Schedule 1—Denial of certain capital losses

Part 1—Specific past rollover scheme amendment

Income Tax Assessment Act 1936

1 After section 160ZP

Insert:

160ZPA Denial of duplicated capital loss where section 160ZZO rollover relief

Operative provision—first case

(1) Subject to subsection (3), if a company has incurred or incurs any eligible rollover losses and paragraphs (2)(a) and (b) do not apply:

(a) if:

(i) any of the eligible rollover losses was incurred in the 1995‑96 year of income or an earlier year of income; and

(ii) the company incurred a net capital loss in the 1995‑96 year of income; and

(iii) there are one or more unused amounts for that year of income in respect of the eligible rollover losses;

the net capital loss is reduced by the sum of the unused amounts; and

(b) if:

(i) any of the eligible rollover losses was incurred or is incurred in the 1996‑97 year of income or any later year of income; and

(ii) assuming section 160ZZO had not applied to the rollover disposal mentioned in paragraph (4)(a), the eligible rollover loss would have been a lesser amount or there would have been no eligible rollover loss;

the eligible rollover loss is reduced so that it equals the lesser amount, or is reduced to nil, as the case requires.

Note: The expressions eligible rollover loss, net capital loss and unused amount are defined in subsections (4), (8) and (6) respectively.

Operative provision—second case

(2) Subject to subsection (3), if:

(a) a company has incurred any eligible rollover losses in the 1996‑97 year of income or an earlier year of income; and

(b) the company furnished its return for the 1996‑97 year of income before 3 pm, by legal time in the Australian Capital Territory, on 29 April 1997;

the following apply:

(c) if:

(i) the company incurred a net capital loss in the 1995‑96 year of income; and

(ii) there are one or more unused amounts for that year of income in respect of the eligible rollover losses; and

(iii) if, in the company’s return for the 1996‑97 year of income, Step 4 in subsection 160ZC(1) was applied in working out whether a net capital gain accrued to the company in respect of that year of income—there is some of the net capital loss incurred in the 1995‑96 year of income that has not been applied in accordance with Step 4;

then, for the purpose of any application of Step 4 in working out whether a net capital gain accrued to the company in respect of the 1997‑98 or any later year of income, the net capital loss incurred in the 1995‑96 year of income, or so much of the net capital loss as was not applied as mentioned in subparagraph (iii), is reduced by the sum of the unused amounts; and

(d) if the company incurred a net capital loss in the 1996‑97 year of income and any of the eligible rollover losses was also incurred in that year of income—the net capital loss is reduced by the unused amount, for that year of income, in respect of the eligible rollover losses incurred in that year of income.

Commissioner to reduce amount under subsection (1) or (2)

(3) If:

(a) the whole or part of the net capital loss of the company, or of an eligible rollover loss of the company, is reduced under subsection (1) or (2); and

(b) the Commissioner, on application by the company, determines that it is fair and reasonable that the amount should not be so reduced, or should be reduced by a lesser amount, having regard to the following:

(i) whether the company has disposed of, or is likely to dispose of, the interest, right or debt mentioned in paragraph (4)(c);

(ii) the extent to which any eligible rollover losses incurred by the company are related, directly or indirectly, to any other capital losses incurred, or that may be incurred, by the company or any other company that is related to the company;

(iii) the respective amounts of the losses mentioned in subparagraph (ii);

(iv) the content and timing of any information provided to the Commissioner by the company in the application or otherwise;

(v) any other matter that the Commissioner considers relevant;

the amount is not so reduced, or is reduced by the lesser amount.

Eligible rollover loss

(4) A capital loss incurred by a company (the loss company) in a year of income in respect of the disposal (the loss disposal) of an asset is an eligible rollover loss if:

(a) the loss company acquired the asset from another company (the transferor) and section 160ZZO applied to the disposal (the rollover disposal) constituting the acquisition by the loss company; and

(b) if section 160ZZO had not applied to the rollover disposal, there would have been no capital loss or a smaller capital loss; and

(c) when the rollover disposal took place, the loss company:

(i) had an interest (see subsection (7)) either directly, or indirectly through successive interests in interposed companies, in the transferor; or

(ii) was owed a debt by the transferor or had a right to acquire an interest in the transferor; or

(iii) had an interest either directly, or indirectly through successive interests in interposed companies, in a company, partnership or trust to which the transferor owed a debt or that had a right to acquire an interest in the transferor; and

(d) the loss company:

(i) acquired the interest mentioned in subparagraph (c)(i) or (iii) or the right mentioned in subparagraph (c)(ii); or

(ii) began to be owed the debt mentioned in subparagraph (c)(ii);

after 19 September 1985; and

(e) immediately after the rollover disposal, the market value of the interest, right or debt was less than its reduced cost base or what would be its reduced cost base if the interest, right or debt were an asset to whose disposal this Part applied; and

(f) the rollover disposal took place before 3 pm, by legal time in the Australian Capital Territory, on 29 April 1997; and

(g) the loss disposal took place no more than 5 years after the rollover disposal.

Exclusion for small businesses and manufacturing business assets

(5) However, a capital loss is not an eligible rollover loss if:

(a) the requirement in subsection 160ZZPP(4) (which relates to the net value of the transferee’s assets etc.) would be satisfied at the time of the loss disposal, assuming the loss company were the taxpayer mentioned in that section; or

(b) the asset is plant, machinery, or a building, used in a manufacturing business:

(i) by the transferor immediately before the rollover disposal; and

(ii) by the loss company for a period of at least 12 months that commences immediately after the rollover disposal.

Unused amount of all eligible rollover losses incurred in a particular year of income

(6) The unused amount, for a year of income (the test year), of all of the eligible rollover losses incurred by a company in a particular year of income (being the test year or an earlier year of income) is:

(a) if the company did not incur a net capital loss in the test year—nil; or

(b) if the test year is the one in which the company incurred the eligible rollover losses, and the company incurred a net capital loss in that year of income—the amount by which:

(i) the net capital loss;

exceeds:

(ii) the amount that would be the net capital loss assuming section 160ZZO had not applied to any of the rollover disposals concerned or, if there would be no net capital loss on that assumption, nil; or

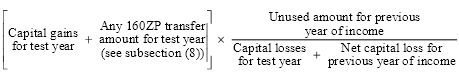

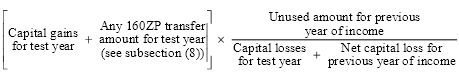

(c) if the test year is after the one in which the company incurred the eligible rollover losses, and the company incurred a net capital loss in the test year—the amount worked out by reducing the unused amount, for the previous year of income, of the eligible rollover losses by the amount calculated using the formula:

Note 1: If the test year is e.g. 2 years after the year of income in which the eligible rollover losses were incurred, it will be necessary first to apply subsection (6) to work out the unused amount for the year in which the losses were incurred, then to work out the unused amount for the next year of income and finally to work out the unused amount for the test year. This will involve applying more than one of the paragraphs in the subsection.

Note 2: The operative provisions (subsections (1) and (2)) refer to the sum of the unused amounts, for e.g. 1995‑96, in relation to eligible rollover losses. To work out the sum, it is first necessary to apply subsection (6) separately to the eligible rollover losses incurred in each year of income in order to work out, for 1995‑96, the unused amount of each, and then to add together all of the unused amounts.

Interest

(7) In this section:

interest means a share in a company or an interest in the income or capital of a partnership or trust.

Net capital loss

(8) For the purposes of this section, a company’s net capital loss is worked out after applying section 160ZP if:

(a) the agreement mentioned in that section was made; and

(b) the gain year mentioned in that section ended;

before 3 pm, by legal time in the Australian Capital Territory, on 29 April 1997. Otherwise it is worked out before applying section 160ZP.

