An Act to make provision for the collection of levies imposed in respect of various financial institutions, and for related purposes

This Act may be cited as the Financial Institutions Supervisory Levies Collection Act 1998.

This Act commences on the commencement of the Australian Prudential Regulation Authority Act 1998.

This Act binds the Crown in each of its capacities.

This Act extends to each external Territory.

(1) This Act applies to Lloyd’s (within the meaning of section 3 of the Insurance Act 1973), at all times after the commencement of this Act, as if Lloyd’s were a body corporate authorised under that Act to carry on insurance business.

(2) Nothing in this Act makes any Lloyd’s underwriter liable to pay levy under this Act.

In this Act, unless the contrary intention appears:

APRA means the Australian Prudential Regulation Authority.

In this Part, unless the contrary intention appears:

ADI has the same meaning as in the Banking Act 1959.

Note: ADI is short for authorised deposit‑taking institution.

authorised NOHC means an authorised NOHC within the meaning of either:

(a) the Banking Act 1959; or

(b) the Insurance Act 1973.

Note: NOHC is short for non‑operating holding company.

business day means a day that is not a Saturday, a Sunday, a public holiday or a bank holiday in the place concerned.

general insurance company means a body corporate that is authorised under the Insurance Act 1973 to carry on insurance business within the meaning of that Act.

late payment penalty means penalty payable under section 10.

leviable body means any of the following types of bodies:

(a) an ADI;

(b) an authorised NOHC;

(c) a life insurance company;

(d) a general insurance company;

(e) an RSA provider;

(f) a superannuation entity.

levy means:

(a) in respect of a leviable body that is an ADI—levy imposed by the Authorised Deposit‑taking Institutions Supervisory Levy Imposition Act 1998; or

(b) in respect of a leviable body that is an authorised NOHC—levy imposed by the Authorised Non‑operating Holding Companies Supervisory Levy Imposition Act 1998; or

(c) in respect of a leviable body that is a life insurance company—levy imposed by the Life Insurance Supervisory Levy Imposition Act 1998; or

(d) in respect of a leviable body that is a general insurance company—levy imposed by the General Insurance Supervisory Levy Imposition Act 1998; or

(e) in respect of a leviable body that is an RSA provider—levy imposed by the Retirement Savings Account Providers Supervisory Levy Imposition Act 1998; or

(f) in respect of a leviable body that is a superannuation entity—levy imposed by the Superannuation Supervisory Levy Imposition Act 1998.

levy imposition day, in relation to the imposition of a levy in respect of a leviable body of a particular type for a financial year, means:

(a) if the leviable body is that type of leviable body on 1 July of the financial year—that day; or

(b) if the leviable body becomes that type of leviable body on a day during the financial year that is after 1 July of the financial year—the day, during the financial year, on which the leviable body becomes that type of leviable body.

levy paying entity means:

(a) a leviable body, other than a superannuation entity; or

(b) the trustee of a superannuation entity.

life insurance company means a company that is registered under the Life Insurance Act 1995.

RSA provider has the same meaning as in the Retirement Savings Accounts Act 1997.

superannuation entity means an entity that:

(a) is a superannuation entity within the meaning of the Superannuation Industry (Supervision) Act 1993; and

(b) is not a self managed superannuation fund within the meaning of that Act.

trustee, in relation to a superannuation entity, means the person who is the trustee of the entity for the purposes of the Superannuation Industry (Supervision) Act 1993.

ADIs

(1) A body corporate that is an ADI at any time during a financial year that ends after the commencement of the Authorised Deposit‑taking Institutions Supervisory Levy Imposition Act 1998 is liable to pay a levy in respect of that financial year.

Authorised NOHCs

(2) A body corporate that is an authorised NOHC at any time during a financial year that ends on or after the commencement of the Authorised Non‑operating Holding Companies Supervisory Levy Imposition Act 1998 is liable to pay a levy in respect of that financial year.

General insurance bodies corporate

(3) A body corporate that is a general insurance company at any time during a financial year that ends after the commencement of the General Insurance Supervisory Levy Imposition Act 1998 is liable to pay a levy in respect of that financial year.

