An Act relating to the provision of assistance to members of the Defence Force and certain other persons to acquire homes, or for other purposes

Part I—Preliminary

1 Short title [see Note 1]

This Act may be cited as the Defence Service Homes Act 1918.

2 Commencement [see Note 1]

This Act shall commence on a date to be fixed by Proclamation.

4 Interpretation

(1) In this Act, unless the contrary intention appears:

additional advance means a subsidised advance to a purchaser or borrower for a purpose referred to in subsection 18(3).

advance for essential repairs means a subsidised advance to a person referred to in section 21 for the purpose referred to in that section.

amending Act means the Defence Service Homes Amendment Act 1988.

approved means approved by the Minister in writing for the purposes of this Act.

Approved welfare organization means an organization approved by an appropriate authority of the Defence Force to provide welfare services (including assistance in the care of the sick or wounded) for members of the Defence Force.

assigned advance means a subsidised advance to an assignee, in accordance with a certificate of assignment issued under section 23A.

assignee means an assignee referred to in section 23A.

assignor means an assignor referred to in section 23A.

Australian Soldier means a person who, during the First World War or the Second World War or during the warlike operations in or in connection with Korea after 26 June 1950 or the warlike operations in or in connection with Malaya after 28 June 1950:

(a) is or was a member of the Naval, Military or Air Forces of Australia enlisted or appointed for or employed on active service outside Australia or on a ship of war; or

(b) is or was a member of any nursing service maintained by the Commonwealth in connexion with the Defence Force of the Commonwealth or any part thereof accepted or appointed for service outside Australia; or

(c) served in the Naval, Military or Air Forces of any part of the King’s Dominions, other than the Commonwealth, and who proves to the satisfaction of the Secretary that he had, before his enlistment or appointment for service, resided in Australia or a Territory; or

(d) was a member of any nursing service maintained by the Government of any part of the King’s Dominions other than the Commonwealth, in connexion with the Naval, Military or Air Forces of that part, and who proves to the satisfaction of the Secretary that she had, before her appointment to that service, resided in Australia or a Territory;

and who, in the case of a person included in paragraph (a) or (b) in relation to service in connection with the Second World War:

(e) was so enlisted, accepted, appointed or employed before 3rd September, 1945; or

(f) was so enlisted, accepted, appointed or employed on or after that date and before 1 July 1951, and who has been discharged or who has ceased to be engaged on war service as defined in section 4 of the Defence Act 1903‑1945;

and includes:

(g) a person who, as a member of the Defence Force, rendered continuous full‑time service outside Australia:

(i) as a member of a unit of the Defence Force that was allotted for duty, within the meaning of the Veterans’ Entitlements Act 1986 as provided in subsection 5B(2) of that Act; or

(ii) as a person who was allotted for duty, within the meaning of the Veterans’ Entitlements Act 1986 as provided in subsection 5B(2) of that Act;

in an operational area described in item 3A, 3B, 4, 5, 6, 7 or 8 in Schedule 2 to the Veterans’ Entitlements Act 1986 during the period specified in that item:

(ga) a person who, as a member of the Defence Force or as a member of a unit of the Defence Force, was allotted for duty within the meaning of subsection 5B(2) of the Veterans’ Entitlements Act 1986 in the operational area described in item 9 of Schedule 2 to that Act during the period specified in that item;

(gb) a person who, as a member of the Defence Force or as a member of a unit of the Defence Force, was allotted for duty within the meaning of subsection 5B(2) of the Veterans’ Entitlements Act 1986 in an operational area described in item 10, 11, 12, 13 or 14 of Schedule 2 to that Act during the period specified in that item and whose first service in the Defence Force began on or before 14 May 1985;

(gc) a member of the Defence Force who is taken, because of section 6D of the Veterans’ Entitlements Act 1986, to have rendered operational service (within the meaning of that Act);

(gd) a member of the Defence Force:

(i) whose first service in the Defence Force began on or before 14 May 1985; and

(ii) who is taken, because of section 6DB or 6E of the Veterans’ Entitlements Act 1986, to have rendered operational service (within the meaning of that Act);

(ge) a member of the Defence Force:

(i) whose first service in the Defence Force began on or before 14 May 1985; and

(ii) who has rendered warlike service;

(h) a national serviceman;

(i) a regular serviceman; and

(j) a person who:

(i) was appointed for service outside Australia as a representative of an approved welfare organization with a body, contingent or detachment of the Defence Force;

(ii) as such, served outside Australia on or after the third day of September, 1939, with that body, contingent or detachment; and

(iii) would, if during that service he had been a member of the Defence Force allotted for duty with that body, contingent or detachment, be, by reason of that service, an Australian soldier as defined by a provision of this definition other than paragraph (h) or (i) or this paragraph.

balance has the same meaning as in the agreement.

borrower means a person who is liable to pay the outstanding amount:

(a) of a subsidised advance in respect of which subsidy is payable; or

(b) secured by a specified portfolio asset (other than a contract of sale) which vests in the Bank under section 6B and in respect of which subsidy is payable and includes an assignee in relation to a subsidised advance.

certificate of assignment means a certificate of assignment issued under section 23A.

certificate of entitlement means a certificate of entitlement issued under this Act.

commencing day means the day on which section 10 of the amending Act commences.

company title, in relation to land, means a right of occupancy of the land, or of a dwelling‑house or part of a dwelling‑house erected on the land, arising from the holding of shares in a corporation that has an interest in the land or dwelling‑house.

Consumer Credit Codes commencing day means the earliest day on which any of the Consumer Credit Codes of the States or Territories comes into force.

contract of sale means a contract for the sale of a dwelling‑house and land under Part IV of this Act as in force before the commencing day.

Corporation means the Defence Service Homes Corporation.

Corporation advance has the same meaning as in the Bank agreement.

court means a court of summary jurisdiction.

credit provider means:

(a) the Bank; or

(b) any other credit provider (within the meaning of the Privacy Act 1988) that is the party to an agreement (within the meaning of this Act).

de facto partner of a person has the meaning given by the Acts Interpretation Act 1901.

Defence Department has the meaning given by the Military Rehabilitation and Compensation Act 2004.

dependent parent means a parent of a person mentioned in paragraphs (a) to (g) of the definition of Eligible person if:

(a) the person so mentioned:

(i) is dead; and

(ii) at the time of death, was not legally married and did not have a de facto partner; and

(b) one of the following subparagraphs applies:

(i) the parent is a widow or widower and was dependent on the person before the person became an eligible person;

(ii) the parent’s spouse or de facto partner is so incapacitated as to be unable to contribute materially to that parent’s support.

Dwelling‑house includes:

(a) a house or building used or to be used by a person, who is included in paragraph (b) or (d) of the definition of Australian Soldier, as a hospital, sanatorium or nursing home; and

(b) the appurtenances, outbuildings, fences, and permanent provision for lighting, water supply, drainage and sewerage provided in connexion with a dwelling‑house;

but does not include any land.

