An Act to make Provision for Contributory Superannuation for Persons who have served as Members of the Parliament

Part I—Preliminary

1 Short title

This Act may be cited as the Parliamentary Contributory Superannuation Act 1948.

2 Commencement

This Act shall be deemed to have come into operation on 1 December 1948.

4 Interpretation

(1) In this Act, unless the contrary intention appears:

allowance by way of salary does not include the following:

(a) in relation to any person—special allowance of office, electorate allowance, travelling allowance or any allowance, or any allowance included in a class of allowances, prescribed for the purposes of this definition;

(b) in relation to an office holder—any portion determined under subsection 7(1B) of the Remuneration Tribunal Act 1973.

annuity means annuity under this Act, including an associate annuity under section 22CD or 22CE.

assessment has the same meaning as in the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

class 1 invalid means a person who is classified by the Trust as a class 1 invalid under Part V.

class 2 invalid means a person who is classified by the Trust as a class 2 invalid under Part V.

class 3 invalid means a person who is classified by the Trust as a class 3 invalid under Part V.

Commonwealth supplement means the amount of the Commonwealth supplement ascertained in accordance with section 16.

contributions means contributions under Part IV.

CSC (short for Commonwealth Superannuation Corporation) has the same meaning as in the Governance of Australian Government Superannuation Schemes Act 2011.

Finance Department means the Department administered by the Finance Minister.

Finance Minister means the Minister administering the Financial Management and Accountability Act 1997.

former spouse, in relation to another person, means a person who previously had had a marital or couple relationship with that other person.

House means a House of the Parliament.

life policy has the same meaning as in the Life Insurance Act 1995.

marital or couple relationship has the meaning given by section 4B.

medical practitioner means a person registered as a medical practitioner under a law of a State or Territory.

member means a member of either House.

Minister of State means a Minister of State who is entitled to a parliamentary allowance.

non‑parliamentary employment means any employment, profession or paid occupation, other than as a member.

office, in relation to a Minister of State, includes the following offices, namely:

(a) Prime Minister;

(b) Deputy Prime Minister;

(c) Leader of the Government in the Senate;

(d) Deputy Leader of the Government in the Senate;

(e) Leader of the House;

(f) Vice‑President of the Executive Council;

(g) Minister of State Assisting another Minister of State;

(h) an office, or an office included in a class of offices, prescribed for the purposes of this paragraph.

office holder means a person who:

(a) is entitled to a parliamentary allowance; and

(b) holds an office in, or in relation to, the Parliament or either House, being an office in respect of which he or she is entitled to an allowance by way of salary;

but does not include a Minister of State.

owner of a life policy has the same meaning as in the Life Insurance Act 1995.

parliamentary allowance means:

(a) an allowance under:

(i) section 3 of the Parliamentary Allowances Act 1920; or

(ii) subsection 4(1) or 5(1) of the Parliamentary Allowances Act 1952, as in force at any time before the commencement of sections 169 and 170 of the Statute Law (Miscellaneous Amendments) Act (No. 1) 1982; or

(b) an allowance by way of salary under section 4 of the Parliamentary Allowances Act 1952 (other than an allowance by way of salary payable by reason of the holding of a particular office, or the performing of particular functions in, or in relation to, the Parliament or either House); or

(c) an allowance by way of salary under clause 1 of Schedule 3 to the Remuneration and Allowances Act 1990:

(i) as in force before the commencement of Schedule 2 (the amending Schedule) to the Remuneration and Other Legislation Amendment Act 2011; or

(ii) as continued in force by item 21 of the amending Schedule; or

(d) parliamentary base salary (within the meaning of the Remuneration Tribunal Act 1973), less any portion determined under subsection 7(1A) of that Act.

participant, in relation to a superannuation scheme applying in relation to any employment, means any person employed in that employment in respect of whom benefits are applicable under the scheme by reason of his or her being so employed, whether or not he or she has made contributions under the scheme.

partner: a person is the partner of another person if the two persons have a relationship as a couple (whether the persons are the same sex or different sexes).

period of service, in relation to a person, means (subject to section 20) the period, or the sum of the periods (whether continuous or not), whether before or after the commencement of this Act, during which the person was entitled to parliamentary allowance, and includes any period by which the period of service of the person is deemed to be increased by virtue of subsection 22Q(4).

retiring allowance, in relation to a person, means the retiring allowance payable to the person under this Act and, in the case of a person who ceased or ceases to be a member after 30 June 1980, includes additional retiring allowance (if any) payable to the person under subsection 18(9).

salary, in relation to a Minister of State, does not include the following:

(a) any allowance;

(b) any portion determined under subsection 7(2A) of the Remuneration Tribunal Act 1973.

spouse has a meaning affected by section 4C.

superannuation guarantee safety‑net amount has the meaning given by section 16A.

surcharge has the same meaning as in the Superannuation Contributions Tax (Assessment and Collection) Act 1997.

surchargeable contributions means surchargeable contributions (within the meaning of the Superannuation Contributions Tax (Assessment and Collection) Act 1997) that are attributable to the operation of this Act.

surcharge debt account, in relation to a person who has held office as a member, means the surcharge debt account that was kept for the person (while he or she held that office) under section 16 of the Superannuation Contributions Tax (Assessment and Collection) Act 1997 and that related to the person’s surchargeable contributions.

surcharge deduction amount, in relation to a person:

(a) who has held office as a member; and

(b) to or in respect of whom benefits become payable under this Act;

means the surcharge deduction amount that is specified in the determination made by the Trust, under section 4E, in relation to the person.

Trust means the Parliamentary Retiring Allowances Trust established under this Act.

trustee means one of the trustees who constitute the Trust, and includes a Minister performing the powers and functions of the Finance Minister as a trustee.

(2) A reference in this Act to the contributions of a person does not include a reference to any contributions that have been refunded to him or her and have not been repaid by him or her.

(3) A reference in this Act to a superannuation scheme shall be read as a reference to a superannuation or retirement scheme, however established, other than the retirement scheme constituted by the provisions of this Act.

(4) For the purposes of this Act, a benefit payable to or in respect of a member under a superannuation scheme shall not be taken to have been based partly on contributions under the scheme by the employer by reason only that the benefit included interest upon contributions made under the scheme by the member.

(4A) For the purposes of this Act:

(aa) a member is taken to be employed by the Commonwealth; and

(a) a member of the Parliament of a State is taken to be employed by the State; and

(b) a member of the Legislative Assembly for the Australian Capital Territory is taken to be employed by the Australian Capital Territory; and

(c) a member of the Legislative Assembly of the Northern Territory of Australia is taken to be employed by the Northern Territory of Australia.

(5) A person shall, for the purposes of this Act, be taken to be, or to have been, entitled to parliamentary allowance during any period in respect of which the person is or was, as the case may be, entitled to be paid parliamentary allowance by virtue of:

(a) section 4 or 5 of the Parliamentary Allowances Act 1920;

(b) subsection 4(3) or (4) or 5(4) or (5) of the Parliamentary Allowances Act 1952, as in force at any time before the commencement of sections 169 and 170 of the Statute Law (Miscellaneous Amendments) Act (No. 1) 1982; or

(c) section 5 or 5A of the Parliamentary Allowances Act 1952.

(6) For the purposes of this Act, if a person ceases to be entitled to a parliamentary allowance, the cessation is taken to be an invalidity retirement if, and only if, the Trust makes a determination under section 15A in relation to that cessation.