Life Insurance companies

(4) A body corporate that is a life insurance company at any time during a financial year that ends after the commencement of the Life Insurance Supervisory Levy Imposition Act 1998 is liable to pay a levy imposed in respect of that financial year.

RSA providers

(5) A body corporate that is an RSA provider at any time during a financial year that ends after the commencement of the Retirement Savings Account Providers Supervisory Levy Imposition Act 1998 is liable to pay a levy imposed in respect of that financial year.

Superannuation entities

(6) A trustee of a superannuation entity that is a superannuation entity at any time during a financial year that ends after the commencement of the Superannuation Supervisory Levy Imposition Act 1998 is liable to pay a levy in respect of that financial year.

(1) Levy payable by a leviable body (other than a superannuation entity) for a financial year under section 8 is due and payable on:

(a) if the levy imposition day relating to the levy payable by the leviable body is 1 July of the financial year—a business day that is:

(i) specified in a notice given to the leviable body by APRA in relation to the financial year; and

(ii) is not earlier than 28 days after the day on which the notice is given; or

(b) if the levy imposition day relating to the levy payable by the leviable body is a day of that financial year after 1 July—by:

(i) the day that is 6 weeks after the day on which the leviable body becomes that type of leviable body; or

(ii) if the day applicable under subparagraph (i) is not a business day, the first business day following that day.

(2) Levy payable under subsection 8(6) for a financial year by a trustee of a superannuation entity is due and payable:

(a) if the entity is a superannuation entity on 1 July of the financial year and became a superannuation entity before that day—on a business day that:

(i) is specified in a notice given by APRA to the trustee on or after the day on which a return under section 36 of the Superannuation Industry (Supervision) Act 1993 that relates to the previous financial year was received by APRA; and

(ii) is not earlier than 6 weeks after the day on which the notice is given; or

(b) if the entity becomes a superannuation entity on or after 1 July of the financial year—on a business day that:

(i) is specified in a notice given by APRA to the trustee; and

(ii) is not earlier than 6 weeks after the day on which the notice is given.

(1) If any levy payable by a levy paying entity:

(a) is not paid on or before the day on which it is due and payable (the due day for payment); and

(b) remains unpaid after the penalty calculation day;

the levy paying entity is liable to pay, by way of penalty, an amount worked out at the rate of 20% per year on the amount unpaid, computed from the end of the due day for payment to the end of the penalty calculation day.

(2) The penalty calculation day is:

(a) if the levy is paid on or after the first day of a month and before the sixth day of that month—the 20th day of the immediately preceding month; or

(b) if the levy is paid on or after the sixth day of a month and before the 20th day of that month—the sixth day of that month; or

(c) if the levy is paid on or after the 20th day of a month and on or before the last day of that month—the 20th day of that month.

(1) Levy and late payment penalty are payable to APRA on behalf of the Commonwealth.

(2) APRA must pay to the Commonwealth any amounts of levy or late payment penalty received by it.

Note: Levy and late payment penalty may be payable to the Commissioner of Taxation because of section 252G of the Superannuation Industry (Supervision) Act 1993.

APRA, on behalf of the Commonwealth, may, if APRA considers it is appropriate to do so, waive the payment of the whole or a part of an amount of levy or late payment penalty that is payable by a levy paying entity.

Note: For example, if levy is payable by a body corporate which has ceased to be authorised under the Insurance Act 1973 to carry on an insurance business and has ceased to be a life company, APRA may waive the payment of the levy if APRA considers it appropriate to do so because payment of the levy would prevent payment in full of claims under contracts of insurance made with the body corporate.

(1) The following amounts may be recovered by the Commonwealth as debts due to the Commonwealth:

(a) levy that is due and payable;

(b) late payment penalty that is due and payable.

(2) APRA is authorised, as agent of the Commonwealth, to bring proceedings in the name of the Commonwealth for the recovery of a debt due to the Commonwealth of a kind mentioned in subsection (1).