Eligible person means a person who:

(a) is an Australian soldier;

(b) is a munition worker;

(c) is a war worker;

(d) is a member of the Young Men’s Christian Association who, during the First World War, was accepted for service with and served abroad with the Naval or Military Forces of Australia as a representative of that Association;

(e) has been awarded, in respect of his employment during the First World War, the Australian Mercantile Marine War Zone Badge, or the British Mercantile Marine Medal; and was during such employment domiciled in Australia or a Territory;

(f) after the commencement of the Second World War, and before the commencement of the War Service Homes Act 1946, was employed under agreement as master, officer or seaman, or under indenture as apprentice, in sea‑going service:

(i) on a ship engaged in trading between a port of a State or Territory and any other port, whether a port of a State or Territory or not; or

(ii) on a ship being a troop transport or hospital ship;

and was, during that employment, domiciled in Australia or a Territory; or

(g) not being a person to whom the last preceding paragraph applies, was, after the commencement of the Second World War, and before the commencement of the War Service Homes Act 1946, employed, otherwise than as a member of the Defence Force, in sea‑going service on a ship being a ship of war, troop transport or hospital ship, and was, during that employment, domiciled in Australia or a Territory;

and includes a widow, widower or dependent parent of a person specified in any of the paragraphs (a) to (g) of this definition.

eligible veteran means:

(a) a person covered by paragraph (a) of the definition of veteran in subsection 5C(1) of the Veterans’ Entitlements Act 1986; or

(b) a member of the Forces (within the meaning of subsection 68(1) of that Act); or

(c) a member of a Peacekeeping Force (within the meaning of subsection 68(1) of that Act); or

(d) a widow or widower (within the meaning of subsection 5E(1) of that Act) of a person covered by paragraph (a), (b) or (c) of this definition.

Finance Minister means the Minister administering the Financial Management and Accountability Act 1997.

further advance means a subsidised advance (other than a widow or widower advance, an advance for essential repairs or a home support advance) to a person who:

(a) has been a purchaser or borrower as defined in this section (as in force before, on or after the commencing day), otherwise than:

(i) merely because the person is or was the personal representative of a deceased purchaser or borrower as so defined; or

(ii) merely because the person is or was a joint purchaser or borrower as so defined with the person’s spouse or de facto partner and became such a purchaser or borrower on the basis that the person’s spouse or de facto partner was an eligible person; and

(b) is not such a purchaser or borrower immediately before the advance is made.

Government authority means a public authority (including a local governing body) established by or under a law of the Commonwealth, of a State or of a Territory.

granny flat means any form of residence:

(a) that is the principal home of an eligible person; and

(b) that is not owned, wholly or partly, by the eligible person; and

(c) that is, or is a part of, a private residence; and

(d) in respect of which the eligible person has a right of accommodation for an indefinite period.

guarantee includes indemnity (other than one arising under a contract of insurance).

guarantor means a person who has given or gives a guarantee to a credit provider in relation to a subsidised advance.

Holding, in relation to an applicant or borrower, means:

(a) land of which he or she is the beneficial owner in fee simple; or

(b) land of which he or she is the lessee under a Crown lease in perpetuity from a State; or

(c) land of which he or she is the lessee under a lease granted for a term of not less than 99 years from a State or from a local governing body; or

(d) land in a Territory of which he or she is the lessee under a lease from Australia or from the Administration of the Territory, being:

(i) a lease in perpetuity;

(ii) a lease granted for a term of not less than 99 years; or

(iii) in the case of Norfolk Island—a lease granted for a term of not less than 28 years; or

(e) a suburban holding held by him or her under the Crown Lands Consolidation Act, 1913 of New South Wales or under that Act as amended at any time or under an Act enacted in substitution for that Act, being a suburban holding an application for which has been confirmed in accordance with the law of that State; or

(f) a unit defined in a units plan registered in accordance with a law of the Australian Capital Territory relating to unit titles, being a unit of which he or she is the lessee under a lease from Australia; or

(g) land which he or she holds by way of a company title; or

(h) land of which he or she is the lessee under a lease that a credit provider considers is adequate security for a subsidised advance to be made to him or her.

Note: An interest in a holding may be a joint interest in accordance with section 4AB.

Home Loans Assistance Act means the Defence Force (Home Loans Assistance) Act 1990.

home support advance means a subsidised advance to a person referred to in section 21A for a purpose referred to in that section.

initial advance means a subsidised advance for a purpose referred to in subsection 18(2) to a person referred to in subsection 18(1) who is not, and has not previously been, a purchaser or borrower as defined in this section (as in force before, on or after the commencing day), otherwise than:

(a) merely because the person is or was the personal representative of a deceased purchaser or borrower as so defined; or

(b) merely because the person is or was a joint purchaser or borrower as so defined with the person’s spouse or de facto partner and became such a purchaser or borrower on the basis that the person’s spouse or de facto partner was an eligible person.

instalment relief has the same meaning as in the agreement.

lease, in relation to land held by way of company title, includes an agreement similar to a lease.

limit has the same meaning as in the agreement.

mortgage includes a security over an interest in shares that are shares giving rise to a company title.

mortgage includes:

(a) any interest in, or power over, property securing obligations of a borrower or guarantor; and

(b) a credit provider’s title to land or goods that are subject to a sale by instalments.

mortgagor means a person who has given or gives a mortgage to a credit provider in relation to a subsidised advance.

Munition worker means a person who, during the First World War:

(a) entered into an agreement with the Commonwealth or the Minister of State for Defence to proceed to Great Britain for the purpose of:

(i) engaging in the work of producing munitions for the Imperial Government or otherwise; or

(ii) serving under the Imperial Government in the Ministry of Munitions; and

(b) engaged in the work of producing munitions for the Imperial Government or otherwise or served under the Imperial Government in the Ministry of Munitions, and whose agreement with the Commonwealth or the Minister of State for Defence was not determined by reason of his failure to observe and perform any term or condition contained in the agreement, or by reason of his dismissal from any work in Great Britain during the continuance of the agreement because of any conduct of the worker which, in the opinion of the Minister, was such as to justify the determination of the agreement.

National serviceman means a person who is a national serviceman in accordance with section 4AAB.

notice of eligibility means a notice of eligibility issued under this Act.

other portfolio agreement has the same meaning as in the Bank agreement.

Owner in relation to land includes every person who has purchased land on credit or deferred payment, and has obtained possession of the land, and, in relation to a dwelling‑house, includes any person who has purchased or contracted to purchase a dwelling‑house together with the land on which it is erected.

parent: without limiting who is a parent of anyone for the purposes of this Act, a person is the parent of another person if the other person is a child of the person within the meaning of the Family Law Act 1975.

portfolio asset has the same meaning as in the Bank agreement.

portfolio contract of sale has the same meaning as in the Bank agreement.

portfolio mortgage has the same meaning as in the Bank agreement.

portfolio supplementary agreement has the same meaning as in the Bank agreement.

purchaser means a person who is liable to pay the outstanding balance of the purchase money in respect of the purchase of land and a dwelling‑house under a contract of sale in respect of which subsidy is payable.

Regular serviceman means a person who is a regular serviceman in accordance with section 4AAA.

retirement village means:

(a) a retirement village registered under an approved law of a State or Territory; or

(b) in the case of a State or Territory that has no approved law—a retirement village within the meaning of the Veterans’ Entitlements Act 1986; or

(c) a granny flat.

reviewable decision means a decision of the Secretary:

(aa) under subsection 4BB(2) (revocation of surrender election);

(a) refusing to issue a notice of eligibility, a certificate of entitlement or a certificate of assignment;

(b) determining an amount under section 25;

(c) cancelling subsidy under section 26;

(d) giving the Bank a notice of the intended cancellation of subsidy under section 27;

(da) cancelling a subsidy under section 27A;

(e) requiring a person to pay an amount under section 29;

(f) determining a maximum term under section 36;

(g) refusing to extend the period for making an application for review under section 43; or

(h) giving, or refusing to give, an approval under section 45A.

