An Act to make provision for Pensions for Judges and their Families

1 Short title

This Act may be cited as the Judges’ Pensions Act 1968.

2 Commencement

This Act shall come into operation on the day on which it receives the Royal Assent.

3 Repeal

(1) The following Acts are repealed:

Judges’ Pensions Act 1948;

Judges’ Pensions Act 1956;

Judges’ Pensions Act 1958;

Judges’ Pensions Act 1961.

(2) The repeal effected by the last preceding subsection does not affect the operation of:

(a) any amendment made by an Act repealed by that subsection to an Act that is not so repealed; or

(b) any provision for the citation of an Act as amended by such an amendment.

4 Interpretation

(1) In this Act, unless the contrary intention appears:

accrued pension factor or APF has the meaning given by subsection 17AD(6).

APF: see accrued pension factor.

appropriate current judicial salary, in relation to a Judge who has retired or died, means:

(a) in the case of a Judge other than a Judge referred to in paragraph (b), (c), (d) or (e)—salary at the rate that would be payable to the Judge if he or she had not retired or died; and

(b) in the case of a Judge who was:

(i) the Chief Judge of the Commonwealth Court of Conciliation and Arbitration;

(ii) the Chief Judge of the Australian Industrial Court;

(iii) the Chief Justice of the Supreme Court of Papua New Guinea; or

(iv) the Chief Justice of Papua New Guinea;

the salary for the time being payable to the Chief Judge of the Federal Court of Australia; and

(c) in the case of a Judge who was the Deputy Chief Justice of Papua New Guinea—salary at a rate equal to the mean of the rates of the salaries referred to in paragraphs (b) and (d); and

(d) in the case of a Judge who was:

(i) a Judge, other than the Chief Judge, of the Commonwealth Court of Conciliation and Arbitration;

(ii) a Judge, other than the Chief Judge, of the Australian Industrial Court;

(iii) a Judge of the Federal Court of Bankruptcy; or

(iv) a Papua New Guinea Judge, other than a Judge referred to in paragraph (b) or (c);

the salary for the time being payable to a Judge, other than the Chief Judge, of the Federal Court of Australia; and

(e) in the case of a Judge who was a Presidential Member of the Australian Industrial Relations Commission—the salary that would be payable to the Judge if section 79 of the Workplace Relations Act 1996 (as in force immediately before the repeal of that section) continued to apply in relation to the Judge.

associate deferred pension means an associate deferred pension under subsection 17AA(3).

associate immediate pension means an associate immediate pension under subsection 17AA(2).

associate pension means an associate deferred pension or associate immediate pension.

base amount means:

(a) for a splitting agreement—the base amount specified in, or calculated under, the agreement; or

(b) for a splitting order—the amount allocated under subsection 90MT(4) of the Family Law Act 1975.

child means a child or an adopted child:

(a) who is under the age of 16 years; or

(b) who:

(i) has reached the age of 16 years but is under the age of 25 years; and

(ii) is receiving full‑time education at a school, college or university.

child of a marital or couple relationship, in relation to a marital or couple relationship, means:

(a) a child born of the marital or couple relationship; or

(b) a child adopted by the people in the marital or couple relationship during the period of the relationship; or

(c) someone who is, within the meaning of the Family Law Act 1975, a child of both of the people in the marital or couple relationship.

eligible child, in relation to a Judge or retired Judge who has died, has the meaning given by section 4AA.

family law value means the amount determined in accordance with regulations under the Family Law Act 1975 that apply for the purposes of paragraph 90MT(2)(a) of that Act. In applying those regulations, the relevant date is taken to be the date on which the operative time occurs.

Note: This amount is determined by applying those regulations, whether or not an order has been made under subsection 90MT(1) of that Act.

Judge means:

(a) a Justice or Judge of a federal court (other than the Federal Circuit Court of Australia);

(b) a person who, by virtue of an Act, has the same status as a Justice or Judge of a court referred to in paragraph (a); or

(ba) a person who was a Judge of the Supreme Court of the Australian Capital Territory immediately before the commencement of the A.C.T. Supreme Court (Transfer) Act 1992; or

(c) a Papua New Guinea Judge.

mandatory retirement day of a person who has served as a Judge means the day on which the person would, under the terms of the person’s appointment as a Judge or otherwise, be required to retire.

marital or couple relationship has the meaning given by section 4AB.

medical practitioner means a person registered or licensed as a medical practitioner under a law of a State or Territory that provides for the registration or licensing of medical practitioners.

member spouse has the same meaning as in Part VIIIB of the Family Law Act 1975.

non‑member spouse has the same meaning as in Part VIIIB of the Family Law Act 1975.

non‑standard pension means a pension under section 9, 10, 11 or 12.

operative time, in relation to a splitting agreement or splitting order, means the time that is the operative time for the purposes of Part VIIIB of the Family Law Act 1975 in relation to a payment split under the agreement or order.

original interest means a superannuation interest to which section 17AA applies.

Papua New Guinea Judge means a Judge of the Supreme Court of Papua New Guinea who was first appointed as such a Judge before 1 December 1973.

partner: a person is the partner of another person if the two persons have a relationship as a couple (whether the persons are the same sex or different sexes).

payment split has the same meaning as in Part VIIIB of the Family Law Act 1975.

Pension Orders means Pension Orders made under subsection 17AI(1).

period of exempt service:

(a) in relation to a Judge who has prior judicial service—means any period in that service in respect of which no superannuation contributions surcharge was assessed to be payable on the Judge’s surchargeable contributions under the Superannuation Contributions Tax (Assessment and Collection) Act 1997; or

(b) in relation to a person:

(i) who is a Judge because of paragraph (b) of the definition of Judge in this subsection; or

(ii) who, being a presidential member of the Administrative Appeals Tribunal, is taken to be a Judge for the purposes of this Act because of repealed section 16 of the Administrative Appeals Tribunal Act 1975 (including that section as it continues to apply because of item 34 of Schedule 1 to the Administrative Appeals Tribunal Amendment Act 2005);

and the period of whose service as a Judge began before 21 August 1996—means the part of that period of service before that date.

period of service as a Judge has a meaning affected by subsection (2).

permanently incapacitated has the meaning given by subsection 17AB(4).

prior judicial service, in relation to a Judge or retired Judge, means:

(a) service as a Judge or acting Judge of a court of a State or of the Supreme Court of Papua New Guinea;

(ab) service as a Judge or acting Judge of the Supreme Court of the Northern Territory, including that Court as in existence at any time before the commencement of the Northern Territory Supreme Court (Repeal) Act 1979;

(ac) service as a Judge or acting Judge of the Supreme Court of the Australian Capital Territory;

(b) service, including acting service, in a State office the holder of which may qualify for a pension or retiring allowance under the law of a State relating to pensions or retiring allowances payable to retired Judges;

(c) service in the office of Coal Industry Tribunal referred to in the Coal Industry Act 1946‑1966; or

(d) service before the commencement of the Northern Territory Supreme Court Act 1961 as the Judge or an acting Judge of the Northern Territory;

being service prior to his or her appointment as a Judge or, if he or she has been appointed as a Judge more than once, before the last such appointment, but does not include service as a Justice of the Peace or Magistrate.

qualified for a pension: a person who has served as a Judge has qualified for a pension on a particular day if:

(a) the person would have become entitled to a pension under subsection 6(1) if the person had retired on that day; or

(b) the person would have become entitled to a pension under subsection 6(2D) if the person had ceased to hold office as a Judge on that day.

qualifying period for a pension, in relation to a person who has served as a Judge, has the meaning given by subsection (3).

qualifying service days has the meaning given by section 4AD.

relevant pension, in relation to a Judge who has died, means the pension that would have been payable to the Judge if the Judge had retired on the date of his or her death and, in a case where subsection (1) of section 6 would not have been applicable in relation to that retirement, the Minister had certified that that retirement was due to permanent disability.

retired Judge means a person who has been a Judge and is or has been in receipt of a pension under this Act.

retirement pension means a pension under section 6.

retires, in relation to a Judge, means ceases to be a Judge otherwise than by death, and retirement has a corresponding meaning (see also sections 4B and 5).

salary means salary at the rate determined under the Judicial and Statutory Officers (Remuneration and Allowances) Act 1984 and the Remuneration Tribunal Act 1973:

(a) excluding any allowances that are paid in lieu of any other entitlement; and

(b) if any arrangements have been entered into for any amount of the rate of remuneration (other than an allowance covered by paragraph (a)) to be provided in the form of another benefit—including that amount.

