An Act to provide certain benefits to certain students and for other purposes

Part 1—Preliminary

1 Short title

This Act may be cited as the Student Assistance Act 1973.

2 Commencement

This Act shall come into operation on a date to be fixed by Proclamation.

3 Interpretation

(1) In this Act, unless the contrary intention appears:

AAT means the Administrative Appeals Tribunal.

AAT Act means the Administrative Appeals Tribunal Act 1975.

AAT first review has the meaning given by section 311.

AAT second review has the meaning given by section 320.

ABSTUDY SSL debt means a debt incurred under section 8B.

ABSTUDY student start‑up loan means a loan for which a person qualifies under Division 2 of Part 2.

Note: Part 2 is taken to be part of the ABSTUDY Scheme and ABSTUDY student start‑up loans are taken to be made under the ABSTUDY Scheme: see section 7B.

ABSTUDY student start‑up loan overpayment has the meaning given by subsection 38A(1).

accumulated ABSTUDY SSL debt has the meaning given by section 9C.

accumulated FS debt has the meaning given by subsection 12ZF(2) or (3).

accumulated HELP debt has the same meaning as in the Higher Education Support Act 2003.

actual repayments, in relation to financial supplement, at a particular time, means the sum of the amounts actually repaid in respect of the financial supplement before that time.

adjusted parental income, for the purposes of Part 4A, has the meaning given by the regulations.

amount notionally repaid, in relation to financial supplement, has the meaning given by subparagraph 12ZA(10)(b)(ii).

amount outstanding, in relation to a financial supplement contract, has the meaning given by section 12X.

approved form has the meaning given by section 388‑50 in Schedule 1 to the Taxation Administration Act 1953.

approved scholarship course has the same meaning as in the ABSTUDY Scheme.

Australia, when used in a geographical sense, includes Norfolk Island, the Territory of Cocos (Keeling) Islands and the Territory of Christmas Island.

Note: In Division 4 of Part 6 (about departure prohibition orders), Australia has an extended meaning.

bank includes, but is not limited to, a body corporate that is an ADI (authorised deposit‑taking institution) for the purposes of the Banking Act 1959.

centrelink program has the same meaning as in the Human Services (Centrelink) Act 1997.

Chief Executive Centrelink has the same meaning as in the Human Services (Centrelink) Act 1997.

Commissioner means the Commissioner of Taxation.

compulsory ABSTUDY SSL repayment amount means an amount that:

(a) is required to be paid in respect of an accumulated ABSTUDY SSL debt under section 10F; and

(b) is included in a notice of assessment made under section 10H.

compulsory repayment amount means an amount that:

(a) is required to be paid in respect of an accumulated FS debt under section 12ZK; and

(b) is included in a notice of an assessment made under section 12ZM.

contract period, in relation to a financial supplement contract, means the period beginning when the contract was entered into and ending on 31 May in the year in which the last of the periods of 12 months referred to in paragraph 12X(3)(b) ends.

current special educational assistance scheme means:

(a) the Assistance for Isolated Children Scheme; or

(b) the ABSTUDY Scheme (also known as the Aboriginal Study Assistance Scheme).

departure authorisation certificate means a certificate under Subdivision D of Division 4 of Part 6.

departure prohibition order means an order under Subdivision A of Division 4 of Part 6 (including such an order varied under Subdivision C of that Division).

discount, in relation to a repayment of an amount of financial supplement, has the meaning given by section 12ZA.

disqualifying education costs scholarship has the same meaning as in the Social Security Act 1991.

education institution means:

(a) a higher education institution; or

(b) a technical and further education institution; or

(c) a secondary school; or

(d) any other institution (including an educational institution), authority or body, that is in Australia and that, in accordance with a determination by the Minister, is to be regarded as an education institution for the purposes of this Act.

eligible student, for the purposes of Part 4A, has the meaning given by section 12C.

Note: A person cannot be an eligible student for the whole or a part of a year that begins on or after the day on which the Student Assistance Legislation Amendment Act 2006 receives the Royal Assent (see subsection 12C(1A)).

enrolment test day has the meaning given by subsection 8B(5).

exempt foreign income has the meaning given by subsection 12ZL(4).

family assistance law has the same meaning as in the A New Tax System (Family Assistance) (Administration) Act 1999.

financial corporation means:

(a) a foreign corporation within the meaning of paragraph 51(xx) of the Constitution whose sole or principal business activities in Australia are the borrowing of money and the provision of finance; or

(b) a financial corporation within the meaning of that paragraph;

and includes a bank.

financial institution has the same meaning as in the Social Security Act 1991.

financial supplement means a loan made by a participating corporation under a financial supplement contract to the other party to the contract.

financial supplement contract means a contract in force as provided by subsection 12K(2).

former accumulated ABSTUDY SSL debt has the meaning given by section 9B.

former special educational assistance scheme means:

(a) the former Aboriginal Secondary Assistance Scheme; or

(aa) the scheme known as the Aboriginal Overseas Study Assistance Scheme or the Aboriginal and Torres Strait Islander Overseas Study Award Scheme; or

(b) the former Adult Secondary Education Assistance Scheme; or

(c) the former Secondary Allowances Scheme; or

(d) the former Living Allowance for English as a Second Language Scheme.

FS assessment debt means an amount that is required to be paid in respect of an accumulated FS debt under section 12ZK and is included in a notice of an assessment made under section 12ZM.

FS debt has the meaning given by subsection 12ZF(1).

HELP debt indexation factor has the same meaning as in the Higher Education Support Act 2003.

HELP repayment income has the same meaning as repayment income has in the Higher Education Support Act 2003.

higher education institution means an educational institution in Australia that, in accordance with a determination by the Minister, is to be regarded as a higher education institution for the purposes of this Act.

Human Services Department means the Department administered by the Human Services Minister.

Human Services Minister means the Minister administering the Human Services (Centrelink) Act 1997.

income tax has the meaning given by subsection 995‑1(1) of the Income Tax Assessment Act 1997.

income tax law has the meaning given by subsection 995‑1(1) of the Income Tax Assessment Act 1997.

income year has the meaning given by subsection 995‑1(1) of the Income Tax Assessment Act 1997.

index number, in relation to a quarter, means the All Groups Consumer Price Index number, being the weighted average of the 8 capital cities, published by the Australian Statistician in respect of that quarter.

indexation amount, in relation to a financial supplement contract, has the meaning given by section 12Y.

Medicare levy means the Medicare levy imposed by the Medicare Levy Act 1986.

medicare program has the same meaning as in the Human Services (Medicare) Act 1973.

minimum HELP repayment income has the same meaning as minimum repayment income has in the Higher Education Support Act 2003.

minimum repayment income has the meaning given by section 12ZLA.

notional repayments, in relation to financial supplement, at a particular time, means the sum of the amounts notionally repaid in respect of the financial supplement before that time.

office, in relation to a financial corporation, has the meaning given by the regulations.

officer means a person performing duties, or exercising powers or functions, under or in relation to this Act and, in relation to a provision of Division 3 of Part 10, includes:

(a) a person who has been such a person; and

(b) a person who is or has been appointed or employed by the Commonwealth and who, as a result of that appointment or employment, may acquire or has acquired information concerning a person under this Act; and

(c) a person who, although not appointed or employed by the Commonwealth, performs or did perform services for the Commonwealth and who, as a result of performing those services, may acquire or has acquired information concerning a person under this Act.

participating corporation has the meaning given by subsection 12D(2).

prescribed benefit, for the purposes of Part 4A, in relation to the ABSTUDY scheme, means a benefit under the scheme concerned that is declared by the regulations to be a prescribed benefit for the purposes of that Part.

prescribed educational scheme overpayment means an amount paid under a prescribed education scheme that should not have been paid.

principal sum, in relation to a financial supplement contract, at a particular time, means the total of the amounts of financial supplement paid under the contract before that time by the relevant participating corporation to the other party to the contract.

protected information means information about a person that:

(a) has been obtained for the purposes of this Act (including the purposes of the administration of the ABSTUDY scheme); and

(b) is held in the records of:

(i) the Department; or

(ii) a Department administered by a Minister responsible for the administration of the Social Security Act 1991; or

(iii) the Human Services Department.

qualification period, for an ABSTUDY student start‑up loan, means a period of 6 months starting on 1 January or 1 July in any year.

qualification test day, for a qualification period for an ABSTUDY student start‑up loan, has the meaning given by subsection 7C(2).

repayable ABSTUDY SSL debt has the meaning given by section 10G.

repayable debt, for an income year, has the meaning given by section 12ZLB.

repayment income has the meaning given by section 12ZL.

return means an income tax return within the meaning of subsection 995‑1(1) of the Income Tax Assessment Act 1997.

secondary school means an educational institution in Australia that, in accordance with a determination by the Minister, is to be regarded as a secondary school for the purposes of this Act.