Secretary means the Secretary of the Department.

specified portfolio asset has the same meaning as in the Bank agreement.

subsidised advance means:

(a) an advance made by a credit provider in accordance with a certificate of entitlement; or

(b) an initial advance that the Bank is taken to have made under section 37.

subsidised advance contract means an agreement for the provision of a subsidised advance whether or not the Commonwealth has terminated the subsidy in respect of the advance.

subsidised advance loan account means:

(a) an account established by the Bank for the purpose of administering a specified portfolio asset; or

(b) an account established by any credit provider for the purpose of administering a subsidised advance.

subsidy means a subsidy payable under Part IV by the Commonwealth to a credit provider, being an amount calculated and payable in the manner provided in the agreement.

supplementary agreement means an agreement between the Commonwealth and the Bank, whether or not set out in a Schedule to this Act, that:

(a) amends the Bank agreement; and

(b) is expressed to be a supplementary agreement to the Bank agreement;

as varied and in force from time to time.

Territory means a Territory in which this Act applies or to which this Act extends.

the agreement means whichever of the following agreements or arrangements is applicable in the circumstances:

(a) the Bank agreement;

(b) an agreement or arrangement in force between the Commonwealth and a credit provider other than the Bank for the provision by the credit provider of subsidised advances or other benefits under this Act.

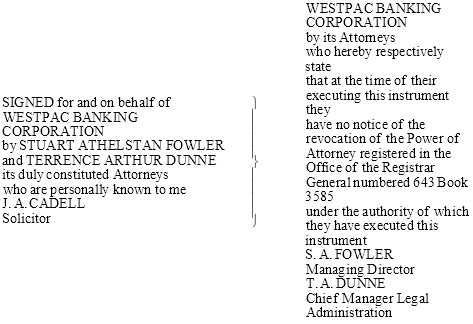

the Bank means Westpac Banking Corporation and, as the context requires and subject to the Bank agreement, any body to which it assigns all or any of its rights or obligations under the Bank agreement, the portfolio assets or subsidised advances or any security for those advances, as provided by the Bank agreement.

the Bank agreement means the agreement made between the Commonwealth and the Bank on 9 November 1988, a copy of which is set out in Schedule 1, as varied or affected by a supplementary agreement or otherwise, and as in force from time to time.

transferee means a person to whom a certificate of entitlement has been issued under section 22.

vesting date, in relation to the portfolio assets in a State or Territory, means the date determined by the Minister under section 6B in relation to those assets.

warlike service has the same meaning as in the Veterans’ Entitlements Act 1986.

War worker means a person, who, during the First World War, entered into an agreement with the Commonwealth to proceed to Great Britain for the purpose of engaging in work as a labourer, fettler or navvy for the Imperial Government or otherwise and engaged in such work, and whose agreement with the Commonwealth or the Minister of State for Defence was not determined by reason of his failure to observe and perform any term or condition contained in the agreement, or by reason of his dismissal from any work in Great Britain during the continuance of the agreement because of any conduct of the worker which, in the opinion of the Minister, was such as to justify the determination of the agreement.

widow of a person who has died includes a woman who was a de facto partner of the person immediately before the person died.

widower of a person who has died includes a man who was a de facto partner of the person immediately before the person died.

widow or widower advance means a subsidised advance to a person referred to in section 20 for a purpose referred to in that section.

winding‑up day means the day on which section 15 of the amending Act commences.

(2) For the purposes of the definition of Australian Soldier in subsection (1), a person shall not be taken to be an Australian soldier in relation to the warlike operations in or in connection with Korea after 26 June 1950, or the warlike operations in or in connection with Malaya after 28 June 1950, unless:

(a) that person was allotted for duty in an operational area within the meaning of subsection 5B(2) of the Veterans’ Entitlements Act 1986 in connection with those operations before 1 September 1957 and, if he was so allotted while in Australia, or in the part of the Queen’s dominions other than the Commonwealth, as the case may be, he left the last port of call in Australia or in that other part of the Queen’s dominions before that date for the purpose of serving in connection with those operations; or

(b) that person, not being a person to whom paragraph (a) applies, served, on or after 1 September 1957 and before 28 May 1963, in an area prescribed to be, or to have been, an operational area for the purposes of this paragraph.

(2A) Subject to subsection (2AA), for the purposes of paragraph (a) of the definition of Australian Soldier in subsection (1), a person who is or was:

(a) a member of the Citizen Military Forces;

(b) a member of the Women’s Royal Australian Naval Service, the Australian Women’s Army Service or the Women’s Auxiliary Australian Air Force;

(c) a member of the Australian Army Medical Women’s Service but not a member of the Australian Imperial Force; or

(d) a member of the Voluntary Aid Detachment;

shall not, by reason only of being or having been such a member, be taken to have been enlisted or appointed for active service outside Australia or on a ship of war.

(2AA) Subsection (2A) does not apply in relation to a person who, during the Second World War, was:

(a) a member of the Women’s Royal Australian Naval Service, the Australian Women’s Army Service or the Women’s Auxiliary Australian Air Force; or

(b) a member of the Australian Army Medical Women’s Service, other than a member of the Australian Imperial Force; or

(c) a full‑time paid member of the Voluntary Aid Detachment.

(2AB) For the purposes of the definitions of further advance and initial advance in subsection 4(1), a person of a kind referred to in subsection (2AA) is not taken to have been a purchaser or borrower, merely because the person previously became a purchaser or borrower on the basis that:

(a) the person’s spouse or de facto partner is or was an eligible person, and as a result they were, under subsection 4A(1), treated together as an eligible person for the purposes of this Act; or

(b) the person’s spouse or de facto partner was an eligible person, and the person became an eligible person because her spouse or de facto partner died; or

(c) the person is an eligible person because she is a dependent parent.

(2AC) For the purposes of the definitions of further advance and initial advance in subsection 4(1), a man who:

(a) was an eligible person in his own right; and

(b) is the widower of a person of a kind referred to in subsection (2AA);

is not taken to have been a purchaser or borrower, merely because he previously became a purchaser or borrower on the basis that:

(c) he was an eligible person in his own right; or

(d) his spouse or de facto partner was an eligible person and they were, under subsection 4A(1), together treated as an eligible person for the purposes of this Act; or

(e) his spouse or de facto partner was an eligible person and he became an eligible person because his spouse or de facto partner died; or

(f) he was an eligible person because he was a dependent parent.

(2B) For the purposes of paragraph (c) of the definition of Australian Soldier in subsection (1), a person shall not be taken to have served in the Naval, Military or Air Forces of any part of the King’s Dominions, other than the Commonwealth, unless he served in such Forces:

(a) in an operational area outside the country or place of his enlistment or appointment for service; or

(b) as a combatant in an active combat unit.

(2C) Subject to subsection (2D), an Australian soldier who, by reason of his misconduct or misbehaviour:

(a) was discharged from, or otherwise ceased to be a member of, the Naval, Military or Air Forces of Australia; and

(b) is included in a class of members specified in the Schedule to the War Gratuity Act 1945;

shall not be treated as an eligible person for the purposes of this Act, but this subsection shall not prevent a widow, widower or dependent parent of such an Australian soldier being an eligible person.

(2D) Where the relevant misconduct or misbehaviour of an Australian soldier referred to in subsection (2C) consisted only of his absence without leave, the Secretary may treat him as an eligible person for the purposes of this Act if the Secretary, having regard to the quality of his service outside Australia, considers it appropriate to do so.

(3) Where, in the case of a person, being a female, who is:

(a) a person described in paragraph (g) of the definition of Australian soldier in subsection 4(1); or

(b) a regular serviceman;

the whole or any part of the service by reason of which she is such a member or such a regular serviceman, as the case may be, was service as a member of a nursing service, she shall, for the purposes of paragraph 18(1)(f), be deemed to be a person included in paragraph (b) of the definition of Australian Soldier in subsection (1) of section 4.

(4) Where:

(a) an applicant is the lessee of land under a lease for a term of years from the Commonwealth, the Administration of a Territory or a State, being a lease under which he is entitled, on the fulfilment of the terms, conditions and covenants of the lease, to a grant in fee simple of the land; and

(b) the applicant satisfies the Secretary that the applicant has a reasonable prospect of carrying out the terms, conditions and covenants of the lease;

the land shall be deemed to be a holding for the purposes of this Act in relation to the applicant.