Scheme means the scheme constituted by this Act for the provision of retirement and other benefits to and in respect of Judges.

scheme value means the amount determined under the Pension Orders.

splitting agreement means:

(a) a superannuation agreement (within the meaning of Part VIIIB of the Family Law Act 1975); or

(b) a flag lifting agreement (within the meaning of that Part) that provides for a payment split.

splitting order has the same meaning as in Part VIIIB of the Family Law Act 1975.

splitting percentage means:

(a) for a splitting agreement—the percentage specified in the agreement under subparagraph 90MJ(1)(c)(iii) of the Family Law Act 1975; or

(b) for a splitting order—the percentage specified in the order under subparagraph 90MT(1)(b)(i) of that Act.

spouse has a meaning affected by section 4AC.

spouse pension means a pension under section 7.

standard pension means:

(a) a retirement pension; or

(b) a spouse pension; or

(c) a pension under section 8; or

(d) an associate pension.

superannuation contributions surcharge has the same meaning as in the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

superannuation interest has the same meaning as in Part VIIIB of the Family Law Act 1975.

Supreme Court of Papua New Guinea includes a court having, after the attainment by Papua New Guinea of the status of an independent sovereign state, unlimited jurisdiction in civil or criminal matters in that state.

surcharge debt account, in relation to a person who has served as a Judge, means the surcharge debt account that was kept for the person (while he or she was serving as a Judge) under section 16 of the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

transfer amount means:

(a) if a splitting percentage applies—the amount worked out by multiplying the splitting percentage by the greater of:

(i) the family law value; and

(ii) the scheme value; or

(b) if a base amount applies and the scheme value is not more than the family law value—the base amount; or

(c) if a base amount applies and the scheme value is more than the family law value—the amount worked out using the formula:

transfer factor means the number rounded to 6 decimal places (rounding up if the seventh decimal place is 5 or more) that is worked out by dividing the number of whole dollars in the transfer amount by the number of whole dollars in the scheme value.

(2) If a Judge has had prior judicial service, the period of that service is to be added to, and is taken to be part of, the period of his or her service as a Judge.

(3) The qualifying period for a pension, in relation to a person who has served as a Judge, is:

(a) if the period of the person’s service as a Judge started when the person was not yet 50—a period equal to the number of years worked out by using the formula:

(b) if the period of the person’s service as a Judge started after the person had turned 50 but before he or she had turned 60—a period of 10 years; or

(c) if the period of the person’s service as a Judge started after the person had turned 60—a period equal to the number of years worked out by using the formula:

where:

age at start of period means the person’s age at the start of the period of his or her service as a Judge.

4AA Meaning of eligible child

For the purposes of this Act, a child is an eligible child of a Judge or retired Judge who has died (deceased Judge) if:

(a) the child is a child of the deceased Judge; or

(aa) the child is a child of the deceased Judge within the meaning of the Family Law Act 1975; or

(b) the Minister is of the opinion that:

(i) at the time of the death of the deceased Judge, the child was wholly or substantially dependent on the deceased Judge; or

(ii) but for the death of the deceased Judge, the child would have been wholly or substantially dependent on the deceased Judge.

4AB Marital or couple relationship

(1) For the purposes of this Act, a person had a marital or couple relationship with another person at a particular time if the person ordinarily lived with that other person as that other person’s husband, wife, spouse or partner on a permanent and bona fide domestic basis at that time.

(2) For the purpose of subsection (1), a person is to be regarded as ordinarily living with another person as that other person’s husband, wife, spouse or partner on a permanent and bona fide domestic basis at a particular time only if:

(a) the person had been living with that other person as that other person’s husband, wife, spouse or partner for a continuous period of at least 3 years up to that time; or

(b) the person had been living with that other person as that other person’s husband, wife, spouse or partner for a continuous period of less than 3 years up to that time and the Minister, having regard to any relevant evidence, is of the opinion that the person ordinarily lived with that other person as that other person’s husband, wife, spouse or partner on a permanent and bona fide domestic basis at that time;

whether or not the person was legally married to that other person.

(3) For the purposes of this Act, a marital or couple relationship is taken to have begun at the beginning of the continuous period mentioned in paragraph (2)(a) or (b).

(4) For the purpose of subsection (2), relevant evidence includes, but is not limited to, evidence establishing any of the following:

(a) the person was wholly or substantially dependent on that other person at the time;

(b) the persons were legally married to each other at the time;

(ba) the persons’ relationship was registered under a law of a State or Territory prescribed for the purposes of section 2E of the Acts Interpretation Act 1901 as a kind of relationship prescribed for the purposes of that section;

(c) the persons had a child who was:

(i) born of the relationship between the persons; or

(ii) adopted by the persons during the period of the relationship; or

(iii) a child of both of the persons within the meaning of the Family Law Act 1975;

(d) the persons jointly owned a home which was their usual residence.

(5) For the purposes of this section, a person is taken to be living with another person if the Minister is satisfied that the person would have been living with that other person except for a period of:

(a) temporary absence; or

(b) absence because of special circumstances (for example, absence because of the person’s illness or infirmity).

4AC Spouse who survives a deceased Judge

(1) In this section:

deceased Judge means a person who was, at the time of his or her death, a Judge or retired Judge.

(2) For the purposes of this Act, a person is a spouse who survives a deceased Judge if:

(a) the person had a marital or couple relationship with the deceased Judge at the time of the death of the deceased Judge (the death); and

(b) in the case of a deceased Judge who was a retired Judge at the time of the death:

(i) the marital or couple relationship began before the retired Judge became a retired Judge; or

(ii) the marital or couple relationship began after the retired Judge became a retired Judge but before the retired Judge reached 60; or

(iii) in the case of neither subparagraph (i) nor (ii) applying—the marital or couple relationship had continued for a period of at least 5 years up to the time of the death.

(3) In spite of subsection (2), a person is taken to be a spouse who survives a deceased Judge if:

(a) the person had previously had a marital or couple relationship with the deceased Judge; and

(b) the person did not, at the time of the death, have a marital or couple relationship with the deceased Judge but was legally married to the deceased Judge; and

(c) in the case of a marital or couple relationship that began after the deceased person became a retired Judge and reached 60—the relationship began at least 5 years before the deceased person’s death; and

(d) in the Minister’s opinion, the person was wholly or substantially dependent upon the deceased Judge at the time of the death.

