in the instrument.

(8) Subsection (7) does not, by implication, limit subsection 33(3A) of the Acts Interpretation Act 1901.

Provider must meet or exceed minimum benchmarks

(9) A primary universal service provider must meet or exceed a minimum benchmark set by an instrument under subsection (6).

Clause 1 of Schedule 1 to the Telecommunications Act 1997 does not apply to a breach of a standard

(10) Clause 1 of Schedule 1 to the Telecommunications Act 1997 does not apply to a contravention of a standard in force under subsection (1).

Note: Clause 1 of Schedule 1 to the Telecommunications Act 1997 requires carriers to comply with this Act.

Clause 1 of Schedule 2 to the Telecommunications Act 1997 does not apply to a breach of a standard

(11) Clause 1 of Schedule 2 to the Telecommunications Act 1997 does not apply to a contravention of a standard in force under subsection (1).

Note: Clause 1 of Schedule 2 to the Telecommunications Act 1997 requires carriage service providers to comply with this Act.

12EF Rules about the location of payphones

(1) The Minister may make a determination setting out rules to be complied with by a primary universal service provider in relation to the places or areas in which payphones are to be located.

Compliance

(2) A primary universal service provider must comply with a determination under subsection (1).

(3) If a primary universal service provider complies with a determination under subsection (1), the provider is taken to have complied with an obligation under paragraph 9(1)(b) or subsection 9(2A), to the extent to which the obligation relates to the location of payphones.

Determination prevails over inconsistent instruments

(4) Each of the following instruments:

(a) an approved policy statement for a primary universal service provider;

(b) an approved standard marketing plan for a primary universal service provider;

has no effect to the extent to which the instrument is inconsistent with a determination in force under subsection (1).

Determination is a legislative instrument

(5) A determination under subsection (1) is a legislative instrument.

12EG Rules about the process for public consultation on the location or removal of payphones

(1) The Minister may make a determination setting out rules to be complied with by a primary universal service provider in relation to the process for public consultation on the location or removal of payphones.

(2) The Minister must ensure that a determination under subsection (1) provides that, if:

(a) a primary universal service provider makes a decision to remove a payphone from a particular location; and

(b) that payphone is the only payphone at that location;

then:

(c) the provider must undertake a process for public consultation on the removal of that payphone; and

(d) if, in accordance with that process, a person makes a submission to the provider—the provider must notify the person, in writing, of the outcome of that process.

Compliance

(3) A primary universal service provider must comply with a determination under subsection (1).

Determination prevails over inconsistent instruments

(4) Each of the following instruments:

(a) an approved policy statement for a primary universal service provider;

(b) an approved standard marketing plan for a primary universal service provider;

has no effect to the extent to which the instrument is inconsistent with a determination in force under subsection (1).

Determination is a legislative instrument

(5) A determination under subsection (1) is a legislative instrument.

12EH Rules about the process for resolution of complaints about the location or removal of payphones

(1) The Minister may make a determination setting out rules to be complied with by a primary universal service provider in relation to the process for resolution of complaints about the location or removal of payphones.

Compliance

(2) A primary universal service provider must comply with a determination under subsection (1).

Determination prevails over inconsistent instruments

(3) Each of the following instruments:

(a) an approved policy statement for a primary universal service provider;

(b) an approved standard marketing plan for a primary universal service provider;

has no effect to the extent to which the instrument is inconsistent with a determination in force under subsection (1).

Determination is a legislative instrument

(4) A determination under subsection (1) is a legislative instrument.

12EI Directions by the ACMA about the removal of payphones

Scope

(1) This section applies if:

(a) a primary universal service provider has made a decision to remove a payphone from a particular location; and

(b) a person notifies the ACMA, in writing, that the person objects to the removal; and

(c) the ACMA is satisfied that:

(i) the removal would breach, or has breached, a determination under subsection 12EF(1); or

(ii) the provider has breached a determination under subsection 12EG(1) in relation to the removal.

Direction

(2) If the payphone has not been removed, the ACMA may, by written notice given to the provider, direct the provider not to remove the payphone from that location.

(3) If the payphone has been removed, the ACMA may, by written notice given to the provider, direct the provider:

(a) to supply and install a payphone at that location; and

(b) to do so within the period specified in the notice.

(4) A period specified under paragraph (3)(b) must not be shorter than 30 days after the notice is given.

(5) A direction under subsection (2) or (3) must not be inconsistent with a determination under subsection 12EF(1).

Compliance

(6) A primary universal service provider must comply with a direction under subsection (2) or (3).

Direction is not a legislative instrument

(7) A direction under subsection (2) or (3) is not a legislative instrument.

Subdivision C—Policy statements and standard marketing plans of primary universal service providers

12F Meaning of expressions