(5) Where:

(a) an applicant is purchasing land from a State on terms that entitle him, on compliance with specified conditions, to a grant in fee simple of the land; and

(b) the applicant satisfies the Secretary that the applicant has a reasonable prospect of complying with those conditions;

the land shall be deemed to be a holding for the purposes of this Act in relation to the applicant.

(6) For the purposes of this Act a person is taken, subject to subsection (7), to have a right of residence in a retirement village if the person has a right of permanent residence in the retirement village, subject to any contractual conditions governing the person’s residence.

(7) For the purposes of this Act a person is not taken to have a right of residence in a retirement village if the person’s right of residence is derived from the person’s interest in a holding of the person.

(8) In this Act, a reference to a person’s retirement village accommodation means that part of a retirement village in which the person has, or the person and the person’s spouse or de facto partner have, obtained a right of residence.

(9) A reference in this Act to an advance that a person may seek from a credit provider, includes a reference to such an advance that a person may seek from a credit provider on behalf of an assignee, or a proposed assignee, of the person.

(10) A reference in this Act to an assignee of a person is a reference to another person in relation to whom the first‑mentioned person is an assignor.

(11) For the purposes of the definitions of further advance and initial advance in subsection 4(1), if the subsidised advance in question is an assigned advance in respect of an assignor:

(a) a reference in those definitions to the person to whom the advance in question is made is a reference to the assignee; and

(b) the assignee is not taken to have previously been a purchaser or borrower merely because the assignee previously became a purchaser or borrower, either as an eligible person in his or her own right or as an assignee in relation to another assignor.

(12) For the purposes of paragraph (b) of the definition of further advance in subsection 4(1), a person is not taken to have been a purchaser or borrower immediately before an assigned advance is made, merely because the person is a purchaser or borrower, as an assignee, in relation to an assignor other than the one in question.

(13) For the purposes of the definitions of further advance and initial advance in subsection 4(1), a person who has been an assignor is taken to have been a borrower unless the person:

(a) was an assignor merely because the person is or was the personal representative of a deceased assignor; or

(b) was an assignor merely because the person is or was an assignor together with the person’s spouse or de facto partner, and became such an assignor on the basis that the person’s spouse or de facto partner was an eligible person.

4AAA Regular Serviceman

(1) Subject to this section, a person is a regular serviceman for the purposes of this Act if:

(a) he has served on continuous full‑time service as a member of the Defence Force, not being service that ended before 7 December 1972, and, during that service, has:

(i) in the case of service that commenced before 17 August 1977—completed, whether before or after 7 December 1972, 3 years’ effective full‑time service as such a member; or

(ii) in the case of service that commenced on or after 17 August 1977—completed a period of 6 years’ effective full‑time service as such a member, being a period at the expiration of which he continued to render full‑time service as such a member otherwise than by reason only of a delay in discharging him or otherwise terminating that service, including a delay for the purpose of the treatment or observation of an illness or injury;

(b) he was engaged to serve as a member of the Defence Force for a period of continuous full‑time service of:

(i) in the case of a person so engaged before 17 August 1977—not less than 3 years; or

(ii) in the case of a person so engaged on or after 17 August 1977—not less than 6 years;

but that service ended, on or after 7 December 1972, by reason of his death or his discharge on the ground of invalidity or physical or mental incapacity to perform duties; or

(c) he was an officer appointed for continuous full‑time service in the Defence Force (other than an officer appointed before 17 August 1977 whose appointment was for a period of continuous full‑time service of less than 3 years or an officer appointed on or after 17 August 1977 whose appointment was for a period of continuous full‑time service of less than 6 years), but that service ended, on or after 7 December 1972, by reason of his death or the termination of his appointment on the ground of invalidity or physical or mental incapacity to perform duties;

but, subject to subsection (5A), not if the person’s first service in the Defence Force began after 14 May 1985.

(2) For the purposes of paragraph (a) of subsection (1):

(a) the service of a person as an officer of the Naval Forces undergoing the course of training at the Royal Australian Naval College, and his service after completion of that course, shall be disregarded unless the officer is subsequently promoted to the rank of sub‑lieutenant or a higher rank;

(b) the service of a person as a member of the Corps of Staff Cadets of the Military Forces shall be disregarded unless the person is subsequently appointed as an officer of those Forces; and

(c) the service of a person as an Air Cadet of the Air Force shall be disregarded unless the person is subsequently appointed as an officer of that Force.

(2A) For the purposes of paragraph (b) of subsection (1), where a person re‑engages to serve as a member of the Defence Force, other than as an officer, for a period of continuous full‑time service, he shall be taken to have been engaged on his enlistment to serve until the expiration of the period for which he re‑engages.

(2B) For the purposes of paragraph (c) of subsection (1), where an officer commences a period of continuous full‑time service immediately after the expiration of a previous period of such service by him, whether as an officer or otherwise, he shall be taken to have been appointed on the commencement of that previous period to serve until the expiration of the later period.

(3) Paragraphs (b) and (c) of subsection (1) do not apply in relation to a discharge or termination of appointment:

(a) that occurred before the person concerned had completed twelve months’ effective full‑time service; and

(b) the ground for which was invalidity, or physical or mental incapacity to perform duties, caused, or substantially contributed to, by a physical or mental condition that:

(i) existed at the time the person concerned commenced full‑time continuous service as a member of the Defence Force; and

(ii) was not aggravated, or was not materially aggravated, by that service.

(4) Paragraph (c) of subsection (1) does not apply in relation to a period of service referred to in paragraph (b) of subsection (6) that was brought to an end by the death, or the termination of the appointment, of the officer concerned.

(5) A member of the Defence Force not on continuous full‑time service who has, whether before or after the commencement of this section, commenced continuous full‑time service in pursuance of a voluntary undertaking given by him and accepted by the appropriate authority of the Defence Force shall:

(a) if he was an officer on the day on which he so commenced—be deemed, for the purposes of paragraph (c) of subsection (1), to have been appointed as an officer of the Defence Force on that day for service for the period for which he was bound to serve on continuous full‑time service; or

(b) if he was a member other than an officer on the day on which he so commenced—be deemed, for the purposes of paragraph (b) of subsection (1), to have been engaged to serve as a member of the Defence Force on that day for service for the period for which he was bound to serve on continuous full‑time service.

First service after 14 May 1985

(5A) A person is a regular serviceman for the purposes of this Act if:

(a) the person is covered by paragraph (1)(b) or (c); and

(b) the person’s first service in the Defence Force began after 14 May 1985; and

(c) the person’s death or discharge from the Defence Force occurred before 19 December 1988; and

(d) a notice of eligibility or a certificate of entitlement has been issued to the person under this Act or regulations made under this Act.

(5B) If a person to whom subsection (5A) applies is dead, the person is taken to have been a regular serviceman immediately before the person’s death.

Note: this subsection has the effect of making a widow, widower or dependent parent of the person an eligible person (see definition of eligible person in subsection 4(1)).

(5C) Subsections (5A) and (5B) do not apply to a person who is or has been a subsidised borrower under the Home Loans Assistance Act.

(6) In this section, effective full‑time service, in relation to a member of the Defence Force, means any period of continuous full‑time service of the member other than:

(a) a period exceeding twenty‑one consecutive days during which the member was:

(i) on leave of absence without pay;

(ii) absent without leave;

(iii) awaiting or undergoing trial on a charge in respect of an offence of which he was later convicted; or

(iv) undergoing detention or imprisonment; or

(b) in the case of an officer of the Defence Force who, on his appointment, was a student enrolled in a degree or diploma course at a university or other tertiary educational institution and was required by the appropriate authority of the Defence Force to continue his studies after his appointment—the period of his service during which, by reason of the requirement to engage in his studies or in activities connected with his studies, he was not regarded by the appropriate authority of the Defence Force as rendering effective full‑time service.