4AD Qualifying service days

The qualifying service days of a person who has served as a Judge is the number of days worked out using the following formula:

where:

appointment age means the person’s age in days on the first day of the period of his or her service as a Judge.

non‑service days means the number of days the person did not serve as a Judge in the period that:

(a) starts on the person’s first day of service as a Judge; and

(b) ends on the day before:

(i) if paragraph (a) or (c) of the definition of qualification age in this section applies in relation to the person—the first day referred to in that paragraph; or

(ii) if a pension under subsection 6(2) has become payable to the person—the day on which the person retired; or

(iii) otherwise—the day on which the person died.

qualification age means:

(a) if a pension under subsection 6(1) or (2D) has become payable to the person—the person’s age in days on the first day on which the person qualified for that pension; or

(b) if a pension under subsection 6(2) has become payable to the person—the person’s age in days on the first day on which the person would have qualified for a pension under subsection 6(1) or (2D) if the person had continued to serve as a Judge until the person’s mandatory retirement day; or

(c) if:

(i) the person died before a pension became payable to the person; and

(ii) the person had qualified for a pension under subsection 6(1) on a day before the person died;

the person’s age in days on the first day the person so qualified; or

(d) if the person died before a pension became payable to the person and subparagraph (c)(ii) does not apply—the person’s age in days on the first day on which the person would have qualified for a pension under subsection 6(1) or (2D) if the person had continued to serve as a Judge until the person’s mandatory retirement day.

4A Certain absences to be included in service

It is declared for the avoidance of doubt that:

(a) for the purposes of the application of this Act to or in respect of a person who is, or has at any time been, a Judge, any period in which the person is or was authorised to make himself or herself unavailable to perform his or her duties as a Judge shall be deemed to be, or to have been, part of the period of the person’s service as a Judge; and

(b) for the purposes of the application of this Act to or in respect of a person who holds, or has at any time held, an office or appointment by virtue of which this Act applies or applied to or in respect of the person as if the person were a Judge, any period in which the person is or was authorised to make himself or herself unavailable to perform his or her duties as the holder of that office or appointment shall be deemed to be, or to have been, part of the period of the person’s service in that office or appointment.

4B Consecutive appointments

(1) If:

(a) a person’s appointment as a Judge terminates; and

(b) a new appointment of the person as a Judge takes effect immediately after the termination;

the person is taken, for the purposes of this Act, not to retire when the earlier appointment terminates.

(2) This section applies to the termination of an appointment however it occurs (whether because of resignation or because of the expiration of the term of the appointment or otherwise).

5 Service in more than one judicial office

(1) For the purposes of this Act, a Judge is taken not to have retired so long as he or she continues:

(a) to hold any office as a Judge; or

(b) to hold any judicial office in relation to a Territory that is remunerated otherwise than on a part‑time basis.

(2) Where, during any period (whether before or after the commencement of this Act), a person has held two or more offices as a Judge, his or her service during that period shall be taken into account for the purposes of this Act in the same way as if, during that period, he or she had held one office as a Judge only.

6 Pensions of Judges

(1) Where:

(a) a Judge, other than a Papua New Guinea Judge, who has attained the age of 60 years; or

(b) a Papua New Guinea Judge who has attained the age of 55 years;

retires after serving as a Judge for not less than 10 years, he or she is entitled to a pension in accordance with subsection 6A(2) or 6B(2).

(2) Where a Judge, not being a Judge to whom subsection (1) applies, retires, and the Minister certifies that the retirement is due to permanent disability or infirmity, he or she is entitled to a pension in accordance with subsection 6A(2) or 6B(2).

(2AA) A Judge (not being a Judge to whom subsection (1) applies) who has retired may apply to the Minister for a certificate under subsection (2) that his or her retirement was due to permanent disability or infirmity and, upon receipt of that application, the Minister shall:

(a) if he or she is satisfied that the retirement of the Judge was due to permanent disability or infirmity—so certify under subsection (2); or

(b) if he or she is not so satisfied—refuse so to certify.

(2A) Where a Papua New Guinea Judge, other than a Judge to whom subsection (1) or (2) applies, retires and is not re‑appointed as a Judge of the Supreme Court of Papua New Guinea, he or she is entitled:

(a) if the Minister certifies that he or she is satisfied that his or her services as such a Judge were no longer required—to a pension in accordance with subsection 6A(2) or 6B(2); and

(b) in any other case—to a pension in accordance with subsection 6A(3) or 6B(2).

(2B) Notwithstanding paragraph (b) of subsection (2A), where the Governor‑General determines that, by reason of special circumstances, a retired Judge who would, but for this subsection, be entitled under subsection (2A) to a pension in accordance with subsection 6A(3) or 6B(2) should receive a pension in accordance with subsection 6A(2) or 6B(2), the retired Judge is entitled to receive a pension accordingly.

(2D) Where:

(a) a Judge, whether by reason of the terms of his or her appointment or otherwise, is to cease to hold office as a Judge upon his or her attaining a particular age;

(b) he or she ceases to be a Judge upon his or her attaining that age;

(c) at the time of his or her so ceasing, he or she had served as a Judge for not less than 6 years; and

(d) he or she is not a person to whom subsection (1), (2), (2A) or (2B) applies;

he or she is entitled to a pension in accordance with subsection 6A(4) or 6B(2).

6A Rate of pension—Judge’s surcharge debt amount not in debit

(1) This section applies to a Judge if the Judge’s surcharge debt account is not in debit when a pension becomes payable to him or her.

Note: For surcharge debt account see subsection 4(1).

(2) Subject to sections 16, 17AD and 17AH, if the Judge is entitled to a pension because of subsection 6(1) or (2) or paragraph 6(2A)(a), the annual rate of the pension is 60% of the appropriate current judicial salary.

Note: For appropriate current judicial salary see subsection 4(1).

(3) If the Judge is entitled to a pension because of paragraph 6(2A)(b), the annual rate of pension is worked out by using the formula:

where:

A means 60% of the appropriate current judicial salary.

B means:

(a) the sum of the total number of years (including a fraction of a year) of his or her service as a Judge and the total number of years (including a fraction of a year) that the Minister certifies to be the period, or aggregate of the periods, (if any) of leave in respect of that service due to the Judge immediately before his or her retirement; or

(b) 10;

whichever is the less.

Note: For appropriate current judicial salary see subsection 4(1).

(4) Subject to sections 16, 17AD and 17AH, if the Judge is entitled to a pension because of subsection 6(2D), the annual rate of that pension is:

(a) 0.5% of the appropriate current judicial salary for each completed month of his or her service as a Judge; or

(b) 60% of the appropriate current judicial salary;

whichever is the lesser rate.

Note: For appropriate current judicial salary see subsection 4(1).

6B Rate of pension—Judge’s surcharge debt account in debit

(1) This section applies to a Judge if the Judge’s surcharge debt account is in debit when a pension becomes payable to him or her.

Note: For surcharge debt account see subsection 4(1).

(2) Subject to sections 16, 17AD and 17AH, the annual rate of the pension to which the Judge is entitled is:

(a) if the period of his or her service as a Judge does not include a period of exempt service—the rate worked out by using the formula:

(b) if the period of his or her service as a Judge includes a period of exempt service that is less than his or her qualifying period for a pension—the rate worked out by using the formula:

(c) if the period of his or her service as a Judge includes a period of exempt service that is equal to or longer than his or her qualifying period for a pension—a rate equal to BP;

where:

BP (basic pension) is the annual rate of the pension that would be payable to the Judge if his or her surcharge debt account were not in debit when the pension becomes payable.

E means the number of years in the Judge’s period of exempt service.

Q means the number of years in the Judge’s qualifying period for a pension.

relevant period, in relation to a Judge, means:

(a) if paragraph (b) does not apply—the Judge’s period of service as a Judge; or

(b) if the Judge’s period of service as a Judge began before 21 August 1996—that part of the period of service that began on that date.

SCS1 means the rate of superannuation contributions surcharge that applies to the Judge for financial year 1 included in the relevant period in relation to him or her, and SCS2 and SCSy each have a corresponding meaning.