160ZP transfer amount

(9) For the purposes of this section, if a company’s net capital loss for a year of income is worked out in accordance with subsection (8) after applying section 160ZP, the company has a 160ZP transfer amount for the year of income equal to the sum of the amounts by which its net capital loss for the year of income is deemed to be reduced under subsection 160ZP(7).

Part 2—General on‑going rollover etc. scheme amendments

Income Tax Assessment Act 1936

2 Subsection 177A(1)

Insert:

capital loss has the same meaning as in Part IIIA.

3 After paragraph 177C(1)(b)

Insert:

or (ba) a capital loss being incurred by the taxpayer during a year of income where the whole or a part of that capital loss would not have been, or might reasonably be expected not to have been, incurred by the taxpayer during the year of income if the scheme had not been entered into or carried out;

4 At the end of subsection 177C(1)

Add:

; and (e) in a case to which paragraph (ba) applies—the amount of the whole of the capital loss or of the part of the capital loss, as the case may be, referred to in that paragraph.

5 Subparagraph 177C(2)(a)(i)

After “Act”, insert “other than section 160ZP or 160ZZO”.

6 At the end of subsection 177C(2)

Add:

; or (c) a capital loss being incurred by the taxpayer during a year of income the whole or part of which would not have been, or might reasonably be expected not to have been, incurred by the taxpayer during the year of income if the scheme had not been entered into or carried out where:

(i) the incurring of the capital loss by the taxpayer is attributable to the making of a declaration, election or selection, the giving of a notice or the exercise of an option by any person, being a declaration, election, selection, notice or option expressly provided for by this Act other than section 160ZP or 160ZZO; and

(ii) the scheme was not entered into or carried out by any person for the purpose of creating any circumstance or state of affairs the existence of which is necessary to enable the declaration, election, selection, notice or option to be made, given or exercised, as the case may be.

7 After subsection 177C(2)

Insert:

(2A) A reference in this Part to the obtaining by a taxpayer of a tax benefit in connection with a scheme is to be read as not including a reference to:

(a) the assessable income of the taxpayer of a year of income not including an amount that would have been included, or might reasonably be expected to have been included, in the assessable income of the taxpayer of that year of income if the scheme had not been entered into or carried out where:

(i) the non‑inclusion of the amount in the assessable income of the taxpayer is attributable to the making of an agreement under section 160ZP or an election under section 160ZZO; and

(ii) the scheme consisted solely of the making of the agreement or election; or

(b) a capital loss being incurred by the taxpayer during a year of income the whole or part of which would not have been, or might reasonably be expected not to have been, incurred by the taxpayer during the year of income if the scheme had not been entered into or carried out where:

(i) the incurring of the capital loss by the taxpayer is attributable to the making of an agreement under section 160ZP or an election under section 160ZZO; and

(ii) the scheme consisted solely of the making of the agreement or election.

8 Subsection 177C(3)

Repeal the subsection, substitute:

(3) For the purposes of subparagraph (2)(a)(i), (b)(i) or (c)(i) or (2A)(a)(i) or (b)(i):

(a) the non‑inclusion of an amount in the assessable income of a taxpayer; or

(b) the allowance of a deduction to a taxpayer; or

(c) the incurring of a capital loss by a taxpayer;

is taken to be attributable to the making of a declaration, election, agreement or selection, the giving of a notice or the exercise of an option where, if the declaration, election, agreement, selection, notice or option had not been made, given or exercised, as the case may be:

(d) the amount would have been included in that assessable income; or

(e) the deduction would not have been allowable; or

(f) the capital loss would not have been incurred.

9 After paragraph 177F(1)(b)

Insert:

or (c) in the case of a tax benefit that is referable to a capital loss or a part of a capital loss being incurred by the taxpayer during a year of income—determine that the whole or a part of the capital loss or of the part of the capital loss, as the case may be, was not incurred by the taxpayer during that year of income;

10 Subsection 177F(2B)

After “under”, insert “paragraph (1)(c) or”.

11 Subsection 177F(2C)

After “and”, insert “, in the case of a determination under subsection (2A),”.

12 Subsection 177F(2G)

After “under”, insert “paragraph (1)(c) or”.

13 After paragraph 177F(3)(b)

Insert:

or (c) if, in the opinion of the Commissioner:

(i) a capital loss would have been incurred by the relevant taxpayer during a year of income if the scheme had not been entered into or carried out, being a capital loss that was not incurred or would not, but for this subsection, be incurred, as the case may be, by the relevant taxpayer during that year of income; and

(ii) it is fair and reasonable that the capital loss or a part of that capital loss should be incurred by the relevant taxpayer during that year of income;

determine that the capital loss or the part, as the case may be, should be incurred by the relevant taxpayer during that year of income;

14 Application

The amendments made by this Part apply in relation to schemes entered into after 3 pm, by legal time in the Australian Capital Territory, on 29 April 1997.

Schedule 2—FBT exemption for approved student exchange programs

Fringe Benefits Tax Assessment Act 1986

1 At the end of Division 13 of Part III

Add:

58ZB Exempt benefits—approved student exchange programs

(1) Where:

(a) a benefit is provided in, or in respect of, a year of tax in respect of the employment of an employee of an employer; and

(b) the benefit is in respect of participation in an approved student exchange program by the employee or an associate of the employee; and

(c) the employer or an associate of the employer did not select, or take part in the selection of, the employee or associate as a participant in the program;

the benefit is an exempt benefit in relation to the year of tax.

(2) An approved student exchange program is a student exchange program run by a body that is registered as a student exchange body with the relevant State or Territory body in accordance with the National Guidelines for Student Exchange that are published by the National Co‑ordinating Committee for International Secondary Student Exchange.

2 Application

The amendment made by this Schedule applies to the year of tax commencing on 1 April 1996 and all later years of tax.

Schedule 3—Fringe benefits tax

Part 1—Amendment of the Fringe Benefits Tax Assessment Act 1986

1 After section 58G

Insert:

58GA Exempt benefits—small business car parking

Exemption

(1) A car parking benefit provided in an FBT year in respect of the employment of an employee is an exempt benefit if:

(a) the car is not parked at a commercial parking station; and

(b) the employer of the employee is not a public company (see subsection (3)), or a subsidiary of a public company (see subsection (3)), in relation to the day on which the benefit is provided; and

(c) the employer is not a government body; and

(d) the sum of the employer’s ordinary income and statutory income for the year of income ending most recently before the start of the FBT year is less than $10 million.

New employers

(2) However, if the employer:

(a) in the case of a tax‑exempt employer (see subsection (3))—did not start to carry out operations or activities; or

(b) in any other case—did not start to carry out business operations;

until after the start of the year of income mentioned in paragraph (1)(d), then:

(c) paragraph (1)(d) does not apply; and

(d) the employer must make a reasonable estimate of the amount that would be the sum of the employer’s ordinary income and statutory income for the year of income (the business start‑up year) in which the employer did start those operations or activities, or those business operations; and

(e) that estimate is to be made on the assumption that the employer had started the operations or activities, or the business operations, at the start of the business start‑up year; and

(f) the benefit is an exempt benefit only if that estimate is less than $10 million.

Definitions

(3) In this section:

ordinary income has the same meaning as in the Income Tax Assessment Act 1997.

public company means a company covered by paragraph 103A(2)(a) of the Income Tax Assessment Act 1936, but reading the reference in that paragraph to the last day of the year of income as a reference to the day on which the benefit is provided.

statutory income has the same meaning as in the Income Tax Assessment Act 1997.

subsidiary of a public company means a subsidiary of a public company within the meaning of subsection 103A(4) of the Income Tax Assessment Act 1936, but reading:

(a) a reference in section 103A of that Act to a year of income as a reference to the day on which the benefit is provided; and

(b) a reference in that section to a public company as a reference to a public company within the meaning of this section.

tax‑exempt employer means an employer all of whose income is wholly exempt from income tax.