4AAB National Serviceman

Subject to this section, a person is a national serviceman for the purposes of this Act if:

(a) he was, immediately before 7 December, 1972, a national serviceman, or a national service officer, for the purposes of the National Service Act 1951‑1971 serving in the Regular Army Supplement; and

(b) on or after that date:

(i) he completed the period of service in that Force for which he was to be deemed to have been engaged to serve or for which he was appointed, as the case may be; or

(ii) that service ended by reason of his death or his discharge, or the termination of his appointment, on the ground of invalidity or physical or mental incapacity to perform duties.

4AA Extension of Act to Norfolk Island

This Act extends to Norfolk Island.

4AB Joint ownership

(1) A reference in this Act to any of the following kinds of property:

(a) land;

(b) a suburban holding under the Crown Lands Consolidation Act, 1913 of New South Wales, or under that Act as amended at any time, or under an Act enacted in substitution for that Act;

(c) a unit defined in a units plan registered in accordance with a law of the Australian Capital Territory relating to unit titles;

(d) a right of residence in a retirement village;

includes a reference to such property held by a person as a joint tenant or tenant in common.

(2) A reference in this Act to a dwelling‑house includes a reference to a dwelling‑house that is built in or on land, such a suburban holding or such a unit, that is held by a person as a joint tenant or tenant in common.

(3) A reference in this Act to a purchaser or borrower includes a reference to a person who is a purchaser or borrower as a joint tenant or tenant in common.

Note: Section 17A deals with the issue of certificates of entitlement in relation to joint tenancies and tenancies in common.

4A Eligible person and spouse or de facto partner may be treated together as eligible person

(1) The Secretary may, in his or her discretion, treat an eligible person and the spouse or de facto partner of that eligible person together as an eligible person for the purposes of this Act, and any reference in this Act to an eligible person shall be read as including a reference to a spouse or de facto partner of that eligible person who is so treated.

(3) The Secretary shall not apply this section in relation to any land, or land and dwelling‑house, if the land, or land and dwelling‑house, is or are owned or proposed to be owned by the eligible person and his or her spouse or de facto partner otherwise than as joint tenants.

(6) The application of this section in relation to land or land and a dwelling‑house does not, except as provided by this section, affect the application of the other provisions of this Act in relation to the land or land and dwelling‑house.

4BA Election to surrender eligible status

(1) An eligible person who:

(a) is a member of the Defence Force:

(i) whose first service in the Defence Force began on or before 14 May 1985; or

(ii) whose first service in the Defence Force began after that day but who is covered by paragraph (ga) of the definition of Australian Soldier in subsection 4(1); and

(b) is not, and has not at any time been, a borrower; and

(c) does not hold a certificate of entitlement that is in force in relation to subsidy on an initial advance;

may elect to surrender his or her status as an eligible person under this Act.

(2) An election must be:

(a) in writing, signed by the person making it; and

(b) given to the Secretary within the prescribed period.

(3) Subject to section 4BB, an election is irrevocable and takes effect on the day on which it is given to the Secretary.

(4) When an election takes effect, the person making it stops being an eligible person for the purposes of this Act.

(5) The Secretary must cause a copy of each election to be given to the Secretary of the Defence Department.

(6) In this section:

prescribed period means the period of 6 months starting on the day on which this section commences.

4BB Revocation of election to surrender eligible status

Revocation of election before 1 July 1992

(1) A person who has elected to surrender his or her status as an eligible person under section 4BA may revoke that election (the surrender election) if:

(a) the person is not and has not been a subsidised borrower under the Home Loans Assistance Act; and

(b) the person gives the Secretary a written notice stating that the person wishes to revoke his or her surrender election; and

(c) the notice is given to the Secretary before 1 July 1992.

Revocation of election before 1 January 1993

(2) A person who has elected to surrender his or her status as an eligible person under section 4BA may revoke that election (the surrender election) if:

(a) the person is not and has not been a subsidised borrower under the Home Loans Assistance Act; and

(b) the person gives the Secretary a written notice stating that the person wishes to revoke his or her surrender election; and

(c) the notice is given to the Secretary on or after 1 July 1992 and before 1 January 1993; and

(d) the person satisfies the Secretary that:

(i) the person was not aware before 1 July 1992 that the person’s surrender election was revocable; and

(ii) the person would not have made the surrender election if the person had been aware of the matters announced in the statement made by the Minister on 22 August 1991 relating to pooling of entitlements under this Act.

Date of effect of revocation

(3) If a person’s surrender election is revoked by a notice under subsection (1) or (2), the revocation takes effect on the day on which the notice is given to the Secretary.

(4) If a person revokes his or her surrender election the Secretary must cause a copy of the notice that revoked the election to be given to the Secretary of the Defence Department.

4B Approval of Bank agreement

The Bank agreement, as executed on 9 November 1988, and its execution on behalf of the Commonwealth, are approved.

4C Compensation for acquisition of property

(1) If, apart from this section, the operation of this Act would result in the acquisition of property from a person otherwise than on just terms, there is payable to the person by the Commonwealth such reasonable amount of compensation as is agreed between the person and the Commonwealth or, failing agreement, as is determined by the Federal Court.

(2) In this section, acquisition of property and just terms have the same respective meanings as in paragraph 51(xxxi) of the Constitution.

4D Exclusion of Consumer Credit Codes in relation to subsidised advances

(1) Except as provided by Part IIIA and section 35A, this Act does not exclude or limit the concurrent operation of the Consumer Credit Codes of the States and Territories.

(2) Nothing in subsection 23AA(2) or section 23H is intended to make matters referred to in that subsection or section subject to the Consumer Credit Codes of the States and Territories.

4E Application of the Criminal Code

Chapter 2 of the Criminal Code applies to all offences against this Act.

Note: Chapter 2 of the Criminal Code sets out the general principles of criminal responsibility.

Part II—Administration

6 Delegation by Minister

(1) The Minister may, by writing under his hand, delegate to any person, either generally or otherwise as provided by the instrument of delegation, all or any of his powers or functions under this Act, except this power of delegation.

(2) A power or function so delegated may be exercised or performed by the delegate in accordance with the instrument of delegation.

(3) A delegation under this section is revocable at will and does not prevent the exercise of a power or the performance of a function by the Minister.

6A Delegation by Secretary

(1) The Secretary may, either generally or as otherwise provided by the instrument of delegation, by writing signed by him, delegate to a person any of his powers under this Act (except this power of delegation) and any powers that the Secretary exercises on behalf of the Commonwealth under Part VI.

(2) A power so delegated, when exercised by the delegate, shall, for the purposes of this Act, be deemed to have been exercised by the Secretary.

(3) A delegation under this section does not prevent the exercise of a power by the Secretary.

6B Transfer of portfolio assets to the Bank

(1) Where a date in relation to the portfolio assets in a State or Territory has been notified in writing by the Bank to the Corporation and the Commonwealth in accordance with the Bank agreement, the Minister shall determine the vesting date in relation to the portfolio assets in that State or Territory.

(2) The Minister may determine a vesting date in relation to the portfolio assets in a State or Territory that is different from the date notified by the Bank but shall not determine a vesting date that is earlier than 3 days before the date notified by the Bank or later than 3 days after that date.

(3) Where the Minister determines a vesting date, the Minister shall forthwith notify the Bank in writing of the determination.

(4) A notice to the Bank shall not be taken, for any purpose, to be the making of the determination to which it relates.