Secretary means the Secretary of the Department.

social security law has the same meaning as in the Social Security Act 1991.

special educational assistance scheme overpayment means an amount paid under a current special educational assistance scheme, or a former special educational assistance scheme, that should not have been paid.

student, in Part 4A, has a meaning affected by subsection 12B(2).

student assistance benefit means a payment under:

(a) the AUSTUDY scheme under this Act as in force before 1 July 1998; or

(b) the Student Financial Supplement Scheme (including the Scheme as in force before 1 July 1998); or

(c) a current or former special educational assistance scheme.

student assistance overpayment means:

(a) an amount:

(i) paid under the AUSTUDY scheme under this Act as in force before 1 July 1998; and

(ii) that should not have been paid; or

(b) a debt due by a person other than a financial corporation to the Commonwealth under paragraph 12QB(2)(d), 12QC(2)(d), 12S(2)(d) or 12U(2)(c) (including a debt accrued under either of those paragraphs as in force before 1 July 1998).

Student Financial Supplement Scheme means the scheme constituted by Part 4A for the payment of financial supplement to students.

Note: An application under the Student Financial Supplement Scheme cannot be made in respect of a year, or a part of a year, that begins on or after the day on which the Student Assistance Legislation Amendment Act 2006 receives the Royal Assent (see subsection 12C(1A)).

subsidy means subsidy under an agreement referred to in section 12D.

taxable income has the meaning given by section 4‑15 of the Income Tax Assessment Act 1997.

tax file number has the same meaning as in Part VA of the Income Tax Assessment Act 1936.

technical and further education institution means an educational institution in Australia that, in accordance with a determination by the Minister, is to be regarded as a technical and further education institution for the purposes of this Act.

termination date, in relation to a financial supplement contract, means the last day of the contract period.

voluntary ABSTUDY SSL repayment means a payment made to the Commissioner in discharge of an accumulated ABSTUDY SSL debt or an ABSTUDY SSL debt. It does not include a payment made in discharge of a compulsory ABSTUDY SSL repayment amount.

year means a calendar year.

(2) For the purposes of the definitions of education institution, higher education institution, secondary school and technical and further education institution in subsection (1), a reference to Australia includes a reference to the Territory of Christmas Island and the Territory of Cocos (Keeling) Islands.

(2A) A determination by the Minister for the purposes of the definition of education institution, higher education institution, secondary school or technical and further education institution is a legislative instrument.

5 Binding of the Crown

(1) This Act binds the Crown in all its capacities.

(2) Nothing in this Act permits the Crown to be prosecuted for an offence.

5A Extension of Act

This Act extends to Norfolk Island, to the Territory of Christmas Island and to the Territory of Cocos (Keeling) Islands.

5B Secretary to have general administration

The Secretary is, subject to section 12ZEA and to any directions of the Minister, to have the general administration of this Act.

Note: Section 12ZEA provides that the Commissioner has the general administration of Division 6 of Part 4A, to the extent that the Division relates to the Commissioner.

5C Principles of administration

In administering this Act, the Secretary is to have regard to:

(a) the desirability of achieving the following results:

(i) the ready availability to members of the public of advice and information services relating to benefits under this Act;

(ii) the ready availability of publications containing clear statements about entitlements under this Act and procedural requirements;

(iii) the delivery of services under this Act in a fair, courteous, prompt and cost‑efficient manner;

(iv) a process of monitoring and evaluating delivery of programs with an emphasis on the impact of programs on people who receive benefits under this Act;

(v) the establishment of procedures to ensure that abuses of the schemes for benefits under this Act are minimised; and

(b) the special needs of disadvantaged groups in the community; and

(c) the need to be responsive to Aboriginality and to cultural and linguistic diversity; and

(d) the importance of the systems of review of decisions under this Act; and

(e) the need to apply government policy in accordance with the law and with due regard to relevant decisions of the Administrative Appeals Tribunal.

Note: In administering this Act, the Secretary is also bound by the Privacy Act 1988 and by the provisions of this Act concerning confidentiality—see Division 3 of Part 10.

5D Minister may determine secondary and tertiary courses etc.

(1) The Minister may, for the purposes of this Act, determine in writing that:

(a) a course of study or instruction is a secondary course, or a tertiary course; or

(b) a part of a course of study or instruction is a part of a secondary course, or a part of a tertiary course.

(2) For the purposes of this section, a determination that:

(a) was made under paragraph 7(1)(c) as in force before the day on which this section commences; and

(b) was in force immediately before that day;

is taken to be a determination under subsection (1) of this section and may be amended or repealed accordingly.

(3) A determination under subsection (1) is a legislative instrument.

5E Application of the Criminal Code

Chapter 2 (except Part 2.5) of the Criminal Code applies to all offences created by this Act.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Part 2—ABSTUDY student start‑up loans

Division 1—Introduction

6A Simplified outline of this Part

ABSTUDY student start‑up loans are income‑contingent loans made under the ABSTUDY Scheme.

Broadly, full‑time students who are receiving Living Allowance might be qualified for an ABSTUDY student start‑up loan. A person can qualify for up to 2 loans each calendar year. To receive a loan, a person must make a claim before the end of the relevant period for each loan.

When the person’s income reaches the minimum repayment income under the Higher Education Support Act 2003, and the person has finished repaying any debt under that Act, or under the Social Security Act 1991 in relation to a student start‑up loan under Chapter 2AA of that Act, the person must start repaying ABSTUDY student start‑up loan debt.

Division 2—Qualification for and amount of ABSTUDY student start‑up loan

7A Simplified outline of this Division

Broadly, full‑time students who are receiving Living Allowance might be qualified for an ABSTUDY student start‑up loan. A person can qualify for up to 2 loans each calendar year.

7B ABSTUDY Scheme

(1) For the purposes of a reference in this Act or another law to the ABSTUDY Scheme:

(a) this Part is taken to be part of the ABSTUDY Scheme; and

(b) ABSTUDY student start‑up loans are taken to be made under the ABSTUDY Scheme.

(2) This Part does not limit the ABSTUDY Scheme. In particular, the ABSTUDY Scheme may make provision for matters relating to ABSTUDY student start‑up loans for which provision is not made in this Act.