2 Subsection 58Z(1)

Repeal the subsection, substitute:

(1) Any benefit arising from taxi travel by an employee is an exempt benefit if the travel is a single taxi trip beginning or ending at the employee’s place of work.

3 After section 115A

Insert:

115B Penalty tax for making unreasonable estimate of income

If:

(a) under subsection 58GA(2), an employer makes an estimate of an amount; and

(b) the amount of the estimate is less than $10 million; and

(c) the estimate is not a reasonable estimate;

then:

(d) the Commissioner may make a reasonable estimate of that amount (taking into account the assumption in paragraph 58GA(2)(e)); and

(e) if the amount of that reasonable estimate is $10 million or more—the employer is liable to pay, by way of penalty, additional tax equal to double the amount of the tax payable in respect of the benefit.

4 Subsection 136(1) (at the end of paragraphs (c) and (e) of the definition of fringe benefit)

Add “or”.

5 Subsection 136(1) (paragraph (e) of the definition of fringe benefit)

After “arrangement”, insert “covered by paragraph (a) of the definition of arrangement”.

6 Subsection 136(1) (after paragraph (e) of the definition of fringe benefit)

Insert:

(ea) a person other than the employer or an associate of the employer, if the employer or an associate of the employer:

(i) participates in or facilitates the provision or receipt of the benefit; or

(ii) participates in, facilitates or promotes a scheme or plan involving the provision of the benefit;

and the employer or associate knows, or ought reasonably to know, that the employer or associate is doing so;

7 Subsection 136(1) (at the end of paragraphs (f) to (m) (inclusive) of the definition of fringe benefit)

Add “or”.

Part 2—Amendment of the Income Tax Assessment Act 1936

8 Section 51AGB

Repeal the section.

9 Division 4A of Part III

Repeal the Division.

10 Subsection 262A(4AK)

Repeal the subsection.

Part 3—Amendment of the Income Tax Assessment Act 1997

11 Section 12‑5 (list entry relating to car parking)

Repeal the entry, substitute:

car parking | |

employee’s car parking expenses, no deduction for .... | 51AGA |

Part 4—Application

12 Application

(1) The amendments made by items 1, 2 and 3 apply to assessments of the fringe benefits taxable amount of an employer of the FBT year beginning on 1 April 1997 and of all later years.

(2) The amendments made by items 4, 5 and 6 apply to assessments of the fringe benefits taxable amount of an employer of the FBT year beginning on 1 April 1998 and of all later years.

(3) The repeals made by items 9, 10 and 11 apply in relation to expenditure to the extent to which it is incurred in respect of the provision of car parking facilities for a car on a day on or after 1 July 1997.

Schedule 4—Effect of bankruptcy on carrying forward tax offsets

Income Tax Assessment Act 1997

1 At the end of Division 65

Add:

65‑50 Effect of bankruptcy

(1) If during the *current year:

(a) you became bankrupt; or

(b) you were released from debts under a law relating to bankruptcy;

you cannot apply a *tax offset that you have carried forward from an earlier income year in working out the tax offset for the current year or a later income year.

(2) Subsection (1) applies even though your bankruptcy is annulled if:

(a) the annulment happens under section 74 of the Bankruptcy Act 1966 because your creditors have accepted your proposal for a composition or scheme of arrangement; and

(b) under the composition or scheme of arrangement concerned, you were, will be or may be released from debts from which you would have been released if instead you had been discharged from the bankruptcy.

65‑55 Deduction for amounts paid for debts incurred before bankruptcy

(1) If:

(a) you pay an amount in the *current year for a debt that you incurred in an earlier income year; and

(b) you have a *tax offset referred to in section 65‑50 for that earlier income year;

you can deduct the amount paid, but only to the extent that it does not exceed so much of the debt as the Commissioner is satisfied was taken into account in calculating the amount of the tax offset.

(2) The total of the following amounts cannot exceed the total of the expenditure that the Commissioner is satisfied was taken into account in calculating the amount of the *tax offset that you are unable to apply because of section 66‑50:

(a) your deductions under subsection (1) for amounts paid in the *current year or an earlier income year for debts incurred in the income year for which you have the tax offset; and

(b) the expenditure that the Commissioner is satisfied was taken into account in calculating any amounts of the tax offset that, apart from section 65‑50, would have been applied in reducing your *net exempt income for the current year or earlier income years.

2 Application

The amendment made by this Schedule applies to assessments for the 1997‑98 income year and later income years.

Schedule 5—Payments of tax by small companies

Income Tax Assessment Act 1936

1 Section 221AZH (paragraph (a) of the definition of final instalment)

Repeal the paragraph, substitute:

(a) for a small taxpayer—the second instalment specified in Table 1 in subsection 221AZK(2) or the single instalment specified in subsection 221AZK(3A) (as the case requires);

2 Section 221AZH (definition of large taxpayer)

After “of section”, insert “221AZKA or”.

3 Section 221AZH (definition of medium taxpayer)

Omit “to section”, substitute “to sections 221AZKA and”.

4 Section 221AZH (definition of medium taxpayer)

After “section 221AZK”, insert “or because of section 221AZKA”.

5 Section 221AZH

Insert:

reckoning day means:

(a) where:

(i) the current year is the 1997‑98 year of income or a later year of income; and

(ii) on or before the first day of month 9, the taxpayer has not lodged an estimate of the likely tax for the current year or a return for the previous year;

the earlier of the day on which the taxpayer first lodges a return for the previous year and the 15th day of month 9; or

(b) in any other case—the first day of month 9.

6 Section 221AZH (definition of small taxpayer)

After “means”, insert “, subject to section 221AZKA,”.

7 Subsection 221AZK(2)

Omit “An instalment taxpayer”, substitute “Subject to subsection (3A), an instalment taxpayer”.

8 Subsection 221AZK(2) (heading to second column of table)

Omit “first day of month 9”, substitute “reckoning day”.

9 Subsection 221AZK(2) (heading to third column of table)

Omit “due on first day of”, substitute “due on”.

10 Subsection 221AZK(2) (table row relating to small companies)

Repeal the row, substitute:

Small | less than $8,000 | 15th day of month 18 | 100% of likely tax for current year |

| | 15th day of month 21 | assessed tax for current year, less previous instalment for current year |

11 Subsection 221AZK(2) (table rows relating to medium and large companies)

Before “month” (wherever occurring), insert “1st day of”.

12 Paragraph 221AZK(3)(a)

Repeal the paragraph, substitute:

(a) a taxpayer is classified as small, medium or large according to the taxpayer’s likely tax for the current year, calculated at the end of the reckoning day;

Note: Sections 221AZKA and 221AZMA can change a taxpayer’s classification.

13 After subsection 221AZK(3)

Insert:

(3A) A small taxpayer whose assessed tax for the current year is more than $300,000 must pay an instalment on the first day of month 18 equal to 100% of the assessed tax for the current year.

14 Section 221AZKA

Omit “first day of month 9” (wherever occurring), substitute “reckoning day”.

15 Subsection 221AZKA(1)

Omit “first day of month 11”, substitute “end of 2 months after that day”.

16 Application

(1) The amendments made by items 2, 3, 4 and 6 have the same application as they would have had if they had been included in Division 1C of Part VI of the Income Tax Assessment Act 1936 as originally inserted by section 54 of the Taxation Laws Amendment Act (No. 2) 1993.

(2) The amendments made by the remaining items of this Schedule apply for the 1996‑97 year of income and all later years of income.

Schedule 6—Dividend imputation and RSAs

Income Tax Assessment Act 1936

1 Section 160APA

Insert:

standard component has the same meaning as in Division 8 of Part III.

2 After paragraph 160APHB(1)(b)

Insert:

(ba) how much of the company tax assessed to a life assurance company for a year of income is attributable to the standard component;

(bb) how much of an amount of a reduction or increase in the company tax of a life assurance company for a year of income is attributable to the standard component;

3 After paragraph 160APHB(2)(b)

Insert:

Note: The general fund component is made up of the standard component and the RSA component.