(5) The Minister may refuse to determine a vesting date, or may revoke any such determination, in accordance with the Bank agreement.

(6) Subject to this section, where the Minister determines a vesting date in relation to the portfolio assets in a State or Territory, then, unless that determination is revoked before that date:

(a) all rights, title and interest of the Corporation in the portfolio assets in that State or Territory as in force immediately before that date vest, by force of this section but not otherwise, in the Bank on that date;

(b) the Bank is on and after that date, by force of this section, liable to pay and discharge all debts, liabilities and obligations of the Corporation that existed immediately before that date under the portfolio assets in that State or Territory;

(c) in spite of any other provision of this Act, any contract in force immediately before that date, being a contract comprising a portfolio asset in that State or Territory, has effect on and after that date as if:

(i) the Bank were a party to the contract instead of the Corporation; and

(ii) any reference in the contract to the Corporation were (except in relation to matters that happened before that date) a reference to the Bank; and

(d) the Commonwealth is, by force of this section, substituted for the Corporation as a party to any proceedings pending in any court immediately before that date (being proceedings to which the Corporation was a party and that relate to a portfolio asset in that State or Territory) and has the same rights in the proceedings as the Corporation had.

(7) The Bank is not liable to pay or discharge any liability or obligation arising out of proceedings to which the Commonwealth is substituted as a party under paragraph (6)(d).

(8) Where a portfolio asset vests in the Bank under this section, the bank is bound by the terms and conditions of that asset and shall abide by and duly perform those terms and conditions and any obligations of the Corporation under that asset.

(9) The provisions of this Act and the Defence Service Homes Regulations specified in Schedule 2, as those provisions were in force immediately before the commencing day, shall be taken to be terms and conditions of portfolio assets which vest in the Bank under this section and, for that purpose, those provisions shall be read as if:

(a) references to the Corporation (other than in section 30 and subsections 35(2A) and 36A(1) of this Act as then in force) were references to the Bank;

(b) expressions used in those provisions that are defined in this Act as then in force had the same respective meanings as provided in those definitions; and

(c) they were further modified as specified in Schedule 2.

(10) A provision of a portfolio asset requiring or permitting a person to make payments under the asset at any office or to any person, other than the Corporation, shall cease to have effect when the portfolio asset vests in the Bank.

(11) An undertaking given by a person in relation to a portfolio asset under paragraph 35(2)(b) of this Act, as in force before the commencing day, shall, to the extent to which it has not been discharged before the day on which that asset vests in the Bank under this section, continue to have effect on and after that day as if it had been given by that person under paragraph 22(2)(b) of this Act.

6C Dealings relating to vested portfolio assets

(1) Where the Corporation, or any of its predecessors, is registered in a State or Territory as the owner of an interest in a portfolio asset which vests in the Bank under section 6B, the Bank may, subject to the Bank agreement, execute any receipt, discharge or other instrument in relation to that interest in its own name, or in the name of the Corporation or the Corporation’s predecessor, as the case may be, and the Registrar‑General, Registrar of Titles, or other appropriate officer, of that State or Territory may make such entries in his or her registers, and do such other things, as are necessary to give effect to that receipt, discharge or other instrument.

(2) The Bank may execute a transfer of land and a dwelling‑house to the purchaser of that land and dwelling‑house under a contract of sale which vests in the Bank under section 6B and any transfer so executed shall be taken to have been made pursuant to and in conformity with the contract of sale.

(3) A transfer referred to in subsection (2) is not liable to any ad valorem tax under a State or Territory law if that ad valorem tax has been paid on the relevant contract of sale.

6D Transfer of certain other assets to Commonwealth

(1) On the winding‑up day:

(a) all prescribed rights that, immediately before that day were vested in the Corporation vest on that day, by force of this subsection, in the Commonwealth; and

(b) the Commonwealth becomes, by force of this subsection, liable to pay or discharge any prescribed debts of the Corporation that existed immediately before that day.

(2) Any prescribed contract to which the Corporation was a party immediately before the winding‑up day has effect on and after that day as if:

(a) the Commonwealth were substituted for the Corporation as a party to the contract; and

(b) any reference in the contract to the Corporation were (except in relation to things that happened before that day) a reference to the Commonwealth.

(3) If, immediately before the winding‑up day, prescribed proceedings to which the Corporation was a party were pending in any court, the Commonwealth is, on that day, by force of this subsection, substituted for the Corporation as a party to the proceedings and has the same rights in the proceedings as the Corporation had.

(4) Where any interest in land situated in a State or Territory vests in the Commonwealth under this section, the Secretary may lodge with the Registrar‑General, Registrar of Titles or other appropriate officer of that State or Territory a notice signed by the Secretary, or by a person authorised by the Secretary for the purpose, stating that that interest is vested in the Commonwealth by this section, and the person with whom the notice is so lodged may make such entries in his or her registers, and do such other things, as are necessary to reflect the vesting of that interest in the Commonwealth.

(5) In this section:

prescribed contract means a contract other than a contract referred to in section 6B or an insurance contract within the meaning of section 38B.

prescribed debt means any debt, liability or obligation other than a debt, liability or obligation referred to in section 6B or an insurance debt within the meaning of section 38B.

prescribed proceedings means proceedings other than proceedings referred to in section 6B or insurance proceedings within the meaning of section 38B.

prescribed right means any right, property or assets other than a right, title or interest referred to in section 6B or an insurance right within the meaning of section 38B.

Part III—Notices of eligibility, certificates of entitlement and certificates of assignment

15 Applications for notices and certificates

(1) A person may apply to the Secretary for any of the following:

(a) a notice of eligibility;

(b) a certificate of entitlement in relation to subsidy on a subsidised advance that the person may seek from a credit provider;

(c) a certificate of entitlement in relation to consent that the person may seek from a credit provider to a transfer;

(d) a certificate of entitlement in relation to instalment relief that the person may seek from a credit provider;

(e) a certificate of assignment.

(2) An application shall be in writing in accordance with the appropriate form approved by the Secretary for the purposes of this section and shall be made in accordance with the agreement.

16 Notice of eligibility

(1) Where, on application by a person for a notice of eligibility, the Secretary is satisfied that the applicant is an eligible person or is an eligible veteran, the Secretary shall issue to the applicant a notice of eligibility.

(2) A notice of eligibility shall state that the person named in the notice is, on the date of the notice, an eligible person or eligible veteran, as the case may be.

17 Certificate of entitlement: advances

(1) Subject to this Act, the Secretary shall, on application by a person for a certificate of entitlement in relation to subsidy on a subsidised advance that the person may seek from a credit provider, issue to the applicant a certificate of entitlement certifying that subsidy is payable by the Commonwealth to the credit provider if, in accordance with the agreement, the credit provider makes that advance to the applicant or the assignee of the applicant.

(2) A certificate of entitlement issued under this section remains in force until:

(a) it lapses as provided in the agreement; or

(b) subsidy in respect of the relevant advance ceases to be payable under this Act;

whichever happens first.

(3) A certificate of entitlement issued under this section shall:

(a) specify the maximum amount in respect of which subsidy is payable, being an amount determined under section 25;

(b) specify the maximum term of the advance;

(c) if subsection 34(2) applies—specify the rates of interest and proportions of the further advance to which each of those rates of interest apply, as required by that subsection;

(d) in any other case—specify the rate of interest payable on the advance; and

(da) contain a statement setting out the effect of section 35AA (which, in some situations, reduces the rate of interest payable on a subsidised advance); and

(e) contain particulars of such other matters as are specified in the agreement.