(3) If, in proceedings brought by APRA under subsection (2), the Commonwealth is ordered to pay costs, APRA must pay the costs out of APRA’s money and the Commonwealth is not liable to reimburse APRA for the payment.

(1) Nothing in a law passed before the commencement of this section exempts a levy paying entity from liability to pay levy.

(2) If a law (including a provision of a law) passed after the commencement of this section purports to exempt a levy paying entity from:

(a) liability to pay taxes under laws of the Commonwealth; or

(b) liability to pay certain taxes under laws of the Commonwealth that would otherwise include levy;

the law does not operate to exempt the levy paying entity from liability to pay levy unless the exemption expressly refers to levy under this Act.

If an Act mentioned in section 8 that imposes levy in respect of a particular type of leviable body commences during a financial year (but not on 1 July of that financial year), this Act has effect in relation to that financial year and that type of leviable body subject to the modifications specified in the regulations.

In this Part, unless the contrary intention appears:

Account means the Superannuation Protection Account established by section 234 of the Superannuation Industry (Supervision) Act 1993.

approved deposit fund has the same meaning as in the Superannuation Industry (Supervision) Act 1993.

fund means a superannuation fund or an approved deposit fund, but does not include a self managed superannuation fund (within the meaning of the Superannuation Industry (Supervision) Act 1993).

late payment penalty means penalty payable under section 20.

levy means levy imposed by regulations under the Superannuation (Financial Assistance Funding) Levy Act 1993.

levy month means one of the 12 months of the calendar year.

superannuation fund has the same meaning as in the Superannuation Industry (Supervision) Act 1993.

trustee, in relation to a fund, has the same meaning as in the Superannuation Industry (Supervision) Act 1993.

unpaid levy means the amount of levy unpaid by the trustee of a fund as at the beginning of a levy month.

(1) This section applies if:

(a) accounts of a fund were prepared for a financial year; and

(b) an amount is shown on those accounts as the value of an asset of the fund as at the end of that financial year.

(2) For the purposes of this Part, the accounts are prima facie evidence of the value of the asset at the end of that financial year.

(3) The Minister may certify that a document is a copy of the accounts.

(4) This section applies to the certified copy as if it were the original.

The trustee of a fund is liable to pay a levy imposed on the fund.

(1) A levy payable by the trustee of a fund is due and payable on such date as is specified in the regulations imposing the levy.

(2) The date to be so specified must not be earlier than the 28th day after the day on which the regulation imposing the levy took effect.

(1) If any levy payable by the trustee of a fund remains unpaid as at:

(a) the beginning of the first levy month after the time when it became due for payment; or

(b) the beginning of a later levy month;

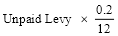

the trustee is liable to pay to the Commonwealth, in respect of that levy month, by way of penalty, the amount worked out using the formula:

(2) Late payment penalty for a levy month is due and payable at the end of the levy month.

Levy and late payment penalty are payable to the Minister.

The Minister may waive the whole or a part of an amount of late payment penalty.

The following amounts may be recovered by the Commonwealth as debts due to the Commonwealth:

(a) levy that is due and payable;

(b) late payment penalty that is due and payable.

(1) If a levy is imposed as a result of a determination by the Minister to make a grant of financial assistance not from the Account, then the following amounts must be paid to the Commonwealth and not credited to the Account:

(a) any amounts of that levy, and of late payment penalty in respect of that levy, that are received by the Minister; and

(b) any repayments of that financial assistance.

(2) If a levy is imposed as a result of a determination by the Minister to make a grant of financial assistance from the Account, then the following amounts must be paid to the Commonwealth and credited to the Account:

(a) amounts equal to any amounts of that levy, and of late payment penalty in respect of that levy, that are received by the Minister; and

(b) amounts equal to any repayments of that financial assistance.

(1) Nothing in a law passed before the commencement of this section exempts a trustee of a fund from liability to pay levy.