4 Section 160APVA

Omit “General fund” (wherever occurring), substitute “Standard”.

5 Section 160APVA

Omit “general fund” (wherever occurring), substitute “standard”.

6 Subsection 160APVBA(2)

Omit “General fund” (wherever occurring), substitute “Standard”.

7 Subsection 160APVBA(2)

Omit “general fund”, substitute “standard”.

8 Subsection 160APVBB(2)

Omit “General fund” (wherever occurring), substitute “Standard”.

9 Subsection 160APVBB(2)

Omit “general fund”, substitute “standard”.

10 Section 160APVC

Omit “General fund” (wherever occurring), substitute “Standard”.

11 Section 160APVC

Omit “general fund” (wherever occurring), substitute “standard”.

12 Section 160APVD

Omit “General fund” (wherever occurring), substitute “Standard”.

13 Section 160APVD

Omit “general fund” (wherever occurring), substitute “standard”.

14 At the end of subsections 160APVH(2) and (5)

Add:

; (c) the assumption that the reference to standard component in the provision concerned were a reference to general fund component.

15 Section 160AQCCA

Omit “General fund” (wherever occurring), substitute “Standard”.

16 Section 160AQCCA

Omit “general fund” (wherever occurring), substitute “standard”.

17 Section 160AQCD

Omit “General fund” (wherever occurring), substitute “Standard”.

18 Section 160AQCD

Omit “general fund” (wherever occurring), substitute “standard”.

19 Section 160AQCE

Omit “General fund” (wherever occurring), substitute “Standard”.

20 Section 160AQCE

Omit “general fund” (wherever occurring), substitute “standard”.

21 Subsection 160AQCJ(2)

Omit “General fund” (wherever occurring), substitute “Standard”.

22 Subsection 160AQCJ(2)

Omit “general fund”, substitute “standard”.

23 Subsection 160AQCK(2)

Omit “General fund” (wherever occurring), substitute “Standard”.

24 Subsection 160AQCK(2)

Omit “general fund”, substitute “standard”.

25 Subsection 160AQCL(2)

Omit “General fund” (wherever occurring), substitute “Standard”.

26 Subsection 160AQCL(2)

Omit “general fund”, substitute “standard”.

27 At the end of subsections 160AQCN(2) and (2AB)

Add:

; (c) the assumption that the reference to standard component in the provision concerned were a reference to general fund component.

28 Application

The amendments made by this Schedule apply to any franking credits or franking debits arising after the day on which the Bill that became the Taxation Laws Amendment Act (No. 1) 1999 was introduced into the House of Representatives.

Schedule 7—Deductible expenditure and CGT cost bases

Part 1—Amendment of the Income Tax Assessment Act 1936

1 At the end of subsection 160AY(3)

Add:

The indexed cost base and the cost base are also adjusted to take account of certain deductions and balancing adjustments (see sections 160ZJA and 160ZJB).

2 Section 160AZA (table item dealing with cost base)

After “160ZH”, insert “, 160ZJA”.

3 Section 160AZA (table item dealing with indexed cost base)

After “160ZJ”, insert “, 160ZJB”.

4 At the end of subsection 160ZH(1)

Add:

Note: Section 160ZJA affects the meaning of the amount of any consideration or the amount of any expenditure.

5 At the end of subsection 160ZH(2)

Add:

Note: Section 160ZJB affects the meaning of the amount of any consideration or the amount of any expenditure.

6 At the end of subsection 160ZH(3)

Add:

Note: Section 160ZK affects the meaning of the reduced amount of any consideration, the reduced amount of incidental costs, or the reduced amount of any expenditure.

7 After section 160ZJ

Insert:

160ZJA Reduction of amounts for purposes of cost base

(1) A reference in subsection 160ZH(1) to the amount of any consideration or the amount of any expenditure, in respect of an asset (other than the taxpayer’s interest in a partnership asset of a partnership in which the taxpayer is a partner) is a reference to the sum of:

(a) the amount of the consideration or the amount of the expenditure, as the case may be (as worked out under section 160ZH); and

(b) any amount that is included in the assessable income of the taxpayer of any year of income by virtue of a provision of this Act other than this Part the effect of which is to reverse a deduction covered by paragraph (c) or subparagraph (d)(iii);

reduced by:

(c) any part of the consideration or of the expenditure that has been allowed or is allowable as a deduction to the taxpayer in respect of any year of income; and

(d) for the purpose of the reference in paragraphs 160ZH(1)(a), (c) and (d):

(i) any amount of expenditure in relation to the asset that, apart from subsections 124ZB(4) and 124ZG(5), would have been allowed or allowable under Division 10C or 10D of Part III as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(ii) any amount that, apart from subsection 388‑55(3) of the Income Tax Assessment Act 1997, would have been allowed or allowable under Subdivision 387‑A or 387‑B of that Act as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(iii) any amount of expenditure that, apart from paragraph 43‑70(2)(h) of the Income Tax Assessment Act 1997, would have been allowed or allowable under Division 43 of that Act as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(iv) any other expenditure that is capital expenditure by the taxpayer or any other person in respect of the asset that has been allowed or is allowable as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income.

(2) The reference in paragraph (1)(b) to an amount that is included in the assessable income of a taxpayer includes a reference to an amount:

(a) that is taken by subsection 60(1A) of this Act to be so included for the asset for the purposes of subsection 60(1); or

(b) that is treated as being deducted for depreciation of another asset under section 42‑285 or 42‑290 of the Income Tax Assessment Act 1997; or

(c) that, apart from roll‑over relief under sections 58, 73E, 122JAA, 122JG, 123BBA, 123BF, 124AMAA, 124GA, 124JD and 124PA, would have been included in assessable income; or

(d) that, apart from Subdivision 41‑A of the Income Tax Assessment Act 1997 (Common rule 1—roll‑over relief for related entities), would have been included in assessable income.

(3) A reference in subsection 160ZH(1) to the amount of any consideration or the amount of any expenditure, in respect of an asset (the taxpayer’s asset), being a taxpayer’s interest in a partnership asset of a partnership in which the taxpayer is a partner, is a reference to the sum of:

(a) the amount of the consideration or the amount of the expenditure, as the case may be (as worked out under section 160ZH); and

(b) any amount that is included in the assessable income of the partnership or of the taxpayer of any year of income by virtue of a provision of this Act other than this Part the effect of which is to reverse a deduction covered by paragraph (c) or subparagraph (d)(iii);

reduced by:

(c) any part of the consideration or of the expenditure that has been allowed or is allowable as a deduction to the partnership or the taxpayer in respect of any year of income; and

(d) for the purpose of the reference in paragraphs 160ZH(1)(a), (c) and (d):

(i) any amount of expenditure in relation to the asset that, apart from subsections 124ZB(4) and 124ZG(5), would have been allowed or allowable under Division 10C or 10D of Part III as a deduction to the partnership or the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(ii) any amount that, apart from subsection 388‑55(3) of the Income Tax Assessment Act 1997, would have been allowed or allowable under Subdivision 387‑A or 387‑B of that Act as a deduction to the partnership or the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(iii) any amount of expenditure that, apart from paragraph 43‑70(2)(h) of the Income Tax Assessment Act 1997, would have been allowed or allowable under Division 43 of that Act as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(iv) any other expenditure that is capital expenditure by the partnership, taxpayer or any other person in respect of the asset that has been allowed or is allowable as a deduction to the partnership or the taxpayer, after the acquisition of the asset, in respect of any year of income.