(4) A certificate of entitlement issued under this section must:

(a) if the certificate relates to an initial advance, or a further advance, that is not an assigned advance—specify that the advance is for the purposes referred to in subsection 18(2) (other than paragraph 18(2)(l)); or

(b) if the certificate relates to an initial advance, or a further advance, that is an assigned advance—specify that the advance is for the purpose of assisting the assignee of the applicant in obtaining a right of residence in the retirement village in question; or

(c) if the certificate relates to an additional advance that is not an assigned advance—specify that the advance is for the purposes referred to in subsection 18(3) (other than paragraph 18(3)(g)); or

(d) if the certificate relates to an additional advance that is an assigned advance—specify that the advance is for the purpose of assisting the assignee of the applicant in continuing to hold a right of residence in the retirement village in question; or

(e) in any other case—specify the purpose of the advance.

17A Criteria for issue of certificate of entitlement: joint ownership

(1) The Secretary must not issue a certificate of entitlement under this Part to an applicant if the applicant’s interest or right is in the form of a joint tenancy, unless the Secretary is satisfied that:

(a) the application was made by a person and his or her spouse or de facto partner who, under subsection 4A(1), are treated together as an eligible person for the purposes of this Act; or

(b) the only other joint tenant is the applicant’s spouse or de facto partner, who is also an eligible person.

(2) The Secretary must not issue a certificate of entitlement under this Part to an applicant if the applicant’s interest or right is in the form of a tenancy in common, unless the Secretary is satisfied that the interest or right, at the time when the application was lodged, would have had a value, if it were unencumbered, of not less than the sum of:

(a) all advances in relation to the applicant, in respect of which subsidy is payable; and

(b) the advance to which the certificate would relate.

(3) In this section:

interest or right, in relation to an applicant, means the applicant’s interest or proposed interest concerned in respect of a holding, or the applicant’s right or proposed right of residence concerned in respect of a retirement village (as the case requires).

18 Criteria for issue of certificate of entitlement: advances other than widow or widower advances, advances for essential repairs and home support advances

(1) Subject to this section, the Secretary shall not issue a certificate of entitlement in relation to subsidy on an advance that a person may seek from a credit provider unless satisfied that:

(a) the person is an eligible person, or the spouse or de facto partner of an eligible person who is temporarily or permanently insane; and

(b) the person:

(i) is not the owner of a dwelling‑house; and

(ii) does not have a right of residence in a retirement village; and

(iii) does not own an interest in shares giving rise to a company title in respect of land on which a dwelling‑house is built;

other than the dwelling‑house, right of residence or company title in respect of which the advance is payable; and

(c) the person is not liable to repay any amount received by way of assistance under an agreement of the kind known as a War Service Land Settlement Agreement; and

(d) the person has not received money from the Commonwealth after 9 December 1987 by way of:

(i) a payment of a cash grant instead of an advance under this Act as in force on or before that day; or

(ii) a payment instead of such a cash grant; and

(e) if the person has a spouse or de facto partner (other than a spouse or de facto partner from whom he or she is permanently separated)—the spouse or de facto partner:

(i) is not the owner of a dwelling‑house; and

(ii) does not have a right of residence in a retirement village; and

(iii) does not own an interest in shares giving rise to a company title in respect of land on which a dwelling‑house is built;

other than the dwelling‑house, right of residence or company title in respect of which the advance is payable; and

(f) except in the case of an advance to a person included in paragraph (b) or (d) of the definition of Australian Soldier in section 4 in relation to a house or building used or to be used as a hospital, sanatorium or nursing‑home—the dwelling‑house or retirement village accommodation in respect of which the advance is payable is intended to be used by the person as a home for the person and any dependants of the person; and

(g) such advance will be secured by:

(i) in the case of an assigned advance—except as provided by the agreement, a first or subsequent mortgage over the assignee’s interest in the retirement village and over any other person’s interest in the retirement village; or

(ii) in any other case—except as provided by the agreement, a first mortgage over the person’s interest in the holding and over any other person’s interest in the holding.

(2) The Secretary shall not issue a certificate of entitlement in relation to subsidy on an advance, other than an additional advance, that a person may seek from a credit provider unless satisfied that the advance is for the purpose of enabling the person:

(a) to build a dwelling‑house on a holding of the person; or

(b) to purchase a holding and build a dwelling‑house on the holding; or

(c) to purchase a dwelling‑house together with the holding on which it is built; or

(d) to complete a partially built dwelling‑house on a holding of the person; or

(e) to enlarge, modify or repair a dwelling‑house on a holding of the person; or

(f) to discharge any mortgage, charge or encumbrance already existing on the person’s interest in a holding; or

(g) to obtain a right of residence in a retirement village; or

(h) to complete the person’s partially‑built retirement village accommodation; or

(j) to enlarge, modify or repair the person’s retirement village accommodation; or

(k) to discharge any debt owed by the person in relation to the person’s retirement village accommodation; or

(l) in the case of an assigned advance—to be assisted in obtaining a right of residence in the retirement village.

(3) The Secretary shall not issue a certificate of entitlement in relation to subsidy on an additional advance that a person may seek from a credit provider unless satisfied that the advance is for the purpose of enabling the person:

(a) to enlarge, modify or repair:

(i) a dwelling‑house on a holding of the person; or

(ii) a person’s retirement village accommodation; or

(b) to meet the cost of roadmaking if the person is liable to meet that cost but is otherwise unable to do so; or

(e) to discharge any mortgage, charge or encumbrance already existing on the person’s interest in a holding; or

(f) to discharge any debt owed by the person in relation to the person’s retirement village accommodation; or

(g) in the case of an assigned advance—to be assisted in continuing to hold a right of residence in the retirement village.

(6) In this section:

advance means a subsidised advance other than a widow or widower advance, an advance for essential repairs or a home support advance.

19 Criteria for issue of certificate of entitlement: further advance

The Secretary must not issue a certificate of entitlement in relation to subsidy on a further advance to a person unless the person is or was a purchaser or borrower in relation to a Corporation advance, a subsidised advance (other than a home support advance) or a contract of sale on or after 9 December 1987.

20 Criteria for issue of certificate of entitlement: widow or widower advances

(1) The Secretary shall not issue a certificate of entitlement in relation to subsidy on a widow or widower advance that a person may seek from a credit provider unless satisfied that:

(a) the person is:

(i) the widow, widower or a widowed parent of an eligible person; or

(ii) a spouse or de facto partner of an eligible person who is temporarily or permanently insane; and

(b) the person is a purchaser or a borrower in relation to:

(i) land; or

(ii) land and a dwelling‑house; or

(iii) a right of residence in a retirement village; and

(c) the widow or widower advance relates to that land, land and dwelling‑house or right of residence.

(1A) For the purposes of paragraph (1)(b), the person is taken to be a borrower in relation to a right of residence in a retirement village if the person is, or will be, an assignor in relation to the advance.

(2) The Secretary shall not issue a certificate of entitlement in relation to a subsidy on a widow or widower advance that a person may seek from a credit provider unless satisfied that:

(a) the advance is for the purpose of keeping the buildings, fences, fixtures and other improvements on the relevant land or of the person’s retirement village accommodation in good order and repair and it would cause financial hardship to the person if he or she were to bear the cost of keeping them in good order and repair; or

(b) the advance is for the purpose of paying rates, taxes, charges or other outgoings in relation to the relevant land, land and dwelling‑house or right of residence in a retirement village and it would cause financial hardship to the person if he or she were to pay those rates, taxes, charges or other outgoings.

(3) In deciding whether a person is suffering financial hardship for the purposes of paragraph (2)(a) or (b), the Secretary is to have regard to any guidelines approved by the Minister under subsection (4).

(4) The Minister may approve guidelines setting out matters to be taken into account in deciding whether a person is suffering financial hardship for the purposes of this Act.