7C Qualification for ABSTUDY student start‑up loan

(1) A person is qualified for an ABSTUDY student start‑up loan for a qualification period if:

(a) on the person’s qualification test day for the period:

(i) the person is qualified for a payment known as Living Allowance under the ABSTUDY Scheme and Living Allowance is payable to the person; and

(ii) the person is receiving Living Allowance and would be receiving Living Allowance if any amounts of pharmaceutical allowance and rent assistance payable to the person under the ABSTUDY Scheme were disregarded for the purposes of working out the person’s rate of that allowance; and

(iii) the person is qualified for Living Allowance because the person is undertaking full‑time study in a course of education that is an approved scholarship course; and

(b) the Secretary is satisfied that the person is not likely to receive the amount or value of a disqualifying education costs scholarship in the period of 6 months starting immediately after that qualification test day; and

(c) the person notifies the Secretary of the person’s tax file number.

Note: If the condition in subparagraph (a)(iii) is no longer met in a certain period starting on the qualification test day, the amount of the loan might become an immediately recoverable debt, rather than an income‑contingent SSL debt: subsection 38A(1) and section 39.

Qualification test day

(2) A person’s qualification test day for a qualification period is the earliest of the following:

(a) the day the Secretary determines the person’s claim for an ABSTUDY student start‑up loan for the qualification period;

(b) if the approved scholarship course ends in the qualification period—the last day of the approved scholarship course;

(c) the last day of the qualification period.

7D Circumstances in which person is not qualified for ABSTUDY student start‑up loan

Despite section 7C, a person is not qualified for an ABSTUDY student start‑up loan for a qualification period if:

(a) immediately before the person’s qualification test day for the period:

(i) a determination is in effect that the person is qualified for an ABSTUDY student start‑up loan for the qualification period; or

(ii) a determination is in effect that the person is qualified for a student start‑up loan under the Social Security Act 1991 for the qualification period; or

(b) in the period of 6 months ending immediately before that qualification test day, the person:

(i) has received a payment known as a student start‑up scholarship payment under the scheme referred to in section 117 of the Veterans’ Entitlements Act 1986; or

(ii) has received a payment known as a student start‑up scholarship payment under the scheme referred to in section 258 of the Military Rehabilitation and Compensation Act 2004; or

(iii) has received the amount or value of a disqualifying education costs scholarship; or

(iv) was entitled to the amount or value of a disqualifying education costs scholarship but has not received the full entitlement only because the scholarship was suspended.

7E Amount of ABSTUDY student start‑up loan

(1) The amount of an ABSTUDY student start‑up loan for which a person is qualified is $1,025.

(2) The amount of an ABSTUDY student start‑up loan is to be indexed under Division 2 of Part 3.16 of the Social Security Act 1991, on each 1 January, as if it were a student start‑up loan amount referred to in the table in subsection 1191(1) of that Act. The indexed amount is taken to be the amount specified in subsection (1) on and from that 1 January.

Division 3—Indebtedness: incurring ABSTUDY SSL debts

8A Simplified outline of this Division

A person incurs an ABSTUDY SSL debt if the person receives an ABSTUDY student start‑up loan (except in certain circumstances when the loan is required to be recovered as a debt under this Act).

8B ABSTUDY SSL debts

(1) A person incurs an ABSTUDY SSL debt to the Commonwealth if the person is paid an ABSTUDY student start‑up loan for a qualification period.

(2) The ABSTUDY SSL debt is incurred by the person on the later of:

(a) the day the person was paid the loan; and

(b) the day after the person’s enrolment test day for the qualification period.

Note: For enrolment test day, see subsection (5).

(3) The amount of the person’s ABSTUDY SSL debt is the amount of the loan, reduced by any amount repaid before the day on which the debt is incurred.

(4) Despite subsection (1), an ABSTUDY SSL debt is not incurred, and is taken never to have been incurred, in relation to a loan if:

(a) the loan has been fully repaid before the day on which the ABSTUDY SSL debt in respect of the loan would be incurred; or

(b) the amount of the loan is a debt under section 39; or

(c) the Secretary has formed an opinion under subsection 38A(3) in relation to the loan (relating to exceptional circumstances beyond the person’s control).

(5) A person’s enrolment test day, for a qualification period, is the earliest of the following days:

(a) if the relevant approved scholarship course ends in the qualification period—the last day of that approved scholarship course;

(b) the last day of the qualification period;

(c) the 35th day of the period starting on whichever of the following applies:

(i) if the person’s qualification test day for the qualification period was before the first day of the relevant approved scholarship course—the first day of that approved scholarship course;

(ii) otherwise—the qualification test day.

8C ABSTUDY SSL debt discharged by death

Upon the death of a person who owes an ABSTUDY SSL debt to the Commonwealth, the debt is taken to have been paid.

Note: ABSTUDY SSL debts are not provable in bankruptcy: see subsection 82(3AB) of the Bankruptcy Act 1966.

8D Notice to Commissioner

(1) If a person incurs an ABSTUDY SSL debt, the Secretary must give the Commissioner a notice specifying the amount of the debt incurred by the person.

(2) The Secretary may include in the notice any other details the Commissioner requests for the purpose of ensuring the Commissioner has the information needed to exercise powers or perform functions of the Commissioner under this Act.

Division 4—Indebtedness: working out accumulated ABSTUDY SSL debts

9A Simplified outline of this Division

Each ABSTUDY SSL debt a person incurs is incorporated into the person’s accumulated ABSTUDY SSL debt. This accumulated ABSTUDY SSL debt forms the basis for working out the amounts the person is obliged to repay.

There are 2 stages to working out a person’s accumulated ABSTUDY SSL debt for a financial year.

In stage 1, the person’s former accumulated ABSTUDY SSL debt is worked out by adjusting the preceding financial year’s accumulated ABSTUDY SSL debt to take account of:

(a) the HELP debt indexation factor for 1 June in that financial year; and

(b) the debts that the person incurs during the last 6 months of the preceding financial year; and

(c) voluntary ABSTUDY SSL repayments of the debt; and

(d) compulsory ABSTUDY SSL repayment amounts in respect of the debt.

In stage 2, the person’s accumulated ABSTUDY SSL debt is worked out from:

(a) the person’s former accumulated ABSTUDY SSL debt; and

(b) the ABSTUDY SSL debts that the person incurs during the first 6 months of the financial year; and

(c) voluntary ABSTUDY SSL repayments of those debts.

9B Stage 1—working out a former accumulated ABSTUDY SSL debt

(1) A person’s former ABSTUDY accumulated SSL debt, in relation to the person’s accumulated ABSTUDY SSL debt for a financial year, is worked out by multiplying:

(a) the amount worked out using the following method statement; by

(b) the HELP debt indexation factor for 1 June in that financial year.

Method statement

Step 1. Take the person’s accumulated ABSTUDY SSL debt for the immediately preceding financial year. (This amount is taken to be zero if the person has no accumulated ABSTUDY SSL debt for that financial year.)

Step 2. Add the sum of all of the ABSTUDY SSL debts (if any) that the person incurred during the last 6 months of the immediately preceding financial year.

Step 3. Subtract the sum of the amounts by which the person’s debts referred to in steps 1 and 2 are reduced because of any voluntary ABSTUDY SSL repayments that have been made during the period:

(a) starting on 1 June in the immediately preceding financial year; and

(b) ending immediately before the next 1 June.

Step 4. Subtract the sum of all of the person’s compulsory ABSTUDY SSL repayment amounts that:

(a) were assessed during that period (excluding any assessed as a result of a return given before that period); or

(b) were assessed after the end of that period as a result of a return given before the end of that period.

Step 5. Subtract the sum of the amounts by which any compulsory ABSTUDY SSL repayment amount of the person is increased (whether as a result of an increase in the person’s taxable income of an income year or otherwise) by an amendment of an assessment made during that period.

Step 6. Add the sum of the amounts by which any compulsory ABSTUDY SSL repayment amount of the person is reduced (whether as a result of a reduction in the person’s taxable income of an income year or otherwise) by an amendment of an assessment made during that period.

(2) For the purposes of this section, an assessment, or an amendment of an assessment, is taken to have been made on the day specified in the notice of assessment, or notice of amended assessment, as the date of issue of that notice.