(4) The reference in paragraph (3)(b) to an amount that is included in the assessable income of the partnership or the taxpayer includes a reference to an amount:

(a) that is taken by subsection 60(1A) of this Act to be so included for the asset for the purposes of subsection 60(1); or

(b) that is treated as being deducted for depreciation of another asset under section 42‑285 or 42‑290 of the Income Tax Assessment Act 1997; or

(c) that, apart from roll‑over relief under sections 58, 73E, 122JAA, 122JG, 123BBA, 123BF, 124AMAA, 124GA, 124JD and 124PA, would have been included in assessable income; or

(d) that, apart from Subdivision 41‑A of the Income Tax Assessment Act 1997 (Common rule 1—roll‑over relief for related entities), would have been included in assessable income.

160ZJB Reduction of amounts for purposes of indexed cost base

(1) A reference in subsection 160ZH(2) to the indexed amount of any consideration or the indexed amount of any expenditure, in respect of an asset (other than the taxpayer’s interest in a partnership asset of a partnership in which the taxpayer is a partner) is a reference to the sum of:

(a) the indexed amount of the consideration or the indexed amount of the expenditure (as worked out under sections 160ZH and 160ZJ), as the case may be; and

(b) any amount that is included in the assessable income of the taxpayer of any year of income by virtue of a provision of this Act other than this Part the effect of which is to reverse a deduction covered by paragraph (c) or subparagraph (d)(iii);

reduced by:

(c) any part of the consideration or of the expenditure that has been allowed or is allowable as a deduction to the taxpayer in respect of any year of income; and

(d) for the purpose of the reference in paragraphs 160ZH(2)(a), (c) and (d):

(i) any amount of expenditure in relation to the asset that, apart from subsections 124ZB(4) and 124ZG(5), would have been allowed or allowable under Division 10C or 10D of Part III as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(ii) any amount that, apart from subsection 388‑55(3) of the Income Tax Assessment Act 1997, would have been allowed or allowable under Subdivision 387‑A or 387‑B of that Act as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(iii) any amount of expenditure that, apart from paragraph 43‑70(2)(h) of the Income Tax Assessment Act 1997, would have been allowed or allowable under Division 43 of that Act as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(iv) any other expenditure that is capital expenditure by the taxpayer or any other person in respect of the asset that has been allowed or is allowable as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income.

(2) The reference in paragraph (1)(b) to an amount that is included in the assessable income of a taxpayer includes a reference to an amount:

(a) that is taken by subsection 60(1A) of this Act to be so included for the asset for the purposes of subsection 60(1); or

(b) that is treated as being deducted for depreciation of another asset under section 42‑285 or 42‑290 of the Income Tax Assessment Act 1997; or

(c) that, apart from roll‑over relief under sections 58, 73E, 122JAA, 122JG, 123BBA, 123BF, 124AMAA, 124GA, 124JD, and 124PA, would have been included in assessable income; or

(d) that, apart from Subdivision 41‑A of the Income Tax Assessment Act 1997 (Common rule 1—roll over relief for related entities), would have been included in assessable income.

(3) A reference in subsection 160ZH(2) to the indexed amount of any consideration or the indexed amount of any expenditure, in respect of an asset (the taxpayer’s asset), being a taxpayer’s interest in a partnership asset of a partnership in which the taxpayer is a partner, is a reference to the sum of:

(a) the indexed amount of the consideration or the indexed amount of the expenditure (as worked out under sections 160ZH and 160ZJ), as the case may be; and

(b) any amount that is included in the assessable income of the partnership or of the taxpayer of any year of income by virtue of a provision of this Act other than this Part the effect of which is to reverse a deduction covered by paragraph (c) or subparagraph (d)(iii);

reduced by:

(c) any part of the consideration or of the expenditure that has been allowed or is allowable as a deduction to the partnership or the taxpayer in respect of any year of income; and

(d) for the purpose of the reference in paragraphs 160ZH(2)(a), (c) and (d):

(i) any amount of expenditure in relation to the asset that, apart from subsections 124ZB(4) and 124ZG(5), would have been allowed or allowable under Division 10C or 10D of Part III as a deduction to the partnership or the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(ii) any amount that, apart from subsection 388‑55(3) of the Income Tax Assessment Act 1997, would have been allowed or allowable under Subdivision 387‑A or 387‑B of that Act as a deduction to the partnership or the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(iii) any amount of expenditure that, apart from paragraph 43‑70(2)(h) of the Income Tax Assessment Act 1997, would have been allowed or allowable under Division 43 of that Act as a deduction to the taxpayer, after the acquisition of the asset, in respect of any year of income; and

(iv) any other expenditure that is capital expenditure by the partnership, taxpayer or any other person in respect of the asset that has been allowed or is allowable as a deduction to the partnership or the taxpayer, after the acquisition of the asset, in respect of any year of income.

(4) The reference in paragraph (3)(b) to an amount that is included in the assessable income of the partnership or the taxpayer includes a reference to an amount:

(a) that is taken by subsection 60(1A) of this Act to be so included for the asset for the purposes of subsection 60(1); or

(b) that is treated as being deducted for depreciation of another asset under section 42‑285 or 42‑290 of the Income Tax Assessment Act 1997; or

(c) that, apart from roll‑over relief under sections 58, 73E, 122JAA, 122JG, 123BBA, 123BF, 124AMAA, 124GA, 124JD and 124PA, would have been included in assessable income; or

(d) that, apart from Subdivision 41‑A of the Income Tax Assessment Act 1997 (Common rule 1—roll‑over relief for related entities), would have been included in assessable income.

8 Application

(1) The amendments made by this Part apply to assets acquired after 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997.

(2) However, the amendments made by this Part do not apply to expenditure incurred before 1 July 1999 in respect of an asset (the deemed asset) where:

(a) the deemed asset is taken to be a separate asset from another asset (the underlying asset) for the purposes of Part IIIA of the Income Tax Assessment Act 1936 under section 160P of that Act; and

(b) the underlying asset is land or a building that was acquired by the taxpayer at or before 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997; and

(c) the deemed asset is acquired by the taxpayer after 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997 but before 1 July 1999.

(3) Subparagraphs 160ZJA(1)(d)(i) to (iii) and (3)(d)(i) to (iii) and 160ZJB(1)(d)(i) to (iii) and (3)(d)(i) to (iii) of the Income Tax Assessment Act 1936 (which relate to eligible heritage conservation expenditure and landcare and water facility expenditure) do not apply to expenditure incurred before the day on which the Bill that became the Taxation Laws Amendment Act (No. 1) 1999 was introduced into the House of Representatives.

(4) For the purposes of a taxpayer’s assessment for the year of income in which 13 May 1997 occurred, a reference in the amendments made by this Schedule to a deduction does not include a reference to a deduction to the extent that it could reasonably be regarded as arising, or relating to a period, before 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997.

Part 2—Amendment of the Income Tax Assessment Act 1997

9 Subsections 110‑25(7) and (8)

Repeal the subsections.

10 Section 110‑30

Repeal the section.

11 At the end of Subdivision 110‑A

Add:

What does not form part of the cost base

110‑40 Assets acquired before 7.30 pm on 13 May 1997

(1) This section prevents some expenditure from forming part of the *cost base of a *CGT asset *acquired at or before 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997. (The expenditure mentioned in this section can include giving property: see section 103‑5.)

For the cost base of a partnership interest you acquire at or before that time, see section 110‑43.

For an extension of the application of this section, see subsection 110‑53(3).

(2) Expenditure does not form part of the second or third element of the cost base to the extent that you have deducted or can deduct it.

(3) Expenditure does not form part of any element of the cost base to the extent of any amount you have received as *recoupment of it, except so far as the amount is included in your assessable income.

110‑43 Partnership interests acquired before 7.30 pm on 13 May 1997

(1) This section prevents some expenditure from forming part of the *cost base of your interest in a *CGT asset of a partnership if you *acquired the interest at or before 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997. (The expenditure mentioned in this section can include giving property: see section 103‑5.)

For an extension of the application of this section, see subsection 110‑53(3).

(2) Expenditure does not form part of the second or third element of the cost base to the extent that you, or a partnership in which you are or were a partner, have deducted or can deduct it.