(5) Guidelines approved by the Minister in accordance with this section are disallowable instruments for the purposes of section 46A of the Acts Interpretation Act 1901.

21 Criteria for issue of certificate of entitlement: advances made for essential repairs

(1) The Secretary shall not issue a certificate of entitlement in relation to subsidy on an advance for essential repairs that a person may seek from a credit provider unless satisfied that:

(a) the person is an eligible person who is a purchaser or a borrower in relation to:

(i) land; or

(ii) land and a dwelling‑house; or

(iii) a right of residence in a retirement village;

(b) the advance relates to that land, land and dwelling‑house or right of residence;

(c) the advance is for the purpose of enabling the person to effect repairs essential to keep the buildings, fences, fixtures and other improvements on that land or of that person’s retirement village accommodation in good order and repair; and

(d) it would cause serious financial hardship to the person if he or she were to bear the cost of keeping them in good order and repair.

(1A) For the purposes of paragraph (1)(a), the person is taken to be a borrower in relation to a right of residence in a retirement village if the person is, or will be, an assignor in relation to the advance.

(2) In deciding whether a person is suffering serious financial hardship for the purposes of paragraph (1)(d), the Secretary is to have regard to any guidelines approved by the Minister under subsection (3).

(3) The Minister may approve guidelines setting out matters to be taken into account in deciding whether a person is suffering serious financial hardship for the purposes of this Act.

(4) Guidelines approved by the Minister in accordance with this section are disallowable instruments for the purposes of section 46A of the Acts Interpretation Act 1901.

21A Criteria for issue of certificate of entitlement: home support advances

The Secretary must not issue a certificate of entitlement in relation to subsidy on a home support advance that a person may seek from a credit provider unless the Secretary is satisfied that:

(a) the person is an eligible person (disregarding subsection 4(2C)) or is an eligible veteran; and

(b) either:

(i) the person is the owner of a dwelling‑house; or

(ii) the person has a right of residence in a retirement village; and

(c) the advance is for a purpose related to the dwelling‑house or the right of residence in the retirement village (other than for a purpose mentioned in paragraph 18(2)(a), (b), (c), (d), (f), (h) or (k)) that will assist the person to remain independently housed; and

(d) if a certificate of entitlement has been issued to the person in relation to an initial advance, an additional advance or a further advance—an advance has been made by the credit provider in accordance with the certificate or an advance that would be in accordance with the certificate has been refused by the credit provider; and

(e) if the person is liable to pay the outstanding amount of any one or more of the following:

(i) an initial advance;

(ii) an additional advance;

(iii) a further advance;

the sum of those outstanding amounts is less than $10,000; and

(f) a certificate of entitlement that relates to an initial advance, an additional advance or a further advance could not be issued to the person in respect of the application concerned.

22 Certificate of entitlement: transfer of property subject to specified portfolio asset or advance

(1) Subject to subsection (1AA), if any land, land and dwelling‑house or right of residence in a retirement village is subject to:

(a) a specified portfolio asset which vests in the Bank under section 6B; or

(b) a mortgage or other security securing a subsidised advance;

a transfer of the estate, interest or right of the purchaser or borrower in that land or land and dwelling‑house, or in relation to that right of residence, being a transfer subject to that specified portfolio asset, mortgage or other security, has no effect unless the Secretary has issued a certificate of entitlement to the proposed transferee in relation to the transfer.

(1AA) Subsection (1) does not apply if the subsidised advance referred to in paragraph (1)(b) is an assigned advance.

(1A) If:

(a) a person has obtained a right of residence in a retirement village; and

(b) the person is a borrower in relation to that right of residence and is liable to pay the outstanding amount of a subsidised advance in respect of which subsidy is payable; and

(c) the relevant credit provider has no security for the subsidised advance;

a transfer of the person’s right of residence, while the person’s liability under paragraph (b) remains, has no effect unless the Secretary has issued a certificate of entitlement to the proposed transferee in relation to the transfer.

(2) The Secretary:

(a) shall not issue a certificate of entitlement in relation to consent that the person may seek from a credit provider to a transfer unless satisfied that, in all the circumstances, it is reasonable to do so; and

(b) may, before issuing the certificate, require a person to take such action (including the giving of an undertaking by the proposed transferee) as the Secretary considers reasonable in the circumstances.

(3) A certificate of entitlement under this section (other than one that relates to a home support advance) may be issued only to a proposed transferee who is an eligible person.

(3A) A certificate of entitlement under this section that relates to a home support advance may be issued only to a proposed transferee who is an eligible person or an eligible veteran.

(4) A certificate of entitlement under this section remains in force until the subsidy to which it relates ceases to be payable under this Act.

(5) A certificate of entitlement under this section shall:

(a) contain a statement to the effect that the Secretary consents to the transfer to the proposed transferee and that the Commonwealth will continue to pay subsidy in relation to the specified portfolio asset or subsidised advance if the transfer to the proposed transferee is carried out;

(b) specify the maximum amount in respect of which subsidy is payable;

(c) specify the maximum term during which subsidy will be paid;

(d) specify the relevant rate of interest payable on the specified portfolio asset or subsidised advance; and

(e) contain particulars of such other matters (if any) as are specified in the agreement.

(6) Subject to this section but in spite of any other provision of this Act, where land, or land and a dwelling‑house, has been transferred to a transferee who is not an eligible person or an eligible veteran, section 45A does not apply to the transferee’s interest in the land, or land and dwelling‑house.

(7) This section does not apply to:

(a) a transfer of land, land and a dwelling‑house or right of residence in a retirement village, to a credit provider as a result of the exercise by the credit provider of its powers under the relevant mortgage or other security; or

(b) where the purchaser or owner of land, land and a dwelling‑house or right of residence in a retirement village, dies—a transmission of the land, land and a dwelling‑house or right of residence in a retirement village, to the executor or administrator of the estate of the purchaser or owner; or

(c) a transfer of a person’s right of residence in a retirement village to the owner or owners of the retirement village.

(8) A reference in this section to a transfer, in relation to land or land and a dwelling‑house, includes a reference to a transfer of shares giving rise to a company title in respect of the land or land and dwelling‑house.

23 Certificate of entitlement: instalment relief

(1) Where, on application by a person for a certificate of entitlement in relation to instalment relief that the person may seek from a credit provider, the Secretary is satisfied that:

(a) the applicant is a purchaser or borrower who is:

(i) the widow or widower of an eligible person; or

(ii) a widowed parent of an eligible person; or

(iii) a spouse or de facto partner of an eligible person who is temporarily or permanently insane; or

(b) the applicant is not a person referred to in paragraph (a) but is a purchaser or a borrower who is an eligible person or is an eligible veteran and the amounts of the instalments payable under the relevant contract of sale, mortgage or other security include an amount of interest calculated at a rate of more than 3.75% per year;

and that it would cause financial hardship to the applicant if the applicant were to pay in full the amounts of the instalments, the Secretary shall determine the amount by which the amounts of the instalments should be reduced and the period during which that reduction should apply.

(2) Where the Secretary makes a determination, the Secretary shall issue to the applicant a certificate of entitlement specifying:

(a) the amount by which the amounts of the instalments should be reduced and the period during which that reduction should apply; and

(b) particulars of such other matters (if any) as are required by the agreement.

(3) The Secretary shall cause a copy of each certificate of entitlement under this section to be given to the credit provider.

(4) On the issue of a certificate of entitlement under this section, the amounts of instalments payable under the contract of sale, mortgage or other security to which the certificate relates are, if the credit provider grants instalment relief to the applicant, reduced by the amount specified in the certificate during the period specified in the certificate.

(5) In deciding whether a person is suffering financial hardship for the purposes of subsection (1), the Secretary is to have regard to any guidelines approved by the Minister under subsection (6).