4A Transfer value payable in respect of previous employment

(1) In this Act:

(a) a reference, in relation to a member, to a transfer value payable to or in respect of the member under a superannuation scheme applicable in relation to any employment in which he or she was employed at any time before the date on which he or she became a member is a reference to a benefit by way of a lump sum payable to or in respect of the member under that scheme upon the termination of the employment otherwise than on the ground of invalidity or of physical or mental incapacity to perform the duties of the employment, being a benefit that was based wholly upon contributions under the scheme by the employer or was based partly upon such contributions and partly upon contributions under the scheme by the member; and

(b) a reference to the amount of a transfer value:

(i) if the transfer value was based in part upon an amount or amounts paid to or in respect of the member under this Act—is a reference to so much only of the lump sum constituting the transfer value as exceeded that amount or the total of those amounts; and

(ii) does not include a reference to any part of the lump sum constituting the transfer value that was based upon contributions by the member that were, or were of a similar nature to, contributions under the Superannuation Act 1922 for reserve units of pension or contributions under section 48 of the Superannuation Act 1976; and

(iii) does not include a reference to any part of the lump sum constituting the transfer value that was based upon any excess contribution multiple within the meaning of the Superannuation Act 1990 of the member.

(2) If, after a transfer value became payable to or in respect of a person under a superannuation scheme, the whole or any part of that transfer value was paid to a person administering another superannuation scheme:

(a) where the whole of the transfer value was so paid—that transfer value shall be disregarded for the purposes of this Act; or

(b) where part of the transfer value was so paid—the amount of that transfer value shall be deemed, for the purposes of this Act, to be reduced by the amount so paid.

(3) Subject to subsection (4), a transfer value shall be deemed for the purposes of this Act to have become payable in respect of a person under a superannuation scheme upon the termination of any employment if, upon the termination of that employment, the person was the owner of a life policy, or was entitled to have the rights of the owner of a life policy assigned to him or her, being a policy the premiums for which were, while the person was employed in that employment, paid in whole or in part by the person’s employer, and, in that case, the surrender value of the policy as at the date of the termination of the employment shall be taken to be the amount of the transfer value.

(4) Where a transfer value is, by virtue of subsection (3), deemed for the purposes of this Act to have become payable in respect of a person upon the termination of any employment by reason that, upon the termination of that employment, the person was the owner of a life policy, or was entitled to have the rights of the owner of a life policy assigned to him or her, a transfer value shall not be deemed, for those purposes, to have become payable in respect of the person upon the termination of any previous employment by reason that, upon the termination of that previous employment, the person was the owner of that policy, or was entitled to have the rights of the owner of that policy assigned to him or her.

4B Marital or couple relationship

(1) For the purposes of this Act, a person had a marital or couple relationship with another person at a particular time if the person ordinarily lived with that other person as that other person’s husband or wife or partner on a permanent and bona fide domestic basis at that time.

(2) For the purpose of subsection (1), a person is to be regarded as ordinarily living with another person as that other person’s husband or wife or partner on a permanent and bona fide domestic basis at a particular time only if:

(a) the person had been living with that other person as that other person’s husband or wife or partner for a continuous period of at least 3 years up to that time; or

(b) the person had been living with that other person as that other person’s husband or wife or partner for a continuous period of less than 3 years up to that time and the Trust, having regard to any relevant evidence, is of the opinion that the person ordinarily lived with that other person as that other person’s husband or wife or partner on a permanent and bona fide domestic basis at that time;

whether or not the person was legally married to that other person.

(3) For the purposes of this Act, a marital or couple relationship is taken to have begun at the beginning of the continuous period mentioned in paragraph (2)(a) or (b).

(4) For the purpose of subsection (2), relevant evidence includes, but is not limited to, evidence establishing any of the following:

(a) the person was wholly or substantially dependent on that other person at the time;

(b) the persons were legally married to each other at the time;

(ba) the persons’ relationship was registered under a law of a State or Territory prescribed for the purposes of section 2E of the Acts Interpretation Act 1901, as a kind of relationship prescribed for the purposes of that section;

(c) the persons had a child who was:

(i) born of the relationship between the persons; or

(ii) adopted by the persons during the period of the relationship; or

(iii) a child of both of the persons within the meaning of the Family Law Act 1975;

(d) the persons jointly owned a home which was their usual residence.

(5) For the purposes of this section, a person is taken to be living with another person if the Trust is satisfied that the person would have been living with that other person except for a period of:

(a) temporary absence; or

(b) absence because of the person’s illness or infirmity.

4C Spouse who survives a deceased person

(1) In this section:

deceased person means a person who was, at the time of his or her death:

(a) a person who was entitled to a parliamentary allowance; or

(b) a person who was entitled to a retiring allowance, whether or not the retiring allowance was immediately payable.

retired member means a person who was entitled to a retiring allowance, whether or not the retiring allowance was immediately payable.

(2) For the purposes of this Act, a person is a spouse who survives a deceased person if:

(a) the person had a marital or couple relationship with the deceased person at the time of the death of the deceased person (the death); and

(b) in the case of a deceased person who was a retired member at the time of the death:

(i) the marital or couple relationship began before the retired member became a retired member; or

(ii) the marital or couple relationship began after the retired member became a retired member but before the retired member reached 60; or

(iii) in the case of neither subparagraph (i) nor (ii) applying—the marital or couple relationship had continued for a period of at least 5 years up to the time of the death.

(3) In spite of subsection (2), a person is taken to be a spouse who survives a deceased person if:

(a) the person had previously had a marital or couple relationship with the deceased person; and

(b) the person did not, at the time of the death, have a marital or couple relationship with the deceased person but was legally married to the deceased person; and

(c) in the case of a marital or couple relationship that began after the deceased person became a retired member and reached 60—the relationship began at least 5 years before the deceased person’s death; and

(d) in the Trust’s opinion, the person was wholly or substantially dependent upon the deceased person at the time of the death.

4D Incapacity

In determining the percentage of a person’s incapacity in relation to non‑parliamentary employment, the Trust or a medical practitioner, as the case may be, must have regard to all relevant matters, including, but not limited to, the following:

(a) the vocational, trade and professional skills, qualifications and experience of the person;

(b) the kinds of non‑parliamentary employment which a person with the skills, qualifications and experience referred to in paragraph (a) might reasonably undertake;

(c) the degree to which any physical or mental impairment of the person has diminished his or her capacity to undertake the kinds of non‑parliamentary employment referred to in paragraph (b);

(d) the income (if any) derived by the person from personal exertion.

4E Surcharge deduction amount

(1) If:

(a) benefits under this Act become payable to or in respect of a person who has held office as a member; and

(b) the person’s surcharge debt account is in debit when those benefits become so payable;

the Trust must determine in writing the surcharge deduction amount that, in its opinion, it would be fair and reasonable to take into account in working out the amount of those benefits.

(2) In making the determination, the Trust must have regard to the following:

(a) the amount by which the person’s surcharge debt account is in debit when those benefits become payable;

(b) the value of the employer‑financed component of those benefits;

(c) the value of the benefits that, for the purpose of working out (under the Superannuation Contributions Tax (Assessment and Collection) Act 1997) the notional surchargeable contributions factors applicable to the person, were assumed to be likely to be payable to the person under this Act on his or her ceasing to hold office as a member;

(d) whether the person has or had qualified for his or her maximum benefit entitlement under this Act;

(e) any other matter that the Trust considers relevant.

(3) The amount determined by the Trust may not be more than the total of the following amounts:

(a) 15% of the employer‑financed component of any part of the benefits payable to the person that accrued between 20 August 1996 and 1 July 2003;

(b) 14.5% of the employer‑financed component of any part of the benefits payable to the person that accrued in the 2003‑2004 financial year;

(c) 12.5% of the employer‑financed component of any part of the benefits payable to the person that accrued in the 2004‑2005 financial year.

(4) Reductions under Division 3 of Part VAA are to be disregarded in applying subsection (3).