(3) Expenditure does not form part of any element of the cost base to the extent of any amount that you, or a partnership in which you are or were a partner, have received as *recoupment of the expenditure, except so far as the amount is included in your assessable income or the partnership’s assessable income.

110‑45 Assets acquired after 7.30 pm on 13 May 1997

(1) This section prevents some expenditure from forming part of the *cost base of a *CGT asset *acquired after 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997. (The expenditure mentioned in this section can include giving property: see section 103‑5.)

For the cost base of interests in partnership assets acquired after that time, see section 110‑50.

For exceptions to the application of this section, see section 110‑53.

Deductible expenditure

(2) Expenditure does not form part of the cost base to the extent that you have deducted or can deduct it for an income year, except so far as:

(a) the deduction has been reversed by an amount being included in your assessable income for an income year by a provision of this Act (outside this Part and Part 3‑3); or

Note: Division 20 contains some of the provisions that reverse deductions. Section 20‑5 lists some others.

(b) the deduction would have been so reversed apart from a provision listed in the table (relief from including a balancing charge in your assessable income).

Note: In the table, provisions of the Income Tax Assessment Act 1997 are identified in normal text. The other provisions, in bold, are provisions of the Income Tax Assessment Act 1936.

Provisions for relief from including a balancing charge in your assessable income |

Item | Provision | Subject matter |

1 | Subdivision 41‑A | Common rule 1—roll‑over relief for related entities |

2 | section 42‑285 or 42‑290 | Depreciation of *plant |

3 | section 58 | Depreciation of plant |

4 | subsection 59(2A) or (2D) | Depreciation of plant |

5 | section 73E | Research and development activity expenditure |

6 | section 122JAA | General mining expenditure |

7 | section 122JG | Quarrying expenditure |

8 | section 123BBA | Expenditure on transport of minerals |

9 | section 123BF | Expenditure on transport of quarry materials |

10 | section 124AMAA | Expenditure on prospecting and mining for petroleum |

11 | section 124GA | Expenditure on forestry roads |

12 | section 124JD | Expenditure on timber mill buildings |

13 | section 124PA | Expenditure on industrial property |

Recouped expenditure

(3) Expenditure does not form part of the cost base to the extent of any amount you have received as *recoupment of it, except so far as the amount is included in your assessable income.

Capital expenditure by previous owner that you can deduct after acquisition

(4) The cost base is reduced to the extent that you have deducted or can deduct for an income year capital expenditure incurred by another entity in respect of the *CGT asset. (This rule does not apply so far as the deduction is covered by paragraph (2)(a) or (b).)

Example: Under Division 43 you can deduct expenditure incurred by a previous owner of capital works you own.

Landcare and water facility expenditure giving rise to a tax offset

(5) Expenditure does not form part of the cost base to the extent that you choose a *tax offset for it under section 388‑55 (about the landcare and water facility tax offset) instead of deducting it.

Heritage conservation expenditure giving rise to a tax offset

(6) Expenditure does not form part of the cost base to the extent that:

(a) it is eligible heritage conservation expenditure (as determined under section 159UO of the Income Tax Assessment Act 1936); and

(b) you could have deducted it for an income year under any of these Divisions (about capital works):

(i) Division 43 of this Act;

(ii) Division 10C or 10D of Part III of that Act;

but for the exclusions in paragraph 43‑70(2)(h) of this Act and subsections 124ZB(4) and 124ZG(5) of that Act.

Note: Because eligible heritage conservation expenditure is the subject of a tax offset, it is also not deductible.

110‑50 Partnership interests acquired after 7.30 pm on 13 May 1997

(1) This section prevents some expenditure from forming part of the *cost base of your interest in a *CGT asset of a partnership if you *acquired the interest after 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997. (The expenditure mentioned in this section can include giving property: see section 103‑5.)

For exceptions to the application of this section, see section 110‑53.

Deductible expenditure

(2) Expenditure does not form part of the cost base to the extent that you, or a partnership in which you are or were a partner, have deducted or can deduct it for an income year, except so far as:

(a) the deduction has been reversed by an amount being included in your assessable income for an income year, or in the assessable income of a partnership in which you are or were a partner, by a provision of this Act (outside this Part and Part 3‑3); or

Note: Division 20 contains some of the provisions that reverse deductions. Section 20‑5 lists some others.

(b) the deduction would have been so reversed apart from a provision listed in the table in subsection 110‑45(2) (relief from including a balancing charge in your assessable income).

Recouped expenditure

(3) Expenditure does not form part of the cost base to the extent of any amount that you, or a partnership in which you are or were a partner, have received as *recoupment of it, except so far as the amount is included in your assessable income or the partnership’s assessable income.

Capital expenditure by previous owner of the asset

(4) The cost base is reduced to the extent that you, or a partnership in which you are or were a partner, have deducted or can deduct for an income year capital expenditure incurred by another entity in respect of the *CGT asset. (This rule does not apply so far as the deduction is covered by paragraph (2)(a) or (b).)

Example: Under Division 43 an entity can deduct expenditure incurred by a previous owner of capital works that the entity owns.

Landcare and water facility expenditure giving rise to a tax offset

(5) Expenditure does not form part of the cost base to the extent that you choose a *tax offset for it under section 388‑55 (about the landcare and water facility tax offset) instead of deducting it.

Heritage conservation expenditure giving rise to a tax offset

(6) Expenditure does not form part of the cost base to the extent that:

(a) it is eligible heritage conservation expenditure (as determined under section 159UO of the Income Tax Assessment Act 1936); and

(b) you, or a partnership in which you are or were a partner, could have deducted it for an income year under any of these Divisions (about capital works):

(i) Division 43 of this Act;

(ii) Division 10C or 10D of Part III of that Act;

but for the exclusions in paragraph 43‑70(2)(h) of this Act and subsections 124ZB(4) and 124ZG(5) of that Act.

Note: Because eligible heritage conservation expenditure is the subject of a tax offset, it is also not deductible.

110‑53 Exceptions to application of sections 110‑40 and 110‑50

(1) Subsection 110‑45(2), (4), (5) or (6) or 110‑50(2), (4), (5) or (6) does not prevent expenditure from forming part of the first, fourth or fifth element of the cost base to the extent that the deduction mentioned in that subsection could reasonably be regarded as arising before 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997, or as relating to a period before that time.

(2) Subsections 110‑45(5) and (6) and 110‑50(5) and (6) do not apply to expenditure incurred before the day on which the Bill that became the Taxation Laws Amendment Act (No. 1) 1999 was introduced into the House of Representatives.

Special rule for the period from 7.30 pm on 13 May 1997 to 30 June 1999

(3) If:

(a) an entity *acquired land or a building (the original asset) at or before 7.30 pm, by legal time in the Australian Capital Territory, on 13 May 1997; and

(b) after that time but before 1 July 1999, the entity *acquires a *CGT asset (the separate asset) that section 160P of the Income Tax Assessment Act 1936 would have treated as a separate CGT asset from the original asset;

section 110‑40 or 110‑43 (as appropriate) applies (instead of section 110‑45 or 110‑50) to expenditure incurred before 1 July 1999 in respect of the separate asset.

12 After subsection 110‑55(6)

Insert:

(6A) Expenditure does not form part of the reduced cost base to the extent that you choose a *tax offset for it under section 388‑55 (about the landcare and water facility tax offset) instead of deducting it.

13 After subsection 110‑60(4)

Insert:

(4A) Expenditure does not form part of an entity’s reduced cost base for its interest in a *CGT asset of a partnership to the extent that the entity chooses a *tax offset for the expenditure under section 388‑55 (about the landcare and water facility tax offset) instead of deducting it.

14 Application

(1) The amendments made by this Part apply to assessments for the 1998‑99 income year and later income years.

(2) However, the amendments made by items 12 and 13 do not apply to expenditure incurred before the day on which the Bill that became the Taxation Laws Amendment Act (No. 1) 1999 was introduced into the House of Representatives.