9C Stage 2—working out an accumulated ABSTUDY SSL debt

(1) A person’s accumulated ABSTUDY SSL debt, for a financial year, is worked out as follows:

where:

ABSTUDY SSL debt repayments is the sum of all of the voluntary ABSTUDY SSL repayments (if any) paid, on or after 1 July in the financial year and before 1 June in that year, in reduction of the ABSTUDY SSL debts incurred in that year.

ABSTUDY SSL debts incurred is the sum of the amounts of all of the SSL debts (if any) that the person incurred during the first 6 months of the financial year.

former accumulated ABSTUDY SSL debt is the person’s former accumulated ABSTUDY SSL debt in relation to that accumulated ABSTUDY SSL debt.

(2) The person incurs the accumulated ABSTUDY SSL debt on 1 June in the financial year.

9D Rounding of amounts

(1) If, apart from this section, a person’s accumulated ABSTUDY SSL debt would be an amount consisting of a number of whole dollars and a number of cents, disregard the number of cents.

(2) If, apart from this section, a person’s accumulated ABSTUDY SSL debt would be an amount of less than $1.00, the person’s accumulated ABSTUDY SSL debt is taken to be zero.

9E Accumulated ABSTUDY SSL debt discharges earlier debts

(1) The accumulated ABSTUDY SSL debt that a person incurs on 1 June in a financial year discharges, or discharges the unpaid part of:

(a) any ABSTUDY SSL debt that the person incurred during the calendar year immediately preceding that day; and

(b) any accumulated ABSTUDY SSL debt that the person incurred on the immediately preceding 1 June.

(2) Nothing in subsection (1) affects the application of section 8B, 8C, 9B or 9C.

9F Accumulated ABSTUDY SSL debt discharged by death

(1) Upon the death of a person who has an accumulated ABSTUDY SSL debt, the accumulated ABSTUDY SSL debt is taken to be discharged.

(2) To avoid doubt, this section does not affect any compulsory ABSTUDY SSL repayment amounts required to be paid in respect of the accumulated ABSTUDY SSL debt, whether or not those amounts were assessed before the person’s death.

Note: Accumulated ABSTUDY SSL debts are not provable in bankruptcy: see subsection 82(3AB) of the Bankruptcy Act 1966.

Division 5—Discharge of indebtedness

Subdivision A—Introduction

10A Simplified outline of this Division

A person who owes a debt to the Commonwealth under this Part may make voluntary ABSTUDY SSL repayments.

The person is required to make repayments, of amounts based on his or her income, if that income is above a particular amount and if the person has repaid the person’s accumulated HELP debts arising under the Higher Education Support Act 2003 and accumulated SSL debts arising under Chapter 2AA of the Social Security Act 1991. The Commissioner makes assessments of repayment amounts, which are collected in the same way as amounts of income tax and those other income‑contingent loan debts.

10B Debts under this Part

(1) The debts under this Part are:

(a) ABSTUDY SSL debts; and

(b) accumulated ABSTUDY SSL debts.

(2) To avoid doubt, debts that arise under section 39 are not debts under this Part.

(3) To avoid doubt, nothing in this section affects section 7B (about the relationship of this Part to the ABSTUDY Scheme).

Subdivision B—Voluntary discharge of indebtedness

10C Voluntary ABSTUDY SSL repayments in respect of debts

(1) A person may at any time make a payment in respect of a debt that the person owes to the Commonwealth under this Part.

(2) The payment must be made to the Commissioner.

10D Application of voluntary ABSTUDY SSL repayments

(1) Any money a person pays under this Subdivision to meet the person’s debts to the Commonwealth under this Part is to be applied in payment of those debts as the person directs at the time of the payment.

(2) If the person has not given any directions, or the directions given do not adequately deal with the matter, any money available is to be applied as follows:

(a) first, in discharge or reduction of any accumulated ABSTUDY SSL debt of the person;

(b) second, in discharge or reduction of:

(i) any ABSTUDY SSL debt of the person; or

(ii) if there is more than one such debt, those debts in the order in which they were incurred.

10E Refunding of payments

If:

(a) a person pays an amount to the Commonwealth under this Subdivision; and

(b) the amount exceeds the sum of:

(i) the amount required to discharge the total debt that the person owed to the Commonwealth under this Part; and

(ii) the total amount of the person’s primary tax debts (within the meaning of Part IIB of the Taxation Administration Act 1953);

the Commonwealth must refund to the person an amount equal to that excess.

Subdivision C—Compulsory discharge of indebtedness

10F Liability to repay amounts

(1) If:

(a) a person’s HELP repayment income for an income year exceeds the minimum HELP repayment income for the income year; and

(b) on 1 June immediately preceding the making of an assessment in respect of the person’s income of that income year, the person had an accumulated ABSTUDY SSL debt;

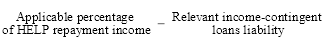

the person is liable to pay to the Commonwealth, in accordance with this Subdivision, so much of the person’s repayable ABSTUDY SSL debt for the income year as does not exceed the amount worked out by the formula:

where:

applicable percentage of HELP repayment income means the amount that is the percentage of the person’s HELP repayment income applicable under the table in section 154‑20 of the Higher Education Support Act 2003.

relevant income‑contingent loans liability means the amount that is the sum of the following:

(a) any amount the person is liable to pay under section 154‑1 of the Higher Education Support Act 2003 for the income year in respect of an accumulated HELP debt;

(b) any amount the person is liable to pay under section 1061ZVHA of the Social Security Act 1991 for the income year in respect of an accumulated SSL debt.

(2) A person is not liable under this section to pay an amount for an income year if the amount worked out under subsection (1) is zero or less.

(3) A person is not liable under this section to pay an amount for an income year if, under section 8 of the Medicare Levy Act 1986:

(a) no Medicare levy is payable by the person on the person’s taxable income for the income year; or

(b) the amount of the Medicare levy payable by the person on the person’s taxable income for the income year is reduced.

10G Repayable ABSTUDY SSL debt for an income year

(1) A person’s repayable ABSTUDY SSL debt for an income year is:

(a) the person’s accumulated ABSTUDY SSL debt referred to in paragraph 10F(1)(b) in relation to that income year; or

(b) if one or more amounts:

(i) have been paid in reduction of that debt; or

(ii) have been assessed under section 10H to be payable in respect of that debt;

the amount (if any) remaining after deducting from that debt any amounts referred to in subparagraph (i) or (ii).

(2) A reference in paragraph (1)(b) of this section to an amount assessed to be payable is, if the amount has been increased or reduced by an amendment of the relevant assessment, a reference to the increased amount or the reduced amount.

Subdivision D—Assessments

10H Commissioner may make assessments

The Commissioner may, from any information in the Commissioner’s possession, whether from a return or otherwise, make an assessment of:

(a) the person’s accumulated ABSTUDY SSL debt on 1 June immediately before the making of the assessment; and

(b) the amount required to be paid in respect of the person’s repayable SSL debt under section 10F.

10J Notification of notices of assessment of tax

If:

(a) the Commissioner is required to serve on a person a notice of assessment in respect of the person’s income of an income year under section 174 of the Income Tax Assessment Act 1936; and

(b) the Commissioner has made, in respect of the person, an assessment under paragraph 10H(b) of this Act of the amounts referred to in that paragraph; and

(c) notice of the assessment under that paragraph has not been served on the person;

notice of the assessment under that paragraph may be served by specifying the amounts concerned in the notice referred to in paragraph (a).

10K Commissioner may defer making assessments

(1) A person may apply in the approved form to the Commissioner for deferral of the making of an assessment in respect of the person under section 10H.