Y means:

(a) if paragraph (b) does not apply—the number of financial years included in the relevant period in relation to the Judge; or

(b) if the Judge becomes entitled to a pension because the Minister certifies under subsection 6(2) that the Judge’s retirement is due to permanent disability or infirmity—the number of financial years included in the qualifying period for a pension in relation to the Judge, less the number of years in the Judge’s period of exempt service.

Note: For qualifying period for a pension see subsection 4(3) and for period of exempt service see subsection 4(1).

6C Commuting superannuation surcharge debt

(1) This section applies to a Judge if:

(a) the Judge retires; and

(b) on retirement, the Judge becomes entitled to a pension in accordance with subsection 6B(2).

(2) The Judge may, within a period of 2 months after retirement, give the Secretary of the Department a written notice electing to have his or her pension calculated under this section, rather than subsection 6B(2).

(3) Subject to sections 16, 17AD and 17AH, if a Judge makes an election under this section, the Judge’s annual rate of pension is worked out using the following method statement:

Method statement

Step 1. Work out the reduction % using the formula:

where:

age factor means the age factor for the Judge on the day on which the pension becomes payable (see subsection (4)).

amount of surcharge debt means the amount by which the Judge’s surcharge debt account is in debit on the day on which the pension becomes payable.

basic pension on retirement means the annual rate of the pension that would be payable to the Judge on retirement if his or her surcharge debt account were not in debit when the pension becomes payable.

Step 2. Work out the Judge’s annual rate of pension using the following formula:

where:

basic pension means the annual rate of pension that would be payable to the Judge if his or her surcharge debt account were not in debit when the pension became payable.

(4) The regulations may prescribe the age factor, or the method for working out the age factor, for the purposes of step 1 of the method statement in subsection (3).

7 Pension to spouse on death of Judge

(1) Subject to section 17AH, if a Judge dies leaving a spouse, a pension shall be paid to the spouse at a rate equal to 62.5% of the rate of the relevant pension in relation to the Judge.

Note: If section 17AD applies in relation to the spouse pension, the rate of the relevant pension may be reduced under subsection 17AD(4).

(2) If:

(a) but for this subsection, the rate of the relevant pension in relation to the Judge would have been worked out under subsection 6B(2); and

(b) the spouse gives the Secretary of the Department a written notice within 2 months after the death of the Judge electing to have the relevant pension worked out under section 6C, rather than subsection 6B(2);

the rate of the relevant pension is taken to be the rate worked out under section 6C, rather than the rate worked out under subsection 6B(2).

8 Pension to spouse on death of retired Judge

Subject to section 17AH, if a retired Judge dies leaving a spouse, a pension shall be paid to the spouse at a rate equal to 62.5% of the rate of the pension that would have been payable to the retired Judge if he or she had not died.

Note: The rate of the pension that would have been payable to the retired Judge may be reduced: see subsection 17AD(8) or 17AH(5).

8A Restoration of pension entitlement if lost due to remarriage

(1) If a person’s pension under section 7 or 8 ceased to be payable before the commencement day because the person remarried, the person may apply to the Minister for the pension to be restored.

(2) If the Minister is satisfied that:

(a) the person is in need; or

(b) the restoration of the person’s pension is otherwise justified;

the Minister may direct in writing that the person’s pension is to be restored.

(3) The Minister may direct that the person’s pension is to be restored from a day before the application day if he or she is satisfied that there are special circumstances that justify restoration of the pension from that earlier day.

(4) The Minister must not specify a day under subsection (3) that is before the commencement day.

(5) If the Minister gives a direction under subsection (2), the person’s pension is restored:

(a) from and including the day specified in the direction; or

(b) if no day is specified in the direction, from and including the application day.

(6) In this section:

application day means the day on which the application under subsection (1) was made.

commencement day means the day on which the Law and Justice Legislation Amendment Act (No. 2) 1992 commences.

8B Notification of decision

(1) If the Minister decides not to restore a person’s pension under section 8A, the Minister must give the person written notice of that decision.

(2) A notice under subsection (1) must include:

(a) reasons for the decision; and

(b) notification of the applicant’s entitlement to apply for review of the decision under section 17A.

9 Pension in respect of children on death of Judge

(1) Where a Judge dies leaving a spouse, there shall, in addition to any pension that is payable to the spouse under section 7, be paid to the spouse, in respect of any eligible child, or any eligible children, of the Judge, a pension at a rate equal to the applicable percentage of the rate of the relevant pension in relation to the Judge.

(2) For the purposes of subsection (1), the applicable percentage is:

(a) where there is one eligible child—12.5%;

(b) where there are 2 eligible children—25%; or

(c) where there are 3 or more eligible children—37.5%.

(3) If:

(a) but for this subsection, the rate of the relevant pension in relation to the Judge would have been worked out under subsection 6B(2); and

(b) the spouse gives the Secretary of the Department a written notice within 2 months after the death of the Judge electing to have the relevant pension worked out under section 6C, rather than subsection 6B(2);

the rate of the relevant pension is taken to be the rate worked out under section 6C, rather than the rate worked out under subsection 6B(2).

10 Pension in respect of children on death of retired Judge

(1) Subject to this section, where a retired Judge dies leaving a spouse, there shall, in addition to any pension that is payable to the spouse under section 8, be paid to the spouse, in respect of any eligible child, or any eligible children, of the retired Judge, a pension at a rate equal to the applicable percentage of the rate of the pension that would have been payable to the retired Judge if he or she had not died.

(1A) For the purposes of subsection (1), the applicable percentage is:

(a) where there is one eligible child—12.5%;

(b) where there are 2 eligible children—25%; or

(c) where there are 3 or more eligible children—37.5%.

(2) If a retired Judge entered into a marital or couple relationship:

(a) after retirement; and

(b) after the retired Judge reached the age of 60; and

(c) less than 5 years before the retired Judge died;

pension is not, upon the retired Judge’s death, payable under this section in respect of a child of that marital or couple relationship.

11 Pension in respect of children on death of spouse

(1) Subject to this section, where the spouse of a Judge or retired Judge, being a spouse who became entitled upon the death of the Judge or retired Judge to a pension under this Act, has died, there shall be paid, in respect of any eligible child, or any eligible children, of the Judge or retired Judge, a pension at a rate equal to the applicable percentage of the rate of:

(a) in the case of the spouse of a Judge other than a retired Judge—the relevant pension in relation to the Judge; or

(b) in the case of the spouse of a retired Judge—the pension that would have been payable to the retired Judge if he or she had not died.

(2) For the purposes of subsection (1), the applicable percentage is:

(a) where there is one eligible child—45%;

(b) where there are 2 eligible children—80%;

(c) where there are 3 eligible children—90%; or

(d) where there are 4 or more eligible children—100%.

(2A) If:

(a) but for this subsection, the rate of the relevant pension in relation to the Judge would have been worked out under subsection 6B(2); and

(b) within 2 months after the Minister determines under section 13 to whom the pension is payable, that person gives the Secretary of the Department a written notice electing to have that rate worked out under section 6C, rather than subsection 6B(2);

the rate of the relevant pension is taken to be the rate worked out under section 6C, rather than the rate worked out under subsection 6B(2).

(3) If a retired Judge entered into a marital or couple relationship:

(a) after retirement; and

(b) after the retired Judge reached the age of 60; and

(c) less than 5 years before the retired Judge died;

pension is not, upon the death of the person with whom the retired Judge had that relationship, payable under this section in respect of a child of that marital or couple relationship.