4F Application of the Criminal Code

Chapter 2 of the Criminal Code applies to all offences against this Act.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Part II—The Parliamentary Retiring Allowances Trust

5 The Parliamentary Retiring Allowances Trust

(1) There shall be a body to be called the Parliamentary Retiring Allowances Trust.

(2) The Trust shall be a body corporate with perpetual succession and a common seal, and shall be capable of holding and disposing of property and of suing and being sued in its corporate name.

(3) The Trust shall be constituted by 5 trustees, namely:

(a) the Finance Minister;

(b) 2 senators; and

(c) 2 members of the House of Representatives.

(4) The powers and functions of the Finance Minister as a trustee may be exercised by any Minister thereunto authorized in writing by the Finance Minister, but no such authorization shall prevent the exercise of those powers and functions by the Finance Minister himself or herself.

(5) A vacancy in the office of a trustee shall not invalidate the proceedings of the trustees.

(6) The seal of the Trust shall not be attached to any document except in accordance with a resolution of the trustees, and shall be authenticated by the signatures of 2 trustees.

6 Appointment of certain trustees

(1) The trustees specified in paragraphs 5(3)(b) and (c) shall be appointed, and may be removed, by the House of which they are members.

(2) A trustee appointed under subsection (1) who has ceased to be a senator or a member of the House of Representatives (as the case may be), by reason of the dissolution or expiration of the House of which he or she was a member, shall not thereby cease to be a trustee until he or she ceases to be entitled to parliamentary allowance.

7 Temporary trustees

(1) If a vacancy occurs in the office of a trustee, the Governor‑General may appoint a trustee to hold office until the vacancy is otherwise filled.

8 Meetings of the trustees

(1) The affairs of the Trust shall be conducted at meetings of the trustees.

(2) At all meetings of the trustees, 3 trustees shall form a quorum.

(3) The Finance Minister (or a Minister exercising the powers and functions of the Finance Minister as a trustee) shall preside at any meeting of the trustees at which he or she is present and, if neither the Finance Minister nor such a Minister is present at a meeting, the trustees present shall elect one of their number to preside at that meeting.

(4) A majority of the trustees present at a meeting shall have power to bind the Trust and to pass resolutions of the trustees, and, if the number of trustees present is 4, the trustee presiding and one other trustee shall also have power to bind the Trust and to pass such resolutions.

(5) The Secretary of the Finance Department, or an officer of the Finance Department appointed by him or her for the purpose, shall attend meetings of the trustees and give such advice and assistance as the trustees require.

9 Delegation

(1) The Trust may, either generally or as otherwise provided by the instrument of delegation, by writing under its common seal, delegate to a trustee any of its powers or functions under this Act, other than this power of delegation.

(2) A power or function so delegated, when exercised or performed by the delegate, shall, for the purposes of this Act, be deemed to have been exercised or performed, as the case may be, by the Trust.

(3) A delegation under this section does not prevent the exercise of a power or the performance of a function by the Trust.

Part IV—Contributions

13 Contributions

(1) A person who is entitled to a parliamentary allowance shall, during his or her period of service, pay contributions to the Commonwealth:

(a) in the case of a person whose period of service is less than 18 years—at the rate per month of 111/2% of the monthly amount of the parliamentary allowance to which he or she is entitled; or

(b) in the case of a person whose period of service is not less than 18 years—at the rate per month of 53/4% of the monthly amount of the parliamentary allowance to which he or she is entitled.

(2) Subject to subsection (4), a Minister of State shall, in addition to the contributions payable by him or her under subsection (1), pay contributions to the Commonwealth, during the period during which he or she serves as a Minister of State, at the rate per month of 111/2% of the monthly amount of the salary to which he or she is entitled as Minister of State.

(3) Subject to subsection (4), an office holder shall, in addition to the contributions payable by him or her under subsection (1), pay contributions to the Commonwealth, during the period during which he or she serves as, and in respect of each office by virtue of which he or she is, an office holder, at the rate per month of 111/2% of the monthly amount of the allowance by way of salary to which he or she is entitled in respect of that office.

(4) If, at any time, a Minister of State or an office holder would, if he or she ceased to be entitled to parliamentary allowance at that time, be entitled to additional retiring allowance under subsection 18(9) at a rate which is:

(a) in a case where he or she would be entitled to additional retiring allowance in respect of one office only—75% of the rate, at that time, at which salary or allowance by way of salary, as the case may be, is payable in respect of that office; or

(b) in a case where he or she would be entitled to additional retiring allowance in respect of 2 or more offices—75% of the rate that is the highest rate, at that time, at which salary or allowance by way of salary, as the case may be, is payable in respect of either or any of those offices;

then, so long as he or she continues to be a Minister of State who, or an office holder who, would, if he or she ceased to be entitled to parliamentary allowance, be entitled to additional retiring allowance under that subsection at that rate, subsection (2) or (3), as the case may be, applies to him or her as if the reference to 111/2% in whichever of those subsections is applicable were a reference to 53/4%.

(5) For the purposes of subsections (1), (2) and (3):

(a) the monthly amount of the parliamentary allowance to which a person is entitled shall be deemed to be one‑twelfth of the annual amount of that allowance;

(b) the monthly amount of the salary to which a Minister of State is entitled as Minister of State shall be deemed to be one‑twelfth of the annual amount of that salary; and

(c) the monthly amount of the allowance by way of salary to which an office holder is entitled in respect of an office shall be deemed to be one‑twelfth of the annual amount of that allowance.

(6) The contributions payable by a person under this section shall be deducted:

(a) in the case of contributions under subsection (1)—from payments of parliamentary allowance made to the person;

(b) in the case of contributions under subsection (2)—from payments of parliamentary allowance made to the person or of salary made to the person as Minister of State; and

(c) in the case of contributions under subsection (3)—from payments of parliamentary allowance made to the person or of allowance by way of salary made to the person as office holder.

(7) Each deduction under subsection (6) shall, as far as practicable, be made in respect of the same period as that in respect of the payment from which it is deducted is made.

(8) Amounts deducted under subsection (6) shall be paid to the Commonwealth.

(9) In this section, month means one of the 12 months of the year.

14 Additional contributions by Ministers of State and office holders in respect of service before 12 June 1978

(1) A reference in this section to a period during which a person served as a Minister of State or an office holder does not include a reference to any period that does not also form part of the period of service of the person for the purposes of this Act.

(2) Where a person who is a member on 12 June 1978 served as a Minister of State or an office holder during any period or periods, or as a Minister of State and an office holder during different periods, before that date, he or she may, within 3 months after that date, by notice in writing signed by the person and delivered personally or sent by post to the Secretary of the Finance Department, elect to have the whole of that period or of those periods taken into account for the purposes of subsection 18(9).

(3) Where a person, not being a person who is a member on 12 June 1978, becomes a member after that date and that person served as a Minister of State or an office holder during any period or periods, or as a Minister of State and an office holder during different periods, before that date, he or she may, within 3 months after the date on which he or she so becomes a member, by notice in writing signed by the person and delivered personally or sent by post to the Secretary of the Finance Department, elect to have the whole of that period or of those periods taken into account for the purposes of subsection 18(9).

(4) A person who makes an election in accordance with subsection (2) or (3) shall:

(a) if he or she received any refund of contributions under Part VA of the Parliamentary Retiring Allowances Act 1948‑1964, or of that Act as amended, not being a refund that was subsequently repaid by him or her under section 22M of that Act, or of that Act as amended, or received any refund of contributions under subsection 22(12) or (13) of the Parliamentary and Judicial Retiring Allowances Act 1973—pay to the Commonwealth an amount equal to that refund (excluding any part of that refund that comprises contributions made in respect of a period to which subsection 19A(7) applies); and

(b) if, during the period that commenced on 8 June 1973 and ended on 11 June 1978, he or she served as a Minister of State or an office holder during any period or periods, or as a Minister of State and an office holder during different periods—pay to the Commonwealth an amount equal to 111/2% of the sum of:

(i) the total of the amounts of salary to which he or she was entitled as Minister of State in respect of the period or periods (if any) during which he or she so served as a Minister of State; and

(ii) the total of the amounts of allowance by way of salary to which he or she was entitled as office holder in respect of the period or periods (if any) during which he or she so served as an office holder.