(2) If a law (including a provision of a law) passed after the commencement of this section purports to exempt a trustee of a fund from:

(a) liability to pay taxes under laws of the Commonwealth; or

(b) liability to pay certain taxes under laws of the Commonwealth that would otherwise include levy;

the law does not operate to exempt the trustee from liability to pay levy unless the exemption expressly refers to levy under this Act.

The Minister may, by signed writing, delegate to APRA all or any of his or her powers under this Part.

(1) A levy paying entity that is affected by a reviewable decision of the decision maker may, if dissatisfied with the decision, request the decision maker to reconsider the decision.

(2) The request must:

(a) be made by notice given to the decision maker within:

(i) the period of 21 days after the day on which the levy paying entity first receives notice of the decision; or

(ii) the further period that the decision maker allows; and

(b) set out the reasons for making the request.

(3) When the decision maker receives the request the decision maker must reconsider the decision.

(4) The decision maker may confirm or revoke the decision or vary the decision in the manner that the decision maker thinks fit. However, if the decision maker does not confirm, revoke or vary the decision within the period of 21 days after the day on which the decision maker received the request, the decision maker is taken to have confirmed the decision immediately after the end of that period.

(5) If the decision maker confirms, revokes or varies the decision during the period of 21 days after the day on which the decision maker received the request, the decision maker is to give a notice in writing to the levy paying entity that made the request. The notice must set out the result of the reconsideration of the decision and the reasons for confirming, varying or revoking the decision, as the case may be.

(6) Applications may be made to the Administrative Appeals Tribunal for review of:

(a) decisions of the decision maker that have been confirmed or varied under subsection (4); and

(b) decisions of the decision maker to revoke reviewable decisions.

(7) If a decision is taken to be confirmed under subsection (4), section 29 of the Administrative Appeals Tribunal Act 1975 applies as if the prescribed time for making application for review of the decision were the period commencing on the day on which the decision is taken to be confirmed and ending on the 28th day after that day.

(8) If a request is made under subsection (1) in respect of a reviewable decision, section 41 of the Administrative Appeals Tribunal Act 1975 applies as if the making of the request were the making of an application to the Administrative Appeals Tribunal for a review of that decision.

(9) The hearing of a proceeding relating to a reviewable decision is to take place in private and the Administrative Appeals Tribunal may, by order:

(a) give directions as to the persons who may be present; and

(b) give directions of a kind referred to in paragraph 35(2)(b) or (c) of the Administrative Appeals Tribunal Act 1975.

(10) In this section:

decision maker, in relation to a reviewable decision, means:

(a) if the reviewable decision is a decision of APRA under section 12—APRA; or

(b) if the reviewable decision is a decision of the Minister under section 22—the Minister.

levy paying entity means:

(a) an entity that is a levy paying entity as defined in section 7; or

(b) a trustee of a fund as defined in section 16.

reviewable decision means:

(a) a decision of APRA under section 12; or

(b) a decision of the Minister under section 22.

(1) If notice in writing is given to a levy paying entity affected by a reviewable decision that the reviewable decision has been made, that notice must include words to the effect that:

(a) the levy paying entity may seek a reconsideration of the reviewable decision by the decision maker in accordance with subsection 27(1) if the levy paying entity is dissatisfied with the decision; and

(b) the levy paying entity may, subject to the Administrative Appeals Tribunal Act 1975, apply to the Administrative Appeals Tribunal for review of a reviewable decision that is confirmed or varied under subsection 27(4), or for review of a decision to revoke a reviewable decision.

(2) If:

(a) the decision maker confirms or varies a reviewable decision under subsection 27(4), or makes a decision to revoke a reviewable decision under that subsection; and

(b) gives the levy paying entity affected by the decision notice in writing of the confirmation or variation of the decision, or of the revocation of the decision;

that notice must include words to the effect that the levy paying entity may, subject to the Administrative Appeals Tribunal Act 1975, apply to the Administrative Appeals Tribunal for review of the reviewable decision as confirmed or varied, or for review of the decision to revoke the reviewable decision.

(3) A failure to comply with the requirements of subsections (1) and (2) in relation to a reviewable decision or a decision under subsection 27(4) does not affect the validity of that decision.