12 Pension in respect of children on death of Judge or retired Judge when spouse’s pension not payable

(1) Subject to this section, where a Judge or retired Judge has died without leaving a spouse who became entitled, upon the death of the Judge or retired Judge, to a pension under this Act, there shall be paid in respect of any eligible child, or any eligible children, of the Judge or retired Judge, a pension at a rate equal to the applicable percentage of the rate of:

(a) in the case of a Judge other than a retired Judge—the relevant pension in relation to the Judge; or

(b) in the case of a retired Judge—the pension that would have been payable to the retired Judge if he or she had not died.

(2) For the purposes of subsection (1), the applicable percentage is:

(a) where there is one eligible child—45%;

(b) where there are 2 eligible children—80%;

(c) where there are 3 eligible children—90%; or

(d) where there are 4 or more eligible children—100%.

(2A) If:

(a) but for this subsection, the rate of the relevant pension in relation to the Judge would have been worked out under subsection 6B(2); and

(b) within 2 months after the Minister determines under section 13 to whom the pension is payable, that person gives the Secretary of the Department a written notice electing to have the relevant pension worked out under section 6C, rather than subsection 6B(2);

the rate of the relevant pension is taken to be the rate worked out under section 6C, rather than the rate worked out under subsection 6B(2).

(3) If a retired Judge entered into a marital or couple relationship:

(a) after retirement; and

(b) after the retired Judge reached the age of 60; and

(c) less than 5 years before the retired Judge died;

pension is not, upon the retired Judge’s death, payable under this section in respect of a child of that marital or couple relationship.

12A Benefit payable where Judge ceases to hold office or dies on or after 1 July 2006

Scope

(1) This section applies if:

(a) a person who is a Judge ceases otherwise than by death to be a Judge on or after 1 July 2006 and no pension is payable to the person or to a spouse or an eligible child of the person; or

(b) a person who is, or has previously been, a Judge dies on or after 1 July 2006 without leaving a spouse or eligible child; or

(c) a person who is, or has previously been, a Judge has died leaving a spouse or spouses or an eligible child or eligible children and:

(i) the pension or pensions payable to the spouse or spouses or the child or children have ceased to be payable; and

(ii) the last such pension that ceased to be payable so ceased on or after 1 July 2006;

and, on the last day on which the person held office as a Judge, the person was not a qualified employee (within the meaning of the Superannuation (Productivity Benefit) Act 1988).

Benefit

(2) Subject to subsection (3), there is payable to the person or, if the person has died, to the personal representative of the person an amount of benefit equal to the sum of the following amounts:

(a) the total of the minimum amounts that the Commonwealth would have had to contribute to a complying superannuation fund or scheme for the benefit of the person in order to avoid having any individual superannuation guarantee shortfalls in respect of the person if it were assumed that:

(i) the person was an employee of the Commonwealth (within the meaning of the Superannuation Guarantee (Administration) Act 1992) in his or her capacity as a Judge and had never been an employee of the Commonwealth (within the meaning of that Act) in any other capacity; and

(ii) this Act had not been enacted; and

(iii) those contributions were made on a monthly basis;

(b) the interest that would have accrued on the contributions covered by paragraph (a) if it were assumed that interest on those contributions had accrued in accordance with the method set out in a determination made by the Minister under subsection (6).

Personal representatives

(3) If an amount of benefit is payable to the personal representative of the person under subsection (2), that amount is to be reduced by the sum of the amounts of the pensions (if any) that were paid to the person or any spouse or eligible child of the person under this Act.

(4) If an amount of benefit is payable under subsection (2) to the personal representative of the person and no personal representative can be found, the amount is to be paid to any individual or individuals that the Minister determines.

Appropriation

(5) A benefit under subsection (2) is payable out of the Consolidated Revenue Fund, which is appropriated accordingly.

Interest method determination

(6) The Minister must, by writing, determine a method for the purposes of paragraph (2)(b).

(7) A method determined under subsection (6) may provide for different interest rates for different periods.

(8) A method determined under subsection (6) may be expressed to relate to a period that began before the determination was made.

(9) A determination under subsection (6) takes effect on the later of the following:

(a) the day after the 15th sitting day of the House of Representatives after a copy of the determination is tabled in that House;

(b) the day after the 15th sitting day of the Senate after a copy of the determination is tabled in the Senate.

(10) The Minister must cause a copy of a determination under subsection (6) to be tabled in each House of the Parliament within 15 sitting days of that House after the determination is made.

(11) If either House of the Parliament, within 15 sitting days of that House after a copy of a determination under subsection (6) has been tabled in that House, passes a resolution disapproving of the determination, the determination does not come into operation.

(12) A determination under subsection (6) may be varied, but not revoked, in accordance with subsection 33(3) of the Acts Interpretation Act 1901.

(13) Subsection (12) does not limit the application of subsection 33(3) of the Acts Interpretation Act 1901 to other instruments under this Act.

(14) A determination under subsection (6) is not a legislative instrument.

(15) The Minister must not exercise a power conferred by this section in a manner that is inconsistent with paragraph 72(iii) of the Constitution.

Definitions

(16) In this section:

complying superannuation fund or scheme has the same meaning as in the Superannuation Guarantee (Administration) Act 1992.

individual superannuation guarantee shortfall has the same meaning as in the Superannuation Guarantee (Administration) Act 1992.

13 Payment of orphans’ pensions

(1) In this section, orphan’s pension means a pension payable in respect of an eligible child, or eligible children, under section 11 or 12.

(2) A payment of an orphan’s pension payable in respect of an eligible child or eligible children shall be made to the child or children or to such other person or persons as the Minister considers appropriate.

(3) Where a payment of orphan’s pension is payable in respect of 2 or more eligible children, the Minister may, having regard to the respective circumstances of the children and to such other matters as he or she considers appropriate, apportion the amount of the payment amongst the children in such manner as he or she thinks fit, and the portion applicable to a particular eligible child or to particular eligible children shall, for the purposes of subsection (2), be deemed to be a payment of orphan’s pension payable in respect of that child or those children.

(4) A payment of orphan’s pension that, under subsection (2), is made to a person or persons other than the eligible child or eligible children in respect of whom it is payable shall be applied for the support, education or other benefit of that eligible child or those eligible children.

14 Payment of pensions

Pensions under this Act:

(a) grow due from day to day but are payable monthly; and

(b) shall be paid out of the Consolidated Revenue Fund, which is appropriated accordingly.

15 Special provision relating to children’s pensions (other than orphans’ pensions)

(1) Where a pension is payable under this Act to the spouse of a Judge or retired Judge in respect of an eligible child or eligible children:

(a) if the Minister is of opinion that the support and education of the child or any of the children will be best assured by doing so, he or she may direct that the pension, or such portion of the pension as he or she thinks fit, be paid to a specified person in respect of the child; or

(b) if the Minister is satisfied that, by reason of special circumstances, it is desirable to do so in the interests of the child or of any of the children, he or she may direct that the pension, or such portion of the pension as he or she thinks fit, be expended in a specified manner for the benefit of the child.

(2) The power of the Minister under subsection (1) to direct payment of a pension, or of a portion of a pension, to a specified person applies only where the child concerned is not living with the spouse.

(3) Application may be made to the Minister for the giving of a direction under subsection (1) in respect of an eligible child and, upon receipt of such an application, the Minister shall:

(a) if he or she is satisfied that he or she should give a direction in respect of the child—give such a direction; or

(b) if he or she is not so satisfied—refuse to give such a direction.

(4) A direction under this section shall be in writing.

15A Allocation of pension if a deceased Judge or retired Judge is survived by more than one spouse

(1) If a Judge or retired Judge dies leaving more than one spouse, the Minister must allocate any pension (including pension in respect of any eligible children) payable to a spouse in respect of the deceased Judge or retired Judge under this Act among the spouses.