(5) If, but for this subsection, subsection 22(2) of the Parliamentary and Judicial Retiring Allowances Act 1973 would apply to and in respect of a person who makes an election under this section, that subsection ceases to apply to and in respect of him or her when the election is made.

(6) Any amounts payable to the Commonwealth by a person under this section shall be paid at such times and in such amounts as are agreed upon between the person and the Finance Minister or, in the absence of agreement, at such times and in such amounts as the Finance Minister determines, but so that the total of the amounts is paid to the Commonwealth within 3 years after the date on which the person made the relevant election under this section.

(7) If a person who has made an election under this section becomes entitled to a retiring allowance and, after becoming so entitled, elects under subsection 18B(3) to convert a percentage of that retiring allowance into a lump sum payment, there shall be deducted from the amount of that lump sum payment the amount (if any) by which the total of the amounts that the person is liable to pay to the Commonwealth under subsection (4) of this section exceeds the total of any of those amounts that the person has paid in accordance with subsection (6) of this section and, upon the deduction being made, the person is, to the extent of the amount deducted, discharged from further liability to make payments under this section.

Part V—Benefits

14A Benefits to be paid by Commonwealth

Payments in respect of benefits (including refunds of contributions) provided for by this Act shall be made by the Commonwealth.

15 Benefits applicable only to present and future members

Subject to section 19A, retiring allowances, annuities and other benefits under this Act shall be payable only to or in relation to persons who are members at the commencement of this Act or become members thereafter.

15A Invalidity retirement

When section applies

(1) This section applies to a person who:

(a) ceases to be a member because of his or her having resigned his or her place before the expiration of his or her term of office; or

(b) ceases to be a senator upon the expiration of the term of office of a class of senators or the dissolution of the Senate and is not, at the time of an election to fill places in the Senate that became vacant when his or her place becomes vacant:

(i) a candidate for election as a senator; or

(ii) if elections of members of the House of Representatives are held, or an election of a member of the House of Representatives is held, at the same time as such a Senate election—a candidate for election either as a senator or as a member of the House of Representatives; or

(c) ceases to be a member of the House of Representatives upon the dissolution or expiration of that House and is not, at the time of the next ensuing elections for the House of Representatives:

(i) a candidate for election to that House; or

(ii) if elections of senators are held, or an election of a senator is held, at the same time as those elections for that House—a candidate for election either as a senator or as a member of the House of Representatives; or

(d) ceases to be a senator because of the election of a successor under section 15 of the Constitution and is not, at the time of the election at which his or her successor is elected:

(i) a candidate for election as a senator; or

(ii) if his or her successor is elected at a general election of members of the House of Representatives—a candidate for election either as a senator or as a member of the House of Representatives.

Invalidity retirement

(2) The Trust may determine that the person’s resignation or failure to be such a candidate is to be treated as an invalidity retirement if:

(a) a written application is made by or on behalf of the person for such a determination; and

(b) the Trust is satisfied that the person is unlikely, because of physical or mental impairment, ever to be able to perform the duties of a member again.

The determination must specify the physical or mental impairment or impairments concerned.

Application to be accompanied by medical certificates

(3) The application must be accompanied by:

(a) such additional information (if any) as the Trust requires; and

(b) a certificate given by a medical practitioner nominated by the Trust; and

(c) a certificate given by a medical practitioner nominated by or on behalf of the person; and

(d) such additional documents (if any) as the Trust requires.

Medical certificates—contents

(4) Each certificate must include:

(a) a statement to the effect that, in the opinion of the medical practitioner concerned, the person is unlikely, because of physical or mental impairment, ever to be able to perform the duties of a member again; and

(b) a statement setting out the medical practitioner’s opinion about the percentage of the person’s incapacity in relation to non‑parliamentary employment.

Consultation about nominated medical practitioner

(5) The Trust must consult a Senior Commonwealth Medical Officer about the identity of a medical practitioner nominated under paragraph (3)(b).

Trust to notify applicant of decision

(6) If the Trust makes a decision refusing an application under subsection (2), the Trust must give the applicant a written notice of the refusal.

15B Invalidity classification

When section applies

(1) This section applies if the Trust determines under subsection 15A(2) that a person’s resignation or failure to be a candidate, as the case may be, is to be treated as an invalidity retirement.

Trust to determine percentage of incapacity

(2) The Trust must determine the percentage of the person’s incapacity in relation to non‑parliamentary employment.

Trust to classify person

(3) The Trust must also classify the person in accordance with the following table:

Table |

% of incapacity | Classification |

60% or more | Class 1 invalid |

30% or more but less than 60% | Class 2 invalid |

Less than 30% | Class 3 invalid |

Trust to notify person of classification

(4) If the Trust makes a decision under this section, it must give the person a written notice setting out the decision.

15C Review of invalidity classification

Persons to whom section applies

(1) This section applies to a person if the person is entitled to a retiring allowance under paragraph 18(2AA)(c) or (d).

Review of invalidity classification

(2) The Trust may, from time to time, review the person’s current classification as a class 1 invalid or a class 2 invalid, as the case may be.

How review is initiated

(3) The Trust may review the person’s classification:

(a) on its own initiative; or

(b) if it is requested to do so by or on behalf of the person.

Request for review

(4) A request under paragraph (3)(b) must:

(a) be in writing; and

(b) be accompanied by:

(i) a written submission in support of the request; and

(ii) a certificate given by a medical practitioner nominated by or on behalf of the person.

Medical certificate in support of request for review

(5) The certificate mentioned in subsection (4) must set out the medical practitioner’s opinion about the percentage of the person’s incapacity in relation to non‑parliamentary employment.

Notification of refusal of request for review

(6) If the Trust makes a decision refusing a request under paragraph (3)(b), the Trust must give the person a written notice of the refusal.

Trust may request attendance at a medical examination

(7) For the purposes of the review, the Trust may, by written notice given to the person, request the person:

(a) to submit himself or herself for medical examination by a specified medical practitioner at a time and place specified in the notice; or

(b) to give to the Trust, within the period specified in the notice, specified information that is relevant to the review; or

(c) to produce to the Trust, within the period specified in the notice, specified documents that are relevant to the review.

Multiple notices

(8) The Trust may give 2 or more notices under subsection (7) in relation to the review.

Senior Commonwealth Medical Officer to be consulted about medical practitioners

(9) The Trust must consult a Senior Commonwealth Medical Officer about the identity of a medical practitioner specified in a notice under subsection (7).

Consequences of failure to attend medical examination, to give information or to produce documents

(10) If the person fails to comply with a notice under subsection (7), the Trust may, by written notice given to the person, suspend the person’s retiring allowance with effect from a specified date. The date must not be earlier than the day on which the notice was given.

Reimbursement of reasonable expenses incurred in attending medical examination

(11) If:

(a) the person submits himself or herself for medical examination in accordance with a notice under subsection (7); and

(b) the person incurs, in respect of attendance at that examination, expenses in respect of:

(i) transport; or

(ii) accommodation; or

(iii) the purchase of food or drink; or

(iv) incidental matters;

the Trust may determine that the person is entitled to be paid by the Commonwealth an amount equal to so much of those expenses as the Trust considers reasonable. The Consolidated Revenue Fund is appropriated for the purposes of this subsection.