Part 3—Amendment of the Taxation Laws Amendment (Landcare and Water Facility Tax Offset) Act 1998

15 Subsection 2(2)

Repeal the subsection.

16 Items 14 to 17 of Schedule 1

Repeal the items.

Schedule 8—Passive income of insurance companies

Income Tax Assessment Act 1936

1 Subsections 446(2) to (5)

Repeal the subsections, substitute:

(2) Despite anything in subsection (1), the passive income of a life assurance company of a statutory accounting period is calculated using the formula:

where:

adjusted passive income means the amount that, apart from this subsection, would be the passive income of the company of the statutory accounting period.

total assets means the average of the total assets of the company for the statutory accounting period.

untainted average calculated liabilities means so much of the total average calculated liabilities of the company for the statutory accounting period as is referable to life assurance policies that do not give rise to tainted services income of the company of any statutory accounting period.

(3) In subsection (2):

total average calculated liabilities has the same meaning as in Division 8 of Part III.

(4) Despite anything in subsection (1), the passive income of a general insurance company of a statutory accounting period is worked out using the formula:

where:

adjusted passive income means the amount that, apart from this subsection, would be the passive income of the company of the statutory accounting period.

net assets means the excess at the end of the statutory accounting period of the total assets of the company over the total liabilities of the company.

outstanding claims means the amount that the company would, at the end of the statutory accounting period, based on proper and reasonable estimates, need to set aside and invest in order to meet liabilities of the company that have arisen or will arise:

(a) under general insurance policies (including reinsurance policies, but not including life assurance policies); and

(b) in respect of events that occurred during or before the period.

solvency amount is the amount worked out under subsection (5).

tainted outstanding claims means so much of the outstanding claims of the company at the end of the statutory accounting period as is referable to general insurance policies that give rise to tainted services income of the company of any statutory accounting period.

total assets means the total assets of the company at the end of the statutory accounting period.

(5) In subsection (4):

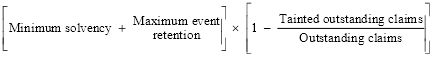

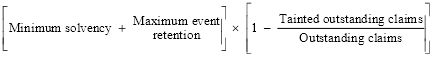

solvency amount is the amount worked out using the formula:

where:

maximum event retention means the amount that, at the end of the statutory accounting period, the company has determined is the maximum that would be payable to the owners of policies as a result of the happening of any one event. The amount must be worked out on the basis of a reasonable and proper estimate.

minimum solvency means the greater of:

(a) 20% of the company’s premium income (within the meaning of the Insurance Act 1973) during the statutory accounting period; and

(b) 15% of the company’s outstanding claims as at the end of the statutory accounting period.

outstanding claims means the amount that the company would, at the end of the statutory accounting period, based on proper and reasonable estimates, need to set aside and invest in order to meet liabilities of the company that have arisen or will arise:

(a) under general insurance policies (including reinsurance policies, but not including life assurance policies); and

(b) in respect of events that occurred during or before the period.

tainted outstanding claims means so much of the outstanding claims of the company at the end of the statutory accounting period as is referable to general insurance policies that give rise to tainted services income of the company of any statutory accounting period.

2 Application

The amendment made by this Schedule applies in calculating passive income that is derived on or after 1 July 1997.

Schedule 9—Average calculated liabilities of life assurance companies

Income Tax Assessment Act 1936

1 Subsection 110(1)

Insert:

significant event, in relation to any of the insurance funds maintained by a life assurance company, means any happening or circumstance that causes an abnormal change in the amount of the company’s liabilities in respect of policies included in the fund concerned.

2 Subsection 112A(1)

Omit all the words after “formula”, substitute:

where:

average calculated liabilities (all resident policies) means the average calculated liabilities of the company for the year of income for policies of all categories (other than eligible non‑resident policies) included in the fund.

average calculated liabilities (exempt policies) means the average calculated liabilities of the company for the year of income for exempt policies (other than eligible non‑resident policies) included in the fund.

3 Subsection 112A(3)

Repeal the subsection, substitute:

(3) Subsection (2) does not apply in relation to a fund if less than one‑third of the average calculated liabilities of the company for the year of income for policies of all categories (other than eligible non‑resident policies) included in the fund relates to Australian policies.

4 Subsection 112C(2)

Omit all the words after “exempt from tax:”, substitute:

where:

average calculated liabilities (all policies) means the average calculated liabilities of the company for the year of income for policies of all categories that:

(a) are included in the fund; and

(b) were issued in the course of carrying on the PE business.

average calculated liabilities (eligible non‑resident policies) means the average calculated liabilities of the company for the year of income for eligible non‑resident policies that:

(a) are included in the fund; and

(b) were issued in the course of carrying on the PE business.

5 Subsection 114(1)

Omit all the words before paragraph (a), substitute:

If an actuarial valuation of liabilities of a life assurance company is made as at a particular time, the company’s calculated liabilities at that time are:

6 Subsection 114(2)

Repeal the subsection, substitute:

(2) If:

(a) it is necessary to work out a life assurance company’s calculated liabilities as at a particular time (the relevant time); and

(b) no actuarial valuation of liabilities of the company as at the relevant time is made;

the calculated liabilities at that time are the amount worked out by using the formula:

where:

current value of assets means the value of all the company’s assets at the relevant time.

previous actuarial valuation of liabilities means the last actuarial valuation of liabilities of the company made before the relevant time.

previous value of assets means the value of all the company’s assets when the last actuarial valuation of liabilities of the company before the relevant time was made.

7 After section 114

Insert:

114A Average calculated liabilities for category of policies

(1) The average calculated liabilities of a life assurance company for a category of policies for a year of income is worked out under this section.

(2) First, divide the year of income into periods as follows:

(a) the first period starts at the start of the year of income;

(b) each later period starts immediately after the last day of the previous period;

(c) each period (except the last) ends immediately before the first day on which a significant event occurs in relation to the insurance fund in which policies of the category are included;

(d) the last period ends at the end of the year of income.

(3) Second, the average calculated liabilities of the company for the category of policies for each period is the amount worked out by using the formula:

where:

calculated liabilities (end of period) means the calculated liabilities of the company for the category of policies at the end of the period.

calculated liabilities (start of period) means the calculated liabilities of the company for the category of policies:

(a) if the period is the first period—at the start of the period; or

(b) otherwise—on the day after the occurrence of the significant event that caused the immediately preceding period to end.

days in period means the number of days in the period.

days in year of income means the number of days in the year of income.

(4) Third, the average calculated liabilities of the company for the category of policies for the year of income is the sum of the amounts of the average calculated liabilities of the company for the category of policies for all the periods into which the year of income is divided.

114B Total average calculated liabilities

The total average calculated liabilities of a life assurance company for a year of income is the sum of the average calculated liabilities of the company for each category of policies for the year of income.

8 Subsection 116CB(2)

Omit all the words after “formula:”, substitute:

where:

average calculated liabilities (all non‑exempt resident policies) means the average calculated liabilities of the company for the year of income for policies of all categories (other than exempt policies or eligible non‑resident policies) included in the fund in which the asset was included immediately before disposal.

average calculated liabilities (category of policies) means the average calculated liabilities of the company for the year of income for policies of the category concerned that are included in the fund in which the asset was included immediately before disposal.

core amount means the core amount.

9 Subsection 116CE(5)

Omit all the words after “formula:”, substitute:

where:

average calculated liabilities (all non‑exempt resident policies) means the average calculated liabilities of the company for the year of income for policies of all categories (other than exempt policies or eligible non‑resident policies) included in the fund.

average calculated liabilities (category of policies) means the average calculated liabilities of the company for the year of income for policies of the category concerned that are included in the fund.

income means the amount of the assessable income to be allocated.