(2) The Minister must have regard to the respective needs of the spouses and eligible children (if any) when making the allocation.

(3) Subject to subsections (4) and (5), a pension is only payable to each of the spouses in accordance with the allocation.

(4) The rate of pension payable to a spouse under the allocation in respect of the spouse or any eligible children must not exceed the applicable rate (as provided in section 7, 8, 9, 10, 11 or 12) of the relevant pension in relation to the Judge or retired Judge.

(5) The aggregate of the rates of pension payable under an allocation must not exceed 100% of the rate of the relevant pension in relation to the Judge or retired Judge.

(6) In this section:

relevant pension, in relation to a retired Judge who has died, means the pension that would have been payable to the retired Judge if he or she had not died.

16 Adjustment by reason of other pensions

(1) Where:

(a) a pension is payable under this Act by reason of the service of a person as a Judge; and

(b) a pension is or becomes payable otherwise than under this Act in respect of prior judicial service of that person;

the amount of the pension that would, but for this subsection, be payable under this Act (disregarding sections 17AD and 17AH) in respect of any period shall be reduced by the amount of the pension in respect of the prior judicial service that is payable in respect of that period.

(2) This section does not apply where the Judge or retired Judge:

(a) was a Judge immediately before the date of commencement of the Judges’ Pensions Act 1968; or

(b) died or retired before that date.

(3) In subsection (1), a reference to a pension in respect of prior judicial service shall be read as a reference to a pension or retiring allowance paid or payable, whether by virtue of a law or otherwise, out of moneys provided in whole or in part by Australia, a State or a Territory, being a pension or retiring allowance paid or payable by reason of prior judicial service, or of prior judicial service and any other service.

17 Pension not payable on removal of Judge

Unless the Governor‑General otherwise directs, a pension under this Act is not payable by reason of the service of a Judge who has been removed under section 72 of the Constitution or under any similar provision in an Act.

17AA Associate pension for non‑member spouse

(1) This section applies to a superannuation interest under this Act (the original interest) if:

(a) the Secretary of the Department receives a splitting agreement or splitting order in respect of the original interest; and

(b) the original interest is not an entitlement to a non‑standard pension; and

(c) the member spouse and the non‑member spouse are both alive at the operative time; and

(d) if a base amount applies—the base amount at the operative time is not more than the family law value or scheme value.

Note: If the same superannuation interest is subject to 2 or more payment splits, then this section applies separately in relation to each of those splits.

Immediate pension if operative time in payment phase

(2) If, at the operative time, a standard pension is payable in respect of the original interest, then the non‑member spouse is entitled to an associate immediate pension from the operative time at the rate calculated under the Pension Orders by reference to the transfer amount.

Deferred pension if operative time in growth phase

(3) If, at the operative time, a standard pension is not payable in respect of the original interest, then the non‑member spouse is entitled to an associate deferred pension in accordance with section 17AB.

Rounding of transfer amount

(4) For the purposes of subsection (2), the transfer amount is to be rounded to the nearest cent (rounding 0.5 cents upwards).

17AB Associate deferred pension

Annual rate

(1) The associate deferred pension is payable at an annual rate calculated under the Pension Orders by reference to the transfer amount.

(2) For the purposes of subsection (1), the transfer amount is to be rounded to the nearest cent (rounding 0.5 cents upwards).

When the pension is payable

(3) Subject to section 17AC, the pension is payable from the later of:

(a) the operative time; and

(b) the earliest of the following days:

(i) if the non‑member spouse is permanently incapacitated—the day that the Secretary of the Department considers to be the day on which the spouse became permanently incapacitated;

(ii) a day notified to the Secretary under subsection (5) of this section;

(iii) the day on which the non‑member spouse turns 65.

(4) The non‑member spouse is permanently incapacitated if the Secretary is satisfied that the spouse is unlikely, because of ill‑health (whether physical or mental), to engage in gainful employment for which the spouse is reasonably qualified by education, training or experience.

(5) The non‑member spouse may give a written notice to the Secretary specifying a day that is not before the day on which the non‑member spouse turns 60.

Death of non‑member spouse

(6) If the non‑member spouse dies before the pension becomes payable, an amount calculated under the Pension Orders must be paid to:

(a) the legal personal representative of the spouse; or

(b) if no such legal personal representative can be found—any individual or individuals that the Secretary determines.

(7) An amount under subsection (6) is payable out of the Consolidated Revenue Fund, which is appropriated accordingly.

17AC Application for payment of associate deferred pension

(1) The associate deferred pension is not payable to the non‑member spouse unless:

(a) a written application has been made to the Secretary of the Department requesting payment of the pension; and

(b) the applicant has provided any information that is necessary to determine whether the pension is payable.

(2) An application for payment on the ground of permanent incapacity must be accompanied by:

(a) a certificate given by a medical practitioner nominated by, or on behalf of, the non‑member spouse; and

(b) such additional information or documents as the Secretary requires.

(3) The certificate mentioned in paragraph (2)(a) must include a statement to the effect that, in the opinion of the medical practitioner, the non‑member spouse is permanently incapacitated.

17AD Operative time during growth phase—reduction of retirement pension etc.

(1) This section applies if:

(a) at the operative time, a retirement pension is not payable to a Judge in respect of the original interest; and

(b) after the operative time:

(i) the retirement pension becomes payable to the Judge; or

(ii) the Judge dies before the retirement pension becomes payable and a spouse pension becomes payable to a spouse of the Judge; and

(c) if:

(i) the retirement pension is a pension under subsection 6(2); or

(ii) the Judge had not qualified for a pension under subsection 6(1) on a day before the Judge died;

the Judge would have qualified for a pension under subsection 6(1) or (2D) if the Judge had continued to serve as a Judge until the Judge’s mandatory retirement day.

Reduction of pensions

(2) In working out the annual rate of the retirement pension that is payable:

(a) work out the annual rate of the pension under section 6A, 6B or 6C; and

(b) reduce that rate by the amount worked out using the formula in subsection (5) of this section.

(3) If section 16 applies in relation to the retirement pension, the annual rate worked out under paragraph (2)(a) must take into account a reduction of the amount of the pension under that section.

(4) For the purposes of working out the rate of the spouse pension that is payable under section 7, the rate of the relevant pension in relation to the Judge is to be worked out as follows:

(a) work out the annual rate of the relevant pension under section 6A, 6B or 6C;

(b) reduce that rate by the amount worked out using the formula in subsection (5) of this section.

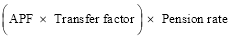

(5) The formula is:

where:

pension rate means the annual rate of the retirement pension or relevant pension worked out under section 6A (disregarding subsection 6A(1)).

Note: If the original interest has been split more than once, see section 17AE for a modification of this formula.

Accrued pension factor

(6) The accrued pension factor for the Judge is:

(a) if at the operative time the Judge was at least 60 and had served as a Judge for at least 10 years—1; or

(b) otherwise—the number worked out by dividing the number of days the Judge had served as a Judge at the operative time by the qualifying service days of the Judge.

(7) The number worked out under paragraph (6)(b) is to be rounded to 6 decimal places (rounding up if the seventh decimal place is 5 or more).

Effect of reduction on other pensions

(8) If:

(a) the annual rate of a retirement pension of a retired Judge is reduced under subsection (2); and

(b) a pension under section 8 later becomes payable because the Judge dies;

then, for purposes of section 8, the rate of the pension that would have been payable to the Judge is the rate worked out for the retirement pension under subsection (2) of this section (disregarding subsection (3)).

(9) If the rate of a retirement pension or relevant pension is reduced under this section, the reduction is to be disregarded in working out the rate of any non‑standard pension that later becomes payable.