Decision on review

(12) For the purposes of the review, the Trust must make a decision:

(a) confirming the person’s classification; or

(b) if the person is a class 1 invalid—re‑classifying the person as a class 2 invalid or as a class 3 invalid; or

(c) if the person is a class 2 invalid—re‑classifying the person as a class 1 invalid or as a class 3 invalid.

The re‑classification must be in accordance with the classification table set out in section 15B according to the percentage of the person’s incapacity in relation to non‑parliamentary employment.

Decision on review to be made on the basis of the original physical or mental impairment

(13) In determining, for the purposes of this section, the percentage of the person’s incapacity in relation to non‑parliamentary employment, the Trust or a medical practitioner, as the case may be, is to ignore any physical or mental impairment of the person unless the impairment is of a kind that:

(a) was specified in the determination made under section 15A in relation to the person; or

(b) is related to an impairment of a kind that was specified in that determination.

When re‑classification takes effect

(14) If the Trust decides to re‑classify the person, the Trust must specify a date as the date on which the re‑classification takes effect. The date must not be earlier than the date on which the decision was made.

Re‑classification to be treated as a classification

(15) If the Trust decides to re‑classify the person, the Trust is taken to have classified the person accordingly on the day on which the re‑classification takes effect.

Notification of decision on review

(16) If the Trust makes a decision under subsection (12), the Trust must give the person a written notice setting out the decision.

Re‑classification as a class 3 invalid—reduction of benefit

(17) If the Trust decides to re‑classify the person as a class 3 invalid, the benefit payable to the person under paragraph 18(2AA)(e) is to be reduced (but not below 0) by the total of the payments of retiring allowance paid to the person under paragraph 18(2AA)(c) or (d) before the re‑classification took effect.

16 Commonwealth supplement

(1) For the purposes of this Act, the amount of the Commonwealth supplement, in relation to a member or former member, shall, subject to this section, be 21/3 times the contributions paid by him or her during his or her period of service or, if that period exceeds 8 years, during the last 8 years thereof.

(1A) Any amounts paid by a person to the Commonwealth under section 14 shall be deemed to be contributions paid by him or her during his or her period of service, or during the last 8 years of his or her period of service, to the extent that those amounts relate to:

(a) in the case of amounts paid in pursuance of paragraph 14(4)(a)—contributions (other than a repayment of a refund) made during his or her period of service, or during those last 8 years of his or her period of service, as the case may be, under Part VA of the Parliamentary Retiring Allowances Act 1948‑1964 or of that Act as amended; and

(b) in the case of amounts paid in pursuance of paragraph 14(4)(b)—any period occurring during his or her period of service, or during those last 8 years of his or her period of service, as the case may be.

(2) For the purpose of ascertaining the Commonwealth supplement in relation to a person who was a member at the date of commencement of the Parliamentary Retiring Allowances Act 1948, he or she shall be deemed to have paid (in addition to the contributions which he or she has paid) the contributions which would have been payable by him or her before the date of commencement of that Act if that Act had commenced at the beginning of his or her period of service.

(3) For the purpose of ascertaining the Commonwealth supplement in relation to a person who paid contributions in accordance with paragraph 13(1)(b), he or she shall be deemed to have paid (in addition to the contributions that he or she has paid under that paragraph and any other contributions that he or she has paid) further contributions equal to the contributions that he or she paid under that paragraph.

(4) For the purpose of ascertaining the Commonwealth supplement in relation to a person who paid contributions in accordance with subsection 13(2) as that subsection has effect by virtue of subsection 13(4), subsection 13(3) as that subsection has effect by virtue of subsection 13(4) or both those subsections as they so have effect, he or she shall be deemed to have paid, in addition to the contributions that he or she so paid (in this subsection referred to as the relevant contributions) and any other contributions that he or she paid, further contributions equal to the relevant contributions.

16A Superannuation guarantee safety‑net amount

Superannuation guarantee safety‑net amount

(1) For the purposes of this Act, the superannuation guarantee safety‑net amount in relation to a person is the sum of the following amounts:

(a) the contributions made by the person during so much of the person’s period of service as occurred after 30 June 1992;

(b) the interest that would have accrued on the contributions covered by paragraph (a) if it were assumed that:

(i) the contributions had been member contributions made under the superannuation scheme established by deed under the Superannuation Act 1990; and

(ii) interest on those contributions had accrued in accordance with determinations by CSC under that scheme as to rates of interest and the method of allocating interest; and

(iii) no interest on those contributions had accrued during any period when the person was not entitled to a parliamentary allowance;

(c) the total of the minimum amounts that the Commonwealth would have had to contribute to a complying superannuation fund or scheme for the benefit of the person in order to avoid having any individual superannuation guarantee shortfalls in respect of the person if it were assumed that:

(i) the only capacity in which the person was, or had ever been, an employee of the Commonwealth (within the meaning of the Superannuation Guarantee (Administration) Act 1992) were the person’s capacity as a member (see subsection 12(4) of that Act); and

(ii) the scheme constituted by the provisions of this Act did not exist; and

(iii) those contributions were made on a monthly basis;

(d) the interest that would have accrued on the contributions covered by paragraph (c) if it were assumed that:

(i) the contributions had been member contributions made under the superannuation scheme established by deed under the Superannuation Act 1990; and

(ii) interest on those contributions had accrued in accordance with determinations by CSC under that scheme as to rates of interest and the method of allocating interest; and

(iii) no interest on those contributions had accrued during any period when the person was not entitled to a parliamentary allowance;

(e) if:

(i) the person was entitled to a parliamentary allowance at all times since the end of 30 June 1992; and

(ii) an amount (the lump sum amount) would have been payable to the person under subsection 18(4) if it were assumed that the person had retired voluntarily at the end of 30 June 1992;

the sum of the following amounts:

(iii) the lump sum amount;

(iv) the interest that would have accrued on the lump sum amount if it were assumed that:

(A) the lump sum amount had been a member contribution made on 1 July 1992 under the superannuation scheme established by deed under the Superannuation Act 1990; and

(B) interest on the contribution had accrued in accordance with determinations by CSC under that scheme as to rates of interest and the method of allocating interest.

Refund of contributions

(2) For the purposes of this Act, if a superannuation guarantee safety‑net amount is paid to a person, so much of that amount as is attributable to the person’s contributions is taken to be a refund of the contributions.

Definitions—superannuation guarantee charge

(3) In this section:

complying superannuation fund or scheme has the same meaning as in the Superannuation Guarantee (Administration) Act 1992.

individual superannuation guarantee shortfall has the same meaning as in the Superannuation Guarantee (Administration) Act 1992.

17 Meaning of voluntary retirement

(1) For the purposes of this Part, the cases in which a member shall be deemed to have retired voluntarily shall be the cases specified in this section.

(2) Notwithstanding anything contained in this section, a member shall not be deemed to have retired voluntarily if he or she has attained the age of 60 years at the time when he or she ceases to be entitled to a parliamentary allowance.

(3) A member who resigns his or her place before the end of his or her term of office is taken to have retired voluntarily if:

(a) the Trust does not determine under section 15A that the resignation is to be treated as an invalidity retirement; and

(b) he or she fails to satisfy the Trust that his or her resignation was made bona fide:

(i) for the purpose of securing election for another electorate or for another State; or

(ii) for the purpose of submitting himself or herself for re‑election by the electors of his or her former electorate; or

(iii) for the purpose of securing election as a member of the House of which he or she was not a member.