10 Application

(1) The amendments made by this Schedule apply to a life assurance company in respect of the first year of income starting on or after 29 April 1997 and all later years of income.

(2) The amendments made by this Schedule also apply to a life assurance company in respect of the year of income that immediately preceded the first year of income referred to in subsection (1) if, and only if:

(a) that immediately preceding year of income ended on or after 29 April 1997; and

(b) a significant event in relation to any of the insurance funds maintained by the company occurred during the part of that year of income occurring on and after that date.

Schedule 10—Depreciation

Income Tax Assessment Act 1936

1 At the end of section 61

Add:

(2) This section has effect subject to section 61A.

2 After section 61

Insert:

61A Tax exempt entities that become taxable

Entities to which section applies

(1) If:

(a) at a particular time, all of the income of a taxpayer is wholly exempt from income tax; and

(b) immediately after that time, the taxpayer’s income becomes to any extent assessable income;

then:

(c) the taxpayer is a transition taxpayer; and

(d) the time when the taxpayer’s income becomes to that extent assessable is the transition time; and

(e) the year of income in which the transition time occurs is the transition year for the taxpayer.

Deduction for depreciation

(2) A deduction allowable to the transition taxpayer for any period after the transition time for depreciation under this Subdivision in respect of a unit of property that was owned by the transition taxpayer at the transition time is to be worked out in accordance with subsections (3) to (9).

Ownership of unit

(3) If the unit was acquired by the transition taxpayer from an exempt government entity:

(a) assume that the transition taxpayer acquired the unit at the time when it was acquired or constructed by the entity; or

(b) where the unit had, before its acquisition by the transition taxpayer, been successively owned by 2 or more exempt government entities—assume that the transition taxpayer acquired the unit at the time when it was acquired or constructed by the first of those entities that owned the unit.

Cost of the unit

(4) If the unit was acquired by the transition taxpayer from an exempt government entity, assume that the cost of the unit to the transition taxpayer is:

(a) subject to paragraph (b)—the amount that was the cost of the unit to the other entity; or

(b) where the unit had, before its acquisition by the transition taxpayer, been successively owned by 2 or more exempt government entities—the amount that was the cost of the unit to the first of those entities that owned the unit.

Effective life of unit

(5) Assume that the effective life of the unit is the period that would have been calculated to be its effective life at the time:

(a) if subsection (3) does not apply—when the unit was acquired or constructed by the transition taxpayer; or

(b) if subsection (3) applies—when the unit is assumed under that subsection to have been acquired by the transition taxpayer.

Elections under section 54A

(6) For the purpose of calculating the assumed effective life of the unit under subsection (5), if the transition taxpayer could have made an election under subsection 54A(1) at a particular time during the period for which the transition taxpayer owned, or is to be assumed to have owned, the unit, assume that the transition taxpayer made the election at that time.

Use of unit for producing assessable income

(7) Assume that the unit had, at all times during the period beginning when it was acquired or constructed, or is assumed to have been acquired, by the transition taxpayer and ending immediately before the transition time, been used wholly for the purpose of producing assessable income by the transition taxpayer, and assume that deductions for depreciation in respect of the unit had been allowed to the transition taxpayer during that period.

Method of depreciation

(8) Assume that the method of depreciation selected by the transition taxpayer in relation to the unit in:

(a) the transition year; or

(b) if the transition taxpayer does not claim depreciation for the transition year—the first year of income after the transition year in which the transition taxpayer claims depreciation;

was also used in each year of income before the transition year by the transition taxpayer.

Application of other sections in calculating depreciation rates

(9) In calculating the rate of depreciation in relation to the unit in each year of income before the transition year:

(a) if section 57AG of this Act as in force at any time before its repeal had applied in respect of that year of income—that section is to be taken into account; and

(b) if section 57AL of this Act as in force at any time before its repeal had applied in respect of that year of income—that section is to be disregarded.

Balancing adjustments on disposal

(10) If the transition taxpayer disposes of a unit of property that was owned by the transition taxpayer at the transition time, subsections (11) and (12) apply but subsections 59(1) and (2) do not apply.

Including an amount in assessable income

(11) If the consideration receivable in respect of the disposal exceeds the unit’s depreciated value, the transition taxpayer’s assessable income is to include the lesser of:

(a) the sum of the amounts that have been allowed or are allowable as deductions for depreciation of the unit; and

(b) the amount by which that consideration exceeds the unit’s depreciated value.

Deducting an amount

(12) If the consideration receivable in respect of the disposal is less than the unit’s notional depreciated value, an amount worked out by using the following formula is an allowable deduction to the transition taxpayer:

where:

actual deductions means the sum of the amounts that have been allowed or are allowable to the transition taxpayer as deductions for depreciation of the unit.

difference means the difference between the consideration receivable in respect of the disposal of the unit and the unit’s notional depreciated value.

notional deductions means the sum of:

(a) the amounts in respect of which deductions for depreciation are assumed under subsection (7) to have been allowed to the transition taxpayer in respect of the unit; and

Note: Subsections (3) to (6), (8) and (9) have effect for the purpose of determining the amounts referred to in paragraph (a) (for example, section 57AG as previously in force at any time is to be taken into account in calculating the rate of depreciation at that time).

(b) if there was any period after the transition time in which the unit was used, or installed ready for use, but was not used wholly for the purpose of producing assessable income—the further amounts in respect of which deductions for depreciation could have been allowed to the transition taxpayer in respect of the unit if it had been used wholly for the purpose of producing assessable income during that period.

Note: If neither subsection (11) nor (12) applies in respect of the unit, no amount is to be included in the transition taxpayer’s assessable income, and no deduction is allowable to the transition taxpayer, as a result of the disposal.

Definitions

(13) In this section:

consideration receivable in respect of the disposal of a unit of property has the same meaning as in section 59.

depreciated value of a unit of property is:

(a) if the unit was acquired by the transition taxpayer from a person other than an exempt government entity or was constructed by the transition taxpayer—its cost to the transition taxpayer; or

(b) if the unit was acquired by the transition taxpayer from an exempt government entity—the amount assumed under subsection (4) to be its cost to the transition taxpayer;

less the sum of the amounts in respect of which deductions for depreciation have been allowed or are allowable to the transition taxpayer in respect of the unit.

exempt government entity means:

(a) the Commonwealth, a State or a Territory; or

(b) an STB, within the meaning of Division 1AB, that is exempt from tax under that Division; or

(c) any municipal corporation or other local governing body, or any public authority, to which paragraph 23(d) applies.

method of depreciation means the way of working out the depreciation allowable under this Act in respect of a unit of property set out in paragraph 56(1)(a) or (b).

notional depreciated value of a unit of property is:

(a) if the unit was acquired by the transition taxpayer from a person other than an exempt government entity or was constructed by the transition taxpayer—its cost to the transition taxpayer; or

(b) if the unit was acquired by the transition taxpayer from an exempt government entity—the amount assumed under subsection (4) to be its cost to the transition taxpayer;

less the sum of:

(c) the amounts in respect of which deductions for depreciation are assumed under subsection (7) to have been allowed to the transition taxpayer in respect of the unit; and

Note: Subsections (3) to (6), (8) and (9) have effect for the purpose of determining the amounts referred to in paragraph (c) (for example, section 57AG as previously in force at any time is to be taken into account in calculating the rate of depreciation at that time).

(d) the amounts in respect of which deductions for depreciation have been allowed or are allowable to the transition taxpayer in respect of the unit; and

(e) if there was any period after the transition time in which the unit was used, or installed ready for use, but was not used wholly for the purpose of producing assessable income—the further amounts in respect of which deductions for depreciation could have been allowed to the transition taxpayer in respect of the unit if it had been used wholly for the purpose of producing assessable income during that period.

3 Application

The amendments made by this Schedule are taken to have applied where the transition time was earlier than 3 July 1995 but not earlier than the start of the year of income in which 1 July 1988 occurred.

4 Saving