17AE Reduction of retirement pension etc. if original interest has been split more than once

(1) If:

(a) section 17AD applies in relation to an original interest; and

(b) before the retirement pension or spouse pension referred to in that section becomes payable, the original interest has been split more than once because section 17AA has previously applied;

the formula in subsection 17AD(5) is modified as set out in subsection (2) of this section.

(2) In applying the formula in subsection 17AD(5), the component (APF Transfer factor) is to be replaced by the number worked out using the following method statement, based on the chronological order of the operative times (starting with the earliest):

Method statement

Step 1. Work out a factor (the interim factor) for the first split using the formula:

Step 2. Work out a factor (the interim factor) for the next split (the current split), using the formula:

Step 3. Work out a factor for each remaining split (if any), using the formula in step 2.

Step 4. Add together the factors worked out under steps 1 to 3.

Example: Assume 2 splits, with the first split having an APF of 0.4 and a transfer factor of 0.5 and the second split having an APF of 0.6 and a transfer factor of 0.5. Applying the above steps, the replacement number for the formula is 0.4, that is:

17AF Operative time during growth phase—reduction of benefit under section 12A

If:

(a) at the operative time, a standard pension is not payable in respect of the original interest; and

(b) after the operative time, a benefit under section 12A becomes payable in respect of the original interest because of paragraph 12A(1)(a);

the amount of the benefit (the benefit amount) is reduced, with effect from the operative time, by the amount calculated by multiplying the benefit amount, worked out at that time, by the transfer factor.

17AG Operative time during growth phase—reduction of associate deferred pension

If:

(a) at the operative time, a standard pension is not payable in respect of the original interest; and

(b) the original interest is an entitlement to an associate deferred pension;

the annual rate of the associate deferred pension (when it becomes payable) is reduced to the amount calculated under the Pension Orders.

Note: Although an associate immediate pension becomes payable at the operative time, an associate deferred pension will often not become payable until some time after the operative time.

17AH Operative time during payment phase—reduction of standard pension

(1) This section applies if, at the operative time, a standard pension is payable in respect of the original interest.

Reduction of pensions

(2) If the standard pension is not a retirement pension, the rate of the pension is reduced to the amount calculated under the Pension Orders.

(3) If the standard pension is a retirement pension, the annual rate of the pension is worked out as follows:

(a) work out the annual rate of the pension under section 6A, 6B or 6C;

(b) reduce that rate to the amount calculated under the Pension Orders.

(4) If section 16 applies in relation to the retirement pension, the annual rate worked out under paragraph (3)(a) must take into account a reduction of the pension under that section.

Effect of reduction on other pensions

(5) If:

(a) the annual rate of a retirement pension of a retired Judge is reduced under subsection (3); and

(b) a pension under section 8 later becomes payable because the Judge dies;

then, for purposes of section 8, the rate of the pension that would have been payable to the Judge is the rate worked out for the retirement pension under subsection (3) of this section (disregarding subsection (4)).

(6) If the annual rate of a retirement pension is reduced under this section, the reduction is to be disregarded in working out the rate of any non‑standard pension that later becomes payable.

17AI Pension Orders

(1) The Minister may, by legislative instrument, make Pension Orders providing for matters:

(a) required or permitted by this Act to be provided; or

(b) necessary or convenient to be provided in order to carry out or give effect to this Act.

(2) Despite regulations made for the purposes of paragraph 44(2)(b) of the Legislation Act 2003, section 42 (disallowance) of that Act applies to the Pension Orders.

17AJ Compensation for acquisition of property

(1) If the operation of sections 17AA to 17AH, or the Pension Orders, would result in an acquisition of property from a person otherwise than on just terms, the Commonwealth is liable to pay a reasonable amount of compensation to the person.

(2) If the Commonwealth and the person do not agree on the amount of the compensation, the person may institute proceedings in the Federal Court of Australia for the recovery from the Commonwealth of such reasonable amount of compensation as the Court determines.

(3) In this section:

acquisition of property has the same meaning as in paragraph 51(xxxi) of the Constitution.

just terms has the same meaning as in paragraph 51(xxxi) of the Constitution.

17A Application for review

Applications may be made to the Administrative Appeals Tribunal for review of:

(a) a refusal of the Minister, on application under subsection (2AA) of section 6, to certify, under subsection (2) of that section, that the retirement of a Judge was due to permanent disability or infirmity; or

(aa) a decision of the Minister under paragraph 4AA(b); or

(aaa) a decision of the Minister under paragraph 4AB(2)(b); or

(aab) a decision of the Minister under subsection 4AB(5); or

(aac) a decision of the Minister under paragraph 4AC(3)(d); or

(ab) a refusal by the Minister to give a direction under subsection 8A(2) or 8A(3); or

(b) a decision of the Minister under section 13; or

(c) a direction of the Minister under subsection (1) of section 15; or

(d) a refusal of the Minister, on application under subsection (3) of section 15, to give a direction under subsection (1) of that section; or

(e) a decision of the Minister under subsection 15A(1); or

(f) a decision of the Secretary of the Department under subparagraph 17AB(3)(b)(i); or

(g) a decision of the Secretary of the Department under subsection 17AB(4); or

(h) a decision of the Secretary of the Department under paragraph 17AB(6)(b).

18 Application of Act to and in respect of certain former Judges

(1) This Act applies to and in respect of Judges, other than Papua New Guinea Judges, who retired or died before the date of commencement of the Parliamentary and Judicial Retiring Allowances Act 1973 (including Judges, other than Papua New Guinea Judges, who retired or died before the date of commencement of the Judges’ Pensions Act 1968) in like manner as it applies to and in respect of Judges who retire or die on or after the first‑mentioned date.

(2) This Act applies to and in respect of Papua New Guinea Judges who retired or died at any time before the date of commencement of this subsection in like manner as it applies to and in respect of Papua New Guinea Judges who retire or die on or after that date.

19 Surchargeable contributions

(1) For the purposes of the Superannuation Contributions Tax (Assessment and Collection) Act 1997, the surchargeable contributions for a financial year of a Judge is the amount worked out by using the formula:

where:

annual salary means the amount that is the Judge’s salary for the financial year.

notional surchargeable contributions factor means the notional surchargeable contributions factor applying to the Judge for that financial year under the regulations.

(2) The regulations may prescribe the notional surchargeable contributions factors that are to apply to a Judge when working out, for the purposes of the Superannuation Contributions Tax (Assessment and Collection) Act 1997, the Judge’s surchargeable contributions.

(2A) For the purposes of the Superannuation Contributions Tax (Assessment and Collection) Act 1997, there are no surchargeable contributions for a Judge for a financial year that ends after 1 July 2005.

(3) Subsection (1) has effect despite any provision of the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

20 Trustee of Scheme for the purposes of the Superannuation Contributions Tax (Assessment and Collection) Act 1997

(1) For the purposes of the definition of trustee in section 43 of the Superannuation Contributions Tax (Assessment and Collection) Act 1997, the Secretary of the Department is taken to be the person who manages the Scheme.

Note: The definitions of public sector superannuation scheme, superannuation fund and trustee in section 43 of the Superannuation Contributions Tax (Assessment and Collection) Act 1997 are relevant to this section.

(2) The Secretary of the Department, in the capacity (because of subsection (1)) of trustee of the Scheme for the purposes of the Superannuation Contributions Tax (Assessment and Collection) Act 1997, may delegate any or all of the functions and powers that, as trustee of the Scheme, he or she has under that Act as follows:

(a) in so far as those functions and powers are to be exercised in relation to persons who were Presidential Members of the Australian Industrial Relations Commission, the President of Fair Work Australia or the President of the Fair Work Commission—to the General Manager of the Fair Work Commission;

(b) in so far as those functions and powers are to be exercised in relation to the presidential members of the Administrative Appeals Tribunal—to any officer of the Tribunal or any member of the staff of the Tribunal;

(c) in any other case—to any person holding, or performing the duties of, a Senior Executive Service office in the Department.