(4) A person who has ceased to be a senator upon the expiration of the term of office of a class of senators or the dissolution of the Senate, or has ceased to be a member of the House of Representatives upon the dissolution or expiration of that House, shall be deemed to have retired voluntarily:

(a) if:

(i) in the case of a person who was a senator—he or she was not, at the time of an election to fill places in the Senate that became vacant at the time when his or her place became vacant, a candidate for election to the Senate or, if elections of members of the House of Representatives were held, or an election of a member of the House of Representatives was held, at the same time as such a Senate election, a candidate either for election as a senator or as a member of the House of Representatives; or

(ii) in the case of a person who was a member of the House of Representatives—he or she was not, at the time of the next ensuing elections for that House, a candidate for election to that House or, if elections of senators were held, or an election of a senator was held, at the same time as those elections for that House, a candidate either for election as a senator or as a member of the House of Representatives;

and both:

(iii) the Trust does not determine under section 15A that his or her failure to be such a candidate is to be treated as an invalidity retirement; and

(iv) he or she does not satisfy the Trust that his or her failure to be such a candidate was due to:

(A) his or her failure to secure the support of a political party from which he or she reasonably sought support; or

(B) his or her expulsion from a political party; or

(b) if he or she was such a candidate but did not, in the opinion of the Trust, genuinely desire to be elected.

(5) A member shall be deemed to have retired voluntarily if his or her place becomes vacant:

(a) under section 20 or 38 of the Constitution; or

(b) by reason of his or her becoming subject to any of the disabilities mentioned in paragraphs 44(iv) and (v) of the Constitution, or because he or she has directly or indirectly taken or agreed to take any fee or honorarium for services rendered to the Commonwealth, within the meaning of paragraph 45(iii) of the Constitution.

(6) Notwithstanding anything contained in this section (except subsection (2)), a member shall be deemed to have retired voluntarily if he or she ceases to be a member in circumstances which, in the opinion of the Trust, should justly be treated as constituting a voluntary retirement for the purposes of this Part.

18 Benefits to members

(1) Subject to this Act, a member who ceases to be entitled to a parliamentary allowance shall be entitled to benefits in accordance with this section.

(1AA) For the purposes of this section, the most recent benefit start‑up time is the time when a benefit becomes payable to the person (ignoring any application of subsection (8A) or (8AC)).

(1A) Where the period of service of a member is not less than 12 years, then, subject to subsections (8A) and (8AC), the benefit shall be a retiring allowance during his or her life‑time at the rate applicable in accordance with the scale set out in subsection (6).

(1B) Where the period of service of a member is less than 12 years but he or she has, on each of at least 4 occasions (including occasions before the commencement of this subsection), ceased to be a member upon the dissolution or expiration of the House of which he or she was then a member or upon the expiration of his or her term of office, then, subject to subsections (8A) and (8AC), the benefit shall be:

(a) if his or her period of service is less than 8 years—a retiring allowance during his or her life‑time at the rate applicable in accordance with the scale set out in subsection (6) in the case of a member whose period of service is 8 years; or

(b) in any other case—a retiring allowance during his or her life‑time at the rate applicable in accordance with the scale set out in subsection (6).

(2) In the case of a member (other than a member to whom subsection (1A) or (1B) applies) who does not retire voluntarily and whose retirement is not an invalidity retirement, the benefit (subject to subsections (8A), (8AC) and (8B)) is:

(a) where his or her period of service is not less than 8 years—a retiring allowance during his or her life‑time at the rate applicable in accordance with the scale set out in subsection (6);

(aa) where his or her period of service is less than 8 years but he or she has, on each of at least 3 occasions (including occasions before the commencement of this paragraph), ceased to be a member upon the dissolution or expiration of the House of which he or she was then a member or upon the expiration of his or her term of office—a retiring allowance during his or her life‑time at the rate applicable in accordance with the scale set out in subsection (6) in the case of a member whose period of service is 8 years; or

(b) in any other case—the greater of the following:

(i) a refund of his or her contributions together with a payment of the Commonwealth supplement;

(ii) the superannuation guarantee safety‑net amount.

(2AAA) If the amount referred to in subparagraph (2)(b)(i) is equal to the amount referred to in subparagraph (2)(b)(ii), paragraph (2)(b) has effect as if the amount referred to in subparagraph (2)(b)(i) were greater than the amount referred to in subparagraph (2)(b)(ii).

(2AA) In the case of a member (other than a member to whom subsection (1A) or (1B) applies) whose retirement is an invalidity retirement, the benefit (subject to subsections (8A), (8AC) and (8B)) is:

(a) if the member’s period of service is not less than 8 years—a retiring allowance during his or her life‑time at the rate applicable in accordance with the scale set out in subsection (6); or

(b) if the member’s period of service is less than 8 years but he or she has, on each of at least 3 occasions (including occasions before the commencement of this subsection), ceased to be a member upon:

(i) the dissolution or expiration of the House of which he or she was then a member; or

(ii) the expiration of his or her term of office;

a retiring allowance during his or her life‑time at the rate of 50% of parliamentary allowance for the time being payable to a member; or

(c) if:

(i) neither of the preceding paragraphs applies; and

(ii) he or she is a class 1 invalid;

a retiring allowance during his or her life‑time at the rate of 50% of parliamentary allowance for the time being payable to a member; or

(d) if:

(i) none of the preceding paragraphs applies; and

(ii) he or she is a class 2 invalid;

a retiring allowance during his or her life‑time at the rate of 30% of parliamentary allowance for the time being payable to a member; or

(e) if:

(i) none of the preceding paragraphs applies; and

(ii) he or she is a class 3 invalid;

the greater of the following:

(iii) a refund of his or her contributions together with a payment of the Commonwealth supplement;

(iv) the superannuation guarantee safety‑net amount.

Note: The references in this subsection to the rate of parliamentary allowance for the time being payable are affected by section 22T.

(2AB) If the amount referred to in subparagraph (2AA)(e)(iii) is equal to the amount referred to in subparagraph (2AA)(e)(iv), paragraph (2AA)(e) has effect as if the amount referred to in subparagraph (2AA)(e)(iii) were greater than the amount referred to in subparagraph (2AA)(e)(iv).

(2AC) If:

(a) a person is entitled to a retiring allowance under paragraph (2AA)(c) or (d); and

(b) under section 15C, the Trust reviews the person’s current classification as a class 1 invalid or a class 2 invalid, as the case may be; and

(c) the Trust decides to re‑classify the person under section 15C;

the following provisions have effect from the date on which the re‑classification takes effect:

(d) the person ceases to be entitled to a retiring allowance under whichever of paragraph (2AA)(c) or (d) was applicable;

(e) the person becomes entitled to a retiring allowance or benefit under whichever of paragraph (2AA)(c), (d) or (e) is applicable to the person as a result of the re‑classification.

(2A) For the purposes of subsection (1B) and paragraphs (2)(aa) and (2AA)(b), every senator whose term of office was 6 years shall, if at the expiration of 3 years after the commencement of that term of office that term of office had not expired, be deemed (in addition to his or her having ceased to be a senator at the actual expiration of that term of office if he or she continued in office for the whole of that term) to have at the expiration of that period of 3 years ceased to be a senator by reason of the expiration of that term of office.

(3) Where a person has been appointed to hold the office of a senator by the Governor of a State under section 15 of the Constitution, his or her ceasing to be a member upon the expiration of 14 days after the beginning of the next session of the Parliament of the State, or upon the election of a successor, as the case may be, shall not be taken into account for the purposes of subsection (1B) or paragraphs (2)(aa) and (2AA)(b).

(4) In the case of a member (other than a member to whom subsection (1A) or (1B) applies) who retires voluntarily, the benefit (subject to subsections (8B)) is the greater of the following:

(a) a refund of his or her contributions together with a payment of 50% of the Commonwealth supplement;

(b) the superannuation guarantee safety‑net amount.