(2) The application must specify:

(a) the income year for which the deferral is being sought; and

(b) the reasons for seeking the deferral.

(3) The income year specified in the application must be:

(a) the income year in which the person makes the application; or

(b) the immediately preceding income year; or

(c) the immediately succeeding income year.

(4) The Commissioner may, on application by a person under this section, defer making an assessment in respect of the person under section 10H if the Commissioner is of the opinion that:

(a) if the assessment were made, payment of the assessed amount would cause serious hardship to the person; or

(b) there are other special reasons that make it fair and reasonable to defer making the assessment.

(5) The Commissioner may defer making the assessment for any period that he or she thinks appropriate.

(6) The Commissioner must, as soon as practicable after an application is made under this section:

(a) consider the matter to which the application relates; and

(b) notify the applicant of the Commissioner’s decision on the application.

Note: Deferrals of making assessments, or refusals of applications, are reviewable under Division 1A of Part 9.

10L Commissioner may amend assessments

(1) A person may apply in the approved form to the Commissioner for an amendment of an assessment made in respect of the person under section 10H so that:

(a) the amount payable under the assessment is reduced; or

(b) no amount is payable under the assessment.

(2) The application:

(a) must be made within 2 years after the day on which the Commissioner gives notice of the assessment to the person; or

(b) must specify the reasons justifying a later application.

(3) The Commissioner may, on application by a person under this section, amend an assessment made in respect of the person under section 10H so that:

(a) the amount payable under the assessment is reduced; or

(b) no amount is payable under the assessment;

if the Commissioner is of the opinion that:

(c) payment of the assessed amount has caused or would cause serious hardship to the person; or

(d) there are other special reasons that make it fair and reasonable to make the amendment.

(4) The Commissioner must, as soon as practicable after an application is made under this section:

(a) consider the matter to which the application relates; and

(b) notify the applicant of the Commissioner’s decision on the application.

Note: Amendments of assessments, or refusals of applications, are reviewable under Division 1A of Part 9.

Division 6—Tax administration matters

11A Simplified outline of this Division

The Secretary and the Commissioner may share information about tax file numbers for the purposes of administering ABSTUDY student start‑up loans. The Commissioner is also responsible for the recovery of debts under this Part and has functions and powers to fulfil that responsibility relating to returns, assessments, collection and other administrative matters.

11B Verification of tax file numbers

(1) The Secretary may provide to the Commissioner a tax file number that a person has notified to the Secretary for the purposes of paragraph 7C(1)(c), for the purpose of verifying that the number is the person’s tax file number.

(2) If the Commissioner is satisfied that the number is the person’s tax file number, the Commissioner may give the Secretary a written notice informing the Secretary accordingly.

11C When person with tax file number incorrectly notifies number

(1) If the Commissioner is satisfied:

(a) that the tax file number that a person has notified to the Secretary for the purposes of paragraph 7C(1)(c):

(i) has been cancelled or withdrawn since the notification was given; or

(ii) is otherwise wrong; and

(b) that the person has a tax file number;

the Commissioner may give to the Secretary written notice of the incorrect notification and of the person’s tax file number.

(2) That number is taken to be the number that the person notified to the Secretary.

11D When person without tax file number incorrectly notifies number

(1) If:

(a) the Commissioner is satisfied that the tax file number that a person notified to the Secretary for the purposes of paragraph 7C(1)(c):

(i) has been cancelled since the notification was given; or

(ii) is for any other reason not the person’s tax file number; and

(b) the Commissioner is not satisfied that the person has a tax file number;

the Commissioner may give to the Secretary a written notice informing the Secretary accordingly.

(2) The Commissioner must give a copy of any notice under subsection (1) of this section to the person concerned, together with a written statement of the reasons for the decision to give the notice.

Note: Decisions to give notice under subsection (1) are reviewable under section 202F of the Income Tax Assessment Act 1936.

11E When tax file numbers are altered

(1) If the Commissioner issues, to a person who has notified a tax file number to the Secretary for the purposes of paragraph 7C(1)(c), a new tax file number in place of a tax file number that has been withdrawn, the Commissioner may give to the Secretary a written notice informing the Secretary accordingly.

(2) That new number is taken to be the number that the person notified to the Secretary.

11F When tax file numbers are cancelled

(1) If the Commissioner cancels a tax file number issued to a person who has notified the tax file number to the Secretary for the purposes of paragraph 7C(1)(c), the Commissioner may give to the Secretary a written notice informing the Secretary accordingly.

(2) The Commissioner must give a copy of any notice under subsection (1) of this section to the person concerned, together with a written statement of the reasons for the decision to give the notice.

Note: Decisions to give notice under subsection (1) are reviewable under section 202F of the Income Tax Assessment Act 1936.

11G Returns, assessments, collection and recovery

Subject to Division 5 and this Division:

(a) Part IV of the Income Tax Assessment Act 1936; and

(b) Division 5 of the Income Tax Assessment Act 1997; and

(c) Part 4‑15 in Schedule 1 to the Taxation Administration Act 1953;

apply, so far as they are capable of application, in relation to a compulsory ABSTUDY SSL repayment amount of a person as if it were income tax assessed to be payable by a taxpayer by an assessment made under Part IV of the Income Tax Assessment Act 1936.

11H Charges and civil penalties for failing to meet obligations

(1) Part 4‑25 in Schedule 1 to the Taxation Administration Act 1953 has effect as if:

(a) any compulsory ABSTUDY SSL repayment amount of a person were income tax payable by the person in respect of the income year in respect of which the assessment of that debt was made; and

(b) paragraph 7C(1)(c), and Divisions 3, 4 and 5 and this Division, were income tax laws.

(2) Subsection (1) does not have the effect of making a person liable to a penalty for any act or omission that happened before the commencement of this subsection.

11J Pay as you go (PAYG) withholding

Part 2‑5 (other than section 12‑55 and Subdivisions 12‑E, 12‑F and 12‑G) in Schedule 1 to the Taxation Administration Act 1953 applies, so far as it is capable of application, in relation to the collection of amounts of a compulsory ABSTUDY SSL repayment amount of a person as if the compulsory ABSTUDY SSL repayment amount were income tax.

11K Pay as you go (PAYG) instalments

Division 45 in Schedule 1 to the Taxation Administration Act 1953 applies, so far as it is capable of application, in relation to the collection of a compulsory ABSTUDY SSL repayment amount of a person as if the compulsory ABSTUDY SSL repayment amount were income tax.

11L Administration of this Part

The Commissioner has the general administration of:

(a) paragraph 7C(1)(c); and

(b) Divisions 3, 4 and 5 and this Division; and

(c) Division 1A of Part 9 (Internal review of certain Commissioner decisions relating to ABSTUDY student start‑up loans).

Note: One effect of this is that these Divisions are taxation laws for the purposes of the Taxation Administration Act 1953.

Part 4A—Financial supplement for tertiary students

Division 1—Preliminary

12A Object and explanation of this Part

(1) The object of this Part is to enable a tertiary student who is, or except for the ABSTUDY parental income test would be, eligible for certain benefits under the ABSTUDY scheme to obtain a repayable financial supplement by choosing to enter into a contract for that purpose with a financial corporation that participates in the Student Financial Supplement Scheme.

(2) The payment of financial supplement will reduce certain other benefits payable to the student under the ABSTUDY scheme. The amount of the supplement that the student is eligible to obtain depends on the total amount of those benefits that the student chooses to receive, and the student may choose to repay some of the benefits, or to receive lower benefits, in order to receive a higher supplement.

(3) The student is not liable to pay interest to the financial corporation in respect of financial supplement obtained, but the Commonwealth will, without cost to the student, pay a subsidy to the financial corporation that includes an amount in lieu of interest.