(3) Section 4 of the Superannuation Contributions Tax (Application to the Commonwealth—Reduction of Benefits) Act 1997 does not apply to the Secretary of the Department acting in the capacity of trustee of the Scheme for the purposes of the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

(4) If an amount becomes payable under subsection 16(6) or (6A) of the Superannuation Contributions Tax (Assessment and Collection) Act 1997 by the Secretary of the Department in the capacity (because of subsection (1) of this section) of trustee of the Scheme for the purposes of that Act, the amount must be paid out of the Consolidated Revenue Fund, which is appropriated accordingly.

20A Recoverable payments

(1) If, apart from this subsection, the Commonwealth does not have power under this Act to pay an amount (the relevant amount) to a person (the recipient) purportedly as a benefit, then the Commonwealth may pay the relevant amount to the recipient.

Recovery

(2) If a payment is made under subsection (1) to the recipient, the relevant amount:

(a) is a debt due to the Commonwealth by the recipient; and

(b) may be recovered by the Secretary of the Department, on behalf of the Commonwealth, in a court of competent jurisdiction.

Appropriation

(3) For the purposes of subsection 12A(5), if a payment under subsection (1) of this section relates to a benefit under subsection 12A(2), the payment is taken to be a benefit under subsection 12A(2).

(4) For the purposes of section 14 (other than paragraph (a) of that section), if a payment under subsection (1) of this section relates to a pension under this Act, the payment is taken to be a pension under this Act.

(5) For the purposes of subsection 17AB(7), if a payment under subsection (1) of this section relates to an amount under subsection 17AB(6), the payment is taken to be an amount under subsection 17AB(6).

Benefit

(6) For the purposes of this section, benefit means:

(a) a pension under this Act; or

(b) a benefit under subsection 12A(2); or

(c) an amount under subsection 17AB(6).

20B Recoverable death payments

(1) If, apart from this subsection, the Commonwealth does not have power under this Act to pay an amount (the relevant amount) in any of the following circumstances:

(a) the relevant amount is deposited to an account kept in the name of a deceased person;

(b) the relevant amount is deposited to an account kept in the names of a deceased person and another person;

(c) the relevant amount is paid by way of a cheque made out to a deceased person;

the Commonwealth may pay the relevant amount in the circumstances mentioned in paragraph (a), (b) or (c), so long as:

(d) on the last day on which changes could reasonably be made to the payment of the relevant amount, the Secretary of the Department did not know that the deceased person had died; and

(e) apart from this subsection, the relevant amount would have been payable as a benefit to the deceased person if the deceased person had not died.

(2) If a payment is made under subsection (1), the relevant amount is taken to have been paid to the deceased person’s estate.

Recovery

(3) If a payment is made under subsection (1), the relevant amount:

(a) is a debt due to the Commonwealth by the legal personal representative of the deceased person; and

(b) may be recovered by the Secretary of the Department, on behalf of the Commonwealth, in a court of competent jurisdiction.

Appropriation

(4) For the purposes of subsection 12A(5), if a payment under subsection (1) of this section relates to a benefit under subsection 12A(2), the payment is taken to be a benefit under subsection 12A(2).

(5) For the purposes of section 14 (other than paragraph (a) of that section), if a payment under subsection (1) of this section relates to a pension under this Act, the payment is taken to be a pension under this Act.

(6) For the purposes of subsection 17AB(7), if a payment under subsection (1) of this section relates to an amount under subsection 17AB(6), the payment is taken to be an amount under subsection 17AB(6).

Benefit

(7) For the purposes of this section, benefit means:

(a) a pension under this Act; or

(b) a benefit under subsection 12A(2); or

(c) an amount under subsection 17AB(6).

20C Reports about recoverable payments and recoverable death payments

(1) During the applicable publication period for a reporting period, the Secretary of the Department must cause to be published, in such manner as the Secretary of the Department thinks fit, a report that sets out:

(a) both:

(i) the number of payments made under subsection 20A(1) during the reporting period; and

(ii) the total amount of those payments; and

(b) both:

(i) the number of payments made under subsection 20B(1) during the reporting period; and

(ii) the total amount of those payments.

(2) However, a report is not required if:

(a) the number mentioned in subparagraph (1)(a)(i) is zero; and

(b) the number mentioned in subparagraph (1)(b)(i) is zero.

Deferred reporting

(3) Paragraph (1)(a) of this section does not require a report to deal with a payment unless, before the preparation of the report, a designated Department official was aware the payment was made under subsection 20A(1).

(4) Paragraph (1)(b) of this section does not require a report to deal with a payment unless, before the preparation of the report, a designated Department official was aware the payment was made under subsection 20B(1).

(5) For the purposes of this section, if:

(a) a payment was made under subsection 20A(1) or 20B(1) in a reporting period; and

(b) either:

(i) because of subsection (3) of this section, paragraph (1)(a) of this section did not require a report to deal with the payment; or

(ii) because of subsection (4) of this section, paragraph (1)(b) of this section did not require a report to deal with the payment; and

(c) during a later reporting period, a designated Department official becomes aware that the payment was made under subsection 20A(1) or 20B(1), as the case may be;

the payment is subject to a deferred reporting obligation in relation to the later reporting period.

(6) If one or more payments made under subsection 20A(1) during a reporting period are subject to a deferred reporting obligation in relation to a later reporting period, the Secretary of the Department must, during the applicable publication period for the later reporting period:

(a) prepare a report that sets out:

(i) the number of those payments; and

(ii) the total amount of those payments; and

(iii) the reporting period during which the payments were made; and

(b) if a report is required under subsection (1) in relation to the later reporting period—include the paragraph (a) report in the subsection (1) report; and

(c) if paragraph (b) does not apply—publish, in such manner as the Secretary of the Department thinks fit, the paragraph (a) report.

(7) If one or more payments made under subsection 20B(1) during a reporting period are subject to a deferred reporting obligation in relation to a later reporting period, the Secretary of the Department must, during the applicable publication period for the later reporting period:

(a) prepare a report that sets out:

(i) the number of those payments; and

(ii) the total amount of those payments; and

(iii) the reporting period during which the payments were made; and

(b) if a report is required under subsection (1) in relation to the later reporting period—include the paragraph (a) report in the subsection (1) report; and

(c) if paragraph (b) does not apply—publish, in such manner as the Secretary of the Department thinks fit, the paragraph (a) report.

Reporting period

(8) For the purposes of this section, a reporting period is:

(a) a financial year; or

(b) if a shorter recurring period is prescribed in an instrument under subsection (9)—that period.

(9) The Minister may, by legislative instrument, prescribe a recurring period for the purposes of paragraph (8)(b).

Applicable publication period

(10) For the purposes of this section, the applicable publication period for a reporting period is the period of:

(a) 4 months; or

(b) if a lesser number of months is prescribed, in relation to the reporting period, in an instrument under subsection (11)—that number of months;

beginning immediately after the end of the reporting period.

(11) The Minister may, by legislative instrument, prescribe a number of months, in relation to a reporting period, for the purposes of paragraph (10)(b).

Designated Department official

(12) For the purposes of this section, designated Department official means an official (within the meaning of the Public Governance, Performance and Accountability Act 2013) of the Department.

21 Regulations

The Governor‑General may make regulations prescribing matters:

(a) required or permitted by this Act to be prescribed; or

(b) necessary or convenient to be prescribed for carrying out or giving effect to this Act.