(5) If the amount referred to in paragraph (4)(a) is equal to the amount referred to in paragraph (4)(b), subsection (4) has effect as if the amount referred to in paragraph (4)(a) were greater than the amount referred to in paragraph (4)(b).

(6) The rate of retiring allowance payable to a person under this section is such percentage of the rate of parliamentary allowance for the time being payable to a member as is applicable in accordance with the following scale:

Number of complete years in period of service of person | Percentage of parliamentary allowance to be paid as retiring allowance |

8 | 50.00 |

9 | 52.50 |

10 | 55.00 |

11 | 57.50 |

12 | 60.00 |

13 | 62.50 |

14 | 65.00 |

15 | 67.50 |

16 | 70.00 |

17 | 72.50 |

18 or more | 75.00 |

Note: The reference in this subsection to the rate of parliamentary allowance for the time being payable is affected by section 22T.

(7) Where:

(a) the number of complete years in the period of service of a person is not less than 8 but less than 18; and

(b) that period of service includes, apart from those complete years, a number of complete days;

the percentage of the rate of parliamentary allowance applicable in relation to the person in accordance with the scale set out in subsection (6) shall be increased by an additional percentage (calculated to 3 decimal places) of that rate ascertained by multiplying the number of those complete days or 364, whichever is the less, by .00685.

(8) Where the additional percentage ascertained in accordance with subsection (7) in relation to a person would, if it were calculated to 4 decimal places, end with a number greater than 4, that additional percentage shall be taken to be the percentage calculated to 3 decimal places in accordance with that subsection and increased by 0.001.

(8A) If:

(a) a person’s surcharge debt account is in debit at the most recent benefit start‑up time; and

(b) apart from this subsection, the person would be entitled to a retiring allowance under subsection (1A) or (1B) or paragraph (2)(a) or (aa) or (2AA)(a), (b), (c) or (d);

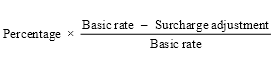

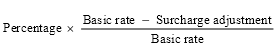

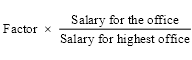

then, instead of the retiring allowance referred to in paragraph (b), and for so long as the person does not make an election under subsection 18A(1) after the most recent benefit start‑up time, the person is entitled to a retiring allowance during his or her life‑time at a rate equal to such percentage of the rate of parliamentary allowance for the time being payable to a member as is worked out by using the formula:

where:

basic rate means the rate at which, at the most recent benefit start‑up time, the retiring allowance referred to in paragraph (b) would have been payable to the person if this subsection did not apply to the person.

percentage means:

(a) if, apart from this subsection, the person would have been, at the most recent benefit start‑up time, entitled to a retiring allowance under subsection (1A) or (1B) or paragraph (2)(a) or (aa) or (2AA)(a)—the percentage of the rate of parliamentary allowance by reference to which the rate of that retiring allowance would have been, at the most recent benefit start‑up time, ascertained (see subsection (6) and, if applicable, subsections (7) and (8)); or

(b) if, apart from this subsection, the person would have been, at the most recent benefit start‑up time, entitled to a retiring allowance under paragraph (2AA)(b), (c) or (d)—the percentage of the rate of parliamentary allowance specified in that paragraph.

surcharge adjustment means the total of the person’s notional adjustment debits arising under any or all of the following provisions at or before the most recent benefit start‑up time:

(a) subsection (8AA);

(b) subsection (8AB);

(c) subsection 18A(6).

(8AAA) Any reduction under section 22CH is to be disregarded in applying the definition of basic rate in subsection (8A) of this section.

(8AA) If:

(a) a person’s surcharge debt account is in debit at the most recent benefit start‑up time; and

(b) apart from subsection (8A), the person would be entitled to a retiring allowance under subsection (1A) or (1B) or paragraph (2)(a) or (aa) or (2AA)(a), (b), (c) or (d);

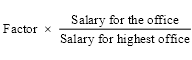

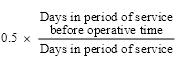

there is taken to have arisen at the most recent benefit start‑up time a notional adjustment debit of the person equal to the amount worked out using the following formula:

where:

conversion factor means the factor applicable to the person under the determination made by the Trust under section 22A.

surcharge deduction amount means the person’s surcharge deduction amount.

(8AB) If:

(a) at the time this subsection commences (the commencement time), a person is entitled to a retiring allowance under subsection (8A); and

(b) that retiring allowance was calculated by reference to a particular surcharge adjustment within the meaning of that subsection as in force before the commencement time;

there is taken to have arisen at the commencement time a notional adjustment debit of the person equal to that surcharge adjustment.

(8AC) If:

(a) a person makes an election under subsection 18A(1) on a particular day (the election day) after the most recent benefit start‑up time; and

(b) if the election had not been made, the person would have been entitled on the election day to a retiring allowance under subsection (1A), (1B) or (8A) or this subsection or paragraph (2)(a) or (aa) or (2AA)(a), (b), (c) or (d);

then, on and after the election day, instead of the retiring allowance referred to in paragraph (b), the person is entitled to a retiring allowance during his or her lifetime at a rate equal to such percentage of the rate of parliamentary allowance for the time being payable to a member as is worked out using the formula:

where:

basic rate means the rate at which, at the most recent benefit start‑up time, a retiring allowance under subsection (1A) or (1B) or paragraph (2)(a) or (aa) or (2AA)(a), (b), (c) or (d) would have become payable to the person if this subsection and subsection (8A) did not apply to the person.

percentage means:

(a) if, apart from this subsection and subsection (8A), the person would have been entitled at the most recent benefit start‑up time to a retiring allowance under subsection (1A) or (1B) or paragraph (2)(a) or (aa) or (2AA)(a)—the percentage of the rate of parliamentary allowance by reference to which the rate of that retiring allowance would be ascertained (see subsection (6) and, if applicable, subsections (7) and (8)); or

(b) if, apart from this subsection and subsection (8A), the person would have been entitled at the most recent benefit start‑up time to a retiring allowance under paragraph (2AA)(b), (c) or (d)—the percentage of the rate of parliamentary allowance specified in that paragraph.

surcharge adjustment means the total of:

(a) the person’s notional adjustment debits arising under any or all of the following provisions before the end of the election day:

(i) subsection 18A(6);

(ii) subsection (8AA);

(iii) subsection (8AB); and

(b) the person’s notional adjustment debits arising under subsection 18B(15) after the most recent benefit start‑up time and before the end of the election day.

(8ACA) Any reduction under section 22CH is to be disregarded in applying the definition of basic rate in subsection (8AC) of this section.

(8B) If:

(a) a person’s surcharge debt account is in debit when a benefit becomes payable to the person; and

(b) apart from this subsection, the person would be entitled to a benefit under paragraph (2)(b) or (2AA)(e) or subsection (4);

then, instead of the benefit referred to in paragraph (b), the amount of the benefit to which the person is entitled is an amount equal to the difference between:

(c) the amount that would be payable to the person under this section if this subsection did not apply to the person; and

(d) the person’s surcharge deduction amount.

(9) Where the period of service of a person who became entitled to a retiring allowance after 30 June 1980 includes a period or periods during which the person served as a Minister of State or as an office holder, the person is entitled, in respect of:

(a) his or her service in each office that he or she held as a Minister of State (other than his or her service in an office, during a period that he or she held more than one office as a Minister of State, that did not affect the salary to which he or she was entitled as Minister of State during that period); or

(b) his or her service in each office by virtue of which he or she was an office holder;

as the case may be, to additional retiring allowance in respect of his or her service in that office at a rate equal to such percentage of the rate, for the time being, at which salary is payable to a Minister of State or allowance by way of salary is payable to an office holder, as the case may be, in respect of that office as is determined in accordance with subsection (10) to be the relevant percentage in respect of his or her service in that office.