(4) However, the amount of the financial supplement that has to be repaid under a contract will be indexed on 1 June in the year next following the year in which the contract is entered into and on 1 June in each subsequent year. The amount by which supplement is increased by indexation is owed by the student to the Commonwealth and not to the financial corporation. The student is entitled, but not required, to make early repayments above a certain amount in respect of the supplement during the period of the contract. There is a discount, worked out under subsection 12ZA(7) or (7A), for repayments made before the end of that period.

(5) If financial supplement obtained by a student is not repaid in full before the end of the period of the contract, the obligation to repay the amount of the supplement that is still outstanding is assigned to the Commonwealth and the indexed amount is repayable by the student to the Commonwealth through the taxation system when the student’s income reaches a certain level.

12B Interpretation

(1) In this Part, unless the contrary intention appears, expressions that are defined in the Income Tax Assessment Act 1936 have the same meanings as in that Act.

(2) For the purposes of the application of this Part in relation to a person at a time after the person entered or first entered into a financial supplement contract with a participating corporation, the person is called a student even though the contract period or any contract period may have ended or the person may have ceased to be a student.

12C Which students are eligible for financial supplement

(1) Subject to subsection (1A), a person is an eligible student for the purposes of this Part in relation to a year or a part of a year if:

(a) the person is undertaking, or proposes to undertake, at an education institution in that year or that part of that year, a prescribed course of study or instruction; and

(b) either of the following subparagraphs applies:

(i) the person qualifies for a prescribed benefit under the ABSTUDY scheme in respect of that year or that part of that year;

(ii) the adjusted parental income in relation to the person in respect of that year or that part of that year is less than such amount as is prescribed by the regulations and, except for the parental income test applicable under the ABSTUDY scheme, the person would have qualified for a prescribed benefit under that scheme in respect of that year or that part of that year.

(1A) A person is not an eligible student in relation to a year, or a part of a year, that begins on or after the day on which the Student Assistance Legislation Amendment Act 2006 receives the Royal Assent.

(2) If:

(a) a person is undertaking a course of study or instruction, or a part of a course of study or instruction, offered by an education institution; and

(b) for the purposes of that course or that part of that course, the person is required or allowed by that institution to attend, and attends, a place other than:

(i) that institution; or

(ii) a place in respect of which a determination under subsection (3) is in force;

the person is, for the purposes of this section, taken to be undertaking that course or that part of that course wholly at that institution.

(3) The Minister may, by legislative instrument, determine that subsection (2) does not apply in relation to a place, or a class of place, specified in the determination.

(5) If a person is undertaking, or proposes to undertake, by correspondence with an education institution:

(a) a course of study or instruction; or

(b) a part of a course of study or instruction;

offered by that education institution, the person is, for the purposes of this section, taken to be undertaking that course, or that part of that course, wholly at that institution.

12D Agreements between Commonwealth and financial corporations

(1) An eligible student may apply for financial supplement only to a financial corporation that has entered into an agreement with the Commonwealth to pay financial supplement in accordance with this Act.

(2) Subject to this section, if the Minister has, whether before or after the commencement of this Part, entered into, on behalf of the Commonwealth, an agreement with a financial corporation for the payment by the corporation, in the year beginning on 1 January 1993 or a subsequent year, of financial supplement to eligible students, the corporation is a participating corporation for the purposes of this Part in respect of that year.

(3) Subsection (2) does not apply in relation to an agreement unless the agreement:

(a) is expressed to have effect subject to this Act; and

(b) provides for the payment by the Commonwealth to the financial corporation, in respect of each amount of financial supplement paid by the corporation to a student that has not been repaid, or in respect of which the rights of the corporation have been assigned to the Commonwealth, of a subsidy of such amount or amounts, or at such rate or rates, and in respect of such period or periods, as are stated in the agreement.

(4) Subject to subsection (5), the parties to an agreement referred to in subsection (2) (or such an agreement as previously amended) may enter into an agreement amending or terminating the first‑mentioned agreement (or that agreement as previously amended).

(5) The amendment or termination of an agreement does not affect any financial supplement contract that was in force immediately before the amendment or termination took effect.

(6) An agreement entered into between the Commonwealth and a financial corporation as mentioned in this section is not subject to any stamp duty or other tax under a law of a State or Territory.

(7) An officer may disclose to a participating corporation any information about a student that is relevant to the exercise or performance by the corporation of any of its rights or obligations in respect of the student under this Part.

(8) A participating corporation may disclose to an officer any information about a student that is relevant to the exercise or performance of any rights, powers or obligations conferred or imposed on an officer or on the Commonwealth in respect of the student under this Part.

Division 2—Applications for financial supplement

12E Explanation of Division

This Division sets out how an eligible student can, if he or she so chooses, obtain financial supplement, the amount of the financial supplement that can be obtained and the effect of payment of the financial supplement on the student’s entitlement to certain other benefits under the ABSTUDY scheme.

12F Secretary to give student notice of entitlement

(1) The Secretary must:

(a) decide whether a person (the student) who applies for benefits under the AUSTUDY scheme or the ABSTUDY scheme in respect of a year or a part of a year is an eligible student in respect of that year or that part of that year; and

(b) give to the student written notice of the decision stating whether the student is an eligible student in respect of that year or that part of that year and, if so, stating:

(i) the minimum and maximum amounts, as determined under the regulations, of the financial supplement that the student is eligible to obtain; and

(ii) such other information as is required by the regulations to be included in such a notice.

(1A) Subsection (1) does not apply in relation to a year, or a part of a year, that begins on or after the day on which the Student Assistance Legislation Amendment Act 2006 receives the Royal Assent.

(2) If the notice under subsection (1) states that the student is an eligible student, the Secretary must give to the student a form of application for the financial supplement approved by the Secretary.

(3) At any time, whether before or after the student has lodged an application for the financial supplement with a participating corporation under section 12G, the Secretary may review the decision and must, if the decision is revoked or varied, give to the student:

(a) a notice under paragraph (1)(b) stating that the decision has been revoked or varied and, if the decision has been varied, setting out particulars of the variation; and

(b) if the decision has been varied before the student lodged an application for the financial supplement—a fresh form of application.

(4) If a notice is given to the student as mentioned in subsection (3), any notice previously given to the student under paragraph (1)(b) before the decision was reviewed is taken to be revoked and the student is not entitled to use any previous notice in connection with an application for financial supplement under section 12G.

12G When must a person apply for financial supplement?

(1) A person who receives a notice under section 12F stating that the person is an eligible student in respect of a year or part of a year, is entitled to apply for the whole or part of the financial supplement he or she is eligible to obtain in respect of the year or part of the year. To obtain financial supplement, the person must apply in accordance with this section.

(2) The person may obtain the financial supplement if the person applies for it while the person is an eligible student in respect of the year or part of the year, as the case requires.

(3) The person may also obtain the financial supplement if:

(a) the person was an eligible student during the year or part of the year, as the case requires; and

(b) the person applies for financial supplement before the end of the calendar year in respect of which, or a part of which, the person was eligible for financial supplement; and

(c) in the opinion of the Secretary, the person:

(i) had taken all reasonable steps to apply for the financial supplement while still an eligible student in respect of the year or part of the year and had been prevented from applying during the year or part of the year (as the case requires) only because of circumstances beyond his or her control; and

(ii) had taken steps to apply for financial supplement in respect of the year or part of the year as soon as practicable after ceasing to be an eligible student.

(4) An application for financial supplement must be made by lodging the form of application, duly completed, together with the notice issued under section 12F, at any office of a participating corporation.

(5) The Secretary must notify an applicant under subsection (3) and the corporation of a decision made under that subsection in respect of the applicant.