(4) In this section:

decision maker, in relation to a reviewable decision, has the same meaning as in section 27.

levy paying entity has the same meaning as in section 27.

reviewable decision has the same meaning as in section 27.

(1) The Governor‑General may make regulations, not inconsistent with this Act, prescribing matters:

(a) required or permitted by this Act to be prescribed; or

(b) necessary or convenient to be prescribed for carrying out or giving effect to this Act.

(2) Without limiting subsection (1), the regulations may, in particular:

(a) provide for the manner of payment for levy, late payment penalty and other amounts payable under this Act; and

(b) provide for the refund (or other application) of overpayments.

Table A

Application, saving or transitional provision

Superannuation Legislation Amendment Act (No. 3) 1999 (No. 121, 1999)

Schedule 2

42 Application provisions

(2) The amendments of the Financial Institutions Supervisory Levies Collection Act 1998 made by this Schedule apply to an entity in respect of the financial year beginning on 1 July 2000 and subsequent financial years.

Financial Sector Reform (Amendments and Transitional Provisions) Act (No. 1) 2000 (No. 24, 2000)

Schedule 12

1 Definitions

In this Part:

Collection Act means the Financial Institutions Supervisory Levies Collection Act 1998.

deferred payment day means the day that is 6 weeks after the day on which this Part commences.

Imposition Act means any of the following Acts:

(a) the Authorised Non‑operating Holding Companies Supervisory Levy Imposition Act 1998;

(b) the General Insurance Supervisory Levy Imposition Act 1998;

(c) the Life Insurance Supervisory Levy Imposition Act 1998;

(d) the Retirement Savings Account Providers Supervisory Levy Imposition Act 1998;

(e) the Superannuation Supervisory Levy Imposition Act 1998.

levy paying entity has the same meaning as in the Collection Act.

Validation Act means any of the following Acts:

(a) the Authorised Non‑operating Holding Companies Supervisory Levy Determination Validation Act 2000;

(b) the General Insurance Supervisory Levy Determination Validation Act 2000;

(c) the Life Insurance Supervisory Levy Determination Validation Act 2000;

(d) the Retirement Savings Account Providers Supervisory Levy Determination Validation Act 2000;

(e) the Superannuation Supervisory Levy Determination Validation Act 2000.

2 Deferral of date for paying levy

(1) This item applies to a levy paying entity if, because of section 4 of a Validation Act:

(a) the entity is liable to pay levy imposed by an Imposition Act; and

(b) the levy payable by the entity would, apart from this item, have been due and payable under section 9 of the Collection Act before the deferred payment day.

(2) The levy payable by the entity is taken to be due and payable on the deferred payment day, despite section 9 of the Collection Act.

Note: This provision affects the calculation of late payment penalty (if any) under section 10 of the Collection Act.

3 No retrospective criminal liability

Nothing in this Part or the Validation Acts is taken to make a person criminally liable in respect of acts or omissions of the person before the day on which this Part commences, if the person would not have been so liable had this Part and the Validation Acts not been enacted.

10 Application of amendments of superannuation legislation relating to financial assistance to funds

The amendments made by Schedule 9 only apply in relation to losses incurred by a fund after the commencement of that Schedule.

Financial Sector (Collection of Data—Consequential and Transitional Provisions) Act 2001 (No. 121, 2001)

Schedule 2

153 Transitional

The amendment made by item 152 applies to the payment of levy (within the meaning of the Financial Institutions Supervisory Levies Collection Act 1998) for the financial year beginning on 1 July 2002 and for all subsequent financial years.

Financial Sector Legislation Amendment Act (No. 1) 2002 (No. 37, 2002)

Schedule 2

4 Application

The amendment made by item 3 applies only to levy that becomes due and payable after the commencement of that item.

Financial Institutions Supervisory Levies Collection Amendment Act 2005

(No. 14, 2005)

Schedule 1

2 Application

The amendment made by this Schedule applies in relation to levy payable for:

(a) the financial year commencing on 1 July 2005; and

(b) each succeeding financial year.