Note: The reference in this subsection to the rate of salary, or allowance by way of salary, for the time being payable in respect of an office is affected by sections 22T and 23.

(10) For the purposes of subsection (9), the relevant percentage in respect of the service of a person in a particular office is:

(a) if the period of service of the person in that office is less than a complete year—the percentage, calculated to 3 decimal places, that is obtained by multiplying 6.25% by the number of days in that period of service and dividing the product by 365;

(b) if the period of service of the person in that office is a complete year—6.25%;

(c) if the period of service of the person in that office is a number of complete years—the percentage obtained by multiplying 6.25% by the number of complete years in that period of service; or

(d) if the period of service of the person in that office is a complete year or a number of complete years and also, apart from that complete year or those complete years, a number of days—the percentage obtained by adding together:

(i) the percentage ascertained in accordance with paragraph (b) or (c) in respect of the complete year or the complete years, as the case requires; and

(ii) the percentage, calculated to three decimal places, that is obtained by multiplying 6.25% by the number of the days and dividing the product by 365.

(10A) Where the relevant percentage ascertained in accordance with subsection (10) in relation to the service of a person in a particular office would, if it were calculated to 4 decimal places, end with a number greater than 4, that percentage shall be taken to be the percentage calculated to 3 decimal places in accordance with that subsection and increased by 0.001.

(10B) Nothing in subsection (9) shall be taken to entitle a person to additional retiring allowance at a rate that exceeds:

(a) in a case where the person is entitled to additional retiring allowance in respect of one office only—75% of the rate, for the time being, at which salary or allowance by way of salary, as the case may be, is payable in respect of that office; or

(b) in a case where the person is entitled to additional retiring allowance in respect of 2 or more offices—75% of the rate that is the highest rate, for the time being, at which salary or allowance by way of salary, as the case may be, is payable in respect of either or any of those offices.

Note: The reference in this subsection to the rate of salary, or allowance by way of salary, for the time being payable in respect of an office is affected by sections 22T and 23.

(11) A reference in this section to a member includes a reference to any person who is entitled to parliamentary allowance.

(12) For the purpose of references in this section to the rate of parliamentary allowance for the time being payable to a member, any reductions under Part 1 of Schedule 3 to the Remuneration and Allowances Act 1990 (about salary sacrifice) of a particular member’s entitlement to parliamentary allowance are to be disregarded.

18A Commutation of retiring allowance—payment of surcharge liability

Election

(1) If:

(a) a person is entitled to a retiring allowance under subsection 18(1A), (1B), (8A) or (8AC) or paragraph 18(2)(a) or (aa) or 18(2AA)(a), (b), (c) or (d); and

(b) an assessment is made of the surcharge on the person’s surchargeable contributions for a financial year; and

(c) the person becomes liable to pay the surcharge under the assessment in accordance with paragraph 10(4)(c) of the Superannuation Contributions Tax (Assessment and Collection) Act 1997;

the person may, within:

(d) 3 months after the assessment was made; or

(e) such longer period as the Trust allows;

give the Secretary of the Finance Department a written notice electing to commute the whole or a part of the person’s retiring allowance to a lump sum benefit equal to the amount specified in the election.

(2) The election must be accompanied by:

(a) a written notice requesting that the amount of the lump sum benefit be:

(i) paid to the Commissioner of Taxation; and

(ii) wholly applied in payment of surcharge under the assessment; and

(b) a copy of the notice of assessment.

Surcharge commutation amount

(3) The amount specified in the election:

(a) must be equal to or less than the amount of surcharge under the assessment; and

(b) must not have the effect of reducing the person’s retiring allowance below zero; and

(c) is to be known as the surcharge commutation amount for the purposes of this section.

Entitlement to lump sum benefit

(4) If a person makes an election under subsection (1), the person is entitled to a lump sum benefit equal to the surcharge commutation amount.

Note: The person’s retiring allowance will be reduced under subsection 18(8AC).

(5) If a person is entitled to a lump sum benefit under subsection (4), the liability to pay that benefit must be discharged by:

(a) paying the amount of that benefit to the Commissioner of Taxation in accordance with the person’s request; and

(b) informing the Commissioner of Taxation of the person’s request that the amount be wholly applied in payment of surcharge under the assessment concerned.

Notional adjustment debit

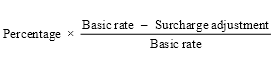

(6) If a person makes an election under subsection (1) on a particular day, there is taken to have arisen at the start of that day a notional adjustment debit of the person equal to the amount worked out using the following formula:

where:

conversion factor means the factor applicable to the person under the determination made by the Trust under section 22B.

One election per assessment

(7) A person is not entitled to make more than one election under subsection (1) in relation to a particular assessment.

18B Commutation of retiring allowance—general

(1) This section applies to a person who becomes entitled to a retiring allowance on or after 12 June 1978 other than a person who:

(a) becomes entitled to that allowance in pursuance of paragraph 18(2)(a) or (aa); and

(b) becomes entitled to that allowance under paragraph 18(2AA)(a), (b), (c) or (d).

Note: For the purposes of this section, a person who is a deferring member for the purposes of Part VA is treated as not becoming entitled to a retiring allowance before the person attains the age of 55 years. See section 22DC.

(3) Notwithstanding anything in this Act, a person may, not earlier than 3 months before, and not later than 3 months after, becoming a person to whom this section applies, by notice in writing signed by the person and delivered personally or sent by post to the Secretary of the Finance Department, elect to convert such percentage (not exceeding 50%) of his or her retiring allowance as is specified in the notice (in this section referred to as the specified percentage) to a lump sum payment determined in accordance with this section.

(3A) A person who has made an election under subsection (3) to convert a percentage of his or her retiring allowance to a lump sum payment may, not later than 3 months after, but not earlier than 3 months before, becoming a person to whom this section applies, by notice in writing given to the Secretary of the Finance Department, elect that the person’s surcharge deduction amount be deducted from the lump sum payment

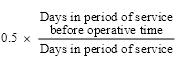

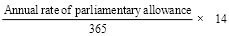

(4) If the person has not made an election under subsection (3A), the amount of the lump sum payment is:

(a) in any of the cases mentioned in subsection (5)—the specified percentage of the annual amount of the retiring allowance payable to him or her multiplied by 10; or

(b) in any other case—the specified percentage of the annual amount of the retiring allowance payable to him or her multiplied by the number ascertained in accordance with the formula  ,

,

where x is the number of whole months in the period that commenced on the day on which he or she attained the age of 65 years and ended on the day immediately before he or she became entitled to the retiring allowance.

(4A) If the person has made an election under subsection (3A), the amount of the lump sum payment is the difference between:

(a) the amount of the lump sum payment that would have been payable to the person under subsection (4) if he or she had not made the election; and

(b) the person’s surcharge deduction amount.

(5) The cases referred to in paragraph (4)(a) are:

(a) the case where the person had not attained the age of 66 years at the time when he or she became entitled to the retiring allowance;

(b) the case where the person attained the age of 66 years after the dissolution or expiration of the House of which he or she was last a member, or after the expiration of his or her last term of office as a member, and before he or she became entitled to the retiring allowance; and

(c) the case where:

(i) the person attained the age of 66 years at a time when he or she was a member;

(ii) the person ceased to be a member upon the dissolution or expiration of the House of which he or she was a member at the time when he or she attained that age or upon the expiration of the term of office during which he or she attained that age; and

(iii) the person did not, after so ceasing to be a member, again become a member before he or she became entitled to the retiring allowance.

(6) Where a person elects to convert a percentage of his or her retiring allowance to a lump sum payment in accordance with subsection (3):