12GA Student may give notice to participating corporation to increase or decrease financial supplement

At any time after a person applies to a participating corporation for an amount of financial supplement, the person may by written notice to the corporation lodged at any office of the corporation tell the corporation that the person requires:

(a) a specified lesser amount of financial supplement (not being an amount that is less than the total financial supplement already paid to the person); or

(b) a specified greater amount of financial supplement (not being an amount that is greater than the maximum amount of financial supplement that the person is eligible to obtain).

12H Effect of financial supplement on certain other benefits

(1) The payment of financial supplement to a person will, as mentioned in subsection 12A(2), reduce the person’s entitlement to certain other benefits under the ABSTUDY scheme in accordance with subsection (2).

(2) If:

(a) apart from this section a person would be entitled to a prescribed benefit under the ABSTUDY scheme in respect of a year or a part of a year; and

(b) an application by the person to a participating corporation for financial supplement in respect of that year or that part of that year is accepted by the corporation in accordance with section 12K;

the benefit referred to in paragraph (a) is reduced by an amount equal to one‑half of the amount of the financial supplement paid to the person.

(3) If, apart from this subsection, the amount by which a benefit would be reduced by subsection (2) is an amount of dollars and cents and the cents include a half of one cent, the amount is increased by a half of one cent.

Division 3—Payment of financial supplement

12J Explanation of Division

This Division sets out the legal relationship between a person who applies for financial supplement and the financial corporation that pays the financial supplement. An application for financial supplement relates only to a year or a part of a year and a separate contract between the person and the corporation therefore arises in respect of each year or part of a year for which an application for financial supplement is made.

12K Contract between applicant for financial supplement and participating corporation

(1) If a person (the student) who is entitled to do so applies to a participating corporation in accordance with section 12G for the payment of financial supplement in respect of a year or a part of a year, the corporation must, as soon as practicable, accept the application by written notice to the student.

(2) The acceptance of the application forms a binding contract in respect of that year or that part of that year between the corporation and the student for the making of a loan by the corporation to the student in accordance with this Division of such amount of financial supplement as the student from time to time requests but not exceeding the maximum amount of financial supplement that the student is from time to time eligible to obtain and for the making, if the student so wishes, of repayments during the contract period in accordance with Division 5 in respect of the amount outstanding from time to time under the contract.

(3) Despite subsection (2), any amount paid to the student by the corporation in accordance with advice provided by the Commonwealth is taken to be financial supplement paid under the contract even though the student may not have been eligible to obtain that amount.

(4) Subsection (3) does not affect the operation of Division 4.

(5) In determining the extent (if any) to which it is liable to make a payment in respect of financial supplement to a student under a financial supplement contract, a participating corporation is entitled to rely on advice provided by the Commonwealth.

(6) Subject to this Part, the validity of a financial supplement contract is not affected merely because the student was not an eligible student when the application was accepted or ceases at a later time to be an eligible student.

(7) A financial supplement contract is not invalid, and is not voidable, under any other law (whether written or unwritten) in force in a State or Territory.

(8) Without limiting the generality of subsection (7), a financial supplement contract is not invalid merely because the student is an undischarged bankrupt when the contract is entered into, and any liability of the student to a participating corporation or the Commonwealth under or because of the contract is enforceable despite the bankruptcy.

12KA Cooling off period for financial supplement contract

(1) An eligible student under a financial supplement contract has a right to cancel the contract. However, the student may waive the right to cancel the contract (see section 12KB). If the student waives the right to cancel the contract, subsections (2) to (6) do not operate in respect of that contract.

(2) To exercise the right to cancel the contract, the student must give to the participating corporation written notice that the student is withdrawing his or her application for financial supplement. The notice may be lodged at any office of the corporation.

(3) The student’s right is exercisable at any time within the period of 14 days (the cooling off period) after the day the corporation accepts the student’s application under subsection 12K(1).

Note: When the corporation accepts the student’s application a binding contract is formed—see subsection 12K(2).

(4) During the cooling off period the corporation must not make a payment to the student under the contract.

(5) If:

(a) the corporation makes a payment to the student under the contract before the end of the cooling off period; or

(b) the corporation makes a payment to the student after the end of the cooling off period and the student has exercised the right to cancel the contract within the cooling off period;

the payment is taken not to be a payment of financial supplement if an amount equal to the payment is repaid by the student to the corporation within 7 days after the day of the payment.

12KB Person may waive right to cancel contract

(1) An eligible student under a financial supplement contract may waive the right to cancel the contract.

(2) To exercise the right of waiver, the student must give to the participating corporation written notice that he or she is waiving the right to cancel the contract immediately after his or her application is accepted by the corporation under subsection 12K(1).

12L Financial supplement contract exempt from certain laws and taxes

(1) A law of a State or Territory relating to the provision of credit or other financial assistance does not apply to a financial supplement contract.

(2) An application for the payment of financial supplement, a financial supplement contract, or an act or thing done or transaction entered into under such a contract, is not subject to taxation under any law of a State or Territory.

Division 4—Payments under financial supplement contract to stop in certain circumstances

12P Explanation of Division

This Division provides for payments in respect of financial supplement to stop if the person in receipt of the financial supplement:

(a) so requests; or

(b) is found to be eligible for a reduced maximum amount of financial supplement and has already been paid that amount; or

(c) ceases to be, or is found never to have been, eligible for financial supplement; or

(d) dies.

12Q Payments to stop at request of student

(1) A student who is a party to a financial supplement contract with a participating corporation may, by written notice to the corporation lodged at any office of the corporation, tell the corporation that he or she does not require any further payments under the contract after a day stated in the notice.

(2) If notice is so given to the corporation:

(a) as from the end of the day stated in the notice, the corporation is discharged from liability to make further payments to the student under the contract; but

(b) if, despite paragraph (a), the corporation makes any payments to the student after that day, any amounts so paid after that day or the end of 4 weeks after the notice was given to the corporation, whichever is the later:

(i) are taken not to be payments of financial supplement made under the contract; and

(ii) are repayable by the student to the corporation; and

(iii) may be recovered by the corporation as a debt due to it by the student.

12QA Payments to eligible student to stop if the maximum amount of financial supplement is reduced to less than the amount already paid

(1) If:

(a) the Secretary reviews the decision (the original decision) made in respect of the student under section 12F; and

(b) the student remains an eligible student in respect of the year or part of the year to which the student’s financial supplement contract relates; and

(c) as a result of the review the Secretary varies the original decision so that the maximum amount (the original amount) of financial supplement that the student is eligible to obtain under the financial supplement contract is reduced (the revised amount); and

(d) the revised amount is less than the amount of financial supplement that the student has already been paid under the financial supplement contract;

the Secretary must give written notice to the student and to a participating corporation that must include the following:

(e) the revised amount that the student is eligible to obtain;

(f) the amount of financial supplement paid in excess of the revised amount;

(g) a statement that the corporation must cease paying financial supplement to the student.

(2) If notice is given to the corporation under subsection (1), then, unless the decision of the Secretary under subsection (1) is set aside or varied:

(a) as from the time the notice is given to the corporation, the corporation is discharged from liability to make further payments to the student under the contract; and

(b) if, despite paragraph (a), the corporation makes payments to the student after that time, any amounts so paid after the end of 4 weeks after the notice is given to the corporation:

(i) are taken not to be payments of financial supplement; and

(ii) are repayable by the student to the corporation; and

(iii) may be recoverable by the corporation as a debt due to it by the student.

(3) This section has effect subject to section 12ZX.

12QB What happens if financial supplement was paid to eligible student after student failed to notify change of circumstances

(1) If the Secretary decides that an eligible student to whom a notice is given under section 12QA failed to notify the Department under subsection 48(1) of the happening of a prescribed event in relation to the student within 14 days of the happening of the event, the Secretary may give written notice of the decision to the student and to the participating corporation.

(2) If notice is given under subsection (1), then, unless the decision of the Secretary under subsection (1) is set aside or varied:

(a) the corporation’s rights in respect of the student under the contract that relate to financial supplement paid by the corporation to the student after the end of the period beginning at the end of the period of 14 days referred to in subsection (1) and ending at the end of the period of 4 weeks referred to in paragraph 12QA(2)(b) (the wrongly paid financial supplement) are assigned to the Commonwealth, by force of this paragraph, at the time when the notice was given to the corporation; and

(b) any actual repayments of financial supplement made by the student before the notice was given to the student under subsection (1) are taken to have been made:

(i) first, in or towards repayment of the wrongly paid financial supplement; and

(ii) secondly, to the extent (if any) to which the sum of those repayments exceeded the amount of the wrongly paid financial supplement, in or towards repayment of the remainder of the financial supplement paid to the student under the contract; and

(c) the Commonwealth is liable to pay to the corporation in respect of the rights referred to in paragraph (a), the amount of any wrongly paid financial supplement that has not been repaid; and

(d) the student is liable to pay to the Commonwealth an amount equal to the sum of:

(i) the amount that the Commonwealth is liable to pay to the corporation under paragraph (c); and

(ii) the part of the total subsidy paid by the Commonwealth to the corporation in respect of the financial supplement paid to the student under the contract that was paid in lieu of interest on the principal sum in respect of the period beginning at the end of the period of 14 days referred to in subsection (1) and ending at the end of the period of 4 weeks referred to in paragraph 12QA(2)(b).

(3) Nothing in this section affects the operation of section 12QA.

12QC What happens if financial supplement was paid to eligible student because of the provision of false or misleading information

(1) If the Secretary decides that false or misleading information was provided to the Commonwealth in relation to an eligible student to whom a notice is given under section 12QA, the Secretary may give written notice of the decision to the student and to the participating corporation.

(2) If notice is given under subsection (1), then, unless the decision of the Secretary under subsection (1) is set aside or varied:

(a) the corporation’s rights in respect of the student under the contract that relate to financial supplement paid by the corporation to the student during the period beginning at the end of the date on which the student was paid an amount equal to the revised amount referred to in paragraph 12QA(1)(e) and ending at the end of the period of 4 weeks referred to in paragraph 12QA(2)(b) (the wrongly paid financial supplement) are assigned to the Commonwealth, by force of this paragraph, at the time when the notice was given to the corporation; and

(b) any actual repayments of financial supplement made by the student before the notice was given to the student under subsection (1) are taken to have been made:

(i) first, in or towards repayment of the wrongly paid financial supplement; and

(ii) secondly, to the extent (if any) to which the sum of those repayments exceeded the amount of the wrongly paid financial supplement, in or towards repayment of the remainder of the financial supplement paid to the student under the contract; and

(c) the Commonwealth is liable to pay to the corporation in respect of the rights referred to in paragraph (a), the amount of any wrongly paid financial supplement that has not been repaid; and

(d) the student is liable to pay to the Commonwealth an amount equal to the sum of:

(i) the amount that the Commonwealth is liable to pay to the corporation under paragraph (c); and

(ii) the part of the total subsidy paid by the Commonwealth to the corporation in respect of the financial supplement paid to the student under the contract that was paid in lieu of interest on the principal sum in respect of the period beginning at the end of the date on which the student was paid an amount equal to the revised amount referred to in paragraph 12QA(1)(e) and ending at the end of the period of 4 weeks referred to in paragraph 12QA(2)(b).

(3) Nothing in this section affects the operation of section 12QA.

12R Payments to stop if student ceases to be eligible for financial supplement

(1) If the Secretary decides that a student who is a party to a financial supplement contract with a participating corporation ceased to be an eligible student during the year or the part of the year to which the contract relates, the Secretary must give written notice to the student and to the corporation stating that the student ceased to be an eligible student and stating the date on which the student so ceased.

(2) If notice is so given to the corporation, then, unless the decision of the Secretary under subsection (1) is set aside or varied:

(a) as from the time when the notice was given to the corporation, the corporation is discharged from liability to make further payments to the student under the contract; but

(b) if, despite paragraph (a), the corporation makes any payments to the student after that time, any amounts so paid after the end of 4 weeks after the notice was given to the corporation:

(i) are taken not to be payments of financial supplement made under the contract; and

(ii) are repayable by the student to the corporation; and

(iii) may be recovered by the corporation as a debt due to it by the student.

(3) This section has effect subject to section 12ZX.

12S What happens if student fails to notify change in circumstances

(1) If the Secretary decides that the student to whom a notice is given under subsection 12R(1) failed to notify the Department under subsection 48(1) that he or she had ceased to be an eligible student within 14 days after he or she so ceased, the Secretary may give written notice of the decision to the student and to the corporation.

(2) If notice is so given, then, unless the decision of the Secretary under subsection (1) is set aside or varied:

(a) the corporation’s rights in respect of the student under the contract that relate to financial supplement paid by the corporation to the student after the end of the date stated in the notice given by the Secretary to the student under subsection 12R(1) and before the end of the period of 4 weeks referred to in paragraph 12R(2)(b) (wrongly paid financial supplement) are assigned to the Commonwealth, by force of this paragraph, at the time when the notice was given to the corporation; and

(b) any actual repayments of financial supplement made by the student before the notice was given to the student are taken to have been made:

(i) first, in or towards repayment of the wrongly paid financial supplement; and

(ii) secondly, to the extent (if any) to which the sum of those repayments exceeded the amount of the wrongly paid financial supplement, in or towards repayment of the remainder of the financial supplement paid to the student under the contract; and

(c) the Commonwealth is liable to pay to the corporation in respect of the rights referred to in paragraph (a), the amount of any wrongly paid financial supplement that has not been repaid; and

(d) the student is liable to pay to the Commonwealth an amount equal to the sum of:

(i) the amount that the Commonwealth is liable to pay to the corporation under paragraph (c); and

(ii) the part of the total subsidy paid by the Commonwealth to the corporation in respect of the financial supplement paid to the student under the contract that was paid in lieu of interest on the principal sum in respect of the period beginning at the end of the period of 14 days referred to in subsection (1) and ending at the end of the period of 4 weeks referred to in paragraph 12R(2)(b).

(3) Nothing in this section affects the operation of section 12R.

12T Payments to stop if student is found never to have been eligible for financial supplement

(1) If:

(a) a student is a party to a financial supplement contract with a participating corporation; and

(b) the Secretary decides that the statement contained in the notice given to a student under paragraph 12F(1)(b) that the student was an eligible student in respect of the year or the part of the year to which the contract relates was incorrect;

the Secretary must give written notice to the student and to the corporation stating that the student had never been eligible for financial supplement in respect of that year or that part of that year.

(2) If notice is so given, then, unless the decision of the Secretary under subsection (1) is set aside or varied:

(a) as from the time when the notice was given to the corporation, the corporation is discharged from liability to make further payments to the student under the contract; but

(b) if, despite paragraph (a), the corporation makes any payments to the student after that time, any amounts so paid after the end of 4 weeks after the notice was given to the corporation:

(i) are taken not to be payments of financial supplement made under the contract; and

(ii) are repayable by the student to the corporation; and

(iii) may be recovered by the corporation as a debt due to it by the student.

(3) This section has effect subject to section 12ZX.

12U What happens if financial supplement was paid because of provision of false or misleading information

(1) If the Secretary decides that the incorrectness of the statement referred to in paragraph 12T(1)(b) resulted from false or misleading information provided to the Commonwealth in relation to the student, the Secretary may give written notice of the decision to the student and to the corporation.

(2) If notice is so given, then, unless the decision of the Secretary under subsection (1) is set aside or varied: